Apex Trader Funding is a proprietary trading firm that allows futures traders to use the firm’s capital instead of their own. To trade with Apex, you must pass an evaluation by meeting profit targets and risk rules. Once approved, you trade in a simulated environment with real payouts.

Key Rules to Know:

- Daily Trade Closure: All trades must be closed, and pending orders canceled by 4:59 PM ET daily. No overnight positions.

- Contract Limits: Each account size has strict limits on the number of contracts you can trade.

- One-Direction Trading: You cannot hedge (e.g., go long and short on the same or correlated instruments).

- Consistency Rule: Your highest profit day cannot exceed 30% of total accumulated profit since the last payout.

- Risk Management: Follow a 5:1 risk-to-reward ratio and avoid aggressive strategies like flipping trades or using fully automated bots.

Breaking these rules can lead to denied withdrawals, account resets, or permanent closures. Staying compliant ensures steady payouts and long-term success. Use tools like the Consistency Rule Calculator to track your progress and maintain eligibility for payouts.

Apex Funding 3.0 – NEW Payout Guidelines and Trading Rules Update!

Main Order Placement Rules at Apex Trader Funding

Apex Trader Funding Account Sizes: Contract Limits and Trailing Thresholds

Daily Trade Close-Out Requirements

At Apex Trader Funding, all trades must be closed, and pending orders canceled by 4:59 PM ET each trading day. A trading day runs from 6:00 PM ET one day to 4:59 PM ET the next, meaning overnight positions or swing trading strategies are not allowed. While the platform will automatically close positions at the cutoff time, traders are advised to manually close their trades to avoid potential risks.

Pending orders that are not linked to an open position must also be manually canceled. Leaving these orders active past the deadline can lead to account failure. It’s worth noting that some markets, like certain agricultural products, close earlier than others. Traders should carefully review market hours and adjust their strategies accordingly. Delaying trade closures increases the risk of price gaps and slippage, which could breach the trailing threshold. To stay on the safe side, it’s best to wrap up trading activities a few minutes before the deadline.

This rule emphasizes the importance of staying proactive and managing trades daily to mitigate risks effectively.

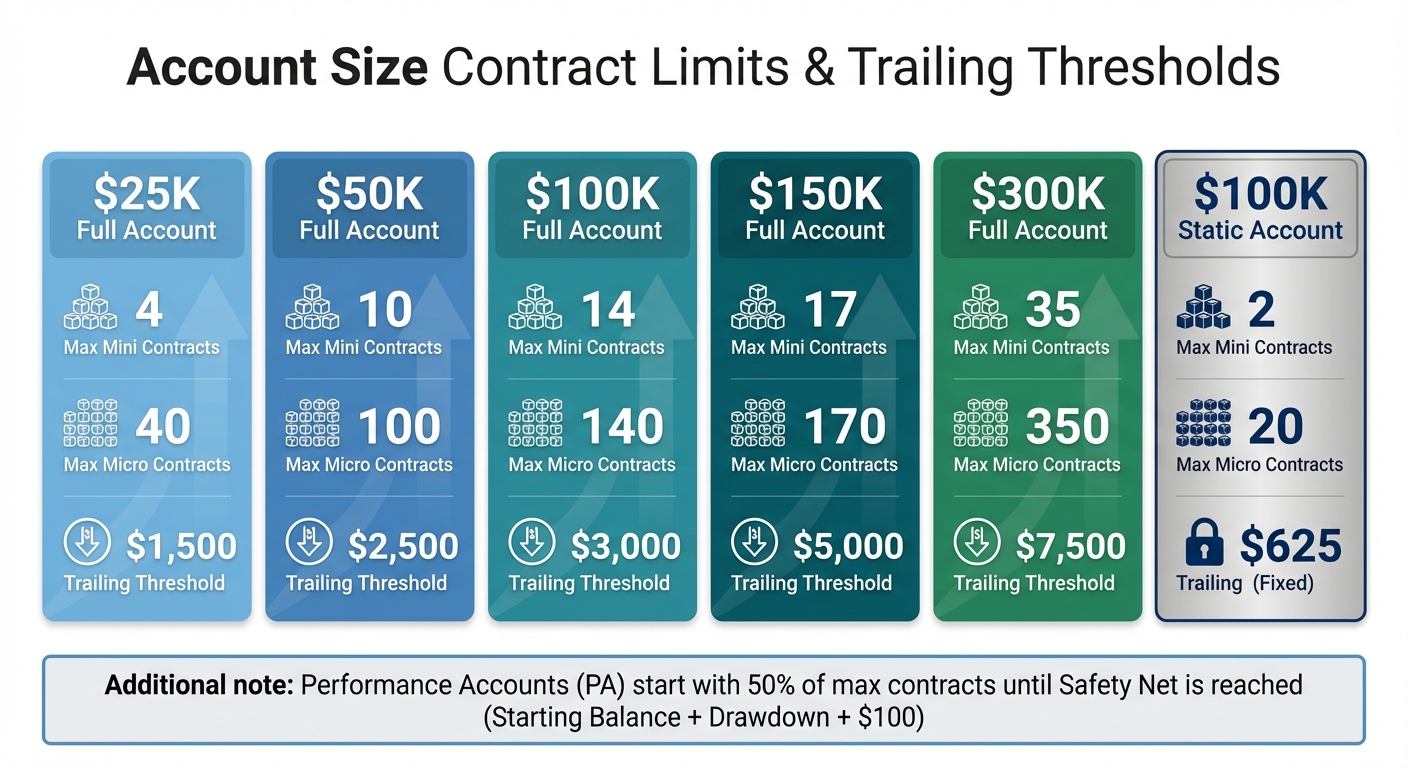

Position Size and Contract Limits

Apex sets strict contract limits based on account size, and the trading platform will block any orders that exceed these limits. These restrictions apply to the total number of positions across all instruments simultaneously. For example, if your limit is 10 contracts, you can trade 7 ES contracts and 3 GC contracts, but any attempt to exceed this total will result in order rejection.

| Account Size | Max Mini Contracts | Max Micro Contracts | Trailing Threshold |

|---|---|---|---|

| $25K Full | 4 | 40 | $1,500 |

| $50K Full | 10 | 100 | $2,500 |

| $100K Full | 14 | 140 | $3,000 |

| $150K Full | 17 | 170 | $5,000 |

| $300K Full | 35 | 350 | $7,500 |

| $100K Static | 2 | 20 | $625 (Fixed) |

In Performance Accounts (PA), traders are initially limited to using only half of their maximum allowed contracts. This restriction stays in place until the account balance reaches the "Safety Net", which is calculated as the starting balance plus the drawdown amount plus $100. You can track your progress toward this threshold using the RTrader or Tradovate dashboard.

If you accidentally exceed the allowed limit before hitting the safety net, it’s crucial to immediately close the excess positions. Failing to do so may result in payout denial or even an account reset.

One-Direction Trading Rule

Apex requires traders to stick to one direction per instrument or correlated instruments – either long or short. Hedging, or holding long and short positions simultaneously, is strictly prohibited.

"All trades must be in one direction – even in another account. You are not permitted to trade a mini in one direction and a micro in another, or go long on ES and short on YM." – Benzinga

This rule aims to promote trading discipline and consistency. For instance, you cannot hold a long position in ES while simultaneously shorting YM, as these are correlated instruments. During times of market volatility, maintaining a single directional bias is particularly important, as frequent trade reversals could lead to payout denial.

If you’re using trade copiers across multiple accounts, ensure all accounts execute trades in the same direction to avoid unintentional hedging violations.

For more details on Apex Trader Funding and its trading rules, check out the full review on Apex Trader Funding.

Banned Trading Practices

Apex Trader Funding has outlined specific prohibited trading practices to maintain consistency and discipline across all accounts. These rules build on the principle of one-direction trading, ensuring traders adhere to fair and transparent strategies.

Non-Directional Order Strategies

Traders are not allowed to hold opposing positions on the same instrument or related ones. For example, you cannot go long on the ES index while simultaneously shorting a correlated index.

This restriction also applies to straddling news events. Placing simultaneous buy and sell orders to capitalize on market volatility during news releases is not allowed. The goal here is to ensure traders have a clear market bias and are not exploiting system inefficiencies or hedging to avoid risk.

The next rule addresses flipping trades and sets clear boundaries for this practice.

Flipping Trades

Flipping trades – switching between long and short positions – is only permitted if it generates a minimum of $50 in profit across five separate trading days. This ensures that flipping reflects calculated decision-making rather than attempts to bypass the minimum trading day requirements.

"Strategies that involve ‘all-in’ trades with maximum contract sizes, particularly at the start of a PA account, to quickly overcome the trailing drawdown are prohibited." – Apex Trader Funding

Fully automated trading systems are also banned. This includes AI-driven bots, algorithms, and high-frequency trading (HFT) systems that operate without active trader involvement. However, semi-automated tools designed to enhance execution speed are allowed, provided traders actively manage their entries and exits.

The guidelines also impose strict controls on Dollar-Cost Averaging (DCA) to ensure disciplined risk management.

Dollar-Cost Averaging (DCA) Restrictions

DCA is allowed but must be applied responsibly. Traders must adhere to the 30% Negative P&L Rule, meaning an unrealized loss on any trade cannot exceed 30% of the day’s starting profit balance. Additionally, a 5:1 risk-to-reward ratio must be maintained – for instance, a 10-tick target requires a stop loss of no more than 50 ticks. Violating these thresholds, such as aggressively averaging down in a losing position, could lead to account review or disqualification.

Aggressive behavior that disregards these risk management rules is prohibited, as it endangers the firm’s capital and reflects poor trading discipline.

sbb-itb-46ae61d

Consistency Rules and Order Placement

What is the Consistency Rule?

Apex Trader Funding enforces a 30% Consistency (Windfall) Rule, which limits your highest profit day to no more than 30% of your total accumulated profit since your last payout. For instance, if you’ve earned $1,000 in total profit, your best trading day shouldn’t exceed $300. This rule encourages traders to focus on steady, smaller gains rather than chasing big wins.

The calculation resets after each approved payout and typically ends after your sixth payout or once you move to a Live Account. Importantly, this rule applies only to Performance and Live accounts – it doesn’t affect evaluation accounts. To check compliance, use this formula:

(Highest Profit Day) ÷ 0.3 = Minimum Required Profit.

Now that the rule is clear, let’s explore how to maintain compliance on a daily basis.

How to Stay Compliant

If your target is $3,000 in total profit, aim for daily gains between $400 and $600, ensuring no single day exceeds the 30% limit. Avoid placing large positions early in your trading period, as this could create profit spikes that delay payouts or prompt account reviews.

Set realistic stop losses for each trade, adhering to the 5:1 Risk-Reward Ratio Rule. This means your stop loss should never be more than five times your profit target. If you have a day where profits exceed the 30% cap, consider reducing position sizes in subsequent trades to balance out the outlier. Use your account dashboard to track how each trading day impacts your eligibility for payouts.

This approach works hand-in-hand with Apex Trader Funding’s order placement and risk management guidelines, helping you stay on track.

Using the Consistency Rule Calculator

To simplify compliance, Apex Trader Funding offers a Consistency Rule Calculator, which you can find on DamnPropFirms. Enter your highest profit day and total accumulated profit into the calculator, and it will determine whether your best day stays within the 30% limit. If you’re not compliant, the tool will show how much additional profit you need to offset the windfall day.

Make it a habit to check the calculator after each trading session, especially before requesting a payout. Running your numbers through the tool ensures you meet the 30% threshold and can avoid payout denials or delays. Staying proactive with this tool is a simple yet effective way to align your trading strategy with Apex Trader Funding’s rules.

Summary and Compliance Tips

Main Rules Review

Apex Trader Funding has specific rules designed to encourage disciplined trading. First, all positions must be closed, and pending orders canceled by 4:59 PM ET daily. Contract limits are strictly enforced – for instance, a $50,000 account permits a maximum of 10 mini contracts, with any orders exceeding this automatically rejected. The firm also enforces a one-direction trading rule, disallowing hedging on the same or correlated instruments, such as ES and YM. Additionally, the 30% Consistency Rule ensures that no single day’s profit exceeds 30% of the total payout profit. Traders must also adhere to a 5:1 Risk-to-Reward Ratio, meaning stop-losses cannot exceed five times the profit target. Certain strategies, including high-frequency trading, fully automated bots, and "flipping" (unless specific profit thresholds are met), are prohibited. These rules reflect Apex Trader Funding’s emphasis on sustainable and disciplined trading practices.

Practical Compliance Steps

To stay compliant with these rules, here are some actionable steps:

- Monitor your trailing drawdown using tools like RTrader Pro or Tradovate, and maintain a buffer of $100–$300 above the liquidation threshold.

- Set daily profit targets to encourage steady growth. For example, aim for $400–$600 per day if working toward a $3,000 goal.

- Use the Consistency Rule Calculator available on DamnPropFirms after every session to ensure you’re within the 30% profit limit before requesting payouts.

- Double-check your contract sizes to ensure they align with your account’s limits.

- Apply strict stop-losses to every trade, meeting both the 5:1 risk-to-reward ratio and the 30% negative P&L rule.

What to Do Next

Now that you’re familiar with the rules and compliance steps, it’s crucial to stay informed. Regularly review Apex Trader Funding’s official rulebook for updates that could impact your trading strategy. Take advantage of resources on DamnPropFirms, such as verified reviews, discount codes, and the Consistency Rule Calculator, to streamline your compliance efforts. Apex Trader Funding rewards traders who stick to the rules and focus on disciplined practices. By prioritizing consistent, smaller gains over risky large wins, you’ll position yourself for long-term success and steady payouts.

FAQs

What should I do if I accidentally leave a trade open after the daily close-out time?

Apex Trader Funding doesn’t clearly outline what occurs if a trade stays open past the daily close-out time. To steer clear of any complications, it’s crucial to manage your trades diligently and close all positions before the specified cut-off time. If you need more details, check their rules or reach out to their support team for assistance.

What is the Consistency Rule, and how does it affect my trading and payouts?

The Consistency Rule at Apex Trader Funding is designed to promote steady and balanced trading by limiting your single best trading day to no more than 30% of your total profit in a funded account. While this rule doesn’t apply during the evaluation phase, it kicks in once you transition to a funded account. The idea is to encourage traders to focus on consistent growth rather than relying on a single, high-risk winning day.

To stay within the rule, aim for consistent daily profits instead of taking big risks on one-off trades. Many traders set achievable daily profit targets, like $50 or more, and distribute their risk across multiple trades. Additionally, the 8-day payout framework requires at least five profitable days with a minimum of $50 per day before withdrawals are permitted. If you exceed the 30% limit on a single day, your payout could be denied – even if you’ve hit the overall profit target.

Following the Consistency Rule not only helps you qualify for quicker withdrawals but also allows you to manage multiple accounts more efficiently, increasing your potential payouts. Tools like the Consistency Rule Calculator can be valuable for planning your daily profit distribution and staying compliant.

Can I use automated trading systems with Apex Trader Funding, and are there any restrictions?

Apex Trader Funding permits the use of automated trading tools, but there’s a catch: traders must stay actively involved in the process. Completely autonomous setups, like hands-free bots or AI-powered systems, are not allowed under any circumstances.

Traders are required to oversee their automated systems in real-time and step in when needed. This hands-on approach ensures accountability and keeps everything in line with Apex Trader Funding’s trading rules.