Futures prop trading in 2025 offers traders a way to trade significant capital without risking their own money. Prop firms provide funded accounts after evaluation, allowing traders to keep a large share of profits, typically 80–90%. However, firms vary in evaluation processes, profit splits, payout timelines, and support. Here’s a quick look at five top firms:

- Apex Trader Funding: Simple evaluations, 100% profit on the first $25K, then 90%. Payouts every 8 trading days but uses a stricter trailing drawdown model.

- Take Profit Trader: Low fees, overnight trading allowed, but lacks transparency on profit splits and other details.

- BluSky Trading: Quick funding access, but limited public information and stricter rules make it hard to evaluate.

- Topstep: Educational resources, weekly payouts, and no time limits for evaluations, but initial profit splits are lower.

- Earn2Trade: Combines education with funding, 80% profit splits, and scalable accounts, though evaluations are more demanding and subscription fees can add up.

Each firm caters to different trading styles and goals. Evaluate profit-sharing structures, evaluation rules, and support quality before choosing.

Quick Comparison:

| Firm | Profit Split | Evaluation Process | Payout Frequency | Key Features |

|---|---|---|---|---|

| Apex Trader Funding | 100% first $25K, 90% after | One-step, 7 days min | Every 8 trading days | Simulated accounts, trailing drawdown |

| Take Profit Trader | Not disclosed | Not disclosed | Not disclosed | Overnight trading allowed, low fees |

| BluSky Trading | Not disclosed | Not disclosed | Not disclosed | Quick funding, limited transparency |

| Topstep | Up to 100% | No time limit | Weekly | Educational resources, partner funding |

| Earn2Trade | 80% | 10 days min | Not specified | Education-focused, scalable accounts |

Choose based on your trading needs and preferences.

Ultimate Futures Prop Firm Tier List 2025 (From A 7 Figure Trader)

1. Apex Trader Funding

Apex Trader Funding has maintained an impressive 4.5/5 rating on Trustpilot over four years, backed by over 13,000 reviews. It’s a popular choice for traders looking for a straightforward route to funded accounts, though some policies may require closer attention.

Profit Splits

One of the standout features is the profit-sharing structure. Traders keep 100% of their first $25,000 in profits per account, ensuring that every dollar up to that amount goes straight into their pocket. Beyond this threshold, the profit split adjusts to 90%.

"Apex Trader Funding stands out for its simplicity, flexibility and lucrative profit split, you get 100% of your first $25,000 profit per account and 90% after that." – Chika Uchendu, Contributor, Benzinga

This setup provides a strong incentive for new traders to hit the ground running.

Evaluation Process

The evaluation process is designed to be efficient, with a one-step model that can be completed in as few as seven days. Traders are required to meet profit targets, stay within loss limits, and follow an Intraday Trailing Drawdown model. However, this model has been noted to result in 67% more account failures compared to End-of-Day (EOD) models. Additionally, traders must close all positions by 4:59 PM EST.

For a $50,000 evaluation account, the process begins at $169 and up.

Funding Speed

Funding is activated after paying a one-time fee, with a standard turnaround time to get started.

Payout Frequency

Payouts are available every eight trading days. After the sixth payout, traders transition to receiving full profit payouts without any initial holdbacks. Processing times typically range from 5 to 10 days.

Trader Support

Apex Trader Funding’s strong Trustpilot rating reflects a reliable support system, though details on communication channels are somewhat limited.

It’s worth noting that traders operate in a simulated funded environment rather than trading with real capital in live markets. If working with actual market capital is a priority, this distinction is something to carefully consider before committing to the evaluation process.

2. Take Profit Trader

Take Profit Trader is a futures prop firm based in the United States. Established four years ago, it offers funding of up to $750,000 and currently holds a rating of 3.4/5 based on 10 reviews. While it provides opportunities in the futures market, much of its operational structure remains unclear to the public.

Profit Splits

Details about profit splits are not publicly available. Traders interested in this information will need to contact the firm directly.

Evaluation Process

Key aspects of the evaluation process – such as profit targets, drawdown limits, and timeframes – are not disclosed. For precise information, reaching out to the firm is necessary.

Funding Speed and Payout Frequency

Information regarding how quickly funding is provided or how often payouts occur is not shared. Again, direct communication with the company is required for clarification.

Trader Support

With limited reviews available, it is difficult to gauge the quality of trader support. Prospective traders should contact the firm to evaluate its responsiveness and assistance.

The lack of transparency in these critical areas makes Take Profit Trader stand out when compared to firms with more openly shared details, as explored in later sections.

3. BluSky Trading

BluSky Trading functions as a futures proprietary trading firm, but the specifics about its offerings and operations remain unavailable to the public. This lack of accessible information makes it harder for traders to determine if the firm aligns with their trading objectives.

Profit Splits

BluSky Trading does not disclose its profit split percentages for funded traders. Without this critical detail, it’s impossible to calculate how earnings would be shared between the trader and the firm. This lack of transparency makes it challenging to evaluate potential compensation and compare the firm to others in the industry.

Evaluation Process

Details about BluSky Trading’s evaluation process are also missing. Traders are left without information on essential criteria like profit targets, drawdown limits, daily loss caps, or the timeframes for completing evaluations. To understand the qualifications required for funding, traders would need to contact the firm directly.

Funding Speed and Payout Frequency

The firm has not shared how quickly traders can access funding or how often payouts are processed. Whether payouts are weekly, bi-weekly, or monthly – and whether minimum thresholds apply – remains unclear. This lack of detail can make financial planning more difficult for prospective traders.

Trader Support

BluSky Trading does not provide information about its trader support services. Elements like customer service responsiveness, educational tools, and technical support are vital for a positive trading experience, yet these aspects are not outlined.

Traders interested in BluSky Trading should reach out directly to inquire about the availability of support channels, response times, and the type of assistance offered. Direct communication may also shed light on other operational details that are currently unavailable.

The limited transparency makes it difficult for traders to conduct thorough research on the firm.

sbb-itb-46ae61d

4. Topstep

Topstep is a futures prop trading firm that gives traders the opportunity to access funded accounts after successfully completing an evaluation phase. The firm provides clear guidelines around profit targets, payouts, and account management. Let’s break down how their profit-sharing model, evaluation process, and payout structure work.

Profit Splits

Instead of a fixed profit split, Topstep allows traders to withdraw funds once they reach specific performance milestones. For example, after achieving 5 non-consecutive profit days with earnings over $200, traders can withdraw up to 50% of their account balance. After 30 non-consecutive profit days, they gain access to 100% of their account balance, though withdrawals are capped at $5,000.

Evaluation Process

Topstep offers three account sizes to choose from: $50K, $100K, and $150K. Each account comes with a corresponding profit target – $3,000, $6,000, and $9,000, respectively. There’s no time limit to meet these targets, and traders are allowed to open a maximum of 5 contracts per account.

Funding Speed and Payout Frequency

Topstep processes payouts weekly, giving traders regular access to their profits. The first withdrawal, capped at 50%, becomes available after 5 non-consecutive profit days with earnings above $200. Full access to the account balance is unlocked after 30 non-consecutive profit days. However, withdrawals count toward the maximum loss limit, so traders need to carefully manage their balance and withdrawal timing to avoid triggering account closure.

5. Earn2Trade

Earn2Trade combines trader education with funding opportunities, offering a clear path for aspiring traders to prove their skills. The company runs two main evaluation programs – Trader Career Path® (TCP) and The Gauntlet Mini™ (GAU) – both designed to assess your trading abilities on simulated accounts before linking you to partner proprietary trading firms for live funding.

Evaluation Process

Earn2Trade’s evaluation process is straightforward, requiring a minimum of ten trading days (effective from April 1, 2024). However, passing the evaluation has become more challenging, with the success rate dropping from 23.38% in 2023 to 10.42% in 2024.

The firm offers seven account sizes across its programs, ranging from $25,000 to $200,000. Each account has specific profit targets, daily loss limits, and contract restrictions. For instance, the TCP $50,000 account requires hitting a $3,000 profit target (6%) with a maximum of 6 contracts, while the GAU $200,000 account sets an $11,000 profit target (5.5%) and allows up to 16 contracts.

| Program | Account Size | Monthly Fee | Profit Target | Max Contracts |

|---|---|---|---|---|

| TCP | $25,000 | $150 | $1,750 (7%) | 3 |

| TCP | $50,000 | $190 | $3,000 (6%) | 6 |

| TCP | $100,000 | $350 | $6,000 (6%) | 12 |

| GAU | $50,000 | $170 | $3,000 (6%) | 6 |

| GAU | $100,000 | $315 | $6,000 (6%) | 12 |

| GAU | $150,000 | $375 | $9,000 (6%) | 15 |

| GAU | $200,000 | $550 | $11,000 (5.5%) | 16 |

Traders must follow a progression ladder, which limits the number of contracts they can trade, and adhere to end-of-day drawdown rules. A notable perk is the flexibility to trade during major economic announcements without restrictions – a feature not all firms offer.

Profit Splits

Once you pass the evaluation, Earn2Trade offers an 80% profit split, giving traders a significant share of their earnings. Additionally, there’s potential to scale up to a $400,000 account, allowing successful traders to expand their opportunities as they demonstrate consistent performance.

Trader Support

Earn2Trade places a strong emphasis on supporting its traders. With a 4.6 Trustpilot rating from over 2,000 reviews, the company has built a reputation for excellent customer service. Traders often highlight the team’s responsiveness and the variety of support options, which include a dedicated director, an active Discord manager, and multilingual assistance.

"The customer service is outstanding. I passed the evaluation one day before paying the monthly fee again and they confirmed everything the same day to let me cancel the subscription and avoid being charged the next day. Really amazing service." – Alejandro

"A company made for traders, being by their side from the beginning of the evaluation for whatever you need. Easy and fast communication. Nice team." – Jaime

With its structured evaluations, educational tools, and dedicated support, Earn2Trade provides a comprehensive pathway for traders looking to secure funding. This approach reinforces its role as a key player in the evolving futures prop trading industry.

Pros and Cons Comparison

When deciding on a trading firm, it’s essential to balance their strengths with any potential drawbacks to find the best match for your trading goals.

Apex Trader Funding is popular for its straightforward evaluation process, which allows traders to secure funding relatively quickly. The firm offers a competitive profit split and permits trading during news events, adding flexibility. On the downside, scaling up account sizes requires consistent performance over multiple payout cycles, and some traders have reported occasional delays in support responses.

Take Profit Trader earns praise for its affordable evaluation fees and prompt payout processing. It also allows traders to hold positions overnight and over weekends, which can be a strategic advantage. However, its conservative loss limits and lower profit split may pose challenges for more aggressive trading styles.

BluSky Trading appeals to experienced traders with its quick funding access and flexible evaluations. That said, it enforces strict consistency rules, which demand disciplined trade management, and its evaluation fees are higher than average.

Topstep has established itself as a reliable and transparent option. In addition to funding, it provides educational resources and structured development programs to help traders improve. The firm also partners with others to expand funding opportunities after evaluations. Still, some traders may find its initial profit split less appealing, and the minimum trading day requirement extends the evaluation period.

Earn2Trade blends funding opportunities with a strong focus on trader education through its structured learning programs. It offers the chance to scale to larger account sizes and provides a competitive profit split. However, the evaluation process has become more demanding, and the subscription-based model can lead to higher costs if multiple attempts are needed. Additionally, some progression criteria may restrict the contract sizes available.

Here’s a quick comparison of each firm’s standout features and limitations:

| Firm | Key Strengths | Main Limitations |

|---|---|---|

| Apex Trader Funding | Streamlined evaluation, competitive profit split, flexible trading options | Gradual scaling process, inconsistent support times |

| Take Profit Trader | Affordable evaluation fees, fast payouts, overnight trading | Conservative loss limits, lower profit split |

| BluSky Trading | Quick funding access, flexible evaluations | Strict consistency rules, higher fees |

| Topstep | Trusted reputation, educational resources, partner funding opportunities | Lower initial profit split, longer evaluation period |

| Earn2Trade | Strong educational focus, scalability, competitive profit split | Challenging evaluations, subscription costs, contract size restrictions |

Choosing the right firm comes down to your individual priorities. If you’re looking for speed and simplicity, Apex Trader Funding might be the best fit. Traders on a budget may prefer Take Profit Trader, while those seeking quick funding could lean toward BluSky Trading. For traders focused on education and long-term growth, Topstep or Earn2Trade may be more suitable.

Take the time to assess your trading style, risk tolerance, and financial goals to find the firm that aligns best with your needs.

Conclusion

Choosing the right futures prop firm in 2025 comes down to finding the best match for your trading style and goals. Here’s a quick overview of each firm’s key strengths and potential drawbacks:

- Apex Trader Funding: A great option for those who value simple processes and flexible evaluations, though it has slower scaling and occasional support delays.

- Take Profit Trader: Perfect for budget-conscious traders due to its low fees and quick payouts, but it may not suit aggressive trading approaches.

- BluSky Trading: Tailored for experienced traders, but its stricter consistency rules and higher fees might be tough for beginners.

- Topstep: Best for traders focused on long-term growth and education, though it offers a smaller initial profit split and a longer evaluation process.

- Earn2Trade: Ideal for those looking for both education and scalability, but be prepared for challenging evaluations and higher costs.

Take the time to align your choice with your trading strategy, budget, and experience level. Refer to the comparison table to weigh their strengths and limitations side by side.

FAQs

What should I look for when selecting a prop firm for futures trading in 2025?

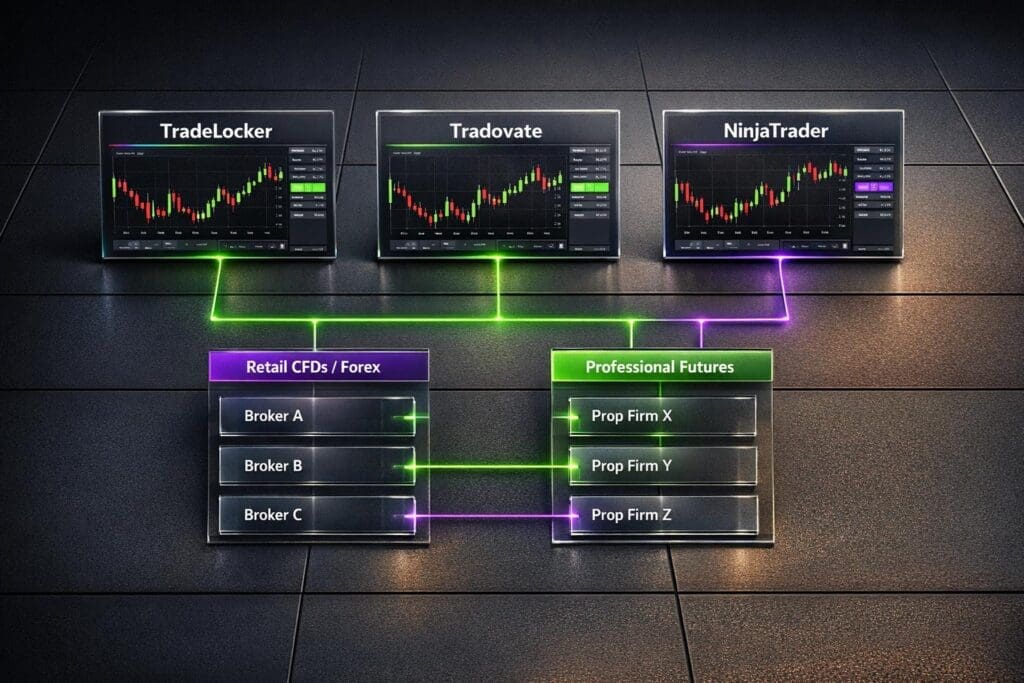

When picking a prop firm for futures trading in 2025, it’s important to focus on a few essential factors to ensure it fits your trading objectives. Start by checking for straightforward trading rules, transparent payout systems, and flexible funding options that match your needs. It’s also worth prioritizing firms that provide trader-focused features, like dependable trading platforms, responsive customer support, and effective risk management tools.

By carefully assessing these elements, you can choose a firm that not only supports your trading journey but also makes the experience smooth and rewarding.

What should traders know about the evaluation process at top futures prop trading firms?

The evaluation processes at futures prop trading firms can differ widely, making it crucial for traders to grasp the specifics. These firms typically set rules like profit targets, drawdown limits, and loss restrictions. While some firms may require traders to meet consistency standards, others offer more leeway, such as removing time constraints.

To perform well, traders need to thoroughly examine each firm’s guidelines to ensure they match their trading approach and risk appetite. Proper preparation for these evaluations is key to securing funding and building a successful trading career.

Why is transparency crucial when choosing a prop trading firm?

Transparency plays a crucial role in helping traders grasp the rules, payout structures, and funding processes of a prop trading firm. When these details are clear, traders can make informed decisions and steer clear of potential scams or unexpected fees.

Firms that emphasize transparency typically offer well-defined guidelines, simple terms, and open lines of communication. This approach fosters trust, allowing traders to concentrate on their performance without the distraction of ambiguous policies or unforeseen issues.