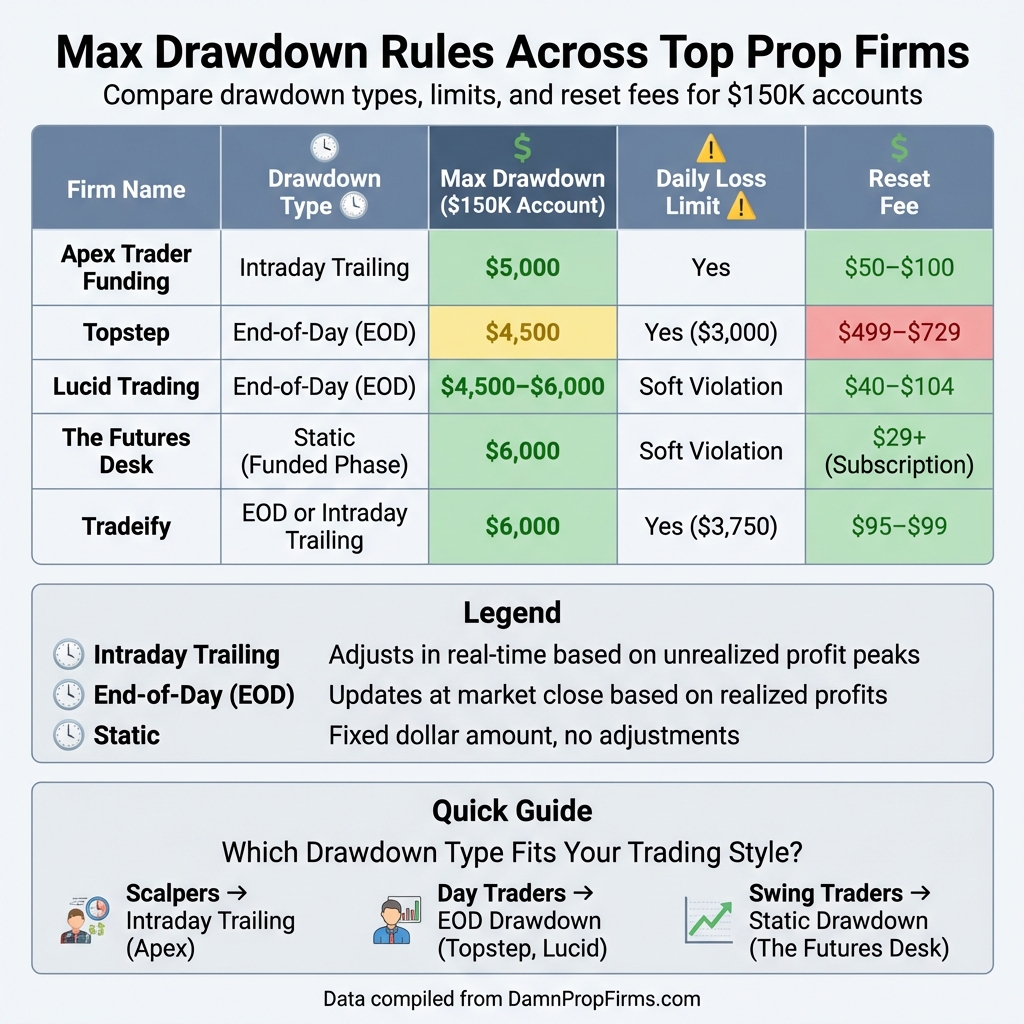

When trading with prop firms, understanding their max drawdown rules is essential. These rules determine the maximum equity loss allowed before your account is liquidated. Here’s a quick breakdown of the key drawdown types and how they differ across top firms:

- Intraday Trailing Drawdown: Adjusts in real time based on your highest unrealized profit. Common with firms like Apex Trader Funding, but it can be tricky as it locks at equity peaks.

- End-of-Day (EOD) Drawdown: Updates at market close based on realized profits. Firms like Topstep and Lucid Trading use this, offering more flexibility during intraday fluctuations.

- Static Drawdown: Remains fixed at a set dollar amount, providing predictability. Popular with firms like The Futures Desk.

Some firms also enforce daily loss limits, which temporarily halt trading if exceeded, while others focus solely on overall drawdown thresholds. Reset options vary, with fees typically ranging from $40 to $729 depending on the firm and account size.

Quick Comparison

| Firm | Drawdown Type | Max Drawdown (Example $150K Account) | Daily Loss Limit | Reset Fee (Approx.) |

|---|---|---|---|---|

| Apex Trader Funding | Intraday Trailing | $7,500 | Yes | $50–$100 |

| Topstep | End-of-Day (EOD) | $4,500 | Yes | $499–$729 |

| Lucid Trading | End-of-Day (EOD) | $4,500–$6,000 | Soft Violation | $40–$104 |

| The Futures Desk | Static (Funded Phase) | $6,000 | Soft Violation | $29+ (Subscription) |

| Tradeify | EOD or Intraday Trailing | $6,000 | Yes | $95–$99 |

Each firm offers unique rules tailored to different trading styles. Intraday trailing drawdowns suit scalpers but require strict risk management. EOD drawdowns are better for swing traders, while static drawdowns are ideal for those seeking fixed limits. Choose based on your strategy and risk tolerance.

Prop Firm Max Drawdown Rules Comparison Chart

1. Apex Trader Funding

Max Drawdown Thresholds

Apex Trader Funding sets itself apart by offering the highest maximum loss limits (MLL) in the futures prop trading industry, with its $300,000 account featuring an impressive $7,500 drawdown threshold. Their drawdown thresholds vary depending on the account size: for instance, a $25,000 account has a $1,500 limit, while a $150,000 account allows $5,000, and a $250,000 account offers $6,500. These thresholds are notably higher than those provided by competitors like Topstep, which tend to impose stricter limits on smaller accounts. Now, let’s break down how Apex handles trailing and static drawdown methods.

Trailing vs. Static Drawdown

Apex primarily employs an unrealized equity-based trailing drawdown, which adjusts based on your highest unrealized profit during a trading session. This type of drawdown locks in at the peak of your account’s unrealized gains and doesn’t decrease, even if those gains diminish later. As DamnPropFirms explains:

"The unrealized trailing drawdown at Apex Trader Funding is the single biggest rule that trips up traders. Unlike a static drawdown, it moves up with your account’s highest unrealized gains and never moves back down".

However, once you transition to a Performance Account (PA), the trailing drawdown changes. It locks at your starting balance plus $100, effectively becoming an absolute drawdown from that point forward. Additionally, Apex offers a Static account option for its $100,000 account. In this setup, the drawdown remains fixed at $99,375, giving traders a $625 cushion to work with.

Drawdown Reset Mechanics

In Performance Accounts, the drawdown employs a locking mechanism. Once your profits push the drawdown threshold to your starting balance plus $100, it locks permanently, and any further profits only expand your cushion. Traders can track their liquidation level using tools like RTrader Pro (Rithmic) or the account dropdown in Tradovate. For those trading in evaluation accounts, breaching the drawdown threshold will require a reset fee, which is often discounted by 50% during promotional periods. To avoid unexpected liquidations during volatile market movements, it’s wise to maintain a buffer of $100–$300 above your liquidation threshold.

2. Take Profit Trader

Max Drawdown Thresholds

Take Profit Trader follows a structured approach to drawdown limits, similar to Apex Trader Funding. The firm sets maximum drawdown limits ranging from $1,500 to $5,000, depending on the account size. For instance, a $150,000 account comes with a $4,500 limit for Pro accounts and $5,000 for Pro+ accounts. Smaller accounts have proportionally lower drawdown thresholds, maintaining a consistent structure across all tiers.

Trailing vs. Static Drawdown

Take Profit Trader uses two distinct drawdown systems based on your account phase. During the evaluation phase (Test accounts), an End-of-Day (EOD) trailing drawdown is applied. This means your drawdown threshold adjusts only at the end of the day based on your highest end-of-day balance, so intraday price swings won’t impact it.

Once you transition to a funded Pro or Pro+ account, the system shifts to an Intraday Trailing Drawdown. This real-time system adjusts based on your peak balance, including unrealized gains. However, the drawdown floor rises immediately with equity peaks and doesn’t move back down if trades reverse. This requires traders to adapt their strategies, as the system is more dynamic and reflects real-time performance.

Daily Loss Limits

In a significant change, Take Profit Trader recently removed daily loss limits for all new Test and Pro accounts. Expert trader Kyle Janas highlighted the importance of this update:

"TPT recently made a crucial change that transformed them from just another prop firm to a serious contender in the space. They completely removed their daily loss limit".

Pro+ accounts never had daily loss limits, but now this added flexibility is extended to Test and Pro accounts as well.

Drawdown Reset Mechanics

Take Profit Trader’s reset mechanics are designed to balance equity protection with profit withdrawal opportunities. For Pro accounts, traders must first build a buffer equal to the maximum drawdown before they can withdraw profits. Once this buffer is in place, the drawdown stops trailing the initial balance, giving traders a safety net. On the other hand, Pro+ accounts skip this requirement entirely, allowing withdrawals from day one.

However, if the maximum drawdown is breached during the evaluation phase, the account is liquidated, and a restart is required. Take Profit Trader has earned a 4.3-star rating on Trustpilot from over 1,100 reviews, with users frequently praising its fair rules and fast payout processing.

3. FundedNext Futures

Max Drawdown Thresholds

FundedNext Futures sets specific loss limits based on account size and trading model. For instance, a $50,000 account comes with a maximum loss limit of $2,000. On a $100,000 Legacy account, the drawdown limit is $3,000, while the $100,000 Rapid account allows a slightly lower cap of $2,500. For $25,000 accounts, the maximum loss threshold is set at $1,000.

| Account Size | Legacy Max Loss (EOD) | Rapid Max Loss (EOD) |

|---|---|---|

| $25,000 | $1,000 | $1,000 |

| $50,000 | $2,000 | $2,000 |

| $100,000 | $3,000 | $2,500 |

Now, let’s break down how FundedNext manages its drawdown system.

Trailing vs. Static Drawdown

FundedNext Futures employs an End-of-Day (EOD) balance-based drawdown system. This means the drawdown limit is recalculated based on the account balance at the close of the trading day, rather than tracking every intraday high. As a result, traders are not penalized for intraday volatility as long as the closing balance stays within the designated limits. This approach offers traders more flexibility compared to systems that lock in every equity peak.

Daily Loss Limits

Unlike many other firms, FundedNext Futures does not impose daily loss limits for either the Legacy or Rapid models. This absence of a daily cap allows traders to navigate high-volatility market sessions with greater freedom. Instead, the firm enforces a rolling 7-day cumulative loss limit known as the Weekly Drawdown Limit. Any breach of this limit could lead to account suspension. Additionally, a 40% consistency rule is in place, requiring that no single day’s profit exceeds 40% of the total profit target during both the evaluation phase and the funded stage.

Let’s take a closer look at how drawdown resets operate for Legacy accounts.

Drawdown Reset Mechanics

For Legacy accounts, the drawdown limit resets to the starting balance after traders meet the performance reward criteria and complete 30 benchmark days. If a trader breaches the maximum loss during the evaluation phase, they can purchase an account reset. Reset fees range from $69.99 for $25K Legacy accounts to $246.99 for $100K Rapid accounts.

FundedNext also boasts a 4.6/5 rating on Trustpilot and promises 24-hour payout processing. If this deadline is missed, traders are compensated with an additional $1,000 bonus.

For a more comprehensive look at FundedNext Futures and their risk management policies, check out our detailed review.

4. Alpha Futures

Max Drawdown Thresholds

Alpha Futures has developed specific Maximum Loss Limit (MLL) parameters aimed at balancing risk and flexibility for traders. For Standard and Zero accounts, the MLL is set at 4% of the starting balance, while Advanced accounts have a slightly lower threshold of 3.5%. Here’s how these limits break down:

| Account Size | Standard/Zero MLL (4%) | Advanced MLL (3.5%) |

|---|---|---|

| $50,000 | $2,000 | $1,750 |

| $100,000 | $4,000 | $3,500 |

| $150,000 | $6,000 | $5,250 |

For instance, a $150,000 Standard account offers a $6,000 buffer, which highlights the firm’s competitive approach to risk management.

Trailing vs. Static Drawdown

Alpha Futures employs an End-of-Day (EOD) trailing drawdown system. This means the MLL is recalculated based on the account’s highest balance at the close of each trading day, rather than being influenced by intraday equity highs. This method allows traders more flexibility during volatile trading sessions since temporary price spikes won’t immediately adjust the drawdown threshold unless the day closes at that elevated level.

"At Alpha Futures, our MLL is calculated off of your end of day balance, unlike other prop firms, who calculate it on unrealized profits intraday (equity watermark high)." – Alpha Futures

Once the MLL reaches the initial starting balance, it becomes static. However, if the MLL is breached – whether through floating equity or the closed balance – the account is immediately liquidated. These mechanics are key to understanding the firm’s approach to risk and daily loss policies.

Daily Loss Limits

For Qualified (funded) accounts, Alpha Futures imposes a 2% daily loss limit for Standard and Zero accounts. For example, a $100,000 account has a $2,000 daily loss cap. During the evaluation phase, Standard accounts do not have a Daily Loss Guard. Advanced accounts previously had a dynamic Daily Loss Guard during evaluation, but this rule was removed for Qualified Advanced accounts as of November 11, 2025. Importantly, triggering the Daily Loss Guard doesn’t result in account failure; trading is simply locked until 6:00 PM ET the next day.

Drawdown Reset Mechanics

If the MLL is breached during the evaluation phase, traders have the option to purchase a reset. The reset fees are:

- $59 for a $50,000 account

- $129 for a $100,000 account

- $199 for a $150,000 account

For Advanced accounts, reset costs are higher: $139, $279, and $419 for $50,000, $100,000, and $150,000 accounts, respectively.

One standout feature of Alpha Futures is that the drawdown buffer remains intact even after payouts. The buffer continues to trail new highs, ensuring it isn’t affected by withdrawals.

For a deeper dive into Alpha Futures’ risk management strategies, check out our comprehensive review.

5. Tradeify

Max Drawdown Thresholds

Tradeify enforces maximum loss limits tailored to four account types – Advanced, Growth, Lightning, and Select. These thresholds vary depending on the account size. Lightning accounts offer the most lenient limits, with a 150K Lightning account allowing up to a $6,000 maximum loss. For 50K accounts, all account types share a $2,000 drawdown limit. For 100K accounts, the limits are $3,000 for Advanced and Select, $3,500 for Growth, and $4,000 for Lightning. At the 150K level, Advanced and Select accounts have a $4,500 limit, Growth accounts allow $5,000, and Lightning accounts offer $6,000.

With over 50,000 traders served and a 4.7/5 Trustpilot rating from 1,629 reviews, Tradeify has earned recognition for its user-friendly drawdown calculations. Many traders appreciate its end-of-day drawdown system. Let’s take a closer look at how Tradeify’s trailing methods align with these limits.

Trailing vs. Static Drawdown

Tradeify employs two types of trailing drawdown systems, depending on the account type. For Advanced accounts, an Intraday Trailing system is used. This method updates the drawdown limit in real time, factoring in both realized and unrealized gains. For instance, if you have an open profit of $1,500, the drawdown limit adjusts immediately, potentially increasing the risk of breaching the limit before the trade closes.

On the other hand, Growth, Lightning, and Select accounts use an End-of-Day (EOD) Trailing system. Here, the drawdown limit is recalculated only at the close of the trading day based on the ending balance. This approach provides flexibility during the day, as temporary unrealized losses don’t affect the failure threshold during trading hours. However, it’s important to note that if your account balance hits the drawdown limit at any point during the day, the account fails immediately.

A standout feature is the Drawdown Locking mechanism for Sim Funded accounts. Once your end-of-day balance surpasses your starting balance by the drawdown amount plus $100, the trailing drawdown locks at a fixed floor, $100 above the initial balance. For example, a 50K Growth account locks at $50,100 when the EOD balance reaches $52,100. Select Flex accounts take this a step further by permanently locking the drawdown at the starting balance – $50,000 for a 50K account – once the first payout is approved.

Daily Loss Limits

Daily Loss Limits are designed to temporarily halt trading rather than permanently fail the account. Growth and Lightning accounts have daily limits ranging from $1,250 for 50K accounts to $3,750 for 150K accounts. Select Daily accounts have slightly lower limits, starting at $1,000 and going up to $1,750. Interestingly, the 25K Lightning account does not impose a daily loss limit. Advanced and Select Flex accounts also operate without daily loss limits. For traders who breach their drawdown limits, Tradeify offers flexible reset options, which we’ll explore next.

Drawdown Reset Mechanics

If you exceed the maximum trailing drawdown during the evaluation phase, the account fails. However, Advanced and Growth evaluations, which operate on a monthly subscription model, automatically reset at the start of the next billing cycle with a fresh balance and drawdown. For immediate restoration, traders can purchase reset credits, typically priced between $95 and $99. These resets restore the account but do not change the existing subscription billing date.

Activation fees vary depending on the account type. Advanced accounts require a one-time $125 fee upon passing evaluation, while Growth and Select accounts currently waive activation fees.

To dive deeper into Tradeify’s account offerings and payout process, check out our comprehensive review.

3 Tips to BEAT Intraday Trailing Drawdown (Apex/TPT)

6. FundingTicks

Let’s take a closer look at FundingTicks, a firm that once operated with a reputation for strict drawdown parameters but is no longer in business.

Important Notice: FundingTicks officially ceased operations on January 18, 2026. The following information is provided for historical context only.

Max Drawdown Thresholds

FundingTicks offered relatively conservative drawdown limits, or Maximum Loss Levels (MLLs), based on account size:

- $1,000 for a $25,000 account

- $2,000 for a $50,000 account

- $3,000 for a $100,000 account

When compared to firms like Apex Trader Funding, which offers a $7,500 drawdown on a $300,000 account, or Tradeify, which allows $6,000, FundingTicks’ limits reflect a more cautious approach to risk management.

| Account Size | Max Drawdown (MLL) | Drawdown Percentage |

|---|---|---|

| $25,000 | $1,000 | 4% |

| $50,000 | $2,000 | 4% |

| $100,000 | $3,000 | 3% |

Trailing vs. Static Drawdown

FundingTicks used an End-of-Day (EOD) trailing drawdown system. This method recalculated the maximum loss based on the account’s closing balance, ensuring that intraday profit spikes didn’t immediately adjust the drawdown limit.

Once the account reached breakeven, the drawdown limit would lock at the starting balance. For instance, if a trader started with a $50,000 account and grew it to $50,500, the drawdown would lock at $50,000. While the $500 profit could be withdrawn, the drawdown threshold wouldn’t change until a new equity high was achieved.

Drawdown Reset Mechanics

FundingTicks didn’t offer a reset option. If a trader breached the maximum loss, the account was immediately closed. To continue, traders had to begin a new evaluation from scratch.

For those seeking active alternatives, consider exploring firms like Apex Trader Funding, Take Profit Trader, and FundedNext Futures. These firms not only remain operational but also offer more flexible reset options and trailing drawdown systems, making them appealing choices for traders looking for structured payout systems and risk management.

7. Lucid Trading

Lucid Trading offers a standout feature with its End-of-Day (EOD) trailing drawdown model. This system updates the drawdown level only at the market close, based on the account’s highest closed balance. This approach allows traders to ride out intraday market swings without immediately impacting their risk cushion.

Max Drawdown Thresholds

Lucid Trading provides three account types: LucidPro (evaluation-based funding), LucidDirect (instant funding), and LucidFlex (no consistency or daily loss limits). Each account type comes with its own maximum loss limits, which vary by account size. For example:

- A $150,000 LucidPro Eval account has a $4,500 drawdown limit, while the LucidDirect version offers a $6,000 cushion.

- Smaller accounts follow similar proportions, like $1,000 for a $25,000 account and $2,000 for a $50,000 account.

Here’s a quick breakdown:

| Account Size | LucidPro Eval MLL | LucidDirect MLL | Drawdown Percentage |

|---|---|---|---|

| $25,000 | $1,000 | N/A | 4% |

| $50,000 | $2,000 | $2,000 | 4% |

| $100,000 | $3,000 | N/A | 3% |

| $150,000 | $4,500 | $6,000 | 3–4% |

For traders who value a larger cushion, the LucidDirect $150,000 account offers $1,500 more in drawdown room than the LucidPro Eval path.

Trailing vs. Static Drawdown

Lucid’s EOD trailing system recalculates the maximum loss only at the close of the trading day, specifically at 4:45 PM EST. This means intraday dips below your drawdown floor won’t trigger a breach, as long as the account recovers by the end of the session.

"End-of-day drawdown makes it easier to trade with a plan instead of trading scared." – DamnPropFirms

Once a LucidPro account surpasses its starting balance by $100, the trailing drawdown locks permanently at that level. For instance, if your $100,000 account closes above $103,100, the drawdown locks at $100,000, effectively converting it into a static risk limit.

Daily Loss Limits

Daily loss limits (DLL) are another layer of risk management. Lucid treats DLL breaches as "soft" violations. If breached, trading pauses until the next session, but the account remains intact unless the overall maximum loss limit is hit. For LucidPro accounts, DLLs are typically 20% of the profit target – for example, $1,200 for a $50,000 account or $2,700 for a $150,000 account.

In funded LucidPro accounts, DLLs become dynamic, adjusting to 60% of your highest end-of-day profit once the account grows beyond the initial trail balance. For those seeking more flexibility, LucidFlex accounts remove the daily loss limit entirely.

Drawdown Reset Mechanics

Lucid offers affordable reset options for rule violations during the evaluation phase. However, if a funded account exceeds its maximum loss limit, the account is permanently closed, requiring requalification through a new evaluation or a fresh LucidDirect plan. Notably, Lucid charges $0 in activation fees once you pass the evaluation, ensuring a smooth transition to a funded account.

For those considering alternatives with flexible reset policies, you might want to explore Apex Trader Funding, Take Profit Trader, or Tradeify.

sbb-itb-46ae61d

8. The Futures Desk

The Futures Desk (TFD) stands out by offering traders the flexibility to choose between End-of-Day (EOD) or Static drawdown during the assessment phase. Once you transition to a live account, the drawdown permanently switches to Static, which is a clear advantage for managing risk.

Max Drawdown Thresholds

For traders opting for TFD’s $150,000 Custom account, the Maximum Loss Limit (MLL) is set at $6,000. This places it in the "Tier 1" category, alongside firms like Lucid Trading, Tradeify, and Alpha Futures. Entry-level plans start at just $119 per month, with a $1,000 drawdown (2% of the account size). As your account grows, TFD increases the number of contracts you can trade and expands your drawdown allowance for every $3,000 in net profit. This structure offers traders a unique way to scale their accounts.

Trailing vs. Static Drawdown

During the assessment phase, you can choose between EOD or Static drawdown. However, after passing the assessment and moving to a live brokerage account, the drawdown becomes permanently Static.

"Start with End-Of-Day or Static during the assessment, but either way, all brokerage accounts are static." – The Futures Desk

This static model provides a significant advantage over intraday trailing drawdowns, like those used by Apex Trader Funding, as it eliminates the need for constant recalculations and offers better flexibility for managing open positions.

Daily Loss Limits

TFD employs a "Soft Daily Loss Limit" system, designed to prevent catastrophic losses without permanently closing your account. If you hit the soft limit, trading is paused for the day, but your account remains intact as long as the overall maximum loss limit isn’t exceeded.

"Our soft limit makes it impossible to blow up in one day – unless you really try to." – The Futures Desk

Drawdown Reset Mechanics

If you don’t pass the assessment, TFD offers an affordable reset option through a subscription renewal. Renewals start after 31 days and cost as little as $29, making it one of the most budget-friendly reset policies in the industry. Unlike many competitors, TFD doesn’t charge any activation fees. Once funded, traders can enjoy daily payouts with no caps, and funds can reach your brokerage account in as little as six days.

For traders looking for alternative reset policies, consider firms like FundedNext Futures, Take Profit Trader, or FundingTicks.

Next, we’ll dive into a comparison of the overall pros and cons across firms.

9. TickTickTrader

TickTickTrader uses a "Pro Drawdown" system that recalculates drawdown only at the end of the trading day, based on realized profits. This approach ensures that traders aren’t penalized if a trade sees significant unrealized gains before pulling back prior to closing.

Max Drawdown Thresholds

For a $100,000 Pro account, the drawdown threshold is $3,500, while the $50,000 Advanced account has a $2,500 threshold. TickTickTrader also offers Express evaluation accounts, with the 100K Express plan standing out because it doesn’t impose a daily loss limit. Direct accounts feature higher end-of-day (EOD) drawdown thresholds – for instance, a $50,000 Direct account allows a $2,000 drawdown, and a $150,000 Direct account permits up to $6,000. The platform has earned the trust of over 6,200 day traders worldwide, as reflected on Trustpilot. Let’s take a closer look at how the trailing drawdown mechanism sets TickTickTrader apart in managing risk.

Trailing vs. Static Drawdown

TickTickTrader’s trailing drawdown mechanism, unlike some other firms, remains fixed during the trading session and only adjusts upward when your account’s closing balance hits a new high. For TTTPerformance accounts, the drawdown continues to trail until it aligns with the starting balance, at which point it becomes static. This setup provides a clear and stable risk limit once you’ve built enough profit, offering more predictability compared to models that adjust intraday.

Daily Loss Limits

Evaluation accounts come with strict daily loss limits: $500 for a $25,000 account, $1,250 for a $50,000 account, and $2,500 for a $100,000 account. Meanwhile, Direct accounts use a more lenient "Soft Rule" for daily losses, though EOD drawdown thresholds still apply. If a trader exceeds the daily loss or drawdown limits, their positions are automatically closed, and the account is deactivated. These rules are complemented by specific reset protocols to handle breaches effectively.

Drawdown Reset Mechanics

TickTickTrader enforces a 30% consistency rule, meaning no single day’s profit can exceed 30% of total gains. For Direct accounts, traders enjoy a 100% profit split during the first three months, which later transitions to a 90/10 split. If an account is deactivated, traders can withdraw up to 20% of their profits, provided safety thresholds are met – $1,600 for a $25K account and $3,600 for a $100K account.

10. Phidias Prop Firm

Phidias Prop Firm stands out by offering two distinct drawdown models: End-of-Day (EOD) Trailing Drawdown and Static Drawdown. The EOD system calculates drawdowns only at the market’s close, providing a buffer against intraday market swings. According to reports, this approach increases trader success rates by 83%, with evaluations being passed three times more frequently.

Max Drawdown Thresholds

Phidias offers three account types, each with its own drawdown limits:

- $25,000 Static Account: Fixed drawdown of $500.

- Fundamental and Swing Accounts:

- $50,000 account: $2,500 EOD trailing drawdown.

- $100,000 account: $3,000 EOD trailing drawdown.

- $150,000 account: $4,500 EOD trailing drawdown.

These thresholds are more restrictive compared to competitors. For example, Apex allows a $7,500 drawdown on a $300,000 account, while Lucid Trading and Tradeify offer $6,000 for $150,000 accounts.

Trailing vs. Static Drawdown

The EOD trailing system updates drawdown levels only at market close. For funded accounts, once the drawdown threshold locks (e.g., $50,100 for a $50,000 account), it remains fixed.

Meanwhile, the Static account maintains a constant $500 drawdown. However, if the account balance hits the drawdown level at any point during the day, the account is liquidated immediately.

Next, let’s examine how Phidias handles daily loss limits.

Daily Loss Limits

Phidias takes a different approach by not imposing daily loss limits on Fundamental or Swing accounts. Instead, the focus is solely on the overall maximum drawdown. This flexibility allows traders to hold positions overnight or through the weekend without fear of forced closures. However, the firm recommends risking no more than 40% of your daily drawdown on a single trade. For instance, on a $50,000 account, this translates to a maximum risk of $1,000 per trade.

Drawdown Reset Mechanics

If you breach a rule during the evaluation phase, you can either purchase a manual reset or wait 30 days for a free automatic reset. Reset fees vary by account size:

- $50,000 account: $40

- $100,000 account: $64

- $150,000 account: $104.

Funded accounts must adhere to a 30% consistency rule, meaning no single day’s profit can exceed 30% of total gains before a payout. The consistency counter resets after each withdrawal.

11. FundedFuturesNetwork

FundedFuturesNetwork (FFN) operates with a hybrid drawdown system. It starts with a trailing drawdown during the Evaluation and Exhibition phases and switches to a static drawdown once the account is funded. This approach balances consistency during the evaluation process with added security for funded traders.

Max Drawdown Thresholds

FFN offers drawdown limits that vary by account size, starting at $1,500 for a $25,000 account and going up to $6,000 for a $250,000 account. For example, the $150,000 account includes a $5,000 drawdown cushion, making it a strong competitor compared to other firms. However, the $50,000 account allows a tighter $2,000 drawdown, which is more restrictive than the limits provided by FundedNext Futures.

Trailing vs. Static Drawdown

FFN uses a "trailing maximum end-of-trade drawdown" during the Evaluation and Exhibition phases. This means the drawdown only updates after a position is closed, not while it is active.

Once the account is funded, the drawdown becomes static, set at $100 above the starting balance. For instance, a $50,000 Funded Pro account begins with a balance of $52,000. If the balance drops to $50,100, the account is liquidated. This static system is considered more lenient than firms that continue using trailing drawdowns after funding.

Daily Loss Limits

FFN does not impose strict daily loss limits. Instead, it combines its trailing drawdown with a consistency rule – 40% for Standard and Exhibition accounts, and 25% for Express accounts. This means no single day’s profit can exceed these percentages of total gains. Traders can also hold positions overnight or over weekends without forced closures. However, for Tier 1 news events, traders must close all positions one minute before and after the event in both Exhibition and Funded accounts.

Drawdown Reset Mechanics

If a trader violates the rules during the evaluation phase, they can reset their account through the FFN Dashboard. Exhibition accounts come with a 7-day reset window after a failure, allowing traders to restart for a fee. Missing this window requires starting a new evaluation. As of early 2026, FFN is running a promotion waiving activation fees for evaluation accounts. These reset options highlight FFN’s flexible approach to risk management.

12. Topstep

Topstep uses an End-of-Day (EOD) Drawdown model to calculate the maximum loss limit based on the account balance at the close of each trading day. Unlike intraday trailing models, this approach allows traders to weather typical market fluctuations during the day without the risk of immediate account closure.

Max Drawdown Thresholds

The Maximum Loss Limit (MLL) at Topstep depends on the account size. For example:

- $2,000 for a $50,000 account

- $3,000 for a $100,000 account

- $4,500 for a $150,000 account

Once traders make their first payout, the MLL locks at $0. This means any future losses will only affect profits already earned, keeping the initial account balance intact .

Trailing vs. Static Drawdown

Topstep’s drawdown system moves upward with profits during the Trading Combine. Once it reaches the starting balance, it locks and no longer adjusts. As explained by Team Topstep:

"End-of-Day Drawdown allows you to play all four quarters. This is how real trading works. You can ride out the ups, downs, and pullbacks as long as you finish the day above your max drawdown limit".

This differs from intraday trailing systems, which adjust in real time based on unrealized profit peaks. Topstep argues that such systems unfairly penalize traders for normal market pullbacks . By using an EOD model, Topstep provides a more forgiving structure for traders to operate within.

Daily Loss Limits

Topstep also enforces a Daily Loss Limit (DLL), which acts as a "soft breach." If traders exceed this limit, all positions are closed, and trading is paused for the rest of the day. However, the account remains active for the next session. The DLL amounts are:

- $1,000 for $50,000 accounts

- $2,000 for $100,000 accounts

- $3,000 for $150,000 accounts

As of August 25, 2024, new or reset accounts on the TopstepX platform no longer have a DLL objective. For Live Funded Accounts, the DLL increases as the account balance grows, giving traders more flexibility as they become more profitable.

Drawdown Reset Mechanics

Topstep offers a Back2Funded option for Express Funded Accounts (XFA) on the TopstepX platform. If traders violate a rule before their first payout, they can reactivate their account up to two times within seven days for a fee:

- $499 for a $50,000 account

- $599 for a $100,000 account

- $729 for a $150,000 account

This feature allows traders to continue their progress without starting the Trading Combine from scratch. Additionally, Live Funded Accounts may receive a "Shoulder Tap" from Topstep Risk Managers during significant drawdowns. This adjustment can modify contract sizes or limits to help traders regain their footing.

Pros and Cons

Here’s a quick breakdown of the key strengths and weaknesses of various drawdown rules, based on the detailed guidelines from each firm. These models balance risk management with opportunities for account growth, but each comes with its own trade-offs.

Intraday trailing drawdown accounts, like those offered by Apex Trader Funding, are known for their low evaluation costs and high maximum drawdown limits – up to $7,500 on a $300K account. However, they can be challenging to manage. Unrealized gains raise the risk threshold during trades, which can push traders into exiting positions earlier than planned.

For those looking for more flexibility, End-of-Day (EOD) trailing rules – used by firms such as Topstep, Lucid Trading, and Tradeify – allow traders to weather intraday pullbacks more easily. The downside? The drawdown threshold adjusts daily, and these accounts tend to have higher costs.

On the other hand, static drawdown accounts, like those from The Futures Desk, offer a fixed risk threshold. This makes them a safer option for risk management, but they come with smaller buffers for losses and can be pricier.

Most firms also impose daily loss limits in addition to maximum drawdown rules. While these safeguards help prevent significant losses in a single session, they can also lock traders out of the market for the rest of the day – even if their overall drawdown remains within acceptable limits. For instance, Tradeify sets a $3,750 daily loss limit on its $150K Lightning account, alongside a $6,000 total maximum loss limit.

To simplify the comparison, here’s a table summarizing the pros and cons of each drawdown model:

| Firm / Rule Type | Strengths (Pros) | Weaknesses (Cons) |

|---|---|---|

| Apex Trader Funding (Intraday Trailing) | Low evaluation costs; high max drawdown limits (up to $7,500); locks once funded | Difficult to manage; unrealized gains increase the risk level mid-trade |

| Topstep / Lucid Trading (EOD Trailing) | Greater flexibility; accommodates intraday pullbacks | Drawdown adjusts daily; higher costs |

| The Futures Desk (Static Option) | Fixed drawdown threshold for consistent risk management | Less room for losses; can be more expensive |

| Tradeify / Alpha Futures (EOD Trailing) | Drawdown locks at starting balance once profit targets are hit | Daily loss limits may halt trading even if overall drawdown is intact |

This comparison highlights how each model caters to different trading styles and risk appetites, helping traders decide which approach best aligns with their strategies.

Conclusion

Understanding each firm’s drawdown rules is crucial to aligning them with your trading approach. For instance, scalpers who close trades quickly at profit peaks might find Apex Trader Funding‘s intraday trailing drawdown appealing. However, its real-time nature requires a disciplined mindset. On the other hand, traders looking for flexibility during the day often benefit from End-of-Day (EOD) drawdowns offered by firms like Tradeify, Topstep, and Lucid Trading. These options let you manage intraday pullbacks without the need to constantly adjust your targets.

Swing traders, who hold positions overnight, might prefer firms designed for such strategies. Options like Phidias Prop Firm with its Swing accounts or The Futures Desk with customizable EOD or static drawdown rules could be a better fit. For those who value predictability, static drawdowns eliminate uncertainty, though they typically come with smaller risk allowances or higher fees.

Daily loss limits are another factor to weigh. While they can shield you from major losses, they might also halt your trading for the day, even if your overall drawdown isn’t breached. Tradeify’s Select evaluations stand out by offering zero daily loss limits, providing full intraday flexibility. Additionally, don’t overlook activation fees – firms like Tradeify and Lucid Trading charge none, while others might add $130 or more to your upfront expenses.

Another key consideration is whether a firm tracks unrealized or realized profit peaks. As Team Topstep explains:

"Intraday Trailing Drawdown punishes normal pullbacks and often causes traders to lose accounts prematurely".

Since drawdown rules and fees can change frequently, staying updated is essential. To keep track of the latest policies and reviews, visit DamnPropFirms. Staying informed ensures you’re always trading with the best fit for your needs.

FAQs

What is the difference between intraday trailing drawdowns and end-of-day drawdowns?

Intraday trailing drawdowns are adjusted in real time during the trading session, reflecting your account’s unrealized profits and losses. This means that even brief market pullbacks while a trade is open can shrink your drawdown limit. If your account drops too much during the day, it could trigger a violation – even if the loss is temporary.

In contrast, end-of-day (EOD) drawdowns are calculated after the market closes, typically at 5:00 PM EST. These are based only on realized gains, giving traders the freedom to navigate intraday fluctuations without facing immediate consequences. Because of this, EOD drawdowns often work well for swing or multi-day trading strategies, offering a bit more breathing room.

What are reset fees, and how do they differ among prop firms?

Reset fees are charges that traders might need to pay if they breach a firm’s rules and want to restart their evaluation. These fees can differ significantly depending on the proprietary trading firm. For example, Apex Trader Funding charges a flat $50 reset fee, while firms like FundingTicks and Take Profit Trader stand out by offering no reset fees, making them appealing to traders.

The way reset fees are structured often ties into a firm’s risk management strategy. Firms with stricter drawdown rules might implement reset fees to cover administrative expenses. On the other hand, firms that emphasize instant funding or no-fee programs may choose to absorb these costs as a way to attract more traders. When evaluating prop firms, it’s important to weigh reset fees alongside other key factors, such as drawdown policies and profit targets. For traders who may need multiple attempts, low or no reset fees can make a big difference.

What type of drawdown rule works best for my trading style?

The best drawdown rule for your trading depends on your approach and risk management preferences. If you lean toward low-volatility strategies like swing or position trading, a static drawdown could be your best option. It sets a fixed loss limit that remains unchanged as your account grows. This consistency allows you to focus on maximizing profits without worrying about the drawdown limit creeping higher.

For those who thrive in fast-moving, high-frequency trading, a trailing drawdown might be a better fit. This adjusts based on your highest account balance, rewarding aggressive profit-taking but potentially penalizing normal intraday pullbacks. If you choose this option, look for a trailing drawdown evaluated at the end of the day to avoid being impacted by brief, intraday fluctuations.

If you prefer holding positions overnight or trading setups prone to intraday swings, an end-of-day (EOD) drawdown provides more flexibility. It only evaluates losses at the close of the trading day, giving you a buffer against temporary market moves.

Key takeaway: Align the drawdown type with your trading style. Scalpers and short-term traders might benefit from static or intraday trailing drawdowns, while swing and position traders often find static or EOD drawdowns more suitable. Aggressive traders who excel at locking in profits may find a trailing drawdown complements their strategy.