Trade copying platforms are essential for managing multiple funded trading accounts efficiently, especially in fast-moving futures markets. These platforms automatically replicate trades from a master account to follower accounts, ensuring compliance with strict prop firm rules like daily loss limits and position sizing. Here’s what you need to know:

- Execution Speed: Fast trade replication is critical to avoid slippage, particularly during volatile market conditions.

- Platform Compatibility: Ensure the platform supports your prop firm’s trading systems (e.g., NinjaTrader, Rithmic, CQG).

- Risk Management: Look for tools like daily loss caps, trade filtering, and account-specific settings to stay within firm guidelines.

- Customization: Features like proportional lot sizing and trade synchronization help maintain consistency across accounts.

- Pricing: Subscription costs vary; consider scalability as you manage more accounts.

Quick Comparison of Platforms

| Platform | Best For | Key Features | Pricing Model |

|---|---|---|---|

| TradeSyncer | Futures prop traders | Fast execution, risk controls, multi-sync | Monthly subscription |

| Duplikium | Multi-broker management | Cloud-based, proportional lot sizing | Subscription-based |

| ZuluTrade | Strategy-based trading | Follows strategy providers, forex focus | Embedded in spreads/fees |

| eToro | Beginners exploring social trading | User-friendly, limited futures support | Spreads, overnight fees |

| Quantower | All-in-one multi-asset trading | Integrated copy trading, premium options | Free core features, paid |

| Traders Connect | Managing multiple funded accounts | Fast execution, centralized dashboard | Scalable monthly fee |

Platforms like TradeSyncer and Traders Connect excel for futures traders due to their speed and tailored risk management tools, while Duplikium offers flexibility for multi-broker setups. Choose based on your trading style, firm requirements, and account growth plans.

How I Use Trade Copiers to Trade Multiple Prop Accounts

What to Look for in a Trade Copying Platform

Choosing the right trade copying platform is a critical step for traders looking to manage multiple funded accounts efficiently while staying compliant with prop firm rules. The platform you select will directly influence your ability to scale operations and maintain performance. Here are the key aspects to evaluate.

Speed and Execution Performance

When it comes to copying trades, execution speed is everything. Futures markets are known for rapid price movements, and even a brief delay can mean missing target prices – especially during high-volatility periods like major economic announcements or market openings.

The most reliable platforms use server-to-server connections, bypassing unnecessary intermediaries to ensure faster trade execution. Look for platforms that provide latency statistics so you can track execution times. A combination of speed and stable connections is essential to protect your trades during fast-paced market conditions.

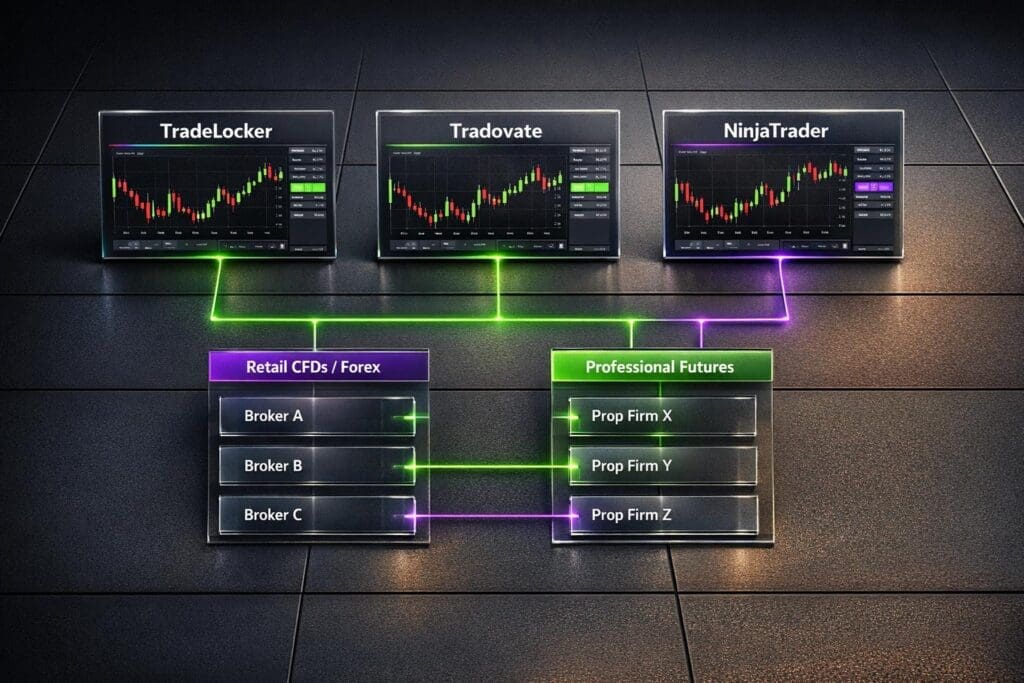

Platform and Broker Compatibility

Different futures prop firms rely on various trading platforms and data feeds. For example, some firms may exclusively use NinjaTrader, while others operate on systems like Rithmic, CQG, or their own proprietary platforms. Your trade copying solution should seamlessly integrate with these infrastructures.

A platform with multi-platform support allows you to work with multiple prop firms simultaneously without needing separate subscriptions or complex setups. It should also accommodate brokers’ specific order routing protocols, authentication methods, and API restrictions to ensure accurate trade signal transmission.

Additionally, the platform should keep accounts synchronized by monitoring active trades, positions, and available balances. This helps prevent overtrading and avoids conflicting positions across your funded accounts.

Risk Management and Customization Options

Prop firms impose strict rules around risk management, and your trade copying platform needs to help you stay within those limits. Whether it’s daily loss caps, maximum drawdowns, or position sizing restrictions, the platform should provide tools to help you stay compliant.

Look for platforms that offer customizable risk settings for each account. Features like trade filtering based on instrument, trade type, or trading hours can be incredibly useful. Built-in safeguards, such as circuit breakers that halt trading when an account approaches its loss limit or automatically close positions at a predefined threshold, are also essential. The platform should ensure all follower accounts mirror the master account’s execution pattern, maintaining consistency and avoiding discrepancies in performance.

6 Trade Copying Platforms Compared

Trade copying platforms come with features tailored to different trading needs, whether you prioritize speed, ease of use, or compatibility with multiple brokers. Choosing the right platform can simplify managing multiple funded accounts. Here’s an overview of six platforms designed with futures prop trading in mind.

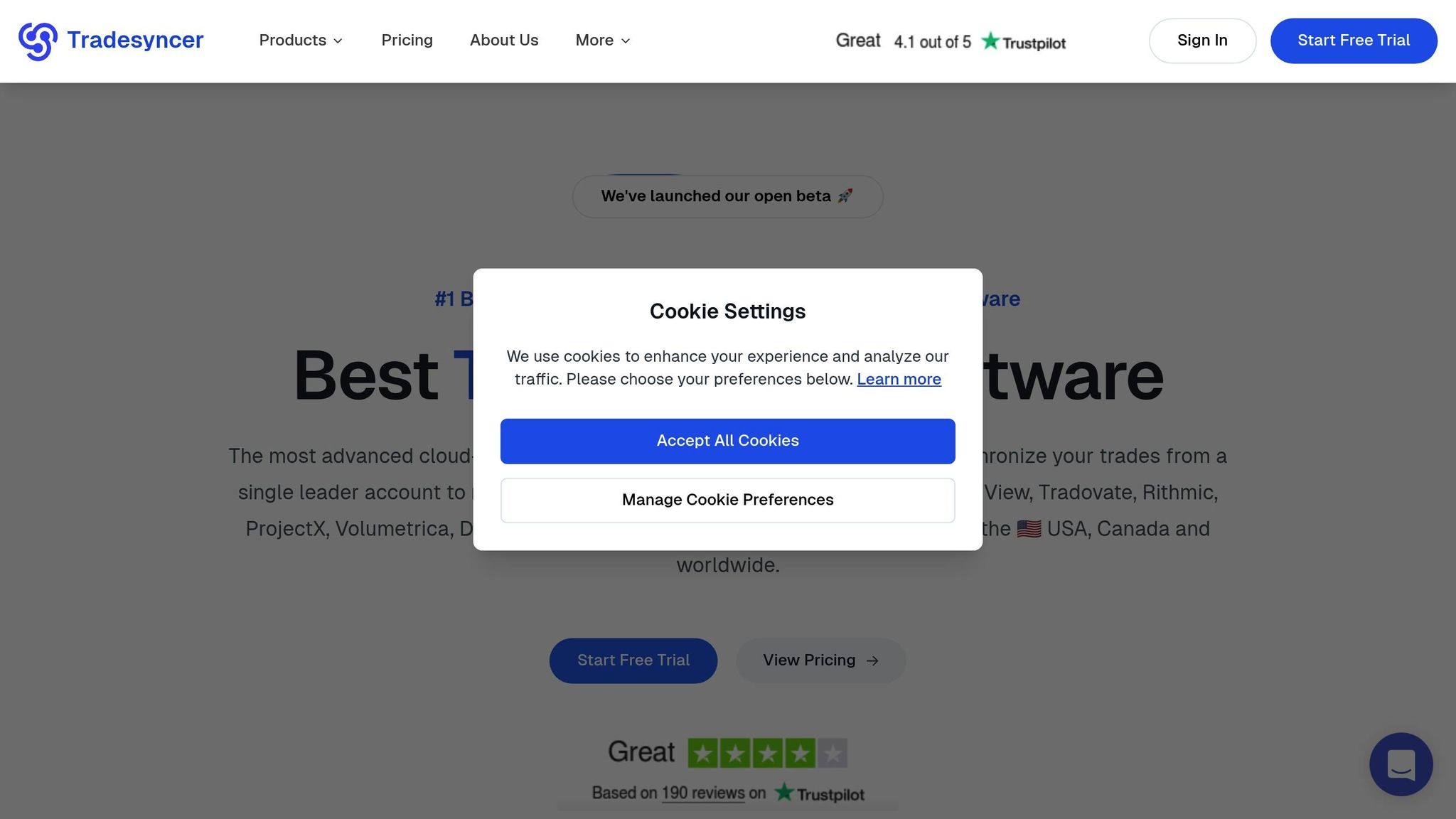

TradeSyncer: Designed for Futures Prop Traders

TradeSyncer caters specifically to futures prop traders. It allows you to sync multiple funded accounts while offering built-in risk management features like daily loss limits and maximum position sizes. Supporting platforms like NinjaTrader, Rithmic, and CQG, it enables seamless account management across various prop firms. This makes it a practical option for traders working with firms such as Apex Trader Funding and Take Profit Trader, where strict risk controls are essential.

Duplikium: Flexible Multi-Broker Support

Duplikium operates as a cloud-based trade copier on dedicated servers, offering compatibility with a wide range of brokers. It supports platforms like MetaTrader 4, MetaTrader 5, and other systems suitable for futures trading. Features like proportional lot sizing automatically adjust trades to match each account’s balance. With a live performance dashboard and a subscription-based model, Duplikium stands out for its multi-broker flexibility.

ZuluTrade: Follow Strategy Providers

ZuluTrade connects traders with a network of strategy providers, allowing you to follow and replicate their trades. The platform provides detailed statistics to evaluate each provider’s performance. While ZuluTrade supports multiple brokers worldwide, its primary focus on forex might make it less ideal for futures traders. Automation tools for setting risk parameters are available, and fees are typically embedded in broker spreads or commissions.

eToro: User-Friendly Social Trading

eToro is known for its straightforward, social trading approach. You can explore portfolios of popular traders and copy their positions effortlessly. While it supports a variety of assets, including stocks, cryptocurrencies, ETFs, and forex, its futures offerings are limited compared to specialized platforms. Be aware of costs such as spreads, overnight fees, and withdrawal charges when using eToro.

Quantower: Integrated Copy Trading

Quantower is a multi-asset platform that incorporates copy trading directly into its interface, eliminating the need for separate software. It connects to data feeds like CQG, Rithmic, and Interactive Brokers, making it suitable for futures trading. You can set up a master account and link follower accounts with customizable risk parameters, such as position size multipliers and trade limits. While the core copy trading features are free, premium options are available via subscription, offering a robust all-in-one solution.

Traders Connect: Fast, Cross-Platform Execution

Traders Connect focuses on fast trade execution across multiple platforms. It works seamlessly with systems like NinjaTrader, Rithmic, and CQG, enabling synchronized trading across several funded accounts. The platform includes filtering tools to control which trades are copied and a centralized dashboard to monitor open positions, account balances, and daily profit or loss. Its scalable monthly subscription makes it a flexible choice for traders managing multiple accounts.

sbb-itb-46ae61d

Platform Comparison Table

The table below compares key features of various platforms designed to manage funded trading accounts effectively.

Feature Comparison in Markdown Format

| Feature | TradeSyncer | Duplikium | ZuluTrade | eToro | Quantower | Traders Connect |

|---|---|---|---|---|---|---|

| Primary Focus | Futures prop trading | Multi-broker flexibility | Strategy provider network | Social trading | Multi-asset platform | Cross-platform execution |

| Execution Speed | Fast (optimized for futures) | Moderate (cloud-based processing) | Variable (depends on provider) | Moderate | Fast (direct feed connection) | Fast (optimized for futures) |

| Platform Support | NinjaTrader, Rithmic, CQG | MT4, MT5, futures platforms | Multiple brokers worldwide | eToro platform only | CQG, Rithmic, Interactive Brokers | NinjaTrader, Rithmic, CQG |

| Pricing Model | Monthly subscription | Subscription-based | Included in spreads/commissions | Spreads, overnight fees, withdrawal charges | Free core features, premium subscription available | Monthly subscription (scalable) |

| Risk Management Tools | Daily loss limits, max position sizes | Proportional lot sizing, risk parameters | Basic automated safeguards | Basic stop-loss tools | Position size multipliers, trade limits | Trade filtering, position controls |

| Futures Prop Firm Compatibility | Excellent (built for prop firms) | Good (multi-broker support) | Limited (forex-focused) | Poor (limited futures offerings) | Good (direct feed access) | Excellent (designed for funded accounts) |

| Account Management | Multi-account sync | Cloud-based dashboard | Strategy provider selection | Copy trader portfolios | Integrated master/follower setup | Centralized dashboard |

| Best For | Traders with multiple funded accounts at firms like Apex Trader Funding | Traders needing multi-broker flexibility | Following established strategy providers | Beginners exploring social trading | Traders wanting all-in-one solution | Managing multiple prop firm accounts efficiently |

| Customization Level | High | High | Medium | Low | High | High |

| Setup Complexity | Moderate | Moderate | Low | Very Low | Moderate to High | Moderate |

This table highlights the strengths and trade-offs of each platform. TradeSyncer and Traders Connect stand out for futures prop traders, as they connect directly to funded-account systems, offering quick execution and built-in risk management tools. These features make them well-suited for traders managing multiple funded accounts.

Duplikium uses a cloud-based approach, allowing traders to manage accounts from anywhere without the need for local software. On the other hand, Quantower integrates trade copying directly into its platform, eliminating the need for separate tools. This makes it particularly appealing for those seeking an all-in-one trading solution.

Platforms like ZuluTrade and eToro cater to different audiences. ZuluTrade is a good fit for traders interested in following proven strategy providers, but its focus on forex makes it less suitable for futures prop trading. Meanwhile, eToro simplifies trading for beginners with its social trading features but lacks the advanced customization and futures-specific tools that professional traders often need.

When it comes to pricing, subscription-based platforms provide predictable costs, while others, like Quantower, offer free core features, making them a low-risk option for those testing trade copying before committing to premium plans.

Integrated risk management tools across these platforms help ensure compliance with strict prop firm trading limits, giving traders peace of mind as they navigate their strategies.

What Futures Prop Traders Need to Consider

When trading with a prop firm’s capital, it’s essential to use a copying platform that strictly enforces rules to protect your account. Here are the critical factors to evaluate when selecting a platform for prop firm trading.

Compliance with Prop Firm Rules

Prop firms enforce strict limits, such as daily loss caps, drawdown thresholds, and position size restrictions. A reliable copying platform should monitor these metrics automatically to prevent any breaches. Tools like TradeSyncer and Traders Connect include risk management features that alert you when you’re approaching key thresholds, helping you stay within the firm’s guidelines.

Some firms, like Apex Trader Funding and Take Profit Trader, also impose limits on your largest winning day’s profit. Monitoring this metric across all accounts is crucial to avoid disqualification.

Platform Compatibility

If you’re trading through Tradeify on Rithmic and Alpha Futures on CQG, your copying platform must integrate seamlessly with both. Compatibility ensures smooth operations across different brokers and data feeds.

Execution Speed

Execution speed can make or break your trades, especially in fast-moving futures markets. Even minor slippage can turn a winning trade into a loss, particularly for scalpers. Direct feed connections generally deliver faster execution compared to cloud-based solutions, making them a better choice for time-sensitive strategies.

Trading Style Considerations

Your trading approach influences the features you should prioritize. Scalpers need platforms with ultra-fast, direct integrations, while swing traders may value comprehensive risk management tools and remote account control more highly.

Scaling Costs

As you grow from managing a few accounts to many, account-based fees can increase significantly. It’s wise to calculate potential costs based on your anticipated growth rather than your current setup.

Customization Options

A good copying platform should automatically adjust contract sizes proportionally when replicating trades. For example, if your master account is $50,000 and follower accounts vary in size, the platform should scale trades accordingly to maintain consistency across accounts.

Server Location and Infrastructure

The location of your data center and server infrastructure affects execution quality. If your master account executes trades on servers in Chicago, but your copying service operates from distant data centers, you could experience latency issues. Platforms offering local server options or allowing you to choose server locations often provide more reliable performance.

Ease of Setup

Choose a platform that matches your technical skill level. Even the most powerful system can be ineffective if it’s too complex to configure properly.

Customer Support and Documentation

Technical problems can cost you both time and money. Opt for a platform with responsive customer support, clear documentation, and active user communities to address any issues quickly.

Backup Plans

Plan for redundancy. If your copying service fails during market hours, having a backup system or the ability to intervene manually can save you from financial losses.

These considerations add depth to the earlier focus on execution speed and risk management, offering a more complete approach to evaluating platforms. For instance, trading with FundedNext Futures may require a different setup than trading with Topstep. The right platform should complement your trading style without introducing unnecessary complications.

Choosing the Right Platform for Your Trading

Picking the right trade copying platform is all about aligning it with your trading style and future goals. What works for a scalper juggling three accounts might be a nightmare for a swing trader managing 20 accounts. Here’s how to approach the decision, building on key considerations like execution speed and risk management.

Start by identifying your priorities. For example, firms like Apex Trader Funding or Take Profit Trader emphasize strict compliance monitoring. Platforms with automated compliance alerts are a smart choice here. Without these safeguards, you risk simultaneous account disqualification – a costly mistake.

Your trading style directly impacts the platform’s technical requirements. Scalpers, who rely on lightning-fast execution, need direct feed connections and sub-second speeds. Even a slight delay – say, 200 milliseconds – can eat into profits when you’re entering and exiting positions within minutes. Swing traders, however, may find value in tools for risk management and remote access, where speed is less critical.

Think ahead to your account growth. If you’re managing two accounts now but plan to scale up to ten in six months, consider the costs. A platform charging $50 per account monthly might seem affordable at first ($100/month for two accounts) but quickly adds up to $500/month for ten accounts. In such cases, flat-rate pricing structures often make more sense as you expand.

Broker compatibility is another essential factor, especially when trading across multiple prop firms. Let’s say you’re using Tradeify on Rithmic, Alpha Futures on CQG, and Topstep on a different platform. You’ll need a copier that integrates seamlessly with all three. Options like Duplikium and ZuluTrade offer broader broker support, while TradeSyncer focuses specifically on futures prop firms. Ensure the platform’s features are intuitive and easy to use.

Match the platform’s complexity to your technical skills. If you’re not particularly tech-savvy, opt for platforms with straightforward setup and responsive customer support. While advanced systems like Quantower offer extensive customization, they can be overwhelming without prior experience.

Server proximity to your master account is another factor to consider. Platforms that allow you to choose server locations or offer local hosting options can significantly reduce latency, ensuring smoother performance.

Finally, test before committing. Take advantage of trial periods to evaluate execution speeds, risk controls, and compatibility. A platform that works well for traders at FundedNext Futures might not be ideal for those at TickTickTrader. Testing ensures you’re not stuck with a system that doesn’t meet your needs.

FAQs

How can I choose the best trade copying platform for my trading style and prop firm needs?

When picking a trade copying platform, a few important factors should guide your decision. First, take a close look at the platform’s features to ensure they align with your trading strategies and objectives. A platform that supports the tools and functionalities you need can make a significant difference in your trading experience.

Next, think about pricing. Make sure the platform fits within your budget without compromising on the essentials you require. Additionally, consider its ease of use – a user-friendly interface can save you time and let you focus on what truly matters: your trading.

Another critical factor is the platform’s compatibility with your proprietary firm’s requirements. If you’re trading futures, for instance, choose a platform that integrates smoothly with futures trading tools and workflows. By carefully evaluating these aspects, you’ll be in a better position to choose a platform that matches your trading style and supports your path to success.

What should I look for in a trade copying platform to ensure fast execution and compatibility with my trading tools?

When selecting a trade copying platform, execution speed should be at the top of your list. Quick execution is crucial to reduce slippage and ensure trades are mirrored precisely and without unnecessary delays. This becomes even more critical in fast-paced markets, where even a slight lag can affect your outcomes.

Another key consideration is whether the platform works well with your existing trading tools, like MT4 or MT5. Ensuring compatibility means your strategies and setups will integrate seamlessly with the trade copying system, helping you maintain efficiency and avoid extra hassles.

How do trade copying platforms help traders follow prop firm rules, like daily loss limits and position sizing?

Trade copying platforms make it easier for traders to adhere to prop firm rules by providing built-in risk management features. These features often include tools like position scaling, which adjusts trade sizes to meet specific criteria, and filters that set limits, such as maximum daily losses or restrictions on the number of contracts per trade.

By automating these protective measures, these platforms allow traders to concentrate on executing their strategies without worrying about unintentionally violating firm guidelines.