A funded futures account lets you trade with capital provided by a proprietary trading firm, without risking your own money upfront. To qualify, you must pass an evaluation by hitting profit targets (usually 8–10%) while staying within strict drawdown limits. Here’s how it works:

- Pay an evaluation fee: Typically $100–$1,000.

- Meet basic requirements: Be at least 18 years old and provide valid ID and proof of address.

- Choose account size: Options range from $25,000 to $250,000, with profit targets and risk limits based on the size.

- Pass the evaluation: Achieve profit targets, follow consistency rules, and stay within daily loss and drawdown limits.

- Activate your funded account: Once approved, you’ll trade in a simulated or live environment, keeping 70–90% of profits.

Success requires discipline, risk management, and consistency. Only a small percentage of traders reach payouts, so focus on following rules and preserving capital. Select a firm that matches your trading style, and use tools like payout calculators to ensure compliance with firm-specific rules.

How to get FUNDED with Futures Prop Firms (73% Win Rate)

Step 1: Meeting Basic Eligibility Requirements

To access a prop firm’s capital, you need to meet a few baseline requirements. These initial steps set the stage for tackling more advanced evaluation criteria later on.

Age and Residency Requirements

To legally trade with a proprietary trading firm, you must be at least 18 years old. While many of these firms are based in the U.S., several also welcome international traders. Before receiving your first payout, you’ll typically need to provide a valid ID and proof of address.

Selecting Your Account Size

Choose an account size that aligns with your trading style and goals. Most firms offer account sizes ranging from $25,000 to $250,000, with $50,000 and $100,000 being the most popular starting options. Your account size will determine key factors like your profit target, maximum drawdown, and contract limits. For example:

- A $50,000 account usually comes with a $3,000 profit target, a $2,000 maximum loss limit, and a 5-contract position cap.

- A $100,000 account doubles those figures, offering a $6,000 profit target, a $4,000 maximum loss limit, and a 10-contract position cap.

Starting with a smaller account can be advantageous, as it keeps monthly fees lower – typically between $97 and $167 – and allows you to focus on discipline without the pressure of higher targets. Once you’ve gained experience, you can scale up or manage multiple accounts to achieve total allocations exceeding $300,000.

Platform and Broker Compatibility

After selecting your account size, make sure your trading platform is compatible with the firm’s required data connection. Most prop firms rely on specific data connections, such as Rithmic or Tradovate, to monitor trades and enforce risk rules in real time. Popular platforms include:

- NinjaTrader

- Tradovate

- TradingView

- Quantower

Some firms provide free platform licenses, while others may require you to purchase your own. If you prefer TradingView’s user-friendly interface, look into firms like FundingTicks or My Funded Futures, which offer seamless integration with Tradovate.

"FundingTicks continues to promote the most reliable, developed and widely used trading platforms for futures trading. These include: Tradovate, NinjaTrader, TradingView"

Be mindful of data fees, as they vary between firms. Check whether these costs are included in your monthly subscription to avoid unexpected expenses.

Step 2: Passing the Evaluation Phase

Once your account is set up and the basic requirements are met, the next hurdle is the evaluation phase. This stage is designed to test your discipline and risk management skills, setting apart those ready for funding from those who need more practice.

Profit Targets and Drawdown Limits

To pass the evaluation, you’ll need to hit profit targets while keeping your losses in check. For instance, if you’re working with a $50,000 account, you’ll typically need to generate $3,000 to $4,000 in profits (6% to 8% of the starting balance). For a $100,000 account, the target usually ranges from $8,000 to $10,000.

Equally important are the loss limits. Most firms set a daily loss limit, which caps how much you can lose in a single trading day – usually between 2% and 5% of your account balance. For a $50,000 account, that’s about $1,000 to $2,500. There’s also a maximum drawdown, which represents your overall loss threshold, typically 6% to 10% of your starting or peak balance.

Many firms use an end-of-day (EOD) trailing drawdown, calculated based on your closing balance. This approach allows for intraday volatility as long as your account stays within the limits by the end of the trading session. For example, Lucid Trading’s $50,000 account features a $2,000 EOD trailing drawdown and a $600 daily loss limit.

| Firm | Account Size | Profit Target | Max Drawdown | Daily Loss Limit |

|---|---|---|---|---|

| Lucid Trading | $50,000 | $3,000 (6%) | $2,000 (EOD Trailing) | $600 |

| FundedNext | $50,000 | $4,000 (8%) | $5,000 (10% Static) | $2,500 (5%) |

| FunderPro | $100,000 | $10,000 (10%) | $10,000 (10% Static) | $5,000 (5%) |

Next, you’ll need to demonstrate consistent performance across trading days.

Consistency Rules and Minimum Trading Days

While landing a big win in a single day might sound appealing, most firms enforce a consistency rule. This limits how much of your total profit can come from one trading day – usually 40% to 50%. For example, FundedNext’s Rapid Accounts require that no single day contributes more than 40% of your total profit, while MyFundedFutures sets their limit at 50%.

Here’s how it works: (Highest Profit Day ÷ Total Profit) × 100%. If your largest profit day exceeds the allowed percentage, you may fail the evaluation.

"The consistency rule is a training tool that builds the discipline required to survive in leveraged markets." – MyFundedFutures

Most firms also require you to trade for a minimum number of days, typically between 2 and 10. Even if you’ve hit your profit target early, you’ll still need to meet this requirement. To avoid unnecessary risks, consider placing smaller trades to fulfill the time requirement without jeopardizing your gains. For example, reduce your position sizes or risk only 0.5% per trade instead of 1%. Additionally, avoid trading during volatile periods, like 30 minutes before or after major news events such as NFP or CPI releases, as these can lead to unpredictable profits and trigger reviews for consistency.

Following these rules is essential, but so is staying within contract limits.

Contract Limits and Risk Management

Each account size comes with specific contract limits. For a $50,000 account, you’re typically allowed up to 5 contracts per position, while a $100,000 account permits up to 10 contracts. Exceeding these limits can result in immediate disqualification.

Stick to these limits and keep your risk per trade between 0.5% and 1%. For a $50,000 account, that’s $250 to $500 per trade. Use a risk-to-reward ratio of at least 1:2 to ensure you’re trading strategically and protecting your capital.

"Most evaluation failures have NOTHING to do with strategy. They come from psychological pressure, rushing, or misunderstanding trailing drawdown behavior." – Vanquish Trader

Finally, close all positions by 4:45 PM EST to avoid overnight risks. If you’re trading on a Friday, make sure to exit by 8:00 PM GMT to prevent potential weekend gaps that could impact your account balance.

sbb-itb-46ae61d

Step 3: Activating Your Funded Account

After completing your evaluation, the next step is activating your funded account and managing your profits effectively.

Account Activation and Simulated Funding

Once you hit your profit targets, your account undergoes a review process lasting 24–48 hours. During this time, the firm ensures you’ve followed all the rules – no exceeding contract limits, no excessive drawdowns, and no trading violations. If everything checks out, you’ll sign a funded trader agreement that details your profit split, responsibilities, and risk management guidelines.

Some firms, like FundingTicks and MyFunded Futures, don’t charge activation fees, while others may impose a one-time fee instead of recurring subscriptions.

It’s worth noting that most funded accounts start as simulated accounts, where you trade in a demo environment but still get paid based on your performance. For instance, MyFunded Futures requires five simulated payouts before transitioning to a live funded account. Between January 2024 and July 2025, only 1.01% of participants in the Simulated Funded Account phase advanced to a Live Funded Account.

"For the first 7 days, do NOT seek to make profit. Seek to adapt to the psychological pressure of a real account." – PropFirmCodes

Experts suggest a 7-day adaptation plan to ease into funded trading. Spend two days observing the market, two days micro-trading with a 0.1% risk, and three days gradually increasing to normal risk levels. This approach helps you adjust to the mental shift from evaluation to funded trading.

Once your account is activated, the next focus is understanding payout criteria.

Payout Eligibility and Profit Splits

Profit splits typically range from 80% to 95%, depending on the firm. For example, FundingTicks offers up to 90%, while MyFunded Futures provides 80%. Some firms impose caps on initial withdrawals – on a $50,000 account, you might be limited to $2,000 per payout during the first few months. MyFunded Futures, for instance, sets a $5,000 cap per payout for specific models and a $100,000 total cap during simulated phases.

To qualify for your first payout, most firms require 5 to 10 active trading days and a minimum profit balance, often around $1,000. Payout schedules vary: some firms allow daily payouts (available 24 hours after your first trade), while others stick to weekly or bi-weekly cycles. Between January 2024 and July 2025, 28.56% of participants who reached the Simulated Funded Stage at MyFunded Futures successfully earned at least one payout.

Many firms enforce a 50% consistency rule, meaning no single trading day can contribute more than half of the total profit needed for a payout. Additionally, some firms refund your initial evaluation fee alongside your first successful payout.

Pro tip: Use the 80/20 buffer strategy – withdraw 80% of your profits and leave 20% in the account as a cushion against future losses. Also, take screenshots of your trading dashboard and metrics before requesting a payout to keep a record in case of any technical disputes.

Now, let’s look at how to scale your funded account effectively.

Scaling Your Funded Account

Scaling your account depends on consistent performance and strict risk management. To qualify for increased capital, you’ll need to maintain profitability for at least three months without any rule violations and achieve a total profit exceeding 10%. FundingTicks, for example, increases your capital by 20% every time you double your initial funded account profit – this is automated and doesn’t require extra fees or re-evaluations. Similarly, FundedNext offers a 40% capital increase every four months if you achieve a 10% profit during that period.

To manage risk, use only half of your maximum allowed contracts until your balance (including the drawdown limit and $100) reaches your "Safety Net" threshold. For instance, on a $50,000 account with a $2,500 drawdown, your safety net would be $52,600. During the first few withdrawal cycles, payouts that drop your balance below this level may be restricted.

Approximately 80% of funded accounts fail within the first few months, often due to overtrading and lack of discipline. Transitioning from a "challenge mentality" (high risk, aggressive performance) to a "funded mentality" (capital preservation, low risk) is critical. Experts recommend the 3-2-1 strategy: limit trading to 3 days per week, 2 trades per day, and aim for a 1% weekly profit target to minimize emotional errors.

Some traders maximize their potential with a multi-account strategy, managing multiple accounts (up to 20 in some firms) and using copy-trading software to replicate trades across them. For example, managing twelve $25,000 accounts through copy-trading could give you access to $300,000 in allocation, spreading risk and amplifying rewards.

Step 4: Top Prop Firms and Their Requirements

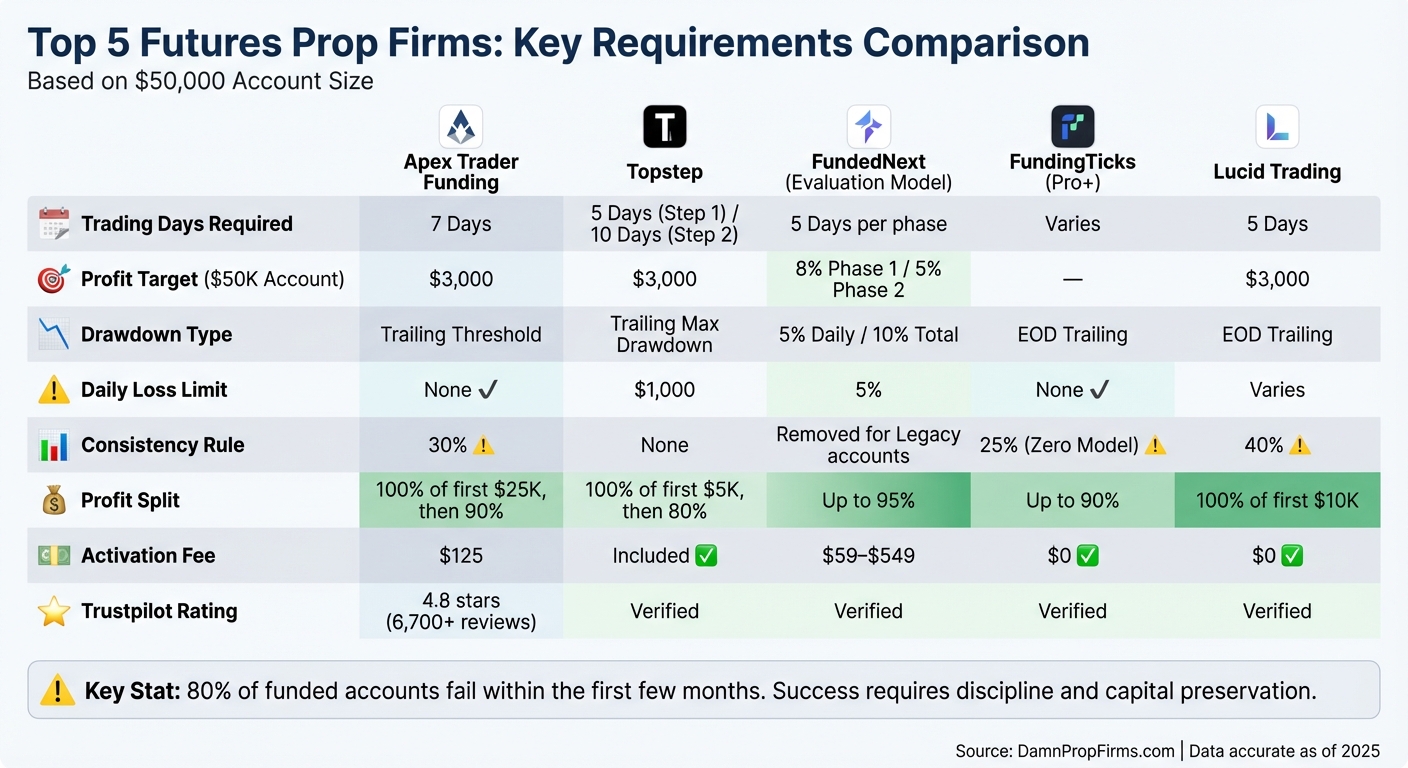

Top 5 Futures Prop Firms Comparison: Requirements and Profit Splits

After understanding the evaluation process, the next step is to compare leading futures prop firms. Carefully reviewing their key metrics can help you choose the right partner for your trading journey.

Prop Firm Comparison: Evaluation Metrics

Each prop firm has its own set of rules and qualifications. Picking the right one can significantly influence your success in funded trading.

Apex Trader Funding requires 7 trading days to meet a $3,000 profit target on a $50,000 account. They use a trailing threshold drawdown of $2,500, which stops adjusting once your balance exceeds the threshold by $100. Apex also enforces a 30% consistency rule, meaning no single day can contribute more than 30% of your total profit when requesting a payout. With a 4.8-star rating on Trustpilot from over 6,700 reviews, they are known for reliable payouts and strong customer support. A $125 activation fee applies to a $50,000 account.

Topstep uses a two-step evaluation process: 5 days to demonstrate profit and 10 days to show risk management. For a $50,000 account, traders must achieve a $3,000 profit target while staying within a $1,000 daily loss limit. You keep the first $5,000 in profits, with an 80% split on additional earnings. Monthly subscription fees range from $150 for a $30,000 account to $375 for a $150,000 account. Topstep prohibits holding positions during major economic releases.

FundedNext Futures offers two models: a 2-step "Evaluation Model" with profit targets of 8% and 5% for each phase, and a 1-step "Express Model" with a 10% target. Both require 5 trading days per phase, with a 5% daily loss limit and a 10% total drawdown. Profit splits can go up to 95%, and entry fees range from $59 for a $6,000 account to $549 for a $100,000 account. Notably, FundedNext removed consistency rules for Legacy accounts bought or reset after November 21, 2025.

FundingTicks provides two models: the Pro+ Model, which has no daily loss limits and uses an end-of-day (EOD) trailing drawdown, and the Zero Model, which offers direct master account access. A $25,000 Pro+ account costs $99 per month, while the Zero Model has a one-time fee of $333. FundingTicks offers profit splits of up to 90% and allows copy-trading with allocations up to $300,000. Capital increases by 20% each time profits double.

Lucid Trading requires 5 trading days to meet a $3,000 profit target for a $50,000 account. They use an EOD trailing drawdown and enforce a 40% consistency rule. The $50,000 LucidTest costs $135 with no activation fee, and traders keep 100% of their first $10,000 in profits. Lucid also allows daily payouts, enabling quick access to earnings.

For more details on firms like Take Profit Trader, Alpha Futures, Tradeify, and others, visit DamnPropFirms for in-depth reviews.

| Feature | Apex Trader Funding | Topstep | FundedNext (Evaluation) | FundingTicks (Pro+) | Lucid Trading |

|---|---|---|---|---|---|

| Trading Days | 7 Days | 5 Days (Step 1) / 10 Days (Step 2) | 5 Days per phase | Varies | 5 Days |

| Profit Target ($50K) | $3,000 | $3,000 | 8% Phase 1 / 5% Phase 2 | – | $3,000 |

| Drawdown Type | Trailing Threshold | Trailing Max Drawdown | 5% Daily / 10% Total | EOD Trailing | EOD Trailing |

| Daily Loss Limit | None | $1,000 | 5% | None | Varies |

| Consistency Rule | 30% | None | Not specified (removed for Legacy accounts) | 25% (Zero) | 40% |

| Profit Split | 100% of first $25K, then 90% | 100% of first $5K, then 80% | Up to 95% | Up to 90% | 100% of first $10K |

| Activation Fee | $125 | Included | $59–$549 | $0 | $0 |

"Apex is more than just a funding provider – we’re here to support your journey and help you develop a strategy that works for you." – Apex Trader Funding

DamnPropFirms Tools and Resources

To make comparing firms easier, DamnPropFirms provides a range of tools and resources. With varying rules for consistency, drawdowns, and profit targets, it’s easy to feel overwhelmed. DamnPropFirms simplifies this process with verified reviews, detailed comparisons, and tools tailored for futures traders.

One standout tool is the Consistency Rule Calculator, which helps you check whether your trading performance aligns with specific firm requirements. Whether it’s the 50% rule at MyFunded Futures, the 30% rule at Apex, or the 25% rule at FundingTicks, this tool ensures you won’t be caught off guard when requesting a payout.

For in-depth breakdowns of evaluation steps, costs, payout structures, and trader feedback, DamnPropFirms offers detailed reviews of firms like Apex Trader Funding, Topstep, FundedNext, FundingTicks, and Lucid Trading.

Conclusion

Getting a funded futures account boils down to four essential steps: meeting the basic eligibility requirements, passing the evaluation phase, activating your funded account, and selecting the right proprietary trading firm. The key ingredients for success? Preparation and discipline.

Here’s a sobering statistic: about 80% of funded accounts fail, and only 10–15% of traders manage to secure consistent payouts. These numbers emphasize why treating the evaluation phase as if it were a live account is critical. The focus should always be on preserving capital rather than obsessing over hitting profit targets.

"The difference between a trader who keeps their account for 6 months and one who keeps it for 5 years? Discipline and long-term strategy." – PropFirmCodes

This quote serves as a reminder of how crucial it is to align with a firm that matches your trading style and goals.

Before diving into the evaluation phase, take the time to review the specific requirements of your chosen firm. Websites like DamnPropFirms can be invaluable. They provide tools like the Consistency Rule Calculator to help you ensure your trading performance meets payout rules. For instance, you’ll find details on the 30% rule at Apex Trader Funding, the 40% rule at Lucid Trading, and the 25% rule at FundingTicks. With verified reviews, in-depth evaluations, and tools tailored for futures traders, DamnPropFirms makes navigating the process much easier.

Ultimately, success in funded trading comes down to consistent execution, strict risk management, and following the rules. Focus on preserving your capital and locking in profits. A disciplined approach and a steady strategy are your best bets for achieving long-term success.

FAQs

What can I do to improve my chances of passing the funded account evaluation?

To improve your chances of passing the evaluation phase for a funded futures account, focus on a few essential strategies. Start with a well-thought-out trading plan. This should include clear entry and exit rules, defined risk limits, and stop-loss levels. Keep your risk per trade low – ideally between 1% and 2% – and set a daily loss cap in the range of 2% to 5%. These limits are designed to protect your account while you work toward hitting the evaluation’s profit targets.

Rely on a trading strategy that’s been thoroughly back-tested across various market conditions. Aim for a win rate between 55% and 65%, with profits ranging from 8% to 15% of the account value. Discipline is your best ally here – stick to your plan, avoid emotional decisions like revenge trading, and treat each trade as a step in a longer journey. To refine your approach, maintain a detailed trade journal. Use it to evaluate your performance and make data-driven adjustments.

Additionally, adhere to the firm’s rules, focus on trading during high-liquidity hours, and steer clear of overtrading. By combining consistent effort, disciplined risk management, and a reliable strategy, you’ll set yourself up for a much better shot at passing the evaluation and securing that funded account.

How can I choose the best funded futures account size for my trading goals?

Choosing the right account size depends on a mix of factors, including your risk tolerance, income goals, and trading style. Larger accounts can offer greater potential profits and higher drawdown limits, but they also come with steeper evaluation fees. On the other hand, smaller accounts are more budget-friendly and less overwhelming, making them a solid choice for those just starting out.

When deciding, think about your income target – whether monthly or yearly – and calculate backward using the firm’s profit split. For instance, with a $50,000 account and a 90% profit split, a 10% return could give you $4,500 a month. A $100,000 account, under the same conditions, could generate $9,000. It’s also important to consider your trading strategy. Scalping often requires more capital per contract, while swing trading can be managed with smaller balances.

Before committing, try out the account size in a demo environment. This will help you determine if it feels manageable. The best account size is one that fits your budget, supports your income goals, and aligns with your trading approach – all without causing unnecessary pressure.

What are the common mistakes that can disqualify traders during the evaluation process?

Traders often face disqualification during evaluations due to breaking risk management rules. Most funded futures programs set strict caps on daily losses and overall drawdowns. Going beyond these limits usually leads to immediate failure. On top of that, many firms enforce a consistency rule, which means they expect profits to be earned steadily rather than relying on a single big winning day. For example, if more than 40-50% of your total profits come from just one trading day, your evaluation could be rejected – even if you hit the profit target.

Another pitfall many traders encounter is bringing a high-risk approach into the funded stage. After passing the evaluation, some continue to overtrade or take on excessive risk, often risking 0.25-0.5% (or more) of their account per trade. Instead, the focus should shift to capital preservation during the initial weeks. This means prioritizing small, low-risk trades to adjust to the funded account’s rules and limitations. The key to keeping your account intact is staying disciplined and consistently following the firm’s guidelines.