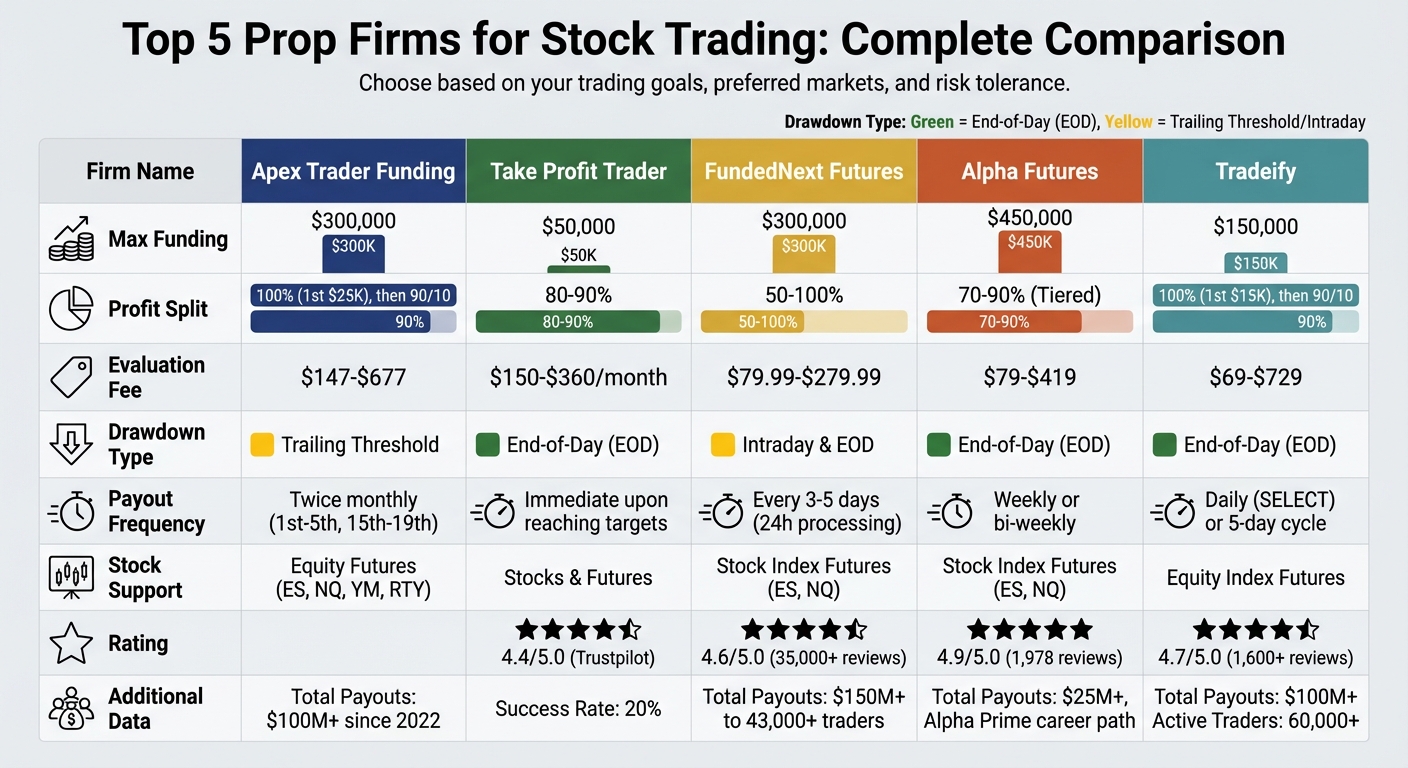

Proprietary trading firms, or prop firms, let traders use the firm’s capital for trading in exchange for a share of the profits. Traders undergo an evaluation phase to qualify for funded accounts (using proven strategies to pass challenges), with profit-sharing typically ranging from 80% to 90%. Firms like Apex Trader Funding, Take Profit Trader, FundedNext Futures, Alpha Futures, and Tradeify offer different funding options, payout structures, and risk management rules tailored to various trading styles. The only official Damn Prop Firms trusted prop firm for stock trading specifically is Vanquish Trader.

Key Highlights:

- Apex Trader Funding: Offers up to $300,000 in funding, with 100% profit on the first $25,000 and a 90/10 split thereafter. Evaluation fees start at $147.

- Take Profit Trader: Specializes in futures and stock accounts with immediate withdrawals upon reaching targets. Profit splits go up to 90%.

- FundedNext Futures: Provides funding up to $300,000 with flexible evaluation paths and payouts processed within 24 hours.

- Alpha Futures: Focuses on futures with account sizes up to $450,000. Includes mentorship and career growth opportunities.

- Tradeify: Supports equity index futures, offering 100% profit on the first $15,000 and a 90/10 split beyond that.

Each firm has unique rules for drawdowns, evaluation phases, and payout processing. Choose based on your trading goals, preferred markets, and risk tolerance.

Quick Comparison:

| Firm | Max Funding | Profit Split | Drawdown Type | Stock Trading Support |

|---|---|---|---|---|

| Apex Trader Funding | $300,000 | 100% (first $25K), 90% | Trailing Threshold | Equity Futures (ES, NQ, etc.) |

| Take Profit Trader | $50,000 | 80%-90% | End-of-Day (EOD) | Stocks & Futures |

| FundedNext Futures | $300,000 | 50%-100% | Intraday & EOD | Stock Index Futures |

| Alpha Futures | $450,000 | 70%-90% | End-of-Day (EOD) | Stock Index Futures |

| Tradeify | $150,000 | 100% (first $15K), 90% | End-of-Day (EOD) | Equity Index Futures |

Pick a firm that aligns with your trading style, whether you prioritize high funding, fast payouts, or flexible rules.

Prop Firms for Stock Trading: Features and Funding Comparison

Best Prop Firms For Beginner Day Traders (2026)

1. Apex Trader Funding

Apex Trader Funding is a futures prop firm that provides traders with access to Equity Futures markets, including popular options like ES, NQ, YM, and RTY.

Funding Options

Apex offers account sizes ranging from $25,000 to $300,000, with a straightforward one-step evaluation process. Traders can qualify for funding in as little as 7 business days and manage up to 20 funded accounts at once. The firm supports two account types: Rithmic, known for its high-speed execution, and Tradovate, which integrates with TradingView and offers mobile trading capabilities.

Evaluation fees depend on the account size, starting at $147 for a $25,000 Rithmic account and going up to $677 for a $300,000 Tradovate account. Once funded, activation fees are $85 for Rithmic accounts and $105 for Tradovate accounts, with optional lifetime fee packages ranging from $130 to $360.

These funding options provide a solid foundation for Apex’s profit-sharing model.

Payout Structures

Apex’s payout structure is designed to benefit traders significantly. Traders keep 100% of the first $25,000 in profits per account. After that, profits are split 90/10, with 90% going to the trader. Since 2022, Apex has distributed over $100 million to traders, averaging around $7 million per month since January 2023. Notably, in April 2025, one trader received a record-breaking payout of $2,552,800.50.

Payouts are processed twice a month, during the 1st–5th and 15th–19th. To qualify for withdrawals, traders need to complete 8 to 10 trading days, with at least $50 in profit on 5 of those days. Initial payout limits are linked to account size, but these restrictions are lifted starting with the sixth payout.

Risk Management

Apex incorporates robust risk management strategies to support its funding and payout systems. One key feature is the Trailing Threshold, which adjusts in real time based on unrealized profits. This approach can be more challenging than traditional end-of-day drawdown rules. The firm also enforces a 30% consistency rule, which caps any single day’s profit at 30% of the total prior to payout. Additionally, traders must adhere to a 5:1 risk-reward ratio, ensuring that stop losses remain within five times the profit target.

Unlike many other firms, Apex does not enforce daily loss limits, giving traders greater flexibility. However, during the first three payouts, traders must maintain a "safety net" balance equal to the account’s maximum drawdown plus $100.

2. Take Profit Trader

Take Profit Trader (TPT) caters primarily to futures traders but also offers a dedicated $50,000 stock trading account for those focused on equities. With a straightforward one-step evaluation process to qualify for funded accounts, TPT has earned a Trustpilot rating of 4.4 out of 5.0 and boasts a 20% success rate among its traders.

Funding Options

The stock trading account is offered exclusively at a $50,000 tier, requiring a $4,000 profit target to qualify. Evaluation fees range from $150 to $360 per month, and there’s a one-time $130 activation fee upon passing the evaluation. The evaluation operates on a monthly subscription model, and traders can reset their PRO account up to three times at a cost of approximately $1,500.

While TPT eliminated daily loss limits for its futures accounts in January 2025, the stock trading account retains a $300 daily loss cap. These terms are designed to encourage disciplined trading while rewarding traders who achieve profits efficiently.

Payout Structures

Once funded, traders benefit from competitive profit splits: 80% for standard PRO accounts, with an option to upgrade to a PRO+ account for a 90% split. One standout feature of TPT is the ability to withdraw profits immediately upon reaching PRO status – no waiting period required.

"Instead here at TPT, when you make it on day one you can take it on day one. There’s no withdrawal restrictions on your profits above the buffer." – Take Profit Trader

To initiate withdrawals, traders must first build a buffer equal to the account’s maximum drawdown. For the $50,000 account, this means reaching $51,250 before standard payouts begin. Withdrawals below the buffer result in account termination and are subject to a reduced profit split: 50% if the account has been active for 60 days or less, or 80% if it has been active for more than 60 days. Payouts are processed through Deel, offering options like ACH, bank transfers, PayPal, Coinbase, and more.

Risk Management

During the evaluation phase, TPT employs an end-of-day (EOD) trailing drawdown, which is generally more lenient than intraday methods. However, once traders transition to a PRO account, the system shifts to an intraday drawdown model, which is stricter. The $50,000 stock account enforces specific limits, including a 500-share position cap, a $300 daily loss limit, and a $1,250 trailing drawdown. Additionally, all positions must be closed by 5:00 PM EST daily.

To promote disciplined trading, TPT imposes additional rules. PRO accounts must remain flat (no open positions or orders) one minute before and after major news events like FOMC, Non-Farm Payroll, and CPI announcements. Traders are also required to execute at least one trade per weekday to avoid account termination due to inactivity. During the evaluation phase, profits on any single day are capped at 50% of the total target, but this restriction is lifted once the account is fully funded. These measures are designed to encourage consistency and responsible trading practices.

3. FundedNext Futures

Continuing our exploration of top-rated proprietary trading firms, FundedNext Futures stands out with its flexible evaluation options and strict risk management protocols. This firm supports stock traders by offering regulated stock index futures contracts, including the popular E-mini S&P 500 (ES) and E-mini Nasdaq 100 (NQ). With a stellar 4.6 out of 5 rating on Trustpilot, based on more than 35,000 reviews, FundedNext Futures has already paid out over $150 million to more than 43,000 traders. Traders can access simulated capital ranging from $25,000 to $100,000 per account, using popular trading platforms like Tradovate, NinjaTrader, and TradingView.

Funding Options

FundedNext Futures provides two evaluation paths tailored to different trader needs.

- Legacy Challenge:

- Fees: $79.99 for a $25K account, $149.99 for $50K, and $249.99 for $100K.

- Profit Targets: $1,250, $2,500, and $6,000, respectively.

- Rapid Challenge:

- Fees: $109.99 for a $25K account, $199.99 for $50K, and $279.99 for $100K.

- Profit Targets: $1,500, $3,000, and $5,000.

FundedNext waives activation fees once traders complete evaluations and offers discounted reset rates starting at $69.99.

Risk Management

To promote disciplined trading, FundedNext enforces structured risk management rules.

- Legacy Challenge Accounts: Traders face an intraday loss cap and an end-of-day (EOD) trailing loss limit of $1,000–$3,000, depending on account size.

- Rapid Challenge Accounts: No daily loss limit applies, but EOD trailing loss limits are slightly stricter at $1,000, $2,000, and $2,500.

A 40% consistency rule ensures no single day’s profit exceeds 40% of the overall target. This rule applies during the evaluation phase for Legacy accounts and extends into the funded stage for Rapid accounts.

Accounts also have inactivity limits: challenge accounts expire after 7 days of no trading, while funded accounts allow up to 30 days. To maintain fair trading practices, FundedNext prohibits high-frequency trading (HFT), latency arbitrage, and grid trading. However, news trading is fully allowed, enabling traders to leverage economic announcements without restrictions on open positions.

Payout Structures

FundedNext offers a straightforward payout system that aligns with its risk controls.

- Legacy Challenge: Withdrawals are available every 5 days after meeting a 5-day "Benchmark Day" requirement. This involves achieving a minimum profit of $100–$200, depending on account size. The profit split starts at 50% and can increase to 100% after 30 benchmark days.

- Rapid Challenge: Withdrawals can be made every 3 days without any benchmark requirements. The profit split is fixed at 80% until withdrawal caps are lifted after the fifth payout.

FundedNext processes payouts within 24 hours and offers a $1,000 bonus if they miss this timeframe. On average, payouts are completed in about 5 hours.

For a deeper dive into FundedNext Futures and its features, check out our review page.

sbb-itb-46ae61d

4. Alpha Futures

Alpha Futures is another standout choice for traders focused on futures, offering access to major stock indices like the E-mini S&P 500 and Nasdaq 100. With a stellar 4.9 out of 5 rating on Trustpilot from 1,978 reviews, the firm has distributed over $25 million in performance fees. Traders can access simulated capital of up to $450,000 through a straightforward one-step evaluation process, utilizing platforms like NinjaTrader, Tradovate, Quantower, or AlphaTicks. This makes Alpha Futures a strong option for high-volume traders. Similarly, TradeDay Prop Firm offers a competitive environment for those seeking multiple funded accounts. Let’s explore their account options and fee structure in more detail.

Funding Options

Alpha Futures provides three account types tailored to different trading preferences. Here’s a breakdown:

- Standard Accounts: Start at $79 for a $50,000 allocation, $159 for $100,000, and $239 for $150,000.

- Zero Accounts: Skip the activation fee and cost $99 for $50,000 or $199 for $100,000.

- Advanced Accounts: Priced at $139 for $50,000, $279 for $100,000, and $419 for $150,000.

Both Standard and Advanced accounts require a $149 activation fee, while Zero accounts waive this charge. Traders can reset their evaluations for a fee ranging from $59 to $79. Those who excel may even be invited to Alpha Prime, a professional trading floor in London, offering a 60% profit split, a monthly salary, weekly mentorship, and static drawdown accounts.

Payout Structures

Alpha Futures offers appealing payout systems that vary by account type:

- Standard Accounts: Earnings are distributed every 14 days with a tiered profit split – 70% for the first two payouts, 80% for the next two, and 90% after that.

- Advanced and Zero Accounts: These accounts offer weekly payouts, provided traders achieve five profitable days with at least $200 in profit each. They also feature a flat 90% profit split from the start.

Withdrawal caps differ by account type. Standard and Advanced accounts allow maximum withdrawals of $15,000 per request, while Zero accounts start with lower caps – $1,500 for $50,000 or $3,000 for $100,000 allocations – until traders complete 30 qualifying days. Payout requests are processed quickly, often within 48 business hours, with many traders reporting same-day payments.

Risk Management

Alpha Futures employs an End-of-Day (EOD) trailing drawdown system, which calculates the Maximum Loss Limit (MLL) based on the end-of-day balance rather than intraday unrealized profits. This method helps traders manage risk more effectively. Key risk rules include:

- Loss Limits: Standard and Zero accounts have a 4% EOD loss limit and a 40% daily profit cap. Advanced accounts, however, are exempt from the daily loss guard and the 40% rule as of November 2025.

- Prohibited Activities: Tick scalping (trades under 10 ticks and 2 minutes), automated trading with bots or AI, and high-risk "all-or-nothing" strategies are not allowed.

- News Trading: Restricted for Standard and Zero accounts but permitted for Advanced accounts.

This disciplined approach ensures that traders operate within clear boundaries, promoting longevity and success in their trading journey.

5. Tradeify

Tradeify supports a community of over 60,000 active traders and has distributed more than $100 million in payouts. While its primary focus is on futures trading, it provides access to major equity index futures through CME and CBOT, including the S&P 500 and Nasdaq-100. This gives traders a way to benefit from stock market trends without directly trading stocks. With a 4.7 out of 5 rating on Trustpilot, based on over 1,600 reviews, Tradeify has earned praise for its fast payout processes. Its approach is tailored to traders seeking stock market exposure through the lens of futures trading.

Funding Options

Tradeify offers several funding plans to suit different trader needs:

- SELECT Plan: Priced at around $111 per month (discounted from $159) for a $50,000 account, this plan includes a 3-day evaluation period.

- Straight to Sim Funded (Lightning): One-time fees range from $349 to $729, depending on account size ($25K to $150K).

- Advanced Accounts: Monthly fees range from $69 to $129, featuring intraday drawdowns.

- Growth Accounts: Monthly fees range from $139 to $339, with end-of-day drawdowns.

Advanced accounts carry a $125 activation fee, while SELECT and Growth accounts do not.

These flexible funding plans are designed to streamline the path toward earning payouts.

Payout Structures

Tradeify’s payout system is designed to reward traders generously. Traders keep 100% of their first $15,000 in profits, with profits beyond that split 90% to the trader and 10% to Tradeify. The SELECT plan offers daily payouts, often processed in under 60 minutes, while Growth and Lightning accounts follow a 5-day payout cycle. Verified users have shared positive experiences, with one reporting bank deposits in less than an hour. Withdrawal limits start at $1,500 for a $50,000 account and increase to $3,000 after the fourth payout.

Risk Management

Tradeify employs strict risk controls to ensure sustainable trading. Advanced accounts use an Intraday Trailing Drawdown, while Growth and SELECT accounts implement an End-of-Day (EOD) Trailing Drawdown, which updates at market close (5:00 PM EST). A Daily Loss Limit halts trading if reached but does not fail the account unless the maximum trailing drawdown is exceeded. Additionally, a consistency rule – 35% for Advanced/Growth accounts and 20% for Lightning accounts – encourages steady performance. As Brett Simba, Tradeify’s Founder and CEO, explains:

"The Consistency Rule is a requirement that traders must maintain steady performance rather than relying on one or two big trades to pass an evaluation or earn payouts".

These risk measures, paired with advanced trading features, help traders maintain disciplined capital management.

Index Futures Trading Features

Although Tradeify doesn’t support direct stock trading, it provides access to equity index futures through platforms like NinjaTrader, Tradovate, and TradingView. For instance, a $50,000 SELECT account allows up to 4 mini or 40 micro contracts, with all positions required to close by 4:59 PM EST to avoid overnight exposure. The platform also includes a free automated trading journal that tracks profits, losses, trade tags, and personalized reports. Traders who demonstrate consistent performance over 4–5 payouts may qualify for Tradeify Elite, which offers live capital, uncapped daily payouts, and one-on-one coaching.

Advantages and Disadvantages

Examining the key metrics of these firms highlights the trade-offs they make to balance risk and reward for traders.

Apex Trader Funding stands out with its profit split – traders keep 100% of the first $25,000 and 90% thereafter. However, its fees range from $147 to $657, and the drawdown tightens significantly as funding increases, dropping from 6% on $25,000 to just 2.5% on $300,000.

Take Profit Trader earns high ratings but offers a lower maximum trading capital, which may limit scalability for some traders.

FundedNext Futures provides funding up to $300,000 paired with competitive evaluation fees, making it an attractive option for those aiming to scale their trading.

Alpha Futures is known for discounted challenges and holds an impressive 4.8/5 rating, appealing to traders looking for cost-effective options.

Tradeify, which focuses on equity index futures, also maintains a strong 4.8/5 rating, making it a solid choice for traders specializing in this niche.

A key factor to consider is how firms handle drawdowns. Some use intraday trailing drawdowns, which can penalize unrealized gains, while others implement end-of-day drawdowns, adjusting only after the market closes. These differences, along with fee structures and profit splits, play a significant role in determining which firm aligns best with a trader’s strategy.

The table below provides a clear comparison of each firm’s key metrics:

| Firm | Max Funding | Profit Split | Drawdown Type | Stock Trading Support |

|---|---|---|---|---|

| Apex Trader Funding | $300,000 | 90% (100% for first $25K) | Trailing Threshold | Equity Futures (ES, NQ) |

| Take Profit Trader | Not disclosed | Not disclosed | Varies | Equity Futures |

| FundedNext Futures | $300,000 | 80% | Varies | Futures |

| Alpha Futures | Not disclosed | Not disclosed | Varies | Equity Futures |

| Tradeify | Not disclosed | Not disclosed | End-of-day | Equity Index Futures |

For traders interested in direct stock trading, it’s important to note that most of these firms focus on equity futures rather than individual stocks. This approach provides access to major stock indices but may not suit those looking to trade individual equities directly.

Conclusion

Choosing the right prop firm comes down to finding one that fits your trading style, risk tolerance, and long-term objectives. To make an informed decision, consider key factors like capital options, payout structures, drawdown rules, and risk management policies.

For traders looking for low-entry promotions and scalable funding, Apex Trader Funding is a solid choice. With funding up to $300,000 and a 100% profit split on the first $25,000, it’s an attractive option for maximizing early earnings. However, its trailing drawdown may pose challenges for traders holding positions during volatile market swings.

If fast scaling and quick payouts are your priorities, FundedNext Futures stands out. It offers funding up to $300,000 with competitive evaluation fees and 24-hour payout processing, making it ideal for traders who value rapid access to their profits.

For those who emphasize payout speed and flexibility, Take Profit Trader delivers immediate payouts and features end-of-day drawdown rules. With a 4.4/5 rating, it’s a go-to option for traders seeking simplicity and quick returns.

Looking for something beyond profit splits? Alpha Futures offers a more traditional career path. Their model includes invitations to Alpha Prime, where traders receive a 60% profit split, a monthly salary, weekly mentorship, and static drawdown accounts. This setup mirrors institutional trading desks and appeals to those seeking mentorship and long-term career growth.

When deciding, align your choice with your trading strategy. For example:

- Scalpers may benefit from end-of-day drawdown models like those offered by Take Profit Trader and Tradeify.

- Aggressive traders looking for low entry costs should consider Apex Trader Funding.

- Traders seeking stability and mentorship might find Alpha Futures to be the perfect fit.

Ultimately, the right prop firm should complement your approach, whether you’re focused on fast payouts, career development, or scaling opportunities.

FAQs

What should I look for when choosing a prop firm for stock trading?

When choosing a prop firm for stock trading, it’s essential to look closely at their funding structure. Some firms require traders to go through a multi-step evaluation process, while others provide instant funding or a simpler, single-step evaluation. Make sure to review details like entry fees, minimum account sizes, and whether the firm offers scaling plans to increase your capital as you demonstrate consistent performance.

Another crucial aspect is the profit split and payout terms. Many firms offer profit splits in the range of 80/20 to 90/10, and some even let traders keep a portion of their initial profits before applying the split. Check how frequently payouts are processed and if there are any restrictions, such as withdrawal caps, that might impact your earnings.

Finally, take a good look at the firm’s risk management rules and trading tools. This includes drawdown limits, maximum position sizes, and the variety of instruments you’re allowed to trade – whether it’s stocks, ETFs, or options. Ensure their trading platforms meet your needs, and explore any extra benefits like mentorship programs or community support that can help you grow as a trader.

How do profit splits and payout structures work at top proprietary trading firms?

Profit-sharing and payout systems differ widely across leading proprietary trading firms. Many firms offer attractive splits, such as 80/20 or 90/10, meaning traders get to keep the majority of their earnings. Some firms even sweeten the deal by letting traders keep their first $10,000 in profits entirely before applying the profit-sharing split to any additional earnings.

These structures are designed to encourage steady performance while giving traders the chance to expand their accounts. Be sure to carefully examine the terms, as they may include specific conditions like withdrawal limits, minimum profit requirements, or other stipulations.

What risk management strategies do prop firms use to protect their capital?

Prop firms implement a range of risk management strategies to protect their capital while giving traders the tools to succeed. These strategies often include strict rules like a daily loss cap, which stops trading if a trader’s losses exceed a set amount in one day, and an overall maximum drawdown that limits total losses over the evaluation or funded period. Many firms also enforce a maximum loss per trade, typically capping it at 1%–2% of the account balance, and require the use of stop-loss orders to keep individual trades in check.

To encourage disciplined and consistent performance, firms track metrics such as a minimum number of profitable days or a required profit-to-loss ratio. Additional measures, like position size limits, real-time monitoring tools, and automated alerts, help ensure traders stick to these guidelines. Together, these rules create a structured framework that aligns traders’ approaches with professional risk management practices.