💰 The Real Cost of Day Trading in 2026

In the traditional stock market, day traders using a margin account must maintain a minimum balance of $25,000. This FINRA regulation aims to protect investors but often discourages beginners. Today, alternatives like futures prop firms and micro futures brokers make trading accessible for less than the cost of a single textbook on finance.

On average, here’s what starting capital looks like in 2026:

| Trading Method | Minimum Starting Cost | Key Limitation |

|---|---|---|

| Stock Margin Account | $25,000+ | Subject to PDT Rule |

| Cash Account | $1,000–$2,500 | Limited to settled funds (T+1) |

| Personal Futures Account | $5,000–$10,000 | High leverage and full personal risk |

| Futures Prop Firm Evaluation | $50–$150 | Simulated capital with performance targets |

📜 Understanding the Pattern Day Trader Rule (PDT)

The PDT Rule, introduced in 2001, requires traders executing more than three day trades within five business days to maintain at least $25,000 in their margin accounts. It applies only to U.S. equity brokers regulated by FINRA — not to futures or funded trading programs.

This rule can make growth difficult for beginners who want to practice consistency. That’s one reason many now turn to futures markets, which operate under the Commodity Futures Trading Commission (CFTC) instead of FINRA. Futures traders can enter and exit trades as often as they want — no PDT limits apply.

The Pattern Day Trader (PDT) rule is being changed, moving from a fixed $25,000 minimum to a more flexible intraday margin requirement. FINRA approved the change, and the SEC is now considering it, with potential implementation likely by late 2025 or early 2026. Under the new rule, day traders must have enough funds to cover their positions throughout the day to avoid margin calls, instead of needing a static $25,000 balance.

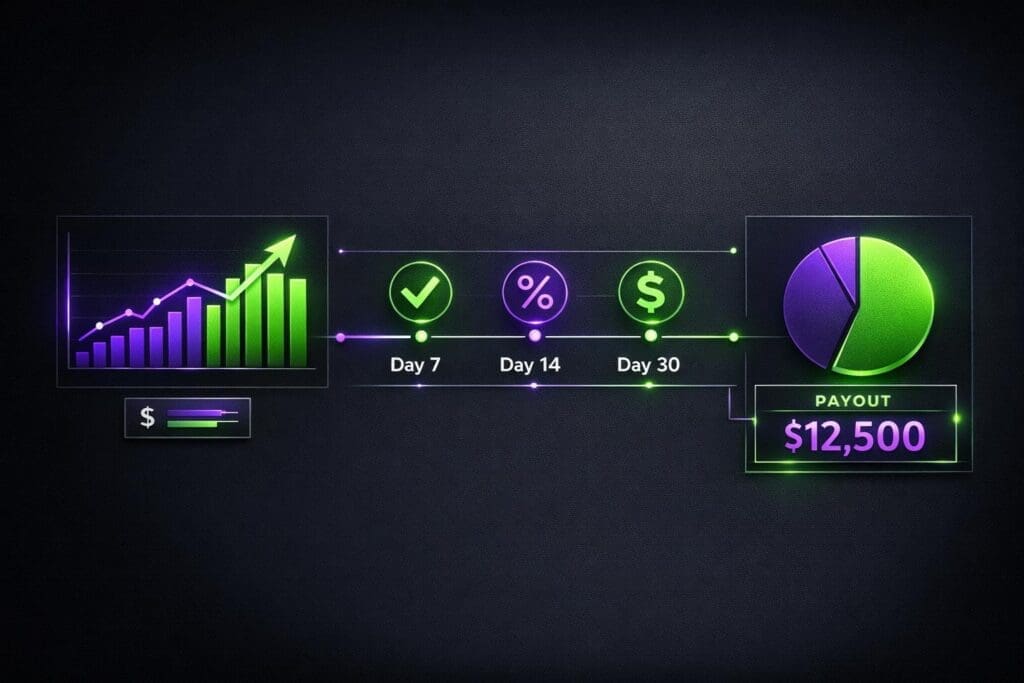

⚡ How Futures and Prop Firms Changed the Game

Futures trading platforms and funded evaluation programs now allow traders to learn and trade under professional conditions — with clear risk parameters and significantly lower financial barriers.

Here’s what makes them different:

- No PDT Rule: Trade daily with no restrictions on frequency.

- Controlled Risk: Daily Loss Limits and Drawdown Rules enforce discipline automatically.

- Low Entry Cost: Instead of funding an entire account, you pay a small evaluation fee to access simulated capital.

- Realistic Training Environment: You trade live market data, often through platforms like Tradovate or Rithmic.

These features make prop firm accounts an educational bridge — letting traders build skill and psychological control before scaling with personal capital.

🧠 How Prop Firm Rules Strengthen Trading Psychology

Beyond funding, prop firm structures directly reinforce trading psychology. Each rule exists to protect both the trader and their mindset:

- Daily Loss Limits stop revenge trading and overexposure.

- Trailing Drawdowns reward consistent performance rather than luck.

- Minimum Trading Days encourage process over impulse.

Unlike retail accounts, where traders often spiral emotionally after large losses, structured programs require step-by-step progress. This helps transform emotional volatility into professional composure.

📊 How Much You Really Need to Start in 2026

The answer depends on your goals. If your target is to make $100 a day, use the basic guideline from professional trading educators:

Daily Goal × 10 = Minimum Account Size

That means aiming for $100 daily requires roughly $1,000 of usable buying power. In a prop firm environment, this same risk profile can be simulated with a $50K evaluation — for less than $100 upfront — giving you exposure without financial danger.

More importantly, the lessons learned from managing drawdown, maintaining discipline, and adapting to stress have greater long-term value than any short-term profit target.

🧭 Final Thoughts

Day trading has evolved. In 2026, you no longer need $25,000 or a margin account to start practicing. Whether you begin with a small cash account or through a structured futures evaluation, your success will depend on discipline, strategy, and risk control.

The best path forward is one that blends education with structure — learning to think like a professional trader before trading like one. Prop firms and futures evaluations offer that opportunity while keeping financial risk manageable.

Ready to Learn Under Real Market Conditions?

Compare the top futures prop firms offering transparent rules and risk-controlled trading environments.

📚 Recommended Reads

- How End-of-Day Drawdown Works in Futures Prop Firms — Understand trailing vs fixed logic to protect psychological capital.

- Tradeify Consistency Rule – Guide for Funded Traders — Turn prop firm consistency into a personal trading advantage.

- Trading Psychology Hub — Mental frameworks and reset strategies for disciplined trading.