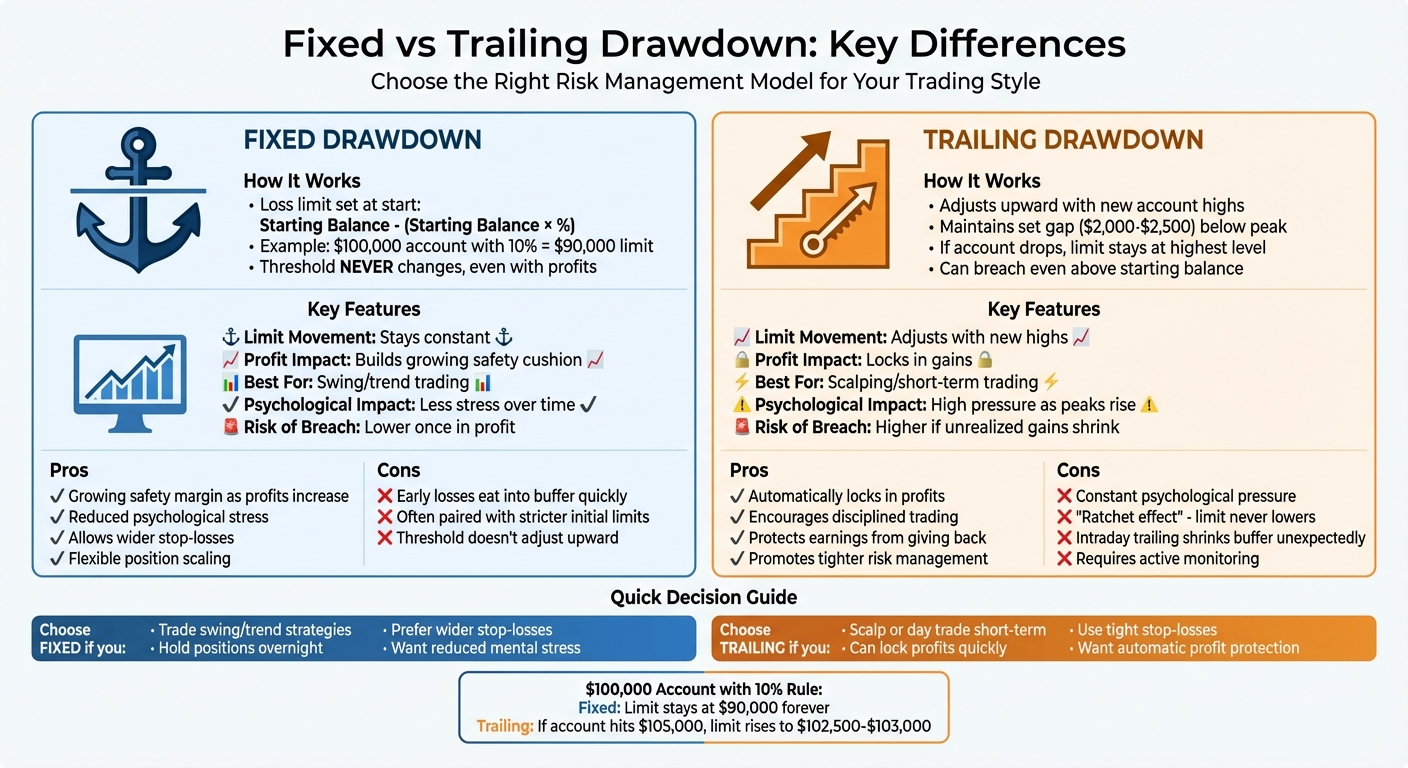

Trailing and fixed drawdowns are key risk management tools used in trading, especially by proprietary trading firms. Here’s a quick breakdown:

- Fixed Drawdown: The loss limit is set at the start and doesn’t change, even as your account grows. For example, a $100,000 account with a 10% fixed drawdown has a limit of $90,000, regardless of any profits made.

- Pros: Provides a growing safety cushion as profits increase. Reduces stress since the limit doesn’t change.

- Cons: Early losses can quickly eat into your buffer. Often paired with stricter initial limits.

- Trailing Drawdown: Adjusts upwards as your account hits new highs, locking in profits. If your account drops, the limit doesn’t lower.

- Pros: Automatically locks in gains, encouraging disciplined trading.

- Cons: Adds psychological pressure since the limit rises but doesn’t fall. Intraday trailing can shrink your buffer unexpectedly due to unrealized gains.

Quick Comparison

| Feature | Fixed Drawdown | Trailing Drawdown |

|---|---|---|

| Limit Movement | Stays constant | Adjusts with new highs |

| Profit Impact | Builds safety cushion | Locks in gains |

| Best For | Swing/trend trading | Scalping/short-term |

| Psychological Impact | Less stress over time | High pressure as peaks rise |

Both models shape trading strategies differently. Fixed drawdowns suit longer-term strategies with wider stop-losses, while trailing drawdowns demand tighter risk management and quicker profit-taking. Choose based on your trading style and risk tolerance.

Fixed vs Trailing Drawdown Comparison Chart for Traders

Fixed Drawdown Explained

How Fixed Drawdown Works

Fixed drawdown, sometimes called static drawdown, establishes a maximum loss limit as a set dollar amount based on your initial starting balance. This limit remains unchanged, no matter how much profit your account generates. The formula to calculate it is straightforward:

Starting Balance – (Starting Balance × Drawdown Percentage).

For instance, if you start with a $100,000 account and have a 10% fixed drawdown, your loss limit is locked at $90,000. Even if your account grows, the $90,000 threshold stays the same, giving you a larger safety cushion over time. However, if your equity (or balance, depending on the firm’s rules) drops to this threshold, your account will be closed.

This fixed approach has distinct advantages and disadvantages, shaping how traders use it effectively.

Benefits of Fixed Drawdown

One major advantage of fixed drawdown is the growing safety margin it provides as your profits increase. Since the loss threshold doesn’t move, the gap between your current balance and the drawdown limit widens as your account grows. This setup is especially useful for swing traders who hold positions overnight or through volatile market conditions, as the limit remains static and unaffected by short-term price movements.

Another benefit is reduced psychological stress. With a fixed drawdown, you don’t need to worry about tracking shifting high-water marks or how unrealized profits might impact your threshold. This static framework allows for more flexibility with wider stop-loss orders and scaling up positions once you’ve built a profit cushion. However, it’s important to check whether your firm calculates drawdown based on balance (closed trades only) or equity (which includes floating profits and losses). Equity-based models can lead to breaches caused by temporary market spikes.

Drawbacks of Fixed Drawdown

The primary downside of fixed drawdown is its inability to adjust as your account grows. While profits increase your safety buffer, the drawdown threshold itself stays fixed. This means a couple of significant losses early on can quickly eat into your buffer.

Additionally, accounts with fixed drawdown often come with stricter initial limits or higher fees compared to trailing drawdown models. To address this, some firms offer hybrid models like "trailing lock." In these setups, the drawdown initially trails profits but becomes fixed once it reaches the starting balance plus a small buffer (e.g., $100). For added protection, you might want to set a personal daily loss limit that’s 30–50% tighter than the firm’s official threshold.

Trailing Drawdown Explained

How Trailing Drawdown Works

Trailing drawdown operates differently from a fixed drawdown. Instead of staying static, it adjusts dynamically as your account reaches new highs, maintaining a set gap – usually between $2,000 and $2,500 – below your peak balance. Here’s the catch: if your account value drops, the drawdown threshold remains locked at its highest previous level. This means your loss buffer gets smaller, and you could end up disqualified even if your account is still above the starting balance, simply because the profits that raised the threshold have been lost.

There are two main types of trailing drawdown: intraday trailing and end-of-day (EOD) trailing. Intraday trailing updates in real time based on floating profits, while EOD trailing only adjusts after the market closes. For example, on a $50,000 evaluation account with a $2,500 trailing rule, if your intraday profits push the account to $50,875, the threshold rises to $48,375. If you close the day at $50,100, you’re left with just a $200 buffer.

Many funded accounts include a locking mechanism where the trailing drawdown stops adjusting once it reaches your initial starting balance (or your starting balance plus a small buffer, such as $100). At this point, it essentially becomes a static limit. Most modern trading platforms display this as an "Auto Liquidate Threshold", making it easier to track the rising floor. This dynamic system not only helps preserve profits but also enforces stricter risk management, which we’ll explore further.

Benefits of Trailing Drawdown

One of the standout advantages of trailing drawdown is its ability to lock in profits automatically. As your account grows, the rising threshold ensures you hold onto gains, reducing the risk of giving back a large portion of your profits. This approach rewards disciplined trading and encourages traders to protect their earnings.

"Trailing drawdown is not your enemy, it’s a test. It rewards consistency, punishes recklessness, and separates real traders from lucky ones." – Seb, Maven Trading

Another benefit is how it promotes tighter risk management. By encouraging traders to secure profits through partial exits or trailing stops, it reduces the likelihood of watching winning trades reverse and erase previously secured gains. This system nudges traders toward a more calculated and disciplined approach.

Drawbacks of Trailing Drawdown

Despite its advantages, trailing drawdown comes with challenges – primarily the psychological pressure it creates. Once the threshold rises, it doesn’t come back down, even if you lose some of the gains that pushed it higher. This "ratchet effect" can lead to premature exits from trades or cause traders to become overly cautious after experiencing success.

"The unrealized trailing drawdown at Apex Trader Funding is the single biggest rule that trips up traders." – DamnPropFirms

Intraday trailing models, in particular, can be tricky. They adjust based on floating profits, which can shrink your safety cushion unexpectedly. For instance, if a trade peaks with $875 in unrealized profit but closes with only a $100 gain, the drawdown threshold still rises by the full $875, reducing your cushion by $775. This dynamic often forces traders to use smaller stop-loss orders, avoid wider risk margins, and secure profits quickly instead of letting winning trades run. It’s a system that demands precision and adaptability, but it can also limit flexibility in volatile markets.

Trailing vs Fixed Drawdown: Main Differences

Side-by-Side Comparison Table

The key difference between fixed and trailing drawdowns lies in how they adjust based on your account’s performance. Fixed drawdown stays locked at a specific level, while trailing drawdown moves upward as your account hits new highs. For example, with a $100,000 account and an 8% drawdown rule, a fixed drawdown keeps your liquidation point at $92,000, regardless of gains. In contrast, a trailing drawdown raises the threshold as your account grows but never lowers it, even if your balance decreases.

| Feature | Fixed (Static) Drawdown | Trailing Drawdown |

|---|---|---|

| Floor Movement | Stays fixed from the start | Adjusts upward with new peaks |

| Profit Impact | Builds a larger safety cushion | Keeps a steady buffer relative to the peak |

| Trading Style | Best for swing and trend trading | Suited for scalping and short-term trading |

| Psychological Pressure | Lessens as account grows | Remains high with rising peaks |

| Risk of Breach | Lower once in profit | Higher if unrealized gains shrink |

These differences highlight how each model shapes trading strategies and mental approaches.

How Each Model Affects Trading Strategy

The choice between fixed and trailing drawdowns has a direct impact on how traders plan and execute their strategies. Fixed drawdown rewards patience and allows for more flexibility. As your account grows, you can afford to use wider stop-losses and hold positions longer, riding out market fluctuations without worrying about your liquidation point. This makes it a solid choice for swing traders and trend followers who rely on setups that need time to mature.

Trailing drawdown, however, demands a more cautious and precise approach. Since your buffer remains tied to your account’s peak, you need to lock in profits sooner, use tighter stops, and avoid holding positions too long. As one trader from DamnPropFirms explains:

"The trailing drawdown is the #1 rule that catches traders off guard, and many blow their evaluation accounts because they don’t fully understand how it works."

Position sizing also varies between the two models. With a fixed drawdown, you can gradually increase your trade sizes as your account grows, giving you more room to maneuver. On the other hand, trailing drawdowns require careful sizing based on current market conditions. Tools like the Average True Range (ATR) can help you manage volatility and ensure that losses stay within your buffer.

Trader Psychology and Practical Factors

While trading strategies are important, the psychological differences between these models are just as impactful. Fixed drawdown offers a sense of security as your profits grow, reducing stress and creating a buffer that distances you from risk. Trailing drawdown, however, keeps the pressure constant. Your safety net doesn’t expand, and this can lead to early exits or overly cautious trading. Many traders fail evaluations because they underestimate the mental strain of a trailing drawdown.

"Max drawdown is your account’s life jacket – ignore it, and you’ll sink fast." – Anastasiia Chabaniuk, Educational Content Editor, Traders Union

Recovery also plays out differently. With a fixed drawdown, each winning trade improves your position, building a larger cushion. In a trailing model, a winning trade might actually raise your liquidation threshold if it hits a new peak but closes with a smaller profit. This dynamic can lead to "analysis paralysis", where traders hesitate to take new trades after a winning streak because the stakes feel higher.

Operationally, trailing drawdowns require more active monitoring. You’ll need to frequently check your "Auto Liquidate Threshold" on platforms like RTrader Pro for Rithmic or review account details in Tradovate to stay updated. Fixed drawdown traders, by contrast, can focus on how far their account has moved from the starting balance without worrying about daily adjustments tied to new highs.

sbb-itb-46ae61d

Choosing a Prop Firm Based on Drawdown Rules

What to Look for in Drawdown Rules

When evaluating a prop firm, the drawdown rules should be a top priority. Start by understanding how the firm calculates drawdowns – whether it’s based on balance (which only accounts for closed trades) or equity (which factors in unrealized gains and losses). Equity-based drawdowns are generally more stringent since they track intraday equity peaks, requiring sharper risk management.

Next, identify the type of drawdown: intraday trailing, end-of-day trailing, or static. Some firms use a feature called drawdown locking, where the trailing threshold stops moving once it reaches a specific point, such as the starting balance (or starting balance plus $100). This effectively turns it into a static drawdown. Many firms also impose daily loss limits – for instance, a $3,750 cap on a $150,000 account – to prevent a single day’s losses from exceeding the total allowable drawdown.

Using DamnPropFirms to Compare Firms

DamnPropFirms simplifies the process of comparing futures prop firms by ranking them based on their Maximum Loss Limit (MLL) and categorizing drawdown types into unrealized (intraday) trailing, end-of-day trailing, and static (fixed). Their detailed reviews help traders avoid unexpected restrictions, like overly tight drawdown limits.

For example, the 2026 rankings highlight that Apex Trader Funding offers a $300,000 account with a generous buffer and intraday trailing MLL. In contrast, Lucid Trading‘s $150,000 LucidDirect account and Tradeify‘s $150,000 Lightning account both feature $6,000 end-of-day trailing drawdowns. Meanwhile, Topstep‘s $150,000 account has a $4,500 end-of-day trailing limit, which is tighter but manageable for disciplined traders.

Beyond rankings, DamnPropFirms provides tools like the Consistency Rule Calculator, verified reviews, discount codes, and access to a Discord community with over 3,000 traders. These resources offer clear insights into how drawdown rules can impact your trading strategy, aligning with the broader risk management principles discussed earlier.

Factors to Consider for Futures Traders

Your trading style plays a key role in choosing between fixed and trailing drawdown models. For scalpers and short-term day traders, intraday trailing drawdowns might be a better fit, as long as they can lock in profits and stick to tight stop-loss strategies. On the other hand, swing traders and trend followers might prefer static or end-of-day trailing rules, which allow for wider stop-losses and longer holding periods without constant adjustments.

Account size and risk tolerance are also critical. Larger accounts with higher MLLs can better handle market volatility, especially during major events like CPI releases or Federal Reserve announcements. If you’re risk-averse or still refining your strategy, firms with static or end-of-day trailing rules may offer a safer option. But if you’re confident in your execution and can maintain discipline, an intraday trailing account could provide quicker and more cost-effective access to funding.

Lastly, consider operational tools and platform visibility. Firms using Rithmic let traders view the "Auto Liquidate Threshold" in RTrader Pro, while Tradovate users can access this through the account dropdown. Real-time monitoring of your drawdown is essential for disciplined risk management, as previously mentioned.

Static vs Trailing Drawdown: Prop Firm Showdown! Day Trading

Conclusion

The choice between trailing and fixed drawdown models plays a key role in shaping your trading approach. A fixed drawdown creates a growing safety net as your profits increase, while a trailing drawdown adjusts upward with each new peak, ensuring gains are locked in and profits are protected along the way. Aligning your drawdown model with your trading strategy is essential for maintaining disciplined risk management – something we’ve emphasized throughout this discussion.

When it comes to trading styles, the impact of drawdown models becomes even more apparent. Scalpers often lean toward intraday trailing models because they come with lower entry costs. On the other hand, swing traders and trend followers can take advantage of the added flexibility provided by static or end-of-day rules. A mismatch between your trading style and the drawdown type can lead to evaluation challenges, as the rules may conflict with your approach.

For a simplified way to compare drawdown rules, DamnPropFirms categorizes them into three types: Unrealized (Intraday), End-of-Day, or Static. You can explore firms like Apex Trader Funding, Take Profit Trader, and FundedNext Futures using tools like verified reviews, discount codes, and the Consistency Rule Calculator.

FAQs

How do trailing and fixed drawdowns affect a trader’s mindset?

Trailing drawdowns offer a dynamic way to manage risk, as they adjust the loss limit upward as your profits increase. This creates a sense of security – your gains feel more locked in – which can encourage traders to stay active and seek out new opportunities. Knowing that a portion of your equity is safeguarded can be a confidence booster. However, this approach comes with a catch: it requires tighter discipline. Since the drawdown is tied to your peak equity, there’s less room for risky maneuvers or emotional trades.

On the other hand, fixed drawdowns provide stability with a consistent loss limit that doesn’t shift. This predictability can be reassuring, but it also has its downsides. Traders might become overly cautious, worried about hitting the unchanging cap. This fear can hold them back, leading to missed opportunities or overly conservative position sizes – especially as the account grows. The key is understanding how these approaches align with your trading style and managing the psychological challenges they bring.

What’s the difference between fixed and trailing drawdowns, and how do they impact trading strategies?

The decision between a fixed drawdown and a trailing drawdown can have a big impact on how you approach trading and manage risk. With a fixed drawdown, the loss limit – say $8,000 on a $100,000 account – stays constant, no matter how much your account grows. This setup allows for greater flexibility to take larger positions as your profits increase, which can be appealing for traders focused on long-term growth. However, it might also tempt you to take bigger risks early on since the loss limit doesn’t adjust as your account balance changes.

In contrast, a trailing drawdown shifts with your account’s peak balance. For instance, if your account grows to $110,000, the loss limit moves up to stay $8,000 below the new high. This approach helps lock in gains but often requires a more cautious trading style. You’ll likely need to focus on smaller, more consistent trades to prevent the loss limit from tightening too quickly.

Choosing between these two options comes down to your trading goals. If you’re aiming for growth and can handle higher risk, a fixed drawdown might suit you. If you value protecting gains and prefer a steadier approach, a trailing drawdown could be better. Tools like DamnPropFirms’ Consistency Rule Calculator can help you figure out which strategy matches your objectives.

What factors should traders consider when evaluating prop firms’ drawdown rules?

When picking a prop firm, understanding how drawdown works is essential. A fixed drawdown is straightforward – it’s calculated from your starting balance and doesn’t change as your account grows. This makes it easier to manage but doesn’t offer any flexibility as your profits increase. On the other hand, a trailing drawdown adjusts based on your account’s highest balance. While this can provide more leeway, it demands careful risk management. Some firms apply trailing drawdowns in real-time during the day, while others calculate it at the end of the trading day, which can significantly influence how you plan your trades.

You should also factor in the maximum loss limit (MLL) and how it fits your trading style. If you use strategies with wider stop-losses, a larger MLL might be more suitable. On the flip side, tighter limits could work better for scalpers or short-term traders. It’s important to see how drawdown rules interact with other risk controls, like daily loss limits, to ensure they align with your risk tolerance and profit objectives. For a deeper understanding, tools like the Consistency Rule Calculator on DamnPropFirms can help you analyze how these rules might impact your trading performance and growth potential. Picking a firm with drawdown rules that align with your trading approach is a crucial step toward long-term success.