TradeLocker is a browser-based trading platform launched in March 2023, designed primarily for retail forex, CFD, and crypto traders. It has gained traction among proprietary trading firms due to its user-friendly interface and TradingView integration. However, it falls short for professional futures traders due to limited execution features and lack of direct exchange integration.

Key Takeaways:

- TradeLocker is best for retail traders with a focus on forex and CFDs. It offers fast execution (under 100ms with brokers like Sage FX) and a visual risk calculator for position sizing.

- Tradovate and NinjaTrader are preferred by futures traders and prop firms due to their robust tools, direct exchange access, and advanced risk management features.

- TradeLocker Limitations: No direct futures trading, relies on broker connections, and lacks advanced tools like Depth of Market (DOM) or order flow analysis.

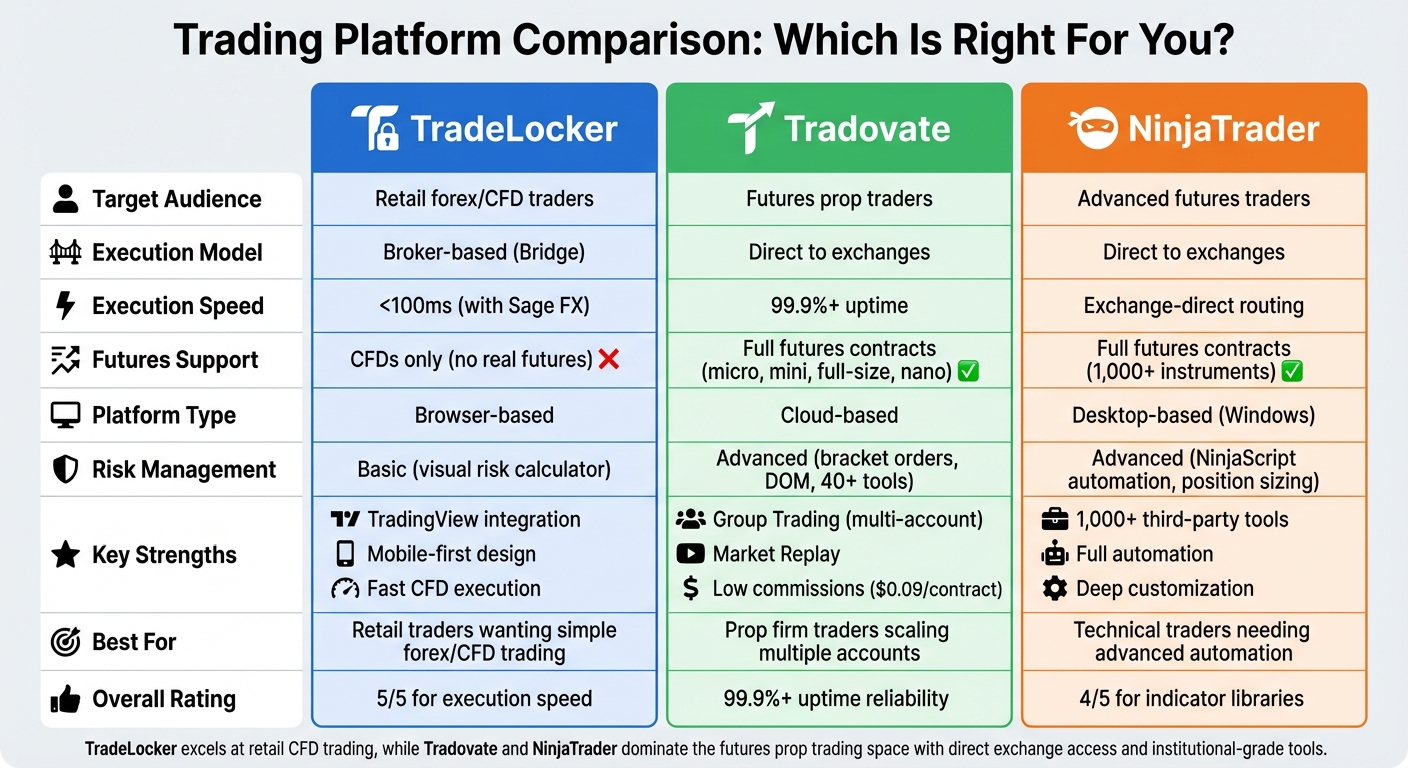

Quick Comparison:

| Feature | TradeLocker | Tradovate | NinjaTrader |

|---|---|---|---|

| Target Audience | Retail forex/CFD traders | Futures prop traders | Advanced futures traders |

| Execution Model | Broker-based (Bridge) | Direct to exchanges | Direct to exchanges |

| Futures Support | CFDs only | Full futures contracts | Full futures contracts |

| Risk Management Tools | Basic (risk calculator) | Advanced (bracket orders) | Advanced (customizable) |

| Platform Type | Browser-based | Cloud-based | Desktop-based |

For retail traders, TradeLocker is a simple and effective platform. But for serious futures trading, Tradovate and NinjaTrader are the better options.

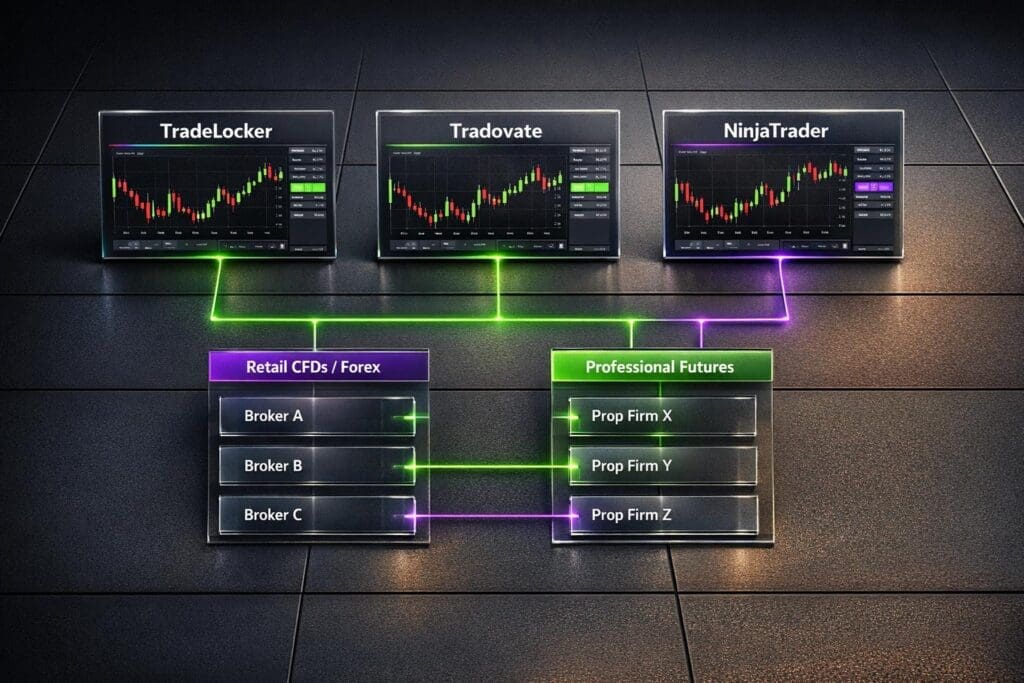

TradeLocker vs Tradovate vs NinjaTrader Platform Comparison

TradeLocker Full Review: Is TradeLocker a Good Trading Platform for Forex and Investing in 2025?

1. TradeLocker

TradeLocker is a web-based trading platform built on TradingView’s charting engine. It caters to forex, CFD, and crypto traders who prefer a straightforward interface without the clutter of older, more complex platforms. In 2025 reviews, it earned a 5/5 score for order execution speed and provides access to over 500 assets.

Execution Quality

TradeLocker is known for its fast execution in CFD and forex trading. For example, orders with Sage FX are consistently executed in under 100 milliseconds. While it may not match the ultra-high-speed performance of platforms like MatchTrader, TradeLocker is more suited to discretionary traders rather than scalpers.

"Execution on EUR/USD is near-instant based on testing, even during high-impact news. If you’re into scalping, Sage FX’s TradeLocker setup is probably one of the best out there." – Paul Holmes

One standout feature is its visual risk calculator, which displays stop-loss and take-profit levels directly on the chart. It shows risk in both dollar amounts and percentages before confirming a trade. This eliminates the need for manual calculations and helps reduce errors in position sizing.

Despite its strengths in execution, TradeLocker has notable limitations when it comes to futures trading.

Futures Support

TradeLocker offers futures trading exclusively as CFDs through brokers like Sage FX, rather than providing access to exchange-traded futures. This is a major drawback, especially for traders in the U.S., where futures trading requires regulatory compliance.

For professional futures trading, platforms like NinjaTrader remain the go-to choice. TradeLocker’s design is better suited for retail and CFD traders, but it lacks the advanced tools required by futures prop traders. For example, it does not offer native integration with CME products or advanced order flow analysis, both of which are critical for serious futures trading.

Scalability for Prop Firms

TradeLocker has gained popularity among forex and CFD prop firms as a viable alternative to MetaTrader, especially after MT4/MT5 license revocations. Firms like Blue Guardian have adopted TradeLocker, offering funding opportunities of up to $400,000. Its mobile-first design and TradingView integration make it particularly appealing to firms targeting retail traders.

However, top futures prop firms avoid TradeLocker due to its execution limitations. The platform connects to brokers through a "Bridge" architecture instead of direct connections to clearing firms, which limits its ability to provide institutional-grade execution. This makes other platforms more attractive for serious prop traders.

Risk Management Tools

TradeLocker includes basic risk management features, such as a risk calculator that calculates position size based on dollar risk and stop distance. It also has a visual margin indicator that shows the percentage of margin used, helping traders avoid stop-outs.

While these tools are helpful for retail traders, they are considered "basic" compared to the advanced risk management systems in platforms like cTrader or MatchTrader. Professional futures traders often require more sophisticated features, such as multi-account management and trailing drawdown logic – features that TradeLocker does not offer.

2. Tradovate

Tradovate is a cloud-based trading platform designed specifically for futures traders. Unlike TradeLocker, which relies on a "Bridge" architecture to connect with brokers, Tradovate offers direct access to centralized futures exchanges like CME Group. This setup sends orders straight to a regulated order book, bypassing the broker’s internal pricing system. Let’s dive into how Tradovate handles execution quality and its features.

Execution Quality

Tradovate operates within the regulated framework of exchange-traded futures, which includes safeguards like Price Banding and Price Limits. Price Banding ensures orders stay within predefined ranges, avoiding erratic fills during market volatility. For Equity Index futures, CME Group implements a three-tier expansion system (7%, 13%, and 20%) to control extreme downside volatility.

Unlike TradeLocker, which uses internal pricing, Tradovate routes orders directly to regulated exchange order books. This direct access enhances transparency and provides the oversight inherent in exchange-traded products.

Futures Support

Tradovate supports a broad range of contracts, including full-size, mini, micro, and nano-sized futures across categories like indices, interest rates, metals, energies, and grains. Day trading margins can be as low as $50 for equity index E-mini futures. Additionally, the platform integrates seamlessly with TradingView, enabling traders to pair Tradovate’s execution capabilities with TradingView’s charting tools.

For those looking to refine their strategies, Tradovate offers a Market Replay feature. This allows traders to test their approaches using historical data without risking real money. It’s especially useful for prop firm traders aiming to perfect their execution before managing larger accounts.

Scalability for Prop Firms

Tradovate’s server-side order management ensures that orders remain intact even during temporary connection disruptions, a critical feature for traders managing multiple funded accounts.

"Orders remain on the server so temporary client-side interruptions are less disruptive." – The Forex Geek

The platform’s pricing structure is also appealing to high-volume traders. For instance, micro futures commissions can drop as low as $0.09 per contract with the Lifetime plan, which requires a one-time payment of $1,499. This setup allows prop traders to scale their volume across multiple accounts without incurring steep per-contract fees.

Tradovate is often used as the execution engine for NinjaTrader, a platform known for its advanced charting and automation tools. This integration ensures traders can leverage their favorite analytical tools while benefiting from Tradovate’s reliable execution environment.

Risk Management Tools

Tradovate provides a suite of advanced risk management features, including bracket orders, multi-target orders, and a spread matrix. The platform also offers over 40 tools, such as a DOM (Depth of Market) and one-click entry, to help traders manage their exposure efficiently.

All settings, layouts, and workspaces are stored in the cloud, allowing traders to seamlessly switch between devices – whether it’s a Mac, PC, iPad, Android, or iPhone – without losing their configurations. This cloud-native approach is invaluable for prop traders who need the flexibility to manage accounts from various locations or devices.

sbb-itb-46ae61d

3. NinjaTrader

NinjaTrader is a desktop platform designed specifically for active futures traders who demand advanced customization and technical tools. Unlike TradeLocker, which relies on a broker-managed bridge to transmit orders, NinjaTrader executes orders directly on exchange-traded futures. This direct execution model provides a strong foundation for evaluating NinjaTrader’s performance in critical areas.

Execution Quality

NinjaTrader focuses on exchange-traded futures, routing orders straight to regulated exchanges. This direct approach ensures a high level of transparency and oversight. For prop firm traders, this setup offers the regulatory clarity and reliability that contracts for difference (CFD) environments often lack.

Futures Support

With access to over 1,000 third-party tools and a wealth of customizable indicators, NinjaTrader empowers traders with extensive technical analysis options. The platform also supports automated strategy development through NinjaScript, giving systematic traders precise control over their execution logic. Its indicator libraries earned a solid 4/5 score, highlighting its depth of technical resources. NinjaTrader’s focus on futures trading is where it truly excels.

Scalability for Prop Firms

Thanks to its reliable execution model, NinjaTrader scales well for prop trading firms. The platform’s automation capabilities, powered by NinjaScript, allow traders to implement consistent strategies across multiple accounts while staying within firm-imposed risk limits, such as a 5% maximum daily loss or a 10% total drawdown. This feature is especially useful for managing multiple funded accounts without the need for manual oversight.

Risk Management Tools

NinjaTrader includes advanced risk management tools like order types, position sizing calculators, and real-time monitoring to help traders comply with strict firm rules. For example, many prop firms prohibit opening new positions within five minutes of high-impact news events to avoid excessive volatility. NinjaTrader’s automation features make it easy to integrate these restrictions directly into trading strategies, minimizing the risk of breaking firm rules. While it has a steeper learning curve compared to TradeLocker, NinjaTrader is ideal for traders who prioritize robust functionality over ease of use.

Pros and Cons

Here’s a quick breakdown of the standout features and limitations of each platform, tailored to different trading styles.

TradeLocker is ideal for traders who value speed and visual risk management. Brokers like Sage FX offer lightning-fast execution with fills in under 100ms. Features like on-chart drag-and-drop tools for stop loss and take profit, combined with a built-in risk calculator, make it easy to see dollar risk at a glance. This eliminates the need for manual pip calculations and helps traders stick to prop firm drawdown limits. However, its ecosystem for custom indicators is still relatively small compared to more established platforms.

Tradovate shines when it comes to managing multiple accounts. Its Group Trading feature allows trades to be copied across several funded accounts seamlessly. With 99.9%+ uptime, it’s a go-to option for scaling within prop firms.

NinjaTrader brings institutional-level execution and deep customization through NinjaScript (C#). It earns high marks for its extensive indicator libraries and support for over 1,000 third-party tools. For traders interested in futures, it offers low margin requirements: $50 for micro futures and $500 for E-minis. However, the platform has a steep learning curve and is limited to Windows for desktop use – though its mobile app saw significant upgrades in 2025.

For prop firm traders, Tradovate and NinjaTrader stand out. Tradovate’s built-in trade copier and NinjaTrader’s automation features provide a clear edge over TradeLocker, which relies on third-party solutions for similar functionality. These distinctions highlight why serious prop traders often lean toward Tradovate or NinjaTrader over TradeLocker.

Conclusion

TradeLocker stands out with its sleek, user-friendly design, appealing to retail traders who value a polished interface and TradingView-style charting features. Its on-chart risk management tools and dependable mobile access make it a practical option for manual forex and CFD trading. However, it’s important to note that TradeLocker is primarily tailored for CFD trading, which leaves it less equipped to meet the demands of serious futures prop traders.

For professional futures traders, other platforms have emerged as the go-to options. Tradovate and NinjaTrader, for instance, are widely recognized for their robust infrastructure. These platforms cater specifically to the needs of prop traders, offering features such as built-in trade copiers for managing multiple accounts, advanced order flow tools like TPO and footprint charts, and exceptional uptime (99.9%+) to ensure reliable execution in high-stakes environments. Unlike platforms retrofitted for futures trading, these tools are purpose-built for futures-first execution, making them the preferred choice for funded futures trading.

FAQs

Why is TradeLocker popular among retail forex and CFD traders?

TradeLocker has gained traction among retail forex and CFD traders thanks to its sleek, user-friendly interface that’s especially welcoming to beginners. The platform stands out with its fast onboarding process and straightforward design, making it less intimidating compared to more complicated trading tools. It also includes built-in risk management features and incorporates TradingView charting, providing both visual appeal and practical functionality for newer traders. While some see it as an alternative to MetaTrader, TradeLocker is tailored more for retail traders who prioritize ease of use over advanced tools or professional-level execution.

Why do prop firms prefer Tradovate and NinjaTrader instead of TradeLocker?

Prop firms often choose Tradovate and NinjaTrader because these platforms are built with professional futures trading in mind. They excel in areas like fast order execution, advanced charting capabilities, and smooth integration with risk management tools tailored for futures trading. These platforms also support multi-account scaling and perform reliably during periods of high volatility – key factors for prop firm traders.

On the other hand, TradeLocker caters more to retail forex and CFD traders. Its user-friendly interface and straightforward design make it appealing to beginners, but it falls short in offering the advanced features, market depth tools, and institutional-grade performance that futures traders need. As a result, most leading prop firms steer clear of TradeLocker.

What are the main drawbacks of using TradeLocker for professional futures trading?

TradeLocker falls short when it comes to professional futures trading, primarily due to some critical shortcomings. It doesn’t offer native futures support, has limited functionality for depth of market and order flow analysis, and lacks integration with professional-grade futures data feeds. On top of that, it imposes restrictions on copy trading and multi-account scaling, which can be a dealbreaker for traders handling multiple funded accounts or relying on advanced tools to optimize their strategies.

These limitations can significantly impact both performance and growth potential for serious futures traders. That’s why many proprietary trading firms opt for platforms specifically tailored to futures trading – ones that deliver high-level execution capabilities and robust risk management features.