No evaluation prop firms let traders skip lengthy testing phases and start trading with funded accounts immediately. These firms appeal to experienced traders by offering quick access to simulated accounts for a one-time fee, usually ranging from $200 to $700 for a $50,000 account. Instead of evaluations, traders follow risk management rules like daily and maximum loss limits. Payouts are based on simulated trading results, with profit splits often starting at 90%.

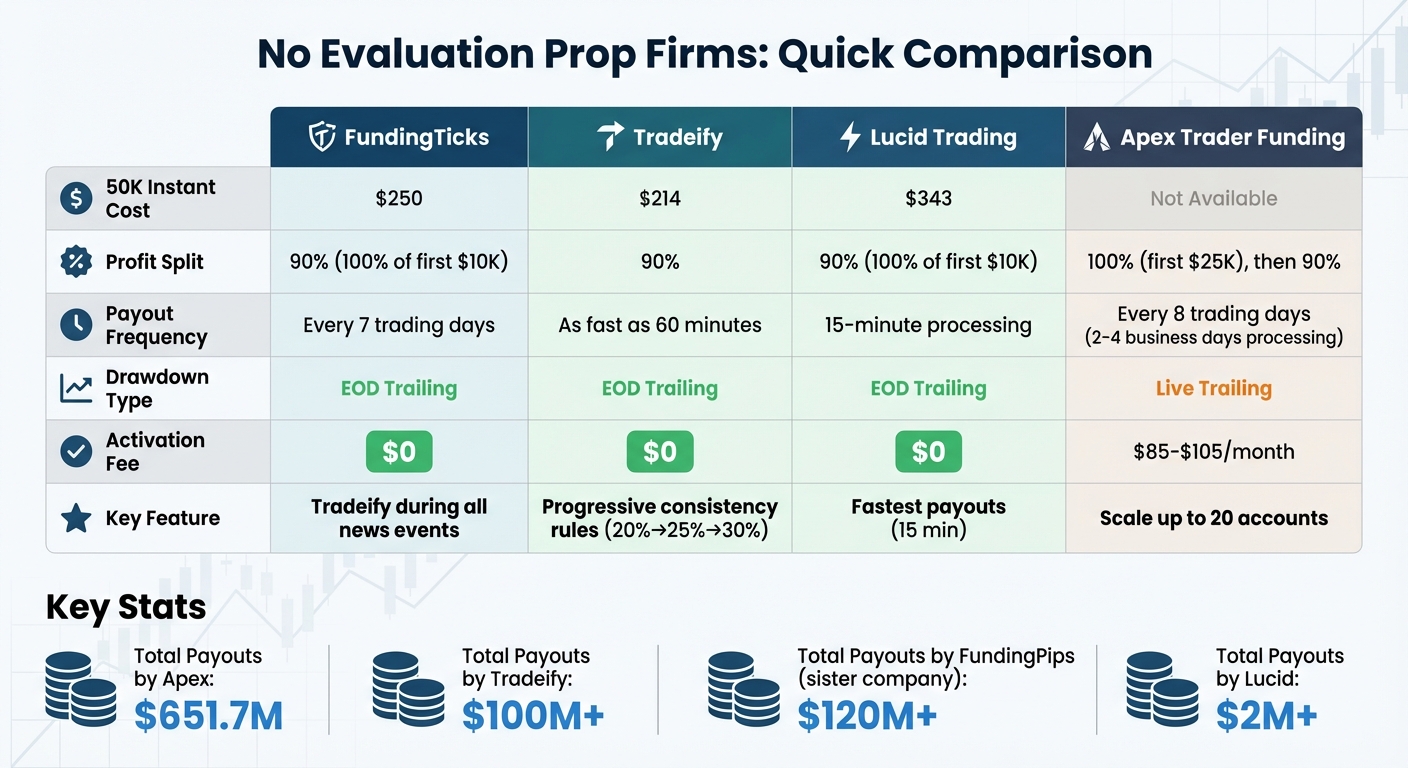

Here’s a quick look at four popular firms offering instant funding:

- Tradeify: 90% profits, progressive consistency rules, and payouts processed in as little as 60 minutes.

- Lucid Trading: 100% of first $10,000 profits, fast 15-minute payout processing, and flexible trading rules.

- Apex Trader Funding: 100% of first $25,000 profits, live trailing drawdown, and scaling up to 20 accounts.

Each firm has unique features like drawdown models, payout speeds, and pricing. Choose based on your trading goals and strategies.

No Evaluation Prop Firms Comparison: Costs, Profit Splits, and Features

Top 5 Futures Prop Firms of 2025 – Instant Funding, No Consistency & Fast Payouts

1. Tradeify

Tradeify’s Lightning Funded program offers traders the chance to access payouts immediately through a simulated funded account. Unlike traditional setups, this program skips the evaluation phase, granting instant trading access. So far, Tradeify has paid out over $100 million to verified traders and boasts a stellar 4.7/5 rating on Trustpilot, based on more than 1,600 reviews.

To get started, traders pay a one-time activation fee, and payouts can be processed in as little as 60 minutes. Even better, you keep 90% of your profits. For example, trader Andy O. shared his experience of receiving $36K in payouts within minutes. The platform also uses an End-of-Day (EOD) trailing drawdown, which adjusts only at the close of the market. This setup provides more flexibility compared to real-time drawdown models, giving traders room to breathe during the trading day.

Account Options and Risk Limits

Tradeify offers account sizes ranging from $25,000 to $150,000, with one-time fees between $244 and $510. Each account comes with specific contract limits and drawdown thresholds. For instance, a $50,000 account allows up to 4 mini contracts (or 40 micros), includes a $2,000 EOD drawdown limit, and requires $3,000 in profit for the first payout. Traders can manage up to 5 active accounts simultaneously, allowing for a combined funding potential of up to $1,000,000.

Progressive Consistency and Growth Path

Tradeify doesn’t just stop at flexible account options – it also provides a structured path for growth. The platform’s progressive consistency rule ensures that no single trading day can account for more than a set percentage of your total profits. This starts at 20% for the first payout, increases to 25% for the second, and caps at 30% from the third payout onward. Once you’ve successfully received five payouts, you qualify for Tradeify Elite. This program offers live capital, higher leverage, uncapped daily payouts, and personalized coaching from professional educators.

Trader Rips shared his enthusiasm for the program, saying:

"Lightning Funded allows me to skip the evaluation process and get to payouts quicker. I love that every single trade I take counts towards the payout!"

2. Lucid Trading

Lucid Trading’s LucidDirect skips the evaluation phase, offering traders real payouts from day one. Since its launch in 2023, the platform has processed over $2 million in payouts and boasts a 4.8/5 Trustpilot rating from more than 689 reviews. With payout processing times of just 15 minutes, Lucid is among the fastest in the industry. Futures trader Phat Trades shared his experience:

"1 Minute Payouts? Wild. Big shoutout to @TradingLucid… Requested: 2:53 PM PST In Bank: 2:54 PM PST".

The profit-sharing structure is straightforward: traders keep 100% of their first $10,000 in payouts. After that, the profit split adjusts to 90/10 in favor of the trader. There are no hidden activation fees or monthly subscriptions – just a one-time upfront cost. Account sizes range from $25,000 to $150,000, with one-time fees between approximately $120 (with discounts) and $699. Each account uses an End-of-Day (EOD) trailing drawdown, meaning the maximum loss limit is based on your highest closing balance rather than intraday fluctuations. This provides traders with more flexibility during active sessions. LucidDirect also implements clear trading rules to maintain risk management.

Trading Rules and Restrictions

LucidDirect has a few important guidelines. Traders must complete 8 trading days before their first payout and between subsequent withdrawals. The platform enforces a 20% consistency rule, which means your largest single-day profit cannot exceed 20% of your total profits when requesting a payout. For example, if your best day earns $1,000, your total profits must reach at least $5,000. All positions must be manually closed by 4:45 PM EST to avoid slippage.

If you hit the daily loss limit, trading is paused until the next session. Exceeding the maximum loss limit results in account termination. For instance, a $50,000 account comes with a $1,200 daily loss limit, a $2,000 maximum loss limit, and allows up to 4 mini contracts (or 40 micros). Scalping and automated systems are permitted, but swing trading is not allowed. Additionally, traders can manage up to 5 funded accounts across Lucid’s programs.

sbb-itb-46ae61d

3. Apex Trader Funding

Since 2022, Apex Trader Funding has distributed an impressive $651,782,981, with promotions like the "1-Day Pass" speeding up the process for traders. Typically, traders go through an evaluation phase, but the "1-Day Pass" allows them to secure a funded Performance Account in just one trading day.

Once funded, traders enjoy a generous profit-sharing structure. They keep 100% of their first $25,000 in profits per account. After that, profits are split 90/10, and following the sixth payout, the split reverts to 100%, with no cap on earnings. Account fees depend on the account size and trading platform. Apex also allows traders to manage up to 20 funded accounts at the same time.

Risk management is a key focus at Apex. The firm employs a live trailing threshold, which stops trailing once the account balance hits the initial funding amount plus the drawdown and an additional $100. For example, a $50,000 account starts with a $47,500 threshold, which locks in once the balance reaches $50,100. Additionally, the 30% Consistency Rule ensures no single trading day contributes more than 30% of the total profit when a withdrawal is requested.

A standout moment for Apex came in April 2025, when a trader received a record-breaking payout of $2,552,800.50 via bank wire. Chris T., a trader, shared his experience:

"Apex is the fastest prop firm payout I’ve seen."

Payouts are processed within 2–4 business days and can be requested every 8 trading days. Apex supports traders in over 150 countries and boasts an industry rating of 4.6/5. Traders are also allowed to trade during news events and holidays, provided they stick to their usual strategies.

Pros and Cons

This section breaks down the key differences between several trading firms, helping traders make informed decisions based on their strategies and priorities.

Each firm brings its own advantages and challenges to the table. For example, firms like FundingTicks, Tradeify, and Lucid Trading offer instant funding, skipping the evaluation phase entirely. However, this convenience comes at a higher cost. On the other hand, Apex Trader Funding provides evaluation accounts with lower upfront fees, but it doesn’t include an instant funding option.

The firms also differ in how they handle drawdowns and consistency rules. Apex Trader Funding uses a Live Trailing Threshold that adjusts in real-time with unrealized profits and enforces a 30% consistency rule. Meanwhile, Lucid Trading and Tradeify implement End-of-Day (EOD) Trailing drawdowns, which update only at the end of each trading session. Notably, Lucid Trading’s "LucidFlex" option removes daily loss limits and consistency rules altogether.

Payout structures also vary significantly. Apex Trader Funding offers traders 100% of the first $25,000 in profits per account, transitioning to a 90/10 split after that, and then returning to 100% after the sixth payout. In contrast, Lucid Trading maintains a consistent 90% profit split across all accounts, while Tradeify typically offers splits ranging from 80% to 90%. Monthly fees also differ: Apex Trader Funding charges $85–$105 for funded accounts, while Lucid Trading, Tradeify, and FundingTicks advertise $0 activation fees.

Here’s a quick comparison of the main features across these firms:

| Feature | Apex Trader Funding | Lucid Trading | Tradeify | FundingTicks |

|---|---|---|---|---|

| 50K Eval Cost | $33–$196 | $78–$85 | $83 | $69 |

| 50K Instant Cost | Not Available | $343 | $214 | $250 |

| Drawdown Type | Live Trailing | EOD Trailing | EOD Trailing | EOD Trailing |

| Payout Split | 100% (first $25k), then 90% | 90% | 80%–90% | Standard Futures |

| Activation Fee | $85–$105/month | $0 | $0 | $0 |

| Consistency Rule | 30% | 20%–40% (varies) | Standard | Standard |

The table highlights the differences in fees, drawdown types, payout structures, and consistency rules, making it easier to weigh the options based on individual trading needs.

Conclusion

Selecting the right firm depends on how well it aligns with your trading style and priorities. For traders who value speed and transparency, Lucid Trading stands out. With quick payout processing and no activation fees, it’s a great choice for those looking to start earning right away. Their LucidFlex option adds even more appeal by removing consistency rules and daily loss limits, offering a more flexible setup for experienced traders.

If instant funding is your priority, Tradeify offers Lightning instant funding for $214 on a $50,000 account, along with profit splits of 90–100% and daily withdrawal options. On the other hand, FundingTicks stands out for its competitive pricing on the Zero Program. These firms highlight key differences in cost, payout speed, and profit-sharing structures.

For traders managing multiple accounts, Apex Trader Funding allows scaling up to 20 accounts and has a strong payout history. However, its Live Trailing Drawdown model can be tricky, especially during volatile markets. Each firm caters to different trading strategies, so your choice should reflect your specific goals.

Firms with End-of-Day (EOD) drawdown models, like Lucid Trading and Tradeify, provide more flexibility compared to real-time trailing models. Aggressive scalpers or news traders may find the EOD model better suited to their needs, while traders focused on long-term growth might benefit from the structured progression of evaluation-based setups.

Take the time to review each firm’s rules and fee structures carefully. Instant funding options come with higher costs but allow you to start live trading immediately, while evaluation programs are more affordable but require you to demonstrate your trading skills first. Align your choice with your budget, risk tolerance, and preferred trading style by considering factors like drawdown types, consistency rules, and payout speeds to find the best fit for your needs.

FAQs

What are the benefits of using no-evaluation prop firms for experienced traders?

No-evaluation prop firms offer a streamlined path for experienced traders to dive straight into trading with real capital. Instead of enduring a lengthy evaluation process, traders can access instant-funded accounts, bypassing the need to prove their strategies through demo challenges. This approach saves both time and energy, allowing traders to focus on what they do best – trading.

These firms typically feature generous profit-sharing models, such as letting traders keep 100% of their initial profits up to a certain threshold, followed by a high percentage split. They also provide greater flexibility with trading rules, offer high payout rates, and support rapid scaling. This setup allows skilled traders to concentrate on execution and managing risk, rather than being tied down by rigid targets.

What are the profit splits and payout structures for the featured instant-funding firms?

Each instant-funding firm structures its profit splits and payouts differently to meet the needs of traders.

LucidDirect stands out by offering traders 100% of the first $10,000 in profits. After that, earnings are split 90/10, with traders keeping 90%. Their LucidFlex account also follows the 90/10 split but adds a perk: payouts processed in as little as 15 minutes after approval.

FundedNext takes a competitive approach, offering traders up to 95% profit retention, depending on the plan selected. This makes it an attractive choice for those prioritizing higher earnings. On the other hand, while Apex Trader Funding is mentioned, specific details about its profit splits and payout timelines are not readily available for direct comparison.

What risk management rules do instant-funding prop firms require traders to follow?

Instant-funding prop firms, even those skipping an evaluation phase, implement strict risk management rules to safeguard their capital. A major rule is the drawdown limit, which is usually calculated at the close of each trading day. If a trader exceeds this limit, their account is immediately stopped. For instance, while some firms may remove daily loss caps for funded accounts, they still closely track total losses to keep risk under control.

These firms also use profit targets and payout thresholds as additional layers of risk management. These measures ensure traders prove consistent profitability before they can make withdrawals. Other safeguards, like profit-split arrangements and consistency requirements during early stages, promote disciplined trading habits. Adhering to these rules helps traders keep their accounts active and focus on long-term growth.