Struggling with trading discipline? It’s not your willpower – it’s your brain under sensory overload.

Trading environments are designed to overwhelm: constant notifications, flashing charts, and high-stakes decisions flood your brain with stress hormones, impairing logical thinking. This isn’t about character flaws; it’s biology. Overstimulation triggers emotional reactions like overtrading or revenge trading, leading to poor decisions and losses.

Here’s the key takeaway: reduce overstimulation to trade more effectively. Simplify your charts, limit distractions, and manage your mental energy with mindfulness techniques. Tools like trading journals and calculators can also help you stay focused and consistent. Trading success isn’t about pushing harder – it’s about creating a calmer, clearer environment for better decisions.

Trading Psychology: How to Beat Overtrading and Impulsive Clicks | Paradigm Shift

What Overstimulation Means for Futures Traders

Overstimulation isn’t just about feeling "busy" or "stressed." It’s a biological state where your brain is bombarded with more sensory input than it can handle. For futures traders managing funded accounts, this often happens when juggling multiple data streams and strict trading limits. With your working memory only able to hold 4–7 items at a time, it doesn’t take much to overwhelm it. When that happens, your brain shifts gears – from logical, clear-headed decision-making to emotional, knee-jerk reactions.

Funded traders face a unique kind of pressure that can make overstimulation even worse. The rigid evaluation criteria – daily loss limits, profit targets – create a high-stakes environment where every move feels like walking a tightrope. One wrong trade could jeopardize your account. On top of that, trading remotely adds another layer of stress. Unlike a bustling trading floor, remote traders often work in isolation, which can magnify the mental strain. As one expert from FunderPro explains:

"Trading isolation isn’t just physical. It’s the psychological pressure that builds when high-stakes decisions happen in silence."

– FunderPro

After a losing streak, being alone with your thoughts can turn your inner voice into a harsh critic, piling on even more mental stress. This overload doesn’t just cloud your judgment – it lays the groundwork for the cognitive challenges we’ll explore next.

How Mental Overload Impairs Trading Decisions

As sensory overload builds, it can evolve into impaired decision-making. Your brain’s emotional center, the amygdala, often takes over, sidelining the rational cortex. Dr. Jaideep Bains from UHN’s Krembil Research Institute explains:

"Your brain is designed to protect you from danger, and that means you can’t really make a rational decision in a stressful situation… because a lot of your energy and thought processes are going towards something dangerous that may occur."

This shift can lead to tunnel vision and rapid decision fatigue, making impulsive reactions more likely. Instead of sticking to your well-thought-out strategy, you might find yourself chasing the latest price movement or reacting to a news headline. Studies show that multitasking in complex situations can increase error rates by up to 50%.

A dopamine loop can also kick in, turning clicking into a compulsive habit that distracts you from your strategy. Jasper Osita, a market analyst at ACY Securities, puts it bluntly:

"You click not because the setup is there, but because you’re uncomfortable with stillness."

Decision fatigue compounds the issue. With humans making an average of 35,000 decisions daily, high-stakes trading quickly drains mental energy. For example, a study on parole board judges revealed that favorable decisions dropped from 65% to nearly 0% as sessions wore on without breaks. Similarly, as your mental energy depletes, the quality of your trading decisions inevitably declines.

Warning Signs of Overstimulation

Catching the early signs of overstimulation can save you from costly mistakes. Physically, you might experience symptoms like a tight chest, shortness of breath, or a racing heart before placing a trade. Feeling unusually exhausted after just a few hours at your desk – even without much physical activity – can also signal that your nervous system is overloaded.

Behavioral warning signs include impulsive trades that ignore your checklist, revenge trading after losses, or entering trades driven by FOMO rather than clear setups.

Cognitively, you might struggle to focus on a single chart, frequently switch between markets or timeframes, or forget your trading rules when you need them most. If you find yourself staring at your screen without a clear reason to act, it’s likely your brain’s way of saying it needs a break. Research shows that sustained attention tasks can significantly reduce accuracy and alertness in just 20–30 minutes.

Kyle Maring from HighStrike LLC explains the difference between controlled and reactive trading:

"The difference between active trading and overtrading is control; disciplined action is strategic, overtrading is reactive."

How to Reduce Overstimulation While Trading

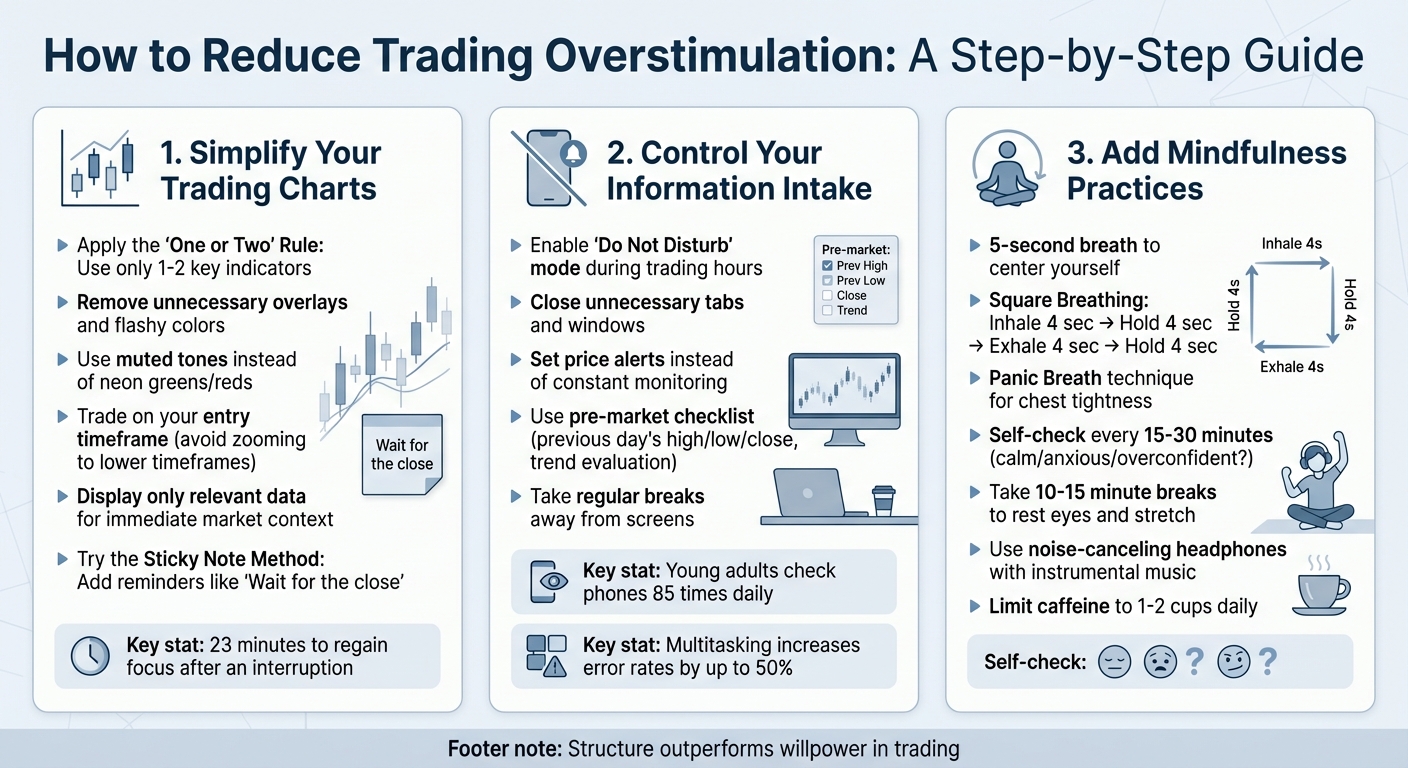

How to Reduce Trading Overstimulation: A Step-by-Step Guide

Once you’ve recognized the signs of overstimulation, it’s time to take steps to manage it. The aim isn’t to eliminate all stimulation – some level of engagement is essential for effective trading. Instead, the goal is to create an environment where your mind can process information without feeling overwhelmed. Here are some strategies to help you stay focused and confident while trading.

Simplify Your Trading Charts and Indicators

Your trading chart should act as a decision-making tool, not a source of confusion. Start by stripping it down – remove unnecessary indicators, overlays, and flashy color schemes. Focus on the essentials like price action and volume. As Katie Gomez from Trade-Ideas wisely states:

"A clean workspace allows for a clear mind."

Stick to the "One or Two" Rule: limit yourself to one or two key tools, such as a single moving average or a horizontal level line. These should guide you, not overwhelm you. Avoid bright, eye-straining colors like neon greens or reds. Instead, opt for muted tones that promote a calm and focused mindset.

Timeframe discipline is just as important. Manage your trades using your entry timeframe or a higher one. Zooming into lower timeframes during a trade can lead to emotional overreactions and disrupt your plan. For intraday trading, only display enough data to understand the immediate market context – there’s no need to review years of history. You might also try the Sticky Note Method: place a small sticky note near your trading screen with reminders like "Wait for the close" to encourage thoughtful decisions before executing trades.

Control Your Information Intake

Managing external inputs is just as critical as optimizing your charts. Overstimulation often comes from too much information. Instead of constantly checking positions, P&L windows, and market news, set strict limits. Research from the University of California, Irvine, reveals it takes about 23 minutes to regain full concentration after an interruption. Every notification or alert chips away at your focus.

Try a Notification Blackout: turn on "Do Not Disturb" mode and close unnecessary tabs during trading hours. Studies show that young adults check their phones an average of 85 times a day, often for just a few seconds, which conditions their attention spans to be fleeting. Louise Bedford, a trader and author, puts it perfectly:

"Attention is like money. It’s finite. We need to be careful about how and where we spend it."

Instead of staring at screens all day, set price alerts or candle-close alarms to stay informed without constant monitoring. Step away from your desk periodically to reset your perspective. Use a written pre-market checklist to outline key levels like the previous day’s high, low, and close, and evaluate the trend before the session begins. As Charles Schwab, former President of US Steel, once advised:

"Every morning, make a list of the things you have to do that day in order of importance. Concentrate on the first task until it is finished, without diverting your attention to anything else."

Add Mindfulness Practices to Your Routine

Mindfulness can help create a pause between what happens in the market and how you react to it. Start with a simple five-second breath to center yourself and release tension. If a trade doesn’t go as planned, take three slow, deep breaths to regain focus and avoid impulsive decisions.

Different breathing techniques can be helpful depending on your emotional state. Square Breathing – inhale for 4 seconds, hold for 4, exhale for 4, and hold for 4 – can lower stress and heart rate during tense moments. If you feel tightness in your chest, the Panic Breath technique, which involves holding your breath as long as possible, can help relieve that pressure. Dr. Julie Manz, a psychologist specializing in trading performance, explains:

"Practicing mindfulness in trading is not about eliminating emotions but about managing them with awareness and composure."

Pause every 15–30 minutes to check in with yourself – are you calm, anxious, or overconfident? This quick self-assessment can keep emotions from influencing your decisions. Taking a 10–15 minute break to rest your eyes and stretch can also boost your mental clarity and discipline. Additionally, noise-canceling headphones paired with instrumental music or white noise can help block distractions and keep you in the zone. Lastly, limit your coffee intake to one or two cups a day – too much caffeine can lead to jitters and restlessness, making it harder to stay composed. These practices can help you maintain the focus needed to execute your trading strategy effectively.

sbb-itb-46ae61d

Tools That Help Maintain Focus and Consistency

When it comes to reducing sensory overload, the right tools can make a world of difference. They help transform distractions into clarity, especially for traders managing multiple accounts or navigating high-pressure environments. Two key approaches stand out: maintaining a detailed trading journal and leveraging specialized tools for account management.

How to Use a Trading Journal

A trading journal is more than just a log of your trades – it’s a mirror that reveals how overstimulation can affect your decisions. By documenting your emotional state before, during, and after each trade, you can uncover patterns. For example, you might notice a tendency to overtrade during volatile markets or take impulsive trades after a losing streak. As professional trader Adam Grimes wisely notes:

"The less you want to do your journal on any period, the more you need to."

To get started, record your conviction level (on a scale of 1 to 10) before each trade. Over time, this will help you determine whether your high-conviction trades consistently outperform impulsive ones. Dr. Pipslow, a trading psychologist at BabyPips, emphasizes the importance of this awareness:

"Knowing is half the battle. Once you have knowledge of what causes distress, you can make the proper adjustments to keep negative situations from affecting your account."

Balance is key. Even in losing trades, note what you did well – like cutting losses early or sticking to your plan despite fear. This practice prevents "negativity fatigue" and helps maintain your confidence. Set a regular review schedule: daily for active traders or weekly for swing traders. The goal is to analyze patterns, not just collect data. Having concrete evidence that your strategy works can keep you grounded during short-term market swings.

While a trading journal sharpens your self-awareness, automated tools can simplify the logistics of trading itself.

DamnPropFirms Tools for Streamlined Trading

Managing multiple funded accounts can feel overwhelming, but DamnPropFirms offers tools designed to cut through the noise. These tools address the mental clutter that comes with juggling account requirements and administrative tasks.

The Consistency Rule Calculator is a lifesaver for staying within prop firm limits. Instead of doing mental math during trading hours, you can quickly check your boundaries and focus on the market. This tool removes the guesswork, ensuring you don’t accidentally violate consistency rules.

For an even more streamlined experience, the TradeSyncer allows you to copy trades across multiple accounts simultaneously. If you’re managing several funded accounts, this tool eliminates the need for manual entries and reduces the risk of errors. With TradeSyncer, you execute a trade once, and the system handles the rest, giving you more mental space to focus on finding quality setups.

Both tools are tailored specifically for futures traders working with funded accounts. By reducing complexity, they help you maintain clarity and focus where it matters most.

Conclusion: Improve Your Trading by Managing Overstimulation

Becoming a consistent trader isn’t about relying on sheer willpower – it’s about cutting through the noise. Simplifying your charts, managing the flow of information, and practicing mindfulness before placing trades can give you the mental clarity needed to make sound decisions. This is especially important in futures prop trading, where a single moment of overstimulation could breach drawdown limits and cost you a funded account.

Structure always outperforms willpower. As ATFunded says, "In trading, luck doesn’t last. Structure does." The traders who succeed in prop firm challenges aren’t necessarily the most skilled – they’re the ones who control their inputs and conserve their mental energy. Focusing on just 1–2 instruments, using a pre-trade checklist, and trading in 90-minute focused blocks with regular breaks not only reduces stress but also builds a repeatable, reliable system. This kind of structure keeps sensory overload in check, allowing for clearer thinking and better decisions.

To make this structured approach work, lean on tools that simplify your decision-making process. The right tools can be as important as your mindset. For example, a trading journal can help you identify emotional patterns you might overlook. Tools like DamnPropFirms’ Consistency Rule Calculator and TradeSyncer streamline administrative tasks, turning raw data into actionable insights. These tools reduce the mental clutter that often leads to poor decisions, freeing you to focus on high-quality setups and execute them with confidence.

Interestingly, many traders dedicate most of their time to perfecting strategies, yet prop firm challenges are often won or lost due to mindset and psychological discipline. Instead of adding more indicators, focus on removing distractions to let your logical side take charge. When logic takes the lead, your trading edge can truly shine. This clarity is the foundation for safe, consistent, and profitable trading.

Start small. Make one adjustment today. Turn off notifications during market hours, remove an unnecessary chart indicator, or try square breathing before your next trade. These small changes help cultivate the calm and focus you need to trade effectively. Over time, consistency will follow.

FAQs

How can I tell if I’m overstimulated while trading?

Overstimulation in trading can manifest in both physical and mental ways. You might notice feelings of restlessness, anxiety, or an uncontrollable urge to keep checking charts and news updates – often when there’s no real need. Physically, it can show up as headaches, tight shoulders, or even a racing heartbeat, all signs that your nervous system is in overdrive. Mentally, it might become harder to concentrate on a single trade setup, you might skip your usual pre-trade checklist, or you could feel a strong impulse to make rash decisions, especially after a loss.

Your trading habits can also hint at overstimulation. Overtrading, making spur-of-the-moment choices, or completely abandoning your trading strategy are all warning signs. Increasing position sizes or tweaking stop-loss levels on a whim are other indicators that emotions are taking charge over logic. Spotting these behaviors early gives you the chance to simplify your trading setup, cut down on distractions, and refocus – helping you make more thoughtful and effective decisions.

What are some simple mindfulness techniques traders can use to stay focused?

Mindfulness techniques offer traders practical ways to stay calm, maintain focus, and handle the pressures of futures trading more effectively. Here are a few strategies worth trying:

- Focused breathing: Set aside a few minutes before or even during trading to take slow, deep breaths. This simple practice can help ease stress and sharpen your concentration.

- Body-scan meditation: Dedicate 5–10 minutes to mentally scan your body, focusing on each part to release any tension and feel more grounded.

- Mindful journaling: After your trading session, jot down your thoughts, emotions, and decisions. This habit builds self-awareness and can reveal patterns in your trading approach.

These techniques are straightforward to integrate into your daily routine, and over time, they can positively impact both your performance and mindset.

How can tools like trading journals and calculators help reduce overstimulation in trading?

Trading journals serve as a reliable partner for futures traders, offering a structured way to record your thoughts, emotions, and trade results. By jotting down your decisions, you free up mental bandwidth and steer clear of overanalyzing previous trades. They also provide a clear feedback loop, helping you spot patterns and fine-tune your strategy without feeling overwhelmed.

Risk and position-size calculators take the guesswork out of numbers by instantly calculating stop-loss levels, contract sizes, and profit-loss scenarios. Instead of juggling spreadsheets or doing manual math, these tools save time and reduce mental effort, letting you concentrate on analyzing the market.

When used together, these tools simplify your trading process by organizing critical information and automating calculations. This minimizes distractions, lowers stress, and helps you stay focused and disciplined – key ingredients for consistent success in the fast-moving world of trading.