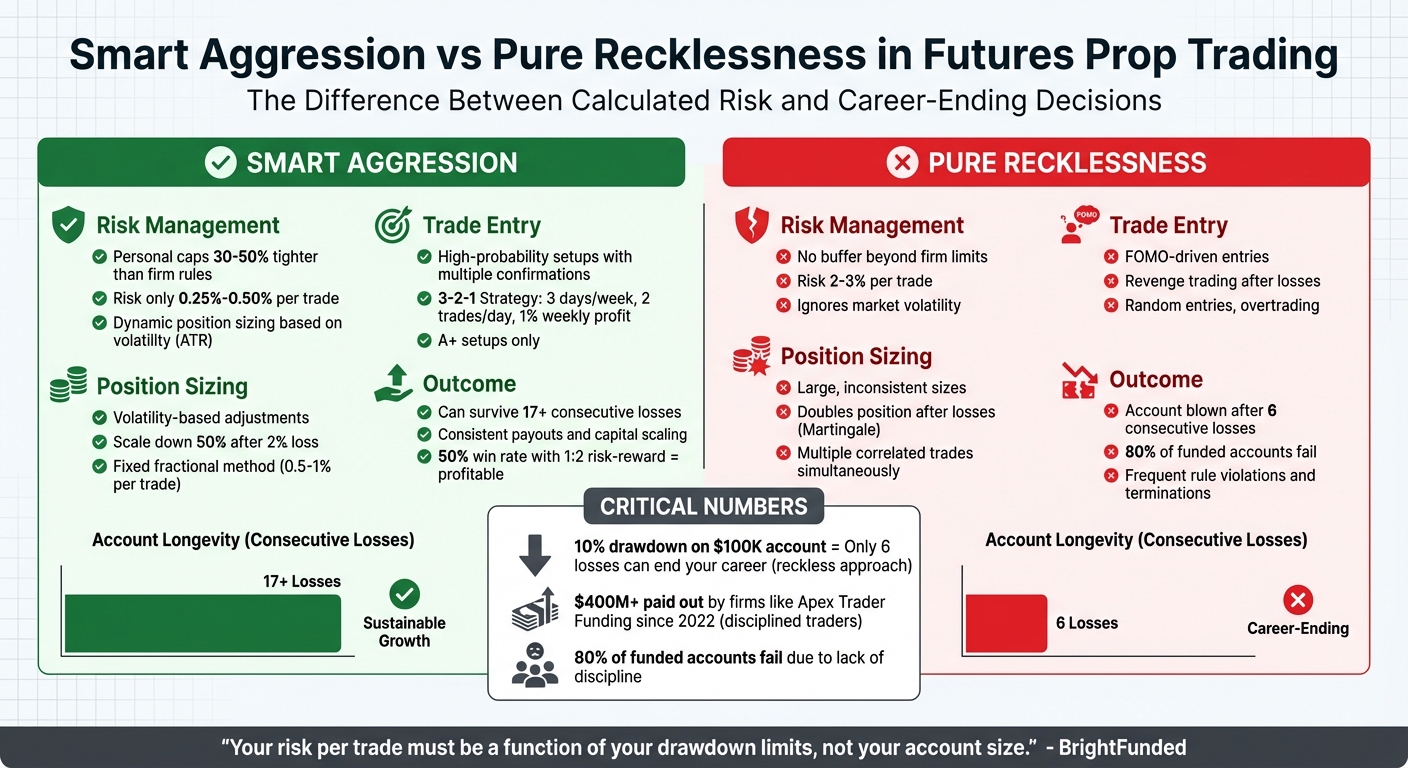

In futures prop trading, the thin line between smart aggression and pure recklessness can make or break your career. Smart aggression is about calculated risks: respecting drawdown limits, using leverage wisely, and focusing on long-term growth. Pure recklessness, however, stems from emotional decisions like revenge trading, oversized positions, and ignoring rules – leading to rapid account termination.

Here’s the key takeaway:

- Smart aggression involves disciplined strategies, such as risking only 0.25%-0.50% per trade, factoring in market volatility, and prioritizing survival over quick gains.

- Recklessness often results in overtrading, ignoring safeguards, and breaching firm-imposed rules, with 80% of funded accounts failing due to lack of discipline.

The stakes are high. For example, a 10% drawdown on a $100,000 account means just six consecutive losses could end your trading journey. Success lies in structured approaches like dynamic risk management, scaling down during losses, and focusing on high-probability setups. Tools like the 3-2-1 Strategy (trading three days a week, two trades per day, aiming for 1% weekly profit) can help maintain discipline.

Ultimately, smart aggression ensures consistent performance and longevity, while recklessness leads to frequent failures. The choice is yours: trade with structure or risk it all.

Smart Aggression vs Pure Recklessness in Futures Prop Trading

Risk Management Protocol for Futures Prop Firms

Smart Aggression vs. Pure Recklessness: Key Differences

Building on the earlier discussion about risk limits, let’s dive into how smart aggression and recklessness differ in trading. Both involve taking action, but the mindset, approach, and outcomes couldn’t be more distinct.

The key difference lies in how traders manage risk. Smart aggression operates within a structured framework. Traders using this approach set personal loss limits that are 30–50% tighter than their firm’s rules, risk just 0.25%–0.50% of their account per trade, and factor in market volatility with tools like the Average True Range (ATR). It’s a calculated, disciplined strategy designed to protect capital and maximize returns over time.

Reckless traders, on the other hand, disregard these safeguards. Instead of creating a buffer below firm-imposed limits, they risk the full allowance – and sometimes more. They make impulsive decisions, such as risking 3% of their capital to recover a 1% loss, and fail to consider market volatility when sizing their trades. Their entries often stem from emotions like FOMO (fear of missing out), boredom, or frustration, rather than high-probability setups.

"Your risk per trade must be a function of your drawdown limits, not your account size." – BrightFunded

Here’s a side-by-side comparison of these two approaches in futures prop trading:

| Criteria | Smart Aggression | Pure Recklessness |

|---|---|---|

| Risk Management | Personal caps 30–50% tighter than firm rules | No buffer beyond firm limits |

| Trade Entry | High-probability setups with multiple confirmations | Random entries, revenge trading, or overtrading |

| Position Sizing | 0.25%–0.50% per trade; volatility-based | Large, inconsistent sizes; increased after losses |

| Drawdown Focus | Protects the high-water mark and unrealized gains | Ignores how open profits adjust trailing drawdown levels |

| Outcome Metrics | Consistent payouts and capital scaling | Frequent account terminations and rule violations |

This comparison highlights the disciplined nature of smart aggression, which prioritizes long-term success over short-term emotional reactions. The results speak for themselves. For example, firms like Apex Trader Funding have paid out over $400 million since 2022, rewarding traders who stick to disciplined strategies. It’s not about raw talent or market expertise – it’s about maintaining discipline and following a structured plan.

1. Smart Aggression in Futures Prop Trading

Smart aggression is all about trading with precision and discipline. It’s not just about taking risks but doing so within a structured framework that protects your capital while setting you up for steady payouts.

Risk Management

Think of your account balance as more than just a number – it’s your lifeline. Instead of treating the entire balance as tradable capital, focus on your maximum drawdown limit. For example, if you’re trading a $100,000 account with a 10% drawdown rule, your priority is to safeguard the $10,000 at risk. A smart move? Reduce your position size by 50% if you hit a 2% loss. This approach gives you room to recover without wiping out your account.

A Progressive Drawdown Recovery Plan can help you bounce back when market conditions improve, ensuring you stay in the game without unnecessary risks.

Trade Entry Criteria

Smart aggressive traders don’t jump on every price movement – they wait for the right moment. These traders focus on "A+ setups" backed by multiple technical indicators, like support and resistance zones combined with tools such as RSI or Bollinger Bands.

To stay disciplined, many use the 3-2-1 Strategy:

- Trade only 3 days per week.

- Limit yourself to 2 trades per day.

- Aim for a modest 1% weekly profit.

Before entering any trade, set clear exit parameters. Your stop-loss and take-profit levels should align with a solid risk-to-reward ratio – ideally 1:2 or 1:3. This ensures every trade is backed by logic and not impulsive decisions.

Position Sizing

Position sizing is where smart aggression really shines. The fixed fractional method is a go-to strategy: risk only 0.5% to 1% of your account equity per trade. But there’s more – volatility-based sizing, using the Average True Range (ATR), adjusts your position size based on market conditions. When markets are more volatile and stop-loss distances increase, your position size decreases to maintain a consistent dollar risk. Whether it’s a calm trading session or a high-impact news event, a $500 risk remains $500.

This kind of precision ensures your risk stays manageable, no matter the market environment.

Outcome Metrics

The real measure of success lies in your cumulative performance. With a 1:2 risk-to-reward ratio, you can afford to lose 60% of your trades and still come out ahead. For seasoned traders, a pass rate of around 50% is often achievable. This isn’t about winning every trade – it’s about sticking to a disciplined strategy that delivers results over time.

2. Pure Recklessness in Futures Prop Trading

Recklessness in trading is the opposite of discipline – it happens when emotions take control and push aside a structured, thoughtful approach. Instead of safeguarding their accounts, reckless traders often amplify their losses, risking violations of key trading rules.

Risk Management

Reckless traders tend to ignore fundamental risk management principles. They treat their entire account balance as if it’s all fair game for trading, which leaves no room for mistakes. These traders might widen or completely remove stop-losses during a trade or even double their position size after losing, relying solely on firm-imposed drawdown limits to stop them.

"Most funded traders lose their account through overtrading, not lack of skill." – PropFirmCodes

When losses occur, these traders often jump back into the market immediately, driven by frustration rather than a calculated strategy.

Trade Entry Criteria

Reckless trading is marked by a lack of planning and is often fueled by FOMO (fear of missing out) or emotional impulses. After a losing trade, some traders engage in "rage clicking", entering positions without waiting for proper technical confirmation. Others may open a flurry of trades – 20, 50, or even more – in rapid succession. A common pitfall is "outsourced thinking", where traders blindly follow signals from Telegram or Discord channels without understanding the market context or rationale behind the trades.

Position Sizing

Position sizing is another area where recklessness shows up. Some traders double their position sizes after losses or overleverage across correlated trades, quickly exhausting their drawdown limits. They might also fail to adjust for market conditions, trading the same size during high-volatility news events as they would during calmer periods. Another frequent mistake is holding multiple highly correlated trades simultaneously. For instance, holding positions in ES, NQ, and YM at the same time effectively triples exposure. If the market moves against them, losses can snowball rapidly.

| Risk per Trade (Reckless Behavior Focus) | Consecutive Losses to Blow Account | Mentality |

|---|---|---|

| 2% | 6 Losses | Reckless / Gambling |

| 1% | 11 Losses | Standard Professional |

| Dynamic (Reducing after loss) | 17+ Losses | Smart Aggression / Professional |

Outcome Metrics

The predictable result of reckless trading? Violations of trailing drawdown limits, daily loss thresholds, and ultimately, losing access to payouts. Trailing drawdowns are particularly unforgiving – they move up with your highest equity (including unrealized gains) but don’t adjust downward when your equity falls. This means impulsively giving back profits can cause an account to close even if your balance stays above the initial starting point.

"If you think that profit is the most important thing in trading, you are wrong. Risk management is." – FunderPro

Discipline is critical: around 80% of funded accounts fail because traders lack it.

sbb-itb-46ae61d

How to Apply Smart Aggression in Futures Prop Trading

Smart aggression in trading is all about focusing on quality rather than quantity. Before making any move, ask yourself four critical questions: What has the market done? What is it trying to do? How well is it doing? And what is most likely to happen next? These questions help you base your decisions on market trends rather than emotions. Start by analyzing broader trends using 1-hour or 30-minute charts, then zoom in to a 5-minute chart for pinpoint execution. Once you’re in a trade, set up OCO (Order Cancels Order) brackets to automate your stop-loss and target levels. This approach minimizes emotional decision-making. Regularly journaling your trades is another key habit – it helps you confirm whether your aggressive setups are delivering the results you expect. This entire process directly influences how you size and scale your trades.

When it comes to position sizing, flexibility is key. Risk only 0.5%–1% of your account on each trade, adjusting your contract sizes to match market volatility. In highly volatile conditions, reduce your position size to manage risk. On the other hand, scale into winning trades, but only after the market confirms your initial analysis.

"My best days aren’t the days that the market’s busy. It’s the days that I’m in rhythm with the market. Focus on getting in rhythm." – Anthony Crudele, Host, Futures Radio Podcast

This perspective highlights the importance of aligning your actions with the market’s flow, reinforcing disciplined entries and exits.

In addition to refining your risk management and entry strategies, firm-specific rules also play a significant role in shaping smart aggression. For instance, Apex Trader Funding enforces a 30% Profit Rule, which means no single trading day can account for more than 30% of your total profits in a Paid Performance account. In a standard $50,000 Apex Trader Funding account, the trailing threshold is set at $2,500. To stay compliant, you can use tools like the DamnPropFirms Consistency Rule Calculator, which helps ensure that one aggressive trading day doesn’t jeopardize your payouts. Another rule to be mindful of is the limit on "flipping" trades – small, repetitive trades made just to log activity. These should account for less than 20% of your total trading days. By following these guidelines, you can channel smart aggression into a disciplined and consistent trading strategy.

Pros and Cons

The table below highlights how trading outcomes differ when comparing smart aggression to pure recklessness.

| Feature | Smart Aggression | Pure Recklessness |

|---|---|---|

| Risk Sizing | Adjusts dynamically based on recent performance | Fixed high percentage or increases after losses (Martingale) |

| Account Longevity | Can endure up to 17+ consecutive losses | Typically collapses after 6–11 consecutive losses |

| Profitability | Builds gains during winning streaks while protecting capital during losing streaks | High potential gains, but rapid depletion of account balance |

| Compliance with Prop Firm Rules | Effectively manages drawdown limits | Often breaches daily or total drawdown limits due to lack of adjustments |

| Execution Strategy | Employs market orders strategically to capture volatility | Impulsive entries, ignoring slippage and spread costs |

| Trading Psychology | Follows a disciplined, pre-defined scaling plan | Driven by emotions, often resorting to "revenge trading" to recover losses |

| Capital Efficiency | Controls large positions with minimal margin (e.g., $100,000 position using $5,000 margin) | Overleverages without considering the notional value of contracts |

| Response to Losses | Gradually reduces risk (e.g., from 2% to 1%, then 0.5%) | Increases risk or doubles down to recover losses |

This comparison emphasizes the critical role of disciplined, adaptive risk management in futures prop trading.

Smart aggression allows traders to act decisively during periods of high volatility while extending their trading lifespan through dynamic risk adjustments. It’s a strategy designed to seize opportunities without jeopardizing long-term survival. On the flip side, recklessness often results in rapid account failure. In fact, 80% of funded accounts fail, not because traders lack technical skills, but due to poor discipline and overtrading.

That said, even smart aggression has its challenges. With a calculated 2% risk per trade, traders can only afford 6 consecutive losses under a prop firm’s 10% drawdown limit. This narrow margin for error can create significant psychological pressure. Recklessness, however, offers no meaningful benefits – it’s a surefire way to breach drawdown limits and deplete your account quickly.

To minimize risks while using smart aggression, adopt dynamic risk management. By progressively reducing risk after each loss, you can significantly extend your trading lifespan – potentially surviving up to 17 consecutive losses compared to just 6 with a fixed 2% risk approach. Tools like the DamnPropFirms Consistency Rule Calculator can help you stay compliant and maintain consistency in your trading strategy.

Conclusion

The difference between smart aggression and recklessness boils down to one key element: structure. Smart aggression involves taking calculated risks, staying within your prop firm’s drawdown limits, adjusting your position sizes based on market conditions, and scaling back during losing streaks. Recklessness, on the other hand, ignores these safeguards, leads to revenge trading, and treats every market condition as an excuse to go all-in.

The ability to manage risk dynamically is what sets successful traders apart. This approach can significantly extend your trading career compared to rigid, fixed-risk methods. The foundation of this strategy is discipline.

To maintain funding and grow your account, focus on dynamic position sizing. Start by risking 1–2% per trade, but when losses occur, scale down to 0.5% or even 0.25%. Tools like the DamnPropFirms Consistency Rule Calculator can help you meet firm requirements without increasing risk unnecessarily.

It’s essential to align your trading aggression with the specific rules of your prop firm. Whether dealing with a trailing drawdown model or a consistency requirement, firms such as Apex Trader Funding and TickTickTrader reward traders who demonstrate steady, calculated performance over time. Success in this space isn’t about hitting massive trades – it’s about staying in the game long enough to let your edge work in your favor.

FAQs

How can traders use smart aggression effectively in futures trading?

Smart aggression in trading is all about taking calculated risks, grounded in a disciplined and structured approach – not impulsive moves. Start by creating a solid trade setup plan. This means narrowing your focus to just a few key futures contracts and clearly defining your entry points, stop-loss levels, and profit targets. The key is to stick to these rules with unwavering consistency. At the same time, practice strict position sizing by risking only a small fraction of your account on each trade – usually between 0.1% and 0.5%. This approach safeguards your capital while still leaving room for potential gains.

Equally important is adhering to your prop firm’s risk guidelines. Respect the daily and overall drawdown limits, use scaling rules to grow your account steadily, and avoid the temptation to chase after big, one-off profits. Instead, aim for consistent performance over time. A great way to reinforce this mindset is by keeping a detailed trading journal, which helps you track your progress and refine your strategies. By combining precise planning, disciplined risk management, and a long-term focus, traders can unlock their potential while staying aligned with firm rules.

How can traders avoid reckless decisions and focus on smart aggression?

To make informed decisions, traders should approach every trade as a calculated risk, not a gamble. Begin with a solid trading plan that clearly outlines the markets you’ll focus on, the setups you’ll rely on, and the specific rules for entering and exiting trades. Stick to this plan – chasing random trades often leads to poor outcomes and unnecessary losses.

Equally important is proper position sizing. Limit your risk to 0.1% to 0.5% of your account per trade, and only consider increasing this amount after achieving consistent success. If you hit a losing streak, reduce your position size to safeguard your capital and ensure you can stay in the game for the long haul.

Another critical safeguard is respecting your firm’s drawdown and leverage rules. Trailing drawdowns only move upward, so avoid overexposing yourself to prevent account closure. Leverage should be used carefully – align it with your risk tolerance and ensure that market fluctuations don’t jeopardize your margin.

Above all, maintain a disciplined mindset. Focus on preserving your capital and striving for consistent results rather than chasing quick profits. When these strategies are combined, traders can achieve a balance of smart aggression while steering clear of reckless behavior.

How does emotional control help traders balance smart aggression and avoid recklessness?

Emotional control plays a crucial role in striking the right balance between smart aggression – taking calculated risks to optimize returns – and avoiding recklessness, which often arises from impulsive decisions fueled by fear or greed. Staying calm allows traders to stick to their plans, manage position sizes wisely, and respect risk limits. This prevents the pitfalls of chasing losses or overcommitting to high-risk trades.

In a prop trading setting, where significant capital is on the line, maintaining emotional discipline becomes even more essential. Tools like stop-loss orders, trade limits, and automated risk management systems can help traders stay grounded, turning volatile market movements into carefully planned strategies. By mastering emotional control, traders can achieve greater consistency and steer clear of the reckless decisions that lead to avoidable losses.