Trailing drawdowns are a dynamic risk management tool used by futures prop firms to protect their capital. They adjust upward as your account reaches new equity highs but do not decrease when your balance drops. Misunderstanding this mechanism can lead to unexpected liquidation, even in profitable accounts. Here’s how it works:

- Definition: A trailing drawdown is tied to your account’s highest equity value (including both realized and unrealized gains). It sets a liquidation threshold that rises with new equity peaks but remains fixed during losses.

- Key Formula:

Trailing Drawdown Level = Highest Equity Achieved – Drawdown Amount

Example: Starting balance = $50,000, drawdown = $2,500. If equity peaks at $50,875, the new threshold becomes $48,375. - Common Mistakes:

- Assuming only closed trades affect the threshold.

- Expecting the threshold to reset after losses.

- Ignoring intraday equity peaks.

Quick Tips for Managing Trailing Drawdowns:

- Build an equity buffer early by starting with smaller positions.

- Monitor your "Auto Liquidate Threshold" on platforms like RTrader Pro.

- Use tools like Average True Range (ATR) for position sizing.

- Set personal loss limits tighter than your firm’s official threshold.

- Lock in profits with partial exits or trailing stops.

Trailing drawdowns reward disciplined trading and penalize recklessness. By understanding and managing this rule effectively, you can maintain your funded account and avoid unnecessary liquidation.

How Trailing Drawdowns Are Calculated

Trailing Drawdown Formula and Key Terms

The formula for calculating a trailing drawdown is straightforward:

Trailing Drawdown Level = Highest Equity Achieved – Drawdown Amount.

This figure determines the point at which your account will be liquidated.

Let’s break down the terms:

- Highest Equity Achieved: Also known as the "high-water mark", this represents the peak value your account has reached. It includes unrealized (floating) profits from open trades, not just closed positions.

- Drawdown Amount: This is the fixed monetary buffer set by your prop firm. For example, you might have a $2,500 drawdown on a $50,000 account.

- Trailing Drawdown Level: This is the specific account value that triggers liquidation if breached. Importantly, this threshold locks in at the highest equity level reached, even if your account experiences losses afterward.

Many firms, such as Apex Trader Funding, calculate the trailing drawdown using the highest intraday equity, including unrealized gains. This means your drawdown floor can rise during the day, even if you close the trade at a lower profit. Let’s walk through some examples to clarify how this works.

Step-by-Step Calculation Examples

Here’s an example for a $50,000 account with a $2,500 drawdown:

- Step 1: Starting threshold: $50,000 – $2,500 = $47,500.

- Step 2: You open a trade that peaks at $50,875 intraday (including unrealized profit). The new threshold becomes: $50,875 – $2,500 = $48,375.

- Step 3: You close the trade at $50,100, realizing a $100 profit. However, the threshold remains locked at $48,375.

- Step 4: Your current cushion is now $50,100 – $48,375 = $1,725, even though your account is still in profit.

Here’s another example from FunderPro Futures (August 2025): A trader starts with $50,000 and a $2,000 trailing drawdown. The account reaches a peak equity of $53,000. The new liquidation level becomes $53,000 – $2,000 = $51,000. Later, the equity drops to $50,950. Even though this is above the initial balance, the account is closed because it falls below the $51,000 threshold.

Common Calculation Mistakes

Misunderstanding how trailing drawdowns work can lead to costly errors. Here are some common pitfalls:

- Assuming only closed trades affect the threshold: Trailing drawdowns often account for unrealized profits. If a trade performs well intraday but reverses, it can unexpectedly trigger a drawdown breach.

- Expecting the threshold to reset after losses: Once your high-water mark is established, it’s fixed. A losing day won’t lower the threshold.

- Ignoring intraday peaks: The drawdown threshold reflects the highest intraday equity, even if the market closes lower.

- Overlooking fees and commissions: These are factored into the net equity used to calculate liquidation thresholds, so they can impact your margin.

To avoid surprises, always monitor your "Auto Liquidate Threshold" on platforms like RTrader Pro instead of focusing solely on your account balance. Keeping a close eye on these details ensures you stay ahead of potential liquidation risks.

Trailing Drawdown in Prop Firm Trading Explained: How to Master It

Trailing Drawdown vs. Static Drawdown

Trailing vs Static Drawdown Comparison for Futures Traders

Key Differences Between Trailing and Static Drawdowns

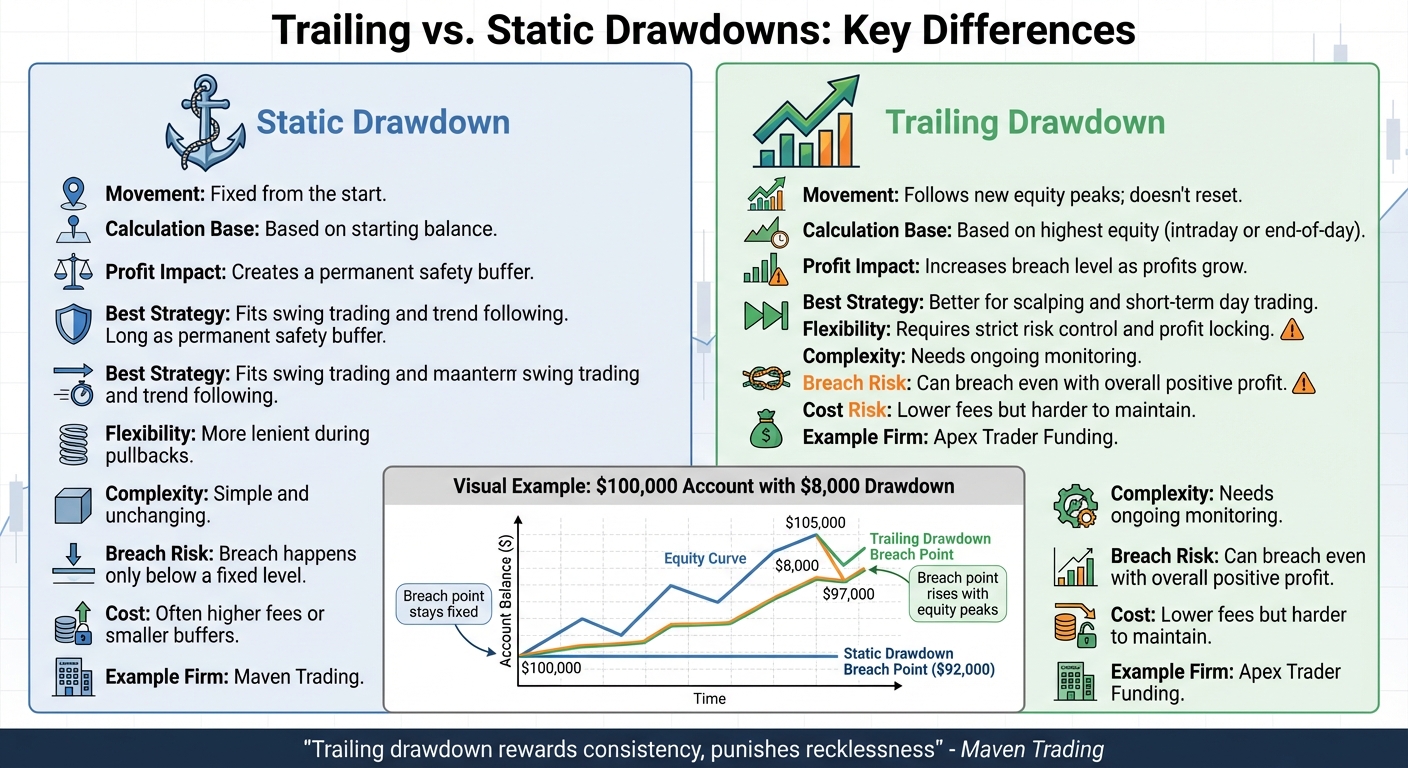

Grasping the distinctions between trailing and static drawdowns is essential for managing risk effectively in prop trading. Static drawdowns are tied to the account’s initial balance. For example, in a $100,000 account with an $8,000 static drawdown, the breach point remains fixed at $92,000, no matter how much the account grows.

Trailing drawdowns, on the other hand, adjust upward with peak equity and do not drop when losses occur. As Maven Trading explains:

"Trailing drawdown is not your enemy, it’s a test. It rewards consistency, punishes recklessness, and separates real traders from lucky ones."

Static drawdowns provide a stable buffer against market fluctuations, making them ideal for strategies like swing trading and trend following. Trailing drawdowns, however, shrink that buffer as profits increase, requiring traders to exercise tighter risk control and actively secure profits. Fred Harrington, Founder of Vetted Prop Firms, elaborates:

"It’s called trailing because it trails your best equity, not balance. If you’re in a trade and your equity spikes, the trailing drawdown adjusts upward."

This mechanism can create pressure for traders to act cautiously after achieving significant gains.

Comparison Table: Trailing vs. Static Drawdowns

Here’s a side-by-side look at how these two drawdown models differ:

| Feature | Static Drawdown | Trailing Drawdown |

|---|---|---|

| Movement | Fixed from the start | Follows new equity peaks; doesn’t reset |

| Calculation Base | Based on starting balance | Based on highest equity (intraday or end-of-day) |

| Profit Impact | Creates a permanent safety buffer | Increases breach level as profits grow |

| Best Strategy | Fits swing trading and trend following | Better for scalping and short-term day trading |

| Flexibility | More lenient during pullbacks | Requires strict risk control and profit locking |

| Complexity | Simple and unchanging | Needs ongoing monitoring |

| Breach Risk | Breach happens only below a fixed level | Can breach even with overall positive profit |

| Cost | Often higher fees or smaller buffers | Lower fees but harder to maintain |

For real-life examples, Maven Trading employs a static drawdown model, while Apex Trader Funding uses a trailing drawdown approach.

sbb-itb-46ae61d

How to Manage Trailing Drawdowns

Building Equity Buffers to Avoid Breaches

The trailing drawdown moves with your peak equity, so building a buffer early is key to managing this risk. Start with smaller positions to avoid rapid increases in your trailing limit. This approach gives you time to establish a cushion before the threshold rises significantly.

FunderPro suggests a practical mindset: "Operate as if the trailing limit sits $500–$1,000 closer than it is". By mentally reducing your available buffer, you create a safety margin for unexpected market reversals. After a solid trading session, scale down your trade size to protect your gains. Treat these realized profits as untouchable until your buffer is strong enough to handle routine market fluctuations.

Be cautious of the "shadow effect." When an open trade pushes your equity to a new high, the trailing drawdown adjusts upward. If the market reverses, this can quickly eat into your buffer, leaving you exposed.

To further safeguard your account, fine-tune your position sizes based on market conditions.

Adjusting Position Sizing Based on Volatility

Leverage tools like Average True Range (ATR) to determine position sizes instead of relying purely on gut instincts. In volatile markets, reducing your position size can help ensure that even unfavorable moves stay within your buffer.

Set a personal daily loss limit that’s tighter than your prop firm’s official threshold – by about 30–50%. If you’re trading correlated instruments like ES and NQ, manage your risk by either focusing on one at a time or lowering your combined exposure proportionally.

Using partial exits and trailing stops can lock in profits before the market turns against you. Automating these exits with bracket or OCO (One-Cancels-Other) orders can eliminate hesitation during fast-paced market movements.

Lastly, keep a close eye on your drawdown levels with real-time monitoring tools.

Using Tools to Monitor Drawdown Levels

Monitoring your drawdown is crucial for making timely adjustments. Most trading platforms offer built-in tools for this purpose. For instance, Rithmic users can check their "Auto Liquidate Threshold" in RTrader Pro for real-time updates. Tradovate users can find similar details in the account dropdown menu.

Focus on tracking your unrealized equity, not just your closed balance. Intraday peaks in open trades can immediately raise your trailing drawdown limit. Before each session, note your current drawdown level and adjust your maximum open risk accordingly. Maintaining a cushion – $100–$300 for smaller accounts or $500–$1,000 for larger ones – above your liquidation threshold can help shield you from unexpected market moves.

Additionally, tools like DamnPropFirms‘ Consistency Rule Calculator can help you manage daily profits within limits, ensuring you stay compliant and in control of your funded account.

Conclusion and Key Takeaways

Key Points to Remember

Trailing drawdowns are designed to rise with your account’s peak value but never drop back down, even if your equity decreases. This means you must secure profits with the same discipline you use to manage your capital. In intraday trailing models, any temporary spike in open profit permanently increases your liquidation threshold – regardless of whether you close the trade at a lower price, as explained earlier.

"Trailing drawdown is not your enemy, it’s a test. It rewards consistency, punishes recklessness, and separates real traders from lucky ones." – Seb, Maven Trading

Keep a close eye on both your unrealized equity and closed balance using your platform’s real-time tracking tools. Before each trading session, check your current drawdown level and aim to build an equity buffer of $100–$300 for smaller accounts or $500–$1,000 for larger accounts above your liquidation threshold. Use volatility-based position sizing, such as Average True Range (ATR), and set personal daily loss limits that are 30–50% tighter than your firm’s official cap.

Many firms stop trailing once your threshold reaches your starting balance plus $100. Knowing whether your firm calculates drawdowns intraday or at the end of the day is crucial. This knowledge allows you to adjust your holding times and profit-taking strategies to avoid breaching thresholds during routine market fluctuations.

Incorporate these strategies into your trading plan to enhance your approach.

Next Steps for Futures Prop Traders

Begin by actively monitoring your drawdown levels using your platform’s tools. For example, if you use Rithmic, check the "Auto Liquidate Threshold" in RTrader Pro, or review the account dropdown in Tradovate. Automating your exits can help you avoid hesitation during rapid market movements.

Explore DamnPropFirms’ reviews and comparison tools to find programs that offer end-of-day or static drawdowns rather than aggressive intraday trailing models. Choose a program that matches your trading style, and focus on building your equity buffer before increasing your position sizes.

FAQs

How can I avoid unexpected liquidation from a trailing drawdown?

To steer clear of unexpected liquidation due to a trailing drawdown, think of the drawdown limit as a moving stop-loss rather than a fixed safety net. It’s important to understand how your firm calculates this limit. Typically, it’s tied to the highest real-time equity, which includes unrealized gains, and it only moves upward when a new equity peak is reached. This setup means that large open profits, if they reverse, can push the drawdown limit higher and increase your risk. To manage this effectively, keep your position sizes modest – aim for around 1–2% of your account balance per trade – and secure profits using trailing stops or partial profit-taking. This approach helps prevent the drawdown from climbing unnecessarily.

You should also use risk-management alerts to monitor your equity as it nears the drawdown limit. Be prepared to reduce your exposure or close trades proactively if necessary. If your firm operates with an End-of-Day (EOD) trailing drawdown, you’ll have more intraday flexibility, but it’s wise to avoid holding large, volatile positions overnight. For firms that calculate the drawdown based on realized gains only, closing profitable trades daily can help stabilize the drawdown limit.

During periods of high market volatility, such as major economic news releases, trade with extra caution. Always stay mindful of the firm’s loss buffer (e.g., $2,000 on a $50,000 account). By combining careful position sizing, timely profit-taking, and vigilant monitoring, you can stay well above the trailing drawdown limit and avoid any unwelcome liquidation surprises.

What’s the difference between a trailing drawdown and a static drawdown?

A static drawdown sets a fixed loss limit based on your starting account balance. For instance, if you have a $100,000 account with an $8,000 static drawdown, your account balance cannot fall below $92,000, no matter how much your account grows. This type of drawdown is simple and predictable, allowing for easier management. However, it can encourage higher risk-taking in the early stages.

In contrast, a trailing drawdown adjusts as your account grows, making it more dynamic. The loss limit is set at a specific amount (e.g., $2,000) below the highest balance or equity your account has reached. For example, if your account balance climbs to $53,000, the trailing drawdown would establish the limit at $51,000. This approach is designed to protect profits but demands stricter discipline, particularly if unrealized gains are included in the calculation.

How do intraday equity peaks impact my trailing drawdown limit?

Intraday equity highs – whether from closed trades or unrealized profits on open positions – can boost your trailing drawdown limit for the rest of the trading day. This limit adjusts upward whenever your account hits a new equity peak, staying a set amount (e.g., $2,000) below that high. Once the limit increases, it remains fixed and won’t decrease, even if your equity drops later.

Here’s an example: Let’s say your $50,000 funded account climbs to $53,000 due to a $3,000 unrealized profit. In this case, the trailing drawdown limit would shift from $48,000 ($50,000 − $2,000) to $51,000 ($53,000 − $2,000). If your equity then falls below $51,000, it would trigger a breach – even though your account is still above the initial $50,000 balance. This system updates in real time throughout the trading day but stops increasing once the limit matches your starting balance. Keeping a close eye on both realized and unrealized equity is essential to staying within these rules and safeguarding your account.