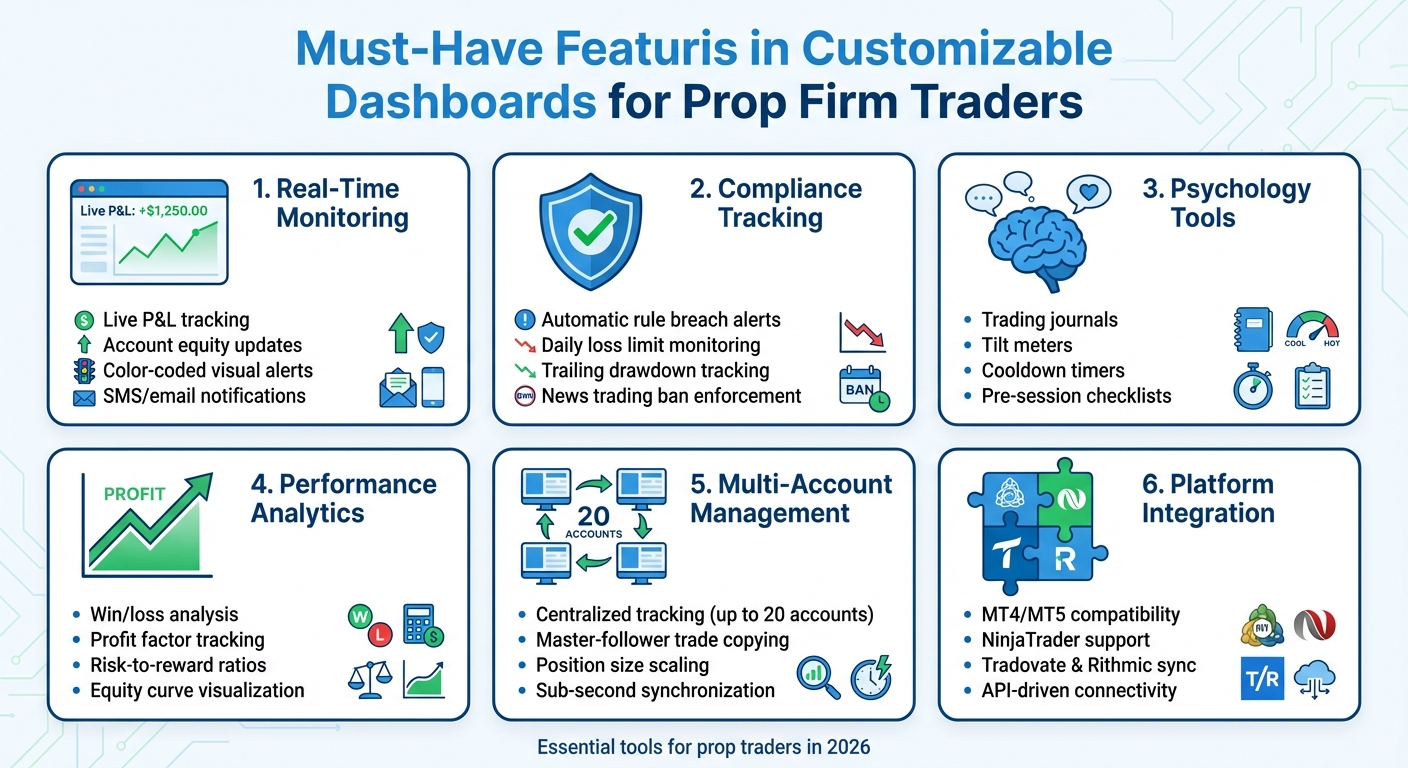

Managing prop firm trading rules manually is risky and inefficient. Automated dashboards simplify this by tracking real-time equity, drawdowns, and compliance thresholds. They help traders avoid costly mistakes like exceeding loss limits or violating news trading bans. Key features include:

- Real-Time Monitoring: Live updates on profit, loss, and risk exposure.

- Compliance Tracking: Automatic alerts for rule breaches (e.g., daily loss limits, trailing drawdowns).

- Psychology Tools: Journals, tilt meters, and cooldown timers to maintain discipline.

- Performance Analytics: Detailed metrics to refine strategies and track consistency.

- Multi-Account Management: Centralized tracking with trade copying platforms and position size scaling.

- Platform Integration: Seamless syncing with MT4, MT5, NinjaTrader, and more.

These tools reduce errors, improve trading performance, and ensure compliance with firm rules, making them indispensable for prop traders in 2026.

Essential Features of Customizable Trading Dashboards for Prop Firm Traders

Problems Prop Firm Traders Face Without Customizable Dashboards

Tracking Prop Firm Rules

Prop firms each come with their own set of rules, and trying to keep track of them manually can lead to costly mistakes. For instance, Take Profit Trader shifts from End-of-Day (EOD) drawdown calculations during evaluations to intraday real-time calculations once you’re funded. This means your unrealized profit becomes the high-watermark, and without a dashboard to monitor this change, traders can suddenly hit their limits and get stopped out unexpectedly. Then there’s the 50% consistency rule, which prohibits any single trading day from contributing more than half of your total profit. A single "monster day" could disqualify you, and recalculating this threshold manually after every session is a headache most traders can’t handle.

"The 50% rule is designed to prevent ‘lottery ticket’ trading. One huge winner doesn’t prove you can trade, repeatability does." – Take Profit Trader Review

Other rules, like news trading bans, also demand constant vigilance. Holding positions during Tier 1 news events – such as FOMC or NFP announcements – even for a minute before or after the event, can result in account termination. Firms such as Apex Trader Funding and Take Profit Trader also enforce policies like daily market close requirements and minimum activity rules (e.g., making at least one trade per week). Juggling these restrictions across multiple accounts without a centralized system can drain your mental energy and make it harder to maintain consistent performance.

Without an automated way to track these rules, traders face increased risks of errors and mismanagement, which can lead to disqualifications or missed opportunities.

Errors from Manual Tracking

Relying on spreadsheets and manual data entry introduces a host of problems. Mistakes in data entry can make it nearly impossible to appeal a disqualification if a prop firm disputes a trade or rule violation. Plus, manual tracking is never real-time, so you might only realize you’ve breached a daily loss limit after the trade has already closed.

Trailing drawdowns are another major pain point. These reset every time your equity hits a new peak, and without automated tracking, many traders miscalculate their "buffer", only to face surprise liquidations. Managing multiple accounts manually compounds these risks. You could easily misapply contract sizes or overlook news bans across different accounts. And without automated "cooldown" triggers, it’s easy to fall into the trap of revenge trading after a loss – a behavior that often leads to hard stop-outs.

"Prop firm success = a journal that keeps you inside rules in real time: daily loss buffer, trailing/static drawdown, phase tracking, rule adherence logging, psychology prompts, and exportable evidence." – TradeTrakR Editorial

These manual inefficiencies not only increase the likelihood of errors but also make it harder to evaluate your overall trading performance accurately.

Poor Performance Analysis

When you don’t have a centralized dashboard, consolidating your trading metrics becomes a slow and confusing process. Fragmented data across platforms makes it difficult to spot profitable strategies or recurring patterns – like consistently losing on Mondays or overtrading after a winning streak. One funded trader found that avoiding Monday trades improved their win rate by 12%, but only after using dashboard analytics to uncover this trend.

Manual tracking also lacks the depth needed to pinpoint which strategies, instruments, or timeframes are actually profitable. You might think your overall approach is solid, but without detailed analytics, you could miss the fact that one specific setup is dragging down your performance. Metrics like the Sharpe Ratio (measuring risk-adjusted returns) or the Sortino Ratio (focusing on downside volatility) are common in institutional trading but nearly impossible to calculate manually in real-time.

"Traders often lose not because of their strategy, but because they ignored the numbers and let emotions take over." – Defcofx

Without a centralized system to analyze these metrics, traders struggle to make informed adjustments, leaving potential improvements on the table.

sbb-itb-46ae61d

Risk Management Tools at Breakout Prop 🛠️ Daily Limits, Trackers & Dashboards

Must-Have Features in Customizable Dashboards

Building on the challenges prop traders face, these features can help tackle those hurdles and enhance trading efficiency.

Real-Time Monitoring

A dashboard that doesn’t offer live profit and loss tracking can leave you in the dark during critical trading moments. Real-time updates on net P&L, account equity, and balance are crucial for making informed decisions, especially during volatile sessions. This feature is particularly valuable when working with instant funding firms like Tradeify or Lucid Trading, where you’re managing live capital from day one.

Timely updates on net P&L and drawdown buffers are essential. For instance, receiving alerts when you’re nearing 80% of your daily loss threshold allows you to account for potential slippage during exits. Features like color-coded visual alerts or instant notifications (via SMS or email) act as an early warning system, helping you stay within risk limits and avoid breaking consistency rules.

"PropOS saved my evaluation. The daily buffer tracker kept me from breaching my limits twice. I passed my FTMO challenge on the first attempt thanks to the pre-session checklist keeping me disciplined." – Jason R., Funded Trader, FTMO

Risk Management and Compliance Tracking

When trading with firms such as Apex Trader Funding or Take Profit Trader, automatic compliance tracking is a game-changer. A dashboard that consolidates all trading rules into one view simplifies monitoring. Automated features can track requirements like minimum trading days, news trading restrictions, and weekend hold policies, while advanced systems can even restrict trading once thresholds (like leverage caps or daily drawdowns) are exceeded.

Consistency calculators are another must-have. They help traders avoid the dreaded 50% rule by recalculating thresholds after every session and flagging any trading day that contributes more than half of the total profit. Some dashboards even offer breach prediction alerts, giving you time to adjust trades before hitting drawdown limits.

Psychological tools are becoming increasingly popular. Pre-session checklists and mental readiness assessments ensure you’re in the right mindset before trading. For example, trader Carlos T. improved his win rate by 12% after using a dashboard feature to track psychological patterns, uncovering a trend of underperformance on Mondays.

Detailed analytics further complement these tools, helping traders refine their strategies while staying compliant with firm rules.

Performance Analytics and Reports

Trade journaling tools that automatically log R-multiples and allow for notes on market bias or emotional states eliminate the hassle of manual data entry. These tools address the data fragmentation issue many traders face. One success story: Amanda M. secured a $100,000 funded account with MyFundedFX after three months of using visual equity curve tracking to maintain consistency.

Win/loss analysis should go deeper than basic percentages. A solid dashboard tracks profit factors, average risk-to-reward ratios (aiming for 1:2 or better), and trade frequency. This level of detail helps uncover patterns and refine strategies. Additionally, the ability to filter performance data by strategy, instrument, timeframe, or session allows traders to identify which setups yield the best results.

"The equity curve visualization is clear. Seeing my consistency improve over time motivated me to stick to my rules." – Amanda M., Funded Trader, MyFundedFX

Customizable reports are another key feature. Exportable data simplifies payout submissions and strategy reviews. Dashboards that track Capital Utilization Rates – showing how much of your allocated capital is actively used in trades – can highlight inefficiencies. Reviewing timestamped trade logs can also reveal whether certain time zones or instruments negatively impact your performance. For prop traders, a Phase Progress Tracker is invaluable, providing a clear view of your progress toward profit targets and remaining trading days to keep you on schedule.

Customization and Integration Options

Managing Multiple Accounts

Managing multiple funded accounts from firms like Alpha Futures or FundedNext Futures becomes far simpler with a centralized dashboard. With cloud-based systems, you can use a master-follower configuration to streamline operations. Here’s how it works: you execute trades manually on a "Master" account, and the "Follower" accounts instantly replicate those trades. This eliminates the need for manual toggling and cuts down delays from minutes to mere seconds.

To ensure risk stays proportional across accounts, position size multipliers come into play. For example, if your master account has $150,000 and you’re managing a $50,000 follower account, applying a 0.33x multiplier scales a 3-contract trade down to 1 contract. On the other hand, for a $250,000 account, a 1.66x multiplier would execute 5 contracts instead. The formula is straightforward: Follower Multiplier = (Follower Account Size / Master Account Size). Firms like Apex Trader Funding even allow traders to manage up to 20 accounts at once, making these tools essential for scaling operations.

With these management tools in place, you can also set up precise alerts to keep everything running smoothly.

Custom Alerts and Notifications

Staying informed without constant screen time is a game-changer. Personalized alerts let you monitor specific scenarios – whether it’s getting close to 80% of your daily loss limit or completing the minimum trading days required for Topstep evaluations. Alerts can be sent via SMS or email, ensuring you don’t miss critical updates. For instance, news protection alerts can trigger automatically, helping you sidestep major losses when the market suddenly moves 40 points in seconds.

Advanced dashboards also track your progress, sending notifications when you hit profit targets or qualify for higher funding levels. Security-focused alerts are equally important, flagging unusual activity like IP address changes or device sharing – issues that could result in account bans. Even better, pre-breach warnings give you time to act before a rule violation occurs, helping you stay compliant.

These alert systems integrate seamlessly with major trading platforms, which we’ll delve into next.

Trading Platform Integration

Seamless integration with popular trading platforms like MT4, MT5, Tradovate, Rithmic, and NinjaTrader ensures smooth data flow and efficient management. API-driven connectivity automates live data tracking for margin usage and equity, eliminating the need for manual input. Additionally, cross-platform synchronization allows, for example, a Tradovate master account to control Rithmic or NinjaTrader follower accounts. This creates a flexible, multi-platform trading ecosystem.

For added efficiency, tools like the Consistency Rule Calculator from DamnPropFirms can be integrated. This calculator helps traders avoid the 50% rule by recalculating thresholds after each session and flagging any trading day that contributes more than half of the total profit. When paired with comparing automated trade copying tools that achieves sub-second synchronization, these integrations minimize slippage and ensure consistent trade execution across all funded accounts. By combining these features, integrated dashboards enhance trading accuracy while reinforcing compliance and managing risk effectively.

Conclusion

Customizable dashboards have grown far beyond basic reporting. Today, they serve as automated tracking systems that seamlessly handle rule tracking, risk monitoring, and performance analytics – all within a single interface.

Automation in 2026 plays a key role in building trust by ensuring consistent rule enforcement. Dashboards that automatically monitor compliance thresholds give traders the confidence that rules are applied fairly across all accounts. This level of transparency is especially crucial for managing multiple funded accounts from firms like Apex Trader Funding or Take Profit Trader, where even a minor mistake could undo months of hard work.

For example, a prop firm in Singapore reported a 40% reduction in trader onboarding times after adopting AI-powered dashboards. Similarly, an Australian company saw a 30% decrease in monthly losses thanks to automated risk controls.

FAQs

How do I set up alerts before I break a prop firm rule?

To configure alerts, head to the notification tools on your trading platform. Most platforms let you set specific conditions, such as drawdown limits or profit targets, and establish threshold levels. Once enabled, these alerts provide real-time updates, helping you stick to your trading rules and steer clear of penalties. For detailed instructions, check the alerts section on your platform to tailor notifications to your preferences.

What should I track for trailing drawdown in real time?

To keep an eye on trailing drawdown in real-time, focus on tracking your unrealized profit or loss compared to your highest equity point. This gives you a clear picture of how close you are to hitting the drawdown limit, allowing you to tweak your trading strategy as needed.

How can I manage multiple prop accounts without mistakes?

Managing multiple prop accounts can feel like juggling several balls at once, but centralized trading dashboards can make it a lot easier. These platforms let you monitor and execute trades across all your accounts at the same time. They’re great for keeping tabs on performance, staying within firm guidelines, and managing risk more effectively by grouping or rotating trades.

Automation tools are another game-changer. They can synchronize trades across accounts, ensuring everything stays consistent without requiring constant manual input. And here’s a key tip: treat each account as its own separate "risk container." This approach helps you avoid situations where correlated losses or unexpected blowups affect all your accounts at once.