If you’re new to futures trading and want to avoid risking your savings, instant funding prop firms might be your solution. These firms provide access to trading accounts – ranging from $25,000 to $150,000 – without requiring you to fund the entire account yourself. Instead, you pay a small fee, often starting at $250, and can start trading immediately, skipping lengthy evaluation processes. Here’s a quick rundown of five beginner-friendly prop firms offering instant funding:

- Apex Trader Funding: Offers accounts up to $100K with profit splits of up to 100% for the first $25K. Payouts every 8 trading days.

- Take Profit Trader: Single-step evaluations, no daily loss limits, and same-day payouts. Discount codes available for reduced fees.

- FundedNext Futures: Rapid accounts for fast evaluations or Legacy accounts with no monthly fees. Payouts within 3 days.

- Alpha Futures: Multiple account options, including Zero Accounts with no activation fees and weekly payouts.

- Tradeify: Instant funding through Lightning accounts, same-day payouts, and support for algorithmic trading.

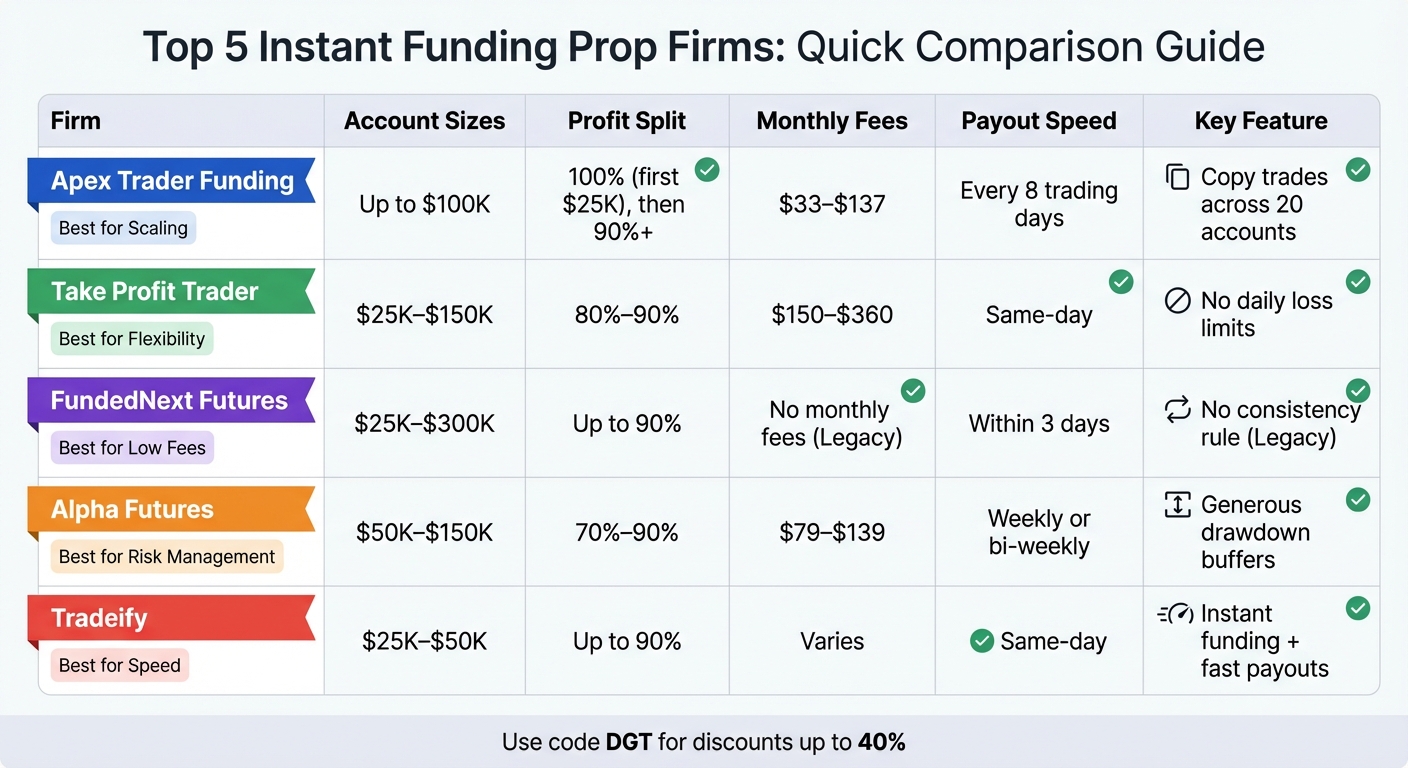

Quick Comparison

| Prop Firm | Account Sizes | Profit Split | Evaluation Type | Fees | Payout Frequency | Key Feature |

|---|---|---|---|---|---|---|

| Apex Trader Funding | Up to $100K | 100% (first $25K) | Short evaluation or instant | $33–$137 (monthly) | Every 8 trading days | Copy trades across 20 accounts |

| Take Profit Trader | $25K–$150K | 80%–90% | Single-step evaluation | $150–$360 (monthly) | Same-day | No daily loss limits |

| FundedNext Futures | $25K–$300K | Up to 90% | Rapid (1-day) or Instant | No monthly fees (Legacy) | Within 3 days | No consistency rule on Legacy |

| Alpha Futures | $50K–$150K | 70%–90% | Pass in 1 day | $79–$139 (varies) | Weekly or bi-weekly | Generous drawdown buffers |

| Tradeify | $25K–$50K | Up to 90% | Instant or 1-day pass | Varies | Same-day | Instant funding with fast payouts |

Instant funding is ideal for beginners seeking low-risk entry into futures trading. Start small, focus on learning, and ensure you understand a firm’s rules before committing. For detailed reviews, visit DamnPropFirms.

Top 5 Instant Funding Prop Firms Comparison for Beginners 2025

Best Beginner Prop Firms with Instant Funding

Apex Trader Funding

Apex Trader Funding has proven itself as a powerhouse in the trading community, paying out over $500 million since 2022 and building a strong Discord presence with 59,000+ traders. Their evaluation process is quick – sometimes as short as a single day during promotional periods. For newcomers, the $50,000 account stands out, offering a $3,000 profit target. Monthly evaluation fees are around $137, but discounts during sales can bring this down to just $33. Platform activation fees range between $85 and $145.

What makes Apex particularly appealing is its profit-sharing structure: a 100% split on the first $25,000 per account, followed by at least 90% for subsequent earnings. Traders can copy trades across 20 funded accounts, and payouts are processed every 8 trading days. In 2025, DamnPropFirms documented a real payout of over $55,000 in one cycle. To help traders stay within the 30% daily profit cap, a free Consistency Rule Calculator is available.

Take Profit Trader

Take Profit Trader simplifies the funding process with a single-step evaluation that can be completed in as few as 5 trading days. They’ve eliminated daily loss limits and instead use an End-of-Day trailing drawdown, which allows beginners to recover from intraday losses. Monthly fees start at $150 for a $25,000 account and go up to $360 for a $150,000 account. By using code DGT, traders can enjoy a 40% discount and skip the activation fee.

Profit splits are structured at 80/20 for PRO accounts and 90/10 for PRO+ accounts, with same-day payouts available from the first day. Between January and August 2023, roughly 20.37% of traders successfully passed the evaluation to reach PRO status. Commissions are $5 per round trip for contracts on Test and PRO accounts, or $0.50 per micro contract.

FundedNext Futures

FundedNext Futures offers two beginner-friendly paths. Rapid Accounts allow traders to complete the evaluation in just one day and receive payouts within three days. Meanwhile, Legacy Accounts remove consistency rules, monthly fees, and activation charges, making it a cost-effective option. Traders can manage up to 12 funded accounts or a maximum of $300,000 in funding, providing room to grow with experience.

Using code DGT gives a 10% discount on account purchases. The absence of a consistency rule on Legacy Accounts provides extra flexibility for those exceptional trading days.

Alpha Futures

Alpha Futures caters to various trading styles with three account options:

- Standard Plan Accounts: Starting at $79 for $50,000, these accounts include a $149 activation fee and larger drawdown buffers, which are beginner-friendly.

- Zero Accounts: Priced at $99 for $50,000, these accounts have no activation fee and offer weekly payouts after 5 winning days.

- Advanced Plan Accounts: Starting at $139 for $50,000, these accounts feature no consistency rule and a Dynamic Daily Loss Guard.

Profit splits range from 70% to 90% for Standard accounts, while Advanced and Zero accounts offer a flat 90% split. Payouts for Standard accounts occur every 14 days, while Advanced and Zero accounts process payouts weekly, completing them within 48 business hours. By using code DGT, traders can get a 30% discount. Alpha Futures has gained a reputation for being trader-friendly, with top performers even invited to Alpha Prime’s live trading floor in London.

Tradeify

Tradeify stands out with its Lightning accounts, which grant instant funding – no evaluation required. The $25,000 Lightning account is a budget-friendly way to dive into instant funding, with same-day payouts often processed within an hour. For those building consistency, the $50,000 Growth account offers a $3,000 profit target and a low minimum payout of $500.

Tradeify has processed over $70 million in verified payouts and holds a 4.7 Trustpilot rating. In 2025, a trader received a $15,000 payout from a Lightning Funded account in just 10 minutes. The platform also features dynamic daily loss limits that shift to a trailing format once profitable, alongside a gradual consistency rule (20% for the first payout, 25% for the second, and 30% for subsequent payouts). Additional perks include trade copying across 5 accounts, support for algorithmic and bot trading, and soft breaches for daily loss limits. Use code DGT for a 30% discount.

Next, explore a detailed comparison of these firms’ instant funding features.

Instant Funding Features Comparison

Comparison Table

Here’s a breakdown of key features – account sizes, profit splits, evaluation types, fees, and payout frequency – to help you find the right fit for your trading style and budget.

| Prop Firm | Account Sizes | Profit Split | Evaluation Type | Fees | Payout Frequency | Special Features |

|---|---|---|---|---|---|---|

| Apex Trader Funding | 100K accounts | Not specified | Not specified | $10 PA on 100K; $40 on other sizes | Every 8 days (up to $70K payouts) | Supports scaling across multiple accounts |

| Take Profit Trader | Not specified | Not specified | Not specified | No activation fee (100% refunded at first payout) | Daily withdrawals | Up to 5 live funded accounts; no consistency rules |

| FundedNext Futures | Varies (Rapid & Legacy) | Up to 90% | Rapid (1 day) or Instant (Legacy) | No monthly fees or activation (Legacy) | Within 3 days (Rapid) | Legacy accounts have no consistency rule |

| Alpha Futures | $50,000–$150,000 | 70%–90% tiered | Pass in 1 day | No activation fee on Zero accounts; fee structure varies | Weekly or bi-weekly | Generous drawdown and robust risk controls |

| Tradeify | Not specified | Not specified | Lightning: Instant; Growth: Pass in 1 day | Not specified | Same-day withdrawals | Lightning instant funding with dynamic consistency rules |

This table highlights how different evaluation methods and features can influence your trading experience.

Understanding the Evaluation Types:

Instant funding lets you dive straight into trading without needing to meet profit targets or complete challenge phases. On the other hand, fast evaluations require achieving a profit target before you can start live trading.

For beginners working within a tight budget, options like FundedNext’s Legacy accounts or Tradeify’s Lightning funding can be appealing. They offer minimal fees and quick access to live trading. For example, earning $1,000 in monthly profits means you’d take home $900 with a 90% profit split, compared to $800 with an 80% split.

Smaller accounts and lower fees can help reduce early losses, especially for those just starting out. Platforms like DamnPropFirms offer tools like the Consistency Rule Calculator and verified reviews to help you make informed decisions. These resources provide an unbiased benchmark beyond each firm’s promotional claims. Instead of focusing solely on the highest profit splits, prioritize straightforward rules, solid risk management, and dependable payout systems. Up next, let’s explore what to consider when choosing a beginner-friendly instant funding prop firm.

Top 5 Futures Prop Firms of 2025 – Instant Funding, No Consistency & Fast Payouts

sbb-itb-46ae61d

Why Instant Funding Works for Beginners

Instant funding brings a unique set of benefits for beginners stepping into trading. Unlike traditional programs that require you to clear multi-phase evaluations with strict targets, instant funding allows you to start trading with a live funded account right from the get-go. This immediate access to real markets exposes you to actual trading pressures, something demo accounts simply can’t replicate. Facing these real-world conditions helps sharpen emotional discipline much more effectively than simulations ever could.

Another big advantage is the lower financial barrier. Typically, self-funding a U.S. futures account can cost thousands of dollars, factoring in margins, platform fees, and potential drawdowns. With instant funding, however, you pay a one-time program fee – usually just a few hundred dollars – for access to $25,000–$50,000 in buying power. This means your risk is limited to that upfront fee, sparing your personal savings. On top of that, some programs even waive monthly fees and activation charges, making the initial investment less daunting.

Profit splits are another highlight. Most instant funding programs offer an impressive 80–90% profit share from day one, and payouts are processed quickly. For example, Tradeify allows withdrawals in as little as five days, while FundedNext Futures processes payouts within three days for Rapid accounts. This fast turnaround not only provides immediate financial feedback but also encourages disciplined trading and helps you refine your strategies.

Without the pressure of evaluations, you can focus on building a consistent trading process instead of rushing to meet arbitrary targets. Traditional evaluation programs often push traders into short-term, high-risk trading to hit goals within a set time frame. Instant funding removes those constraints, giving you the freedom to trade in a way that matches your style – whether it’s scalping, intraday, or swing trading. You can take your time to document trades, tweak your entry points, and improve risk management without worrying about deadlines or minimum trading days.

Scaling plans are another feature that stands out. These plans let you grow your account and earnings as you demonstrate consistency, aligning perfectly with your skill level and future goals. Comparisons from DamnPropFirms highlight how scaling options and fast payouts can fuel account growth, helping you choose a program that matches your trading ambitions.

What to Look for in a Beginner Instant Funding Prop Firm

When choosing an instant funding prop firm as a beginner, start by examining their pricing structure. Look for firms that charge a one-time fee, typically ranging from $100 to $300 for account sizes between $50,000 and $100,000, and steer clear of hidden costs like activation, reset, or withdrawal fees. For example, Take Profit Trader stands out with no activation fees and a 100% refund on your first payout. On the other hand, Apex Trader Funding has a modest $10 fee per account for 100K accounts. Tools like DamnPropFirms can help you compare fees and find discounts.

Next, consider how profits are shared. Most instant funding accounts offer profit splits between 70% and 90%, with some firms giving 100% of the first $10,000 in profits before shifting to a 90/10 split. Payout speed is also critical – processing times vary widely. For instance, FundedNext Futures processes payouts in just three days, while Tradeify takes about five days.

Trading rules can significantly impact your experience. Beginner-friendly firms usually offer straightforward drawdown structures, often calculated at the end of the day rather than using complex trailing stops. They also tend to have reasonable rules around trading consistency, with some even removing these rules entirely for funded accounts. Avoid firms with overly restrictive daily loss limits (e.g., less than 2% of your account size) or confusing position restrictions. To evaluate these rules, you can use tools like the Consistency Rule Calculator on DamnPropFirms.

Transparency and educational support are essential markers of a good prop firm. The best firms clearly outline their rules – such as drawdown limits, consistency requirements, and payout timelines – in simple terms. They back this up with responsive customer service, verified payout records, and real trader reviews. Additional resources like onboarding guides, strategy tutorials, and access to a trading community can help you learn faster. Platforms like DamnPropFirms compile verified reviews, flag potential concerns, and offer monthly rankings based on factors like payout speed and fairness, helping you make an informed choice.

For beginners, starting with a smaller account – between $5,000 and $25,000 – can be a smart move. This allows you to test the firm’s payout reliability and gain confidence without risking too much capital. The best instant funding prop firms should feel like a partner in your trading journey, helping you succeed rather than creating obstacles to your earnings.

Conclusion

Instant funding prop firms provide an excellent opportunity for beginners to trade futures without putting their own money at risk. The five firms highlighted here – Apex Trader Funding, Take Profit Trader, FundedNext Futures, Alpha Futures, and Tradeify – are especially appealing because of their beginner-friendly rules, straightforward pricing, and quick access to funded accounts. Whether your focus is on scaling across multiple accounts, taking advantage of daily withdrawals, or avoiding strict consistency rules, these firms offer solid starting points for new traders in the U.S. futures market.

To make an informed decision before paying any fees, check out DamnPropFirms. This platform allows you to compare the latest rules, pricing, and verified trader reviews all in one place. Tools like the Consistency Rule Calculator help ensure you distribute profits properly without running afoul of firm guidelines. Plus, you can save money upfront by using discount codes like DGT, which can reduce fees by 10–90%. Monthly rankings based on fairness, payout speed, and community feedback provide an up-to-date look at which firms are living up to their promises.

Starting small is a smart way to transition from research to live trading. Focus on strategy and disciplined execution rather than chasing big wins. Aim to secure your first payout before considering scaling up. Keep track of your compliance and equity curve to develop habits that will help you maintain a funded account over time. Once you’ve honed your strategy and can manage risk effectively, you might explore additional accounts with other well-regarded prop firms like Topstep, FundedFuturesNetwork, or FundingTicks to diversify and grow your trading capital.

For even more support, join the Damn Good Traders Discord community, where over 3,000 traders share honest feedback and tips based on real-world experiences. By combining the insights from this guide with DamnPropFirms’ tools and reviews, you’ll be better equipped to choose the right firm and focus on what truly matters: building a profitable and sustainable trading strategy. With the right mix of discipline and informed decision-making, you’ll be well on your way to achieving long-term success in futures trading.

FAQs

What are the advantages of using an instant funding prop firm as a beginner?

Choosing an instant funding prop firm comes with several perks, especially for those just starting out. One of the biggest benefits is gaining immediate access to trading capital. This means you can dive into live trading right away, skipping the wait and getting hands-on experience in real-market conditions. It’s a great way to start building your trading journey.

Another advantage is the removal of lengthy evaluation phases. Instead of spending time proving yourself through drawn-out tests, you can focus on actual trading and working toward potential profits sooner. For beginners, this setup offers a solid opportunity to build confidence and sharpen skills in a live trading environment.

How do instant funding prop firms manage profit splits and payouts?

Instant funding prop firms generally provide traders with a profit share, often between 60% and 80%. These firms focus on fast payout processing, typically completing transactions within 5 to 10 business days, so traders can access their earnings promptly.

Certain firms may impose no limits or restrictions on payouts, giving traders the opportunity to grow their accounts and earnings freely. However, since terms can differ, it’s crucial to carefully review each firm’s policies before diving in.

What should beginners consider when choosing a prop firm with instant funding?

When choosing a prop firm with instant funding, beginners should consider several important aspects. Start by seeking firms with simple and fair evaluation processes – this makes it easier to dive into trading with confidence. Another critical factor is a transparent payout system, ensuring you can access your earnings quickly and without complications.

It’s also a good idea to look at verified reviews and community feedback to get a sense of the firm’s reliability and overall reputation. The best instant funding options come with clear, straightforward requirements, allowing new traders to begin without unnecessary roadblocks. Opt for firms that create a supportive atmosphere, helping you develop and succeed as a trader.