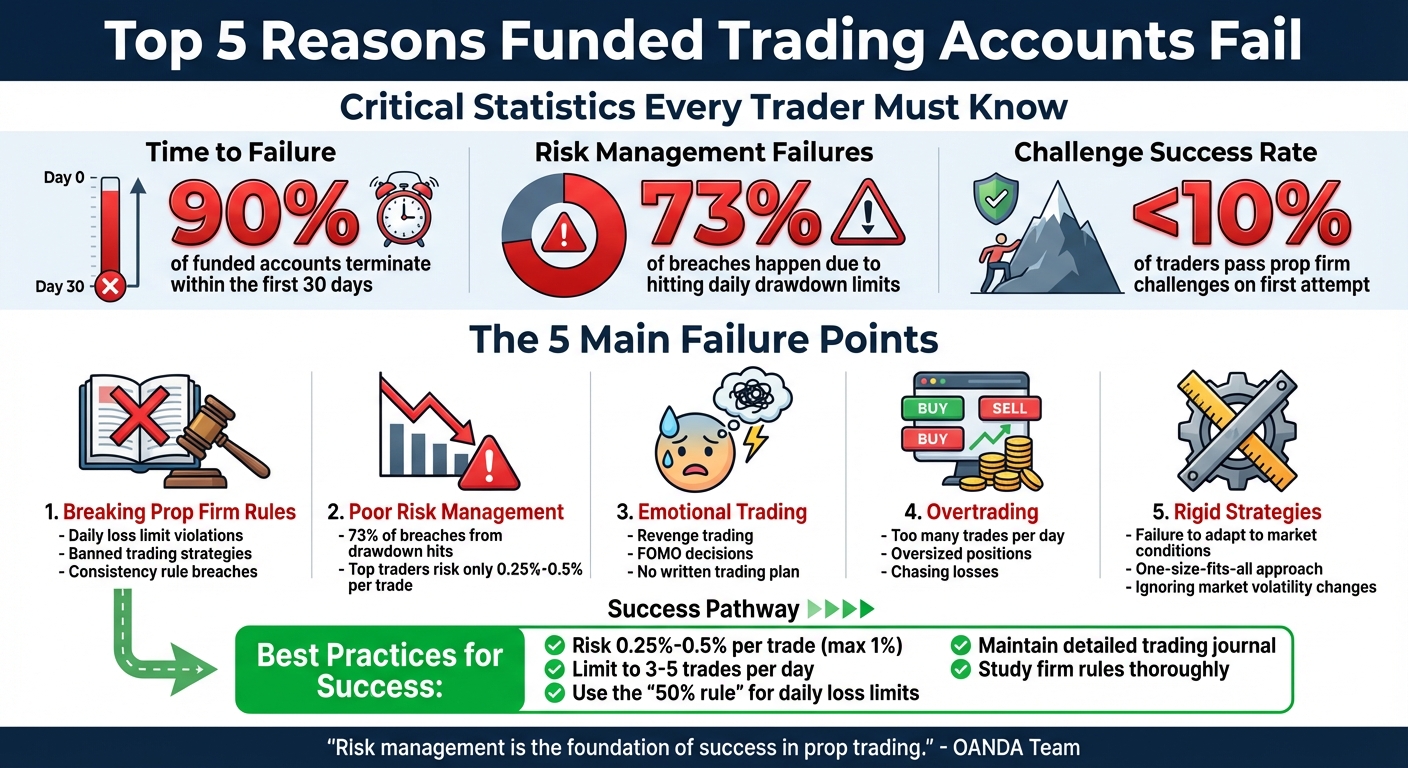

Funded trading accounts give traders access to capital without risking their own money, but they come with strict rules and challenges. Most traders fail due to common mistakes like breaking rules, poor risk management, emotional trading, overtrading, and sticking to rigid strategies. These issues often lead to quick account terminations, especially during the first 30 days. By understanding these pitfalls and implementing disciplined practices, traders can improve their chances of long-term success.

Key Takeaways:

- Breaking Rules: Violating firm rules (e.g., loss limits, banned strategies) leads to disqualification.

- Poor Risk Management: Over-risking and skipping stop-losses are major account killers.

- Emotional Trading: Lack of a plan causes impulsive decisions like revenge trading or FOMO.

- Overtrading: Too many trades or oversized positions increase losses.

- Rigid Strategies: Markets change, and traders must adjust their approach accordingly.

Quick Tip: Study your prop firm’s rules, use strict risk management, and maintain a detailed trading journal to avoid repeating mistakes.

Top 5 Reasons Funded Trading Accounts Fail: Statistics and Key Lessons

I’ve Failed 6 Funded Challenges… Here’s What I’ve Learned

1. Breaking Prop Firm Rules Gets You Disqualified

Prop firms lay out strict rulebooks with clear standards, limits, and conditions. Breaking even one of these rules leads to immediate disqualification.

The most frequent violations involve surpassing daily loss limits or maximum trailing drawdown limits. These safeguards are in place to protect the firm’s capital and ensure traders manage risks effectively. For example, if a firm sets a $1,000 daily loss limit and you exceed it, your account is terminated on the spot. To enforce these rules, firms rely on internal risk engines and real-time monitoring systems to detect breaches as they happen.

Another common reason for disqualification is using banned trading strategies. Many firms prohibit high-frequency trading, scalping, latency arbitrage, grid systems, and Martingale methods. Additionally, using copy trading or signal mirroring services – especially those involving unapproved third-party providers or multiple accounts – can get you disqualified.

The Consistency Rule trips up many traders as well. This rule ensures that profits come from steady, reliable trading rather than a few lucky trades. If one day’s profit makes up a disproportionately large share of your overall gains, or if you suddenly change your trading style after hitting a profit target, you could violate this rule and lose your account.

To avoid these pitfalls, thoroughly review your firm’s rulebook before you start trading. Pay close attention to details about loss limits, banned strategies, and consistency requirements. Rulebooks are updated periodically, so staying informed is essential. Many traders lose their funded accounts not because of poor trading skills but because they failed to fully understand the rules they agreed to follow. Knowing these rules inside and out is just as important as managing your trading risks.

2. Bad Risk Management Destroys Accounts Fast

Breaking the rules might lead to immediate disqualification (as discussed in Section 1), but poor risk management can slowly chip away at your trading success. In fact, bad risk management is the leading cause of funded account failures. A staggering 73% of funded account breaches happen because traders hit their daily drawdown limit. Even more surprising? Around 90% of funded account terminations occur within the first 30 days. Many of these traders were profitable but failed to manage risk effectively.

Beyond following the rules, mastering risk management is the next big hurdle. Over-risking on trades leaves little room for error. The best prop traders, for instance, only risk between 0.25% and 0.5% of their account per trade. Take Sarah, for example. She managed a $100,000 Instant Funding account and always risked 1% per trade, regardless of market conditions. With a 55% win rate and winners averaging 2.2 times her losers, she achieved an impressive 8% monthly return over 18 months. She avoided any Guardian Shield breaches and earned over $120,000 in payouts.

Another common pitfall? Ignoring stop-loss orders. Skipping stop-losses can turn minor losses into catastrophic breaches. If the market gaps or reverses suddenly, what could have been a manageable loss might spiral out of control. Stop-loss orders allow traders to plan their exits calmly, rather than making emotional decisions during volatile moments.

Experienced traders also rely on the "50% rule" to add an extra layer of protection. Instead of using the full daily loss limit, they treat half of it as their personal cap. For example, if your firm allows a $1,000 daily loss, you should stop trading once you hit $500 in losses. This buffer shields you from unexpected market swings, slippage, or impulsive decisions. To implement this, divide your personal loss limit by the number of trades you expect to make, and stick to that risk per trade.

"Risk management is the foundation of success in prop trading." – OANDA Team

Next, let’s explore how trading without a clear plan can lead to costly emotional mistakes.

3. Trading Without a Plan Creates Emotional Mistakes

Having a clear trading plan isn’t just a nice-to-have – it’s a must if you want to avoid emotional missteps. Without a written plan to guide you, it’s easy to lose focus and fall back on gut instincts instead of solid analysis. And the numbers don’t lie: fewer than 10% of traders pass a prop firm challenge on their first try.

When you don’t have clear entry and exit rules, self-doubt creeps in, especially after a loss. That doubt can lead to emotional reactions like revenge trading, chasing trades out of FOMO (fear of missing out), or even overconfidence after a win. These emotions often push traders to make impulsive decisions, like taking trades that don’t align with their strategy or abruptly switching approaches mid-challenge. As Babypips.com wisely puts it:

"If you fail to plan, then you’ve already planned to fail".

A well-thought-out trading plan is your safety net against these emotional traps. It should include specific guidelines for entries and exits, risk management rules, position sizing, and even when to stay out of the market – like during major economic announcements. Writing your plan down, reviewing it regularly, and making updates only when the market is closed keeps your decision-making grounded. Using a pre-trade checklist can also help ensure every trade aligns with your strategy by asking questions like, "Does this fit my plan?" or "Am I trading because I’m prepared, not just bored?" This kind of discipline helps you stay consistent.

The best traders treat their plan as a living document – a roadmap for growth. They keep detailed trading journals to track their mindset before each trade and identify patterns that lead to mistakes. By analyzing these records, they gain valuable insights into what’s working and what isn’t. This objective review process, paired with strong risk management, makes it easier to learn from past trades and avoid repeating the same errors. Without it, emotional decisions and repeated mistakes become almost inevitable.

sbb-itb-46ae61d

4. Overtrading and Wrong Position Sizes Increase Losses

Risk management is essential, but overtrading and poor position sizing can quickly undermine it. These are two of the most common ways traders put their funded accounts at risk. Taking too many trades or using oversized positions can lead to mounting losses, especially when trying to recover from a drawdown. For instance, doubling your position after a 1% loss might seem like a quick fix, but it can amplify losses and potentially breach your daily limit. These missteps are often fueled by emotional reactions rather than sound strategy.

Emotions play a significant role in overtrading. Revenge trading (trying to recover losses immediately), FOMO (fear of missing out), overconfidence after a winning streak, or even plain boredom can push traders to make impulsive decisions that don’t align with their trading plan. Winning streaks, in particular, can create a false sense of confidence, tempting traders to increase their position sizes – only to see a single losing trade wipe out previous gains. Warren Buffett’s timeless observation says it best:

"The stock market is designed to transfer money from the impatient to the patient".

To avoid these pitfalls, set clear boundaries. Limit yourself to 3–5 trades per day, focus on trading during peak liquidity hours, and step away from the market afterward to avoid impulsive decisions [26, 19]. A pre-trade checklist can also help ensure that each trade meets a solid 2:1 risk-to-reward ratio.

For position sizing, the rule of thumb is to risk no more than 1% of your account per trade. Top-tier traders often risk as little as 0.25% to 0.5% and always use stop-loss orders [16, 19]. Keep your position sizes consistent, resisting the urge to increase lot sizes after a winning streak or during a losing spell [16, 17]. If you’re new to trading, it’s wise to start small – typically with 1–2 contracts – until you’ve proven you can trade consistently. Prop firms like Apex Trader Funding value steady performance over big wins, so disciplined trading will always outshine risky bets [16, 19].

Remember, trading isn’t about chasing every price fluctuation. Focus on quality over quantity. As Jesse Livermore famously said:

"It was never my thinking that made the big money. It was my sitting".

5. Rigid Strategies Fail When Markets Change

Markets are anything but predictable. Some days they trend sharply, other days they meander sideways, and sometimes they seem completely erratic. Traders who cling to one unchanging strategy, regardless of what the market is doing, often see their funded accounts vanish. A strategy built for trending markets, for instance, can fall apart in range-bound conditions. Similarly, scalping methods that thrive in high-volatility environments may falter when the market quiets down. This constant shift in conditions means traders must adapt their strategies rather than stubbornly stick to one game plan.

The issue isn’t the strategy itself – it’s the inability or refusal to adapt. Markets evolve continuously, driven by news, economic shifts, and other factors. If the market is sluggish and choppy, forcing trades because "the strategy says so" is a surefire way to rack up losses. A better approach is to wait for setups that align with the current conditions. On the flip side, when markets are trending strongly, it’s often wiser to ride the trend rather than cutting profits short based on a rigid target.

To navigate these changes, traders need to embrace flexibility. This doesn’t mean abandoning your overall plan – it means learning to adjust within it. For example, avoid trading right before major news events, as these can cause sudden, unpredictable volatility. If your tried-and-true setups aren’t appearing, don’t force trades out of boredom or impatience. Recognize when the market isn’t playing to your strengths and step back.

Building this kind of flexibility requires ongoing learning and regular self-assessment. Keeping a trading journal can help you identify which conditions suit your strategies and when to dial up or down your trading activity. Prop firms like Apex Trader Funding and Take Profit Trader value traders who can perform consistently across different market environments – not just those who happen to excel during one favorable period.

Each trading session is unique, and the best traders treat it that way. Assess the market conditions before executing your strategy, and be honest about whether your approach is suitable for what’s unfolding. The ability to adapt isn’t just helpful – it’s essential for staying in the game. This ties back to the importance of dynamic risk management and planning discussed earlier.

How to Apply These Lessons with Top Prop Firms

Now that you’re familiar with the five major pitfalls that can jeopardize funded accounts, it’s time to see how these lessons can be put into practice with some of the top proprietary trading firms. Each firm operates with its own set of rules, and understanding these details beforehand can help you avoid common missteps. Let’s break down how these firms incorporate these principles into their structures.

The first step is to select a prop firm whose rules align with your trading style and experience. For instance, Apex Trader Funding uses a trailing drawdown during the evaluation phase, which stops at your starting balance once you’re funded. Unlike many firms, they don’t enforce a daily loss limit during the evaluation period. This setup encourages disciplined trading while managing risk. Once you’re funded, Apex implements a 30% consistency rule, meaning no single day’s profit can account for more than 30% of your total monthly gains. Additionally, they have a 30% negative risk rule, ensuring unrealized losses on open positions stay within 30% of your daily profit.

If you prefer fewer restrictions, Take Profit Trader might be a better fit. They offer a streamlined evaluation process without scaling rules, allowing you to trade full contract sizes right away. They also provide same-day payouts whenever you decide to withdraw, and they emphasize having "no weird consistency rules", which can be appealing for traders who value simplicity and flexibility.

On the other hand, Topstep imposes a 30-day evaluation period, which might not be ideal for part-time traders who can’t commit several hours each day to trading.

Here’s a quick comparison of these firms:

| Prop Firm | Evaluation Time Limit | Daily Loss Limit (Eval) | Consistency Rule (Funded) | Payout Frequency | Max Accounts |

|---|---|---|---|---|---|

| Apex Trader Funding | None | None | 30% rule | Twice per month (1–2 days) | 20 |

| Take Profit Trader | N/A | Fewer restrictions | None stated | Same-day, anytime | 5 |

| Topstep | 30 days | Varies by plan | Varies by plan | Varies by plan | Varies by plan |

To make the decision process easier, DamnPropFirms offers side-by-side comparisons and verified reviews of these firms. Matching your trading approach with a firm that complements your style can help you avoid repeating past mistakes. The platform also provides tools like the Consistency Rule Calculator and connects you with a community of over 3,000 traders in the Damn Good Traders Discord, where you can exchange insights and strategies. Additionally, the TradeSyncer Copy Trader tool lets you execute trades across multiple accounts, saving you time and reducing the risk of errors. These resources can help turn previous challenges into actionable strategies for smarter, more disciplined trading.

Conclusion

Losing a funded account can be a turning point that leads to smarter trading practices. The five lessons we’ve discussed – rule violations, poor risk management, emotional trading, overtrading, and rigid strategies – highlight the most common reasons traders stumble. The good news? Each of these mistakes can be avoided with the right mindset and preparation. Think of these lessons as a guide to sidestep past errors and work toward consistent success.

To improve, take time to reflect on your past trading missteps. Keep a detailed trading journal, stick to strict risk management guidelines (risking no more than 0.5%–1% per trade), and thoroughly study your firm’s rules, including drawdown limits, consistency requirements, and restricted activities. Aleksandr L., who lost his $50,000 funded account in January 2025, shared a valuable takeaway:

"Every trader must thoroughly study the rules of their prop firm. This will help avoid unexpected situations, like mine, where breaching restrictions cost the account".

Platforms like DamnPropFirms make this process easier by offering verified reviews, side-by-side firm comparisons, and tools like the Consistency Rule Calculator. Whether you’re exploring firms like Apex Trader Funding, Take Profit Trader, or Topstep, having access to transparent data and a community of over 3,000 traders in the Damn Good Traders Discord can make a real difference. Use these resources and insights to refine your trading strategy and build a path toward sustainable growth. These lessons from failed accounts aren’t just warnings – they’re a blueprint for trading smarter and achieving long-term success.

FAQs

What are the best ways to improve risk management in a funded trading account?

Effective risk management is a must for keeping your funded trading account in good shape. A good starting point? Limit your risk on every trade to 1–2% of your account balance. For instance, if you’re working with a $100,000 account, cap your risk at $1,000–$2,000 per trade. To figure out your position size, set a stop-loss and calculate how much capital is at risk within that range. This approach helps you stay within the firm’s drawdown limits and shields you from big losses.

But managing risk doesn’t stop there – it’s about daily discipline too. Each trading day, check your remaining risk allowance based on the firm’s daily and overall drawdown rules. Stick to a 1:2 risk-to-reward ratio at the very least, use hard stop-loss orders, and steer clear of pitfalls like revenge trading or doubling down on losing trades. Spreading your trades across different instruments and keeping an eye on correlations can also lower your risk. By following these practices consistently, you’ll not only safeguard your account but also set yourself up for long-term success.

What are the most common mistakes that cause traders to lose their funded accounts?

The main reasons traders lose their funded accounts often boil down to breaking the critical risk management rules set by prop firms. For instance, exceeding the daily loss limit or the maximum drawdown can instantly disqualify an account, no matter how much profit was previously made. Another frequent issue is placing trades that go beyond the allowed position size or leverage limits. Traders also run into trouble with end-of-day drawdown caps, which set strict limits on how much the account balance can drop before the trading day ends.

Overtrading is another common misstep. This happens when traders take on too many or overly aggressive positions in an attempt to seize every opportunity, which often leads to breaching risk limits. On top of that, many firms enforce consistency rules, requiring profits to be more evenly distributed across trading days. If a large portion of profits – typically more than 40-50% – comes from a single day, the account may be disqualified, even if the overall profit target is reached.

To steer clear of these issues, traders can rely on tools like the Consistency Rule Calculator available on DamnPropFirms. This tool helps monitor performance and ensures traders stay within the boundaries of prop firm requirements.

Why should traders adjust their strategies to match changing market conditions?

Markets are always changing, and keeping your trading strategy in sync with these shifts is essential. What worked well yesterday might fall apart today due to fluctuations in volatility, liquidity, or risk factors. Many traders lose funded accounts because they fail to adapt, leading to mistakes like over-leveraging, revenge trading, or exceeding drawdown limits.

Flexibility in your approach does more than just manage risk – it helps you avoid psychological pitfalls. Winning streaks can create overconfidence, making it easy to overlook emerging risks. On the flip side, sticking rigidly to a single setup can result in overtrading and burnout. By regularly reviewing your performance, tweaking position sizes, and staying aligned with current market dynamics, you can boost your chances of long-term success. In unpredictable markets, adaptability isn’t just helpful – it’s a necessity.