Trading more contracts might seem like a quick way to increase profits, but it often leads to bigger losses, emotional decision-making, and breaches of trading rules. Here’s why:

- Losses Multiply: Each additional contract increases your exposure. For example, trading five E-mini S&P 500 contracts instead of one means a 10-point move could result in a $2,500 loss instead of $500.

- Emotional Strain: Larger positions create stress, leading to impulsive actions like revenge trading or ignoring stop-losses.

- Prop Firm Limits: Strict rules like daily loss limits and trailing drawdowns make it harder to manage large positions.

- Recovery Challenges: Losing 50% of your account requires a 100% gain to break even, emphasizing the risk of over-leveraging.

The key to long-term success? Stick to smaller, consistent position sizes, follow risk management rules, and avoid emotional trading traps. Trading is about staying in the game, not chasing quick wins.

How More Contracts Increase Losses and Drawdowns

Contract Size and Tick Value Basics

Futures trading comes with a key concept: tick value – the dollar amount you gain or lose for each tick the market moves. For example, trading one E-mini S&P 500 (ES) contract means risking $12.50 per tick. But here’s where it gets risky: adding more contracts multiplies your exposure. Two contracts? Now you’re looking at $25.00 per tick. Five contracts? That jumps to $62.50 per tick.

This pattern holds across all futures markets. Take Crude Oil (CL), for instance. Each tick is worth $10.00. A 75-tick move against a trader holding two contracts results in a $1,500 loss. For many funded accounts, this single trade could blow past the daily loss limit. The more contracts you trade, the faster losses pile up.

The Math Behind Bigger Losses

Let’s break it down further. One E-mini S&P 500 contract controls over $300,000 in notional value, while requiring as little as $500 in day-trading margin. A 1% market move in either direction could mean a 20% gain or loss of your margin.

Now, imagine trading five contracts instead of one. A 10-point move in the ES would swing your account by $2,500. In a $50,000 prop firm account, that’s a 5% drawdown – enough to breach most daily loss limits. Compare this to trading just one contract, where the same 10-point move results in a $500 loss, or only 1% of your account.

| Instrument | Tick/Point Value | Risk: 1 Contract (10-Point Move) | Risk: 5 Contracts (10-Point Move) |

|---|---|---|---|

| E-mini S&P 500 (ES) | $50.00/point | $500 | $2,500 |

| E-mini Nasdaq (NQ) | $20.00/point | $200 | $1,000 |

| Crude Oil (CL) | $10.00/tick | $100 (10 ticks) | $500 (10 ticks) |

The numbers also highlight the challenge of recovery. If you lose 1% of your account, you only need a 1.01% gain to recover. But lose 50%, and you’ll need a 100% gain just to break even.

How This Affects Prop Firm Accounts

These amplified risks clash with the strict controls of prop firm accounts. Most prop firms enforce daily loss limits of 3% to 5%. Trading multiple contracts increases the likelihood of hitting these limits during normal market swings. But the bigger issue lies in trailing drawdowns – dynamic limits that rise with your account’s highest equity, including unrealized gains.

"A trailing drawdown is a dynamic equity limit that moves up as your account reaches new highest equity… and never moves down when your equity falls." – FunderPro Futures

Here’s how it plays out: imagine holding five ES contracts and seeing a 15-point move in your favor. That’s an unrealized profit of $3,750, which raises your trailing drawdown floor. But if the market reverses by 20 points, you’re suddenly $5,000 down from your peak equity. Even though you’re still above your entry point, the trailing drawdown violation could end your trading session.

"Position sizing is 100 percent controllable. Although the futures markets are often unstable in nature, the implementation of leverage need not be." – StoneX

The takeaway? Trading more contracts might seem like a fast track to higher profits, but it also magnifies your risks, making it easier to breach account limits and harder to recover from losses.

Why Larger Positions Lead to Emotional Trading Mistakes

Fear and Greed with Bigger Positions

When you take on larger positions, your focus often shifts away from analyzing the market itself to obsessing over your immediate profit and loss (P&L). Each tick represents a bigger dollar movement, creating an emotional rollercoaster that can throw off your ability to stick to your trading plan.

"Big losses create fear and frustration, which lead to revenge trading and impulsive decisions. Small, consistent losses keep your emotions steady so you can stick to your plan." – Kathy Lien

Fear tends to creep in after a streak of losses. It can make you second-guess valid setups or cut winning trades short just to lock in small gains. On the flip side, a winning streak can lead to overconfidence. Suddenly, you’re trading as if the money at risk isn’t real, and you might double your position size impulsively. This is a common trap – 50% of traders fail to apply proper position sizing, which is why winning streaks often end in significant losses or even blown accounts. Just one or two missteps when managing multiple contracts can wipe out a large portion of your account.

Here’s a stark example: If you risk 1% of your account per trade, 10 consecutive losses result in about a 9.5% drawdown. But if you’re risking 10% per trade, those same 10 losses can drain over 65% of your account. The fallout from an oversized loss can be devastating – not just financially but mentally. It often triggers revenge trading, where the desperation to "make it back" leads to even riskier decisions. These emotional reactions can spiral out of control, undermining both your account balance and your ability to trade effectively.

Loss of Focus on Your Trading Plan

Larger positions don’t just stir up emotions – they also pull your attention away from your strategy. Instead of analyzing price action, support levels, or planned exits, you’re glued to your P&L ticker. This heightened stress can lead to poor decisions, like moving stop-losses, removing them entirely, or freezing when it’s time to act.

"When traders take positions that seem significant, fear or excitement can distort their judgment, leading to errors such as overtrading or revenge trades." – AquaFunded

What works with smaller positions often falls apart with larger ones. For instance, you might start averaging down on losing trades, hoping to improve your entry price – only to increase your risk at the worst possible moment. Or you might abandon carefully placed bracket orders mid-trade, convinced you can "sense" when the market will turn. These habits can unravel even the most disciplined trading plan.

Disciplined risk management is often the defining trait of successful traders, separating them from the 95% who fail. The key isn’t raw talent – it’s the ability to stick to your plan, no matter how tempting it is to veer off course. Larger positions amplify the psychological challenges, but staying grounded in your strategy is what keeps you in the game.

Position Sizing 101 for Futures Trading

Prop Firm Rules That Limit Contract Scaling

To address the risks of over-leveraging, prop firms enforce strict guidelines designed to protect their capital and ensure traders stick to disciplined strategies.

Drawdown Limits and Consistency Rules Explained

Futures prop firms rely on well-defined risk management frameworks to safeguard their funds and encourage responsible trading. One of the most critical safeguards is the drawdown limit, which can take several forms: Daily, Trailing, End-of-Day, or Static. These limits are designed to cap losses, with many firms setting daily loss thresholds between 3% and 5% of the account balance. Even slight breaches, including unrealized losses, can result in immediate account termination. These restrictions are closely tied to consistency rules, which discourage impulsive trading and reckless contract scaling.

Trailing drawdowns are particularly strict, requiring traders to protect their gains and adjust positions as their account grows. When your account hits a new high, the trailing drawdown threshold moves up accordingly and never resets downward. For example, if your account grows from $50,000 to $53,000 with a $2,500 trailing drawdown, your new loss limit adjusts upward, effectively tightening risk as you earn.

Consistency rules further reinforce disciplined behavior. For example, FTMO mandates at least 10 trading days during its challenge phase to ensure profits are achieved through steady and consistent trading. Some firms also enforce profit caps, such as a 30% limit on daily profits contributing to the total payout, preventing traders from relying on a single high-risk trade to skew results.

Scaling Plans and Contract Restrictions

In addition to daily loss limits, scaling plans are used to ensure traders earn the ability to increase their position sizes only after proving consistent performance. Even after passing an evaluation, many firms impose initial trading restrictions until traders demonstrate reliable profitability. For instance, Take Profit Trader ties position limits to account size. On a $50,000 account, traders are capped at 6 standard contracts (or 60 micro contracts). However, many firms allow only 50% of this maximum until traders reach a "Safety Net" threshold, typically defined as the starting balance plus the drawdown limit. For example, on a $50,000 account with a $2,500 drawdown, the Safety Net would be $52,600, limiting traders to 3 contracts until the threshold is met.

| Futures Account Size | Maximum Position Size | Micro Contract Limit | Initial Scaling Limit (50%) |

|---|---|---|---|

| $25,000 | 3 Contracts | 30 Micros | 1–2 Contracts |

| $50,000 | 6 Contracts | 60 Micros | 3 Contracts |

| $75,000 | 9 Contracts | 90 Micros | 4–5 Contracts |

| $100,000 | 12 Contracts | 120 Micros | 6 Contracts |

| $150,000 | 15 Contracts | 150 Micros | 7–8 Contracts |

Apex Trader Funding follows a similar model, with additional rules like a 5:1 maximum risk-to-reward ratio. For example, if your profit target is 10 ticks, your stop loss cannot exceed 50 ticks. This approach prevents traders from placing overly risky, unbalanced bets. For more details, check out reviews of Apex Trader Funding and Take Profit Trader.

"Drawdown management is not simply a technicality. It is a foundational element of professional trading."

– Prop Firm Plus

"The consistency rule is aimed at weeding out gamblers, scammers, and schemers who might trade a large contract one time while trading micros the rest of the time."

– Sarah Edwards, Benzinga

Interestingly, over 70% of rule violations occur in areas related to drawdown and hedging restrictions, highlighting the importance of gradual scaling and strict risk controls.

sbb-itb-46ae61d

How to Calculate the Right Position Size

Position Sizing Formula Based on Risk

To determine the correct position size, use this formula: (Account Balance × Risk %) ÷ (Stop Loss Distance × Tick Value).

Many seasoned traders stick to risking just 1% of their account per trade. This strategy helps cushion the impact of losing streaks, ensuring your account balance remains intact for future opportunities.

Here are a few practical examples:

- October 2025: If you have a $10,000 account and risk 1% with a 50-point stop and a tick value of $2, your position size would be calculated as $100 ÷ (50 × $2) = 1 micro contract.

- August 2025: Trading WTI Crude Oil on a $10,000 account with a 3% risk ($300), a 15-tick stop, and a tick value of $10, the position size becomes $300 ÷ (15 × $10) = 2 contracts.

- November 2025: For a $50,000 account risking 1.5% ($750) on an S&P 500 CFD with an 8-point stop and a point value of $5, the calculation is $750 ÷ (8 × $5) = 18.75. After rounding down, this equals 18 contracts. Always account for commissions and slippage to stay within your risk tolerance.

"The number one goal of trading isn’t to make money fast; it’s to stay in the game." – Kathy Lien, Market Analyst

These scenarios demonstrate how using smaller position sizes can shield your account from steep losses while maintaining consistent risk exposure.

To make this process even easier and ensure compliance with prop firm guidelines, the DamnPropFirms Consistency Rule Calculator can be a game-changer.

Using the DamnPropFirms Consistency Rule Calculator

While calculating position sizes manually is helpful, the DamnPropFirms Consistency Rule Calculator simplifies the process, especially when dealing with prop firm requirements. This tool applies the position sizing formula automatically while keeping track of essential factors like margin requirements and contract limits.

Prop firm consistency rules are designed to prevent traders from relying too heavily on a few big trades or over-leveraging their accounts. The calculator monitors these rules in real time, alerting you when your position sizes or profits become disproportionate to your account size. For example, it ensures you’re not trading more contracts than allowed or concentrating too much profit in a single day.

The tool also considers contract caps based on your account size. For instance, if you’re trading a $50,000 account with Take Profit Trader, you’re limited to 6 standard contracts (or 60 micro contracts). The calculator tracks these limits, helping you avoid accidental violations that could put your account at risk. By promoting disciplined risk management, it aligns perfectly with the principles of steady, balanced trading.

"Position sizing is like choosing a lifeboat size for a voyage; it does not control the sea, but it decides whether you can survive the storm and row again." – AquaFunded

Practical Risk Management Strategies for Funded Accounts

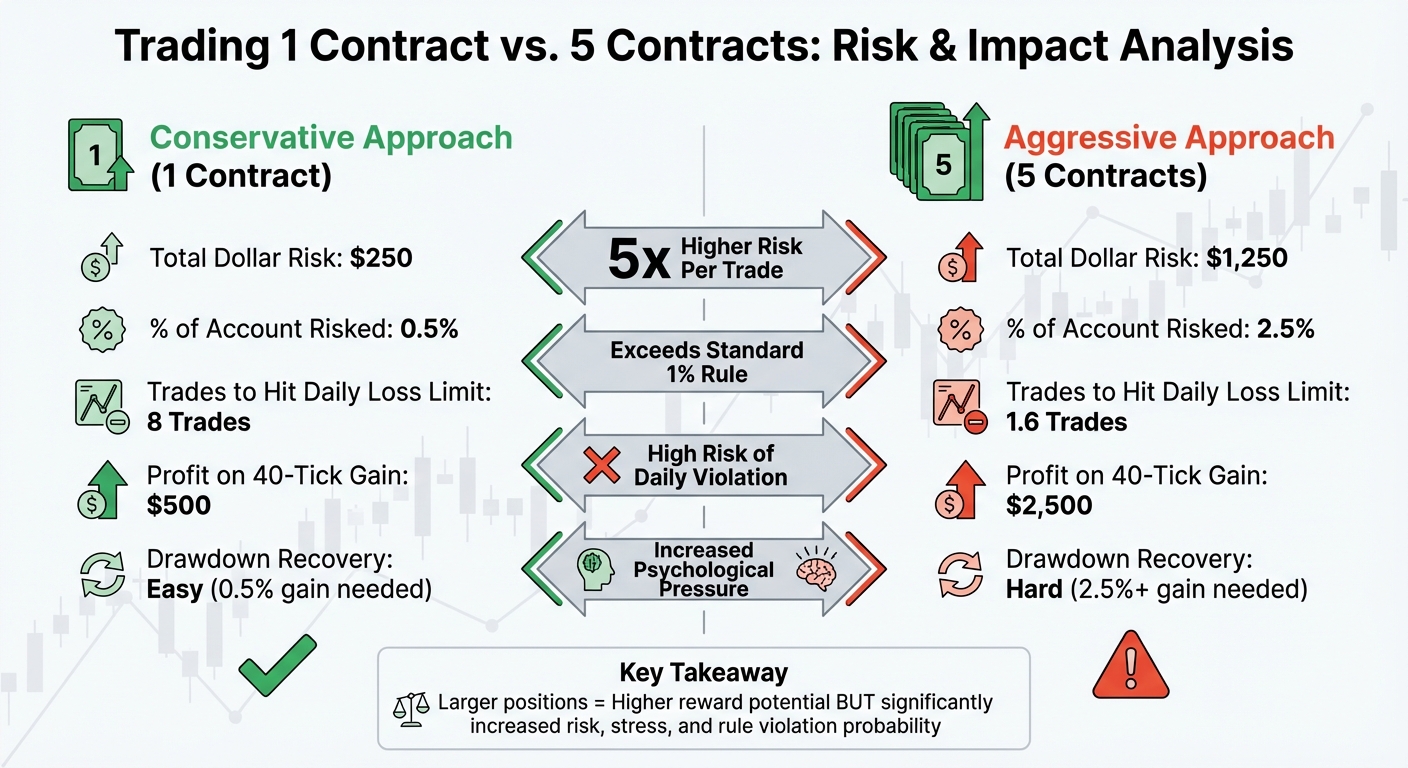

Trading 1 vs 5 Contracts: Risk and Impact Comparison

Fixed Fractional Sizing and Volatility-Based Adjustments

Fixed fractional sizing involves risking a consistent percentage – usually between 0.5% and 1% – of your account on each trade. Keeping your risk at 1% per trade means that even after ten consecutive losses, your drawdown would be about 9.5%. In contrast, risking 10% per trade could lead to a staggering 65% drawdown after the same number of losses.

When market volatility spikes, adjusting your position size based on the Average True Range (ATR) can help control risk. The ATR measures typical price fluctuations, and if it doubles, you can halve your position size to maintain the same dollar risk. This approach ensures consistent risk management during volatile periods. Many professional traders aim for at least a 2:1 reward-to-risk ratio, which helps offset the impact of commissions and fees over time.

"Position sizing is 100 percent controllable. Although the futures markets are often unstable in nature, the implementation of leverage need not be." – StoneX

Spreading Risk Across Multiple Futures Markets

Trading multiple contracts in a single market doesn’t diversify your risk – it amplifies it. For instance, trading MES, MNQ, and MYM simultaneously exposes you to the same market movements since these equity index futures are highly correlated. If one drops, the others are likely to follow.

True diversification involves trading across sectors influenced by different market factors. For example, pairing an equity index like the E-mini S&P 500 with Crude Oil (MCL) or 10-Year T-Notes (ZN) can spread your risk. Energy markets tend to react to supply disruptions and geopolitical events, while bonds are sensitive to interest rate changes. This mix can help protect your account – when one sector struggles, the other may remain steady or even move in your favor.

Comparison: Trading 1 Contract vs. 5 Contracts

The table below highlights how trading different contract sizes impacts risk and reward on a funded account. Using a $50,000 account, the example assumes trading the E-mini S&P 500 (ES) with a 20-tick stop loss ($250 per contract) and a $2,000 (4%) daily loss limit.

| Metric | 1 Contract (Conservative) | 5 Contracts (Aggressive) | Impact of Oversizing |

|---|---|---|---|

| Total Dollar Risk | $250 | $1,250 | 5x higher risk per trade |

| % of Account Risked | 0.5% | 2.5% | Exceeds standard 1% rule |

| Trades to Hit Daily Loss Limit | 8 Trades | 1.6 Trades | High risk of daily violation |

| Profit on 40-Tick Gain | $500 | $2,500 | Higher reward, but higher stress |

| Drawdown Recovery | Easy (0.5% gain needed) | Hard (2.5%+ gain needed) | Increased psychological pressure |

Trading 5 contracts may offer higher profit potential, but it also brings significant risks. With such a large position, a single bad trade could push you to your daily loss limit. On the other hand, trading 1 contract provides more breathing room, allowing you to weather multiple losses and continue trading. The trade-off for larger positions is not just financial – it also comes with increased emotional stress and a higher likelihood of breaking prop firm rules.

Conclusion

Trading more contracts doesn’t guarantee higher profits – it often means increased risk, heightened stress, and a faster path to depleting your account. The numbers don’t lie: taking on larger positions amplifies risk, making it harder to recover from losses.

"The number one goal of trading isn’t to make money fast; it’s to stay in the game." – Kathy Lien, Investing.com

Beyond managing risk, keeping your emotions in check is just as important. In trading, consistency outshines fleeting moments of success. Sticking to drawdown limits, using fixed fractional position sizing, and avoiding overly correlated markets are key strategies for staying profitable over the long haul. The most successful traders grow their accounts gradually, scaling up their positions based on performance milestones – not impulsive decisions.

DamnPropFirms provides tools like the Consistency Rule Calculator to help you navigate strict prop firm rules and avoid common mistakes with position sizing. Whether you’re exploring firms like Apex Trader Funding, Take Profit Trader, or Tradeify, understanding proper sizing is the cornerstone of long-term success. Join over 3,000 traders on the DamnPropFirms Discord to exchange insights with others who have mastered balancing risk and reward. By following these principles, you protect your account and set yourself up for sustainable success in trading.

FAQs

How does trading more contracts increase emotional stress?

Trading larger contract sizes can ramp up emotional stress, as the stakes – and potential outcomes – become more intense. Bigger positions mean the possibility of larger gains, but also steeper losses, which can stir up emotions like fear, greed, or anxiety. These feelings often cloud judgment and may lead to rash, impulsive decisions.

This kind of emotional strain can derail logical thinking, making it tougher to stick to your trading plan. By carefully managing your position sizes, you can keep stress levels in check and stay focused on achieving consistent, long-term success.

How do prop firm rules affect trading larger contract sizes?

Prop firm rules exist to manage risk and encourage consistent trading practices, but they can also restrict your ability to trade larger contract sizes. One key rule is the maximum position size limit, which determines how many contracts you’re allowed to trade based on your account tier. For instance, if you have a $50,000 account, you might be limited to six standard contracts. Exceeding this limit – even on a profitable trade – can immediately breach your account.

Another common restriction is the drawdown threshold, which could be daily or based on a trailing balance tied to your account’s equity. Larger contract sizes amplify price movements, making it easier to hit these limits. For example, a single unfavorable tick on a large position could quickly eat into a $2,000 daily drawdown allowance, potentially forcing you to scale down or even leading to account closure.

Lastly, risk-management rules – such as capping risk at 1% of your account equity per trade – become harder to stick to with larger positions. Bigger contracts mean higher dollar risk per tick, so even a small market movement can push you past the allowed risk threshold. Essentially, trading larger contracts not only heightens the chances of breaking firm rules but also reduces your ability to sustain profitability over the long term.

How can I effectively manage risk when trading futures contracts?

Managing risk in futures trading starts with smart position sizing. This means matching your contract size to your account balance and keeping potential losses on any single trade to a small percentage – like 1% of your total capital. By doing this, you protect your account from significant losses, even if you hit a rough patch. On top of that, using stop-loss orders is a must. They act as a safety net, capping losses on individual trades and ensuring you still have capital available for future opportunities.

Since futures trading involves high leverage, keeping an eye on your leverage usage is critical. Overexposing your portfolio can lead to trouble, so stick with contracts that fit comfortably within your margin limits. Avoid loading up on too many correlated positions, as they can magnify risks during volatile market swings. Having a cash buffer is also a smart move – it gives you the flexibility to weather unexpected market moves without being forced to close positions prematurely.

Another way to manage risk is by scaling in and out of trades. Adding contracts gradually as a trade works in your favor or taking partial profits along the way can help you control exposure and soften the blow of sudden price reversals. It’s also important to respect your drawdown limits, whether they’re daily or trailing. Setting clear daily loss caps and keeping an eye on your account equity can help you stay within safe boundaries and avoid account termination.

Finally, steer clear of overtrading. Stick to a clear trading plan and diversify across different markets to spread out your risk. These strategies can help you strike a balance between risk and reward, giving your account a better chance to thrive in the long run.