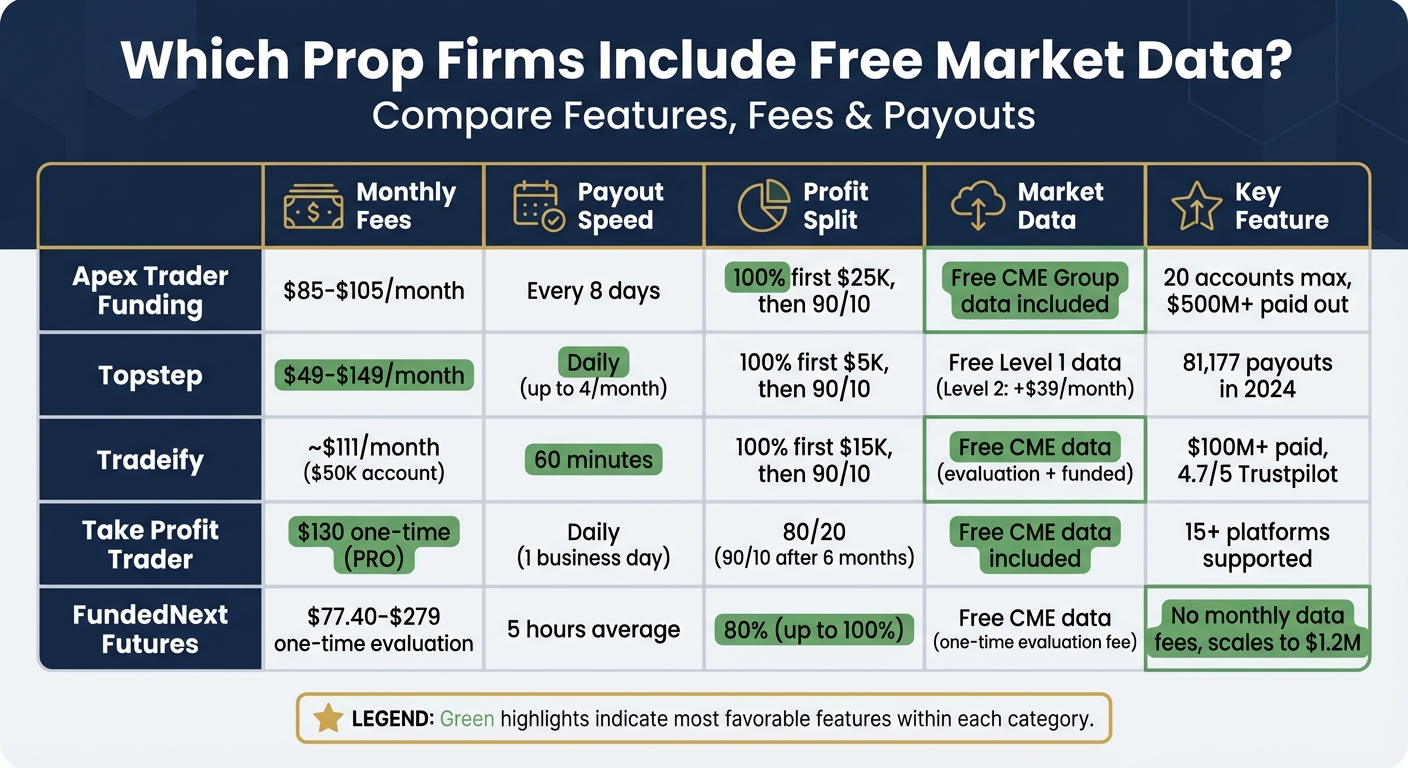

If you’re trading futures and want to avoid costly market data fees, some prop firms offer free market data as part of their services. Here’s a quick look at five firms that help traders cut down on expenses while providing essential tools and features:

- Apex Trader Funding: Includes free CME Group market data with subscriptions and offers a 100% profit split on the first $25,000. Monthly fees range from $85 to $105, and payouts are processed every 8 days.

- Topstep: Provides free Level 1 market data with Trading Combine subscriptions. Level 2 data is available for an extra $39 per month. Daily payouts are offered, but withdrawals count against your Maximum Loss Limit.

- Tradeify: Offers free market data during evaluations and funded stages. Payouts are processed within 60 minutes, and traders keep 100% of the first $15,000 in profits.

- Take Profit Trader: Includes CME data with subscriptions. Payouts are processed daily once a $2,000 profit buffer is reached. Profit splits start at 80/20 and can increase to 90/10 after six months.

- FundedNext Futures: Eliminates monthly data fees by charging a one-time evaluation fee. Payouts average just 5 hours, and profit splits begin at 80%, with potential to reach 100%.

These firms aim to reduce the financial burden of market data fees, allowing traders to focus on strategy and execution. Choose the one that aligns with your trading style, platform preferences, and payout needs.

Prop Firms with Free Market Data: Features and Fees Comparison

1. Apex Trader Funding

Free Market Data Availability

Apex Trader Funding offers real-time market data feeds included with all evaluation and funded account subscriptions at no extra cost. This data covers key CME Group futures markets, saving traders around $55 per month in data fees. The best part? It’s all bundled into your monthly subscription fee.

On top of that, you’ll also get a free NinjaTrader license – normally worth $75 per month – alongside the data feed. However, to keep access, you’ll need an active subscription. For funded accounts, the data access is included in the monthly fee: $85 for Rithmic-based plans or $105 for Tradovate-based plans.

Platform Support

Apex supports an impressive range of trading platforms, including NinjaTrader, Tradovate, TradingView, ATAS, Bookmap, Jigsaw, MotiveWave, Quantower, Sierra Chart, and Volfix.

Payout Speed

When it comes to payouts, Apex stands out with one of the fastest cycles in the industry – every 8 calendar days. Since November 2024, they’ve also allowed traders to request payouts multiple times per month. To date, the firm has paid out over $500,000,000 to its customers since 2022, a figure that speaks volumes. Their Trustpilot rating of 4.4 out of 5, based on 16,547 reviews, further highlights customer satisfaction with their payout process.

Profit Splits

Apex offers a standout profit-sharing model: you keep 100% of your first $25,000 in profits per account, followed by a 90% split on any additional earnings. This arrangement is far more generous than many competitors, who typically cap the 100% profit split at just $10,000. Plus, Apex allows you to manage up to 20 funded accounts at once, giving you the opportunity to significantly boost your earnings. To qualify for a payout, you’ll need to hit your profit goal and meet a minimum withdrawal threshold of $100.

Next, we’ll take a closer look at another top prop firm that includes free market data for its traders.

2. Topstep

Free Market Data Availability

Topstep offers free Level 1 market data with every Trading Combine subscription. If you’re looking for more detailed insights, Level 2 data is available as an optional upgrade. This enhanced data provides 5 to 10 levels of bid and ask prices and is seamlessly integrated into TopstepX through a dedicated data feed. The same feed also supports commission-free trading, giving traders a solid foundation for their strategies [3, 14].

Platform Support

Topstep’s proprietary platform, TopstepX, is packed with features designed to enhance the trading experience. It includes integrated TradingView charts, a built-in trade copier, and the Tilt Indicator, which provides real-time updates on trade progress [13, 14]. These tools, combined with the free market data, help traders make informed decisions and manage trades efficiently. Over the past 12 years, Topstep has funded futures traders and processed 81,177 payouts in 2024. The platform also offers access to popular futures contracts like the E-mini S&P 500, NASDAQ 100, Crude Oil, Gold, and Micro Bitcoin [3, 14].

Payout Speed

Topstep places a strong emphasis on fast and flexible payouts. Traders can request payouts daily, with up to four withdrawals allowed per month once eligibility criteria are met. To qualify, traders need five winning days with a minimum profit of $150 each. Withdrawals are immediately deducted from your account, ensuring uninterrupted trading. However, keep in mind that withdrawals count against your Maximum Loss Limit (MLL). On the bright side, Topstep calculates the MLL based on your end-of-day balance rather than intraday unrealized profits, offering added flexibility during volatile market sessions [13, 14].

Profit Splits

Topstep has a trader-friendly profit-sharing model. You keep 100% of your first $5,000 in profits, and anything beyond that is split 90/10 in your favor [12, 15]. Subscription pricing is straightforward: $49 per month for $50K buying power, $99 per month for $100K, and $149 per month for $150K. If you choose the Standard path, there’s a one-time $149 activation fee after passing the evaluation. Alternatively, the No Activation Fee path eliminates this fee but comes with a higher monthly subscription cost.

3. Tradeify

Free Market Data Availability

Tradeify provides free real-time market data during both the evaluation and funded stages. This includes access to CME Group exchange data (CME, CBOT, NYMEX, COMEX), which can save traders around $60 per month in fees.

Platform Support

Tradeify supports two major trading platforms: Tradovate and NinjaTrader. Both platforms come equipped with essential tools, including a built-in trade journal. If you’re using NinjaTrader, you’ll need to log into Tradovate and sign a Non-Professional Data Agreement to access the market data. Impressively, Tradeify has paid out over $100 million in verified payouts and currently supports a community of more than 60,000 traders.

Payout Speed

One of Tradeify’s standout features is its fast payout process. The firm promises automated payouts within 60 minutes. However, many traders report even faster results. For instance, Pascal Kemelong, a verified trader, shared his experience:

"Payout request approved in less than 2 minutes and money in my bank account in 10 minutes on a Saturday".

Profit Splits

Tradeify offers an attractive profit-sharing structure. Traders keep 100% of their first $15,000 in profits. After that, profits are split 90/10, with 90% going to the trader. To make things even better, the firm has done away with activation fees on its Growth and Select plans, lowering the initial costs for traders.

For a $50,000 account, monthly fees start at roughly $111 (discounted from $159), with reset fees ranging between $95 and $100. The firm’s reputation is solid, boasting a 4.7/5 rating on Trustpilot from 1,629 reviews, and an impressive 75% repeat purchase rate among its traders.

Next, let’s dive into what another prop firm brings to the table.

4. Take Profit Trader

Free Market Data Availability

Take Profit Trader includes market data as part of its subscription and activation fees for both evaluation and PRO accounts. Traders gain free access to CME futures data, which spans major exchanges like CME, CBOT, NYMEX, and COMEX. This data is delivered through CME-approved providers, including Rithmic, Tradovate, and NinjaTrader. For PRO accounts, there’s a one-time fee of $130 that covers all data and technology expenses.

Platform Support

In addition to free market data, Take Profit Trader supports more than 15 trading platforms by leveraging Rithmic and CQG data feeds. Popular platforms like NinjaTrader and Tradovate are among the supported options, ensuring orders are routed directly through CME-approved providers.

Payout Speed

With PRO accounts, traders can withdraw profits daily once they reach a $2,000 profit buffer. Payments are processed through Plaid (for U.S. bank accounts), PayPal, or Wise, and are typically completed within one business day. Trader Coleman has highlighted how immediate payouts positively impact trading performance.

Profit Splits

Take Profit Trader offers an 80/20 profit split, allowing traders to retain 80% of their earnings. For those looking to increase their share, upgrading to a PRO+ account adjusts the split to 90/10. Additionally, traders can manage up to five PRO accounts at the same time. Success rates for users range from 16.86% to 20.37%. The firm also holds a strong reputation, with a 4.4/5 rating on Trustpilot based on 7,846 reviews.

sbb-itb-46ae61d

How To Get Free Order Flow – Ninjatrader Prop / Tradeovate Prop

5. FundedNext Futures

FundedNext Futures makes a notable impression by cutting out recurring data fees and offering strong funding options for traders.

Free Market Data Availability

One of the standout features of FundedNext Futures is the elimination of monthly and activation fees for market data. Traders gain access to professional-grade CME data feeds – typically costing up to $140 per month per exchange – without any ongoing charges. Instead, a one-time evaluation fee grants access to CME, CBOT, NYMEX, and COMEX data. This fee structure helps traders avoid continuous expenses. Evaluation fees range from about $77.40 for a $25,000 account to $279.00 for a $100,000 account.

Platform Support

FundedNext Futures supports popular trading platforms like Tradovate, NinjaTrader, and TradingView. This integration enables traders to explore a variety of futures instruments, including 3 mini and 9 micro contracts on a $50,000 account, without requiring additional platform subscriptions.

Payout Speed

Payouts are processed quickly, with FundedNext Futures promising to deliver them within 24 hours – and often averaging just 5 hours. If a payout isn’t completed within the promised 24-hour window, the firm compensates traders with an extra $1,000. By early 2026, over $241.8 million has been distributed to more than 87,000 traders, with some receiving payouts in as little as 3 days.

Profit Splits

Traders start with an 80% profit split, with the potential to reach 100% through specific account models. During the Challenge Phase, an additional 15% performance reward is included. Account sizes range from $25,000 to $100,000, with scaling options that can go up to $1.2 million. FundedNext Futures has earned strong reviews, holding a 4.8/5.0 rating on Trustpilot from 3,923 reviews and a 4.6/5.0 rating on FXVerify. These features highlight the firm’s commitment to reducing costs and rewarding performance effectively.

Pros and Cons

When it comes to market data inclusion, payout structures, and trading flexibility, each proprietary trading firm has its own set of advantages and trade-offs. Below is a summary of what you can expect from some of the most popular firms.

Apex Trader Funding stands out with 14 platform options and allows traders to retain 100% of their first $25,000 in profits. However, payouts are processed on an 8-day cycle, which may not suit everyone’s needs.

Topstep offers free Level 1 data through its TopstepX platform and impresses with daily payouts, often completed within seven hours of a request. On the downside, professional data fees can reach up to $560 per month for trading across all four CME exchanges, and advanced data features require an additional $39 monthly fee.

Tradeify and Take Profit Trader both provide daily payouts, but their requirements differ. Tradeify does not enforce minimum trading days, while Take Profit Trader requires at least five. Take Profit Trader starts with an 80/20 profit split, which increases to 90/10 after six months, whereas Tradeify maintains a steady 90/10 split from the outset.

FundedNext Futures takes a different approach by eliminating monthly data fees, instead charging a one-time evaluation fee ranging from $77.40 to $279.00. Payouts are processed quickly, averaging five hours, and they even offer a $1,000 bonus if payouts are delayed beyond 24 hours.

| Prop Firm | Key Strengths | Notable Limitations |

|---|---|---|

| Apex Trader Funding | 14 platform options; 100% of first $25k profits; no daily loss limits | Payout cycle every 8 days; $1,000 minimum withdrawal |

| Topstep | Daily payouts in ~7 hours; 81,177 payouts in 2024; strong education resources | Professional data fees up to $560/month; $39/month for advanced data |

| Tradeify | Daily payouts; no minimum trading days; 90/10 split | Limited account scaling |

| Take Profit Trader | Daily payouts; profit split increases to 90/10 after 6 months | 80/20 starting profit split; 5-day minimum trading requirement |

| FundedNext Futures | No monthly data fees; 5-hour average payout; scales to $1.2M | One-time evaluation fee required upfront |

With these details, you can better evaluate which firm aligns with your trading goals and preferences. Each offers a unique blend of features and limitations tailored to different trading styles.

Conclusion

Choosing a prop firm with free market data that aligns with your trading style is crucial. Here’s a quick breakdown of what each firm offers to help you make an informed decision.

If you’re just starting out, Topstep might be the right fit. Their TopstepX platform combines integrated data feeds, TradingView charts, and a supportive community. Plus, Topstep’s solid track record in funding adds to its appeal for beginners.

For more seasoned traders, Apex Trader Funding stands out. With the ability to manage up to 20 accounts simultaneously, funding of up to $1.5 million, and 100% of the first $25,000 in profits – all without daily loss limits – it’s tailored for those ready to scale their trading.

Need quick access to your earnings? Take Profit Trader allows profit withdrawals starting from Day 1, making it an attractive option for traders looking for fast payouts.

By removing market data fees, these firms let you focus entirely on perfecting your strategy without added expenses. Before committing, take a close look at their fee structures, payout policies, and platform compatibility to ensure they meet your needs.

Whether you prioritize educational resources, scalability, or immediate earnings, there’s a firm that aligns with your trading goals. Take the time to evaluate their offerings carefully and find the one that fits your approach.

FAQs

What are the benefits of choosing a prop firm that offers free market data?

Choosing a proprietary trading firm that offers free market data can be a game-changer for traders. For starters, it eliminates the need to shell out money for expensive market data subscriptions, which can quickly eat into profits over time. This cost-saving perk allows traders to allocate their resources more effectively.

Another big advantage is having access to real-time market data at no extra cost. With up-to-the-minute information, traders can make quicker, more informed decisions – an essential edge in fast-moving markets.

For those trading futures, free market data removes some of the financial barriers that might otherwise make entry more challenging. It lets traders focus on sharpening their strategies and improving performance without the added stress of extra expenses. This is particularly helpful for beginners or anyone aiming to boost their profitability.

What are the profit splits offered by prop firms with free market data?

Profit-sharing arrangements differ widely across prop firms and depend on the funding program you select. Typically, firms allocate a percentage of the trader’s net profits, with splits starting around 50% for beginner-level accounts and going up to 90% for top-tier or high-performance accounts.

Traders who achieve higher performance benchmarks or manage larger account sizes are usually rewarded with a bigger share of the profits. In contrast, entry-level accounts often offer smaller profit splits, which align with the lower risk and commitment required. It’s essential to carefully review the terms of each firm to ensure they align with your trading objectives.

Which prop firm has the quickest payout process?

FundedNext Futures stands out for its swift payout process. Once approved, traders can have their payments processed and in their hands within 24 hours, offering a smooth and efficient way to access their earnings without delay.