Trade copying platforms help futures traders manage multiple accounts by automating trade replication from a master account to follower accounts. These tools save time, reduce errors, and ensure consistent execution, especially for strategies like scalping or high-frequency trading. Here’s a quick look at five of the best options for November 2025:

- TradeSyncer: Designed for professional traders, it offers ultra-low latency, compatibility with major trading platforms (e.g., NinjaTrader, TradingView), and advanced risk controls for prop firms.

- ZuluTrade: A social trading platform with access to 10,000+ signal providers and support for over 100 brokers. Best for swing or position traders.

- MetaTrader (MT4/MT5): Popular for forex and CFDs, it provides broad broker compatibility and low costs. Execution speed depends on broker infrastructure.

- eToro: User-friendly with a focus on retail traders, offering 2,300+ instruments. Limited for prop firm and futures-specific needs.

- IC Markets: Supports multiple platforms (e.g., MetaTrader, cTrader, ZuluTrade) with competitive pricing. Great for algorithmic traders.

Quick Comparison

| Platform | Supported Platforms | Execution Speed | Prop Firm Features | Best For |

|---|---|---|---|---|

| TradeSyncer | NinjaTrader, TradingView, etc. | Ultra-low latency | Yes, with risk controls | Professional traders & prop firms |

| ZuluTrade | 100+ brokers | Moderate | Limited | Social trading and strategy variety |

| MetaTrader | MT4/MT5-compatible brokers | Varies by broker | Basic | Cost-conscious traders |

| eToro | Proprietary platform | Standard | Limited | Beginners and retail traders |

| IC Markets | MetaTrader, cTrader, ZuluTrade | Moderate | Moderate | Algorithmic and futures traders |

Each platform offers unique advantages. Choose based on your trading style, speed requirements, and whether you’re managing funded accounts with prop firms.

How I Use Trade Copiers to Trade Multiple Prop Accounts

1. TradeSyncer

TradeSyncer is a specialized tool designed for futures traders managing multiple accounts at once. Unlike social trading platforms that connect users to a wide array of signal providers, TradeSyncer operates as a private trade-copying system built for precision and performance. It allows traders to scale their strategies across several funded accounts while keeping their methods secure.

With a 4.4-star rating on Google Reviews, TradeSyncer has earned its place as the #1 trade copier and cloud-based copy trading software. It’s trusted by traders and proprietary trading firms across the USA, Canada, and beyond. This reputation stems from its ability to perform reliably in fast-paced trading environments where speed is critical. Here’s how TradeSyncer addresses key needs for futures traders.

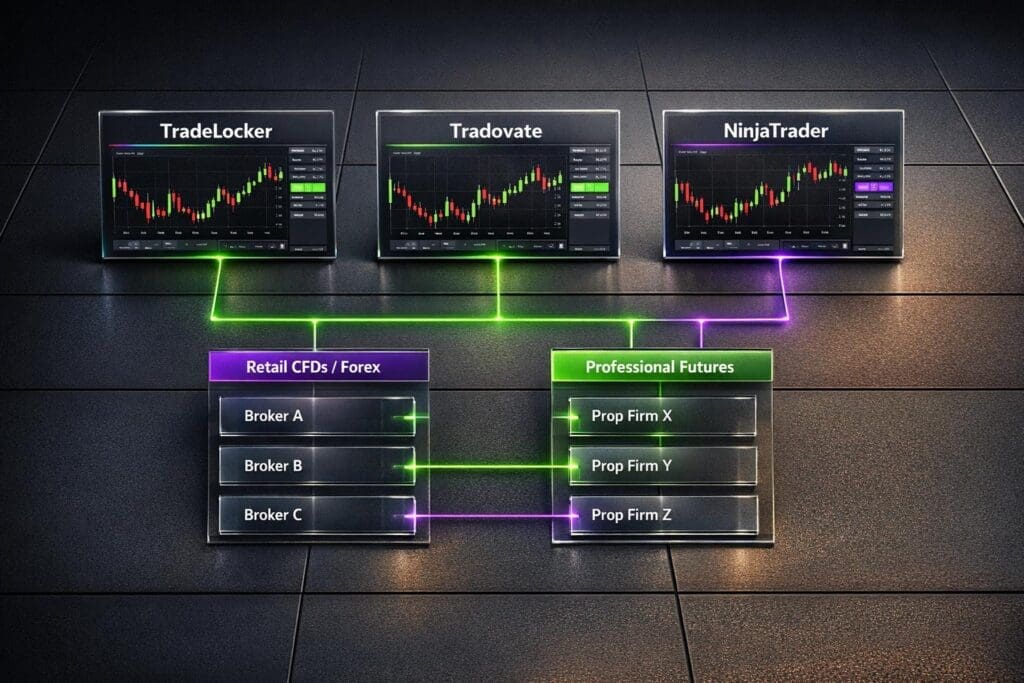

Platform Compatibility

TradeSyncer works seamlessly with all major futures trading platforms, including NinjaTrader, TradingView, Tradovate, Rithmic, ProjectX, Volumetrica, and DxFeed. This broad compatibility means you’re not tied to a single broker or ecosystem. Whether you’re managing an account with a Tradovate partner or another with a Rithmic provider, TradeSyncer can replicate trades from one master account to multiple follower accounts. The platform supports both desktop and mobile devices, making it easy to monitor accounts and manage risks while on the move.

Speed of Trade Execution

Speed is one of TradeSyncer’s standout features. Using ultra-low latency cloud infrastructure, the platform ensures fast trade replication – an essential feature for scalpers and high-frequency traders. In futures markets, where prices can shift in milliseconds, even slight delays in copying trades can result in slippage. TradeSyncer’s cloud-based system minimizes these delays, making it a perfect fit for time-sensitive trading strategies. This speed is particularly important when trading within the strict frameworks of proprietary firms.

Compatibility with Prop Firms

TradeSyncer is designed to meet the compliance needs of proprietary trading firms by ensuring trade activity looks natural. Prop firms closely monitor accounts, and TradeSyncer’s setup replicates trades in a way that mimics native trading behavior. The platform integrates seamlessly with firms listed on DamnPropFirms. By November 2025, traders were using TradeSyncer to synchronize trades from one master account to over 40 follower accounts within these firms.

The platform also includes custom risk management tools, allowing users to reverse trades, adjust lot sizes, and set firm-specific risk parameters. This flexibility helps traders scale their strategies while staying within compliance guidelines. Risk controls such as position limits, maximum loss caps, and automatic stop-loss rules can be applied across all copied accounts, providing an added layer of security.

Pricing and Trial Option

In addition to its technical capabilities, TradeSyncer offers flexible pricing options. To help users get started, the platform includes a free 7-day trial. This trial period allows traders to test its compatibility with their brokers, evaluate trade replication speeds in live markets, and ensure the built-in risk tools align with their needs. For more details, visit DamnPropFirms.

2. ZuluTrade

ZuluTrade is a broker-independent copy trading platform that connects traders with a global network of signal providers. Supporting over 100 brokers worldwide, it allows futures traders to access diverse strategies without needing to change their existing broker relationships. This flexibility makes it particularly appealing for those who want to explore new trading approaches while sticking with their current setup.

The platform caters to various trading strategies by integrating multiple asset classes. With a network of over 10,000 signal providers from across the globe, ZuluTrade offers one of the largest social trading ecosystems. This vast pool of traders provides futures traders with a wide range of strategies, risk profiles, and trading styles – all accessible through a single interface. Instead of creating a strategy from scratch or relying on just one signal provider, users can browse and choose traders whose performance aligns with their goals.

Platform Compatibility

ZuluTrade’s broker-agnostic design ensures broad compatibility, supporting multiple asset classes such as forex, cryptocurrencies, and CFDs on stocks and commodities. For those interested in crypto trading, the platform offers 24/5 availability, providing diversification opportunities beyond traditional futures markets. It integrates seamlessly with brokers like IC Markets and FXCM, acting as a bridge between your broker account and the signal providers you follow.

Trade Execution Speed

Since ZuluTrade operates as a third-party social trading network, its execution speed depends largely on your broker’s infrastructure and the connection between ZuluTrade’s servers and your broker’s API. This setup can introduce some latency compared to direct execution or institutional-grade systems. For scalpers, where every millisecond counts, this latency may lead to slippage. However, ZuluTrade is better suited for swing traders and position traders, whose strategies are less dependent on ultra-fast execution.

Prop Firm Compatibility

ZuluTrade’s strength lies in its flexibility and access to a wide range of trading strategies, rather than in institutional-grade compliance features. It’s an excellent option for individual traders looking to diversify their strategies. For futures traders managing multiple funded accounts through prop firms, ZuluTrade can be a valuable tool for strategy research and diversification. That said, its public marketplace model may lack the advanced risk management features required by some prop firms. If you’re working with firms listed on DamnPropFirms, ensure that ZuluTrade’s execution and risk management capabilities align with your firm’s compliance requirements.

Pricing and Cost-Effectiveness

The cost of using ZuluTrade depends on your broker and account type. It typically operates on a commission or subscription-based model, with fees varying across asset classes. It’s important to check with your broker for the most accurate pricing. The platform is designed to be user-friendly, especially for those new to copy trading. Sophisticated filtering and ranking tools let you sort traders by performance, risk level, and trading style, making it easier to make informed decisions. Additionally, its educational resources and accessible tools make it a practical choice for traders transitioning from manual to copy trading.

3. MetaTrader (MT4/MT5)

MetaTrader 4 and MetaTrader 5 are well-known trading platforms, primarily associated with forex and CFD trading. Over time, both platforms have expanded their capabilities to include copy trading, giving traders the flexibility to blend self-directed strategies with automated trade copying. However, it’s worth noting that these platforms weren’t initially designed with futures markets in mind.

Platform Compatibility

MetaTrader stands out for its compatibility with a wide range of brokers and trading solutions, making it a versatile option. For example, IC Markets is a popular choice for algorithmic copy trading, offering support for MetaTrader 4 alongside several copy trading tools. Other prominent brokers, like AvaTrade and FXCM, also support MetaTrader-based copy trading, allowing traders to compare spreads, commissions, and other trading conditions across platforms.

That said, while MetaTrader can complement certain trading strategies, platforms specifically built for futures trading often provide more specialized features tailored to those markets.

Trade Execution Speed

The speed of trade execution on MetaTrader largely depends on the broker’s infrastructure. While the platform is reliable for most standard trading activities, it may not match the ultra-low latency offered by platforms dedicated to futures trading. Traders using swing or position strategies generally find MetaTrader’s performance sufficient. However, scalpers and high-frequency traders – who rely on rapid execution – might encounter limitations.

When using third-party copy trading networks with MetaTrader, trades often pass through several layers, including the signal provider, the copy trading network, and the broker’s servers. This additional routing can introduce latency, which may impact strategies requiring quick entries and exits in fast-moving markets. As a result, the platform’s effectiveness can vary based on the specific trading approach.

Prop Firm Compatibility

Prop firm traders can use MetaTrader, though the platform isn’t specifically optimized for the unique requirements of prop trading environments. If your prop firm supports MetaTrader, copy trading can be managed through its built-in features or third-party integrations. However, many prop firms favor specialized trade copier software that offers advanced functionality, such as reverse trading, custom risk controls, and lot size adjustments tailored to firm-specific parameters.

If you’re managing multiple funded accounts through firms listed on DamnPropFirms, it’s essential to confirm whether your prop firm allows MetaTrader copy trading. Some firms have strict rules regarding automated and copy trading methods, so always check their policies before implementing a new solution.

Although MetaTrader provides basic risk management tools like stop-loss orders, take-profit levels, and position sizing controls, these features are fairly general. In contrast, specialized trade copier solutions for futures trading often include more advanced safeguards, such as position limits, maximum loss caps, and automated stop-loss rules. These enhanced controls are especially valuable in prop firm environments, where compliance and risk management are critical.

Pricing and Cost-Effectiveness

MetaTrader itself is free to use, but the overall costs depend on the broker’s fees and the specific copy trading service you choose. For instance, Tickmill offers a cost-efficient setup for MetaTrader-based copy trading, with ultra-tight spreads and competitive raw account options. If you opt for third-party networks like ZuluTrade, additional costs – such as spreads, commissions, or subscription fees – should be considered. Some brokers integrate copy trading into their services at no extra charge beyond standard trading fees, while others may impose separate fees.

Ultimately, MetaTrader’s affordability and accessibility make it a strong contender. However, traders should carefully weigh these advantages against the specialized features – like faster execution, lower latency, and advanced risk management – that dedicated futures platforms may provide.

sbb-itb-46ae61d

4. eToro

eToro has carved out a niche as a social copy trading platform, celebrated for its intuitive design. But while its interface is tailored for retail traders, it doesn’t quite meet the advanced demands of professional futures trading. If you’re managing multiple funded accounts or working with proprietary trading firms, it’s important to understand where eToro fits into the broader futures trading landscape.

Platform Compatibility

eToro relies solely on its proprietary desktop platform, which, while easy to use, lacks the advanced features typically found in dedicated futures trading systems. The platform provides access to over 2,300 trading instruments – including exchange-traded securities, forex, CFDs, and cryptocurrencies – but its all-in-one design might feel restrictive for traders who need advanced charting tools, diverse order types, or deeper market data. This focus on simplicity sets eToro apart from platforms designed specifically for futures trading professionals.

Trade Execution Speed

When it comes to speed, eToro isn’t built for high-frequency trading or strategies that demand ultra-low latency. Its infrastructure prioritizes accessibility and user experience over the lightning-fast execution that scalpers or institutional traders might require.

Prop Firm Compatibility

For traders operating in prop firm environments or managing multiple funded accounts, eToro may not be the best fit. Its consumer-focused design lacks the advanced controls and compliance tools often required in these setups. For instance, if you’re trading with firms highlighted on DamnPropFirms, you might find eToro falls short in meeting firm-specific risk management and monitoring standards. Always check with your prop firm to confirm whether eToro’s copy trading features align with their requirements.

Pricing and Cost-Effectiveness

eToro appeals to retail traders with its competitive spreads and fees, making it an attractive option for those who value simplicity and a community-driven trading experience. However, for traders needing institutional-level performance, multi-platform functionality, or better compatibility with prop firms, these cost savings may not outweigh the platform’s limitations.

5. IC Markets

IC Markets sets itself apart by offering access to multiple copy trading platforms rather than sticking to a single proprietary system. This approach makes it especially appealing for traders who value flexibility, particularly algorithmic traders and futures traders looking to keep costs low while having a variety of options.

Platform Compatibility

IC Markets supports a range of copy trading platforms, allowing you to choose the one that best fits your trading style. Options include MetaTrader 4’s Signals market for algorithmic trading, cTrader’s Copy module for direct trade replication, Myfxbook’s AutoTrade for automated strategies, ZuluTrade for social trading with thousands of traders to follow, and the IC Social mobile app, powered by Pelican Exchange. This variety is a big plus, especially if you’re already familiar with MT4 or cTrader.

However, platform availability can vary depending on where you live. For example, futures traders in the U.S. should check which copy trading modules are accessible in their region, as regulatory restrictions might limit certain third-party integrations. This multi-platform setup provides flexibility while ensuring smooth trade execution.

Trade Execution Speed

IC Markets is well-known for its low-cost trading environment and diverse copy trading options. While specific latency metrics aren’t provided, the platform is better suited for algorithmic copy trading rather than ultra-high-frequency strategies that require the fastest execution speeds. If you’re into scalping or high-frequency trading, testing IC Markets’ execution speed against your needs is essential. The platform emphasizes affordability and versatility over delivering the absolute lowest latency.

Prop Firm Compatibility

For traders managing multiple funded accounts through proprietary trading firms, IC Markets offers a practical solution. Its integration with both MetaTrader and cTrader allows you to automate trade replication across funded accounts while benefiting from competitive spreads. However, it’s crucial to confirm that third-party copy trading is permitted by your specific prop firm, especially if listed on DamnPropFirms. IC Markets is more aligned with traders looking to scale systematic strategies rather than those needing specialized compliance features tailored to prop firm regulations.

Pricing and Cost-Effectiveness

IC Markets positions itself as a budget-friendly platform, offering competitive pricing across its various copy trading solutions. This makes it an attractive choice for futures traders who want to minimize costs while exploring different copy trading approaches. Whether you’re interested in algorithmic signals, direct trade replication, or social trading networks, IC Markets provides an affordable way to access a range of tools without being locked into a single system.

Platform Comparison Table

When selecting a trade copying platform, consider features, speed, and compatibility with prop firms. Below is a comparison of TradeSyncer, ZuluTrade, MetaTrader, eToro, and IC Markets, highlighting key attributes like supported platforms, execution speed, and pricing.

| Platform | Supported Trading Platforms | Execution Speed | Prop Firm Compatibility | Trader Network Size | Pricing Model | Best For |

|---|---|---|---|---|---|---|

| TradeSyncer | NinjaTrader, TradingView, Tradovate, Rithmic, ProjectX, Volumetrica, DxFeed | Ultra-low latency (cloud-hosted) | Yes – institutional-grade with custom risk controls | Private infrastructure (no public network) | Contact for pricing; 7-day free trial available | Professional traders & prop firms |

| ZuluTrade | 100+ brokers worldwide | Standard | Limited – lacks specialized prop firm features | 10,000+ trader providers globally | Varies by broker integration | Multi-broker flexibility and social trading |

| MetaTrader (MT4/MT5) | MT4/MT5 compatible brokers with third-party integrations | Standard (varies by broker) | Varies by broker | Depends on third-party service | Typically low-cost; varies by broker | Cost-conscious traders seeking simplicity |

| eToro | Proprietary platform only | Standard | Limited – retail-focused | 2,300+ instruments with large investor base | Spreads-based; no commission on stock trades | Beginners seeking ease of use and community |

| IC Markets | MetaTrader 4, MetaTrader 5, cTrader, ZuluTrade, Myfxbook AutoTrade | Standard | Moderate | Multiple networks via different integrations | Competitive spreads and low-cost environment | Algorithmic traders wanting platform variety |

This table provides a snapshot of each platform’s offerings, helping you weigh their strengths and limitations.

Understanding the Trade-Offs

TradeSyncer stands out with its ultra-low latency and institutional-grade compliance. It’s particularly suited for professional traders and prop firms, as it can synchronize trades from one master account to over 40 follower accounts. Supported prop firms include Apex Trader Funding, Take Profit Trader, Tradeify, Lucid Trading, and FundedNext. With a 4.4/5 rating on Google Reviews, it’s a go-to choice for those needing precision and scalability.

ZuluTrade, on the other hand, connects to over 100 brokers worldwide and boasts a network of more than 10,000 trader providers. While its broker-agnostic model provides flexibility, it lacks the specialized compliance features that are often required by prop firms.

MetaTrader (MT4/MT5) remains a staple in the copy trading world. Its broad broker support and typically low costs make it an accessible choice for traders experimenting with copy trading strategies.

eToro is designed with simplicity and community in mind. With access to over 2,300 instruments via its proprietary platform, it’s ideal for beginners. However, its ecosystem is somewhat restrictive, limiting users to its platform.

IC Markets offers a variety of copy trading solutions, including MetaTrader, cTrader, ZuluTrade, and Myfxbook AutoTrade. This makes it a versatile and cost-effective option for algorithmic traders seeking platform diversity.

Regional Considerations for U.S. Traders

For U.S. traders, platform availability and regional restrictions are important factors. Some third-party integrations, like those from IC Markets, may have limitations in the U.S., so it’s essential to confirm accessibility before committing. In contrast, TradeSyncer’s cloud-based infrastructure ensures consistent performance regardless of location.

If you’re managing funded accounts through prop firms listed on DamnPropFirms, ensure your chosen platform supports third-party copy trading.

Mobile Access and Cross-Device Trading

TradeSyncer provides seamless functionality across desktop and mobile devices, allowing for constant trade monitoring. While most platforms include mobile apps, the quality and feature parity with desktop versions can differ. Testing mobile functionality is crucial if you rely on it for active trading. Consistent performance across devices ensures precise trade execution, especially when managing multiple accounts.

Conclusion

Choosing a platform that aligns with your priorities – whether it’s speed, compliance, or risk management – is key to optimizing your trading strategy. This summary outlines the essential trade-offs between speed, cost, and compliance to help you make an informed decision.

For scalpers and high-frequency traders, execution speed is critical. Platforms like TradeSyncer, with their ultra-low latency and cloud-hosted infrastructure, ensure rapid trade replication – perfect for time-sensitive strategies. If you’re working with a smaller budget, platforms with low minimum deposits might be more appealing.

Prop firm traders often need advanced compliance and risk-management tools. Some platforms provide institutional-grade compliance features and centralized risk controls, while others, such as ZuluTrade, expand your broker options and connect you to a broad network of traders. If you’re a MetaTrader user focused on cost efficiency, brokers like Tickmill offer ultra-tight spreads and MT4/MT5 compatibility for copy trading.

For leveraged futures trading, robust risk controls are a must. Features like customizable position sizing, daily loss limits, and trade reversal options help manage risk effectively.

Platforms like DamnPropFirms simplify these choices by offering verified reviews and comparisons of top-rated prop firms. They also provide tools like the Consistency Rule Calculator, along with perks such as discounts, instant funding options, and access to a Discord community of over 3,000 traders. These resources can guide you in selecting prop firms and trade copying platforms that meet both technical and compliance standards.

Testing demo accounts is a smart way to evaluate execution quality and risk controls before committing real capital. This approach allows you to build confidence and scale your trading as you refine your strategy. Ultimately, the right platform depends on your trading style, account size, and whether you’re managing funded prop accounts. Choose the one that best supports your goals and delivers the results you need.

FAQs

How do TradeSyncer and ZuluTrade compare for futures trading?

While there isn’t detailed information available to directly compare TradeSyncer and ZuluTrade for futures trading, each platform likely brings its own set of features designed for specific trading preferences. To decide which one suits your needs, take the time to explore both platforms thoroughly and see how their offerings match your trading goals and strategies.

How does the execution speed of MetaTrader compare to platforms like TradeSyncer for futures trading?

The speed at which trades are executed on platforms like MetaTrader and specialized futures trading tools such as TradeSyncer can vary greatly. This difference often depends on factors like the quality of server infrastructure, broker connections, and how well the platform is optimized for its intended use.

MetaTrader is a popular choice for forex and CFD trading, but it may not be the best fit for the rapid demands of futures trading. Platforms like TradeSyncer are specifically built for futures traders, focusing on delivering speed and precision. If fast execution is a key part of your trading strategy, opting for a platform designed for futures markets could help reduce latency and improve overall performance.

What factors should futures traders consider when selecting a trade copying platform for managing multiple funded accounts?

When selecting a trade copying platform, futures traders need to consider a few important factors. These include how well the platform integrates with their funded accounts, how user-friendly it is, its pricing structure, and most importantly, the reliability of its trade execution. For those managing multiple accounts, having a platform that supports efficient scalability is crucial. Additionally, features that ensure compliance with proprietary firm rules can make a big difference.

DamnPropFirms provides a range of tools and resources to help traders find trade copying solutions that fit their specific needs. They also offer insights into highly-rated futures prop firms and strategies designed to help traders maximize their payouts.