E8 Futures: Rules, Payouts, Drawdowns, And How The Program Works

E8 Futures is the futures side of E8 Markets’ trading evaluations. This guide breaks down the key rules, drawdown logic, payout structure, and requirements so you can decide if their Signature Futures model fits your style.

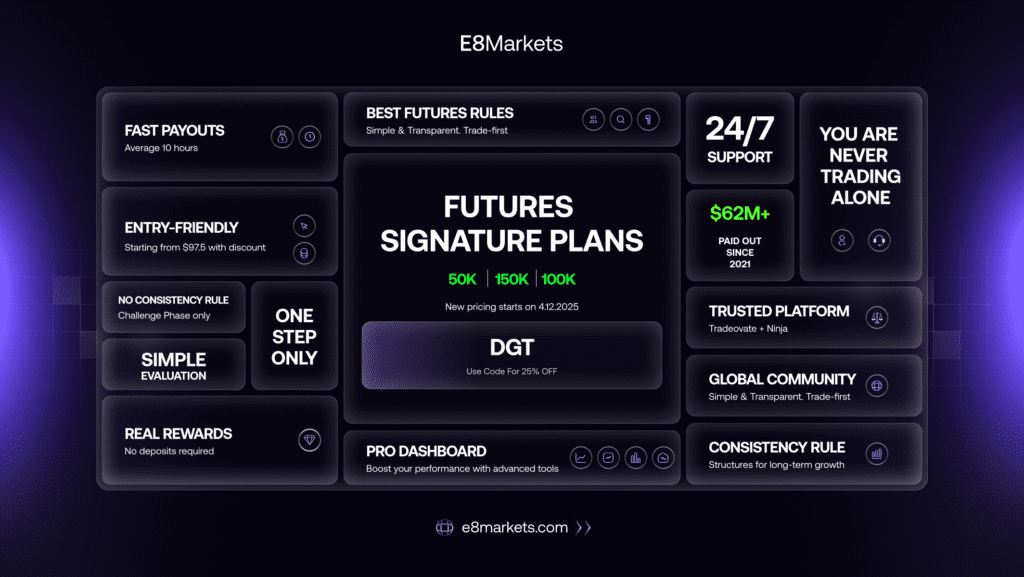

Quick deal: you can get a discount on any E8 account, including futures, forex and crypto, with code DGT.

What Is E8 Futures

E8 Futures offers evaluation accounts that simulate real futures market conditions. Pass the evaluation and you move to E8 Trader (Simulated Funded), then potentially to E8 Pro Dedicated. The program is designed to promote disciplined risk management and consistent profitability.

Evaluation Rules Overview

Core objectives you will see in the E8 Signature Futures model:

-

Profit target: fixed percent target to pass the evaluation. Signature specifies a 6% profit target on the account.

-

EOD trailing drawdown: end of day trailing limit that moves up with equity highs, measured against running or closed loss.

-

Best Day or Profit Cap: Signature uses a 35% Best Day rule at payout time to promote consistency.

-

Daily pause: in funded simulation, a 2% daily loss pause stops trading until the next session without failing the account.

-

Profitable days: minimum number of profitable days required between payouts.

-

News and overnight: news trading allowed during evaluation, restricted for funded simulation and E8 Pro. Overnight holding is not allowed for funded simulation.

EOD Trailing Drawdown Levels

EOD trailing applies in the evaluation and simulated funded stages. For Signature Futures:

-

$50,000 account → $2,000 EOD trailing

-

$100,000 account → $3,000 EOD trailing

-

$150,000 account → $4,500 EOD trailing

The trailing level moves up with new end-of-day highs. Breaching the EOD level violates the account.

Daily Pause And Risk Controls

In the E8 Trader simulated funded stage:

-

2% Daily Pause: if your floating or closed daily loss reaches 2% of that day’s starting balance, trading pauses until the next day. This does not instantly fail the account. It is a protective stop that resets at the next session.

In both evaluation and funded simulation:

-

EOD trailing always applies. Do not let running or closed loss exceed your EOD limit.

Best Day Rule And Consistency

To request a payout on E8 Signature Futures, your best single day’s profit must be 35% or less of your total generated profit since the last payout.

Example: if your total profit is $3,100, 35% is $1,085. If your best day is $1,500, you must continue trading until 35% of total profit exceeds $1,500.

Attempts to game the rule via partial closes or hedging can be consolidated into one day. Keep your growth steady to clear this filter quickly.

E8 Futures - Pros and Cons

| Pros | Cons |

|---|---|

|

|

Profitable Day Requirement

For E8 Trader (Simulated Funded):

-

Minimum profitable days between each payout: 5

-

Profitable day definition: 0.3% or more realized closed PnL for E8 Signature (0.5% on other models like Model 1 and Model 2)

After you request a payout, your profitable day count resets.

Payout Caps And Buffers

Before your first payout, you must leave a buffer equal to your EOD trailing amount in the account. This prevents post-payout EOD breaches.

Buffer examples

-

$50K account → $2,000 buffer

-

$100K account → $3,000 buffer

-

$150K account → $4,500 buffer

Payout caps per cycle

-

First payout: 2.5%

-

Second payout: 2.5%

-

Third payout: 4.5%

-

Fourth payout: 5.5%

-

Fifth payout and beyond: up to $25,000 per request or request transfer to E8 Pro Dedicated

Minimum payout: $312.50

You can request less than the max cap as long as you maintain the buffer and meet rules. E8 publishes balance examples for each cycle to reach max payout amounts.

News And Overnight Policies

-

Evaluation: you can place and hold trades during news.

-

Simulated Funded and E8 Pro: no trading or holding through T1 high-impact news. Positions must be flattened at least 2 minutes before the event.

-

Overnight and weekend: positions must be closed before rollover. Overnight holding is not allowed for funded simulation and E8 Pro.

T1 events include impactful economic releases, central bank decisions, and major geopolitical announcements.

Copy Trading And Contract Sizing

-

Copy trading is allowed on evaluations, simulated funded, and E8 Pro Dedicated.

-

Maximum contract size varies by model. E8 publishes specific limits per instrument and account size. Make sure your micros versus minis mix respects the ceiling.

Accounts, Subscriptions, And Fees

E8 Signature Futures uses a one time fee during evaluation, with no activation fee when you pass.

-

One time fee with no subscription on futures accounts.

-

E8 Pro Dedicated uses a monthly subscription deducted from account balance, not your card.

-

Current published Signature pricing examples:

-

$50K: $98

-

$100K: $179

-

$150K: $267

-

Account quantity

-

Evaluations: unlimited

-

E8 Trader (Simulated Funded): up to 5

-

E8 Pro Dedicated: 1

Inactivity

-

No time limit, but 7 days of inactivity disables the account in evaluation and simulated funded.

E8 Futures FAQ

Everything you need to know about E8 Futures rules, payouts, drawdowns, subscriptions, and eligibility.

What is E8 Futures

E8 Futures is the futures evaluation side of E8 Markets. You trade a simulated futures account, meet profit and risk objectives, then move to E8 Trader simulated funded and potentially E8 Pro Dedicated.

What is the profit target for E8 Signature Futures

The E8 Signature Futures evaluation uses a 6 percent closed profit target on the account to pass.

How does the End-of-Day trailing drawdown work on E8 Futures

EOD trailing is the max distance your balance can fall from the highest end of day balance. It applies to running or closed loss. Levels for Signature Futures:

- $50,000 account → $2,000 EOD

- $100,000 account → $3,000 EOD

- $150,000 account → $4,500 EOD

If you breach the EOD level the account fails.

Is there a daily loss rule in the funded simulation

Yes. E8 Trader simulated funded has a 2 percent Daily Pause based on the day’s starting balance. If reached, trading pauses until the next session. This does not auto fail the account. EOD trailing still applies separately.

What is the Best Day rule on E8 Signature Futures

You must keep your best single day profit at 35 percent or less of your total generated profit since the last payout. If your best day is above 35 percent you must continue trading until total profit raises that 35 percent threshold above your best day. Attempts to split or hedge to bypass can be consolidated into one day.

How many profitable days are required between payouts

Minimum of 5 profitable days between each payout on E8 Signature Futures. A profitable day is 0.3 percent or more realized closed PnL on Signature. Other models use 0.5 percent.

What are the payout caps and the payout buffer

You must leave a buffer equal to your EOD trailing amount before the first payout. Payout caps per cycle:

- First payout → 2.5 percent

- Second payout → 2.5 percent

- Third payout → 4.5 percent

- Fourth payout → 5.5 percent

- Fifth and beyond → up to $25,000 per request or request a transfer to E8 Pro Dedicated

Minimum payout is $312.50. You may request less than the cap if you still meet buffer and day requirements.

Can I trade news and can I hold overnight on E8 Futures

Evaluation accounts can trade and hold during news. E8 Trader simulated funded and E8 Pro Dedicated cannot hold through T1 high impact news. All positions must be flattened at least 2 minutes before a T1 event. Overnight and weekend holding is not allowed in funded simulation. Positions must be flat before rollover.

Is copy trading allowed on E8 Futures

Yes. Copy trading is allowed on evaluations, simulated funded accounts, and E8 Pro Dedicated accounts. You still must respect contract limits and all risk rules.

What are the maximum contract sizing limits

Each model has a maximum open contracts allowance per instrument and account size. Check the E8 Futures instrument specifications and contract size tables before trading. Micros versus minis count toward the ceiling.

How many E8 Futures accounts can I have

Evaluations are unlimited. E8 Trader simulated funded is limited to 5 accounts. E8 Pro Dedicated is limited to 1 account.

Is there a time limit or inactivity rule

No fixed time limit. However, 7 days of inactivity disables the account in evaluation and simulated funded. Log activity regularly to keep accounts active.

How do subscriptions and activation fees work for Signature Futures

Signature Futures uses a monthly subscription during the evaluation. There is an activation fee when you pass to simulated funded. If you fail and forget to cancel, the subscription can create a new evaluation on the next billing date. E8 Pro Dedicated has a monthly subscription deducted from account balance.

What are current Signature Futures price points

Published examples: $50K → $98 monthly and $88 activation, $100K → $179 monthly and $149 activation, $150K → $267 monthly and $198 activation. Check live pricing and promos, and apply code DGT here https://bit.ly/E8-DGT.

When can I request a payout

Once you meet all payout requirements: 35 percent Best Day rule satisfied, buffer in place, minimum 5 profitable days since last payout, and minimum amount met. After a payout, profitable day count resets to zero for the next cycle.

Does the Daily Pause violation fail my account

No. Hitting the 2 percent Daily Pause in simulated funded pauses trading until the next session. It does not auto fail the account. EOD trailing breaches do fail the account.

Are strategies restricted on E8 Futures

E8 prohibits strategies that exploit simulated market imperfections or would not be sustainable in live markets. Trade responsibly and avoid behaviors that attempt to game fills, latency, or the Best Day filter.

What happens after the fifth payout

After the fifth payout, you can request up to $25,000 per payout on each account or request a transfer to an E8 Pro Dedicated account.

Can I get a discount on E8 Futures

Yes. Use code DGT on any E8 account. Check current deals here https://bit.ly/E8-DGT.

See How E8 Futures Ranks Among the Best

Curious where E8 Futures stands compared to other leading futures prop firms? Explore our full rankings, reviews, and real trader insights on the Best Futures Prop Firms page.

View Rankings💡 Use code DGT for exclusive discounts on the top-rated futures prop firms.