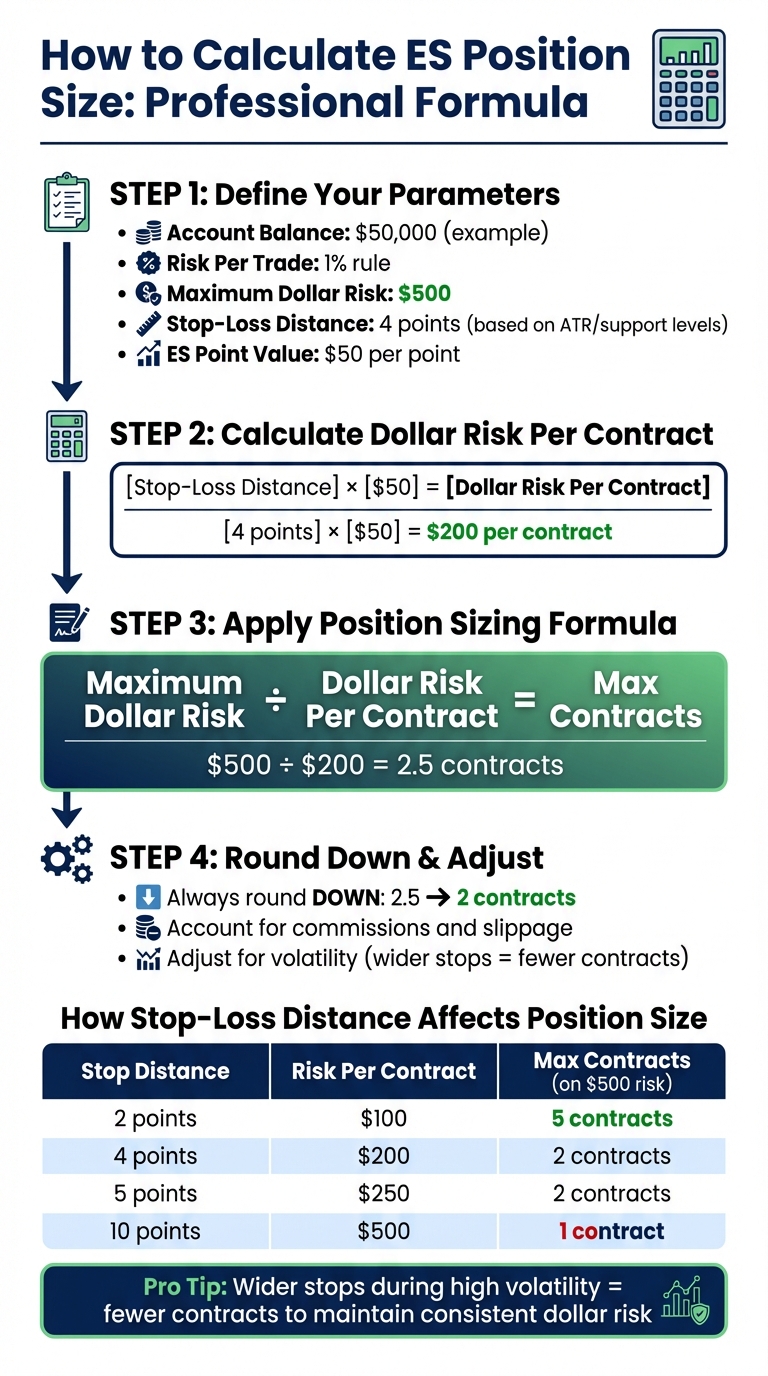

Most traders fail not because of bad strategies but because they risk too much per trade. Professionals keep their risk low – usually 1% or less of their account – while amateurs gamble with oversized positions. Here’s how to size trades like a pro:

- Risk Management First: Limit each trade to 1% of your account. For a $50,000 account, that’s $500 max.

- Use a Formula: Divide your risk by the dollar amount at stake per contract (based on stop-loss distance). Example: $500 risk ÷ $200 per contract = 2 contracts.

- Adjust for Volatility: Wider stop-losses mean fewer contracts. Use tools like ATR to calculate volatility and refine your position size.

- Prop Firm Rules: Follow strict limits like daily drawdowns (e.g., 2%) and max contracts. Breaking these ends your account.

Trading ES futures without proper sizing is a fast track to losses. Stick to these steps to control risk and trade consistently.

ES Futures and Position Sizing Basics

What Position Sizing Is and Why It Matters

Position sizing is all about deciding how many contracts to trade for each setup. It doesn’t tell you when to enter or exit a trade – it’s entirely focused on controlling your potential loss. Ali Moin-Afshari, CEO of Advanced Technical Methods, Inc., explains it perfectly:

"Position sizing is the component responsible for the variability of trading results. Two traders can trade the same instrument using the exact same entries and exits but implement different position sizing methods. The difference in their results will be significant."

Here’s why it’s so important: A 50% loss on your account means you’ll need a 100% gain just to get back to where you started. That’s why professional traders stick to risking only 0.5% to 1% of their account per trade. This approach helps limit losses, keeps your emotions in check, and ensures you stay within the drawdown limits of proprietary trading firms. Without a disciplined position sizing strategy, leverage can quickly become a double-edged sword, cutting into your account.

Once you grasp the basics of position sizing, the next step is understanding the specifics of ES and MES contracts to apply these techniques effectively.

ES and MES Contract Specifications

The E-mini S&P 500 (ES) and Micro E-mini (MES) are the go-to contracts for traders looking to gain exposure to the S&P 500 index. Knowing their key specifications is essential for precise position sizing.

| Feature | ES (E-mini S&P 500) | MES (Micro E-mini S&P 500) |

|---|---|---|

| Contract Multiplier | $50 per index point | $5 per index point |

| Tick Size (in points) | 0.25 index points | 0.25 index points |

| Tick Value | $12.50 | $1.25 |

| Contract Ratio | 1 ES = 10 MES | 1 MES = 0.1 ES |

As of late 2025, the initial margin for trading an ES contract is $15,344, with a maintenance margin of $14,697. That said, many brokers and prop firms offer intraday margins as low as $500 for ES or $50 for MES. While these lower margins make it easier to access leverage, they also amplify the need for careful position sizing. ES is one of the most liquid futures contracts in the world, often trading over 1.2 million contracts daily during active sessions.

Mastering these details is critical to managing the risks that come with leverage.

How Leverage Increases Risk and Reward

Leverage can be a powerful tool, but it cuts both ways – it amplifies both your gains and your losses. For example, a 10-point move in the ES contract translates to $500. That’s the full value of a $500 intraday margin. Without proper position sizing, a single bad trade could wipe out your margin entirely.

StoneX provides a key insight into this:

"Position sizing is 100 percent controllable. Although the futures markets are often unstable in nature, the implementation of leverage need not be."

Your position size determines how much leverage you’re actually using. For instance, trading one ES contract on a $10,000 account keeps your risk manageable. But trading ten contracts on the same balance? That’s a recipe for disaster. A disciplined approach to sizing is essential, especially if you want to protect your account during volatile market swings – a must for anyone trading with a funded prop firm account.

How to Calculate Position Sizing and Risk Per Trade

How to Calculate ES Position Size Step-by-Step

ES Futures Position Sizing Calculator: 4-Step Professional Risk Management Formula

Define Your Key Sizing Parameters

Before stepping into a trade, you need to establish a few critical numbers: account balance, maximum risk per trade, stop-loss distance, and dollar risk per contract.

Start by identifying your account balance. For instance, if you’re managing a $50,000 funded account, that’s your baseline. Next, figure out how much you’re comfortable losing on a single trade. Many experienced traders stick to the 1% rule – risking no more than 1% of their total account equity per trade. For a $50,000 account, this equates to $500.

Your stop-loss distance isn’t a random guess; it’s based on your trade setup. Use tools like support and resistance levels or the Average True Range (ATR) to determine this. Let’s say your strategy calls for a 4-point stop on the ES (E-mini S&P 500 Futures); that’s the number you use. Finally, calculate the dollar risk per contract by multiplying the stop-loss distance by $50 (the ES point value). For a 4-point stop, your risk per contract would be $200.

As market analyst Kathy Lien wisely advises:

"The number one goal of trading isn’t to make money fast; it’s to stay in the game."

Once you’ve nailed down these parameters, you can use them to calculate your position size.

The Position Sizing Formula

The formula for position sizing is simple: Maximum capital at risk ÷ dollar risk per contract = max contracts. Let’s break it down with an example using a $100,000 account, 1% risk, and a 2-point stop.

- Maximum dollar risk: $1,000 ($100,000 × 1%)

- Dollar risk per contract: $100 (2 points × $50)

- Max contracts: $1,000 ÷ $100 = 10 ES contracts

If your stop widens to 4 points, your dollar risk per contract doubles to $200, reducing your position size to 5 contracts.

Here’s how different scenarios might play out:

| Risk % | Max Dollar Risk | Stop Distance (Points) | Dollar Risk/Contract ($50/pt) | Max ES Contracts |

|---|---|---|---|---|

| 1% | $1,000 | 2 Points | $100 | 10 |

| 1% | $1,000 | 4 Points | $200 | 5 |

| 2% | $2,000 | 2 Points | $100 | 20 |

| 2% | $2,000 | 5 Points | $250 | 8 |

These calculations ensure you’re not overexposing your account to unpredictable market swings.

If your calculation results in a fractional number, like 18.75 contracts, always round down to 18. Rounding up would exceed your risk limit. It’s also smart to account for commissions and slippage – assume the worst-case scenario based on your trading history.

Adjust for Volatility and Market Conditions

Markets are constantly changing, and your position size should reflect that. When volatility increases, the ATR typically rises, and your stop-loss distance may need to widen to avoid being stopped out by routine price movements. A wider stop means fewer contracts to keep your dollar risk consistent.

For example, if your stop moves from 2 to 5 points, the risk per contract increases from $100 to $250. With a $100,000 account and 1% risk ($1,000), your position size would drop from 10 contracts to just 4. This adjustment ensures your total risk remains capped at $1,000, no matter how volatile the market becomes.

During periods of extreme volatility, consider halving your position size to protect against gap risk. Alternatively, you can trade MES (Micro E-mini S&P 500 Futures) contracts for finer adjustments. Since MES contracts are 1/10th the size of ES contracts, you could trade 40 MES contracts instead of 4 ES contracts, giving you better control over your exposure.

Position Sizing for Futures Prop Firm Rules

Prop Firm Constraints You Need to Know

Prop trading firms enforce strict rules – like daily loss limits, trailing drawdowns, and contract caps – that you must follow to stay in the game. Breaking these rules often leads to immediate disqualification.

Most firms allow a risk of only 1–2% per trade and set daily loss limits around 2–3% of your account’s equity. For instance, on a $100,000 account, the daily loss limit would be about $2,500.

Trailing drawdowns are dynamic and tied to your account’s peak equity. For example, if you grow a $50,000 account to $55,000, the drawdown limit adjusts upward as well. Monitoring your peak balance is crucial to avoid unexpected violations.

Many firms also control how many ES contracts you can trade. Typically, you start with 2–3 contracts and can scale up as you hit profit milestones. There’s often a rule that no single day’s gains can exceed 30–40% of your profit target. This means you need to carefully calculate your contract size to ensure no single trade skews your overall performance. Tools like the Consistency Rule Calculator can help you determine the right number of contracts to stay compliant.

Sizing for Intraday vs. Overnight Trades

Position sizing also depends on whether you’re trading during the day or holding positions overnight. Most standard prop firm accounts require you to close all ES trades by the market’s close. To hold positions overnight, you’ll need a "Swing" account, which typically has higher fees and stricter drawdown rules.

For intraday trades, you have more flexibility, but it’s still wise to size cautiously. Off-peak hours or low-liquidity periods can result in slippage, causing your stop-loss to execute at a worse price than expected. Adjust your position size in these situations to keep your dollar risk consistent.

Overnight trades come with additional risks, like price gaps, reduced liquidity, and margin changes. If you’re trading through a Swing account, it’s a good idea to cut your position size in half compared to your intraday trades. For instance, if you normally trade 4 ES contracts during the day, reduce that to 2 contracts for overnight holds.

Using DamnPropFirms Tools to Optimize Sizing

DamnPropFirms offers tools that help you align your position sizing with firm rules and your personal risk tolerance. One of their standout features is the Consistency Rule Calculator, which lets you calculate the maximum number of contracts you can trade based on your profit target and daily profit limits.

For example, if your firm caps daily profits at 40% of your total profit target, and you’re aiming for $3,000 on a $50,000 account, you can’t earn more than $1,200 in a single day. With a 10-point target per ES contract (equal to $500 profit), you’d be limited to trading 2 contracts to stay compliant.

DamnPropFirms also reviews top prop firms like Apex Trader Funding, Take Profit Trader, and Topstep. These reviews break down key details like drawdown rules, contract limits, and overnight policies, helping you select a firm that matches your trading style before you pay for an evaluation.

If your calculated position size exceeds the firm’s contract limits, you might consider trading MES (Micro E-mini S&P 500) contracts. Since MES moves at $5 per point compared to $50 for ES, you can trade up to 10 MES contracts for the same exposure as 1 ES contract, giving you more flexibility to manage your risk.

sbb-itb-46ae61d

Professional Position Sizing Models for ES Futures

Fixed Fractional and Fixed Dollar Risk Models

When it comes to sizing trades in ES futures, two popular approaches are fixed fractional and fixed dollar risk models. Each method has its strengths, depending on your trading goals and experience level.

The fixed fractional model involves risking a set percentage of your account equity, typically 1% to 2%, on each trade. As your account grows, the dollar amount you risk increases automatically. Conversely, if your account shrinks, the amount you risk decreases proportionally. This approach adjusts risk during losing streaks and amplifies gains during winning periods, making it a favorite among professional traders and prop firms.

On the other hand, the fixed dollar risk model keeps things simple. Here, you risk a constant dollar amount – say $500 – on every trade, regardless of your account balance. This method is ideal for beginners and for testing strategies since it ensures predictable losses. However, it doesn’t take advantage of compounding gains as your account grows.

Here’s a quick side-by-side comparison:

| Model | Risk Basis | Best For | Key Advantage |

|---|---|---|---|

| Fixed Fractional | Percentage of equity | Prop firm & professional trading | Automatic compounding and loss protection |

| Fixed Dollar | Constant dollar amount | Beginners & strategy testing | Simplicity and predictable loss limits |

For prop firm traders, fixed fractional sizing is often the smarter choice. Most firms enforce strict daily loss limits – typically 2% to 3% of equity – so keeping your risk per trade between 0.5% and 1% helps you stay within those boundaries. For instance, on a $100,000 account, risking 1% per trade means a maximum loss of $1,000 per ES trade. If your stop-loss is 4 points away (equivalent to $200 per contract), you could trade 5 ES contracts while staying within your risk limits.

Once you’ve chosen a base model, the next step is to adapt it to account for market volatility.

Volatility-Based Sizing

Volatility-based sizing fine-tunes your position size based on how much the market is moving. When volatility spikes, you trade fewer contracts to keep your dollar risk consistent. Conversely, in calmer markets, you can trade more contracts without increasing your exposure. The Average True Range (ATR), calculated over 14 days, is a go-to tool for measuring volatility.

In high-volatility conditions, price bars widen, which means your stop-loss needs to be farther away to avoid being triggered by normal market fluctuations. A wider stop translates to fewer contracts to maintain the same dollar risk. For example, if your usual stop-loss is 2 points (risking $100 per ES contract) but volatility pushes it to 10 points (risking $500 per contract), you’d reduce your position size from 10 contracts to 2 contracts to keep your total risk at $1,000. Advanced traders often use ATR percentiles to create "volatility buckets" that adjust position sizes automatically during volatile periods.

With volatility accounted for, you can further improve your trading by scaling in and out of positions.

Scaling In and Out of Positions

Scaling allows traders to enhance their profits while keeping risk under control. Once a trade moves in your favor and you adjust your stop-loss (e.g., moving it to break-even), your risk decreases. At this point, you can add contracts without exceeding your initial dollar risk.

For instance, you might start with 2 ES contracts, risking $500. If the market moves 5 points in your favor, you could move your stop to break-even. With the reduced risk, you might add 2 more contracts, bringing your total to 4, while still keeping your total risk at $500.

Scaling out works in the opposite way. As the trade progresses, you can take partial profits by closing part of your position, while letting the remainder run with a trailing stop. This approach locks in gains and reduces your exposure in case the market reverses. Using Micro E-mini (MES) contracts instead of standard ES contracts can make scaling even more precise, as each MES contract is 1/10th the size of an ES contract.

"Experienced traders… can risk as much as three to four percent capital exposure per trade… Most traders must not risk more than 2%… Beginners must never risk more than 1%."

- Ali Moin-Afshari, CEO, Advanced Technical Methods, Inc.

Risk Controls for Professional ES Trading

Once you’ve calculated your position sizes, having solid risk controls is what keeps you in the game for the long haul.

Hard Rules for Risk Management

A golden rule: never risk more than 1% of your total account equity on a single trade. For example, if your account is worth $100,000, limit your potential loss per trade to $1,000.

Stop-loss placement is another critical factor that separates serious traders from those taking unnecessary risks. Always set your stop-loss at key technical levels like support, resistance, or other chart structures – never at random points. For instance, placing a stop 5 points away because it fits your risk tolerance is ineffective if the market demands a 10-point stop. In such cases, reduce the number of contracts you trade rather than compromising on stop placement.

Establish a daily loss cap that’s stricter than the limit set by your proprietary trading firm. While most firms enforce a 5% daily drawdown cap, seasoned traders often stick to 3% to avoid hitting that threshold. Think of it as a personal "circuit breaker" to protect your account. If your account suffers a 5% drop, stop trading for a week to reset.

"Your primary job as a trader is not to maximize gains on every trade, but to stay in the game long enough to let your edge play out over time." – Prop Firm Plus

During losing streaks, cut your risk per trade in half. For instance, if you typically risk 0.5% of your account per trade, reduce it to 0.25% until you recover your previous equity peak.

Finally, tailor your risk controls to handle market events and correlated risks effectively.

Preparing for Market Events and Correlated Risks

Risk management isn’t just about fixed rules – it’s also about adapting to external factors. Major market events, like Federal Reserve announcements or Non-Farm Payrolls, often lead to sharp volatility and potential slippage. Professionals avoid initiating trades 15 minutes before and after these events. The danger isn’t just the direction of the move but the erratic price swings that could hit your stop-loss prematurely.

To manage overnight risks, reduce your positions during less liquid sessions. Also, be cautious about correlated exposures. Trading ES (S&P 500), NQ (Nasdaq-100), and YM (Dow) simultaneously isn’t diversification – they often move in sync, amplifying your risk. For genuine diversification, mix equity index futures with uncorrelated assets like Crude Oil (CL) or 10-Year T-Notes (ZN).

"Trading multiple contracts that move together is not diversification." – Optimus Futures

Keep an eye on your total portfolio exposure, not just individual trades. For example, risking 1% on an ES trade and another 1% on an NQ trade effectively doubles your risk during a correlated market move. A robust risk management system should track the combined exposure of all open positions to ensure a single market swing doesn’t exceed your overall risk tolerance.

Using Tools to Track and Improve Risk Management

To stick to these risk controls, leverage tools and systematic tracking. Professional traders avoid relying on mental calculations during live trading. Instead, use a position sizing calculator in Excel or built-in platform tools to match your account size, stop-loss distance, and contract count for every trade. Keep this tool accessible – open it on a second monitor for quick reference during fast-paced ES sessions.

Modern platforms like Optimus Flow offer real-time margin tracking and automated safeguards against over-leveraging. Set alerts to warn you when you’re nearing your daily loss cap or exceeding your total risk threshold. Automation helps remove the emotional urge to chase losses or take impulsive trades.

Maintain a trading journal to log entries, slippage, and maximum adverse excursion (MAE). Review this data monthly to refine your position sizing and identify patterns. Beyond numbers, document your emotional state before and after trades to uncover psychological triggers that may lead to breaking your rules.

Before each session, run a volatility check using the Average True Range (ATR). Update your risk levels daily – use smaller positions on volatile days and standard sizes during calmer markets. This habit ensures your trading adapts to current conditions instead of relying on outdated assumptions.

| Total Account Drawdown | Action |

|---|---|

| -3% | Reduce risk to 0.25% per trade |

| -5% | Stop trading for 1 week (Emergency Brake) |

| -7% | Cease trading for 2 weeks and conduct a full strategy review |

Finally, stress-test your risk rules over a trailing 90-trade sample before implementing changes. Keep in mind that strategies effective in trending markets may falter in choppy conditions. The goal isn’t perfection – it’s staying in the game long enough for your strategy to yield results.

"Position sizing is the component responsible for the variability of trading results." – Ali Moin-Afshari, CEO, Advanced Technical Methods, Inc.

Conclusion

Position sizing isn’t about trying to predict the market – it’s about managing your journey through it. The line between a professional trader and a gambler is drawn by one key principle: math triumphing over emotion. Here’s a stark example: if you risk 1% of your account per trade, 10 consecutive losses would shrink your account by roughly 9.5%. But if you risk 10% per trade, those same 10 losses would wipe out over 65% of your capital. And don’t forget – a 50% loss means you need a 100% gain just to get back to where you started.

A simple formula can guide you: Dollar Risk ÷ (Stop Distance in Points × $50) = Number of ES Contracts. Sticking to this calculation, especially during tough losing streaks, is what separates long-term success from failure. This formula forms the backbone of risk management for prop firm traders.

"Position sizing is the component responsible for the variability of trading results. Two traders can trade the same instrument using the exact same entries and exits but implement different position sizing methods. The difference in their results will be significant." – Ali Moin-Afshari, CEO, Advanced Technical Methods, Inc.

For traders working with prop firms, disciplined position sizing isn’t just important – it’s non-negotiable. Exceeding drawdown limits results in immediate account termination. To stay on track, rely on tools like position sizing calculators, volatility checks using ATR, and automated alerts to ensure you operate within your risk parameters. And don’t skip the habit of journaling every trade – it’s invaluable for adapting your sizing to evolving market conditions.

The key is to start small, stay consistent, and let your trading edge shine over time. Professional trading is all about keeping risk under control so your strategy has the space it needs to deliver results.

FAQs

Why is position sizing important for successful trading?

Position sizing plays a key role in managing risk and safeguarding your trading account. By capping the amount of capital you put at risk on each trade – say, 1% of your account balance – you can protect yourself from large losses while aiming for steady, long-term growth.

On the flip side, taking positions that are too large can drain your account quickly and disrupt your ability to trade consistently. Sticking to effective position sizing methods ensures your trading stays aligned with disciplined risk management, giving you a better shot at maintaining success over time.

What tools can I use to adjust my position size based on market volatility?

To fine-tune your position size in response to market volatility, try incorporating the Average True Range (ATR) indicator into your strategy. This tool allows you to adjust your trade size based on market conditions, offering a way to manage risk more effectively.

You can also take advantage of online position size calculators. By entering details like your account size, risk percentage, and volatility measurements, these calculators can quickly determine the optimal trade size for your strategy. Leveraging such tools can help you stay consistent and maintain a structured approach to trading.

How do prop firm rules impact my trading strategy and position sizing?

Prop firm rules – like daily loss limits, overall drawdown caps, and maximum risk-per-trade guidelines – exist to keep traders disciplined and safeguard funded accounts. Breaking these rules isn’t just a small misstep; it can cost you your account. That’s why managing risk should always take precedence over chasing profits.

When it comes to position sizing, start by looking at your account balance and deciding how much you’re willing to risk on a single trade. For instance, if you’re comfortable risking 1% of a $10,000 account, that’s $100 per trade. From there, calculate how many E-mini S&P 500 (ES) contracts you can trade based on your stop-loss distance. Let’s say your stop-loss is $10 per contract – this means you could trade up to 10 contracts without going over your $100 risk limit. But if the firm enforces a daily loss cap, like $500, you’ll need to scale back your trades or stop trading altogether if you’re nearing that limit.

These rules also shape the kind of strategies you can use. For example, high-volatility setups with wide stop-losses might not work within the firm’s risk parameters. Instead, you might focus on setups with tighter stop-losses or consider scaling into trades more gradually. Tools like risk calculators or spreadsheets can be invaluable for staying within these limits and sticking to a disciplined trading approach.