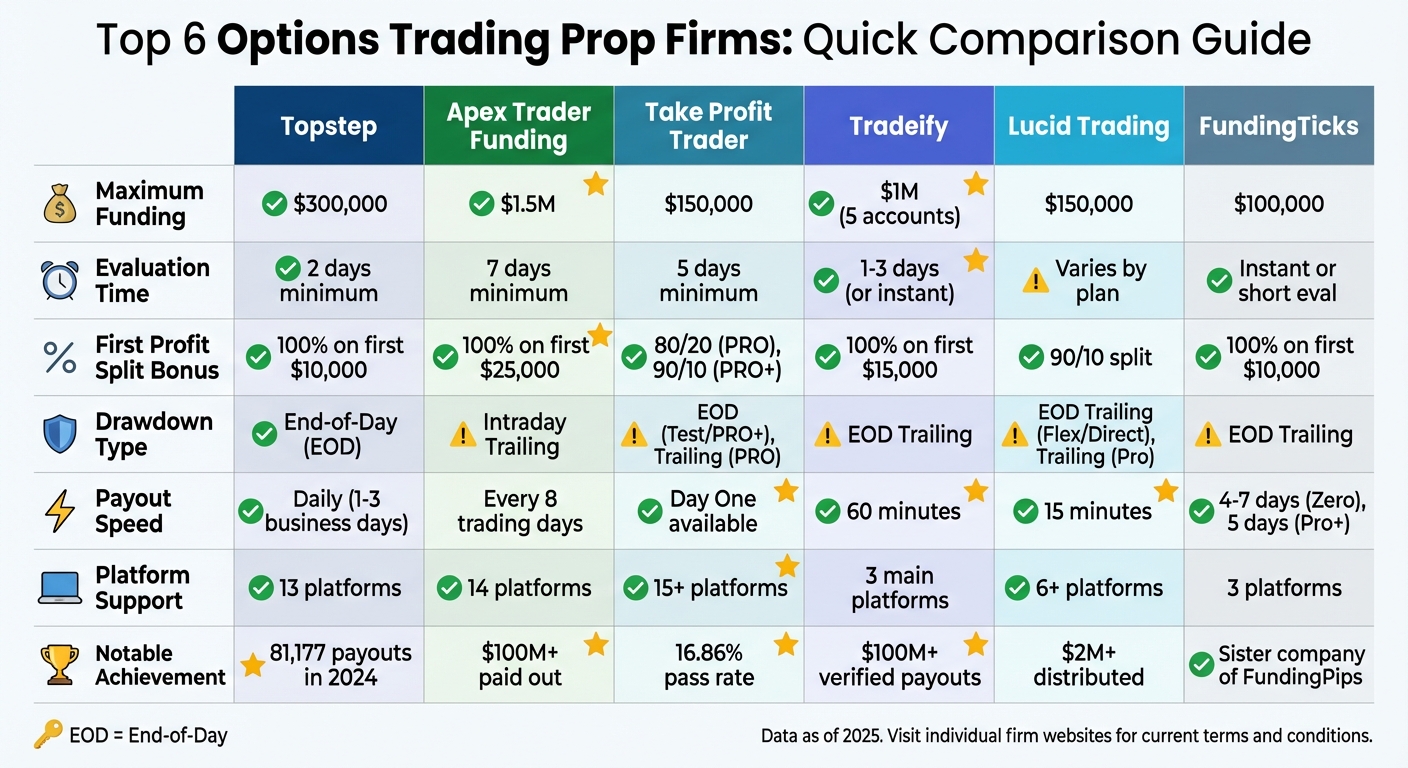

Options trading prop firms offer traders access to capital after completing an evaluation process. These firms assume financial risks, enforce strict rules, and share profits with traders. Popular firms like Topstep, Apex Trader Funding, and Tradeify provide diverse funding models, profit-sharing structures, and risk guidelines to suit different trading styles. Here’s a quick breakdown:

- Topstep: Focuses on futures trading with end-of-day drawdown policies. Traders can earn funding in as little as two days and keep 100% of the first $10,000 profits (90/10 split thereafter).

- Apex Trader Funding: Offers up to $1.5M in funding with a 100% profit split on the first $25,000. Traders must follow a trailing drawdown and complete at least eight trading days for payouts.

- Tradeify: Features instant funding options and a 100% profit split on the first $15,000. Evaluation paths are quick, with some requiring just one day.

Each firm has unique rules, payout processes, and platform support. Choose based on your trading strategy and experience level.

Options Trading Prop Firms Comparison: Funding, Profit Splits, and Key Features

The BEST Prop Firms In 2025 (Tier List)

1. Apex Trader Funding

Apex Trader Funding is a futures proprietary trading firm that provides options traders with access to the markets. Since 2022, the firm has paid out over $100 million to its traders. In April 2025, one trader achieved a record-breaking single-day payout of $2,552,800.50 – the highest in the firm’s history at that time. Below, we’ll break down the details of Apex’s funding models, profit-sharing structure, risk rules, payout processes, and platform support.

Funding Models

Apex’s funding process is centered around its evaluation and account structures. Traders undergo a straightforward, one-step evaluation where they must hit a profit target within a minimum of seven trading days – without exceeding the maximum drawdown. The firm offers two account types: Full accounts, which use a dynamic trailing threshold, and Static accounts, which have fixed maximum loss limits. Evaluation accounts range in size, starting at $25,000 (with a $1,500 profit target) and going up to $300,000 (with a $20,000 profit target).

Profit Splits

Apex offers traders an appealing profit-sharing setup. For the first $25,000 in profits per account, traders keep 100%. After reaching that milestone, the profit split adjusts to 90/10 in favor of the trader. Additionally, traders can manage up to 20 funded accounts at the same time, which opens up opportunities for strategy diversification and greater combined buying power. Withdrawals require a minimum of $500, and traders need to complete at least eight active trading days between withdrawal requests.

Risk Management Rules

Apex enforces strict rules to encourage disciplined trading. Key policies include:

- 30% Negative P&L Rule: Unrealized losses cannot exceed 30% of the profit balance at the start of the day.

- 5:1 Risk-Reward Ratio Rule: Stop-loss orders must not exceed five times the profit target.

- 30% Consistency Rule: Limits any single trading day’s contribution to 30% of the total profit balance at payout time. As Apex explains:

"The 30% Consistency Rule ensures that no single trading day accounts for more than 30% of the total profit balance… This rule promotes consistent trading practices and discourages high-risk, erratic trading styles."

Unlike many competitors, Apex does not enforce fixed daily drawdown limits. Instead, Full accounts use a trailing threshold that adjusts with your peak unrealized balance. Once the "Safety Net" – calculated as the initial balance plus the drawdown limit and $100 – is reached, the threshold becomes fixed. For the first three payouts, traders must maintain this safety net balance.

Payout Processes

To qualify for the first payout, traders must meet specific criteria: a minimum of 8 trading days, with at least 5 of those days showing profits of $50 or more. In December 2024, trader Patrick Wieland received a notable payout of $608,000, with verified bank documentation of the transaction.

Platform Support

Apex offers compatibility with several trading platforms, including NinjaTrader 8 (which comes with free licenses), Tradovate (integrated with TradingView), Rithmic RTrader Pro, and WealthCharts. The firm provides access to major markets such as CME, CBOT, NYMEX, and COMEX, which are commonly used for trading futures options. Monthly evaluation fees are budget-friendly, starting at under $150, with reset fees ranging between $80 and $100 if the maximum drawdown is breached.

2. Topstep

With more than 12 years of experience in futures funding, Topstep has made a significant mark by funding over 10,000 accounts and facilitating 81,177 payouts, amounting to over $10 million in 2024. Impressively, traders can secure funding in as little as two days.

Funding Models

Topstep takes a unique approach to funding through its Trading Combine, which uses a single-step evaluation process. This method focuses on end-of-day metrics rather than intraday highs. To qualify, traders must meet a profit target while staying within the Maximum Loss Limit (MLL), calculated based on their end-of-day balance.

"Topstep’s MLL is based on your end of day balance, unlike other prop firms, who calculate it on unrealized profits intraday (high water mark). We have the best drawdown in the business."

Topstep offers three account sizes:

- $50,000 Account: $2,000 MLL and a $3,000 profit target

- $100,000 Account: $3,000 MLL and a $6,000 profit target

- $150,000 Account: $4,500 MLL and a $9,000 profit target

Monthly fees depend on the account size and the evaluation path selected. The "Standard" path requires a one-time $129 activation fee after passing the Trading Combine, while the "No Activation Fee" path has higher monthly costs but eliminates the activation fee. After passing the Trading Combine, traders move to an Express Funded Account (a simulated account eligible for payouts) and can eventually progress to a Live Funded Account. To ensure consistency, traders must also meet a specific target: their best trading day cannot account for more than 50% of their total profits.

Profit Splits

Topstep’s profit-sharing terms vary based on when traders joined. Those who signed up before January 12, 2026, keep 100% of the first $10,000 in profits before switching to a 90/10 split. Traders who joined after this date start with the 90/10 split immediately. Additionally, traders are allowed to manage up to five Express Funded Accounts at the same time.

Risk Management Rules

Topstep’s approach to risk management stands out. The MLL is based on the end-of-day balance, offering flexibility during volatile market conditions. For traders using platforms other than TopstepX, a Daily Loss Limit applies, calculated from both realized and unrealized P&L. However, TopstepX accounts do not have this restriction as of August 2024. After the first payout, the MLL resets to $0, safeguarding the account’s initial level.

Payout Processes

To request a payout, traders must have five winning days with a net P&L of $150 or more, and the minimum payout amount is $125. For Express Funded Accounts, payouts are capped at $5,000 or 50% of the balance. In Live Funded Accounts, traders can withdraw up to 50% after five winning days. Once they achieve 30 non-consecutive winning days, daily payouts of up to 100% of the balance become available. Payouts can be received via Wise, ACH (1–3 business days), or Wire/SWIFT (3–10 business days). There is a $20 fee for ACH and Wire transactions, and the five-day winning cycle resets after each payout request.

Platform Support

Topstep is transitioning to its proprietary TopstepX platform, which includes features like trade copying platforms, TradingView charts, and the Tilt Indicator. It also supports other platforms like NinjaTrader, Tradovate, and 11–12 additional systems. Available markets include the E-mini S&P 500, NASDAQ 100, Crude Oil, Gold, and Micro Bitcoin.

3. Take Profit Trader

Take Profit Trader focuses exclusively on futures trading, leaving out options, stocks, forex, and cryptocurrencies.

Funding Models

Take Profit Trader uses a three-stage process: Test, PRO, and PRO+ accounts. You can complete the single-step evaluation in as little as five days by achieving a 6% profit target while following strict risk guidelines. Once you pass this stage, you move to a PRO Account, a simulated trading environment where profit withdrawals are available from day one. The final stage is the PRO+ Account, where trades are executed directly on the exchange via Tradovate, a regulated broker.

Evaluation fees are charged monthly, ranging from $150 for a $25,000 account to $360 for a $150,000 account, with an additional one-time setup fee of $130 after passing the evaluation.

Once traders progress through the stages, they can take advantage of competitive profit-sharing arrangements.

Profit Splits

PRO accounts offer an 80/20 profit split, while PRO+ accounts increase the split to 90/10. Between January 1, 2024, and December 31, 2024, only 16.86% of all Trading Tests were successfully passed, highlighting the challenging but achievable nature of this funding model.

Risk Management Rules

After profits are distributed, strict risk management rules are in place to ensure trading discipline. Drawdown policies vary depending on the account stage. Test and PRO+ accounts use an end-of-day (EOD) drawdown, while PRO accounts apply an intraday trailing drawdown. Additionally, traders must establish a Buffer Zone equal to the maximum drawdown (for example, a $50,000 account must grow to $52,000) before they can withdraw full profits.

Other rules include a daily limit of 50 executions (equivalent to approximately 25 trades), a consistency rule that caps the best day’s profit at 50% of total gains during the evaluation, and restrictions on news trading and holding positions overnight.

Payout Processes

Take Profit Trader allows Day One payouts, meaning you can withdraw profits as soon as the Buffer Zone is established – no minimum trading days required. If you choose to close your account, you’ll receive 50% of the buffer if the account was active for 60 days or less, or 80% if it was held for a longer period.

Platform Support

The firm supports over 15 platforms, including NinjaTrader, Tradovate, and TradingView, using CQG or Rithmic data feeds. It also holds a Trustpilot rating of 4.4 out of 5 stars based on 7,846 reviews.

This well-organized evaluation and payout system emphasizes efficiency and disciplined risk management, making it a standout choice in the prop trading world.

4. Tradeify

Tradeify continues to stand out among top proprietary trading firms, thanks to its unique funding paths and risk management features. With a community of over 60,000 traders and verified payouts exceeding $100 million, Tradeify has made a name for itself in the trading world. While its primary focus remains on futures trading, the firm offers three distinct funding options tailored to different trading styles: Growth (1-day evaluation), Select (3-day evaluation), and Lightning Funded (instant funding).

Funding Models

Tradeify’s funding plans cater to varying needs:

- Growth Plan: A quick 1-day evaluation process.

- Select Plan: A slightly longer 3-day evaluation process.

- Lightning Funded: Skips the evaluation stage entirely. For a one-time fee of about $509, traders gain access to a $50,000 account, or for $729, they can manage a $150,000 account.

Select accounts are priced at $111 per month when using promotional codes, and both Growth and Select plans come with the added benefit of no activation fees.

One standout feature is the End-of-Day (EOD) trailing drawdown, which tracks the account balance at market close. This provides traders with extra flexibility during volatile market conditions. After achieving five successful payouts in the simulated funded stage, traders can graduate to "Tradeify Elite", where trades are executed with live capital. These flexible funding options are paired with a profit-sharing model that’s hard to ignore.

Profit Splits

Tradeify offers one of the most appealing profit-sharing structures:

- Traders keep 90% of their profits across most simulated funded plans.

- On the first $15,000 earned, traders enjoy a 100% profit split.

- Impressively, 75% of traders opt to purchase additional accounts after their initial experience.

Risk Management Rules

Tradeify enforces clear risk management rules to protect traders:

- Daily Loss Limits: For example, a $50,000 Growth account has a daily loss cap of $1,250.

- Consistency Rules: The Growth plan requires traders to follow a 35% consistency rule, while the Select plan does not.

- Contract Limits: A $50,000 account typically allows 4–5 mini contracts. Additionally, all positions must close by 4:59 p.m. ET, with no overnight or weekend holdings permitted.

These well-defined risk parameters, combined with a straightforward payout process, make Tradeify an attractive choice for traders.

Payout Processes

Tradeify boasts a 60-minute payout turnaround. The firm offers two payout options:

- Select Flex: Allows withdrawals every five winning days with no minimum balance required for the first withdrawal.

- Select Daily: Enables daily withdrawals but requires maintaining a buffer balance (e.g., $2,100 for a $50,000 account).

With over 1,600 reviews and a stellar 4.7 out of 5-star rating on Trustpilot, Tradeify has earned the trust of its traders.

"Lightning Funded allows me to skip the evaluation process and get to payouts quicker. I love that every single trade I take counts towards the payout!" – Rips, Professional Trader and Mentor

Platform Support

Tradeify supports popular platforms like Tradovate, NinjaTrader, and TradingView, all of which include real-time data in their plans. Traders can manage up to five active simulated funded accounts simultaneously, giving them access to as much as $1 million in trading capital. However, the firm restricts access from certain countries, including Russia, Ukraine, Vietnam, and Pakistan.

For a deeper dive into Tradeify’s funding options and performance, check out our full review here.

sbb-itb-46ae61d

5. Lucid Trading

Since its launch in 2023, Lucid Trading has made waves in the trading community, distributing over $2 million to traders and earning a stellar 4.8 out of 5-star rating on Trustpilot from more than 689 reviews. What sets Lucid apart is its trio of funding options – LucidPro, LucidDirect, and LucidFlex – designed to suit different trading styles and goals.

Funding Models

Lucid Trading provides three distinct funding paths to cater to traders’ varying needs:

- LucidPro: This is a one-phase evaluation model with a 40% consistency rule for accounts purchased or reset after November 28, 2025. To move to a funded account, traders must hit profit targets and work within a buffer system.

- LucidDirect: Perfect for those who want to skip evaluations, this instant funding option allows traders to start immediately. However, it enforces a stricter 20% consistency rule and requires a minimum of 8 trading days before the first payout.

- LucidFlex: Offering the most relaxed structure, this one-phase evaluation model has no daily loss limits and eliminates payout buffers once funded. Traders can take up to 6 payouts before transitioning to a "LucidLive" account, capped at $5,000 for the move-to-live balance.

Account sizes range from $25,000 to $150,000, though LucidDirect is unavailable for $100,000 accounts. Evaluation fees start as low as $120 for a $25,000 account, with LucidPro evaluations often waiving activation fees.

Profit Splits

Lucid offers an impressive 90/10 profit split across all funding models, allowing traders to keep 90% of their earnings. For LucidLive accounts with instant funding, traders can retain 100% of their profits until their first payout. Compared to the industry-standard 80/20 split, this means an additional 12.5% in take-home pay. Plus, traders save over $1,000 annually by avoiding monthly performance fees, which Lucid has completely eliminated.

"Lucid’s 15-minute payouts are game-changing. No monthly fees and EOD trailing drawdown make this a solid choice for scalpers." – Jeremih J., Professional Trader & Prop Firm Analyst

Risk Management Rules

Lucid’s approach to risk management is tailored across its models. LucidFlex and LucidDirect accounts use an End-of-Day (EOD) trailing drawdown, which updates only at the end of the trading day, giving traders more flexibility to recover from intraday losses. Meanwhile, LucidPro employs a traditional trailing drawdown that tracks the highest account balance.

Daily loss limits vary: LucidFlex and LucidPro evaluations have none, while LucidLive imposes strict limits. Consistency rules also differ – LucidFlex requires 50% consistency during evaluations but drops this rule once funded. LucidPro enforces a 40% consistency rule, and LucidDirect requires 20%. Additionally, LucidLive accounts have a total funding cap of $150,000.

Payout Processes

Lucid sets itself apart with fast payouts, processing them in about 15 minutes for certain account types. The minimum payout is $500 across all accounts. LucidPro accounts require at least 5 trading days before the first payout, while LucidDirect requires 8. Once approved, payouts are typically completed within 2 business days.

For LucidFlex accounts, there are payout caps based on account size: $1,000 for $25,000 accounts, $2,000 for $50,000 accounts, $2,500 for $100,000 accounts, and $3,000 for $150,000 accounts. After 6 successful payouts, traders graduate to LucidLive, where trades are executed using real capital.

Platform Support

Lucid supports a wide range of trading platforms, including NinjaTrader, Tradovate, TradingView, Quantower, Sierra Chart, and its proprietary LucidX platform. The firm offers both CQG (for TradingView and Tradovate) and Rithmic (for Sierra Chart and Quantower) data feeds, ensuring robust compatibility. Traders can also manage multiple accounts simultaneously, with a total live funding cap of $150,000.

For more details on Lucid Trading’s funding options and features, check out the full review here.

6. FundingTicks

FundingTicks stands out as a dynamic option in the world of options trading prop firms, offering funding solutions tailored for swift market entry. Established in March 2025, it operates as the sister company of FundingPips – a well-known forex prop firm that has distributed over $120 million to traders. Although its primary focus is on futures trading, the firm’s compatibility with platforms like TradingView and Tradovate makes it an attractive choice for options traders seeking flexible funding opportunities. Here’s a breakdown of what FundingTicks brings to the table, including its funding models, profit-sharing structure, risk management rules, and platform support.

Funding Models

FundingTicks provides traders with three distinct funding options: Zero (instant funding), Pro+ (no activation fee), and the One Plan.

- Zero Plan: Offers immediate funding without requiring an evaluation process.

- Pro+ and One Plan: Require a short evaluation phase but waive activation fees.

Account sizes range from $25,000 to $100,000, catering to traders with varying levels of experience and capital needs.

Profit Splits

Traders with FundingTicks enjoy a 90/10 profit split, but there’s an added perk: the first $10,000 in profits is entirely theirs before the split applies. Payout schedules differ by plan – Zero accounts allow withdrawals every 4 to 7 days, while Pro+ accounts follow a fixed 5-day payout cycle.

Risk Management Rules

FundingTicks employs an End-of-Day (EOD) trailing drawdown, which updates only at market close. This approach offers traders more flexibility during periods of market volatility.

- Zero Plan: Includes a 25% consistency rule, meaning no single trading day can contribute more than 25% of total profits.

- Pro+ Plan: Applies a 40% consistency rule.

Contract limits depend on account size. For instance, a $25,000 account allows 1 mini or 10 micros, while a $100,000 account permits up to 5 minis or 50 micros. Additionally, news trading is unrestricted for Zero accounts, but Pro+ Master accounts impose restrictions during major events like NFP, FOMC, and CPI announcements.

Platform Support

Traders can take advantage of FundingTicks’ support for popular platforms like TradingView, NinjaTrader, and Tradovate. This compatibility ensures that users can seamlessly integrate their preferred charting and execution tools. For a deeper dive into FundingTicks’ features and funding options, check out the full review here.

Advantages and Disadvantages

Each prop trading firm has its own strengths and limitations, which can influence how well it aligns with your trading style. Here’s a comparison of key features across Topstep, Apex Trader Funding, and FundingTicks to help you decide.

Topstep shines with its end-of-day drawdown policy. Instead of tracking intraday unrealized profits, it calculates the Maximum Loss Limit based on your end-of-day balance, which can provide more leeway during volatile trading sessions. The firm processes payouts daily and has a proven track record, funding over 10,000 traders and issuing 81,177 payouts in 2024 alone. However, there are some limitations: trading is restricted to day sessions, with positions required to close by 3:10 PM CT, and the maximum funding is capped at $300,000.

Apex Trader Funding stands out for its higher scaling potential, offering funding up to $1.5 million and supporting 14 trading platforms. Traders can keep 100% of their first $25,000 in profits before the 90/10 profit split kicks in. However, the firm uses an intraday trailing drawdown, which tracks unrealized profits during trading sessions – a feature that can be challenging for some traders. Additionally, Apex enforces a 30% profit retention rule on withdrawals. As Sarah Edwards from Benzinga explains:

"The 30% Rule in Apex Trader Funding applies to withdrawals from funded accounts. It means you must leave at least 30% of total profits in your account when withdrawing".

FundingTicks offers a more flexible trading experience, with a maximum funding amount of $100,000. Like Topstep, it uses an end-of-day drawdown mechanism, which can appeal to traders who prefer less pressure during intraday sessions. The firm’s payout schedule varies depending on the plan you choose, and it supports three trading platforms: TradingView, NinjaTrader, and Tradovate.

| Feature | Topstep | Apex Trader Funding | FundingTicks |

|---|---|---|---|

| Max Funding | $300,000 | $1.5 million | $100,000 |

| Drawdown Type | End-of-Day | Intraday Trailing | End-of-Day |

| Payout Frequency | Daily | Every 8 trading days | 4–7 days (Zero), 5 days (Pro+) |

| Trading Styles | Day trading only | Day, Swing, Scalping | Flexible |

| Platform Count | 13 | 14 | 3 (TradingView, NinjaTrader, Tradovate) |

This table provides a quick snapshot of each firm’s key features. For day traders who value flexibility during volatile markets, firms with end-of-day drawdown calculations may be a better fit. Meanwhile, swing traders or those looking for higher funding potential might lean toward firms that allow overnight positions or offer greater scalability. Use these insights to align your choice with your trading strategy.

Conclusion

When choosing a prop firm, it’s essential to find one that aligns with your trading style and level of experience. Topstep is a standout option for beginners, thanks to its structured educational resources and supportive trader community. Its end-of-day Maximum Loss Limit offers more flexibility during volatile sessions compared to intraday trailing drawdowns.

For scalpers and day traders, Topstep provides added perks like commission-free trading on TopstepX and the absence of Daily Loss Limits, making it particularly appealing. However, it’s worth noting that Topstep enforces a strict day-trading policy, requiring all positions to close by 3:10 PM CT. If holding overnight positions is a key part of your strategy, this firm might not be the right fit.

Experienced traders looking for higher funding options should prioritize firms offering capital above $300,000 and multiple account support. The end-of-day drawdown structure offered by some firms can also provide greater flexibility, helping traders navigate normal market fluctuations without being stopped out unnecessarily.

FAQs

What are the main differences between the funding models of Topstep, Apex Trader Funding, and Tradeify?

Topstep employs a three-step evaluation process known as the Trading Combine. To succeed, traders must hit a profit target, demonstrate consistent performance, and adhere to strict loss limits – both daily and overall. Once funded, traders retain 90% of their profits, while Topstep assumes the financial risk.

Apex Trader Funding takes a simpler funding route, offering traders immediate access to capital ranging from $25,000 to $300,000. With fewer restrictions on risk and faster payouts, it’s a popular option for those who value flexibility in their trading.

As for Tradeify, specific details about its funding structure are not currently available, making a direct comparison difficult.

How do profit-sharing models work for options trading prop firms?

Profit-sharing models aim to reward traders generously while accounting for the firm’s funding and operational risks. For instance, some firms let traders keep 90% of the net profits, retaining just 10% as a fee for providing the funding and managing risk. In other cases, firms might offer a 100% payout on initial profits – say, the first $25,000 – before transitioning to a 90%-10% split, favoring the trader.

This setup allows traders to reap substantial rewards for their success while the firm takes care of the financial risks involved.

What risk management rules should I consider when choosing a prop firm for options trading?

When choosing a prop firm for options trading, it’s crucial to familiarize yourself with their risk management rules. These rules are in place to safeguard both your funds and the firm’s capital. A common safeguard is the Maximum Loss Limit (MLL), which sets a hard cap on your total allowable losses. Another key measure is the Daily Loss Limit, which halts trading for the day if your losses exceed a predetermined amount. These measures are designed to help you maintain discipline and avoid significant setbacks.

Prop firms often have additional requirements, such as meeting a Profit Target, achieving a Consistency Target, and adhering to position size limits (like a maximum number of contracts per trade). Breaking these rules can result in account suspension or even losing access to funding. Moreover, staying within these boundaries is often tied to eligibility for payouts and opportunities to scale your account. Understanding and respecting these guidelines is essential for building a sustainable trading career.