Scaling plans are structured systems used by futures prop firms to help traders gradually increase their trading capital and position sizes. These plans are tied to performance milestones, ensuring traders grow responsibly while managing risk. Here’s what you need to know:

- What It Is: A scaling plan limits your contract size initially. As you hit profit targets and meet consistency rules, your firm increases your trading limits.

- How It Works: For example, a $50,000 account may start with a 2-contract limit. After earning $1,500 in profits, the limit might increase to 3 contracts. However, if profits dip below a set threshold, limits are reduced.

- Key Metrics: Firms evaluate traders based on profit targets (8%-10% of starting capital), consistency (e.g., no single day contributing more than 20%-35% of total profits), and drawdown limits (5%-10% of the account).

- Compliance: Traders must follow rules like avoiding over-leveraging, maintaining consistency, and observing minimum trading days (if required).

Scaling plans protect traders from over-leveraging and encourage long-term, disciplined growth. Top firms like Apex Trader Funding, Topstep, and Tradeify use these systems to balance risk and reward.

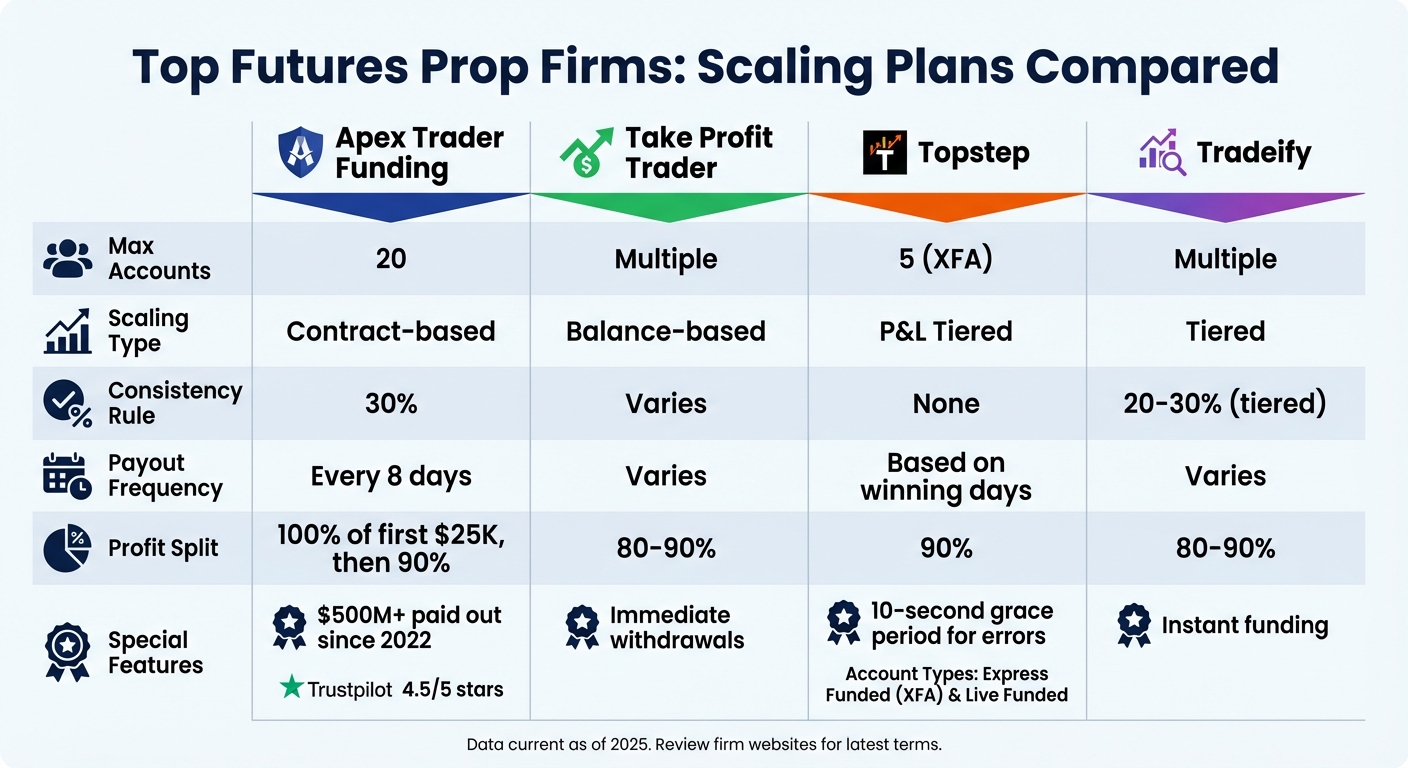

| Firm | Max Accounts | Scaling Type | Consistency Rule | Profit Split |

|---|---|---|---|---|

| Apex Trader Funding | 20 | Contract-based | 30% | 100% of first $25K, then 90% |

| Take Profit Trader | Multiple | Balance-based | Varies | 80%-90% |

| Topstep | 5 (XFA) | P&L Tiered | None | 90% |

| Tradeify | Multiple | Tiered | 20%-30% (tiered) | 80%-90% |

Scaling plans are not just about increasing limits – they’re about proving consistency, managing risk, and growing as a trader. By following firm rules and using tools like trade reports and consistency calculators, you can meet these requirements and advance in your trading career.

How Scaling Plans Work

What Are Scaling Plans?

A scaling plan is essentially a step-by-step guide designed to gradually increase your trading capital, position size, and risk exposure as you hit specific milestones. Instead of giving you full access to maximum buying power right away, proprietary trading firms start you off with limited contract sizes. As you demonstrate your ability to manage risk and trade responsibly, your account size or contract limits expand.

These adjustments typically occur after the daily trade report is processed. For example, if your end-of-day balance increases, your contract limit may grow as well. However, these changes don’t take effect immediately. Most firms update your buying power at the end of the trading day, often around 5:00 PM CT. So, even if you hit a profit milestone during the trading session, you’ll need to wait until the next day to access the increased position size.

Some firms also offer a brief grace period – about 10 seconds – to correct accidental over-leveraging. If you exceed your contract limit by mistake, closing the excess within this window can help you avoid a rule violation.

Now, let’s dive into the key performance metrics that determine when these adjustments happen.

Key Performance Metrics

Scaling plans rely on specific metrics to assess whether you’re ready for the next level. Profit targets are the most common benchmark. Typically, firms require traders to achieve 8% to 10% of their starting capital before they qualify for increased allocations. For instance, if you’re trading with a $50,000 account, you might need to generate $4,000 to $5,000 in realized profits to move to the next tier.

Consistency is another critical factor. Firms often have rules to ensure that your growth isn’t based on one lucky trade. For example, no single trading day can account for more than 20% to 35% of your total profit. Tradeify’s Lightning accounts use a tiered system: the first payout requires 20% consistency, while subsequent payouts allow up to 30%. These rules promote steady trading habits and discourage risky, high-stakes bets.

Drawdown limits are also a key consideration. Most firms set thresholds – usually between 5% and 10% of your account balance – to ensure traders manage losses effectively. Exceeding these limits can result in account termination or a reduction in your contract size. Additionally, some firms require a minimum number of winning days – typically five days with profits ranging from $100 to $300 – before approving payouts or allowing account transitions.

By combining these metrics, scaling plans not only minimize risk but also encourage disciplined and sustainable trading practices.

Why Scaling Plans Matter

Scaling plans play a vital role in protecting traders from over-leveraging, especially in the early stages. By limiting position sizes initially, they help safeguard your account. For example, Topstep has reported a noticeable increase in trader longevity since introducing their scaling plan.

"The scaling plan isn’t a punishment; it’s a framework. It teaches discipline, enforces proper risk management, and ensures funded traders grow step by step instead of rushing into positions that could wipe out their accounts." – Topstep

Beyond managing risk, scaling plans provide a clear pathway for career development. You begin with smaller positions, prove your consistency, and gradually earn the ability to manage larger capital allocations – sometimes reaching as high as $2 million. This gradual progression also helps traders adapt to the psychological challenges of managing larger sums. As your account grows, so does the potential dollar risk, making it crucial to maintain discipline and consistent decision-making, even when the stakes are higher.

Requirements for Scaling Plan Compliance

Profit Targets and Time Limits

Most proprietary trading firms base scaling adjustments on end-of-day realized profits, rather than tracking intraday performance in real time. This means your eligibility for scaling is typically updated daily, using reports generated at the close of each trading day.

Profit targets are usually structured in tiers. As you hit specific profit milestones, your contract limits increase. For example, on a $50,000 account, the allowable number of mini contracts might grow from 3 to 5 as your profits rise.

Some firms set percentage-based targets instead. For instance, City Traders Imperium requires traders to achieve a 10% profit within a set timeframe to scale up to $1 million. Similarly, The Trading Pit sets targets of either 8% or 10%, depending on the starting account size, for scaling up to $5 million.

If your profits fall below the threshold for your current tier, most firms will scale you back down at the end of the trading day. To regain access to higher contract limits, you’ll need to rebuild your equity buffer. Many firms also provide a brief grace period – typically 10 seconds – to correct accidental over-leveraging. Closing excess positions within this window can help you avoid violating the rules.

Consistency Rules and Drawdown Limits

Hitting profit milestones is just one part of scaling; firms also enforce rules designed to promote consistent and disciplined trading. Consistency rules ensure that profits stem from repeatable skills rather than a single lucky trade. For example, many firms limit the contribution of any single trading day to the overall profit target, with caps ranging from 20% to 50%. At MyFundedFutures, daily gains cannot exceed 50% of the profit target during the evaluation phase.

Tradeify’s Lightning accounts use a tiered consistency system: 20% for the first payout, 25% for the second, and 30% for all subsequent payouts. If you exceed these limits on a given day, instead of terminating your account, the firm adjusts your profit target upward. You can calculate the new target using this formula:

Biggest profit day ÷ Consistency % = Total profit required.

Drawdown limits act as a safeguard to manage risk. These limits, whether static or trailing, typically fall between 5% and 10% of the account balance. For instance, MyFundedFutures employs a static end-of-day drawdown that locks after your first payout. On a $50,000 account, this might lock at around $50,100, giving you extra room to grow while still managing risk.

Minimum Trading Days and Rule Compliance

While some firms have done away with minimum trading day requirements, others still rely on them to measure performance consistency over time. MyFundedFutures, for example, has removed this requirement, allowing traders to focus solely on results without being constrained by time. However, many traditional scaling plans continue to require a minimum number of active trading days to demonstrate reliability.

Adhering to contract limits is another critical aspect of compliance. Although platforms like Tradovate and NinjaTrader may block orders that exceed these limits, the ultimate responsibility lies with you. To avoid mistakes, consider enabling Order Confirmation settings on your trading platform. This feature can help prevent accidental entries. Additionally, reviewing your trade reports daily ensures you remain within your allowed contract limits for the next session.

The path to scaling is challenging. Between January 2024 and July 2025, only 1.01% of participants in MyFundedFutures’ simulated funded accounts advanced to Live Funded Accounts, illustrating how difficult it is to meet all scaling plan requirements. Tools like the Consistency Rule Calculator can be invaluable for tracking whether a particularly profitable day has inadvertently increased your overall profit target due to consistency adjustments.

These compliance measures lay the groundwork for the risk management strategies discussed in the next section.

The Truth About Prop Firm Scaling Plans…

sbb-itb-46ae61d

Scaling Plans at Top Futures Prop Firms

Futures Prop Firm Scaling Plans Comparison: Apex, Topstep, Tradeify & Take Profit Trader

Top futures prop firms have developed specific strategies to reward traders who consistently perform well. Let’s dive into how some of the leading firms structure their scaling plans.

Apex Trader Funding Scaling Plan

Apex Trader Funding offers a standout multi-account scaling model, allowing traders to manage up to 20 funded accounts simultaneously. This approach can lead to payouts of up to $70,000 in just 8 days. Since 2022, the firm has paid out over $500 million to traders. Notably, traders keep 100% of the first $25,000 in profits per account before transitioning to a 90% profit share.

For a $50,000 evaluation, the monthly cost is typically around $137, though discounts often bring it down to roughly $33. There’s also a $140 activation fee. Apex enforces a 30% consistency rule, which means no single trading day can account for more than 30% of the profits required for payout eligibility. With over 15,000 reviews on Trustpilot and a 4.5/5 rating, Apex has built a strong reputation for its trader-friendly policies.

Take Profit Trader Scaling Plan

Take Profit Trader uses a balance-based scaling system. As traders hit profit milestones, their capital increases, and they can make immediate withdrawals. This straightforward approach ensures that traders are rewarded as they grow their accounts.

Topstep Scaling Plan

Topstep employs two distinct scaling models, depending on the account type:

- Express Funded Accounts (XFA): This model uses a fixed contract-based plan. For example, a $50,000 account starts with a limit of 2 contracts, which scales up as the end-of-day balances grow.

- Live Funded Accounts: This plan adjusts both daily loss limits and contract sizes as traders generate profits. Once a trader reaches Tier 4 or achieves a $100,000 balance, they can request "Expanded Contract Sizing."

Topstep also incorporates safeguards like automatic order blocking for trades exceeding the current scaling tier. Additionally, minor errors corrected within 10 seconds don’t result in penalties, making it a trader-friendly system .

Tradeify Scaling Plan

Tradeify offers instant funding with a tiered consistency model. Depending on the trader’s progress, the consistency requirement ranges between 20% and 30%. This tiered approach ensures that traders are rewarded for steady performance.

Scaling Plan Comparison Table

Here’s a quick overview of the scaling plans offered by these firms:

| Firm | Max Accounts | Scaling Type | Consistency Rule | Payout Frequency | Profit Split |

|---|---|---|---|---|---|

| Apex Trader Funding | 20 | Contract-based | 30% | Every 8 days | 100% of first $25K, then 90% |

| Take Profit Trader | Multiple | Balance-based | Varies | Varies | 80-90% |

| Topstep | 5 (XFA) | P&L Tiered | None | Based on winning days | 90% |

| Tradeify | Multiple | Tiered | 20-30% (tiered) | Varies | 80-90% |

Up next, we’ll explore strategies to help traders successfully meet these scaling plan requirements.

How to Meet Scaling Plan Requirements

Risk Management Methods

Protecting your capital is key to meeting scaling plan requirements. One effective approach is the 1% rule – limit your risk on each trade to just 1% (or even 0.5%) of your total account equity.

Another critical strategy is dynamic position sizing. Instead of trading the same number of contracts each time, adjust your position based on market volatility and your confidence in the trade setup. Micro futures contracts, which are 1/10 the size of standard E-mini contracts, can give you greater flexibility when scaling up gradually. Kyle Maring from HighStrike LLC emphasizes this point:

"The ability to leverage positions in futures trading requires a deep understanding of capital protection methods… one mistake should not destroy their entire strategy."

Setting personal limits below firm thresholds is also a smart move. For example, if your firm’s daily loss limit is $2,000, consider capping yourself at $1,500. This buffer can help prevent emotional "revenge trading" after a tough day. Many traders also rely on automated risk controls through tools like Advanced Trade Management (ATM). These tools execute stop-loss and take-profit orders within milliseconds of your entry, removing emotional decisions from the equation.

Combining these risk management techniques with disciplined trading habits will keep you on track to meet your scaling goals.

Maintaining Consistency and Discipline

Success in trading is largely about mindset and discipline, which account for 90% of the journey. Scaling plans are designed to instill this discipline and discourage over-leveraging, especially early in your trading career.

Consistency rules are often the most challenging part of scaling plans. Firms like Tradeify and Apex enforce rules that require traders to spread profits across multiple days, rather than relying on one big win. For instance, Tradeify updated its consistency rules in September 2025 for Lightning Accounts. If a trader with a $150,000 account and a 20% consistency requirement has a "best day" of $2,500, they must achieve a total profit of $12,500 to qualify for a payout. If their total profit is only $9,000, the $2,500 day would exceed the 20% threshold, violating the rule.

Another important principle is to avoid trading the maximum number of allowed contracts. Just because your plan permits 10 contracts doesn’t mean you should use them all. Trading conservatively minimizes the risk of accidental rule violations. As Ngan Pham from H2T Funding explains:

"Discipline in the first weeks is the real test, not just profit targets."

Tools for Tracking Compliance

To stay compliant with your scaling plan, having the right tracking tools is essential.

Your prop firm’s daily Trade Report is one of the most valuable resources. For example, Topstep updates its report daily at 5 PM CT, showing your contract limits for the next trading session. Make it a habit to review this report before you start trading.

Another useful tool is the Consistency Rule Calculator from DamnPropFirms. This tool helps you check if your largest profit day stays within the allowed percentage before requesting a payout. It’s especially helpful for firms like Tradeify and Apex Trader Funding that enforce strict consistency thresholds.

Platforms like TopstepX simplify compliance by integrating scaling rules directly into their interface, preventing you from exceeding your position size limits by mistake. On trading platforms like Rithmic or NinjaTrader, pay attention to rejection messages such as "Rejected at RMS – Total buy/sell quantity of contract would exceed its limit", which signal you’ve hit your scaling cap.

Finally, keep a detailed trading journal to document every trade. Record your entry and exit points, the emotions you felt, and your reasoning behind each decision. This can help you spot patterns, like abandoning stop-losses or overleveraging, before they become costly habits. Tools like TradeSyncer include built-in journals and analytics, making it easier to track performance across multiple accounts – a must if you’re managing several prop firm accounts at once.

Conclusion

Scaling plans provide a clear framework for managing larger amounts of capital while minimizing risk. These strategies act as safeguards against over-leveraging – often considered the biggest threat to long-term trading success. By sticking to structured scaling plans, traders can extend their career lifespan and cultivate disciplined growth.

"A well-designed scaling plan is a prop firm’s greatest promise to its traders. It shows the firm is invested in your long-term development and offers a structured, professional path to build a real trading career."

Top-performing prop firms prioritize steady, consistent gains over flashy, short-lived profits. Firms like Tradeify and Apex Trader Funding emphasize consistency, ensuring traders focus on sustainable, disciplined strategies rather than chasing quick wins.

To succeed, it’s essential to understand your firm’s rules and expectations. Regularly review your trade reports and use tools like the Consistency Rule Calculator from DamnPropFirms to stay on track before requesting payouts. Scaling isn’t about taking unnecessary risks or maxing out positions – it’s about proving your professionalism through steady, rule-based progress.

FAQs

How do scaling plans help traders manage risk effectively?

Scaling plans are structured to help traders keep risk under control by capping the maximum number of contracts or the amount of capital they can use. These caps increase incrementally, but only after traders achieve specific profit goals and stay within set drawdown limits. This method encourages traders to expand their positions carefully, avoiding over-leveraging while promoting disciplined and responsible trading habits.

What performance metrics are used to determine progress in scaling plans?

Scaling plans often hinge on a handful of key performance metrics to track a trader’s progress. These typically include:

- Profit targets: For instance, reaching a 10% growth in account value.

- Maximum drawdown limits: Usually capped at 5% or less to manage risk.

- Consistency requirements: Such as showing profitability in 2 out of 4 months.

Traders may also encounter metrics like the profit split percentage, which defines how profits are divided, and the rate of scaling increments, which outlines how account sizes grow over time.

Grasping these metrics is crucial for traders looking to meet scaling benchmarks and expand their accounts successfully.

Why is consistency key to success in scaling plans?

Consistency plays a key role in scaling trading plans, as it reflects a trader’s ability to deliver steady profits while keeping risks under control. Prop firms look at this reliable track record to confidently allocate more capital, allowing traders to grow their accounts in a responsible manner.

When traders maintain consistent results, they can also secure improved profit-sharing terms and gain access to advanced opportunities for further account growth. This disciplined approach not only strengthens trust with proprietary firms but also sets the stage for sustainable success in trading.