Trading Strategies

Explore Prop Firms

The Difference Between Smart Aggression and Pure Recklessness

Learn how disciplined, volatility-adjusted position sizing and dynamic drawdown rules separate smart aggression from reckless trading in futures prop firms.

Risk-to-Reward Lies Traders Tell Themselves

Stop chasing arbitrary R:R targets – align win rate, position sizing, and drawdown limits to survive prop-firm challenges.

Why Stop Loss Distance Matters More Than Entry Precision

Why stop loss distance matters more than entry precision: it sets position size, controls dollar risk, and keeps you compliant with prop-firm drawdown rules.

How to Size ES Trades Like a Professional (Not a Gambler)

Step-by-step guide to sizing ES/MES trades: calculate contracts, use ATR-based volatility, follow prop firm limits, and keep risk under 1% per trade.

How to Trade NQ Pullbacks Without Chasing Like an Idiot

Rule-based NQ pullback guide: identify trend with 20 EMA/VWAP, wait for Fibonacci or MA retracements, enter on price-action confirmation, and control risk.

Mean Reversion on ES: When It Works and When It Will Ruin You

Mean reversion on ES wins in range-bound, low-volatility markets — but in trends or volatility spikes it can wipe funded accounts without strict risk controls.

Why Most Traders Fail NQ Breakouts and How to Trade Them Properly

Why 87% of NQ breakout trades fail — learn a 3-step method to confirm breakouts, use ATR stops, size positions, and meet prop-firm rules.

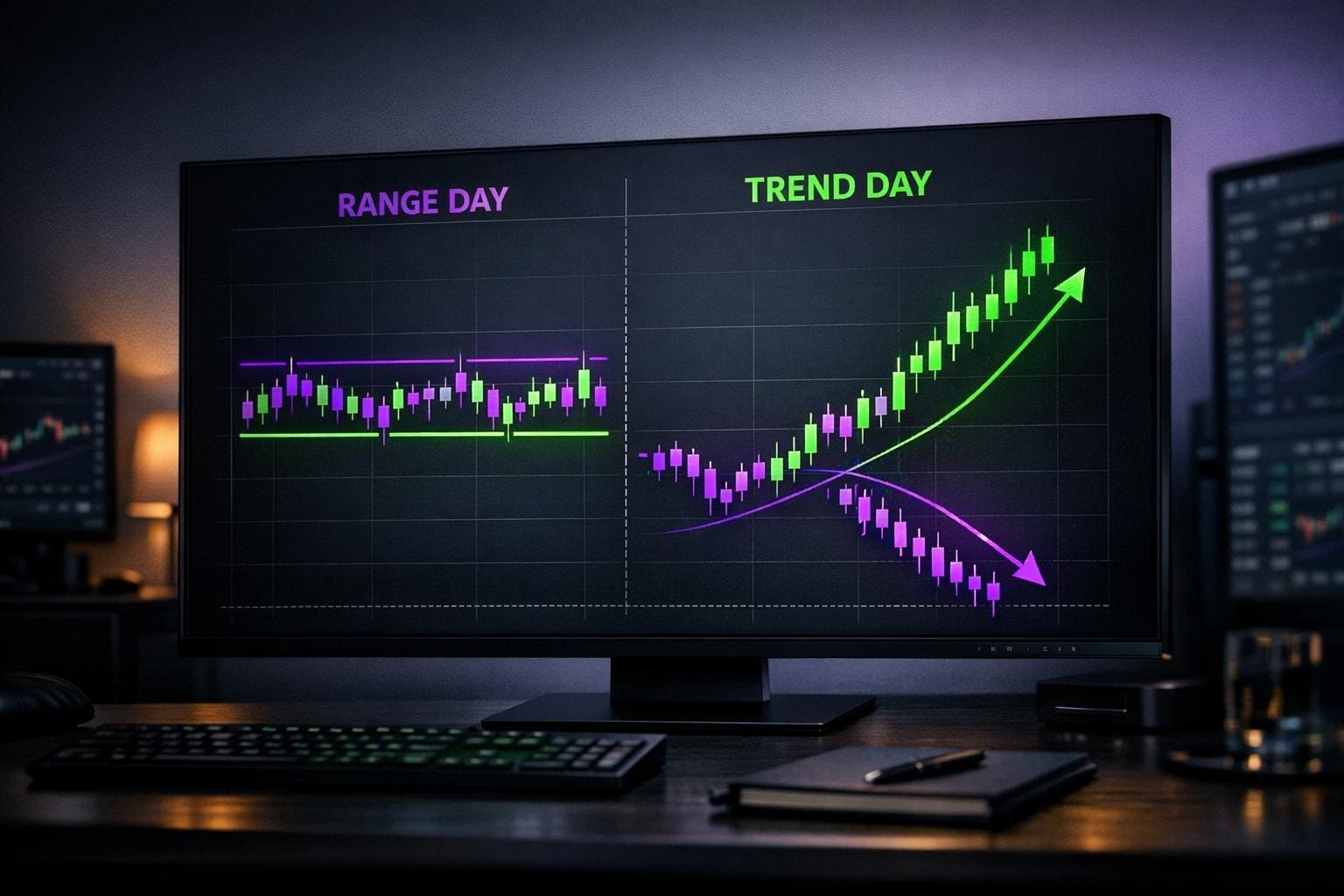

Range Days vs Trend Days on ES: How to Identify Them Before You Lose Money

Mistaking a trend day for a range day destroys profits—use ATR, pre-market volume and opening range to know before the bell.

Core Strategy & Execution (NQ / ES Specific)

Rules-based strategies and execution for trading NQ (Nasdaq‑100) and ES (S&P 500) futures, covering session timing, micro contracts, risk controls, and order types.

Prop Firm Risk Rules: Adapting to Market Volatility

Adapt position sizing, set personal loss caps, and use compliance tools to avoid breaching prop firm drawdown and daily-loss rules during volatile markets.

How Volume Profile Reveals Hidden Support Zones

Volume Profile reveals support hidden inside consolidation ranges by mapping traded volume—use HVNs, POC and VAL to place data-driven entries, stops, and manage futures risk.

Volume Profile vs Price Action: Key Differences

Compare Volume Profile and Price Action to learn how each method reads markets, their strengths and limits, and when to use or combine them for better trades.

Risk-Reward Ratio vs. Win Rate: Key Differences

Strong risk-reward ratios can offset low win rates; learn how to calculate break-even win rates, expected value, and balance metrics for consistent trading.

How to Meet Trading Objectives During Evaluations

Pass prop firm evaluations by prioritizing risk management, consistency, demo testing, and a written trading plan to protect capital and meet targets.

Position Sizing for Risk-Adjusted Scaling

Learn effective position sizing strategies for risk management in trading, including fixed fractional, R-multiple, and volatility-based methods.

Funded Account Checklist: 10 Steps Before Trading

Prepare for success in funded trading accounts with this essential checklist that covers rules, risk management, and platform setup.

Instant Funding vs Traditional Challenges: Which Wins?

Explore the differences between instant funding and traditional evaluation challenges in trading, and find the best fit for your style and goals.

How to Pass Prop Firm Challenges: 5 Key Strategies

Unlock the secrets to passing prop firm challenges with essential strategies for risk management, consistency, and effective trading practices.

Gold Futures Platforms: Brokers vs Prop Firms for GC

Trading Gold Futures (GC/MGC) has never been more accessible. You can open a personal brokerage account with Schwab or Webull, or start for under $100 using a futures prop firm like Topstep, FundedNext, or Take Profit Trader. Learn how platforms such as ProjectX and Tradovate provide built-in risk management tools…

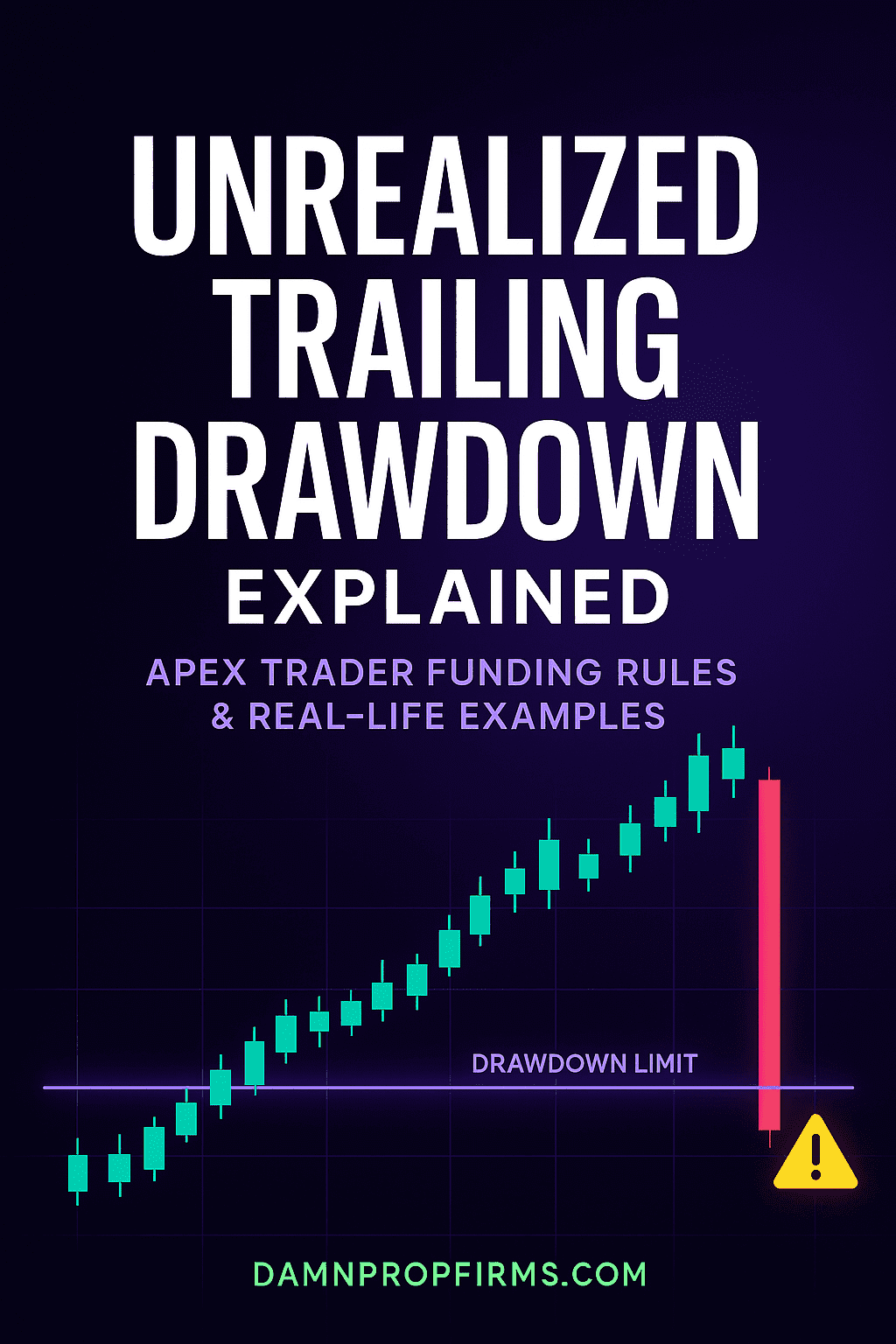

Unrealized Trailing Drawdown Explained – Apex Trader Funding Rules (With Real Life Examples)

The unrealized trailing drawdown at Apex Trader Funding is the single biggest rule that trips up traders. Unlike a static drawdown, it moves up with your account’s highest unrealized gains and never moves back down—meaning intraday peaks can shrink your safety cushion even if you later close lower. In this…