Prop firms make money by charging fees and sharing profits with traders. Here’s how it works:

- Evaluation Fees: Traders pay fees (ranging from $40 to $3,000) to participate in challenges or evaluations to qualify for funded accounts.

- Account Resets: If traders fail evaluations, they can reset their accounts for an additional fee, often $50–$100.

- Recurring Fees: Some firms charge monthly or activation fees for using funded accounts.

- Profit Sharing: Firms take a small percentage of trader profits after a certain threshold (e.g., 10% after $25,000).

- Broker Commissions: Some firms earn from spreads or commissions on trades in live accounts.

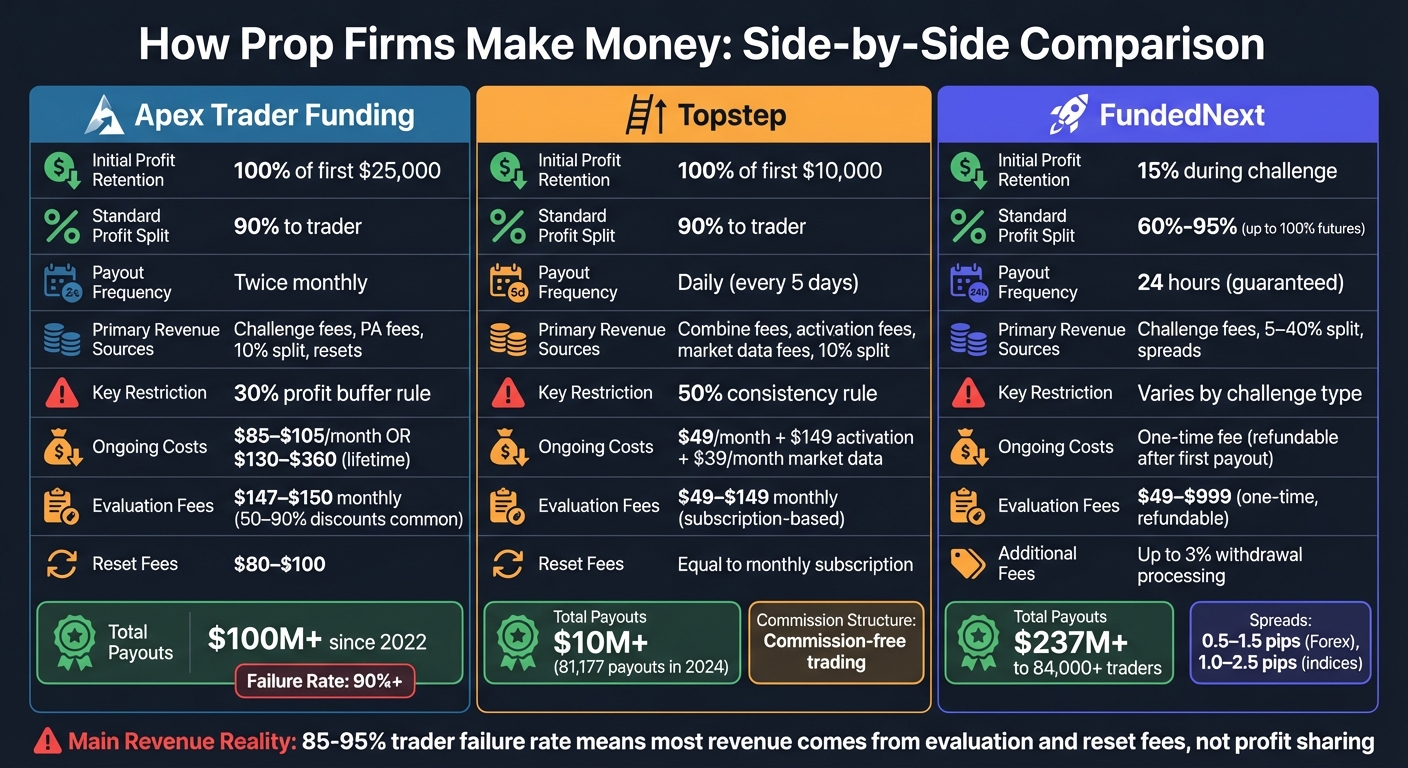

With failure rates between 85%–95%, most revenue comes from evaluation and reset fees, not trader payouts. Firms like Apex Trader Funding, Topstep, and FundedNext structure their models differently, but all rely heavily on these income streams. Apex, for instance, has paid over $100M to traders since 2022, while Topstep and FundedNext have distributed $10M+ and $237M+, respectively. The key takeaway? These firms profit even if most traders don’t succeed.

1. Apex Trader Funding

Evaluation Fees

Apex Trader Funding requires traders to pay monthly subscription fees while completing their evaluation challenge. These fees typically range between $147 and $150 for account sizes of $25,000 to $50,000. However, traders often hold off on signing up due to frequent promotional discounts that range from 50% to 90%.

If a trader breaks the rules or exceeds the drawdown limit, they’ll face a reset fee of about $80 when using Rithmic or $100 with Tradovate. The trailing drawdown rule is the most common reason traders fail and need to reset. With failure rates exceeding 90%, these non-refundable evaluation and reset fees are a major source of revenue for Apex. Let’s take a closer look at how these fees tie into the company’s profit-sharing model.

Profit Splits

Apex offers traders 100% of their profits up to $25,000. Beyond that threshold, profits are split 90/10 in the trader’s favor. This structure complements the revenue generated from evaluation fees. Since 2022, Apex has distributed over $100 million to traders, with average monthly payouts totaling around $7 million. One standout moment occurred in April 2025 when a trader earned a record-breaking single-day payout of $2,552,800.50. Alongside profit-sharing and evaluation fees, the firm also benefits from recurring activation fees.

Recurring Fees

Once traders pass the evaluation, they must pay an activation fee to use their funded Performance Account. They can choose between a monthly fee ranging from $85 to $105 or a one-time lifetime fee between $130 and $360. The monthly subscription model provides a steady revenue stream for Apex, while the lifetime fee option attracts traders looking for long-term engagement.

2. Topstep

Evaluation Fees

Topstep stands out by using a subscription-based model instead of a one-time evaluation fee. Traders pay $49 per month for a $50,000 account, $99 per month for a $100,000 account, or $149 per month for a $150,000 account. If a trader violates the rules, they must pay an account reset fee equal to their monthly subscription cost. After successfully passing the evaluation, traders are required to pay a one-time activation fee of $129 to access their funded account. For those looking to avoid the activation fee, Topstep offers a "No Activation Fee Path", though this option comes with higher monthly subscription fees. These recurring fees not only provide traders with access to the platform but also contribute to Topstep’s profit-sharing framework.

Profit Splits

Topstep allows traders to keep 100% of their first $10,000 in profits. Beyond that, profits are split 90/10, with traders retaining the larger share. In 2024 alone, the company processed 81,177 payouts for traders. Traders who meet the eligibility criteria – five winning days with at least $150 in profits – can request payouts every five days, with processing times of one to two business days. To date, Topstep has distributed over $10 million to its traders.

Broker Commissions

One of Topstep’s key benefits is its commission-free trading structure. However, traders with Live Funded Accounts are still responsible for monthly exchange data fees, such as CME Group fees, which are typically billed around the 26th of each month. This commission-free approach differentiates Topstep from traditional brokers that depend on spreads and commissions for revenue. Instead, Topstep’s model relies on challenge fees and profit-sharing agreements to sustain its operations.

"Unlike brokers, prop firms do not earn from spreads or commissions. Their main revenue sources come from challenge fees and profit sharing." – Myfxbook

Behind the Scenes: How Prop Firms Really Make Money

sbb-itb-46ae61d

3. FundedNext

FundedNext stands out with its approach of charging a refundable, one-time evaluation fee and offering flexible profit-sharing models.

Evaluation Fees

FundedNext’s evaluation fee depends on the account size and challenge type. For instance, a $15,000 account starts at $49, while a $200,000 account can cost up to $999. Here’s the kicker: if you’re using the Evaluation model, the fee is fully refundable after your first payout. Plus, there are no recurring fees once you’ve passed the evaluation. As a bonus, traders can earn a 15% profit share even during the evaluation phase.

Profit Splits

Profit sharing with FundedNext starts at 80% for Evaluation model accounts and 60% for Express models. These splits can grow over time, climbing to as high as 90% or 95% as traders hit profit milestones[33,34,29]. For traders aiming to scale, meeting a 10% profit target allows them to increase their capital by 40% every four months. With a global presence of over 1 million traders, FundedNext has paid out more than $237 million to over 84,000 traders[35,36].

Broker Commissions

FundedNext operates without direct commission charges, incorporating trading costs into the spreads. For Forex majors, spreads typically range from 0.5 to 1.5 pips, while spreads for indices fall between 1.0 and 2.5 pips. However, withdrawal processing fees can go up to 3%, depending on the payment provider. For those needing a swap-free account, an additional 10% of the initial evaluation fee applies.

Pros and Cons

Prop Firm Revenue Models Comparison: Apex vs Topstep vs FundedNext

After examining the fee structures and profit splits of each firm, let’s break down the key benefits and drawbacks that directly impact trader profitability.

Each firm’s revenue model comes with its own set of perks and challenges. Apex Trader Funding, for example, allows traders to keep 100% of their profits on the first $25,000 [10,15]. However, the 30% profit buffer rule means you need to leave nearly a third of your gains in the account before making withdrawals, which can limit your liquidity. Additionally, monthly PA fees ($85–$105) or the one-time lifetime fee options ($130–$360) create ongoing costs that can eat into your net earnings.

On the other hand, Topstep encourages faster profit growth with its daily payout option [10,15]. But its fee structure includes several costs: a monthly Trading Combine fee starting at $49, a one-time activation fee of $149, and a monthly market data fee of $39. These fees can add up, especially for traders who take longer to pass evaluation phases. Another challenge is the 50% consistency rule, which can add pressure to maintain balanced trading. As Faisal from TradePro Academy explains:

"If you have a gain of $1,000 one day, then $200 the rest of the 4, you have to trade until that $1,000 is under 50% of overall gains".

Meanwhile, FundedNext stands out by offering traders a 15% profit share even during the challenge phase, which helps offset some of the initial risks [10,34]. Its 24-hour payout guarantee, backed by a $1,000 compensation if delayed, adds a layer of security. However, its lower initial profit splits (60% for Express models) and withdrawal processing fees of up to 3% can reduce overall earnings [29,33]. Additionally, trading cost spreads (ranging from 0.5 to 1.5 pips for Forex majors) can slightly impact net profits.

| Feature | Apex Trader Funding | Topstep | FundedNext |

|---|---|---|---|

| Initial Profit Retention | 100% of first $25,000 | 100% of first $10,000 | 15% during challenge |

| Standard Profit Split | 90% to trader | 90% to trader | 60%–95% (up to 100% futures) |

| Payout Frequency | Twice monthly | Daily | 24 hours (guaranteed) |

| Primary Revenue Sources | Challenge fees, PA fees, 10% split, resets | Combine fees, activation fees, market data fees, 10% split | Challenge fees, 5–40% split, spreads |

| Key Restriction | 30% profit buffer rule | 50% consistency rule | Varies by challenge type |

| Ongoing Costs | $85–$105/month or $130–$360 (lifetime) | $49/month + $149 activation + $39/month market data | One-time fee (refundable after first payout) |

These comparisons illustrate how each firm’s fee structures and payout rules influence trader outcomes, highlighting the trade-offs between upfront costs, profit retention, and payout flexibility.

Conclusion

Understanding how prop firms generate revenue sheds light on the balance between the capital they provide and the effort they expect from traders. For example, Apex Trader Funding focuses on high trading volume and enticing discounts to attract users. In just three years, the firm has paid out over $378 million, with most of its income coming from challenge fees.

On the other hand, Topstep takes a more measured approach, using a layered fee structure and a multi-step evaluation process. Over 13 years, it has paid out more than $23 million, emphasizing trader education and disciplined trading practices.

Then there’s FundedNext Futures, which stands out by offering a 15% profit share even during the evaluation phase and ensuring quick payouts. The firm boasts over $158 million in payouts to date.

These examples highlight the variety of fee structures that define the prop trading industry. Evaluation fees and profit splits are at the heart of this model, and understanding them is key to making informed decisions. Prop trading isn’t inherently unfair – it’s about knowing the costs, rules, and potential rewards. Before diving in, carefully analyze each firm’s payout history, fee structure, and policies to calculate your total expenses and assess whether the opportunity aligns with your goals.

FAQs

How do evaluation fees influence a trader’s decision to join a prop firm?

Evaluation fees play a big role in whether traders decide to join a prop firm. These upfront costs, usually falling between $100 and $1,000 for simulated challenges, are essentially the price of entry for those aiming to secure a funded account. However, since these fees are non-refundable if the trader doesn’t pass the evaluation, they serve as both a financial barrier and a way to weed out participants who might not be fully committed.

For traders, the perceived value of these fees often depends on what the firm brings to the table. Factors like clear rules, realistic profit targets, and extras like educational tools can make the cost feel more justified. Prop firms that are transparent about their funding model and show how traders can benefit stand a better chance of attracting those willing to take the financial leap. In the end, evaluation fees force traders to weigh the upfront expense against the potential of trading with access to significantly larger capital.

Why do so many traders fail in prop firms?

Many traders find it tough to succeed in prop firms due to their strict rules and high-pressure environment. To qualify for a funded account, traders must first pay an evaluation fee, which typically ranges from $100 to $3,000. From there, they face the challenge of hitting ambitious profit targets while staying within strict drawdown and daily loss limits. These rules, combined with the psychological strain of risking money to prove their skills, often lead to errors or violations.

Prop firms, on the other hand, generate revenue not just from successful traders but also from evaluation fees, reset fees, and additional services. This creates a system where only a small fraction of participants succeed. Statistically, fewer than 10% of traders pass the evaluation stage, and an even smaller group manages to consistently withdraw profits. Many traders simply lack the experience or the disciplined risk management required to navigate these conditions, which contributes to the high failure rate.

How do profit-sharing models vary between prop firms like Apex, Topstep, and FundedNext?

Profit-sharing arrangements can vary widely across proprietary trading firms. For instance, Apex and Topstep typically operate on an 80/20 split, allowing traders to retain 80% of their earnings. Meanwhile, FundedNext stands out by offering traders the chance to earn up to a 100% profit share, provided they achieve specific high-performance benchmarks.

These differences highlight how each firm tailors its approach to motivate traders while maintaining its business operations. This variety gives traders the freedom to choose a model that best fits their personal objectives and trading style.