Lucid Trading is climbing fast because it focuses on what actually keeps traders alive: end-of-day drawdown, simple rules, and fast payouts.

This guide explains the account types, who it fits, and how to choose the right path without getting wrecked by bad risk management.

Quick Links

What Is Lucid Trading?

Lucid Trading is a futures prop firm offering multiple account paths designed around a simple idea:

reduce rule friction so traders can execute without getting chopped up by nonsense.

If you want the full breakdown of pricing, discounts, and account rules in one place, start here: Lucid Trading review on DamnPropFirms.

This post is not a spec sheet. It is the context behind why Lucid is gaining momentum and how to choose the right setup.

If you trade like a gambler, none of this will save you. If you trade like a professional, Lucid can be a strong fit.

Why Traders Are Paying Attention

1) End-of-day drawdown reduces execution stress

The biggest silent killer in prop trading is panic execution caused by drawdown mechanics.

When you are trading under constant intraday trailing pressure, you take profits early, cut winners, and overtrade.

End-of-day drawdown makes it easier to trade with a plan instead of trading scared.

2) Fast payouts matter more than marketing

Traders do not care about slogans. They care about getting paid.

If you want a clear explanation of payout timing, payout windows, and what tends to trigger issues across firms, read: Prop firm payouts common questions answered.

3) Fewer rules means fewer ways to get violated

Most traders do not fail because they cannot find entries. They fail because they violate rules under pressure.

Use this before you trade any funded account: funded account checklist steps before trading.

Lucid Account Types Explained

Lucid offers multiple account paths because traders are not all the same.

Pick the wrong structure and even a good trader will struggle.

Pick the right one and the rules stay out of your way.

LucidPro

LucidPro is built for traders who want a structured progression and clear expectations.

This path rewards traders who:

-

Respect consistency limits

-

Can trade within defined buffers

-

Prefer a slower, more controlled path toward live capital

If you have a repeatable process and do not need flexibility to stay disciplined, LucidPro does exactly what it is designed to do.

LucidFlex

LucidFlex removes friction without removing responsibility.

There is no funded-stage consistency rule and no daily loss limit, but that does not mean reckless trading survives here. Poor sizing still ends accounts quickly.

LucidFlex fits traders who:

-

Hate payout buffers

-

Want end-of-day risk logic

-

Can self-regulate without artificial guardrails

If you are constantly chopping accounts, the problem is not the rules. Fix your sizing first: scaling funded accounts risk management essentials

Instant Funding Style Accounts

Instant funding is not a shortcut. It is exposure.

The LucidDirect accounts remove the evaluation phase and immediately test execution, discipline, and emotional control. Sloppy traders fail faster. Clean traders compress time.

Instant funding works best for traders who:

-

Already understand drawdown mechanics

-

Trade smaller relative size

-

Want faster access to withdrawals

It amplifies whatever habits you already have.

LucidBlack (Premium Evaluation Model)

LucidBlack sits above the other paths and is built for traders focused on payout optimization, not shortcuts.

It is still an evaluation, but with:

-

No daily loss limit

-

End-of-day drawdown that locks

-

Stricter consistency requirements

-

Faster access to funded payouts

The defining feature of LucidBlack is bonus payout eligibility once funded. Traders who exceed standard profit goals can unlock larger withdrawals without additional fees.

LucidBlack is not designed for beginners or rule testers. It is for traders who already know how to manage risk and want higher payout upside per cycle.

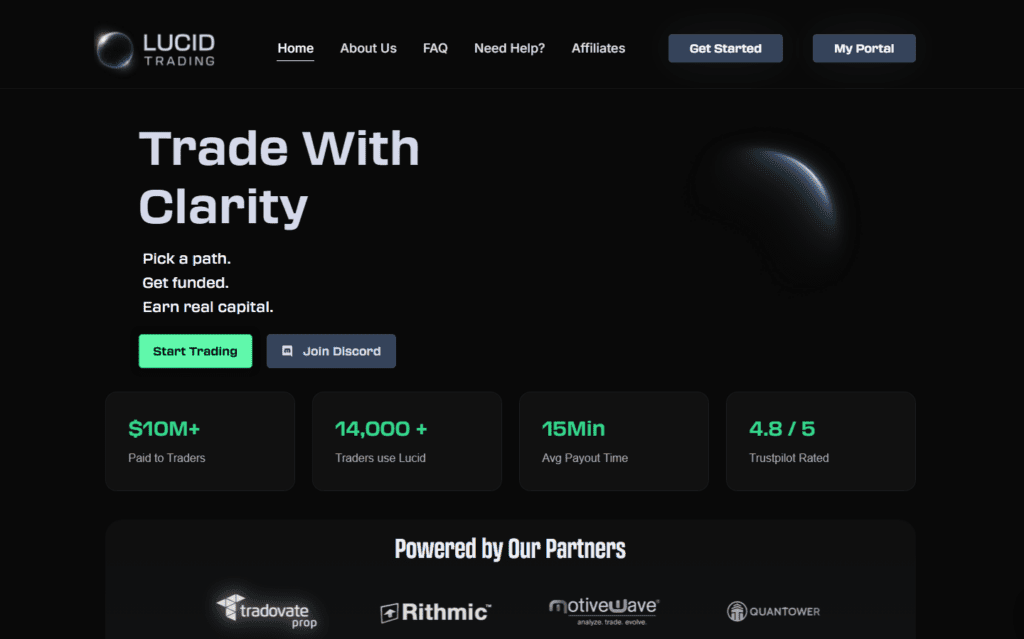

Lucid Trading’s homepage clearly emphasizes fast payouts, funded account paths, and platform stability, which aligns with why traders are choosing it in 2026.

Rules, Drawdown, and Payouts

Drawdown: understand the mechanic or you are done

Traders love to obsess over profit targets and ignore drawdown structure.

That is backwards. Drawdown is the real game.

Learn how consistency and risk limits typically work across firms here: prop firm consistency rules calculator guide.

Payouts: play the rules, get paid

Most payout problems are self-inflicted. Traders push size, spike one day, then fail the consistency threshold or violate risk limits.

If you want the payout rules explained in plain English with real examples, read: prop firm payouts common questions answered.

News and event trading: stop acting surprised

A lot of traders blow accounts during major events then blame the firm.

Most firms restrict news trading for a reason. If you do not understand the why, read this: why prop firms restrict news event trading.

Lucid Trading vs Other Prop Firms

This is the decision-stage content Google loves because it matches what traders search right before they buy.

If you want a deeper comparison, use your Lucid review as the hub: Lucid Trading review page.

Lucid vs intraday trailing drawdown firms

If you have been trapped in intraday trailing drawdown, you already know the pain:

one pullback and you are stopped out by the rule, not the market.

Lucid becomes appealing because end-of-day drawdown gives you room to execute like a human.

Lucid vs strict consistency environments

Consistency rules are not evil. Your lack of risk control is.

If you spike PnL with oversized trades, consistency rules punish you.

Fix it. Use the calculator guide: consistency rules calculator guide.

Who Lucid Is Best For

- Process-driven futures traders who want clean rules and fewer moving parts

- Traders burned by intraday trailing drawdown who need end-of-day structure

- Traders focused on withdrawals who care about payout cycles and predictability

If you are still in the phase where you need adrenaline to feel alive, Lucid is not your fix.

Your problem is not the firm. Your problem is your behavior.

Common Mistakes That Blow Lucid Accounts

- Oversizing after a win.

You think you are confident. You are actually reckless. - Trading every session like it is a payout deadline.

That mindset creates forced trades and dumb losses. - Ignoring the payout math.

Learn the payout rules and the consistency thresholds before you trade.

Start here: prop firm payouts common questions answered. - News-event gambling.

If you cannot explain why firms restrict event trading, you should not trade it.

Read: why prop firms restrict news event trading.

If you want a clean pre-trade routine that prevents violations, use the checklist: funded account checklist steps before trading.

Final Verdict

Lucid Trading is gaining momentum because it reduces the most common sources of prop firm failure:

rule friction, drawdown stress, and payout uncertainty.

It is not magic. It is structure.

Want the full breakdown with pricing, discounts, and account rules?

Go here: Lucid Trading Review on DamnPropFirms.

Lucid Trading FAQ

These are the questions traders actually type into Google before they buy. If you want more traffic and more conversions, you answer these better than everyone else.

How fast are Lucid Trading payouts?

Lucid Trading is known for fast payout processing once you meet payout eligibility. In practice, payout speed depends on your account type, your eligibility status, and the firm’s payout review checks. If you are trying to maximize payout approvals across any prop firm, read this: Prop firm payouts common questions answered .

The main reason traders get delayed is not the firm. It is traders breaking rules, spiking one oversized day, or failing consistency requirements. Stay consistent, stay within risk, and you avoid most payout drama.

Does Lucid Trading have consistency rules?

Some Lucid account types include consistency-style limits or payout distribution rules designed to prevent one-day yolo payouts. Other account types are more flexible. The exact consistency constraints can vary by product, so always confirm the rules for the specific Lucid account you are purchasing.

If you want to understand consistency rules across prop firms and how to avoid getting clipped by them, use: Prop firm consistency rules calculator guide .

Is Lucid Trading end-of-day drawdown?

Lucid is widely known for prioritizing end-of-day drawdown structures instead of intraday unrealized trailing drawdown. That matters because end-of-day drawdown reduces execution panic and makes it easier to hold trades without getting “rule stopped.”

End-of-day drawdown does not mean you can trade sloppy. If you oversize, you can still get buried. If you want the fundamentals of scaling and protecting funded accounts, read: scaling funded accounts risk management essentials .

What is the best Lucid Trading account type for beginners?

If you are new or inconsistent, do not touch instant funding. The “best” option is the one that forces you to trade small and survive long enough to build consistency. Most beginners should prioritize an evaluation-style path where you can learn the rule set without rushing withdrawals.

Before you trade any funded account, use this checklist: Funded account checklist steps before trading .

Does Lucid Trading allow news and event trading?

Most prop firms restrict news/event trading in some form, especially around major scheduled releases. Even when “allowed,” slippage and volatility can cause violations fast. If you do not understand why these rules exist, read: why prop firms restrict news event trading .

The harsh truth: most traders blow accounts on news because they are gambling, not trading.

Where can I read the full Lucid Trading review with pricing and discounts?

Here is the full breakdown with account types, rules, pricing, and any current discounts: Lucid Trading review page .