Market volatility makes it harder to follow strict risk rules set by prop trading firms. When the E-mini S&P 500 or similar instruments experience sudden price swings (e.g., during FOMC announcements or CPI releases), even disciplined traders risk breaching drawdowns or daily loss limits.

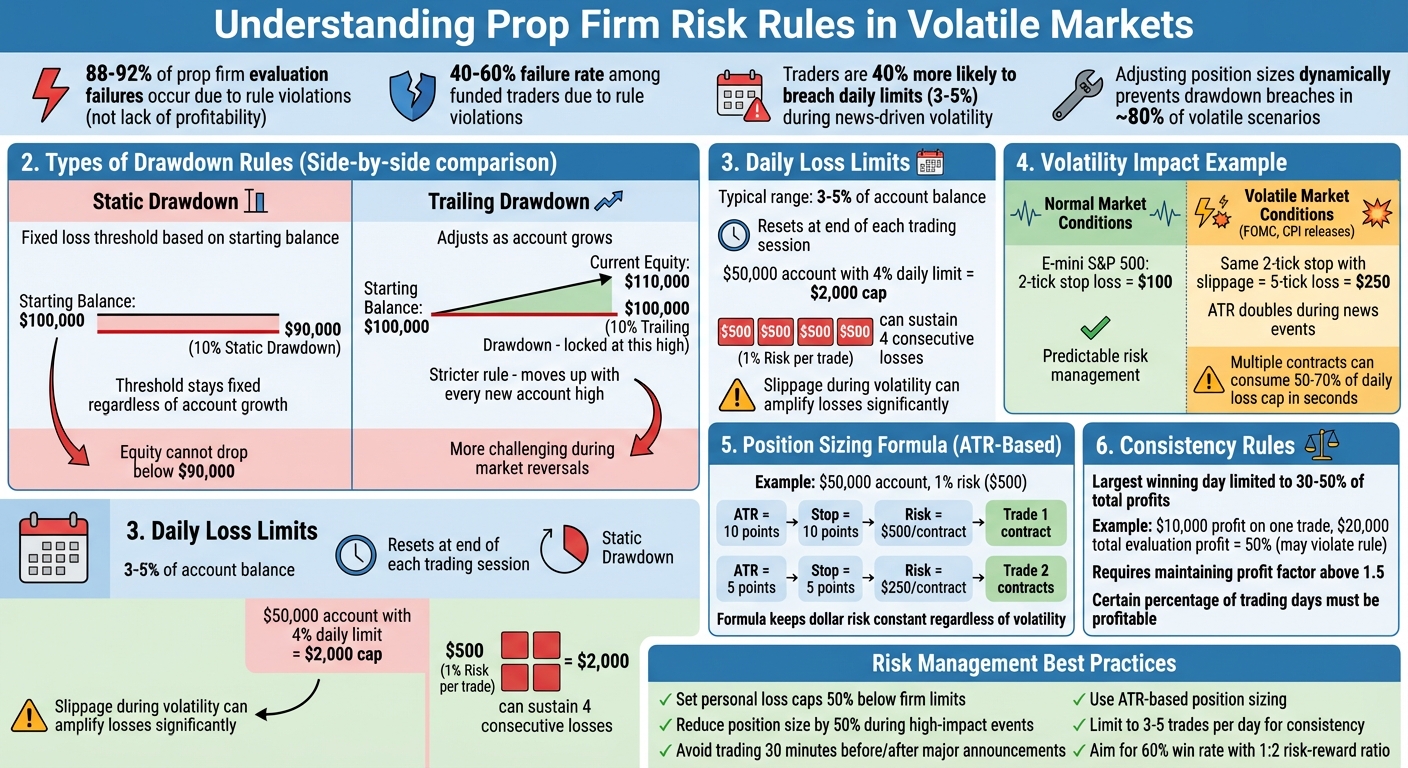

Here’s the problem: Most prop firm evaluation failures (88–92%) happen due to rule violations – not lack of profitability. Firms like Apex Trader Funding, Topstep, and Take Profit Trader enforce strict limits, such as trailing drawdowns and daily caps, which become more challenging during volatile sessions. Misunderstanding these rules or failing to adjust your strategy for high-impact events can lead to immediate account termination.

Key takeaways for staying compliant in volatile markets:

- Adjust position sizes based on volatility metrics like ATR to keep risk steady.

- Set personal loss caps below firm limits to avoid breaching thresholds.

- Use tools like the Consistency Rule Calculator from DamnPropFirms to track and plan within firm-specific rules.

The ONLY Prop Firm Risk Management Guide You Will Ever Need!

How Market Volatility Affects Prop Firm Risk Rules

Prop Firm Risk Rules Comparison: Drawdown Types and Daily Loss Limits

Volatile markets bring a unique set of challenges for traders, especially when it comes to navigating the strict risk rules set by futures prop firms. These firms implement rules like maximum drawdown, trailing drawdown, daily loss limits, intraday caps, consistency rules, and scaling requirements to safeguard their capital. While these rules are manageable under normal market conditions, volatility can make them much harder to stick to. Events like FOMC announcements, CPI releases, or sudden market crashes can create wider price swings, slippage, and rapid reversals, which significantly increase the risk of breaching these limits. For instance, when the E-mini S&P 500’s average true range (ATR) doubles during a news event, a trade that typically risks $500 per contract might suddenly expose you to much higher losses due to slippage. Interestingly, most failures in retail-focused prop evaluations occur because traders hit risk limits – like daily loss or drawdown thresholds – rather than simply failing to meet profit targets. Let’s break down how market volatility puts extra pressure on these rules.

Maximum Overall and Trailing Drawdown Limits

Static drawdown sets a fixed loss threshold based on your starting balance. For example, if you start with $100,000 and have a 10% static drawdown, your account equity cannot drop below $90,000. Trailing drawdown, on the other hand, adjusts as your account grows. If your balance increases to $110,000, a 10% trailing drawdown would now be locked at $100,000. This makes trailing drawdown stricter since it moves up with every new account high.

Volatility adds an extra layer of difficulty here. Imagine trading crude oil futures during a geopolitical event. Your account might see a quick surge in profits, pushing your trailing drawdown higher. But if the market suddenly reverses, you could breach that tighter limit – even if you’re still up overall. This situation is particularly common in high-volatility periods, like those following major Fed announcements, where trailing drawdown breaches are frequently reported.

Daily Loss Limits and Intraday Caps

Daily loss limits, often set between 3–5% of your account balance, reset at the end of each trading session. These are designed to prevent a single bad day from wiping out your account. Intraday caps take it a step further by monitoring real-time losses and sometimes triggering automated “kill switches” to close all positions if a predefined loss threshold is hit.

In volatile markets, these limits are much easier to hit. For example, on an E-mini S&P 500 contract, a 2-tick stop loss might typically cost $100. But during a news spike, slippage could turn that into a 5-tick loss, costing $250. If you’re trading multiple contracts, one sharp price move could eat up 50–70% of your daily loss cap in seconds. Situations like these are especially common around major U.S. economic data releases, such as Nonfarm Payrolls or CPI reports. Many traders avoid trading in the first few minutes after such events to reduce the risk of sudden breaches.

Consistency Rules and Scaling Requirements

Consistency rules ensure traders aren’t relying on a few large trades to hit their profit targets. These rules might limit your largest winning day to 30–50% of your total profits or require a certain percentage of your trading days to be profitable. Scaling requirements, meanwhile, tie the size of your trades to your account balance and often include metrics like maintaining a profit factor above 1.5.

Volatile markets can create both big opportunities and big risks. For example, if you make a $10,000 profit on a crude oil trade during a supply shock, but your total evaluation profit is only $20,000, you could violate a 50% consistency rule. Even if your account remains profitable, the firm might disqualify you for uneven performance. Additionally, trading at maximum size when ATR doubles can dramatically increase your risk per trade, making it harder to stay within drawdown limits and meet consistency metrics.

Some firms, such as Tradeify, offer “Dynamic Consistency” models that adapt to volatile conditions. Others, like Apex Trader Funding, Take Profit Trader, and FundedNext, provide “no consistency rule” options to simplify compliance. Tools like the Consistency Rule Calculator on DamnPropFirms can help traders track their performance and avoid unexpected disqualifications. Adjusting your trading approach to account for these dynamics is crucial when markets become unpredictable.

Common Mistakes Traders Make During Volatile Markets

Navigating volatile markets can be tricky, even for seasoned traders. The temptation to chase rapid price swings or recover losses often leads to poor decisions, which not only erode profits but can also result in account termination. In fact, rule violations are a significant factor, contributing to a 40–60% failure rate among funded traders.

Overtrading and Revenge Trading

Overtrading occurs when traders exceed their planned strategy, often driven by the fear of missing out (FOMO) or the thrill of fast-moving markets. On the other hand, revenge trading is an emotional response to losses, where traders attempt to recover quickly without sticking to their plan. Both behaviors can lead to breaching critical limits, such as daily drawdowns or position size restrictions.

Let’s break it down with an example: Imagine a trader managing a $50,000 funded account with a 4% daily drawdown limit (equivalent to $2,000). If the trader risks 1% per trade (about $500), they could theoretically sustain four consecutive losses before hitting their limit. However, during a high-volatility event like a Nonfarm Payroll release, slippage might amplify losses, leaving them down $1,800 after four trades. Frustrated, the trader might double their position size in a desperate bid to recover. But that oversized trade could push losses beyond the $2,000 limit, resulting in immediate account termination – even if the trader had the potential for a profitable month overall.

The root causes? Fear of missing out, frustration from early losses, and the lure of quick price movements. To avoid these traps, many traders adopt a “risk manager first” approach. This could mean setting a cap on daily trades or stopping altogether once a personal loss threshold is reached. These strategies help maintain discipline and protect accounts during turbulent sessions.

Failing to Adjust Position Sizing for High Volatility

Using the same position sizes in volatile markets is like driving at full speed through a parking lot – it’s reckless and increases your risk unnecessarily. When price swings intensify, sticking to fixed contract sizes can lead to outsized losses that rapidly breach daily or trailing drawdown limits.

For instance, if the average true range (ATR) doubles during a volatile session, a position that typically risks 0.5% of your account could suddenly result in losses four times larger than expected. Research shows that adjusting position sizes dynamically – like reducing contract sizes when volatility spikes – can prevent drawdown breaches in roughly 80% of volatile scenarios. Adapting your trade size to match market conditions is a straightforward way to manage risk and protect your account.

Misunderstanding Firm-Specific Rule Variations

Not all prop trading firms follow the same rules, and assuming they do can be an expensive mistake. For example, some firms use a trailing drawdown that tightens as your account grows, while others rely on a fixed drawdown tied to your starting balance. Additionally, some firms calculate drawdowns based on total equity (including open trades), while others only consider closed positions.

Take Apex Trader Funding, which uses a trailing maximum drawdown. This means your allowable loss decreases as your account balance increases. In contrast, TradeDay calculates drawdowns only at the end of the trading day, ignoring intraday fluctuations. Confusion over these differences can lower pass rates by 20–30%, leading to immediate account terminations, forfeited evaluation fees (often $300–$500), and delays in payouts.

To avoid these costly errors, make it a habit to review your firm’s dashboard for real-time drawdown tracking. Resources like DamnPropFirms can help you compare rule variations across firms like Take Profit Trader, FundedNext, and Tradeify. Setting personal buffers – say, 50% below the firm’s limits – can provide an extra layer of protection during volatile trading conditions. Understanding and adapting to firm-specific rules is essential to maintaining funded accounts and avoiding preventable losses.

sbb-itb-46ae61d

How to Stay Compliant During Volatile Markets

Navigating volatile markets while staying within prop firm risk limits takes a disciplined approach. It’s all about managing your position sizes, setting stricter personal risk limits, and using tools to monitor your compliance in real time. These strategies are key to protecting your funded account from sudden market fluctuations. Traders who successfully handle these conditions often rely on three main practices: adjusting position sizes to match market volatility, setting personal risk thresholds below firm limits, and leveraging tools to track their compliance. Here’s how you can implement these strategies effectively.

Adjust Position Sizing Based on Volatility Metrics

Basing your position size on the Average True Range (ATR) is a smart way to keep your dollar risk steady. Let’s break it down: if you’re trading a $50,000 account and want to risk 1% ($500) per trade, and the 14-period ATR on the E-mini S&P 500 is 10 points, you would set your stop loss at 10 points. Since each point on the ES equals $50, a 10-point stop means $500 of risk per contract – so you can only trade one contract. If the ATR drops to 5 points the next day, your risk per contract would be $250, allowing you to trade two contracts while still capping your total risk at $500.

This method ensures you’re not caught off guard by market shifts. When volatility spikes – like during market openings or major news releases – scaling down your position size helps you stay within daily and overall drawdown limits.

Set Personal Risk Limits Below Firm Requirements

Prop firms often allow daily losses of up to 5% and overall drawdowns of 10%, but waiting until you hit those thresholds can jeopardize your account. Instead, set your own limits that are stricter. For instance, if your firm permits a $5,000 daily loss on a $100,000 account, consider capping your losses at $2,000–$3,000. Similarly, during volatile periods, reduce your risk per trade from 0.5% to 0.25%. You can also limit the number of trades you take – say, a maximum of six per day – or take a mandatory 30-minute break if you hit half your daily loss cap.

By tightening your risk controls, you’re less likely to face account-ending losses, even during unpredictable market swings.

Use Calculators and Firm Reviews for Rule Monitoring

To stay compliant, it’s essential to fully understand your firm’s drawdown model and other rules. Tools like DamnPropFirms offer a free Consistency Rule Calculator that helps you simulate worst-case scenarios and check if you’re staying within limits. Beyond calculators, detailed reviews of futures prop firms – such as Apex Trader Funding, Take Profit Trader, FundedNext Futures, and others – can be invaluable. These reviews compare drawdown structures, daily loss caps, and consistency requirements across firms.

Using these resources helps you understand exactly how much room you have for error, how to size your trades based on current volatility, and when it’s time to scale back. This kind of preparation is critical for staying compliant during turbulent market conditions.

Creating a Trading Plan for Volatile Markets

Crafting a trading plan that aligns with your firm’s risk guidelines is a crucial step for navigating volatile markets. Since each proprietary firm operates with its own set of rules – covering drawdowns, consistency, and scaling requirements – what works for one firm might not suit another. Your plan should reflect these nuances, prepare for economic events that trigger volatility, and track how your performance shifts in turbulent conditions.

Match Your Strategy to Each Firm’s Risk Model

Your trading strategy needs to fit the risk model of the firm you’re working with. For instance, Apex Trader Funding uses a trailing drawdown model, which encourages conservative risk management – typically limiting risk to 0.5% to 1% per trade to avoid triggering a reset. On the other hand, FundedNext Futures operates with fixed daily loss limits (around 4%) and overall limits between 6% and 10%, which makes it better suited for strategies that avoid overnight positions. Meanwhile, Take Profit Trader calculates risk based on equity, so it’s essential to consistently account for the risk on your open trades.

For firms with consistency rules, like Alpha Futures, it’s wise to limit yourself to 3–5 trades per day and aim for a win rate of around 60% to meet scaling requirements. Firms without such rules, such as Apex during evaluations or Take Profit Trader in funded accounts, offer more flexibility, allowing traders to focus profits on fewer trading days. Regardless of the firm, backtesting your strategy is key – ensure you can maintain at least a 40% win rate with a 1:2 risk-reward ratio to stay compliant even during losing streaks.

Once your strategy aligns with the firm’s rules, it’s time to prepare for market events that can shake things up.

Plan Ahead for High-Impact Economic Events

Major U.S. economic events, like CPI data releases or Federal Reserve announcements, often lead to sharp market swings that can breach daily loss limits. To avoid unnecessary risks, review your economic calendar 24 to 48 hours in advance and adjust your plan accordingly. This could mean reducing your position sizes by 50% or stepping away from trading entirely during the 30 minutes before and after the event.

For firms with intraday loss caps, it’s often safer to close all positions before such events to avoid potential gap risks. For example, one trader on a $100,000 Apex account suffered a 6% loss in a single day due to a surprise Fed rate hike, which triggered the trailing drawdown and led to account termination. Similarly, another trader breached Take Profit Trader’s 3% daily limit after a post-CPI gap, a situation that might have been avoided by steering clear of overnight positions and adjusting position sizes for volatility. Incorporating these precautions into your trading plan can help you navigate high-risk scenarios more effectively.

Track Performance by Market Conditions

To strengthen your trading approach, it’s essential to monitor how your strategy performs under varying market conditions. Keeping a detailed trading journal can help. Record the details of each trade, including the date, VIX level, ATR, profit or loss, drawdown impact, and a volatility rating (low, medium, or high). Regularly reviewing this data can uncover patterns, such as noticing that most of your losses occur when the VIX exceeds 25 or that rule violations double during highly volatile sessions.

Focus on key performance metrics like win rates during high-volatility periods (aim for above 50%), average drawdowns (try to keep them under 1% daily during volatility spikes), and risk-reward ratios by event type. Studies show that traders are 40% more likely to breach daily limits of 3% to 5% during news-driven volatility. Use these insights to fine-tune your rules. For instance, you might decide to limit yourself to only two trades during particularly volatile sessions or lower your leverage when certain conditions arise.

Platforms like DamnPropFirms provide tools and verified reviews that can help you compare scaling rules and consistency requirements across firms. They also offer detailed insights into firms like Tradeify, FundingTicks, Lucid Trading, and Topstep.

Conclusion

Thriving in volatile markets comes down to three key principles: understanding how volatility affects drawdown limits and daily caps, steering clear of common trading mistakes, and crafting a plan that aligns with the risk models of specific firms. In trading, discipline often trumps strategy. By using dynamic risk management techniques – like adjusting position sizes with ATR (Average True Range) and setting conservative personal limits – you can build safeguards to stay compliant during unpredictable price movements. This approach ensures your trading strategy adapts as market conditions evolve.

Different proprietary firms have unique risk models, each requiring tailored strategies. Aligning your trading methods to a firm’s specific rules and analyzing performance under varying market conditions can reveal important patterns during periods of high volatility.

As mentioned earlier, tools for adjusting position sizes and tracking compliance are crucial. Platforms like DamnPropFirms provide valuable resources, including the Consistency Rule Calculator and verified reviews of firms such as Apex Trader Funding, Take Profit Trader, FundedNext Futures, Tradeify, FundingTicks, Lucid Trading, and Topstep. They also offer exclusive discounts, which can significantly reduce evaluation costs. These tools make it easier to compare scaling requirements, track compliance in real time, and choose firms that align with your ability to manage volatility effectively. With the right preparation, volatility can become a gateway to more disciplined and successful trading.

FAQs

What strategies can traders use to manage risk during volatile markets?

During volatile markets, managing risk becomes more crucial than ever. Traders should prioritize strengthening risk controls by taking steps like reducing trade sizes, setting tighter stop-loss levels, and steering clear of excessive leverage. Another smart move? Spread your risk by diversifying trades across various instruments.

Discipline plays a huge role here – stick to your trading plan and resist the urge to make impulsive decisions. Tools such as consistency calculators can be incredibly useful for tracking your performance and ensuring you meet prop firm requirements. By staying cautious and flexible, traders can handle market turbulence with greater confidence.

What’s the difference between static and trailing drawdown limits in prop trading?

Static drawdown limits are predetermined loss thresholds that remain constant, no matter how your trading progresses. They establish a firm cap on the amount you can lose, providing a clear boundary that cannot be crossed.

Trailing drawdown limits work differently – they shift as your account balance increases. When you earn profits, the limit rises accordingly, helping to secure those gains while still guarding against significant losses. This flexible method encourages steady performance but demands careful attention to risk management to ensure you stay within the rules.

Why is it essential to understand a prop firm’s rules when trading in volatile markets?

Understanding the rules of a prop firm becomes especially important during volatile market conditions. Each firm has its own set of guidelines around things like drawdowns, trading limits, and evaluation benchmarks. During periods of high market unpredictability, these rules can tighten or have a greater impact on your trading.

Taking the time to fully understand these guidelines allows you to adapt your strategies, avoid breaking the rules, and safeguard your account. It’s not just about staying compliant – it’s also about positioning yourself for consistent payouts and building a foundation for long-term trading success.