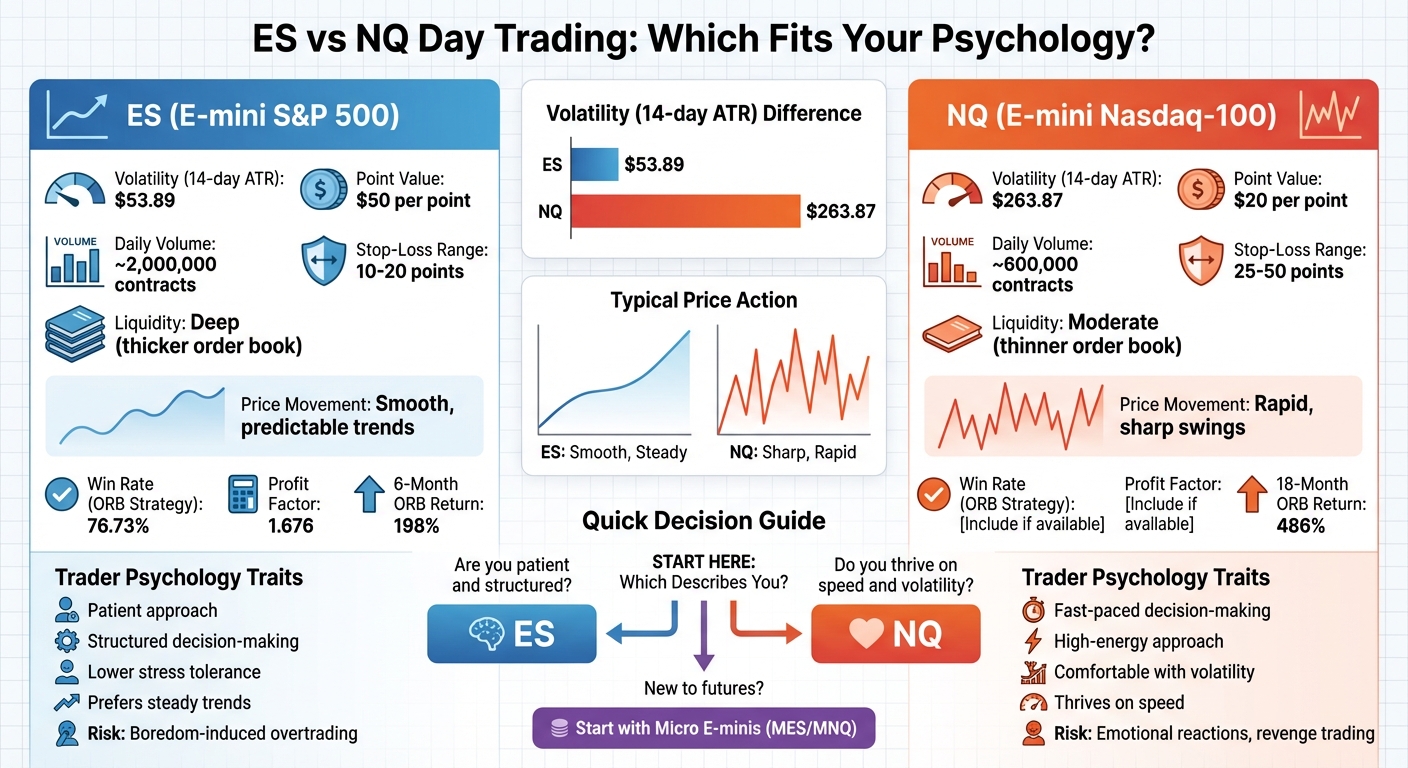

Picking between ES (E-mini S&P 500) and NQ (E-mini Nasdaq-100) comes down to how you handle market pressure. ES offers steadier price movements and suits traders who prefer a calm, structured approach. NQ, with its fast-paced volatility, is better for those who thrive on quick decisions and high-energy trading.

Key Takeaways:

- ES (E-mini S&P 500):

- Lower volatility (14-day ATR: ~$53.89).

- Smoother price action with deeper liquidity (2M+ daily contracts).

- Ideal for patient traders who prefer predictable trends.

- Point value: $50, smaller moves = less stress.

- NQ (E-mini Nasdaq-100):

- Higher volatility (14-day ATR: ~$263.87).

- Rapid, sharp price swings (600K daily contracts).

- Fits traders comfortable with fast decisions and big reversals.

- Point value: $20, but larger moves = higher risk.

Quick Comparison Table:

| Feature | ES (E-mini S&P 500) | NQ (E-mini Nasdaq-100) |

|---|---|---|

| Volatility (ATR) | ~$53.89 | ~$263.87 |

| Point Value | $50 per point | $20 per point |

| Daily Volume | ~2,000,000 contracts | ~600,000 contracts |

| Stop-Loss Range | 10–20 points | 25–50 points |

| Trader Fit | Patient, structured | Fast-paced, high-energy |

If you’re new, start with Micro E-minis (MES or MNQ) to manage risk and learn each market’s behavior. Your choice depends on your temperament: steady and patient? Go with ES. Thrive on speed and volatility? NQ might be your match.

ES vs NQ Futures Trading Comparison: Volatility, Volume, and Trader Psychology

Key Differences Between ES and NQ Futures

Contract Specifications and Dollar Impact

When comparing ES and NQ futures, the differences in point value and volatility stand out. A single point in ES is valued at $50, while the same point in NQ is worth $20. At first glance, NQ might appear more accessible due to its lower point value, but its higher volatility often means it covers more ground in terms of points throughout the day. For example, a 0.25-point move in ES equates to $12.50, whereas in NQ, it’s just $5.00.

Because of NQ’s volatility, traders typically use wider stop-loss levels to manage risks effectively. While ES traders might set stops between 10 and 20 points, NQ traders often go for stops ranging from 25 to 50 points. This ensures that the dollar risk remains comparable. For instance, risking 15 points on ES amounts to $750 (15 × $50), while a 35-point stop on NQ equals $700 (35 × $20).

For traders with smaller accounts, Micro E-mini contracts (MES and MNQ) offer a scaled-down alternative. These contracts are worth one-tenth of their standard counterparts, with MES valued at $5 per point and MNQ at $2 per point. This allows for more precision in position sizing, as ten micro contracts equal one standard E-mini contract. These differences in contract specifications also influence liquidity and price movement.

Liquidity and Market Behavior

Liquidity plays a crucial role in how ES and NQ behave in the market. ES dominates in trading volume, averaging over 2,000,000 contracts daily, while NQ sees about 600,000 contracts traded. This disparity creates a "thicker" order book for ES, with hundreds of contracts available at each price level. As a result, ES tends to have smoother and more predictable price movements. On the other hand, NQ’s "thinner" order book can lead to more sudden price swings and wider bid-ask spreads, especially during volatile periods.

"ES trades levels more ‘true’… NQ, on the other hand, has a habit of blowing through levels before making a sharp reversal." – Ryan Bailey

This difference in liquidity also impacts how large institutional orders affect the market. ES can handle significant orders with minimal disruption, while NQ is more prone to sharp price jumps during periods of high activity. These characteristics shape the overall trading experience for each contract.

Volatility and Price Movement Speed

The contrast in volatility between ES and NQ is striking. ES has a 14-day Average True Range (ATR) of $53.89, while NQ’s ATR is nearly five times higher at $263.87. Additionally, ES adheres to its ATR about 75% of the time, compared to 73% for NQ.

"NQ can take you from break-even to max loss faster than ES." – edgeful

This heightened volatility means NQ often requires quicker decision-making. Price moves of 20–50 points can occur within seconds, leaving traders with little room to hesitate. In contrast, ES’s slower, more deliberate price action provides traders with a bit more time to assess key levels like support and resistance. A six-month study of Opening Range Breakout strategies highlights this dynamic: NQ delivered a total P&L of 486%, compared to 198% for ES. While NQ offers greater opportunities, it also demands a sharper, faster trading approach to manage its risks effectively. This balance between opportunity and risk is a key consideration when aligning trading styles with these contracts.

Matching Your Trading Psychology to ES or NQ

Trader Traits That Fit ES

The ES contract is ideal for traders who value structure and patience. If you like to take your time analyzing trends and key levels before making a move, ES gives you that opportunity. Its predictable price action and deep liquidity mean you can avoid the high-pressure decisions that come with faster markets. For traders with a lower tolerance for stress, ES offers smoother movements that make position management less nerve-wracking.

However, trading ES isn’t without its challenges. The market can often settle into tight, slow-moving ranges, which can test your discipline. During these lulls, it’s easy to feel bored and tempted to force trades that don’t meet your criteria. Staying patient and avoiding impulsive decisions during these periods is key. If you can resist overtrading, ES rewards patience with trends that are often more reliable.

Trader Traits That Fit NQ

NQ, on the other hand, is a better fit for traders who thrive in fast-paced, high-pressure environments. Its rapid price movements demand quick decision-making and little room for hesitation. If you’re comfortable with sharp reversals, explosive volatility, and the potential for significant price swings in seconds, NQ could be your ideal match.

"If you thrive on speed, volatility, and fast scalps → NQ is your playground. If you prefer steady trends, structure, and a slower pace → ES is your zone." – EQ.Trades, EPIQ Trading Floor

That said, trading NQ comes with its own set of psychological demands. The tech-heavy composition of the index often leads to sudden, large moves that can quickly hit daily loss limits. If you’re prone to emotional responses, NQ’s volatility can be overwhelming, leading to panic exits or revenge trading after losses. Managing these emotional reactions is critical to succeeding in this fast-moving market.

Common Psychological Mistakes in ES and NQ

No matter which contract aligns with your trading style, avoiding common psychological pitfalls is essential for success.

For ES traders, boredom is often the biggest enemy. The slower pace can tempt you into overtrading or taking setups that don’t meet your criteria. Another common issue is taking profits too early. The controlled nature of ES can create anxiety about losing gains, causing traders to exit trades before trends fully mature.

NQ traders, on the other hand, often face challenges tied to its volatility. Sudden price reversals and rapid swings can derail even the best-laid plans, leading to premature exits from winning trades or holding onto losing positions in the hope of a turnaround. Mismanaging stop-loss orders is another frequent issue; stops that are too tight for NQ’s natural volatility can result in being stopped out unnecessarily. Revenge trading, driven by the urge to recover losses quickly, is another trap that many NQ traders fall into.

| Psychological Trait | Better Fit | Reason |

|---|---|---|

| Patient, structured approach | ES | Slower trends allow more time for analysis |

| High-speed decision-making | NQ | Rapid moves require instant reactions |

| Lower stress tolerance | ES | Smoother price action reduces pressure |

| Comfort with volatility | NQ | Can handle sharp reversals and wide swings |

| Prone to boredom | NQ | Constant activity prevents overtrading |

| Emotional reactions to losses | ES | Predictable moves help reduce panic |

Understanding your psychological strengths and weaknesses is just the first step. To succeed, you must also work to avoid the common mistakes tied to each contract’s unique challenges. Consistency comes from mastering both your strategy and your mindset.

Day Trading Strategies for ES and NQ

Day Trading Strategies for ES

When trading ES (E-mini S&P 500), the strategy you choose should align with your trading style. This market rewards traders who value structure and patience, making it a great fit for strategies based on institutional levels and predictable price patterns. One standout approach is the Opening Range Breakout (ORB). During the first hour of trading (9:30–10:30 AM EST), institutional desks execute large overnight orders, setting the tone for the day’s market direction. Over a 6-month study, the ORB strategy achieved a win rate of 76.73% with a profit factor of 1.676.

Another solid approach is the VWAP Bounce Play. Institutional traders often use the Volume Weighted Average Price (VWAP) as a benchmark, treating pullbacks to this level as prime entry points during trending markets. The key here is to wait for price confirmation before entering, as impulsive moves can lead to unnecessary losses.

The Gap Fill Strategy is also effective for ES. Data reveals that roughly 60% of price gaps – whether up or down – are filled within the same trading session. If ES opens with a gap, there’s a strong likelihood the price will return to fill it later in the day. However, ensure you see confirming price action before jumping in.

Risk management is critical when trading ES. The contract allows for tighter stop-loss placements, with typical stops ranging from 2 to 4 points for scalping setups or 10 to 20 points for swing trades. Since each point is worth $50, a 4-point stop translates to a $200 risk per contract. Adopting the 3-5-7 rule – risking no more than 3% of your capital per trade, limiting overall exposure to 5%, and aiming for a 7% return on winning trades – can help maintain a favorable risk-reward balance.

The Daily Level Sweep & Reversal strategy is another favorite among experienced traders. This method takes advantage of “liquidity hunting,” where institutions push prices beyond key daily highs or lows to trigger retail stop-losses before reversing. Traders monitor these levels closely and enter positions when the price reclaims the swept zone.

Day Trading Strategies for NQ

Trading NQ (E-mini Nasdaq-100) requires a different mindset. Its fast and volatile price movements make it better suited for momentum and breakout strategies rather than patient trend-following. While the Opening Range Breakout works for both ES and NQ, it’s often more explosive on NQ. An 18-month study ending in September 2025 showed that an optimized ORB strategy for NQ delivered a 486% profit compared to a 198% return for ES over a 6-month period.

Scalping is a favorite tactic for NQ traders, focusing on quick moves of 10–20 points. The 14-day Average True Range (ATR) for NQ is $263.87 – nearly five times higher than ES’s $53.89. This higher volatility means traders need wider stop-losses, typically between 25 and 50 points, to avoid being shaken out by routine market fluctuations.

Another effective strategy for NQ is the Fair Value Gap (FVG) Rejection. This approach involves spotting price imbalances – gaps created by aggressive institutional activity – that can act as either magnets or rejection zones when revisited.

Managing risk on NQ is especially important due to its volatility. Each point is worth $20, so a 30-point stop results in $600 of risk per contract. To calculate position size, divide your maximum acceptable risk (e.g., 3% of your account) by the stop-loss distance. For example, with a $10,000 account, risking 3% equals $300. Since a 30-point stop risks $600 per contract, you’d trade half a contract or consider using the Micro NQ (MNQ) for more flexibility.

"Nobody should trade NQ until they can trade ES profitably. Master the fundamentals on the smoother instrument first." – Edgeful

These strategies provide a solid foundation, but combining them with advanced market analysis tools can elevate your trading game.

Tools for Analyzing Market Behavior

Having the right tools can make or break your trading performance. One essential tool is ATR (Average True Range), which helps gauge daily market movement. For instance, NQ’s ATR of $263.87 suggests that setting a 10-point stop is too tight and likely to result in premature exits.

Depth of Market (DOM) is another valuable resource. It shows real-time buy and sell orders at various price levels. In ES, the deep liquidity often creates visible “walls” where institutions defend key levels. On the flip side, NQ’s lower liquidity means these levels can be swept aside quickly.

"NQ tends to blow through levels lately because of a lack of liquidity… even using the DOM is harder because you’re only seeing 10 levels, and that can be worked through in a second or two." – Gotcha, EliteTrader Forum Member

Volume Profile Analysis is also indispensable. It highlights high-volume nodes that act as support or resistance and low-volume areas where prices can move quickly.

One often-overlooked but critical tool is journaling. By recording details of every trade – entry, exit, stop-loss, and reasoning – you can identify patterns in your performance. For example, you might notice consistent success with VWAP bounces but struggle with breakouts. Tracking these insights is key to refining your strategies like the 3-5-7 rule.

For traders using funded accounts, tools like the Consistency Rule Calculator are invaluable. These help ensure you stay within daily profit requirements and loss limits, which is just as important as generating returns when trading with external capital.

sbb-itb-46ae61d

Using Prop Firm Accounts for ES and NQ Trading

How Prop Firm Rules Affect ES and NQ Trading

Prop firm accounts let traders use external capital but come with strict risk management rules. These rules, like daily loss limits and maximum drawdowns, impact trading differently for the ES (E-mini S&P 500) and NQ (E-mini Nasdaq 100) due to their unique volatility patterns. ES tends to move more steadily, which can make it easier to stay within tight risk limits. On the other hand, NQ’s sharp price swings can quickly take a trade from break-even to hitting the max loss limit.

Let’s break it down: on a $50,000 account with a $2,000 daily loss limit, trading ES gives you about 40 points of room (at $50 per point). NQ, with $20 per point, offers 100 points of flexibility, but its higher volatility can eat that buffer in no time. Prop firms prioritize steady, consistent gains over erratic swings. Tools like the Consistency Rule Calculator from DamnPropFirms can help traders ensure their biggest winning days don’t violate a firm’s profit distribution rules.

It’s not just about point counts – it’s about dollar risk. For instance, a 50-point stop on NQ equals a $1,000 risk, which is similar to a 20-point stop on ES. Many traders overlook this and treat stops on NQ as if they’re the same as ES, risking their accounts in the process. During evaluations, using micro contracts like MES (Micro E-mini S&P 500) or MNQ (Micro E-mini Nasdaq 100) can help you fine-tune position sizes without breaching loss limits.

These differences underline the importance of using specialized tools and strategies to manage risk effectively.

DamnPropFirms Tools for ES and NQ Traders

DamnPropFirms offers a range of resources to support traders navigating the ES and NQ markets. Here are three key tools:

- Verified Reviews: The platform provides detailed reviews of futures prop firms, highlighting differences in drawdown and consistency rules. This helps traders choose firms that align with their trading style and contract preferences.

- Discounts and Promo Codes: By offering discounts for evaluations, DamnPropFirms lowers the financial barrier to entry. This is especially helpful for testing strategies on different account sizes without committing significant capital upfront.

- Consistency Rule Calculator: This tool helps traders avoid payout issues by tracking whether a single large winning day skews their profit distribution. It’s particularly useful for NQ traders, who might experience strong momentum runs but later face problems with consistency guidelines.

Additionally, the platform ranks top prop firms like Apex Trader Funding, Take Profit Trader, and Tradeify. Each ranking includes direct links to comprehensive reviews, making it easier to find a firm that suits your needs. For further support, traders can join a Discord community of over 3,000 members to discuss strategies and firm-specific rules for ES and NQ trading.

Scaling Your Strategy with Funded Accounts

Once you understand the rules and tools, scaling your strategy requires a step-by-step approach. Start with micro contracts during evaluations – 10 MES contracts, for example, are equivalent to 1 ES contract in dollar terms. This approach gives you precise control over risk. After passing evaluations and securing funding, gradually increase your position size as your account balance grows, rather than maxing out your buying power right away.

A good rule of thumb is to risk no more than 1% of your account balance on any single trade. For a $50,000 account, this means keeping your risk at $500 per trade. For ES, that translates to a 10-point stop (at $50 per point) with one contract. For NQ, a 25-point stop (at $20 per point) aligns with the same $500 risk. As your account grows – say, to $75,000 – you can scale up to two contracts while sticking to the 1% risk limit.

Moving from evaluation to funded trading often brings a shift in mindset. During evaluations, the pressure to hit profit targets can feel overwhelming. Once funded, the focus shifts to preserving capital and maintaining consistent gains. ES’s steadier price action can make it easier to achieve the modest, regular profits that prop firms reward with account increases and profit splits.

"Discipline is crucial in trading as it ensures traders stick to their strategies and trading plans. This helps them avoid impulsive decisions driven by emotions." – Maverick Trading

Keeping a detailed trading journal is invaluable. It helps track not just entries and exits, but also how close you come to daily loss limits and whether your profit distribution meets consistency guidelines. Many traders who excel with ES during evaluations find the transition to NQ on a funded account challenging due to its rapid price movements. Conversely, NQ specialists might find ES’s slower pace less engaging, which can lead to overtrading.

NQ vs ES Futures: Which to Trade?

Conclusion: Choosing the Right Contract for Your Psychology

Deciding between ES and NQ comes down to understanding your trading psychology and how it aligns with each contract’s characteristics. If you prefer steady trends and a pace that allows for careful decision-making, ES might be your best match. With a 14-day ATR of $53.89 and smoother price movements, ES rewards discipline and patience, offering opportunities to manage positions without feeling rushed.

On the other hand, if you thrive in high-energy environments and enjoy quick decision-making, NQ could be the better choice. Its 14-day ATR of $263.87 and tech-heavy nature bring faster, more volatile price action, requiring emotional resilience and the ability to handle rapid market shifts.

For those who are risk-averse and prefer a methodical approach, ES offers deeper liquidity and tighter spreads, helping you maintain strict control over losses. Meanwhile, traders who excel in fast-paced, momentum-driven situations may find NQ’s dynamic movements more rewarding. Aligning your personality and trading style with the behavior of these contracts can significantly enhance your trading success.

To test the waters, consider starting with Micro E-minis (MES for ES and MNQ for NQ). These smaller contracts allow you to experience the nuances of each market without exposing yourself to substantial risk. Pay close attention to how you handle losing streaks, sudden reversals, and nearing your daily loss limits. Tools like DamnPropFirms’ Consistency Rule Calculator can also help ensure your trading style meets prop firm payout requirements.

FAQs

How can I decide if ES or NQ is better suited to my trading style and psychology?

When deciding between ES (E-mini S&P 500) and NQ (E-mini Nasdaq-100), it all comes down to your trading style and tolerance for risk. If you prefer steadier, more predictable price movements, ES might be your go-to. It offers a slower pace, which can reduce stress and allow for more measured decision-making.

On the flip side, NQ is all about speed and volatility. Its sharper price swings attract traders who thrive on quick decisions and are comfortable managing higher levels of risk.

Think about how you handle market fluctuations, your patience during slower trading periods, and how you respond to high-pressure situations. Aligning your trading approach with the pace and risk level of the contract can help you trade with more confidence and control.

What are the best risk management strategies for day trading ES and NQ futures?

Effective risk management is a must when trading ES (E-mini S&P 500) and NQ (E-mini Nasdaq-100) futures. One key strategy is setting strict stop-loss orders to cap potential losses on each trade. A widely used rule of thumb is to risk no more than 2% of your account balance per trade, adjusting your position size to reflect current market conditions.

It’s also smart to apply a risk-reward ratio – for instance, 1:2 – so your potential gains outweigh your potential losses. Keep a close eye on market volatility, as ES and NQ futures are known for their quick price movements. And when it comes to leverage, use it cautiously to avoid overexposing yourself and to maintain disciplined trading over the long haul.

Why is it better to start with Micro E-minis before trading standard contracts?

If you’re new to futures trading, Micro E-minis offer a practical way to get started while keeping your risk in check. These smaller-sized contracts allow you to explore market movements and fine-tune your trading strategies without the stress of committing to larger financial stakes.

Another advantage? Micro E-minis require significantly less upfront capital. This makes them an excellent choice for gaining confidence and learning how to navigate market volatility. Starting with these contracts gives you the chance to sharpen your skills and better understand your trading mindset – all without putting too much strain on your account.