To start a proprietary trading firm, you’ll need a clear plan, proper technology, and compliance with regulations. Prop firms provide traders with capital to trade and share profits based on performance. The business model often includes evaluation challenges where traders prove their skills for funding. Here’s a quick overview:

- Business Model: Decide between evaluation-based challenges, direct funding, or a hybrid approach.

- Revenue Streams: Earn from trader evaluation fees, profit sharing (keeping 10%-20%), reset fees, and platform markups.

- Costs: Startup costs range from $50,000 to $1,000,000. Monthly expenses depend on firm size, typically $40,000 or more.

- Regulations: Register with the CFTC and NFA if required, and ensure compliance with KYC and AML protocols.

- Technology: Invest in trading platforms, risk management tools, and evaluation engines. White-label solutions can speed up the process.

- Risk Controls: Set clear rules on drawdowns, daily loss limits, and trading behavior to protect capital.

- Growth: Use marketing strategies like SEO, referral programs, and community engagement to attract traders.

Starting a prop firm involves balancing trader success with firm profitability. Focus on automation, compliance, and transparency to build trust and scale effectively.

How to Start a Proprietary Trading Firm: Models, Requirements & Insider Tips | Adam Tracy

Creating Your Business Plan

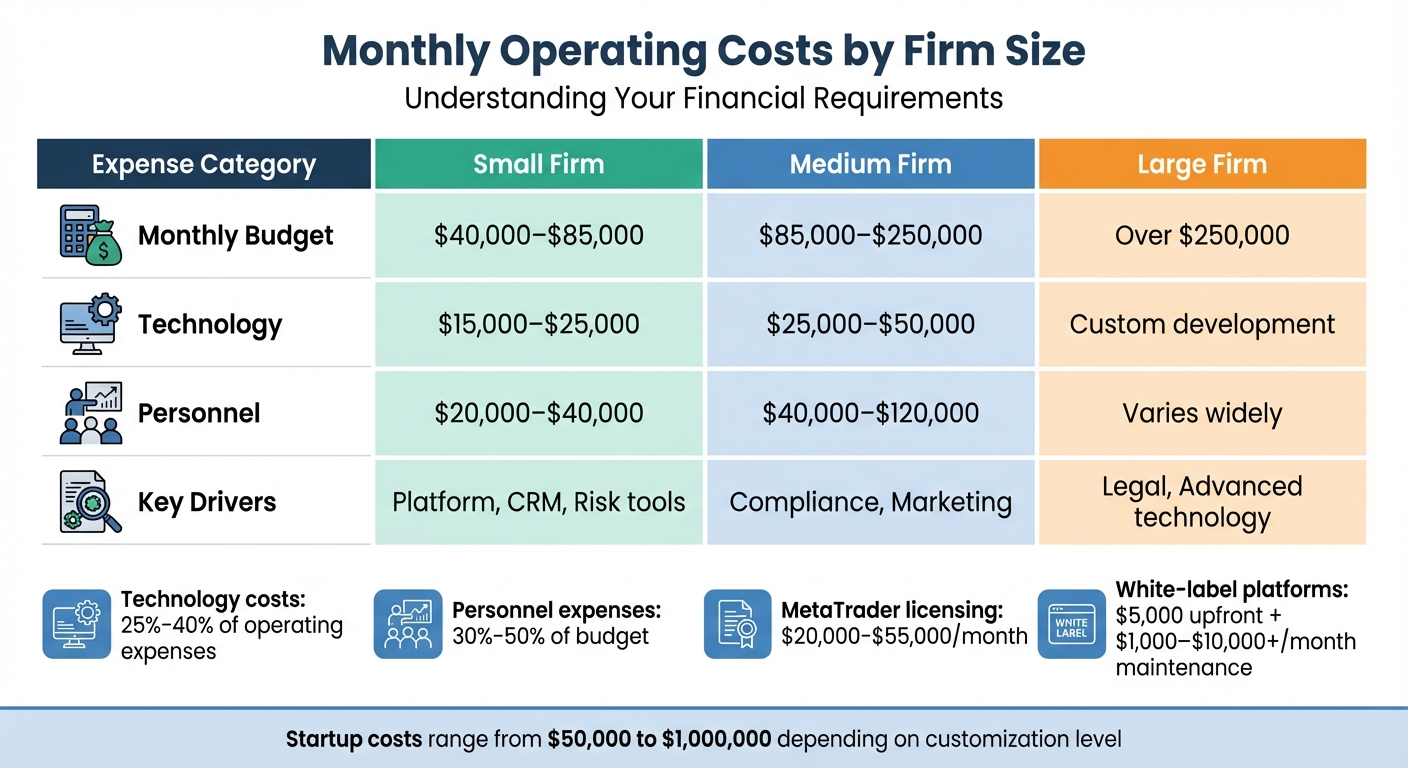

Prop Firm Monthly Operating Costs by Firm Size

A well-thought-out business plan is the backbone of any successful proprietary trading firm. It should clearly outline how your firm will generate income, the traders you aim to work with, and what makes your firm stand out. Before diving into hiring or investing in expensive technology, take time to map out your revenue model, target audience, and financial strategy.

Setting Your Goals and Target Market

The first step is deciding on your business model: evaluation (challenge), direct funding, or a hybrid approach. In the evaluation model, traders pay a fee to prove their skills. Direct funding, on the other hand, involves backing traders with verified track records.

Next, define what makes your firm special. Whether it’s offering weekly payouts, a 90% profit split, or trader-friendly rules, your unique value proposition will help you attract the right traders.

Understanding your target traders is critical. Are you catering to day traders, swing traders, or scalpers? Each group has different needs. For example, scalpers thrive on ultra-low latency and tight spreads, while swing traders might prioritize overnight position holding.

Establish risk management rules early. This includes setting daily loss limits (commonly $1,000 to $3,000, depending on account size), maximum drawdown thresholds (typically 6%–10% of starting capital), and position sizing guidelines. To ensure stability, keep capital reserves of at least 10%–20% of funded capital and enough cash to cover 6–12 months of operating expenses.

Finally, diversify your revenue streams to create a more stable financial foundation.

Selecting Your Revenue Model

Successful proprietary trading firms don’t rely on just one income stream. Here’s a breakdown of the key revenue models:

- Evaluation Fees: Traders pay fees ranging from $100 to $3,000 to attempt challenges, depending on the account size they’re aiming for. With only 5%–10% of traders passing these challenges – and overall success rates often below 0.1% – evaluation fees provide a steady and predictable cash flow. Diversifying income sources is still essential to weather fluctuations in trader sign-ups.

- Profit Sharing: Many firms earn by taking 10%–20% of the profits generated by funded traders, leaving the remaining 80%–90% for the traders. For example, if a trader managing a $100,000 account earns $3,000 in profit in a month (a 3% return), the firm could earn $600 in performance fees with an 80/20 split.

- Other Revenue Streams: Firms often charge reset fees for traders who break rules and wish to restart their evaluation. These fees are typically slightly lower than the initial challenge fee. Additional earnings can come from brokerage markups on spreads or commissions, as well as monthly subscription fees for platform access or premium data feeds.

Interestingly, evaluation fees account for 80%–95% of revenue for most proprietary trading firms.

Estimating Costs and Revenue

Once you’ve chosen a revenue model, it’s time to crunch the numbers. Calculate your startup costs and monthly expenses to ensure your business is financially viable. A detailed forecast is essential for long-term success.

Startup costs can vary widely – from $50,000 for a lean, white-label setup to over $1,000,000 for a fully customized operation.

Here’s a rough breakdown of monthly expenses by firm size:

| Expense Category | Small Firm | Medium Firm | Large Firm |

|---|---|---|---|

| Monthly Budget | $40,000–$85,000 | $85,000–$250,000 | Over $250,000 |

| Technology | $15,000–$25,000 | $25,000–$50,000 | Custom development |

| Personnel | $20,000–$40,000 | $40,000–$120,000 | Varies widely |

| Key Drivers | Platform, CRM, Risk tools | Compliance, Marketing | Legal, Advanced technology |

Technology costs often make up 25%–40% of operating expenses. For example, licensing MetaTrader can cost $20,000–$55,000 per month, while white-label platforms might require a $5,000 upfront fee plus $1,000 to $10,000+ in monthly maintenance. Personnel expenses typically account for 30%–50% of your budget.

When projecting revenue, take a conservative approach. For instance, if you charge $200 per evaluation and attract 100 new traders each month, that’s $20,000 in evaluation fees. Add $5,000 from profit sharing with 10 funded traders earning $500 each, and your total monthly revenue would be around $25,000. Compare this to your monthly expenses to assess sustainability.

It’s worth noting that about 14% of proprietary trading firms are expected to shut down in 2024. Many fail because they underestimate costs or overestimate trader success rates. To mitigate risk, consider starting with lower funding caps (e.g., $10,000 to $50,000 per trader) and scaling up as traders prove their consistency.

Legal Setup and Regulatory Requirements

Once your business plan is in place, ensuring compliance with legal and regulatory requirements becomes essential for smooth operations. In the derivatives industry, firms must adhere to the Commodity Exchange Act (CEA) by registering with the Commodity Futures Trading Commission (CFTC) and becoming members of the National Futures Association (NFA). If your firm operates solely as a proprietary trading entity – trading your own capital or funding traders under your firm’s accounts – you are not required to register as a Futures Commission Merchant (FCM). However, if you actively buy or sell futures contracts for your own account, you will likely need to register as a Floor Trader Firm (FTF).

With the legal groundwork in place, the next step is registering your business entity and key personnel.

Registering Your Business Entity

To protect personal assets, structure your business as a Limited Liability Company (LLC). Under the CEA, you’ll need to determine the appropriate registration category for your firm, such as Floor Trader Firm (FTF), Introducing Broker (IB), Commodity Pool Operator (CPO), or Commodity Trading Advisor (CTA).

Appoint a Security Manager to oversee the registration process through the NFA’s Online Registration System (ORS). Your firm must complete Form 7-R to register with both the CFTC and NFA. Additionally, each principal and Associated Person (AP) must submit Form 8-R, and at least one principal must register as an AP to maintain NFA membership.

Include fingerprint cards with Form 8-R for FBI background checks, a process that may take six weeks or more for first-time applicants. As the NFA explains:

"The primary purposes of registration are to screen an applicant’s fitness to engage in business as a futures professional and to identify those individuals and organizations whose activities are subject to federal regulation".

Set up a prepaid NFA account to cover fee payments. The application fee for FCM registration is $500 (non-refundable), and the registration fee for each principal or AP is $85. Be sure to disclose all disciplinary history accurately, as omissions can disqualify you from registration.

Once registered, staying compliant with CFTC and NFA requirements is an ongoing responsibility.

Meeting CFTC and NFA Requirements

To maintain compliance, file an Annual Registration Update and pay the necessary maintenance fees. Missing the 30-day filing or payment deadline is considered a withdrawal request from registration.

All principals and APs must meet proficiency standards by passing the required futures or swaps exams. According to NFA Bylaw 301(a)(iii):

"No person… shall be eligible to become or remain a Member unless at least one of its principals is registered as an ‘associated person’ under the Act and Commission Rules".

This makes it mandatory for at least one principal to hold AP status for your firm to operate.

Additionally, compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols is federally mandated. Use the NFA’s Online Registration System to track application status and ensure all fitness-related questions are answered truthfully to avoid delays or penalties. Payments to the NFA can be made via U.S. bank accounts, wire transfers, or checks, but credit cards are not accepted.

| Registration Item | Form/Action | Cost |

|---|---|---|

| Firm Application | Form 7-R | $500 (FCM) |

| Individual Registration | Form 8-R | $85 per person |

| Background Check | Fingerprint Cards | Included |

| Annual Maintenance | Annual Update | Varies by category |

Setting Up Your Technology Stack

Launching a competitive and compliant proprietary trading firm starts with building a solid tech stack. Once the legal groundwork is in place, focus on creating a system that handles trade execution, risk monitoring, trader evaluations, and payouts efficiently. Thanks to advancements in technology, building a prop firm today is far less complicated and expensive than it used to be.

Key components of your tech stack include a trading platform back office, a risk management engine, a trader evaluation engine, and KYC/payment integrations. The trading platform back office should support multiple asset classes and allow you to manage trading conditions. The risk management engine ensures you can track drawdowns, enforce stop-loss and position limits, and automatically suspend accounts that breach rules. A trader evaluation engine monitors performance against specific challenge criteria – like profit targets or daily loss limits – and automates upgrades or failures. Meanwhile, KYC integrations and payment gateways handle identity verification, challenge fees, and payouts.

The cost of setting up a tech stack typically ranges from $50,000 to $200,000. Licensing fees can add $8,000–$25,000 upfront and $3,000–$8,000 monthly. Most firms recover these costs within four to eight months. As the Spotware team explains:

"When you start a proprietary trading firm today, it no longer requires millions in upfront capital, but rather demands precision in tech, compliance, and trader scaling".

Once this foundation is in place, you’ll be ready to integrate the trading platforms and risk tools discussed next.

Choosing Trading Platforms and Risk Tools

The trading platform you choose plays a huge role in earning trader trust and ensuring smooth operations. Popular platforms include cTrader, MT4/MT5, NinjaTrader, and Tradovate (the latter being ideal for futures trading). Transparency is key here, as Spotware highlights:

"A prop firm offering cTrader is automatically a trusted one because the platform protects traders from price manipulation".

Make sure your platform includes REST and FIX API access to connect trading data with your CRM, payment processors, and evaluation engines. For example, integrating platforms like cTrader usually takes about five days. Specialized evaluation engines – such as PropPulse, Axcera, or Kenmore – help automate rule enforcement, which reduces the need for manual oversight and allows for scalable growth.

Mobile compatibility is another must-have. Traders expect high-quality mobile apps to monitor their positions anytime, anywhere. Before launching, test demo accounts to evaluate spread behavior during volatile market conditions and verify connection stability.

With your platform and risk tools ready, the next step is to ensure reliable market data access.

Connecting Data Feeds and Market Access

Real-time market data and efficient trade execution are essential for maintaining your firm’s reputation. Start by deciding which asset classes you’ll offer – such as forex, futures, stocks, crypto, or commodities – as this will determine the data feeds and liquidity providers you need. For futures and stocks, you may need exchange memberships with organizations like the NYSE or NSE to access official data.

Partnering with a multi-asset liquidity provider ensures you get deep market access and low-latency routing. As Alexander Shishkanov from B2Broker points out:

"For live-funded traders, your execution quality is part of your brand".

The initial cost for institutional-grade liquidity typically ranges from $5,000 to $50,000 or more, with ongoing monthly fees of $3,000 to $8,000 for maintaining data feeds and infrastructure. To save costs during the evaluation phase, use demo servers with simulated pricing. Only route trades to live liquidity once a trader passes the challenge and gets funded. Focus on providers that offer ultra-low latency and invest in redundant infrastructure to ensure smooth operations during high-volatility periods.

Using White-Label Software

White-label solutions are a fast and cost-effective way to get started. These pre-packaged systems can be deployed in about a week, compared to the two to four months needed for custom setups. White-label platforms come with pre-integrated liquidity for multiple asset classes, eliminating up to 90% of the integration and maintenance workload.

While white-label solutions are cheaper upfront and quicker to launch, they often come with limited backend access and may not scale as well as custom platforms. However, for new firms, this trade-off is often worth it. As the Spotware team notes:

"The right technology partner will save you months of development time and reduce your cost-to-launch".

White-label packages typically include the trading platform, evaluation engine, KYC tools like Sumsub or Veriff, and payment gateways such as Stripe or crypto processors. This setup allows the CRM to manage onboarding while the evaluation engine monitors trading activity via API, automatically flagging rule violations. The risk management system can then suspend accounts or process payouts based on this data.

sbb-itb-46ae61d

Creating Trading Rules and Risk Controls

Once your technology is in place, the next step is to establish clear trading rules and risk controls. These not only safeguard your capital but also help attract skilled traders. The key is finding the right balance: rules strict enough to deter reckless behavior but flexible enough to allow talented traders to thrive. As B2Broker notes:

"The best firms balance difficulty and accessibility: they attract skilled traders but keep barriers low enough to drive volume".

Many futures proprietary firms use an evaluation-based model where traders pay an upfront fee – typically ranging from $137 to $677, depending on the account size – to demonstrate their skills in a simulated environment before gaining access to live capital. This evaluation phase, often called a "Trading Combine", requires traders to hit profit targets (usually 6% to 10% of the starting balance) while adhering to strict drawdown limits. Traders must also meet profit-day requirements before payouts are allowed, with profit splits often set at 90/10 in favor of the trader.

To protect your capital, enforce daily loss limits (2%–5%) and maximum drawdown limits (3%–10%). A dynamic trailing drawdown, which adjusts based on the account’s peak balance, is a common practice in the industry to lock in profits. Additionally, consistency rules – such as capping a single day’s profit contribution to 30%–40% of the total profit target – ensure that traders don’t rely on one lucky, volatile day to pass the evaluation.

Define clear payout eligibility requirements. Most firms require traders to meet a minimum number of trading days (typically 5 to 10) and achieve a minimum profit per day (e.g., $50 or $200) to ensure consistent performance. A bi-weekly payout schedule, combined with a 20% profit buffer, can motivate traders while preserving firm capital. Automated systems should flag rule violations and handle account suspensions and payouts, ensuring seamless integration with your evaluation process.

Setting Evaluation and Payout Rules

After establishing your financial framework, you’ll need to design an evaluation process that separates disciplined traders from the rest. Decide between a one-step or two-step challenge. In a one-step model, traders must hit a single profit target (e.g., 8% of the starting balance) while staying within loss limits. In a two-step model, traders first meet an initial profit target (e.g., 8%) and then pass a verification phase with a lower target (e.g., 5%) before gaining access to funded capital.

For example, on a $50,000 account, an 8% target means the trader must earn $4,000 in profits during the evaluation. Pair this with a daily loss limit of 2%–5% of the starting balance to prevent a single bad day from wiping out the account. Use a dynamic trailing drawdown that adjusts with intraday peaks to further protect your capital.

Consistency rules are critical to avoid traders relying on one-off lucky trades. Require that no single trading day contributes more than 30%–40% of the total profit needed to pass. This prevents traders from exploiting high-impact news events like Non-Farm Payrolls or FOMC announcements. Also, enforce a minimum number of trading days – typically 5 to 10 – to ensure strategies are repeatable rather than flukes.

Once traders pass the evaluation, set clear payout rules. For instance, require a minimum number of "winning days" (days with profits above a set threshold, like $200) before the first withdrawal request is allowed. Apex Trader Funding, which has paid out over $378 million as of January 2025, uses this approach to ensure consistent profitability. Industry-standard profit splits range from 80/20 to 90/10 in favor of the trader, with some firms offering 100% of the first $25,000 in profits to attract top talent. Regular bi-weekly payouts, combined with a profit buffer (typically 20%), help ensure accounts remain viable after funding. Firms like Topstep process payout requests quickly – usually within 1 to 3 business days – building trust and encouraging trader retention.

Implementing Risk Management Controls

Your risk management system should operate in real time, automatically suspending accounts when rules are breached. For example, if a trader exceeds a daily loss limit or hits the maximum drawdown, trading should be disabled immediately. Automation ensures consistent enforcement across all accounts.

A tiered breach system can address different levels of violations. A "Soft Breach", like hitting the daily loss limit, might disable trading for the rest of the day but allow the trader to resume the next session. A "Hard Breach", such as exceeding the maximum trailing drawdown, should result in immediate account closure and evaluation failure.

Mandatory stop losses on every trade are essential. Your platform should reject any orders that don’t include a stop loss, preventing catastrophic losses from runaway positions. Additionally, enforce a maximum risk-to-reward ratio – typically around 5:1 – to discourage traders from taking small gains with disproportionately large risks.

Explicitly ban high-risk strategies in your terms of service. This includes Martingale systems (doubling position sizes after losses), high-frequency latency arbitrage, and grid trading without stop losses. Restrict trading during high-impact news events, and require positions to be closed before weekends to minimize gap risk.

For added security, implement a three-tier protection system:

- At 2% drawdown: Alert traders to reduce position sizes by 50% and limit trades to one per day.

- At 4% drawdown: Enforce a three-day trading pause for strategy review.

- At 6% drawdown: Halt trading for a week and require a comprehensive trading plan revision.

As PropFirmCodes highlights:

"Fewer trades = Fewer emotional errors. Most funded traders lose their account through overtrading, not lack of skill".

Launching and Growing Your Firm

Marketing Your Prop Firm

Once your infrastructure is ready, the next step is to build visibility and attract talented traders. Between early 2020 and mid-2024, interest in proprietary trading firms skyrocketed by 8,409%. To tap into this growing demand, consider a multi-channel strategy that blends content marketing, community engagement, and strategic partnerships.

Start by creating SEO-optimized content for platforms like YouTube, TikTok, and your blog. Educational videos explaining your evaluation process, payout structures, and risk management policies can help establish trust and credibility. At the same time, ensure your website is professional and transparent. Clearly outline details like profit splits, payout timelines, and fee structures. As TradeLocker emphasizes:

"Your website is your storefront. It should build trust, explain who you are, and make it easy for traders to get started."

Affiliate marketing and influencer partnerships can also fast-track your growth. Collaborate with well-known trading educators and set up referral programs that reward existing traders for bringing in new participants. Before your official launch, use a "coming soon" landing page to collect email addresses and build a ready-to-go user base. Additionally, establish a trader community on platforms like Discord to provide support, share educational resources, and combat the isolation traders often feel. For instance, Topstep uses live-streaming tools like TopstepTV to deliver real-time market commentary and performance coaching – offering value that goes beyond just funding capital.

Email automation is another powerful tool. Use it to welcome new users, share promotional offers, and remind leads to complete their challenges. By combining these strategies, you’ll position your firm for sustainable growth while creating a strong foundation for scale.

Scaling Your Operations

Once your technology and compliance systems are in place, the focus shifts to operational growth. Key performance indicators like trader pass rates, churn, payout consistency, and rule violations will help you refine your processes. If managed carefully, most proprietary trading firms break even within 4 to 8 months.

When profitability kicks in, reinvest in automation tools to streamline operations. These tools can enforce trading rules, manage drawdowns, and execute trades through APIs, reducing the need for manual oversight. Platforms like PickMyTrade and PropTradeTech make it easier to scale while maintaining efficiency. Additionally, adopting white-label technologies like TradeLocker or cTrader can help you expand into new asset classes – such as forex or crypto – without overhauling your existing system.

Consider implementing tiered funding models to reward traders who demonstrate consistent performance. For example, Topstep offers its top traders access to funding of up to $150,000, along with performance bonuses exceeding $250,000.

A great example of scaling comes from Owen Morton, founder of FunderPro. In November 2025, Morton introduced a daily payout model, eliminating the traditional multi-week waiting periods. This change, powered by TradeLocker’s modular technology, supported significant growth and now serves as the backbone for over 100 prop firms worldwide. As Morton explains:

"When traders can access their capital immediately, they trade with sharper intent, turning consistency into growth."

To further diversify your revenue streams, look beyond evaluation fees. Profit splits, subscription plans, commission markups, and spread markups can all provide additional income, ensuring your firm remains profitable while offering value to its traders.

Conclusion

Starting a futures prop firm requires top-notch technology, a solid legal framework, effective risk management, ample liquidity, a clear evaluation process, and a focus on sustainable growth. The initial financial investment typically falls between $50,000 and $200,000.

To succeed, there are three core pillars to focus on: adhering to strict regulatory standards, implementing automated risk controls to protect capital, and fostering transparency to earn trader trust. As PropAccount emphasizes:

"A proactive attitude towards compliance will preserve your firm’s reputation and avoid expensive legal issues."

The prop trading industry is expected to grow significantly – from $5.8 billion in 2024 to $14.5 billion by 2033. This creates a wealth of opportunities for firms that are well-prepared. White-label solutions can help new firms enter the market in as little as a week, but long-term success hinges on operational excellence. This includes processing payouts within 1 to 3 business days, enforcing rules consistently, and diversifying income streams beyond evaluation fees.

The key to thriving in this competitive landscape lies in building a trader-focused, sustainable business model. Firms that prioritize the success of their traders over exploitative practices gain a lasting edge. By laying a strong foundation – leveraging advanced technology, maintaining disciplined risk management, and adopting a "Traders First" mindset – you can secure a meaningful share of this rapidly growing market.

Plan carefully, launch with intention, and scale responsibly. A strong reputation will not only attract top trading talent but also ensure your firm’s long-term success.

FAQs

What are the first steps to legally set up a proprietary trading firm?

Starting a proprietary trading firm requires careful attention to legal and regulatory steps to ensure everything is set up correctly. The first decision you’ll face is choosing the right legal entity structure – options like an LLC or corporation are common. This choice will depend on your business goals and how much personal liability protection you want. Once that’s decided, you’ll need to officially register your business with the relevant state and federal agencies and secure any licenses or permits required for proprietary trading.

It’s equally important to work with a legal or financial expert to ensure your firm meets all regulatory requirements. In the United States, this includes compliance with rules from agencies like the SEC or CFTC. Having the right documentation, contracts, and policies in place will not only keep your firm on the right side of the law but also create a strong foundation for smooth operations.

How can a prop firm ensure both trader success and business profitability?

Balancing trader success with profitability hinges on creating a solid risk management framework. This framework should safeguard the firm’s capital while empowering traders to perform at their best. Key elements include setting strict limits on position sizes, daily losses, and maximum drawdowns. Automated systems are essential for enforcing these limits and preventing breaches. To further encourage high performance, firms can implement tiered capital allocation – granting larger accounts only to traders who consistently meet risk-adjusted performance benchmarks.

A clear and fair profit-sharing structure plays a crucial role in aligning incentives. For instance, a 70/30 profit split – where traders keep 70% of profits and the firm retains 30% – can keep traders motivated while maintaining the firm’s revenue stream. Performance-based scaling offers additional rewards: traders who hit profit targets and stick to risk parameters can earn access to more capital and improved splits. Regular payouts, whether weekly or monthly, help maintain trader engagement. Meanwhile, the firm can channel its share of earnings into enhancing technology, securing liquidity, and funding growth strategies to ensure both immediate and long-term success.

What technology do I need to start a prop trading firm?

To launch a prop trading firm, having a solid technology setup is non-negotiable. You’ll need tools to handle trader onboarding, manage accounts, and support real-time trading operations seamlessly. A cloud-based platform is key here – it automates funding programs, evaluates trader performance, and provides a secure portal for account management. This platform must also connect with brokerages or exchanges using API integration, ensuring fast order execution and access to low-latency market data for precise pricing.

Equally important is a risk management system to protect your firm’s capital. Features like per-trade loss limits, daily drawdown caps, and real-time position tracking are essential. On the compliance side, modern tools can streamline trade logging, maintain audit trails, and enforce regulatory standards automatically. To stay on top of performance and growth, a real-time analytics dashboard can track trader activity, payouts, and the overall health of your firm.

These elements – cloud platforms, API connectivity, market data, risk controls, compliance tools, and analytics – form the backbone of a competitive and efficient prop trading operation in the U.S.