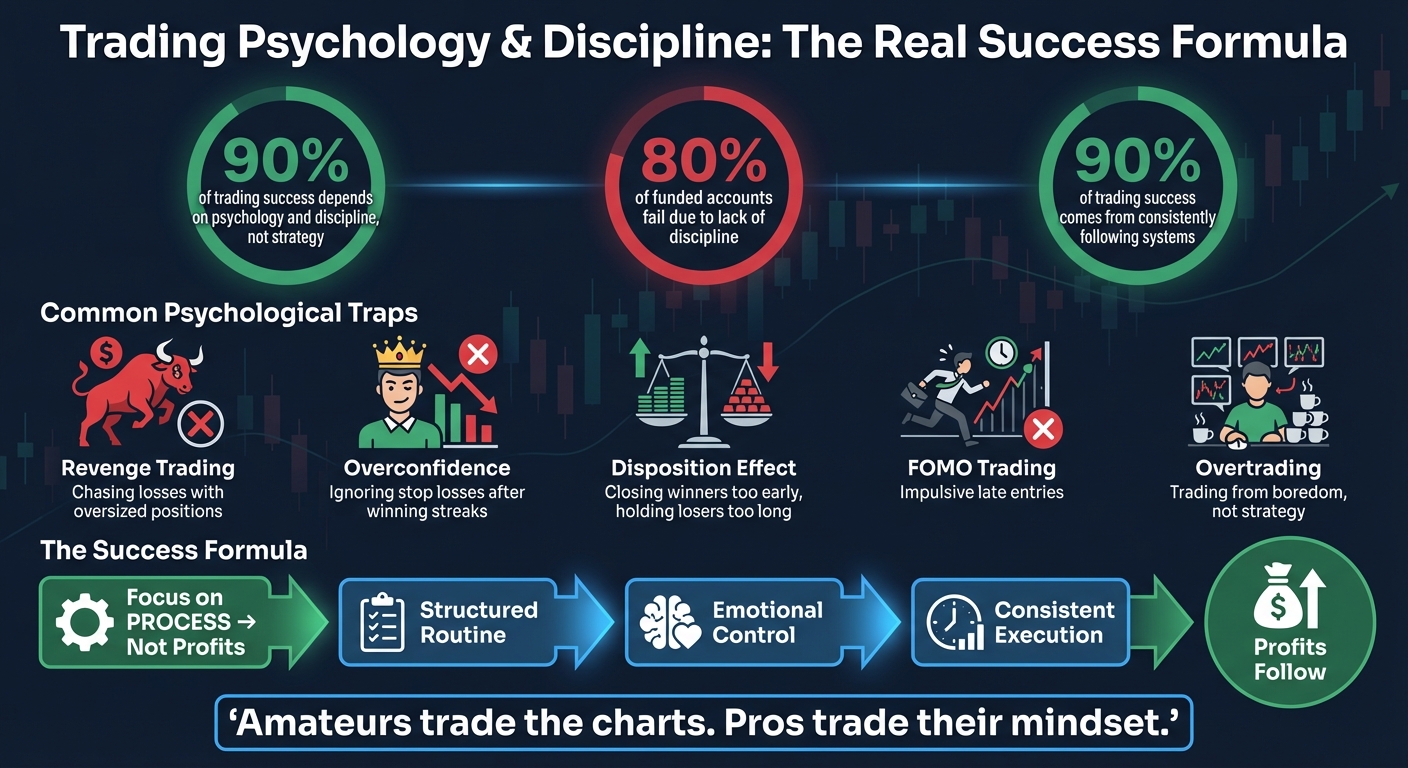

Mastering trading isn’t just about technical skills – it’s about controlling your mindset. In prop trading, where you handle firm capital under strict rules, 90% of success depends on psychology and discipline, not strategy. Emotional decisions like revenge trading, overconfidence, or fear can destroy accounts faster than any flawed strategy.

The key to long-term success? Focus on the process, not profits. Stick to a structured routine, manage emotions, and follow your plan no matter the outcome. Use tools like pre-market checklists, trading journals, and hard risk limits to stay consistent. Remember, trading is about making sound decisions – profits are just the byproduct.

"Amateurs trade the charts. Pros trade their mindset."

Trading Psychology Statistics: Why 90% of Success Depends on Mindset

Mental Challenges in Futures Prop Trading

Why Prop Trading Demands Strong Mental Resilience

Futures prop trading isn’t just about technical skill – it’s a mental game, too. When you’re trading with a firm’s capital, every decision feels heavy. A single mistake during a losing streak can do more than hurt your profit and loss statement; it might break account rules and lead to the loss of your funding altogether. This creates a high-pressure environment where every loss feels amplified, and the fear of failure is always lurking in the background.

The speed of the futures market only adds to the challenge. Unlike swing trading, which allows time for reflection, futures trading moves at lightning speed. You’re forced to make decisions in the blink of an eye, leaving you vulnerable to two extremes: freezing up from overthinking or making impulsive trades driven by FOMO (fear of missing out).

If you’re trading remotely, the isolation can make things even tougher. Without a team nearby, self-doubt can creep in, and the blurred lines between work and personal life can lead to burnout. Plus, with markets always accessible, it’s all too easy to overtrade, draining yourself emotionally.

These pressures make it clear why so many traders fall into common psychological traps.

Common Psychological Mistakes Traders Make

One of the most damaging mistakes is revenge trading. After taking a loss, the temptation to recover quickly can lead to oversized positions and reckless trades. Instead of bouncing back, this often results in even deeper drawdowns.

Overconfidence is another trap. A winning streak can give traders a false sense of invincibility. This overconfidence can lead to ignoring stop losses, increasing position sizes, and abandoning the strategies that worked so well before.

Then there’s the disposition effect – a behavior rooted in loss aversion. Traders often rush to close winning trades to “lock in” profits while holding onto losing positions, hoping they’ll turn around. This approach can turn a solid strategy into one that consistently underperforms.

These psychological hurdles underline the importance of discipline and having a structured routine in place. Without these, even the most technically skilled trader can struggle in the high-stakes world of prop trading.

Discipline: The Core of Consistent Trading Performance

How Poor Discipline Causes Trading Failure

In prop trading, discipline isn’t an added bonus – it’s the foundation. A trader lacking discipline can destroy a profitable strategy in no time, while someone with discipline can turn even a mediocre approach into long-term success. The real game-changer isn’t technical expertise or market savvy – it’s sticking to a plan, even when emotions try to take over.

The stats paint a harsh reality. Around 80% of funded accounts fail due to a lack of discipline, while 90% of trading success comes from consistently following systems. This shows that the key to success isn’t just having a good strategy – it’s sticking to it. Many traders don’t fail because their strategies are flawed; they fail because their mindset gets in the way.

Discipline failures often show up in predictable ways. Revenge trading, for instance, is a classic example of how emotions derail strategy. Overtrading – triggered by boredom – leads to taking subpar setups just for the thrill of being in the market. FOMO (fear of missing out) can push traders into late entries, turning what should be patience into unnecessary losses.

"Amateurs trade the charts. Pros trade their mindset." – The Forex Online School

Prop trading amplifies the consequences of these mistakes. With strict drawdown limits and profit targets, you’re working with capital that isn’t yours. One impulsive session where you abandon your rules can wipe out your account in an instant. And here’s the kicker: breaking your rules is considered a failure, even if the trade ends up profitable. In the prop trading world, success is measured by process, not just outcomes.

The uncomfortable reality is that your mind often prefers familiar losses over the discomfort of disciplined wins. Cutting losses swiftly can feel unnatural. Sitting on your hands while the market moves can feel like you’re missing out. And sticking to a simple system might seem dull when complexity feels more impressive. But here’s the truth: what feels comfortable isn’t always profitable.

| Self-Destructive Behavior | Replacement Habit (Rewire Action) |

|---|---|

| Revenge Trading: Chasing losses to recover. | Set a daily max-loss limit with your broker; stop immediately when it’s hit. |

| Excitement Addiction: Trading out of boredom. | Stick to pre-validated setups and let boredom work in your favor. |

| Complexity Addiction: Overloading with indicators. | Commit to a fixed ruleset for 100 trades before making any changes. |

| Confirmation Bias: Ignoring opposing signals. | Log the counterarguments for every trade idea before entering. |

Building these habits starts with creating a solid daily trading routine.

Creating a Daily Trading Routine

A good routine takes willpower out of the equation. When you follow a structured plan, your decisions aren’t dictated by your mood – you’re executing a system designed to work no matter how you feel. Professional traders rely on routines to eliminate impulsive behaviors and prevent emotional decision-making, ensuring they stick to their strategies.

A well-structured pre-market routine should last about 60 minutes and cover four key areas. Spend 15 minutes reviewing market news and economic events that could influence the day’s trading. Use 10 minutes to evaluate how your strategy aligns with current market conditions – whether volatility is high or low, or if the market is trending or ranging. Dedicate another 15 minutes to identifying key levels, such as yesterday’s close, overnight highs and lows, and major support and resistance zones. Finally, spend 20 minutes crafting a detailed trade plan, including the setups you’re targeting, entry and exit points, and your maximum risk for the day.

During the trading session, pause tactics can keep impulsive decisions in check. Before hitting "buy" or "sell", state your entry reason, profit target, and stop loss out loud. This small pause forces you to confirm that your actions align with your plan, not your emotions. If you can’t clearly explain why you’re entering a trade, it’s better to skip it.

The post-market reflection is where discipline turns into habit. At the end of each session, update your trading journal. Don’t just log trade data – also note your emotional state and how well you followed your rules. Rate your discipline on a scale of 1 to 10. If you stuck to your rules, consider the day a success, even if you ended in the red. This approach separates your behavioral progress from your profit and loss, helping you identify patterns that lead to rule-breaking.

"The real difference between traders who make it and those who don’t comes down to one thing: consistency." – Team Topstep

To solidify these habits, commit to a 30-day checklist covering your pre-market, execution, and post-market routines. Thirty days is enough time to turn discipline into second nature. During this period, measure success by how well you follow your rules – not by short-term profits. Breaking the rules, even if it leads to gains, is a failure. On the other hand, sticking to your plan, even if it results in losses, is a win.

Additionally, prioritize 7-8 hours of sleep and regular exercise, as both improve impulse control. Keep your workspace organized to reduce decision fatigue. When your environment is set up for efficiency and your routine runs smoothly, you save mental energy for making sound trading decisions.

Finally, ask your broker to set hard caps on daily losses and maximum contract quantities. These safeguards act as a backup for moments when willpower falters, ensuring your routine stays intact even during challenging losing streaks that can stretch for weeks or months.

Top Trading Psychologist Reveals Guide To Self Discipline

Managing Emotions While Trading

Mastering your emotions is just as important as sticking to a disciplined trading routine. Without emotional control, even the best strategies can fall apart.

How to Control Fear and Greed

Fear and greed are the two emotions most likely to derail your trading. Fear can manifest as hesitation, premature exits, or analysis paralysis. Greed, on the other hand, might push you to over-leverage, hold trades beyond your targets, or double down on losing positions in the hope of a turnaround. Both pull you away from your trading plan and lead to impulsive decisions.

Successful traders focus on execution, not individual wins or losses. They reframe losses as part of the business – necessary costs of trading – rather than personal failures. This mindset shift builds resilience and helps detach self-worth from the outcome of a single trade.

"You don’t rise to the level of your strategy; you fall to the level of your identity." – Paulina, FundingPips

When emotions spike, the STOP Technique can help you regain control: Stop what you’re doing, Take a breath, Observe your physical sensations (like a racing heart or tension), and Proceed with awareness. Pair this with 4-7-8 breathing – inhale for 4 counts, hold for 7, and exhale for 8 – to calm your stress response.

Another effective tactic is equity neutrality: hide your account balance and P&L during trading sessions. By removing real-time profit and loss feedback, you can focus purely on execution and price action. Combine this with pre-set drawdown protocols, such as reducing risk after a 2% loss or stopping entirely after a 5% drawdown for the week. These rules act as safety nets when emotions threaten to take over.

| Emotion | Symptoms | Corrective Action |

|---|---|---|

| Fear | Hesitation, early exits, avoiding stops | Visualization, pre-trade checklists, smaller positions |

| Greed | Over-leveraging, revenge trading | Enforce risk-to-reward ratios, automated take-profits, "Pause Button" |

| Anger | Revenge trading, increasing risk | Take a break, use the STOP Technique, document emotional breaches |

Tracking these emotional triggers is key to long-term improvement, and a trading journal can be your most valuable tool for this.

Using a Trading Journal to Master Your Emotions

A trading journal is more than a log of trades; it’s a mirror reflecting your trading psychology. While many traders record entry prices and stop losses, the real insights come from tracking your emotional state. Jot down brief notes about how you felt during each trade – anxious, overconfident, or even bored. These notes can reveal patterns over time.

The goal is to identify recurring emotional triggers. After 30 to 50 trades, you might notice trends, like overconfidence after a winning streak or revenge trading after consecutive losses. Recognizing these patterns allows you to create targeted strategies to counteract them. For example, if you tend to get overly euphoric after a win, you could implement a mandatory 10-minute break before placing your next trade.

"Awareness precedes mastery. You can’t change what you refuse to confront." – FundingPips

One simple method is the One-Sentence Rule: after each session, write down one sentence about what went well and one about what didn’t. This keeps self-reflection manageable while building awareness. Additionally, assign a discipline rating (1 to 10) for each trade to measure how well you followed your rules, regardless of the outcome.

For traders working alone, a journal becomes a silent mentor. Without colleagues to provide feedback, the journal acts as your accountability partner. Review it weekly to spot trends like revenge trading or status quo bias. Attach chart screenshots to connect your technical setups with your emotional state. This visual context helps you understand the decisions you made in the moment.

| Journal Element | Purpose for Decision-Making |

|---|---|

| Entry/Exit Emotions | Identifies if trades were driven by FOMO or strategy |

| Discipline Rating | Measures rule adherence under pressure |

| Market Conditions | Evaluates strategy performance in different environments |

| Process Wins | Reinforces positive behavior, independent of outcomes |

| Chart Screenshots | Links emotional state to technical setups |

sbb-itb-46ae61d

Building Resilience Under Pressure

Once you’ve got the tools to manage your emotions, the next step is learning how to stay resilient when market pressure mounts. Losing streaks and high-pressure evaluations can expose weaknesses, but successful traders bounce back by adjusting quickly and staying disciplined.

Staying Strong During Losing Streaks

Losses hurt. In fact, they sting more than equivalent gains feel good. This pain can lead to impulsive actions like revenge trading or over-leveraging. Why? Because your brain sees losses as threats, triggering a fight-or-flight response that clouds rational thinking.

The first thing you need is a circuit breaker. Set rules, like a three-strike policy or a daily drawdown cap at 50% of your maximum loss. These act as emergency brakes, stopping emotional decisions from spiraling out of control.

"Where you want to be is always in control, never wishing, always trading, and always, first and foremost, protecting your butt." – Paul Tudor Jones

When you hit the brakes, take a step back and figure out what went wrong. Were your losses due to changes in the market, or was it how you executed your trades? Pinpointing the cause helps you avoid ditching a solid strategy just because of normal market fluctuations.

Once you’re ready to return, ease back in by cutting your position size by half. For the next 10 days, focus entirely on following your plan with unwavering discipline. Avoid tweaking your strategy until you’ve completed at least 100 trades. Even with a 70% win rate, losing streaks can happen due to normal variance.

Here’s a quick look at some common psychological traps traders face during losing streaks and how to address them:

| Psychological Trap | Why It Happens | Fix |

|---|---|---|

| Self-Doubt | Recency bias from recent losses | Review your journal of past successful trades to rebuild confidence |

| Overtrading | Driven by excitement, boredom, or greed | Cap your trades to 2–3 per day |

Lastly, change how you view losses. Instead of seeing them as personal failures, think of them as business expenses. Every business has costs, and in trading, losses are just part of the game. This shift helps separate your self-worth from your profit and loss statement – an essential mindset for staying resilient.

With your mindset and strategy realigned, let’s tackle the stress of prop firm evaluations.

Managing Stress During Prop Firm Evaluations

Prop firm evaluations can push you into one of two extremes: playing it too safe or taking reckless risks. This often happens because traders tie their identity to the outcome.

The solution? Focus on process-based goals. Instead of thinking, "I need to pass this challenge in five days", reframe it as, "I’ll only take A+ setups that align with my plan over the next 10 trading days". The first goal creates anxiety because the market is out of your control. The second reduces stress because your behavior is something you can control.

"Trading is a business of making good decisions. The money is a byproduct." – FunderPro

Before each session, take 60 seconds to visualize yourself executing trades with precision. Follow this with a quick centering ritual to release tension.

Structure your work in 90-minute blocks with 10–15 minute breaks in between. Get 7–8 hours of sleep, stay hydrated, and maintain your focus and impulse control.

Use your broker’s tools to set hard limits, like daily max-loss caps or contract quantity restrictions. These act as guardrails when emotions run high, preventing revenge trading and helping you stick to your plan.

During high-stakes evaluations, step away from your desk for at least 10 minutes after a significant win or loss. This break helps reset your stress response and brings back rational thinking. Resist the urge to check charts or review your P&L – just focus on calming your nervous system.

Finally, trading can feel isolating, especially in remote prop firm setups. Consider joining a trading community or finding an accountability partner. Sharing a weekly process win and challenge with a peer can ease the emotional toll and keep you grounded.

Focus on Process, Not Profits

Building on the disciplined routines and emotional control discussed earlier, it’s time to shift your focus to the process rather than the profits. The moment you prioritize profit over process, you’re setting yourself up for failure. Many traders fall into what Dr. Andrew Menaker describes as "resulting" – judging a trade based on its outcome rather than whether they followed their rules. Even if a poorly planned trade happens to succeed, it’s a dangerous precedent. Likewise, a loss on a well-executed trade doesn’t mean your strategy is flawed.

Once your trade is in motion, market forces – completely beyond your control – dictate price movement. What remains in your hands is how you manage your entry, exit, and risk. Traders who focus on their process understand this, while those chasing profits often find themselves in boom-and-bust cycles: making gains one week and losing them the next.

Why Process-Focused Traders Have the Edge

The key difference between a professional trader and a gambler lies in how they define success. A professional asks, “Did I stick to my plan?” while a gambler simply wonders, “Did I make money?” This focus on profits alone can lead to one of the biggest pitfalls: Type 4 trades. These are instances where a poor process results in a positive outcome. While these wins might feel rewarding, they reinforce bad habits that can ultimately lead to failure.

"Resulting occurs when you equate outcome quality with decision quality. Ego-based trading keeps you attached to outcomes. It traps you in that boom-and-bust cycle." – Dr. Andrew Menaker, Clinical Psychologist and Performance Coach

Instead of setting profit-based goals like “I need to make $500 this week,” aim for process-based goals such as “I will execute my strategy with 100% discipline for 10 consecutive days.” Profit-based goals can create unnecessary stress because the market doesn’t operate on your schedule. Process-based goals, on the other hand, reduce anxiety by keeping your focus on what you can control.

Here’s a quick breakdown of the two mindsets:

| Feature | Profit Chaser | Process-Focused Trader |

|---|---|---|

| Primary Goal | Hit a specific dollar target quickly | Execute the strategy with 100% discipline |

| View of Losses | Personal failure or "bad luck" | A necessary business cost and valuable data point |

| Emotional State | High stress; reactive to P&L swings | Emotionally neutral; detached from outcomes |

| Decision Making | Impulsive; driven by fear or greed | Rule-based; driven by a pre-defined plan |

| Long-term Result | Boom-and-bust cycles | Consistent, scalable performance |

A practical way to commit to the process is by using a pre-trade checklist. Before executing any trade, ensure that the setup aligns with your rules, your emotional state is neutral, and your risk is capped at 2% or less. If any of these conditions aren’t met, skip the trade. Over time, this routine will become second nature and help stabilize your trading outcomes.

Using Psychology and Discipline as Your Edge

This focus on process ties directly into the discipline and emotional control you’ve already developed. While many traders spend endless hours tweaking indicators and backtesting strategies, success in prop firm challenges often boils down to mindset. Without strict adherence to your plan and emotional discipline, even the best strategy will fail – your psychology and discipline are what truly set you apart.

"Amateurs trade the charts. Pros trade their mindset." – The Forex Online School

Think of risk management as your emotional safety net. Knowing that you can’t lose more than 2% on a single trade eliminates the fear that often leads to revenge trading.

It’s also crucial to separate your identity from your profit-and-loss statement. A losing trade doesn’t define your competence – it’s simply a statistical inevitability in trading. Successful traders view losses as a cost of doing business, not a personal failure.

Before you evaluate your strategy, commit to executing it over at least 100 trades. Even a system with a 70% win rate will experience losing streaks due to normal variance. If you abandon your strategy after a few tough trades, you’ll never know if it actually works. Process-focused traders trust the math and let the law of large numbers play out.

Another helpful habit is verbalizing your trade plan before execution. Say your entry rationale, profit target, and stop-loss out loud. This simple step acts as a “mental speed bump,” helping you stay rational and avoid impulsive decisions.

At firms like Apex Trader Funding and Topstep, the traders who succeed aren’t chasing quick wins. They show up daily, stick to their plan, and approach trading like a disciplined business. By mastering your psychology and committing to your process, the profits will naturally follow.

Conclusion

Having the perfect technical setup is only part of the equation – without discipline and emotional control, even the best strategies can fall flat. In fact, research indicates that 90% of trading success comes down to psychology, not strategy.

Look at the traders thriving at firms like Apex Trader Funding and Topstep. They’re not chasing quick wins. Instead, they stick to their routines – following pre-trade checklists, journaling their emotions, and treating losses as part of the process. For them, trading is about making sound decisions, with profits being the natural result.

Pick one habit from this guide – whether it’s the 90-minute block system, a pre-trade checklist, or keeping a daily journal – and stick with it for 30 days. Pay attention to how you feel before and after each trade, watch for patterns, and tweak your approach as needed.

"The shortcut is to stop looking for shortcuts".

FAQs

How can I create a disciplined trading routine for success?

Developing a disciplined trading routine is key to thriving in futures prop trading. Start your day with a consistent morning ritual – wake up at the same time, review your process-focused goals, and mentally prepare. Activities like light stretching or checking the economic calendar for potential market-moving events can help set the tone.

Before diving into the trading day, narrow your focus to 2-3 instruments. Take time to analyze key levels, overnight price movements, and any news that could drive the market. Have a clear plan for each trade, ensuring your setups align with your rules, risk limits, and pre-set stop-loss and profit targets. Following a step-by-step checklist can help you avoid impulsive decisions and stick to your strategy.

Once the trading session ends, take time to review your performance. Log your entries, exits, emotions, and any moments where you strayed from your plan. Reflect on what worked, what didn’t, and where adjustments might be needed. To close the day, establish a mental reset by shutting down your trading screens at a set time. This structured approach can help you stay consistent, manage risk effectively, and handle the pressures of trading with greater confidence.

What are the most common psychological challenges traders face in prop trading?

Many traders face challenges in keeping their emotions in check, especially when handling someone else’s capital. Performance anxiety often leads to behaviors like overtrading, cutting positions too soon, or making impulsive decisions. On the flip side, a fear of loss can prompt traders to abandon their strategies after experiencing a drawdown. And then there’s overconfidence – a winning streak might tempt traders to take oversized positions or disregard risk management entirely.

Impatience is another hurdle, often manifesting as chasing trades, forcing entries, or stubbornly clinging to losing positions in the hope of a turnaround – commonly known as "revenge trading." Then there’s FOMO (fear of missing out), which pushes traders to overtrade when quality setups are hard to come by. Breaking established rules or exceeding risk limits after a tough day can also throw progress off track and disrupt consistency.

Tackling these emotional pitfalls takes discipline, self-awareness, and a steadfast commitment to sticking with a well-structured trading plan.

Why is focusing on the trading process more effective than chasing profits?

Focusing on the trading process – your disciplined actions and strategies – puts the spotlight on what you can control, rather than the unpredictable swings of the market. By committing to a well-defined trading plan, sticking to your entry and exit rules, and treating losses as opportunities to learn instead of failures, you can reduce emotional decision-making and maintain consistency, even in tough market conditions.

Adopting a process-driven mindset also builds resilience. Setting process-based goals, such as following your trading plan with complete discipline for a certain number of days, gives you achievable targets regardless of market performance. This approach helps ease anxiety, curbs impulsive decisions, and reinforces habits that lead to long-term success. By prioritizing how you trade over how much you make each day, you develop discipline, manage stress more effectively, and improve your chances of steady profitability in prop trading.