Most traders fail not because of poor strategies, but due to flawed assumptions about risk-to-reward ratios. While many swear by ratios like 1:3 or 1:5, the truth is these numbers mean little without factoring in win rates, market conditions, and strict rules from proprietary trading firms.

Key takeaways:

- A high win rate doesn’t guarantee success if your risk-to-reward ratio is too low.

- Chasing large ratios like 1:5 often leads to more losses due to low probability of hitting targets.

- Prop firm rules, like drawdown limits, expose poor risk management quickly.

- Success lies in balancing realistic ratios, win rates, and disciplined position sizing.

For example, risking 2% per trade on a $100,000 account might breach a 5% daily drawdown limit after just three losses. Reducing risk to 0.5% gives you more room to recover and pass challenges.

The bottom line? Stop chasing arbitrary ratios. Focus on expectancy, position sizing, and aligning your strategy with firm rules.

Risk-to-Reward Ratios and Breakeven Win Rates for Prop Trading

The Ugly Truth About Risk To Reward Ratio (95% Of Traders Get It Wrong)

5 Risk-to-Reward Lies Traders Tell Themselves

Traders often cling to certain "truths" about risk-to-reward ratios that seem logical at first glance but crumble under the pressure of real market conditions. These misconceptions can wreak havoc on trading accounts, cause failures in proprietary trading challenges, and lead to endless frustration. Let’s break down these common myths and how they undermine effective risk management.

Lie 1: A High Win Rate Makes Up for Bad Risk-to-Reward Ratios

Relying solely on a high win rate is a slippery slope. While it may feel like a safety net, a single large loss can wipe out multiple small wins. Many traders focus on their win percentages, ignoring the critical role of risk-to-reward calculations, which creates a dangerous illusion of success.

Jack D. Schwager, a well-known futures analyst and author, summed it up perfectly:

"The idea of just looking at returns as a performance measure is a mistake. It should always be return-to-risk. Returns are a meaningless statistic otherwise."

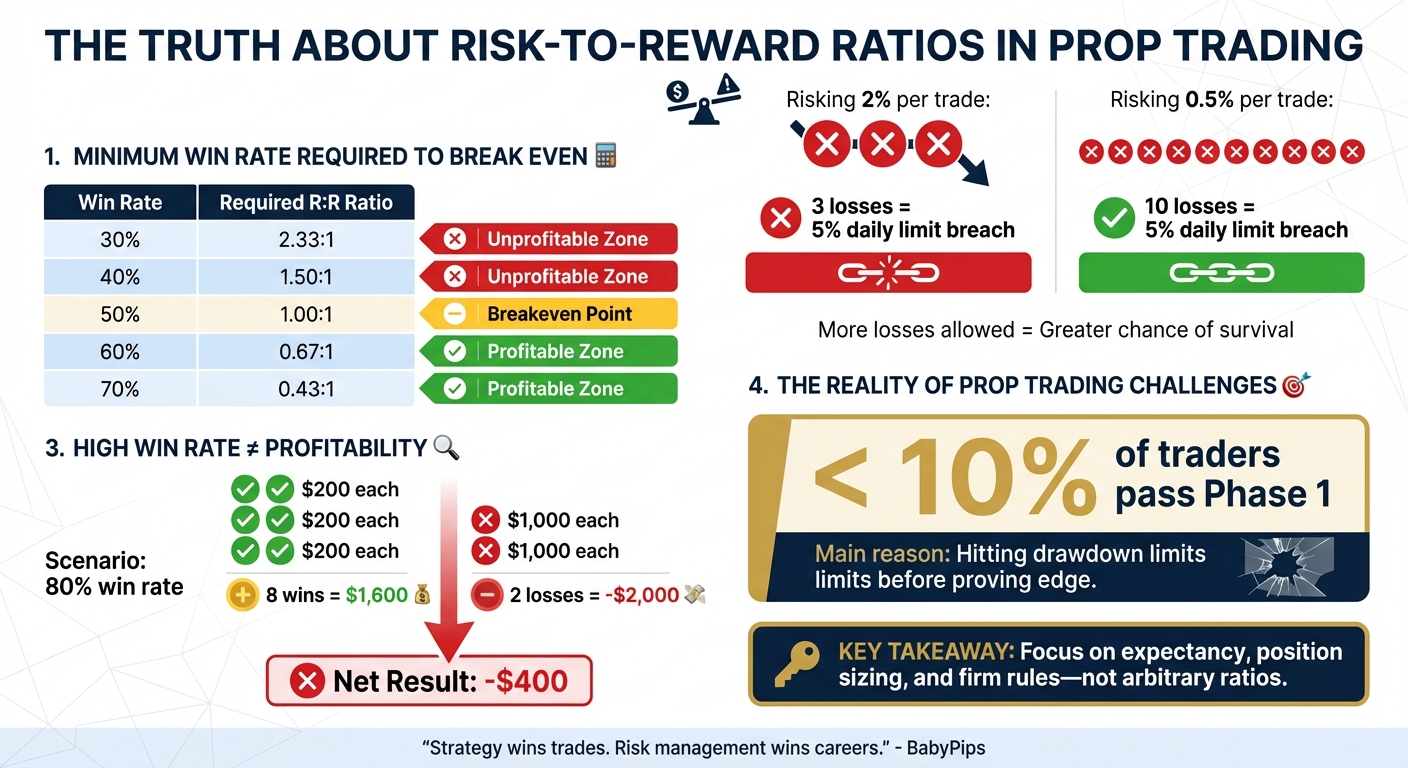

The math doesn’t lie. For example, with a 60% win rate, you need at least a 1.6 risk-to-reward ratio to break even. A 55% win rate? That jumps to 1.8. Factor in commissions and fees, and many traders end up in the red. Imagine winning 8 out of 10 trades, earning $200 per win ($1,600 total), but losing $1,000 on each of the 2 losses ($2,000 total). Despite an 80% win rate, you’re still down $400.

This cycle often leads to revenge trading, where emotions take over, and disciplined strategies get tossed aside.

To avoid this trap, use the formula (1 / win rate) to calculate your minimum risk-to-reward ratio. For example:

- A 50% win rate requires a 1:2 ratio.

- A 40% win rate demands a 1:2.5 ratio.

Anything less, and you’re setting yourself up for long-term losses.

Lie 2: A 30% Win Rate Works Fine with 1:3 Risk-to-Reward

On paper, a 30% win rate paired with a 1:3 ratio looks like a winning formula. In reality, factors like commissions, spreads, and slippage chip away at those gains. For instance, if you’re risking 3 pips with a 2-pip spread, you might need a 4:1 ratio just to hit your target.

Tight stops required for a 1:3 ratio often fall victim to normal market noise, especially in volatile futures markets. As Rayner Teo, founder of TradingwithRayner, explains:

"You can look for trades with a risk reward ratio of 1:2 and remain a consistent loser… because the risk-reward ratio is only part of the equation."

A 30% win rate also means enduring long losing streaks, which can breach the daily and maximum drawdown limits imposed by proprietary trading firms. Psychologically, it’s grueling. Losing 7 out of 10 trades while staying disciplined is no easy feat and often leads to abandoning strategies or revenge trading.

Instead of rigidly aiming for a 1:3 ratio, tailor your profit targets to the market structure. Place them near actual support and resistance levels, and size your positions to handle the worst-case losing streak your account can sustain.

Lie 3: Larger Risk-to-Reward Ratios Always Mean More Profit

Chasing overly ambitious ratios like 1:5 might seem like a shortcut to higher profits, but it often backfires. The higher the ratio, the lower the probability of reaching your target. To hit a distant profit target, the price must break through multiple levels of support or resistance – areas where reversals are common.

Erich Senft, a contributor to Indicator Warehouse, calls out this flawed mindset:

"A risk-reward ratio is one of those trading lies that sound good but don’t work in real life… no one knows the reward side of the equation!"

Some traders even manipulate their stop-losses to create an attractive ratio, only to see their positions stopped out prematurely or reversed just before hitting their targets. A study revealed that traders who consistently used a positive risk-to-reward ratio were nearly three times more likely to be profitable than those who didn’t.

The takeaway? Set realistic profit targets based on market conditions. Tools like Average True Range (ATR) can help you define logical goals rather than relying on arbitrary multiples.

Lie 4: Risk-to-Reward Doesn’t Depend on Win Probability

Risk-to-reward ratios must align with your win rate for long-term success. Here’s a quick breakdown of breakeven requirements:

| Win Rate | Required RRR for Breakeven |

|---|---|

| 30% | 2.33 |

| 40% | 1.50 |

| 50% | 1.00 |

| 60% | 0.67 |

For example, if you’re winning 40% of your trades but using a 1:1 ratio, you’re likely losing money. Similarly, a 30% win rate with anything below a 1:2.33 ratio will erode your capital over time. The key metric here is expectancy – how much profit you generate for every dollar risked. A 1:2 ratio with a 20% win rate leads to losses, while a 1:1.5 ratio with a 60% win rate can yield steady gains.

Jack D. Schwager underscores this point:

"Risk management is more important than your particular approach in trading the markets. And that’s something that retail investors and traders don’t really understand."

Instead of clinging to arbitrary ratios, focus on setting orders that reflect actual market conditions. Use your historical win rate to determine the minimum viable ratio, and adjust your stop-loss and take-profit levels accordingly.

Lie 5: Moving Your Stop Loss Improves Risk-to-Reward

Adjusting your stop loss to "give the trade more room" might seem like a good idea, but it often leads to disaster. Your position size is calculated based on the original stop distance. Moving the stop invalidates that calculation, exposing you to much larger losses than intended.

Investopedia warns against this behavior:

"When you start moving stops with the market, you’ve transformed a tool for managing risk into one where you might amplify it. This behavior can kickstart major losses and can turn manageable setbacks into account-threatening disasters."

The fix? Stick to your original stop-loss levels. Fixed stops aren’t just good practice – they’re critical for adhering to the risk controls set by proprietary trading firms. By respecting your preset limits, you protect your account from unexpected losses and maintain the integrity of your trading plan.

How Prop Firm Rules Expose These Risk-to-Reward Lies

Prop firms have a way of cutting through the noise, forcing traders to confront the flaws in their risk-to-reward assumptions. These firms impose strict rules that demand discipline and precision, testing not just profitability but also how well traders manage risk under pressure. With daily drawdown limits (usually 3–5%) and maximum drawdown caps (typically 8–10%), these rules create a structured environment that reveals the truth about ratios, win rates, and position sizing. This rigid framework leaves no room for wishful thinking, pushing traders toward realistic risk management.

Here’s a staggering statistic: fewer than 10% of traders pass Phase 1 of a prop firm challenge. And it’s not because their strategies are inherently flawed. Most fail because they hit drawdown limits before they can prove their edge. For instance, risking 2% per trade on a $100,000 account means just three consecutive losses could breach a 5% daily loss limit. On the other hand, reducing the risk per trade to 0.5% stretches survivability to ten losses.

Sam Eder, CEO of MarketMates, sums it up perfectly:

"The challenge isn’t testing your upside. It’s testing your ability to manage risk, stay composed, and stick to your process – consistently."

Prop firms also use dynamic drawdown limits, which adjust upward with your account’s peak equity – including unrealized gains – but never move downward. This means if you’re aiming for a 1:5 risk-to-reward ratio and the market reverses before you hit your target, those unrealized gains can shrink your drawdown buffer. A normal pullback could then disqualify you. To add another layer of scrutiny, firms often enforce consistency rules, such as requiring no single trade to account for more than 30% of total profits. This eliminates the illusion that a single big win equals trading mastery. These rules highlight why position sizing is so critical in the prop firm ecosystem.

Breakeven Win Rates Under Prop Firm Rules

While understanding breakeven win rates is essential, prop firm rules introduce an added layer of complexity that pure math doesn’t capture. On paper, a 1:3 ratio only requires a 25% win rate to break even. But in practice, the likelihood of consecutive losses in such a system often leads to drawdown violations before your edge has a chance to shine.

| Risk-to-Reward Ratio | Breakeven Win Rate | Losses to Hit -5% Daily Limit (1% Risk) | Losses to Hit -10% Total Limit (1% Risk) |

|---|---|---|---|

| 1:1 | 50% | 5 | 10 |

| 1:2 | 33.3% | 5 | 10 |

| 1:3 | 25% | 5 | 10 |

| 1:5 | 16.7% | 5 | 10 |

The table paints a clear picture: regardless of the risk-to-reward ratio, risking 1% per trade results in the same number of losses before hitting drawdown limits. This underscores the importance of position sizing over the ratio itself. By lowering your risk per trade, you gain more breathing room to weather inevitable losing streaks. Prop firms aren’t just evaluating whether you can win – they’re testing whether you can endure long enough for your strategy to prove itself.

sbb-itb-46ae61d

How to Set Realistic Risk-to-Reward Goals for Prop Trading

Setting realistic risk-to-reward goals means aligning them with your win rate, trading style, and the rules of your prop firm. Many traders fail prop challenges not because they lack skill, but because their expectations for risk and reward don’t fit within strict drawdown limits and profit targets. Success lies in tailoring your strategy to the math.

Calculating Risk-to-Reward Ratios That Work

The expectancy formula can help you determine if your risk-to-reward ratio is viable:

E = [1 + (W/L)] × P – 1

Here, W is your average win size, L is your average loss size, and P is your win rate. For example, a trader with a 50% win rate and a 1:2 risk-to-reward ratio can expect an average gain of 0.5R per trade. Over 40 trades, this translates to roughly 10% account growth.

Position sizing is another critical factor. Here’s the formula for futures:

Position size = Amount Risked / (Stop Loss × Value per pip/tick)

This tells you how many contracts to trade. For instance, if you’re trading the E-mini S&P 500 on a $50,000 account, risking 0.5% per trade ($250), with a stop loss of 1.5 points (each point worth $50), your position size would be:

$250 / (1.5 × $50) ≈ 3.33 contracts (round down to 3).

This keeps you within the firm’s daily loss limits while allowing room for potential losses.

Here’s a quick reference table to match win rates with minimum risk-to-reward ratios:

| Historic Win Rate | Required RRR (Minimum) |

|---|---|

| 40% | 1:1.5 |

| 50% | 1:1.0 |

| 60% | 1:0.67 |

| 70% | 1:0.43 |

A higher win rate lets you aim for tighter ratios. For example, if your win rate is 60%, a 1:1 ratio may suffice instead of chasing a 1:3 setup. Before entering a trade, use the "Highway Technique" to check if the market has enough room to reach at least a 1:1 ratio before hitting major resistance or swing highs.

Also, don’t overlook transaction costs. For example, a 2-pip spread on a 3-pip stop-loss could widen your effective ratio significantly. Always factor in spreads and commissions when setting targets. Once your ratios are calculated, adjust your strategy to fit the payout structures of your prop firm.

Matching Risk-to-Reward to Prop Firm Payout Structures

After determining your ratios, align them with your prop firm’s profit targets and drawdown rules. Each firm has its own requirements, and your strategy should reflect those specifics. For instance, Apex Trader Funding requires a profit target of $3,000 on a $50,000 account (6%) with a $2,500 trailing drawdown and a 30% profit rule. An overly aggressive ratio, like 1:5, on a single large win could trigger the consistency rule and disqualify you.

FundingTicks, on the other hand, enforces a 25% consistency rule and offers a 20% capital increase if you double your initial profit target through their scaling program. This setup rewards traders who focus on smaller, repeatable wins. A 1:2 ratio with a 50% win rate can help you progress steadily without violating consistency rules.

Here’s a comparison of key features from these two firms:

| Feature | Apex Trader Funding | FundingTicks |

|---|---|---|

| Profit Target ($50k Account) | $3,000 | $3,000 (Pro+) |

| Max Drawdown ($50k Account) | $2,500 (Trailing) | $2,500 (End-of-Day Trailing) |

| Consistency Rule | 30% Profit Rule | 25% Consistency Rule |

| Payout Structure | 100% of first $25k; 90% after | Up to 90% profit split |

| Minimum Trading Days | 7 (Evaluation) / 10 (Payout) | 5 (Pro+ Payout) |

For Apex Trader Funding, you might have more room to set wider targets due to the 30% rule. Meanwhile, FundingTicks’ stricter consistency requirements may call for lower ratios paired with higher win rates. For more details, check out the full reviews on Apex Trader Funding and FundingTicks.

To stay disciplined, set a personal daily loss cap below the firm’s maximum – 1.5% instead of 5%. If your total drawdown reaches -5%, take a week off to reassess your strategy. Prop firms reward traders who manage risk well and stay consistent long enough for their edge to shine. Pair your calculated ratios with the specific payout structures of your chosen firm for the best results.

Tools for Tracking Risk-to-Reward in Prop Challenges

Keeping a close eye on your risk-to-reward ratio is a game changer in prop challenges. Many traders stumble not because their strategies are flawed, but because they exceed drawdown limits. The difference between success and failure often boils down to having the right tools to track your risk in real time. These tools not only provide live performance insights but also fit seamlessly into your risk management plan.

Risk Management Tools to Use

- TradingView‘s Risk/Reward Tool

This chart-based tool allows you to set entry, stop-loss, and take-profit levels visually. It calculates your risk-to-reward ratio and suggests the ideal position size based on your account balance and risk level. For instance, if you’re trading E-mini S&P 500 futures with a $50,000 account and want to risk 0.5% (or $250) per trade, the tool helps determine the correct number of contracts based on your stop-loss distance. - Position Size Calculators

These calculators are essential for sticking to the widely accepted 1% risk rule. By entering your account balance and stop-loss distance, you’ll get precise lot sizes or contract quantities. For example, if you’re risking $250 with a 1.5-point stop on the E-mini S&P 500 (where each point is worth $50), the calculator confirms that trading 3 contracts aligns with your risk limit. - R-Multiple Tracking

Instead of focusing on dollar amounts, tracking your trades in "R" – the amount risked per trade – provides a clearer path to your profit targets. For example, if your Phase 1 goal is a 10% profit, think of it as needing to achieve +10R before hitting –10R. This approach shifts your focus from individual trades to overall performance. - Consistency Rule Calculator

Tools like the Consistency Rule Calculator from DamnPropFirms help you stay within profit distribution limits set by firms like Apex Trader Funding (30% rule) and FundingTicks (25% rule). Simply input your total profit and largest winning trade to see if you’re at risk of breaching these consistency requirements. - Sierra Charts‘ Heatmap

Sierra Charts’ Heatmap provides a visual representation of order flow and market depth, making it easier to set precise stop-loss and take-profit levels.

Refining Your Strategy with Performance Data

Once you’ve incorporated these tools, use performance data to fine-tune your trading strategy. Conduct "ratio audits" by comparing your planned risk-to-reward ratio for each trade with the actual outcomes logged in your trading journal. If you notice a pattern of exiting trades at lower ratios than intended, it could mean you’re moving stop-losses prematurely or cutting winners too early.

"The risk-reward ratio is meaningless on its own… you must combine your risk-reward ratio with your winning rate to know whether you’ll make money in the long run."

- Rayner Teo, Founder, TradingwithRayner

Understanding your trading expectancy – by combining your win rate with your average risk-to-reward ratio – reveals how much your strategy earns per dollar traded over time. Regularly reviewing this metric allows you to make adjustments to your setups and improve consistency.

To ensure targets align with logical support and resistance zones, consider techniques like the highway method. Platforms like TradingView and MetaTrader offer built-in ratio calculators to help you avoid errors during volatile market conditions.

Additionally, audit your intended versus actual risk-to-reward ratios regularly and implement circuit breaker rules, such as reducing risk after a –5% drawdown. These practices can help prevent breaches and maintain discipline.

Finally, monitor your Consistency Rule metrics alongside your risk-to-reward performance. Many prop firms require profits to be distributed across multiple trades rather than relying on one or two big wins. The Consistency Rule Calculator from DamnPropFirms simplifies this process, ensuring compliance while helping you refine your strategy. Successful traders aren’t swinging for home runs – they’re consistently hitting singles and doubles.

Conclusion

Traders often make the mistake of viewing the risk-to-reward ratio as a standalone metric, rather than integrating it into a broader, well-rounded trading system. For instance, a 1:3 ratio sounds appealing, but it’s meaningless if your win rate can’t sustain you through inevitable losing streaks. On the flip side, even an impressive win rate won’t save you if you’re risking $500 to make just $100. The math doesn’t lie, and the strict drawdown limits imposed by prop firms expose these flaws quickly. It’s no surprise that fewer than 10% of traders pass Phase 1, as many overlook the critical "survival equation".

"Strategy wins trades. Risk management wins careers." – BabyPips

This underscores the importance of disciplined risk management and creating strategies tailored to your trading goals. Simple adjustments, like limiting risk to 0.5% or 1% per trade, defining exit points before entering a position, and evaluating performance in terms of R-multiples instead of dollar amounts, can make all the difference. For example, with a 0.5% risk per trade, you could endure up to 10 consecutive losses before hitting a 5% daily drawdown limit. But if you risk 2% per trade, just three losses could knock you out. The contrast between these two approaches often determines whether you secure a funded account or face yet another failed challenge.

To put these principles into action, leverage tools like those offered by DamnPropFirms. Their Consistency Rule Calculator helps you stay on track with profit distribution guidelines, while their verified reviews of platforms like Apex Trader Funding, Take Profit Trader, and Tradeify can guide you in selecting the right challenge structure for your trading style. Plus, by joining their Discord community of over 3,000 traders, you’ll gain access to real-world performance data to refine your approach and avoid self-sabotage.

Forget chasing the "perfect" trade. Focus on managing your risks, and the rewards will take care of themselves.

FAQs

How can I determine the minimum risk-to-reward ratio based on my win rate?

To figure out the minimum risk-to-reward ratio required to break even, use this simple formula: Minimum Risk-to-Reward Ratio = (1 – Win Rate) / Win Rate.

Let’s break it down with an example. Suppose your win rate is 60% (or 0.6). Plugging that into the formula, you get: (1 – 0.6) / 0.6 = 0.67. In practical terms, this means that for every $1 you risk, your target profit should be at least $0.67 to ensure you break even over time.

Grasping this concept is essential for setting realistic goals and staying consistently profitable in the long run.

Why is position sizing important for succeeding in prop firm challenges?

Position sizing plays a crucial role in managing risk and adhering to the strict drawdown limits required by prop firms to secure a funded account. By capping the potential loss on each trade to a small, fixed percentage of your account – often around 1% – you safeguard your capital, even during rough patches. For instance, if you were to face ten consecutive losses at 1% each, your account would shrink by roughly 9.5%. In contrast, ten losses at 10% each could result in a devastating 65% reduction.

This disciplined method not only shields you from catastrophic losses but also ensures you remain in the game long enough for your trading strategy to prove itself. Taking it a step further, dynamic position sizing can add another layer of control by adjusting risk based on your account’s performance – scaling back after losses and increasing exposure following gains. Sticking to these principles consistently can significantly boost your chances of passing the challenge and achieving sustained profitability.

What are the risks of focusing too much on high risk-to-reward ratios?

Focusing only on high risk-to-reward (R:R) ratios might seem like a solid strategy, but it can actually lead to poor trading decisions. Many setups with appealing R:R ratios often come with small potential profits paired with large stop-losses. The problem? Just one loss can erase the gains from several wins. This approach often overlooks the win rate – a key factor in achieving long-term profitability. A high R:R ratio means little if the odds of winning are too low.

In a prop firm setting, chasing overly ambitious R:R targets can push traders into over-leveraging and taking unnecessary risks to hit strict profit or drawdown benchmarks. This pressure can lead to abandoning disciplined strategies, opening oversized positions, and racking up losses that could have been avoided. On top of that, fixed R:R targets fail to adapt to shifting market conditions. This mismatch can result in repeated losses when the anticipated rewards don’t pan out. Over time, such an approach can hurt performance and reduce payout opportunities.