Understanding end of day drawdown is one of the most important parts of success with futures prop firms. It defines how much flexibility you have, when your balance is evaluated, and what determines whether your account remains active or fails.

Many of the top prop firm futures end-of-day trailing drawdown accounts now use this model because it allows traders to operate more naturally throughout the day without being punished for normal price movement.

Let’s break it down clearly.

What Is End-of-Day (EOD) Drawdown?

End-of-Day Drawdown, or EOD Drawdown, is a risk management rule that tracks your account balance only at the end of the day, not during active hours.

Instead of following your balance tick-by-tick, this system waits until all positions are closed and the day is settled before calculating your new minimum account requirement.

This design provides more breathing room than unrealized or intraday drawdown, which can trigger liquidations even if the day ends profitably.

Curious how unrealized trailing drawdown works and how it compares?

Read this next: Unrealized Trailing Drawdown Explained (Apex Trader Funding Rules with Real-Life Examples)

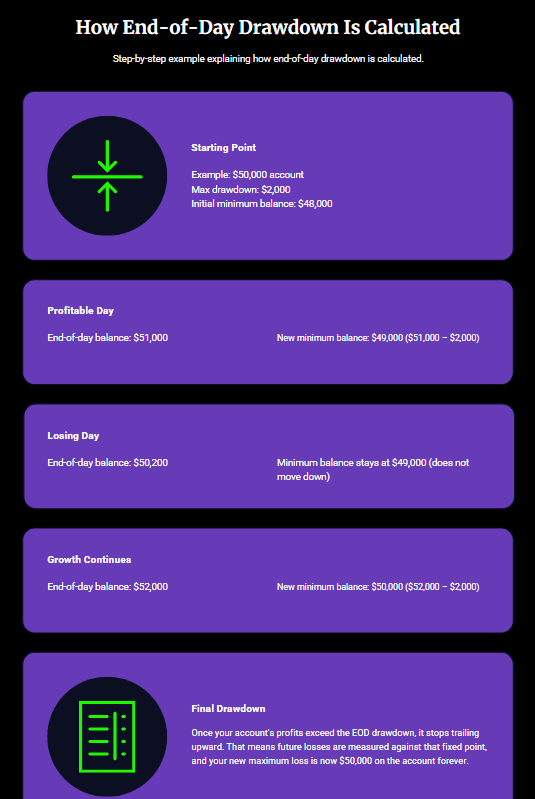

How End-of-Day Drawdown Is Calculated

Here’s a step-by-step example to make it simple:

-

Starting Point

-

Example: $50,000 account

-

Max drawdown: $2,000

-

Initial minimum balance: $48,000

-

-

Profitable Day

-

End-of-day balance: $51,000

-

New minimum balance: $49,000 ($51,000 – $2,000)

-

-

Losing Day

-

End-of-day balance: $50,200

-

Minimum balance stays at $49,000 (does not move down)

-

-

Growth Continues

-

End-of-day balance: $52,000

-

New minimum balance: $50,000 ($52,000 – $2,000)

-

Once your minimum reaches the starting balance ($50,000), it stops trailing upward. That means future losses are measured against that fixed point, and your maximum loss is now $50,000 on the account.

Why End-of-Day Drawdown Is So Popular in Futures Prop Firms

1. More Flexibility

Accounts are not penalized for normal intraday volatility. You can manage positions confidently, knowing temporary fluctuations will not end your account.

2. Reduced Stress

Since your limit is only evaluated at the close, it removes the anxiety of watching every tick. This encourages calmer, more structured performance.

3. Rewarded Consistency

Profitable days gradually move your minimum balance higher, locking in gains and creating long-term stability. Most prop firms also have consistency rules to be aware of, but don’t let it get to your head.

4. Cleaner Rule Enforcement

It’s simple: as long as your final end-of-day balance stays above the drawdown limit, your account remains safe.

Which Prop Firms Use End-of-Day Drawdown?

Several leading futures funding programs now use end-of-day trailing drawdown because it’s fair, transparent, and easier to manage.

✅ Lucid Trading

Lucid uses EOD drawdown across its funding programs, both in LucidTest and LucidDirect (Instant Funding). This gives participants freedom to manage their strategy throughout the day without fear of intraday violations.

✅ TickTick Trader

TickTick’s S2F+ and evaluation programs operate with end-of-day or static drawdown, making them ideal for those who prefer predictable, rule-based structures.

✅ Alpha Futures

Alpha Futures offers customizable account options, and its EOD trailing drawdown model helps minimize unnecessary rule breaks from intraday volatility. Along with one of the largest max loss limits, Alpha Futures is a great choice for prop firm traders.

✅ FundedNext Futures

FundedNext also relies on end-of-day drawdown, which aligns with its focus on consistency, rapid scaling, and flexible payout scheduling.

✅ FundingTicks

FundingTicks’ One Plan accounts also feature EOD drawdown, allowing smoother progress toward live funding goals without the constant pressure of unrealized monitoring.

Learn More: Which prop firm is better, Funding Ticks or FundedNext?

⚙️ Take Profit Trader

Take Profit Trader uses end-of-day drawdown during the evaluation and Pro+ stages (live funded accounts).

However, during the Pro stage, the firm enforces unrealized trailing drawdown, which means balance checks can occur intraday based on floating performance.

The Downsides of EOD Drawdown

While EOD drawdown is widely considered more forgiving, it still requires discipline.

-

If your account closes below the minimum balance, even briefly after settlement, the account can be closed.

-

The trailing threshold only moves up, never down, so mistakes late in the process can be costly.

- Any realized profit earned while your balance is within the drawdown zone will not increase your maximum loss limit (MLL) for the next day. However, during that same day, your MLL will automatically move upward by the exact amount of profit you’ve locked in, giving you a little more breathing room before hitting your limit.

Example:

Let’s say your account starts with a $50,000 balance and a $2,000 drawdown limit, meaning your minimum balance is $48,000.

If you close a position during the day for a $500 realized profit, your temporary MLL for that same day increases to $48,500.

When the next day begins, your MLL resets based on your official end-of-day balance, not intraday fluctuations.

This setup allows some flexibility throughout the day while still maintaining strict control over long-term risk exposure.

Still, compared to intraday rules, the benefits far outweigh the risks for most participants.

Why Damn Prop Firms Is the Best Place to Learn About These Rules

At DamnPropFirms, every review and guide is written by people with real experience in futures prop firm funding programs.

You can explore detailed breakdowns for Lucid Trading, FundedNext, Take Profit Trader, TickTick Trader, FundingTicks, and Alpha Futures, along with verified discounts and updated rule explanations.

Whether you are learning how end-of-day trailing drawdown works or comparing it to unrealized drawdown systems, Damn Prop Firms is your complete guide to understanding how each firm handles risk and payouts.

Final Thoughts

The end-of-day drawdown model is one of the most balanced and beginner-friendly systems in the futures prop firm space. It protects capital, encourages consistency, and eliminates much of the stress that comes from intraday volatility.

If you want to explore which firms offer this system, visit DamnPropFirms for up-to-date reviews, comparisons, and the latest funding discounts.

Frequently Asked Questions About End-of-Day Drawdown & Maximum Loss Limits

An End-of-Day Drawdown is a rule that evaluates your balance only after the market closes. It sets a maximum loss limit (MLL) based on your final end-of-day balance, allowing flexibility during the day while maintaining strong risk management.

Your EOD drawdown is calculated from your starting balance minus a fixed drawdown amount. At the close of each profitable day, the minimum account balance increases by your gains. Example: A $50,000 account with a $2,000 drawdown starts with a $48,000 minimum. If you finish the day at $51,000, your new minimum becomes $49,000.

Any realized profit earned inside the drawdown zone will not raise your maximum loss limit the next day, but during the same day, your MLL temporarily increases by that profit amount, giving you a little more room before reaching your limit.

Example: Starting balance $50,000 with a $2,000 drawdown (minimum $48,000). If you close a trade with $500 profit, your temporary MLL rises to $48,500 for that day. When the next day begins, the MLL resets based on your official end-of-day balance.

Several top firms use End-of-Day trailing drawdown including Lucid Trading, FundedNext, TickTick Trader, Alpha Futures, and FundingTicks. Take Profit Trader also uses EOD drawdown in its Evaluation and Pro+ phases, but its Pro phase switches to Unrealized Trailing Drawdown.

End-of-Day drawdown updates only after market close, based on your settled balance, while Unrealized trailing drawdown changes in real time with open positions and unrealized profits. EOD is more forgiving and helps maintain stability throughout the day.

Prop firms prefer End-of-Day Drawdown because it balances safety with flexibility. It allows steady performance growth, reduces unnecessary stress, and prevents liquidation from normal intraday fluctuations. This approach has become one of the most trusted systems among futures prop firms.

Comparison: End-of-Day vs Unrealized Trailing Drawdown

Learn how end-of-day drawdown compares to unrealized trailing drawdown across top futures prop firms. Each approach affects flexibility, risk, and rule enforcement differently.

| Feature | End-of-Day (EOD) | Unrealized Trailing |

|---|---|---|

| Evaluated When | After market close and all positions are settled. | In real time during open positions as profits or losses fluctuate. |

| Risk Flexibility | High — allows normal intraday fluctuations without penalty. | Low — balance monitored live, increasing risk of intraday violations. |

| Ideal For | Steady consistency and end-of-day management. | Strict real-time control and short-term precision. |

| Used By | Lucid Trading, FundedNext, TickTick Trader, Alpha Futures, FundingTicks. | Take Profit Trader (Pro phase), Apex Trader Funding. |

| Common Violation | End-of-day close below minimum balance threshold. | Intraday dip breaching the trailing limit before close. |

💡 Tip: Swipe to view full comparison on mobile.