Day Trading

Explore Prop Firms

The Difference Between Smart Aggression and Pure Recklessness

Learn how disciplined, volatility-adjusted position sizing and dynamic drawdown rules separate smart aggression from reckless trading in futures prop firms.

Risk-to-Reward Lies Traders Tell Themselves

Stop chasing arbitrary R:R targets – align win rate, position sizing, and drawdown limits to survive prop-firm challenges.

Why Stop Loss Distance Matters More Than Entry Precision

Why stop loss distance matters more than entry precision: it sets position size, controls dollar risk, and keeps you compliant with prop-firm drawdown rules.

Why Trading More Contracts Makes You Less Profitable

Bigger futures positions multiply losses, trigger emotional trading, and risk prop-firm rules—use proper position sizing and fixed risk to protect your account.

Trailing Drawdown Math Explained for Futures Prop Traders

How trailing drawdowns work in futures prop accounts, how they’re calculated with intraday equity, and practical tips to avoid unexpected liquidation.

How to Size ES Trades Like a Professional (Not a Gambler)

Step-by-step guide to sizing ES/MES trades: calculate contracts, use ATR-based volatility, follow prop firm limits, and keep risk under 1% per trade.

Risk Management (This Is Where Most Traders Die)

Risk rules for futures prop traders: position sizing, pre-set stop-losses, daily limits, 1:2 risk-to-reward, and firm-specific limits to protect capital.

Why Simplicity Beats Indicators in Nasdaq Futures

Simplicity beats indicators in Nasdaq futures: trade price action, VWAP, volume and key levels to act faster, cut losses, and meet prop firm rules.

How to Trade NQ Pullbacks Without Chasing Like an Idiot

Rule-based NQ pullback guide: identify trend with 20 EMA/VWAP, wait for Fibonacci or MA retracements, enter on price-action confirmation, and control risk.

Mean Reversion on ES: When It Works and When It Will Ruin You

Mean reversion on ES wins in range-bound, low-volatility markets — but in trends or volatility spikes it can wipe funded accounts without strict risk controls.

Why Most Traders Fail NQ Breakouts and How to Trade Them Properly

Why 87% of NQ breakout trades fail — learn a 3-step method to confirm breakouts, use ATR stops, size positions, and meet prop-firm rules.

Daily Loss Limits Explained for Beginners

Clear explanation of daily loss limits, static vs trailing rules, reset times, and practical tips to manage risk and protect trading capital.

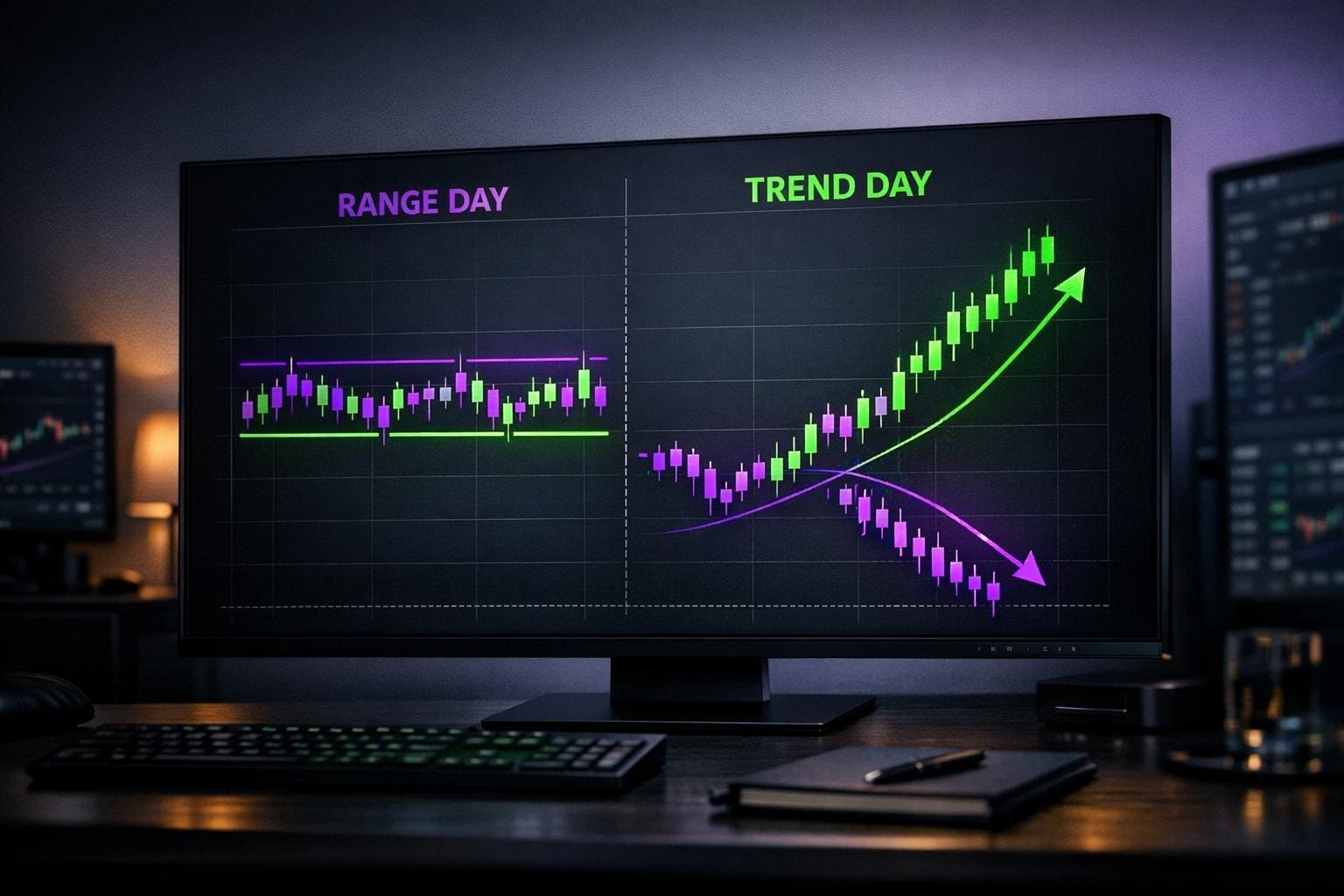

Range Days vs Trend Days on ES: How to Identify Them Before You Lose Money

Mistaking a trend day for a range day destroys profits—use ATR, pre-market volume and opening range to know before the bell.

How I Trade the First 90 Minutes of NQ Without Getting Chop-Killed

Practical NQ (Nasdaq-100) plan for the first 90 minutes: pre-market prep, opening range setups, position sizing, risk rules, and chop filters.

The Only 3 Intraday Market Structures That Matter on NQ

Master three intraday NQ structures—mid pivot, upper rotation, lower support—and trade Nasdaq futures with VWAP/volume confirmation and funded-account risk rules.

Lucid Trading Explained: Why This Futures Prop Firm Is Gaining Serious Momentum in 2026

Lucid Trading is gaining serious momentum in 2026 because it fixes the biggest problems traders face with prop firms. Instead of intraday trailing drawdown and bloated rule sets, Lucid focuses on end-of-day drawdown, fast payouts, and clean account structures that reduce execution stress. Traders can choose between evaluation-style accounts, flexible…

ES vs NQ Day Trading: Which One Actually Fits Your Psychology

Compare ES and NQ futures by volatility, liquidity, strategies, and trader psychology to find which contract matches your risk tolerance.

Top 5 Lessons from Failed Funded Accounts

Most funded trading accounts fail because traders break rules, mismanage risk, trade emotionally, overtrade, or refuse to adapt.

Why Nasdaq (NQ) Punishes Overtraders Faster Than Any Other Contract

NQ futures’ high leverage and volatility punish overtraders. Learn position sizing, stop-loss rules and discipline to avoid prop-firm breaches.

Core Strategy & Execution (NQ / ES Specific)

Rules-based strategies and execution for trading NQ (Nasdaq‑100) and ES (S&P 500) futures, covering session timing, micro contracts, risk controls, and order types.

Rithmic Setup for Prop Firms

Step-by-step Rithmic setup for prop firms: get credentials, install R|Trader Pro, enable plugin bridging, connect to NinjaTrader/Quantower, and troubleshoot issues.

Prop Firm Risk Rules: Adapting to Market Volatility

Adapt position sizing, set personal loss caps, and use compliance tools to avoid breaching prop firm drawdown and daily-loss rules during volatile markets.

MNQ Tick Value: Micro E-mini Futures Contract Specs

MNQ contract breakdown: 0.25 tick size, $0.50 tick value, $2 multiplier, trading hours, margins, and why traders use MNQ for precise risk and prop-firm evaluations.

Beginner Prop Firms with Instant Funding Options

Compare five beginner-friendly futures prop firms that offer instant funding, low fees, simple rules, and fast payouts.

Platform Fees vs. Data Feed Fees: Key Differences

Compare platform vs data feed fees for futures traders—what they cover, typical monthly costs, who charges them, and ways to reduce recurring expenses.

How Volume Profile Reveals Hidden Support Zones

Volume Profile reveals support hidden inside consolidation ranges by mapping traded volume—use HVNs, POC and VAL to place data-driven entries, stops, and manage futures risk.

Trade Copier Latency: Causes and Fixes

Identify and fix trade copier latency: network, hardware, software, and broker solutions to reduce slippage and sync multiple funded accounts.

Ultimate Guide to Trading Psychology in Risk Management

Manage fear, greed, and overconfidence in futures trading with rules, routines, stop-losses, journals and prop-firm alignment for consistent risk control.

Volume Profile vs Price Action: Key Differences

Compare Volume Profile and Price Action to learn how each method reads markets, their strengths and limits, and when to use or combine them for better trades.

Risk-Reward Ratio vs. Win Rate: Key Differences

Strong risk-reward ratios can offset low win rates; learn how to calculate break-even win rates, expected value, and balance metrics for consistent trading.

Best Prop Firms for Futures Trading: 2025 Review

Compare top futures prop firms’ profit splits, evaluation rules, payouts and support to find the best fit for your trading style.

How to Meet Trading Objectives During Evaluations

Pass prop firm evaluations by prioritizing risk management, consistency, demo testing, and a written trading plan to protect capital and meet targets.

What Is Trade Copying in Futures Prop Trading?

Automated trade copying mirrors trades across multiple futures prop accounts for fast execution while demanding strict position sizing and drawdown limits.

Top 5 Trade Copying Platforms for Futures Traders

Compare five leading copy-trading platforms for futures—execution speed, prop-firm compatibility, platform support and pricing for scalpers, algos, and retail traders.

Funded Account Checklist: 10 Steps Before Trading

Prepare for success in funded trading accounts with this essential checklist that covers rules, risk management, and platform setup.

Futures Contract Size Converter

Convert futures contract sizes instantly! From S&P 500 E-mini to Gold, switch between full, mini, or micro units with our simple trading tool.

Futures Trading Profit Calculator

Calculate your futures trading profits or losses instantly with our free tool. Enter contract size, entry/exit prices, and see detailed results!

Nasdaq Futures Risk Management Planner

Plan your futures trading risk with our free tool! Input account size and risk percentage to get tailored position sizing. Trade smarter today!

How Many Trading Days Are In A Month?

U.S. stock markets average 20–22 trading days per month, but holidays and weekends change that count. This guide breaks down the 2026 trading calendar, explains how trading days impact futures traders and prop firm evaluations, and shows how rules like Daily Loss Limits and Consistency Requirements help build discipline and…

How Much Money Do You Need to Day Trade (No PDT Rule Required)

Wondering how much money you really need to start day trading? In this guide, we break down daily profit goals, account types, and the updated Pattern Day Trader (PDT) rule—now shifting from a fixed $25,000 minimum to a flexible intraday margin requirement by 2026. Learn how leverage, cash vs. margin…

How Many Trading Days In a Year 2025, 2026, 2027

U.S. stock markets operate roughly 250 to 252 trading days per year, depending on how weekends and federal holidays fall. Each year, the NYSE and Nasdaq close for select market holidays, leaving around 250 active trading sessions where investors and futures traders can participate. This guide breaks down the exact…