Finding U.S.-friendly proprietary trading firms for futures can be challenging due to strict regulations by the CFTC and NFA. Many firms avoid U.S. clients to sidestep compliance issues, but some still cater to American traders. Here’s a quick rundown of five firms that accept U.S. clients:

- Apex Trader Funding: Based in Texas, offers funding up to $6 million across 20 accounts. First $25K profit is 100% yours, then a 90/10 split. Payouts processed twice monthly.

- Topstep: Chicago-based, with 12+ years of experience. Offers $50K–$150K accounts, 90/10 profit split, and end-of-day drawdown rules.

- Take Profit Trader: Florida-based, allows withdrawals starting Day 1. Offers 80%-90% profit split and a streamlined evaluation process.

- FundedNext Futures: Provides forex and futures funding, with up to 80% profit splits and payouts starting Day 4.

- Lucid Trading: Launched in 2025, supports instant funding with a 90/10% profit split.

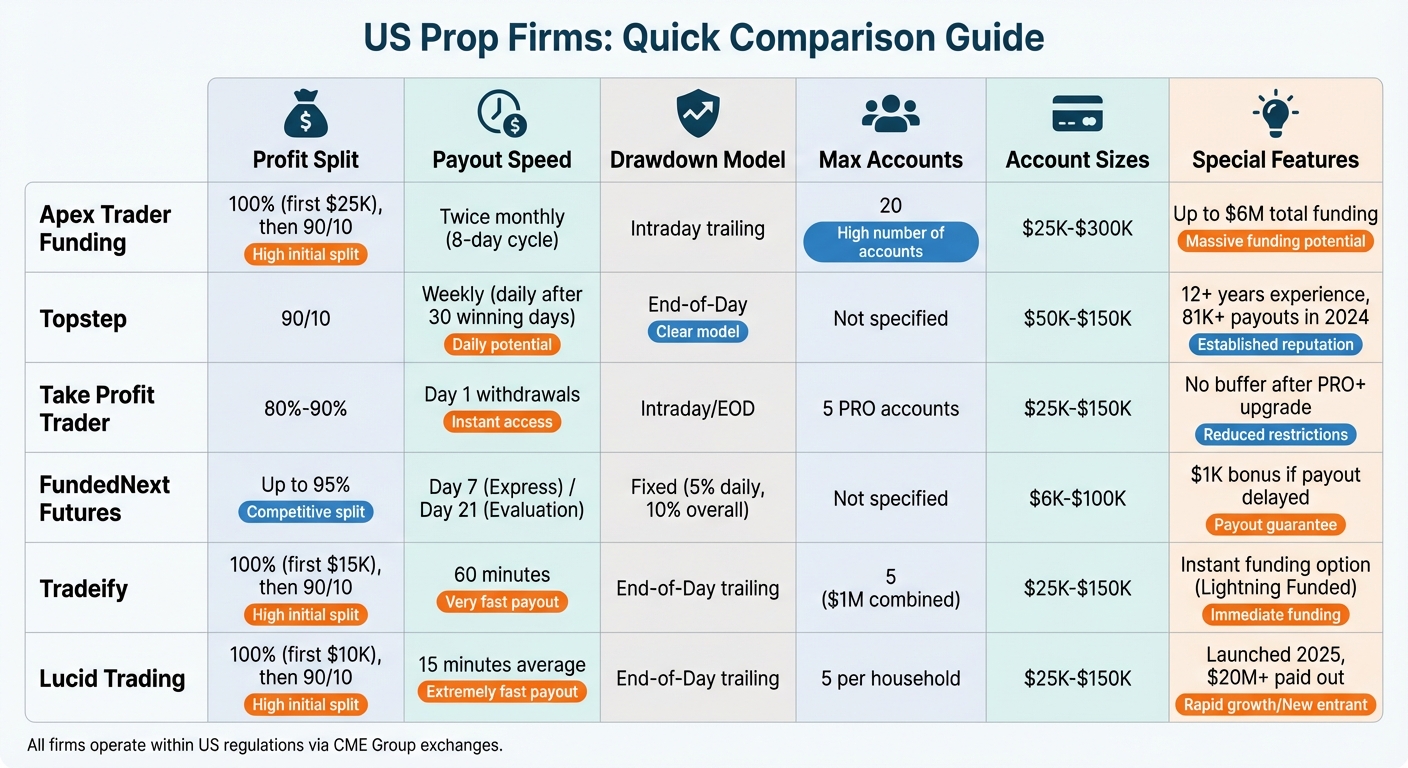

Quick Comparison

| Firm | Profit Split | Payout Speed | Drawdown Model | Max Accounts |

|---|---|---|---|---|

| Apex Trader Funding | 100% (first $25K), 90/10 after | Twice monthly | Intraday trailing | 20 |

| Topstep | 90/10 | Weekly | End-of-Day | Not specified |

| Take Profit Trader | 80%-90% | Day 1 withdrawals | Intraday/EOD | Not specified |

| FundedNext Futures | Up to 80% | Weekly | Fixed drawdown | Not specified |

| Lucid Trading | 90/10 | 15 minutes | End-of-Day trailing | 5 per household |

These firms operate within U.S. regulations, focusing on futures contracts through CME Group exchanges. Choose a firm based on your trading style, funding needs, and payout preferences.

US Prop Trading Firms Comparison: Profit Splits, Payouts & Account Limits

Lucid Trading Payout In Under 30 Seconds from Request to Bank.

Ultimate Futures Prop Firm Tier List 2025 (From A 7 Figure Trader)

sbb-itb-46ae61d

1. Apex Trader Funding

Apex Trader Funding, based in Austin, Texas, is a prominent U.S. futures proprietary trading firm. Since its inception in 2021, the firm has made waves by paying traders over $651.7 million, with average monthly payouts of $13.1 million as of January 2024. Its stellar reputation is reflected in a 4.9/5.0 Trustpilot rating, backed by more than 2,100 reviews. The firm’s funding model is structured to accommodate a variety of trading strategies.

Funding Options

Apex offers six account sizes tailored for futures trading: $25,000, $50,000, $100,000, $150,000, $250,000, and $300,000. The smaller accounts – $25k, $50k, and $100k – cost $196 per month, while the larger accounts – $150k, $250k, and $300k – are priced at $296 per month. Traders can manage up to 20 accounts simultaneously, enabling a combined allocation of up to $6 million.

The evaluation process is straightforward, requiring traders to meet profit targets without exceeding an intraday trailing drawdown limit. For example, a $100k account comes with a $6,000 profit target and a $3,000 trailing drawdown.

Profit Sharing

Apex offers an attractive profit-sharing arrangement. Traders retain 100% of the first $25,000 in profits per account. Beyond that, earnings are split 90/10 in favor of the trader. Notably, in April 2025, a single trader achieved a record-breaking payout of $2,552,800.50 in one day, while another trader, Patrick Wieland, withdrew $608,000 in December 2024.

To ensure consistent trading performance, Apex enforces a 30% consistency rule, which means no single day can account for more than 30% of the total profit balance when requesting a payout. Additionally, there are initial payout caps for the first five withdrawals based on account size. For instance, a $25k account has a maximum payout of $1,500, while a $300k account allows up to $3,500. These limits are lifted after the first five withdrawals.

Payout Timeline

Payouts are processed twice a month during specific windows: 1st–5th and 15th–19th. Apex advertises an 8-day payout cycle, though actual processing times depend on the banking method. ACH transfers, for example, typically take 2–4 business days once approved. Many traders report receiving payouts within a week.

Before making their first withdrawal, traders must complete 8 to 10 calendar days of active trading. Monthly platform fees range from $85 for Rithmic to $105 for Tradovate, while evaluation resets cost between $80 and $100, depending on the platform.

Regulatory Oversight

Operating out of Texas, Apex focuses on futures contracts traded on regulated exchanges like the CME Group, which is overseen by the CFTC and NFA. U.S.-based traders are classified as independent contractors and receive a Form 1099 for tax purposes. The platform is compatible with popular trading tools such as Rithmic, Tradovate, NinjaTrader, and WealthCharts.

2. Topstep

Based in Chicago, Topstep brings over 12 years of experience to the table, catering specifically to U.S. traders through its three funding tiers: $50,000, $100,000, and $150,000 accounts. The company’s evaluation process and funding structure are tailored to align with U.S. regulatory standards. Traders progress through a three-step process: the Trading Combine, the Express Funded Account (a simulated account), and finally, the Live Funded Account.

Funding Allocation

Topstep’s funding model is built to balance risk management with rewarding consistent trading performance. Traders can choose between two pricing options:

- Standard Path: Monthly fees of $49, $99, and $149 for $50K, $100K, and $150K accounts, respectively, plus a $129 activation fee.

- No Activation Fee Path: Higher monthly rates of $89, $139, and $189 for the same account levels.

One standout feature is how Topstep calculates its Maximum Loss Limit (MLL). Unlike many other firms that base this on intraday unrealized profits, Topstep uses the end-of-day balance.

"Topstep’s MLL is based on your end of day balance, unlike other prop firms, who calculate it on unrealized profits intraday (high water mark). We have the best drawdown in the business and give you more room to trade".

For instance, a $100K account comes with a $6,000 profit target and a $3,000 Maximum Loss Limit, offering traders a clear framework for managing risk.

Profit Split

Topstep provides a competitive profit-sharing structure. Traders who join on or after January 12, 2026, receive a 90/10 profit split immediately. Those who joined earlier keep 100% of their first $10,000 in profits before moving to the 90/10 split.

To encourage consistent trading, Topstep enforces a 50% consistency rule: no single trading day can contribute more than half of the total profits during the evaluation or withdrawal period. In Express Funded Accounts, payouts are capped at $5,000 or 50% of the account balance, whichever is lower. These terms are designed to help U.S. traders operate within a strict regulatory framework.

Payout Speed

Topstep processes payout requests within 1–3 business days, with funds typically delivered in 10 business days. Traders can choose from ACH, Wise, or Wire/SWIFT transfers. ACH and Wise transfers usually clear within 1–3 business days, while wire transfers take 3–5 business days.

To qualify for a payout, traders must meet a few conditions:

- Achieve at least five winning days, each with a net profit of $150 or more.

- Request a minimum withdrawal amount of $125.

There’s a $30 processing fee for ACH or wire payouts. Additionally, traders in Live Funded Accounts can unlock daily payouts after hitting 30 non-consecutive winning days with $150+ profits.

Regulatory Compliance

Operating out of Chicago, Topstep gives traders access to regulated futures markets via CME Group exchanges, which are overseen by the CFTC and NFA. The company complies with OFAC sanctions, meaning its services are unavailable to citizens of countries like Russia, Iran, and North Korea.

For U.S.-based traders, Topstep uses sub-accounts within a master account structure, which the firm confirms qualifies as a U.S.-based account. Traders must also meet a minimum age requirement of 18 years. As an added benefit, Topstep covers the $133 monthly CME exchange data fee for Live Funded Account participants.

3. Take Profit Trader

Based in Windermere, Florida, Take Profit Trader (TPT) offers futures traders a range of account sizes to suit their needs: $25,000, $50,000, $75,000, $100,000, and $150,000. These accounts can be managed across up to five PRO accounts, providing a combined total of $750,000 in trading capital. What sets TPT apart is its "Day One" withdrawal policy, which allows traders to start withdrawing profits as soon as they achieve PRO status. This approach underscores TPT’s streamlined process for evaluation, funding, and profit-sharing.

Funding Allocation

TPT’s evaluation process is designed to be quick and straightforward, making it appealing to U.S.-based traders. The evaluation phase takes just five trading days, after which traders pay a one-time activation fee of $130. Monthly fees vary depending on the account size, starting at $150 for a $25,000 account and going up to $360 for a $150,000 account.

To withdraw profits, traders must first exceed a "buffer zone", which is equal to the account’s maximum drawdown. For example, a $50,000 account comes with a $2,000 buffer, meaning traders need to surpass this threshold to access profits at the standard rate. Standard PRO accounts operate with an intraday trailing drawdown, while the invite-only PRO+ upgrade offers more favorable terms, including end-of-day drawdown calculations and the removal of the buffer.

Profit Split

TPT offers a competitive profit-sharing model. Standard PRO accounts allow traders to keep 80% of their profits above the buffer, while the PRO+ upgrade increases the split to 90/10. For accounts closed within the first 60 trading days, profits within the buffer zone are shared equally at 50/50. After 60 days, the profit split reverts to 80/20.

From January to August 2023, 20.37% of traders successfully passed the evaluation to reach funded status. However, in 2024, this percentage declined slightly to 16.86%.

Payout Speed

TPT ensures payouts are processed quickly and efficiently. The process involves two steps: funds are first transferred from the PRO account to the TPT Wallet within 24 hours, followed by payout approval within 12 business hours. For U.S. traders using Plaid, bank transfers are nearly instant. Withdrawals over $250 are fee-free, but amounts of $250 or less come with a $50 fee. Additionally, traders must complete a W-9 form and verify their identity before their first payout.

Regulatory Compliance

TPT operates as a funding firm rather than a broker, which exempts it from NFA/CFTC membership requirements. Instead, it collaborates with regulated brokers like Tradovate and NinjaTrader and relies on CME-approved data providers such as Rithmic. This ensures traders have access to regulated futures markets within TPT’s framework. To maintain an active PRO account, traders are required to place at least one trade per week.

TPT also supports over 15 trading platforms, including those compatible with Rithmic and CQG, providing flexibility for traders who prefer specific tools.

4. FundedNext Futures

FundedNext Futures offers funding opportunities for both forex and futures traders, making it a flexible choice for U.S. clients. The firm provides two evaluation paths to suit different trading preferences and timelines: the Evaluation Model (a two-phase process) and the Express Model (a one-phase process). These options are designed to cater to diverse trading styles while offering flexible funding and profit-sharing arrangements.

Funding Allocation

FundedNext offers account sizes ranging from $6,000 to $100,000. The evaluation fees are paid as a one-time charge, with pricing as follows:

- $59 for a $6,000 account

- $199 for a $25,000 account

- $299 for a $50,000 account

- $549 for a $100,000 account

For traders who show consistent results, FundedNext provides a scaling program. Accounts can grow by 40% every four months if traders meet these criteria: achieving at least 10% profit over the period, receiving at least one payout per month, and avoiding any rule violations. Additionally, the firm employs a fixed drawdown system with a 5% daily limit and a 10% overall drawdown cap. Traders are free to use various strategies, including news trading, Expert Advisors (EAs), and holding positions overnight or over weekends.

Profit Split

The profit-sharing structure depends on the evaluation model:

- Evaluation Model: Offers a profit split of up to 80% for Futures accounts..

- Express Model: Provides a 60% profit split, along with a 15% bonus from profits earned during the evaluation phase.

Payout Speed

Payout schedules vary by model:

- Express Model: First payout is available on Day 7, with weekly payouts afterward.

- Evaluation Model: Payouts start on Day 21 and recur every 14 days.

Additionally, the evaluation fee is refunded after the first successful payout.

Regulatory Compliance

FundedNext operates its evaluation and funding processes using simulated capital, which allows the firm to bypass SEC broker-dealer registration requirements. U.S.-based traders are classified as independent contractors and receive 1099 forms for their profit-share income. By enforcing structured challenges and clear risk parameters, the firm ensures that traders have access to regulated futures markets while maintaining compliance with industry standards.

5. Tradeify

Tradeify is a prop trading firm based in the U.S. that stands out for its quick funding options and trader-friendly payout structure. With over $110 million paid out to more than 80,000 traders and a 4.7/5 rating on Trustpilot from 1,678 reviews, Tradeify has made a strong impression on the trading community. U.S. traders can choose from three funding paths tailored to their preferences: Growth (1-day evaluation), Select (3-day evaluation), or Lightning Funded (instant funding with no evaluation required).

Funding Allocation

Tradeify offers U.S. traders access to up to five simulated funded accounts, with a combined funding limit of $1,000,000 – far exceeding the typical range of $200,000–$400,000. Individual account sizes range from $25,000 to $150,000. Their End of Day (EOD) trailing drawdown model is often praised for being more lenient than traditional intraday models, giving traders more flexibility.

Pricing for Growth accounts starts at $139 per month for a $50,000 account and goes up to $339 for a $150,000 account. The Select 50k account is priced at $159 per month, though discounts often bring it down to $111. Notably, Growth plans come with no activation fees, adding to their appeal[37,40].

Profit Split

Tradeify’s profit-sharing setup is another highlight. Traders keep 100% of their first $15,000 in earnings, after which profits are split 90/10 in the trader’s favor. For those opting for Lightning Funded accounts, payouts can begin immediately, skipping the evaluation process. As one trader put it:

"Lightning Funded allows me to skip the evaluation process and get to payouts quicker. I love that every single trade I take counts towards the payout!"

– Rips, Professional Trader and Mentor

The Tradeify LIVE program offers another layer of opportunity. After four successful payouts, the initial profit split remains at 90/10, but subsequent earnings shift to an 80/20 split.

Payout Speed

When it comes to payouts, Tradeify is impressively fast. Requests are processed within 60 minutes, even on weekends and holidays. Many traders report receiving their funds in less than an hour once their requests are approved. One trader shared their experience:

"I’ve taken $36k in payouts in the last couple of months and the money hits my bank account in less than an hour."

– Andy O., Trader

The minimum payout thresholds are $500 for simulated accounts and $1,000 for live accounts. Payouts can be requested during three monthly windows: the 1st–4th, 11th–14th, and 21st–24th[39,40].

Regulatory Compliance

Tradeify also prioritizes regulatory compliance, ensuring a secure trading environment for U.S. clients. The firm operates a simulated-to-live model, allowing traders to start with simulated accounts (Sim Funded) and transition to live capital through the Tradeify Elite program after achieving four successful payouts. This setup provides access to regulated futures markets without requiring SEC broker-dealer registration.

U.S.-based traders are classified as independent contractors and receive proper tax documentation for their profit-sharing income. Additionally, Tradeify supports platforms like Tradovate and NinjaTrader, offering free real-time data to enhance the trading experience.

6. Lucid Trading

Lucid Trading made its debut in early 2025, and since then, it has paid out more than $20 million to over 24,000 traders. With a stellar 4.8/5 rating on Trustpilot from 1,123+ reviews, it’s clear that traders hold this firm in high regard. Lucid Trading provides two funding options: LucidPro, a single-phase evaluation, and LucidDirect, which offers instant funding without any evaluation process [41,42]. Below, we’ll dive into the details of their funding options, profit-sharing model, and payout structure tailored for U.S. traders. With a new LucidFlex and LucidBlack account offering you can choose which account suits your trading style best based on trading rules.

Funding Allocation

Lucid Trading offers account sizes ranging from $25,000 to $150,000, giving traders flexibility based on their trading goals. You can manage up to 10 evaluation accounts at the same time, but households are limited to a maximum of 5 funded accounts. The firm uses an End of Day (EOD) trailing drawdown system, which helps maintain risk control.

Here’s a quick overview of the account options:

- $25,000 account: Costs $110 with a $1,500 profit target.

- $50,000 account: Costs $135 with a $3,000 profit target.

Good news – there are no activation fees for these accounts [41,42].

Profit Split

Lucid Trading offers an attractive profit-sharing structure. Traders used to keep 100% of their first $10,000 in payouts. Now the profit split adjusts to 90/10, still heavily favoring the trader [41,43]. One trader, Sukhninder, shared their positive experience:

"The best prop firm out there. I requested 2 payout and in 5 minutes I got money…"

– Sukhninder, Verified Trader

Payout Speed

Lucid Trading prides itself on fast payouts, processing withdrawals in an average of just 15 minutes. Funds are available daily, with a minimum withdrawal amount of $500. Once requested, payments typically arrive within 2 business days. To qualify for withdrawals, traders must meet the following requirements:

- Complete at least 5 profitable trading days per cycle for LucidPro accounts.

- Complete 8 profitable trading days per cycle for LucidDirect accounts.

Regulatory Compliance

Lucid Trading operates with a strong focus on compliance, ensuring its services align with U.S. regulations. Using simulated challenges, the firm avoids the need for SEC broker-dealer registration. They clearly state that their services are not investment advice or investment services, adhering to all applicable laws.

For traders who succeed, Lucid Trading transitions them to live capital accounts regulated by the CME, following all CME futures market rules. The firm exclusively supports CME futures markets – such as ES, NQ, YM, CL, and GC – and integrates with popular U.S.-compatible platforms like NinjaTrader and Tradovate. Keep in mind, all positions must be closed by 4:45 PM EST daily, and overnight or weekend holding is not permitted.

Comparison of Firms: Strengths and Weaknesses

Finding the right proprietary trading firm depends on your trading style, experience, and priorities. Below, we’ve broken down the strengths and weaknesses of some best futures prop firms to help you make an informed choice.

Apex Trader Funding is a great option for experienced traders looking to scale quickly. The firm allows you to manage up to 20 accounts simultaneously using trade copying platforms, and you keep 100% of your first $25,000 in profits for each account. However, their intraday trailing drawdown is stricter compared to an end-of-day drawdown system.

Topstep caters to newer traders and has been a trusted name for over 12 years, with 81,177 payouts issued in 2024 alone. Its end-of-day loss limit offers more flexibility for traders. That said, new traders who join after January 12, 2026, will receive a flat 90% profit split, replacing the previous 100% on the first $10,000.

Take Profit Trader stands out by allowing profit withdrawals starting from day one. Similarly, FundedNext Futures offers a 100% profit split with an impressive 24-hour payout guarantee, plus a $1,000 bonus if the payout deadline is missed. For traders who want to skip the evaluation phase entirely, Tradeify and Lucid Trading provide instant funding, giving immediate access to trading capital.

Here’s a quick overview of the key metrics:

| Firm | Profit Split | Payout Speed | Drawdown Model | Max Accounts |

|---|---|---|---|---|

| Apex Trader Funding | 100% (first $25k), then 90% | Every 8 trading days | Trailing (Intraday) | 20 |

| Topstep | 90% (new traders) | Weekly (daily after 30 days) | End-of-Day | 5 |

| Take Profit Trader | 80%-90% | From day one | EOD (Eval) / Intraday (Funded) | 5 |

| FundedNext Futures | 80% | Every 5 days (24-hour guarantee) | Not specified | 5 |

| Tradeify | Varies by plan | Not specified | EOD Always | 5 |

| Lucid Trading | 100% (first $10k), then 90/10 | Average 15 minutes | End-of-Day Trailing | 5 funded per household |

These comparisons highlight the trade-offs between firms, making it easier to weigh your options. For example, Apex Trader Funding offers unmatched scaling potential but enforces a 30% consistency rule through your first six payouts. Topstep provides user-friendly drawdown rules, but its monthly fees – ranging from $49 to $189 depending on account size – are on the higher side. Meanwhile, FundedNext Futures impresses with lightning-fast payouts, though it doesn’t have the long track record that Topstep boasts with over a decade in the industry.

Conclusion

The best prop firm for you depends on how well it aligns with your trading approach and priorities. For instance, if you’re new to trading and value a firm with a solid track record, Topstep is a standout choice. With over 12 years of experience and 81,177 payouts issued in 2024, they offer an end-of-day drawdown model and extensive educational resources – ideal for traders who want both flexibility and guidance.

For seasoned traders looking to scale rapidly, Apex Trader Funding is worth exploring. They offer capital allocations of up to $6 million across multiple accounts and let you keep 100% of your first $25,000 in profits. However, their intraday trailing drawdown model requires careful risk management.

If quick payouts are your main concern, FundedNext Futures guarantees payments within 24 hours, even offering a $1,000 bonus if delayed. For traders seeking long-term cost savings, Take Profit Trader is a strong contender. Their PRO account eliminates recurring fees once you pass the evaluation phase, using proven prop firm challenge strategies making it a budget-friendly option.

Need instant capital? Tradeify and Lucid Trading skip the evaluation process entirely, providing immediate funding.

For U.S.-based traders, focusing on futures prop firms is a smart move to avoid the legal challenges tied to offshore CFD providers. All the firms mentioned operate within regulated futures markets, such as the CME, ensuring compliance and transparency. Before committing, confirm the platform meets U.S. regulatory standards, especially as MetaTrader access becomes increasingly restricted for American traders.

FAQs

What should I look for when selecting a futures prop firm as a U.S.-based trader?

When picking a futures prop firm, the first step is to check if they’re legally compliant for U.S. traders and operate with a clear, service-focused approach. Make sure to review their eligibility criteria – some firms require you to pass trading challenges, while others skip the lengthy assessments and offer quicker funding options.

Take a close look at the funding structure. This includes the maximum capital allocation (which can range from $50,000 to $1,000,000), profit-split percentages (commonly 80–90%), and any additional fees like monthly memberships or activation charges. Payout speed matters too – firms that offer same-day or fast withdrawals can help keep your cash flow steady.

Don’t overlook the trading platform and risk rules. The firm should support the futures markets you trade, provide access to real-time data, and have straightforward risk-management policies, such as drawdown limits and stop-loss requirements. Strong customer support and educational tools can also make your trading experience smoother. By evaluating these aspects, you’ll be in a better position to choose a firm that matches your trading style and objectives.

What are the differences in profit splits and payout processes among the mentioned prop firms?

Profit sharing and payout methods differ among firms, giving traders various options to consider. Topstep provides funded traders with 90% of their net profits, while keeping 10% for itself. Apex Trader Funding takes a slightly different approach by allowing traders to retain 100% of their first $25,000 in earnings, after which a 90/10 split (in favor of the trader) applies. On the other hand, Take Profit Trader mentions profit sharing but does not reveal exact percentages.

When it comes to payouts, Topstep implements a structured system. Traders must meet profit targets and adhere to compliance rules, and withdrawals impact the Maximum Loss Limit. Apex Trader Funding offers daily payout processing for funded accounts, emphasizing its capacity to manage even substantial withdrawals. Meanwhile, Take Profit Trader enables withdrawals from day one for PRO accounts, though details such as minimum amounts or payout schedules remain unspecified.

What should U.S.-based traders know about regulations when using prop firms?

For traders in the U.S., it’s crucial to recognize that many proprietary trading firms operate in a regulatory gray area. Unlike brokers, these firms usually don’t need to register with regulatory agencies like the SEC, CFTC, or NFA. This lack of oversight means they aren’t bound by rules like maintaining capital reserves, segregating client funds, or providing mandatory disclosures. As a result, some firms might alter their rules, delay payments, or even shut down entirely, leaving traders with little to no recourse.

That said, the regulatory landscape is shifting. In February 2024, the SEC broadened the definition of "dealer" to include certain proprietary trading firms. Firms that fall under this updated definition are now required to register with the SEC and FINRA, adhere to capital requirements, and undergo regular inspections. To reduce risks, traders should confirm whether a firm is registered, thoroughly review its terms, and investigate its payout history. Doing your homework is key to navigating these evolving regulations with confidence.