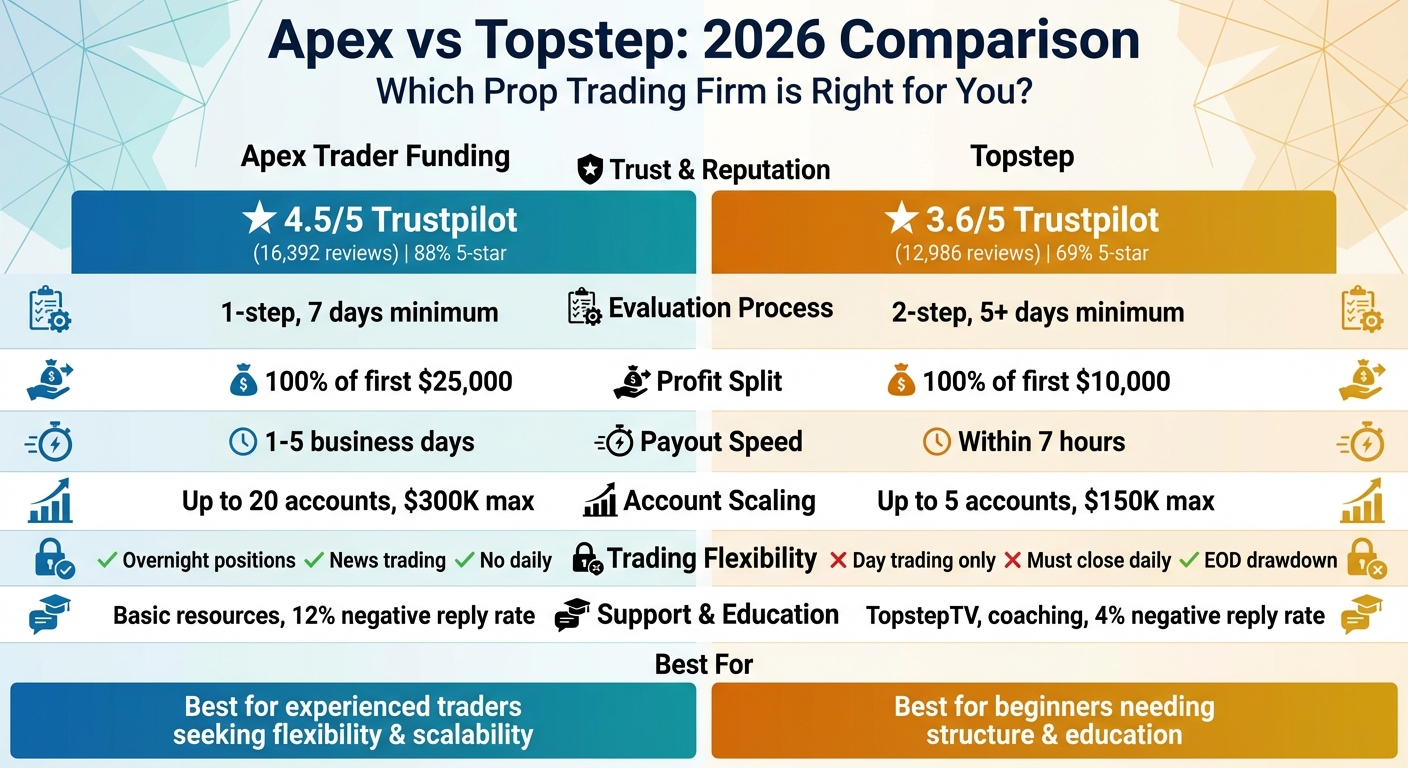

Deciding between Apex Trader Funding and Topstep? Here’s what you need to know:

- Apex Trader Funding: Launched in 2021, Apex has a 4.5/5 Trustpilot rating from 16,392 reviews. It’s popular for its one-step evaluation, fast payouts, and flexibility in trading rules. However, some users complain about intraday trailing drawdown, delayed customer support, and indefinite account reviews for successful traders.

- Topstep: Established in 2010, Topstep has a 3.6/5 Trustpilot rating from 12,986 reviews. It’s known for its educational resources, daily payouts, and end-of-day drawdown rules. However, recent platform outages, strict trading rules, and higher fees have frustrated some traders.

Quick Comparison:

| Feature | Apex Trader Funding | Topstep |

|---|---|---|

| Trustpilot Rating | 4.5/5 (16,392 reviews) | 3.6/5 (12,986 reviews) |

| Evaluation Process | One-step, 7 days or one day to pass during promos | Two-step, 2+ days |

| Profit Split | 100% of first $25,000 | 100% of first $10,000 |

| Payout Speed | 1–5 business days | Within 7 hours |

| Trading Rules | No daily loss limits, flexible | No daily loss limit, must use ProjectX platform |

| Customer Support | Slower responses (1–2 weeks) | Faster and more accessible |

| Platform Issues | Technical glitches reported | Recent outages in Dec 2025 |

If you value flexibility and higher profit splits, Apex may be your choice. If education and structured rules are your focus, Topstep might suit you better. Both have pros and cons, so pick based on your trading style and priorities.

Apex vs Topstep Trading Platform Comparison 2026

Apex Trader Funding User Reviews

Average User Ratings

Apex Trader Funding holds an average rating of 4.5 out of 5 stars on Trustpilot, based on a substantial 16,392 reviews. This rating categorizes the firm as "Excellent." It ranks #113 out of 191 in the Alternative Financial Services category and #25 out of 26 in Coaching Centers. While the high volume of reviews adds weight to these ratings, recent feedback has flagged concerns, particularly regarding account reviews for successful traders. Let’s dive into what users are saying.

Positive User Feedback

Many traders commend Apex for its quick payout process, with approvals completed in under 48 hours and funds deposited within five business days. The profit-sharing model is another highlight – traders keep 100% of the first $25,000 in profits. The firm’s one-step evaluation process is a favorite among users, as it can often be completed in just one day. Frequent discount promotions, which reduce evaluation costs, are another appreciated feature.

Other standout benefits include the lack of a daily loss limit, the ability to trade during news events, and the option to manage up to 20 performance accounts using trade copiers. Many traders also credit the company’s trailing drawdown rule with helping them improve their risk management skills and develop better trading discipline.

Negative User Feedback

Despite its strengths, Apex Trader Funding has faced criticism in several areas. One common complaint involves the intraday trailing drawdown rule, which tracks unrealized profits. Traders note that this can quickly diminish their cushion when a winning trade retraces. Additionally, some users report payouts being denied due to vague "risk management" violations, particularly a retroactively applied 30% rule that limits single-day profits.

Customer support has also come under fire, with users citing response delays of one to two weeks, despite a stated turnaround time of 1–2 business days. Technical issues on the Tradovate platform, such as ghost orders and API glitches, have led to account failures for some traders. Another recurring issue is the indefinite review periods for profitable accounts, which temporarily block new evaluations and payouts without providing clear timelines.

👐 Topstep vs Apex Trader Funding 🎯 Which Prop Firm Is Best for You?

Topstep User Reviews

Continuing from Apex insights, let’s delve into what users have to say about Topstep.

Average User Ratings

As of January 2026, Topstep has a 3.6 out of 5 rating on Trustpilot, based on around 13,000 reviews. This reflects a decline from its earlier standing in mid-2025, when 86% of reviews were 5-star. The drop in ratings seems tied to widespread platform outages during December 2025, which left many traders frustrated. Despite these setbacks, Topstep has paid out more than $400 million to traders since 2022. This mixed reception highlights a variety of user experiences, as reflected in the feedback below.

Positive User Feedback

Topstep’s customer support has earned praise, with specific mentions of team members Ramez and Leela for their quick and effective assistance. Users also value the platform’s educational resources, which include daily live classes, TopstepTV content, and psychological training sessions, all aimed at improving trading discipline. Another frequently mentioned benefit is the transparency in funding, as traders report receiving their funds immediately after meeting their objectives.

Negative User Feedback

On the flip side, platform stability has been a major source of frustration. Many users have criticized the forced migration to the proprietary TopstepX platform, which was largely inaccessible during the outages. Cost concerns are another recurring theme. Traders face monthly fees ranging from $49 to $149, a one-time activation fee of $149, a $39 monthly data fee for level 2 data, and a $50 withdrawal fee for amounts under $500. Additionally, withdrawals require five winning days before they can be processed. The platform’s daily loss limits and the rule mandating that all positions be closed each day have also been described as overly restrictive by some users.

Ratings Comparison Table

Here’s a side-by-side look at user ratings and engagement metrics for Apex Trader Funding and Topstep, as of January 2026:

| Metric | Apex Trader Funding | Topstep |

|---|---|---|

| Trustpilot Rating | 4.5 / 5 | 3.6 / 5 |

| Trustpilot Review Count | 16,392 | 12,986 |

| Trustpilot Category | Excellent | Average |

| 5-Star Percentage | 88% | 69% |

| 1-Star Percentage | 5% | 18% |

| Modest Money Rating | 4.8 / 5 | 1.0 / 5 |

| Negative Review Reply Rate | 12% | 4% |

| Top Positive Mentions | Payouts, Customer Service, Ethics | Payment, Support, Education |

| Top Negative Mentions | Fees, Trailing Drawdown | Outages, KYC Issues, Platform Problems |

Apex Trader Funding outshines Topstep in several key areas, ranking among the best futures prop firms for user satisfaction. With a Trustpilot rating of 4.5 stars compared to Topstep’s 3.6, Apex also boasts an impressive 88% five-star review rate, while Topstep has a notably higher share of one-star reviews at 18%. Trustpilot categorizes Apex as "Excellent", whereas Topstep is marked as "Average."

When it comes to addressing negative feedback, Apex responds to 12% of negative reviews – typically within a month. In comparison, Topstep replies to only 4%, though they usually respond within two weeks. This difference highlights contrasting approaches to user engagement and problem resolution.

For more detailed insights, check out these reviews on DamnPropFirms:

- Apex Trader Funding Review

- Topstep Review

sbb-itb-46ae61d

Strengths and Weaknesses Comparison

Taking a closer look at the strengths and weaknesses of both firms highlights some notable differences.

Apex Trader Funding stands out for its scalability. Traders can manage up to 20 accounts, with account sizes reaching as high as $300,000. The profit split is also appealing – 100% on the first $25,000 and 90% thereafter. Another perk is the flexibility to hold positions overnight, trade during news events, and operate without daily loss limits. However, the intraday trailing drawdown remains a sticking point, often cutting into profits when retracements occur. There’s also a recurring concern among users: some report that consistently profitable accounts are placed under indefinite "review", which has raised eyebrows in the trading community.

Topstep, on the other hand, shines with its robust educational resources, such as TopstepTV, performance coaching, and webinars. Its end-of-day drawdown is often seen as more forgiving compared to Apex’s intraday model. As Jeremy Biberdorf from Modest Money points out:

"Topstep’s structured approach is ideal for those who need to become more disciplined and who are looking to become more consistent with their trading".

Additionally, Topstep allows traders to request daily payouts once they meet the requirement of five winning days, with each day generating at least $200 in profit.

However, Topstep has its downsides. It enforces strict daily loss limits and prohibits overnight holding, which can be frustrating for swing traders. The maximum account size is limited to $150,000, and the 100% profit retention applies only to the first $10,000. Another drawback is that funded traders are classified as professionals, leading to higher exchange data fees – about $133 per month.

| Aspect | Apex Trader Funding | Topstep |

|---|---|---|

| Main Strength | High scalability (up to 20 accounts, $300K max size) and 100% split on first $25K | Comprehensive educational tools (TopstepTV, coaching) and trader-friendly EOD drawdown |

| Main Weakness | Intraday trailing drawdown and reports of prolonged "review" periods for profitable traders | Strict daily loss limits in live funding, ProjectX only platform and smaller max account size ($150K) |

| Flexibility | Allows news trading, holiday trading, and one day to pass | Day trading only with scaling plan in funded, pass in 2 days max. |

| Educational Support | Limited; mostly basic videos | Extensive; includes live broadcasts, coaching, and webinars |

This comparison offers a clear snapshot of user experiences, paving the way for a deeper dive into key areas like payouts, customer support, and trading rules.

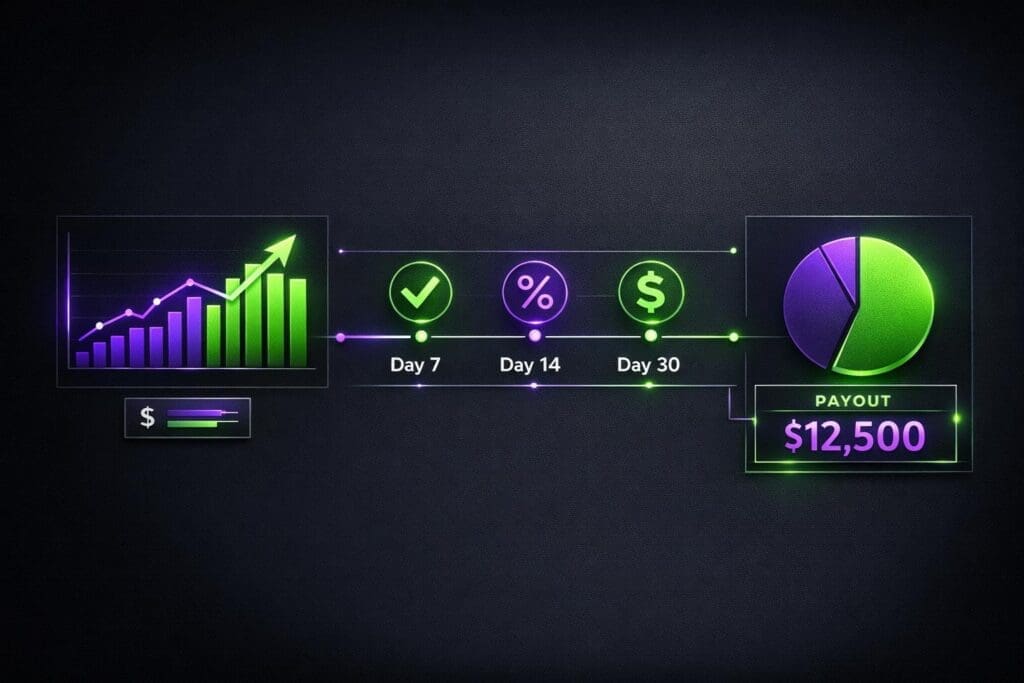

Payouts and Customer Support Reviews

Apex Trader Funding handles payouts twice a month – on the 15th and the last business day. Approvals take between 1 and 48 hours, with bank settlements potentially taking up to 15 days. Since 2022, the company has distributed over $500 million in payouts. For instance, in December 2025, a trader in El Salvador received a $700 payout. On the other hand, Topstep processes payouts much faster, typically completing them within 7 hours, rivaling the best prop firms with instant funding. Funds usually arrive in 1–2 business days, though a $20 processing fee is deducted for ACH or wire transfers. However, some traders have voiced frustration with Topstep’s strict KYC policies. In January 2026, one trader forfeited $9,500 because another individual was present during their verification process.

Customer support also sets these two firms apart. Apex users generally describe their support as responsive, with most issues resolved within 24 hours. Meanwhile, Topstep offers a more comprehensive support system, including chat and email assistance, live coaching sessions, educational content through TopstepTV, and an active Discord community. Specific agents like Kyle, Mukesh, and Nick G have received praise for their clear, step-by-step guidance. However, some challenges have emerged – Topstep’s Trustpilot rating dropped to 3.6 out of 5 as of January 4, 2026, following platform outages on December 16–17, 2025.

Both firms require traders to meet specific conditions before their first payout, which can significantly shape trader experiences. Apex enforces the "30% rule", requiring traders to leave at least 30% of their total profits in their accounts during withdrawals. This is a frequent topic for clarification by their support team.

| Feature | Apex Trader Funding | Topstep |

|---|---|---|

| Payout Frequency | Every 8 trading days, 5 days $50+ and 3 flip days allowed | Daily / 5 trading days +$150 |

| Processing Speed | 1–5 business days for approval; up to 15 days for bank arrival | Processed within 7 hours; 1–2 business days for arrival |

| First Payout Requirement | 8 trading days | 5 profitable days (min. $150/day) |

| 100% Profit Threshold | First $25,000 | First $10,000 |

| Trustpilot Rating | 4.5/5 (16,000+ reviews) | 3.6/5 (13,000 reviews) |

Trading Rules and Evaluation Reviews

Apex Trader Funding and Topstep take noticeably different paths when it comes to trading rules, and reviews from users often highlight strong preferences for one over the other.

One key difference lies in Apex’s 7-day evaluation period and the absence of daily loss limits, which many traders see as an advantage. However, the intraday trailing drawdown during evaluations can be a significant hurdle for some.

Topstep, on the other hand, uses a "one rule" system centered around the Maximum Loss Limit (MLL). This limit is based on the end-of-day balance rather than intraday fluctuations, offering a level of clarity that appeals to many traders. Another notable feature is Topstep’s option to complete evaluations in as little as two trading days.

Consistency requirements also differ between the two firms. Apex applies a 30% Consistency Rule for payouts. For instance, if a trader earns $5,000 in profit, no single day’s gain can exceed $1,500 when requesting a withdrawal. In contrast, Topstep requires at least five winning days with a minimum profit of $200 each before allowing the first payout.

Trading flexibility is another area where these programs diverge. Apex offers 23-hour trading, including during holidays and news events, and allows traders to hold positions overnight. Topstep, however, enforces a strict day-trading policy, requiring all positions to be closed by market close. Additionally, Apex supports up to 20 funded accounts per trader, while Topstep limits traders to five accounts.

Both firms maintain a Trustpilot rating of around 4.5 out of 5, but user complaints reveal different pain points. Apex has faced criticism for placing accounts under indefinite review once they become profitable. Meanwhile, some Topstep users highlight challenges with the strict scaling plans and daily loss limits. Finally, Apex allows traders to keep 100% of their first $25,000 in profits, compared to Topstep’s $10,000 threshold.

Final Verdict from User Reviews

Seasoned traders often highlight Apex’s appeal due to its flexibility and broad options. The platform allows traders to manage up to 20 funded accounts, supports overnight and news trading, and doesn’t enforce daily loss limits. It’s also been praised for its promotional discounts and the enticing 100% profit split on the first $25,000 earned per account.

For beginners, Topstep stands out with its structured and educational focus. Features like TopstepTV’s educational broadcasts, personalized coaching, and the proprietary TopstepX platform provide solid guidance for those just starting out. Additionally, its "one rule" evaluation system – based on end-of-day balances rather than intraday swings – offers clarity that many new traders find reassuring. Topstep boasts a TrustScore of 4.5/5 from over 7,900 reviews, with 86% of users giving it a 5-star rating.

While both firms share similar Trustpilot ratings (approximately 4.5/5), they cater to different trader needs. BestPropFirms rated Topstep higher at 89/100 compared to Apex’s 37/100, citing more favorable trading conditions and stronger support. These differences emphasize the unique strengths each platform brings to the table.

FAQs

How do the evaluation processes differ between Apex Trader Funding and Topstep?

Apex Trader Funding uses a single-step evaluation process where traders aim to reach a profit target while staying within a total-loss limit. One major advantage is the absence of daily drawdown limits, giving traders more flexibility in their strategies, including approaches like dollar-cost averaging. Once traders hit the profit target, funding is provided immediately, with account sizes ranging from $25,000 to $300,000. The fees are relatively low, making it a straightforward choice for many traders.

Topstep takes a different approach with its two-step evaluation process, known as the Trading Combine. This process comes with daily loss limits, position size restrictions, and stricter trading rules. Traders must successfully complete both phases to qualify for funding. The program also includes mandatory coaching tools, which can be appealing for those who prefer a more structured path with clear guidelines.

For an in-depth comparison of these firms, DamnPropFirms offers verified reviews, discount codes, and tools like the Consistency Rule Calculator to help traders make informed decisions.

What are the differences in payout structures between Apex Trader Funding and Topstep?

Apex Trader Funding and Topstep both operate on a profit-sharing model, but the way they handle early profits sets them apart. With Apex, traders get to keep 100% of their first $25,000 in profits before transitioning to either a 90/10 split or, in some cases, a more trader-friendly 75/25 split for ongoing earnings.

Topstep, by comparison, allows traders to retain 100% of their first $10,000 in profits, followed by a standard 90/10 split for everything beyond that. Essentially, Apex gives traders a larger initial profit cushion, and certain plans may even offer a more favorable long-term split compared to Topstep’s fixed structure.

For those who value maximizing early earnings and potentially better splits, Apex’s model might stand out. On the other hand, Topstep provides a steady and straightforward approach that some traders may prefer.

What are the main user complaints about Apex Trader Funding and Topstep?

For Apex Trader Funding, traders often mention frustration with the intraday trailing drawdown. This rule can penalize them for unrealized profits on open trades, making it tricky to manage positions. Another frequent concern is the need to close trades quickly to avoid accidental rule violations, which can add pressure. Some users also point out the high reset frequency for restarting evaluations, describing it as an expensive and repetitive process.

For Topstep, user complaints are less frequently detailed. That said, traders commonly note the difficulty of meeting the platform’s strict evaluation criteria, which can be especially challenging for those just starting out.