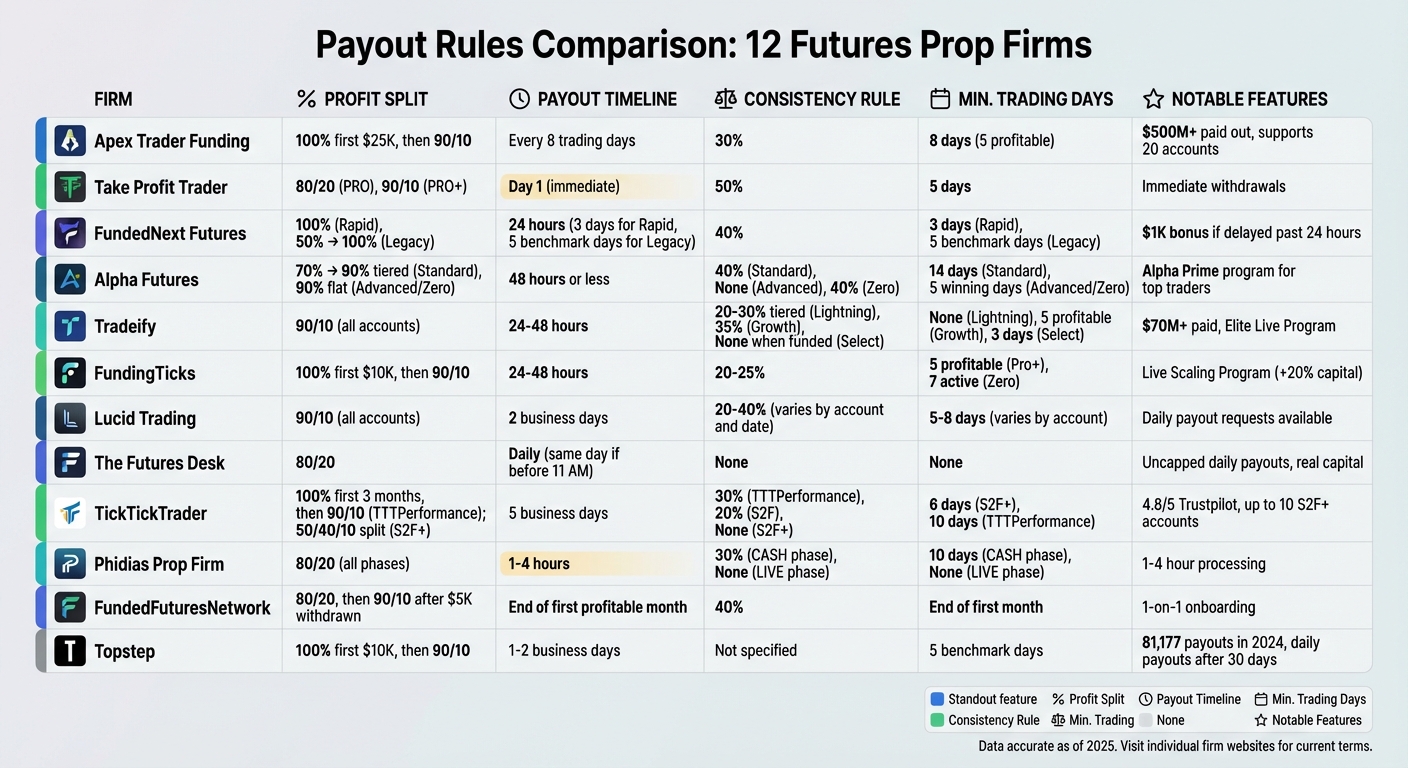

Futures proprietary trading firms allow traders to access firm capital, but payout eligibility depends on specific rules. These rules often include minimum trading days, profit consistency requirements, and payout caps. Violations can delay or deny withdrawals, even for profitable traders. Here’s a quick summary of key details from the best futures prop firms:

- Profit Splits: Ranges from 80% to 100%, with some firms offering 100% on initial profits (e.g., Apex Trader Funding).

- Payout Timelines: Varies from daily to bi-weekly, with some firms processing payouts in as little as 24 hours.

- Consistency Rules: Many firms limit how much a single day’s profit can contribute to the total (e.g., 30%-40%).

- Minimum Trading Days: Common requirements include 5-10 trading days before the first withdrawal.

- Withdrawal Caps: Initial payouts may be capped but often increase with account progression.

Each firm has unique guidelines tailored to different trading styles. Below are highlights from notable firms:

- Apex Trader Funding: 100% split on the first $25,000; 30% consistency rule; payouts every 8 trading days.

- Take Profit Trader: Immediate withdrawals for PRO accounts; 50% consistency rule only in eval, no consistency in PRO accounts or PRO+.

- FundedNext Futures: 24-hour payout processing; two challenge models with varying requirements.

- Alpha Futures: Tiered profit splits up to 90%; Advanced accounts have no consistency rules.

- Tradeify: Instant funding options; tiered payout caps for Lightning accounts.

- Topstep: 100% of the first $10,000 in profits; daily payouts after 30 trading days.

For a detailed breakdown of each firm’s rules, including payout timelines, profit splits, and consistency requirements, explore the sections below.

Futures Prop Firm Payout Rules Comparison: 12 Major Firms

I got 300+ Payouts, here are the hidden rules Prop Firms won’t tell You

1. Apex Trader Funding

Apex Trader Funding offers a 100% profit split on the first $25,000 earned per account. After hitting this milestone, the profit split adjusts to 90/10, with 90% going to the trader. Since 2022, this structure has resulted in payouts exceeding $500 million. In fact, in April 2025, a single trader received an impressive payout of $2,552,800.50.

To qualify for withdrawals, traders need to complete 8 trading days, including 5 profitable days where each day earns at least $50. Additionally, the account balance must surpass a set minimum threshold. For instance, a $50,000 account requires a balance of $52,600 to initiate a withdrawal. The minimum payout amount is $500, and requests can be made every 8 trading days.

Apex enforces a 30% consistency rule to ensure profits aren’t overly reliant on a single trading day. Specifically, no single day can contribute more than 30% of the total profit balance at the time of withdrawal. This is calculated using the formula:

Highest Profit Day ÷ 0.3 = Minimum Total Profit Required.

If this rule is violated, traders must continue trading until the total profit increases enough to meet the requirement.

For the first three payouts, accounts must maintain a "safety net" – this is the unrealized trailing drawdown limit plus drawdown limit plus $10000. Starting with the sixth payout, withdrawal caps are removed, allowing traders full access to their profit balance (subject to the 90/10 split beyond $25,000). Approved payouts are typically processed within 3 to 7 business days.

"Getting my first payout took less than a week from request to money in my bank account. Apex is the fastest prop firm payout I’ve seen." – Chris T., Funded Trader

For traders managing multiple accounts, withdrawals of $2,000 per $50,000 account can be made every 8 trading days. A one-time activation fee ranging from $85 to $145 applies, depending on the account size and platform.

Next, we’ll dive into the payout guidelines provided by Take Profit Trader.

2. Take Profit Trader

Take Profit Trader offers a standout feature: a "day one" payout policy, allowing traders to withdraw earnings immediately upon reaching PRO status. The profit-sharing structure is generous, with PRO accounts receiving an 80/20 split and PRO+ accounts – an invite-only tier for top performers or those making $10,000 in a single day – enjoying a 90/10 split.

To qualify, traders must pass a one-step evaluation by hitting profit targets and trading for at least five days. A 50% consistency rule ensures no single day dominates the total profits. Once funded, traders need to place at least one trade weekly to stay eligible for payouts.

For PRO accounts, there’s a buffer requirement based on the account’s maximum drawdown before withdrawals can begin. For instance, on a $50,000 account, the balance must reach $52,000 before profits above the buffer are available at the 80% split. PRO+ accounts, however, skip this buffer entirely, giving traders instant access to all profits at the 90% split.

Withdrawals are streamlined and processed within one business day using tools like Plaid, PayPal, or Wise. Between January and August 2023, Take Profit Trader reported a 20.37% evaluation pass rate, with traders allowed to manage up to five active accounts at once.

"You need to look at TakeProfit because they have changed the nature of the prop industry where you had to wait this long period of time… in order to get a payout." – Ben, Funded Trader

A one-time activation fee of $130 applies to PRO accounts, while monthly evaluation subscriptions range from $150 to $360. To maintain eligibility, all positions must be closed by 5:00 PM EST daily.

Next, we’ll explore how FundedNext Futures approaches payout eligibility and milestones.

3. FundedNext Futures

When it comes to prop firm payout rules, FundedNext Futures stands out with its two challenge models: Rapid and Legacy. Each model has its own payout timelines and eligibility requirements.

With the Rapid Challenge, traders can request their first payout just 3 days after successfully completing the evaluation. On the other hand, Legacy accounts require 5 Benchmark Days – these are defined as days where traders earn at least $100 on a $25,000 account or $200 on larger accounts – before they can make their first withdrawal.

Profit splits vary depending on the account type. Rapid accounts offer 100% of requested rewards, but initial payouts are capped between $800 and $2,500. These caps are lifted after the fifth payout. Legacy accounts, however, start with a 50% profit split for the first 30 Benchmark Days, which then increases to 100%. Initial payout caps for Legacy accounts range from $3,000 to $6,000 and are removed after 30 Benchmark Days. A 40% consistency rule is also in place: for Rapid accounts, this rule applies during the funded stage, while for Legacy accounts, it only applies during the evaluation phase. This rule ensures that no single day contributes more than 40% of total profits.

Traders who accumulate $100,000 in active profits are eligible for the Live Trading Program, which allows them to trade with real capital. Payouts in this program are settled within 3–5 business days.

"If FundedNext delays your payout beyond 24 hours (excluding trader or processor errors), you automatically earn an extra $1,000." – FundedNext Futures Brand Promise

FundedNext processes payout requests within 24 hours, with an average processing time of just 5 hours. The firm has a strong reputation, boasting a 4.6/5 rating on Trustpilot. Additionally, there are no activation or monthly fees after passing the challenge. Challenge fees range from $79.99 to $249.99.

Now, let’s take a look at how Alpha Futures approaches payouts with its unique structure.

4. Alpha Futures

Alpha Futures provides traders with three account options: Standard, Advanced, and Zero, each featuring distinct payout structures and requirements.

Standard accounts come with a 14-day waiting period and a 40% consistency rule, meaning no single day’s profit can exceed 40% of total net profits. The profit split is tiered: traders receive 70% for the first two payouts, 80% for the third and fourth, and 90% for all subsequent payouts. Payouts range from a minimum of $200 to a maximum of $15,000.

Advanced accounts operate differently. To qualify, traders must achieve 5 winning trading days, each with at least $200 in profit. These accounts do not impose the consistency rule and offer a flat 90% profit split starting from the first payout. However, until traders complete 30 qualifying trading days with $200+ profits, only 50% of profits can be withdrawn. After meeting this milestone, the flat 90% split applies. Withdrawals start at a minimum of $1,000, with a maximum cap of $15,000.

Zero accounts also require 5 winning trading days with $200+ profits but enforce a 40% consistency rule. These accounts feature a flat 90% profit split from the beginning and have no activation fees. Payouts start at $200, with maximum withdrawals capped at $1,500 for 50K accounts and $3,000 for 100K accounts.

"Alpha Futures payout policies are extremely straightforward; follow the rules and you will be paid out. No additional hoops to jump through or hidden denials."

- Benjamin Chaffee, Author, Alpha Futures Limited Help Center

Payout requests are processed quickly, typically within 48 business hours or less. Traders who achieve a payable balance of $40,000 or complete 5 payouts may be invited to join Alpha Prime, the firm’s live trading program based in London. This program offers a monthly salary, a 60% profit split, and the option for daily payouts.

With Alpha Futures’ account structures detailed, let’s turn our attention to how Tradeify handles its payout system.

5. Tradeify

Tradeify offers three account types – Lightning, Growth, and Select – each designed with specific payout structures. All accounts come with a 90% profit split, making it an appealing choice for traders.

Lightning accounts provide instant funding with no evaluation process. Traders can withdraw profits as soon as they hit their goals, with no minimum trading days required. However, payout caps are tiered: for a $50K Lightning account, the first three payouts are capped at $2,000, increasing to $2,500 for subsequent payouts. The consistency rule also scales, starting at 20% for the first payout, moving to 25% for the second, and reaching 30% for all following payouts. One trader reportedly received a $15,000 payout in under 10 minutes.

For those who prefer a structured evaluation, Growth accounts offer a different setup. These accounts require traders to achieve five profitable days before making a withdrawal. For $50K accounts, daily profit thresholds begin at $150. A flat 35% consistency rule applies across all payouts. Payout caps are more generous compared to Lightning accounts – a $50K Growth account starts with a $1,500 cap for the first payout and increases to $3,000 by the fourth payout. Minimum payouts are set at $500 for $50K accounts and $1,000 for larger accounts.

Select accounts take a unique approach by removing consistency rules after funding. Following a 3-day evaluation, traders can choose between two options: Select Daily, which allows daily withdrawals but includes a Daily Loss Limit, or Select Flex, which permits withdrawals every five trading days without a Daily Loss Limit and offers higher payout caps. Both options require a $1,000 minimum payout, and withdrawals are typically processed within 24 to 48 hours.

After completing five successful payouts, traders qualify for the Tradeify Elite Live Program, which provides the ability to request daily payouts and eliminates the Daily Loss Limit altogether. Tradeify has processed over $70 million in verified payouts and holds a 4.7 Trustpilot rating, earning a reputation for quick processing times.

With Tradeify’s account options covered, the next section will explore how FundingTicks handles withdrawals.

6. FundingTicks

FundingTicks provides traders with three account options – One, Pro+, and Zero – each designed to let users keep 100% of their first $10,000 in profits before switching to a standard 90/10 profit split. Here’s a closer look at the specifics of each account type:

Pro+ Rewards Account

The Pro+ Rewards Account requires traders to complete at least five profitable trading days before they can request their first payout. Daily profit minimums must also be met:

- $100 for a $25K account

- $150 for a $50K account

- $200 for a $100K account

Additionally, traders need to reach the breakeven point on their trailing drawdown, which is set at $1,000 (25K), $2,000 (50K), and $3,000 (100K). Once these conditions are satisfied, payouts can be requested every five trading days. The maximum withdrawal is capped at 60% of profits, with a limit of $5,000, while the minimum payout ranges from $250 to $1,000, depending on the account size.

One Rewards Account

The One Rewards Account offers more flexibility. Traders can request payouts every seven calendar days starting from their first executed trade, and there’s no cap on withdrawals. However, to comply with the tick scalping rule, at least 50% of trades and profits must come from positions held for over 10 seconds. The minimum payout is set at 1% of the initial balance.

Zero Rewards Account

The Zero Rewards Account has stricter requirements for the first payout. Traders need at least seven active trading days per cycle and must meet profit targets of:

- $1,500 for a $25K account

- $3,000 for a $50K account

- $6,000 for a $100K account

Additionally, this account enforces a 25% consistency rule, which is higher than the standard 20%. Payouts are processed every 4 to 7 trading days, and once approved, funds are typically transferred within 24 to 48 hours via bank transfer, PayPal, or cryptocurrency.

Additional Features

FundingTicks also offers a Live Scaling Program, which increases account capital by 20% each time profits equal the initial balance. Traders can also engage in copy trading across multiple accounts, with a maximum combined allocation of $300,000.

7. Lucid Trading

Lucid Trading offers three distinct account programs – LucidPro, LucidDirect, and LucidFlex – designed to cater to various trading styles and risk preferences, as detailed in our futures prop firm reviews. Each program has its unique payout structure and rules, providing flexibility for traders with different strategies. Let’s break down how these accounts operate and the specific payout conditions tied to each.

For LucidPro accounts, traders must complete at least 5 trading days before they can request their first payout. A consistency rule applies, ensuring no single trading day contributes more than 40% of total profits for accounts created or reset on/after November 28, 2025 (accounts opened earlier follow a 35% threshold). Additionally, the account balance must exceed the Initial Max Loss Limit by at least $100 at the time of withdrawal. For instance, a $50,000 account must maintain a minimum balance of $52,100 to qualify for a payout. LucidPro accounts offer a 90/10 profit split, with a minimum payout amount of $500.

LucidDirect accounts, which provide instant funding, require 8 trading days before the first payout can be requested. After that, traders can withdraw profits every 8 trading days. These accounts enforce a stricter consistency rule, capping single-day profits at 20% of the total. Unlike LucidPro, LucidDirect accounts do not require a buffer balance.

With LucidFlex accounts, traders must complete 5 profitable days within a payout cycle to qualify for their first withdrawal. Once funded, these accounts eliminate consistency rules, daily loss limits, and buffer requirements. All three programs allow daily payout requests, which are processed within 2 business days after approval. To stay compliant, traders must close all positions by 4:45 PM EST each day.

Here’s a quick comparison of the key features for each account type:

| Account Type | First Payout | Recurring Schedule | Consistency Rule | Buffer |

|---|---|---|---|---|

| LucidPro | 5 Trading Days | Daily (when eligible) | 40% (New) / 35% (Old) | Yes |

| LucidDirect | 8 Trading Days | Every 8 Trading Days | 20% | No |

| LucidFlex | 5 Profitable Days | Daily (when eligible) | None (when funded) | No |

sbb-itb-46ae61d

8. The Futures Desk

The Futures Desk operates on a straightforward real capital progression model. Traders start with a one-step assessment and then enter a simulation phase. During this phase, they build a simulated balance equivalent to their drawdown limit before transitioning to a live brokerage account. This entire process can take as little as six days, allowing traders to access uncapped daily payouts quickly. The setup ensures a smooth path to immediate and consistent access to funds.

In the live brokerage stage, traders can request payouts every weekday. Requests submitted before 11:00 AM are processed the same day through Riseworks. There are no restrictions like consistency rules or minimum trading day requirements, making the system flexible for traders.

"Everything in your account is real capital. No matter how much you make, you can take a payout. Any time, any amount. Just maintain your balance."

The profit split is set at 80/20, with traders keeping 80% of their earnings. While this might seem less generous compared to firms like TradeDay offering a 90/10 split, the advantages of immediate, unlimited withdrawals and no activation fees provide a strong counterbalance. Additionally, traders who withdraw $10,000 are invited to partner with the firm, which includes K-1 tax treatment for U.S. residents.

To qualify for withdrawals, traders must maintain their account balance above the initial drawdown threshold. The firm allows a maximum of two active accounts per trader and includes the first month’s professional data fee of $140. With an "Excellent" rating of 4.6/5 on Trustpilot from 380 reviews, users frequently highlight the responsive support team and the absence of hidden restrictions.

9. TickTickTrader

TickTickTrader stands out with its quick and adaptable payout options, offering a range of account types tailored to different trading strategies. Using a futures risk management planner can help traders optimize these strategies. The S2F+ (Straight-to-Funded Plus) account is particularly appealing for those seeking rapid withdrawals. Traders using this account can request their first payout after just six trading days, and there are no consistency rules to follow – perfect for those who achieve large profits in a single session. On the other hand, TTTPerformance accounts require traders to meet specific safety thresholds before withdrawing. For instance, a $100,000 account mandates a $3,600 safety threshold.

The profit-sharing structure varies depending on the account type. TTTPerformance accounts allow traders to keep 100% of their profits for the first three months, transitioning to a 90/10 split starting in the fourth month. With S2F+ accounts, profits are divided into 50% cash, 40% allocated to a "Live Wallet" for capital growth, and 10% retained by the firm. Meanwhile, standard S2F accounts follow an 80/20 split, a policy introduced in March 2025.

Withdrawals are processed within five business days, and traders can request payouts any time during the month as long as their balance exceeds the safety threshold. A minimum withdrawal amount of $250 applies. For faster transactions, the firm recommends using cryptocurrency, specifically USDT TRC20. Once traders achieve live funded account status – typically after six payouts in S2F+ accounts – they gain access to daily withdrawals.

Most accounts, except S2F+, enforce consistency rules. TTTPerformance accounts cap daily profits at 30% of total earnings, while standard S2F accounts limit daily profits to 20%. Additionally, KYC verification is required before any withdrawal.

TickTickTrader has earned a strong reputation, boasting a 4.8/5 rating on Trustpilot from over 6,200 reviews. The platform is frequently praised for its efficient processing and responsive customer support. Traders can manage up to three active TTTPerformance accounts or as many as 10 active S2F+ accounts, allowing for significant scalability. Even deactivated accounts can withdraw up to 20% of total profits, provided safety thresholds are met.

TickTickTrader’s efficient withdrawal process and trader-friendly policies make it a compelling choice for those prioritizing fast and flexible access to their earnings.

10. Phidias Prop Firm

Phidias operates with a two-phase system: a simulated CASH phase followed by a LIVE phase using real capital. Each phase has its own set of payout rules and requirements. Here’s a breakdown of how it works:

During the CASH phase, you’ll need to complete 10 trading days to become eligible for your first three withdrawals. To count as a trading day, your profits must meet specific thresholds: $150 for a $50K account, $200 for a $100K account, or $250 for a $150K account. There’s also a 30% consistency rule, meaning no single day’s profits can exceed 30% of your total profits at the time of withdrawal. Withdrawal limits are set at $2,000 for the $50K account, $2,500 for the $100K account, and $2,750 for the $150K account.

For the 25K Static Account, you’ll transition to LIVE status once you hit a $1,500 profit target during the CASH phase. At this point, you’ll also receive a $1,000 bonus.

"Monday morning evaluation, Wednesday afternoon payout. I thought it was marketing BS until I did it myself. $1,600 profit in 48 hours."

- Sarah K., US Trader

Once you move to the LIVE phase, either by completing three payouts or earning $75,000 cumulatively, the rules become more flexible. Daily payouts are available, and there are no minimum trading day requirements or consistency rules. The profit split remains 80/20 across all account types, and the minimum withdrawal amount is $500. Withdrawals are processed quickly, typically within 1–4 hours on business days, and funds are delivered via RISE within 24–48 hours.

To make a withdrawal, your account balance must meet specific thresholds: $52,600 for the $50K account, $103,700 for the $100K account, and $154,500 for the $150K account. After withdrawing, you’ll need to maintain a buffer equal to your starting balance plus $100.

For a detailed overview of Phidias Prop Firm’s offerings, check out our Phidias Prop Firm review.

11. FundedFuturesNetwork

FundedFuturesNetwork offers traders an 80/20 profit split, allowing you to keep 80% of your earnings. Once you’ve withdrawn $5,000 per account, you can qualify for a live-funded upgrade with a 90/10 split and daily payouts, pending approval from a risk manager.

The firm provides clear guidelines for payouts. Your first withdrawal becomes available at the end of your first profitable month. To qualify for same-day payouts, you need to maintain a balance at least $100 above your starting amount and ensure that your best trading session accounts for no more than 40% of your total profits. Payments can be processed via ACH, bank wire, or PayPal, with a minimum withdrawal amount of $500.

"I love that FFN provides a 1-on-1 onboarding call with new clients to make sure that they understand the rules and set up the trading platform correctly."

- Dr. Cindy Cork, Trader

Their consistency rule is relatively lenient compared to some competitors. Specifically, your top trading session cannot exceed 40% of your total profits. However, this restriction is completely removed once you reach the live-funded stage. During the initial sim-funded phase, there’s a $10,000 maximum withdrawal limit per payout, but this limit is lifted when you transition to live status.

It’s important to note a few trading restrictions. If you lose your funded account, all accumulated profits are forfeited and cannot be withdrawn. Additionally, trading is prohibited during Tier 1 news events – you must close all positions one minute before and after such announcements.

For a detailed breakdown of what FundedFuturesNetwork offers, check out our FundedFuturesNetwork review.

12. Topstep

Topstep stands out with payout rules designed to reward traders for consistent performance. Here’s how it works: you keep 100% of the first $10,000 in profits. After that, profits are split 90/10, with you taking 90% and Topstep retaining 10%.

To qualify for your first payout, you need at least five Benchmark Trading Days – days where your net profit hits $150 or more. These days don’t have to be consecutive, giving you the flexibility to trade at your own pace. Many traders use a trade copier for futures to manage multiple accounts while meeting these consistency requirements. The minimum withdrawal amount is $125, ensuring a structured and straightforward payout process.

In 2024, Topstep handled an impressive 81,177 payouts, proving the reliability of their system. Payouts are processed in 1–2 business days using Wise, ACH, or Wire/SWIFT. Note that ACH and Wire transactions come with a $20 processing fee.

| Account Type | Payout Frequency | Payout Amount Limit | Daily Profit Requirement |

|---|---|---|---|

| Express Funded | Every 5 winning days | Up to $5,000 or 50% of balance | $150+ Net P&L |

| Live Funded | Every 5 winning days | Up to 50% of balance | $150+ Net P&L |

| Live Funded (30+ Days) | Daily | Up to 100% of balance | $150+ Net P&L |

This setup offers traders increasing flexibility as they progress. After completing 30 Benchmark Trading Days in a Live Funded Account, you unlock daily payouts and can request up to 100% of your profit share. However, keep an eye on your Maximum Loss Limit – it resets to $0 after your first payout. To avoid falling below your starting balance, it’s wise to build a profit cushion before making your first withdrawal.

For a deeper dive into what Topstep offers, check out our Topstep review.

Pros and Cons

Here’s a breakdown of the payout structures and key features for each firm to help you weigh their pros and cons:

Apex Trader Funding: This firm offers a standout benefit – 100% of the first $25,000 in profits per account. It also supports copy trading across multiple accounts. However, traders need to meet specific trading day requirements and consistency standards before making their first withdrawal. Payouts are processed twice a month, during the 1st–5th and 15th–20th windows.

Take Profit Trader: One of its key benefits is the ability to make immediate withdrawals. However, traders must maintain a buffer to keep the standard profit split.

Alpha Futures: This firm offers a flat 90% profit split for select accounts and a tiered split for standard accounts. Zero plans come with no activation fees, and payouts are processed within 48 business hours. High-performing traders can transition to Alpha Prime, a live trading floor in London, where they can earn a 60% profit split along with a monthly salary.

FundingTicks and Lucid Trading: Both firms allow traders to keep initial profits before moving to a 90/10 split. FundingTicks processes payouts every 4–7 days and does not charge activation fees on Pro+ accounts. Lucid Trading, on the other hand, requires traders to wait 8 days for their first withdrawal and follows a bi-weekly payout schedule. Both firms enforce consistency rules during evaluations, which could be challenging for traders who rely on large single-day gains.

Tradeify: This firm uses a tiered consistency rule for its Lightning accounts – traders receive 20% for the first payout, 25% for the second, and 30% for subsequent payouts. Payouts are processed every 5 days under a competitive 90/10 split, rewarding consistent performance.

Topstep: Traders earn 100% of their first $10,000 in profits, followed by a 90/10 split. After completing 30 Benchmark Trading Days, they unlock daily payouts and gain access to 100% of their profit share. However, the Maximum Loss Limit resets to $0 after the first payout, which means traders must maintain a sufficient profit cushion to avoid account violations.

Understanding how futures prop firms work is the first step toward securing a payout. This overview provides the essential details to help you evaluate each firm’s payout structure before making a decision.

Conclusion

This guide has explored how various firms tailor their payout rules to suit different trading styles and goals. If you’re looking for quick access to funds, FundedNext Futures stands out with its 24-hour payout guarantee – plus an extra $1,000 if they miss the mark. Similarly, Take Profit Trader allows withdrawals from the very first day of being funded.

For traders aiming to maximize profit splits, Apex Trader Funding offers 100% of the first $25,000 in profits per account. By contrast, Topstep and FundingTicks cap initial profits at $10,000. Meanwhile, Alpha Futures Advanced accounts provide a flat 90% profit split with no restrictions on consistency or news trading.

For those prioritizing scalability, Apex Trader Funding supports up to 20 simultaneous accounts, offering a combined funding potential of $6 million.

To stay updated on payout rules, access futures prop firm discounts like DGT, or compare firms in detail, check out DamnPropFirms. Their tools, such as the Consistency Rule Calculator and Payout Junction, simplify decision-making. The calculator helps ensure you’re eligible for withdrawals, while Payout Junction tracks real-time blockchain data to confirm active payout processing. These resources empower traders to align their choices with their specific trading objectives.

FAQs

What are the main differences in payout structures at top futures prop firms?

Payout structures at top futures prop firms differ in profit splits, eligibility criteria, and payout schedules.

TakeProfit Trader, for instance, offers an 80/20 profit split, meaning traders keep 80% of their profits. Withdrawals can be requested once the account balance surpasses the buffer zone – such as $52,000 for a $50,000 account. Apex Trader Funding stands out by providing 100% of the first $25,000 in profits and 90% thereafter, with payouts processed every 8 days. Alpha Futures allows traders to retain up to 90% of profits, with no cap on withdrawal amounts. FundingTicks highlights uncapped payouts from the start, although they don’t publicly disclose their profit split.

These variations let traders pick a firm that matches their profit goals, cash flow preferences, and overall trading strategy.

What are consistency rules, and how do they affect profit withdrawals in futures prop firms?

Consistency rules are designed to promote steady, reliable trading performance instead of relying on a single standout day of profits. These rules typically cap the percentage of total profits that can come from one trading day, usually between 20% and 40%, depending on the firm. For instance, a firm might require traders to spread their profits more evenly over multiple days, showcasing disciplined risk management and a well-thought-out trading strategy.

If a trader breaks the consistency rule – such as by earning more than the allowed profit percentage on their best trading day – it can lead to delays or even blocks on withdrawals. In some cases, the firm might suspend the trader’s account until they meet the required profit distribution criteria. On the flip side, following these rules ensures smooth and timely payouts, often processed as quickly as the next business day, depending on the firm’s policies.

In short, meeting consistency rules is a key step in securing withdrawals and staying aligned with the firm’s trading standards.

What do I need to qualify for my first payout from a futures prop firm?

To receive your first payout from a futures prop firm, you’ll usually need to satisfy a few essential conditions:

- Successfully complete the evaluation phase by hitting the profit target while staying within the firm’s drawdown limits.

- Trade for a required minimum number of days, often at least 7 qualifying trading days after passing the evaluation phase.

- Achieve a daily profit threshold, which is typically a manageable amount, such as $200 per day, during the qualifying period.

Each firm has its own set of rules, so it’s important to carefully review their payout policies. By consistently showing profitability and adhering to the firm’s guidelines, you’ll be well-positioned to request your first payout.