A daily loss limit is a safeguard that caps your trading losses within a single day. It automatically halts trading when losses reach a set dollar amount or percentage of your account equity. This tool is widely used by traders and firms to manage risk, prevent emotional decisions, and protect capital.

Key Points:

- Definition: A cap on how much you can lose in one day, set as a fixed dollar amount or percentage.

- Purpose: Shields your account from large losses, prevents revenge trading, and ensures you can trade another day.

- Types:

- Static limits: Fixed throughout the day.

- Trailing limits: Adjust upward with profits but never downward.

- Reset Time: Typically resets at the start of the next trading session (e.g., 6:00 PM ET for futures markets).

- Usage: Common in prop trading firms and retail trading accounts. Firms like Topstep and Apex Trader Funding apply different rules to enforce these limits.

Quick Advice:

- Set your limit wisely: Risk 0.5%–2% of your account per day.

- Use stop-loss orders: Automate risk management to avoid emotional trading.

- Track your performance: Stay aware of your losses in real-time to avoid breaches.

Daily loss limits are a critical part of risk management for traders at all levels. They help you maintain discipline and protect your trading capital from irreversible damage.

How to Set Daily Loss Limits That Actually Work (Most Traders Get This Wrong)

How Daily Loss Limits Work

Daily Loss Limits Comparison: Static vs Trailing and Top Prop Firms

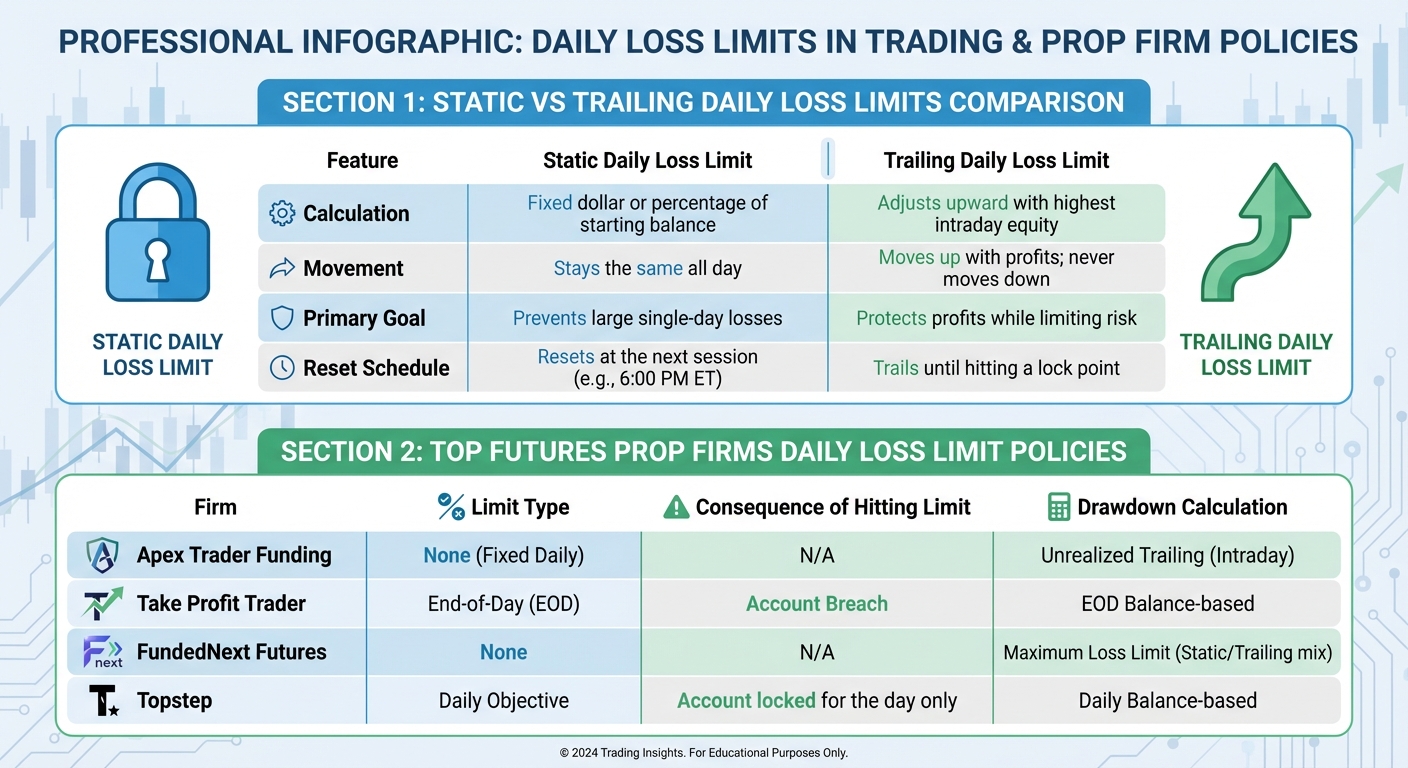

This section dives into how daily loss limits are structured and adjusted, building on their importance in trading risk management.

Fixed Dollar vs. Percentage-Based Limits

Prop firms generally calculate daily loss limits in two ways: fixed dollar amounts or percentage-based limits.

A fixed dollar limit, such as a $1,000 cap, stays the same no matter the account size. This straightforward method is especially popular among retail traders who maintain consistent position sizes.

On the other hand, percentage-based limits link your risk to your account equity. For example, a common setup might be 1% to 2% of the starting balance. If you have a $100,000 account, a 1% limit means you can lose up to $1,000 in a day before trading is halted. As your account grows, the dollar amount of your allowable loss increases accordingly.

For instance, Alpha Futures employs a Daily Loss Guard set at 2% of the starting account balance. On a $50,000 account, this equals $1,000. Once the combined profit and loss (including fees) reaches this limit, the system automatically closes all positions.

Trailing vs. Static Daily Loss Limits

Daily loss limits can also be categorized as static or trailing, each serving a distinct purpose.

Static daily loss limits remain unchanged throughout the day. For instance, if your limit is $1,000, it stays at $1,000 no matter whether you’re up $500 or down $200. These limits reset at the start of a new trading session, typically around 6:00 PM ET when futures markets reopen.

Trailing daily loss limits, on the other hand, adjust upward as your account reaches new profit peaks during the day, but they never move back down. For example, if you start with a $100,000 account and a $2,500 trailing drawdown, your account can drop to $97,500 before breaching the limit. If a trade pushes your intraday balance to $100,875, the threshold moves up to $98,375. Even if profits later decrease, the limit stays locked at $98,375, providing a higher safety net while tightening risk.

| Feature | Static Daily Loss Limit | Trailing Daily Loss Limit |

|---|---|---|

| Calculation | Fixed dollar or percentage of starting balance | Adjusts upward with highest intraday equity |

| Movement | Stays the same all day | Moves up with profits; never moves down |

| Primary Goal | Prevents large single-day losses | Protects profits while limiting risk |

| Reset Schedule | Resets at the next session (e.g., 6:00 PM ET) | Trails until hitting a lock point |

When Daily Loss Limits Reset

Understanding when daily loss limits reset is just as important as knowing how they work.

For most futures prop firms, the daily loss limit resets at the start of the next trading session, usually at 6:00 PM ET, when markets reopen. So, if you hit your limit on a Monday afternoon, your account will unlock Monday evening when the new session begins.

If the limit is breached, all positions are liquidated, and the account remains locked until the next session begins. This ensures that traders start fresh with a clean slate.

Daily Loss Limits at Top Futures Prop Firms

Prop firms have different ways of managing daily losses, depending on their risk management strategies. Some enforce strict daily limits, while others either eliminate them or treat them as flexible guidelines.

Apex Trader Funding Daily Loss Limits

Apex Trader Funding takes a unique approach by not enforcing a fixed daily loss limit in most of its evaluation plans. Instead, the firm uses an unrealized trailing drawdown system that adjusts based on your peak equity. Here’s the catch: even if you close a trade, the trailing drawdown is calculated using your highest intraday balance. So, monitoring your open positions is crucial.

Once you advance to the Performance Account (PA) stage, things get a bit easier. The trailing drawdown locks at your starting balance plus $100, reducing the risk compared to the evaluation phase. Apex also sweetens the deal with discounts of up to 90% off evaluation plans, offering traders more flexibility. For a full breakdown of their rules and pricing, check out the Apex Trader Funding review.

Take Profit Trader Daily Loss Limits

Take Profit Trader uses an End-of-Day (EOD) drawdown system, which updates only after the market closes. This means your daily loss is calculated based on your balance at the end of the trading day. For example, if you’re down $800 during the day but recover to –$200 by the close, the drawdown is based on that final –$200 figure. However, breaching the account rules will terminate your trading challenge. If you’re curious about their specific rules and account options, check out the Take Profit Trader review.

FundedNext Futures Daily Loss Limits

FundedNext Futures doesn’t impose direct daily loss limits. This gives traders the freedom to manage their own risk, as long as they stay within the Maximum Loss Limit (MLL). For example, under the Legacy model, a $100,000 account has an MLL of $3,000. FundedNext also offers discounts of up to 25% for futures-exclusive accounts, making it an attractive option for those seeking flexibility. For a detailed look at their rules, visit the FundedNext Futures review.

Topstep Daily Loss Limits

Topstep approaches Daily Loss Limits (DLL) differently. Instead of terminating accounts, they treat the DLL as a temporary lock. If you hit the limit, your positions are automatically liquidated, and your account is locked for the rest of the day. The good news? Your account resets at the next market open, allowing you to trade again.

"Topstep Funded Traders™ and those in the Trading Combine will never again lose their account because they hit or exceed their Daily Loss Limit."

– John Doherty, Topstep

For more details on their evaluation process and pricing, check out the Topstep review.

| Firm | Limit Type | Consequence of Hitting Limit | Drawdown Calculation |

|---|---|---|---|

| Apex Trader Funding | None (Fixed Daily) | N/A | Unrealized Trailing (Intraday) |

| Take Profit Trader | End-of-Day (EOD) | Account Breach | EOD Balance-based |

| FundedNext Futures | None | N/A | Maximum Loss Limit (Static/Trailing mix) |

| Topstep | Daily Objective | Account locked for the day only | Daily Balance-based |

These varied strategies highlight how leading futures prop firms adapt their daily loss rules to suit different trading styles, giving traders the tools they need for effective risk management during the trading day.

sbb-itb-46ae61d

How to Stay Within Your Daily Loss Limit

Plan Trades Around Your Loss Limit

Before you dive into any trade, it’s critical to figure out your position size so that one bad trade doesn’t wipe out your entire daily allowance. For example, if your daily loss limit is $2,000, aim to risk only 1–2% per trade. This approach keeps you in the game with multiple opportunities to recover losses or build profits.

Think about setting a "soft" limit that’s about 25% below your official cap. Why? It gives you a cushion for unexpected market swings. For instance, if your firm’s daily loss cap is $1,000, consider setting your personal stop-out point at $700. This extra buffer can protect you from accidental overages during volatile trading sessions.

"The key is to see the rule not as a restriction, but as a shield that saves you from yourself on bad days." – 4proptrader

If you’re just starting out, a smart baseline is to limit your daily losses to 1% or less of your total account value. More seasoned traders often align their daily loss limits with their average winning days. For example, if you usually make $1,000 on profitable days, setting a limit between $500 and $1,000 can help keep any single bad day from spiraling out of control.

By planning around these limits, you build a framework for disciplined and calculated trading.

Set Stop Loss Orders Correctly

Once you’ve structured your trades, using stop-loss orders is essential for sticking to your daily loss limits. While stop-loss orders manage risk on individual trades, your daily loss limit safeguards your overall account performance. Always use hard stops – automated orders placed in your trading platform – rather than relying on mental stops. Hard stops take the emotion out of the equation, preventing you from holding onto losing trades longer than necessary or chasing losses.

If you’ve had a trade that brought you close to your daily limit, consider reducing your position sizes for the rest of the day. This adjustment can help extend your trading capacity. For accounts with unrealized trailing drawdowns, maintaining a cushion of $100 to $300 above your liquidation threshold can help you avoid accidental breaches during intraday market dips.

Track Your Daily Performance

Keeping tabs on your performance in real time is non-negotiable. Use platform tools like the Auto Liquidate Threshold or trailing drawdown indicators to stay aware of how close you are to your daily limit. It’s also a good idea to keep your daily loss limit clearly visible on your trading platform as a constant reminder.

"3% is the most anyone should be losing in a single day. Set your limit at 3% or lower." – Cory Mitchell, CMT, Founder, TradeThatSwing

If you hit your profit target early in the session, consider calling it a day. Pushing for more could lead to a late-session reversal that wipes out your gains and triggers your daily loss limit. Sometimes, the smartest move is knowing when to walk away.

Real-time tracking ties everything together – your pre-trade planning, stop-loss strategies, and overall risk management – helping you stay disciplined throughout the trading day.

Conclusion

Daily loss limits play a crucial role in safeguarding your trading capital and fostering disciplined decision-making. By setting a cap on losses, these limits help traders avoid the kind of impulsive decisions that often follow a string of setbacks, when emotions can cloud judgment and derail a well-thought-out strategy.

"A daily loss limit is not about avoiding losses. It is about preventing damage that becomes unrecoverable." – Singapore Forex Club

These limits aren’t just about risk management – they also encourage the development of disciplined trading habits. Many modern proprietary trading firms, like Topstep, have adapted their policies to make daily loss limit breaches less punitive. Instead of terminating accounts, they impose temporary lockouts, allowing traders the opportunity to learn from their mistakes without facing irreversible consequences. As highlighted in discussions of various prop firm models, consistently applying these risk controls is a cornerstone of long-term trading success. If you frequently find yourself hitting your daily limit, it’s a red flag that your strategy, position sizing, or alignment with market conditions might need reevaluation.

Successful traders aren’t those who avoid losses altogether – they’re the ones who know when to step back. By adopting and adhering to a daily loss limit, you shift from a gambler’s mindset to that of a professional risk manager. For traders aiming for sustainability in this challenging field, sticking to daily loss limits is non-negotiable. For tools and resources to help you find prop firms with fair daily loss limits and other trader-focused features, visit DamnPropFirms for verified reviews and comparisons.

FAQs

What’s the difference between static and trailing daily loss limits?

Static daily loss limits are straightforward: they remain fixed throughout the trading day, regardless of how much profit you earn. For example, if you set a $1,000 limit, your trading must stop as soon as your losses hit $1,000 – even if your account balance grew earlier in the session. This simplicity makes it easy to manage, but it also means you can’t increase your risk-taking after successful trades.

Trailing daily loss limits work differently. These adjust based on the highest balance your account reaches during the day. As your account grows, the loss limit moves up, staying a set distance below the peak balance. For instance, with a $2,000 trailing limit, if your account gains $5,000, the limit rises accordingly, allowing losses up to $2,000 from the new high. Importantly, the limit never decreases after a loss, so your gains remain secure. This approach provides more flexibility but requires you to keep a close eye on your account’s performance.

When and how do daily loss limits reset on trading platforms?

Daily loss limits generally reset at the beginning of a new trading day, but the way this happens depends on the platform. For instance, platforms like Topstep automatically reset the limit at midnight, letting traders resume their activities the next day. On the other hand, platforms such as FundedNext Futures calculate the daily loss limit based on the account’s starting balance, adjusting it for any gains or losses throughout the day, and then resetting it after the trading session concludes.

Some platforms take a slightly different approach. For example, OANDA bases its reset on the end-of-day equity from the previous trading day. Regardless of the method, most platforms will stop trading immediately if the limit is breached and only allow it again when the next session begins. Knowing how these resets function is crucial – it helps traders manage their risks better while staying compliant with platform rules.

What is a daily loss limit, and why is it essential for traders?

A daily loss limit is the maximum amount you’re willing to lose in a single trading day. This rule plays a key role in risk management, acting as a safeguard for your trading capital and helping you avoid emotional decisions – like revenge trading – that can spiral into even bigger losses.

With a daily loss limit in place, you can prevent one rough day from completely throwing off your trading strategy. This level of discipline keeps you in the game, giving you the chance to bounce back and refine your approach over time.