Slippage is the difference between the price you expect when placing a trade and the actual price at execution. It happens due to market volatility, low liquidity, large order sizes, or execution delays. For futures traders, even small slippage can significantly reduce profits or disrupt risk management. Here’s what you need to know:

- Market Volatility: Fast price swings during events like CPI or FOMC announcements can cause slippage, especially with market orders.

- Low Liquidity: Thin markets or trading outside regular hours can lead to unfavorable fills.

- Large Orders: Big trades may "sweep the order book", filling at worse prices.

- Execution Delays: Latency from slow systems or connections can worsen slippage.

To minimize slippage:

- Use limit orders to control prices.

- Trade during high-liquidity periods like U.S. market hours.

- Consider micro futures contracts to reduce financial impact.

- Leverage low-latency tools like Direct Market Access (DMA) or server-side execution.

Slippage is unavoidable but manageable. Tracking it, using the right tools, and trading strategically can protect your profits and improve execution accuracy.

Trading Strategy vs. Execution | EdgeShorts: Futures, Fast & Simple

sbb-itb-46ae61d

What Causes Slippage in Futures Trading?

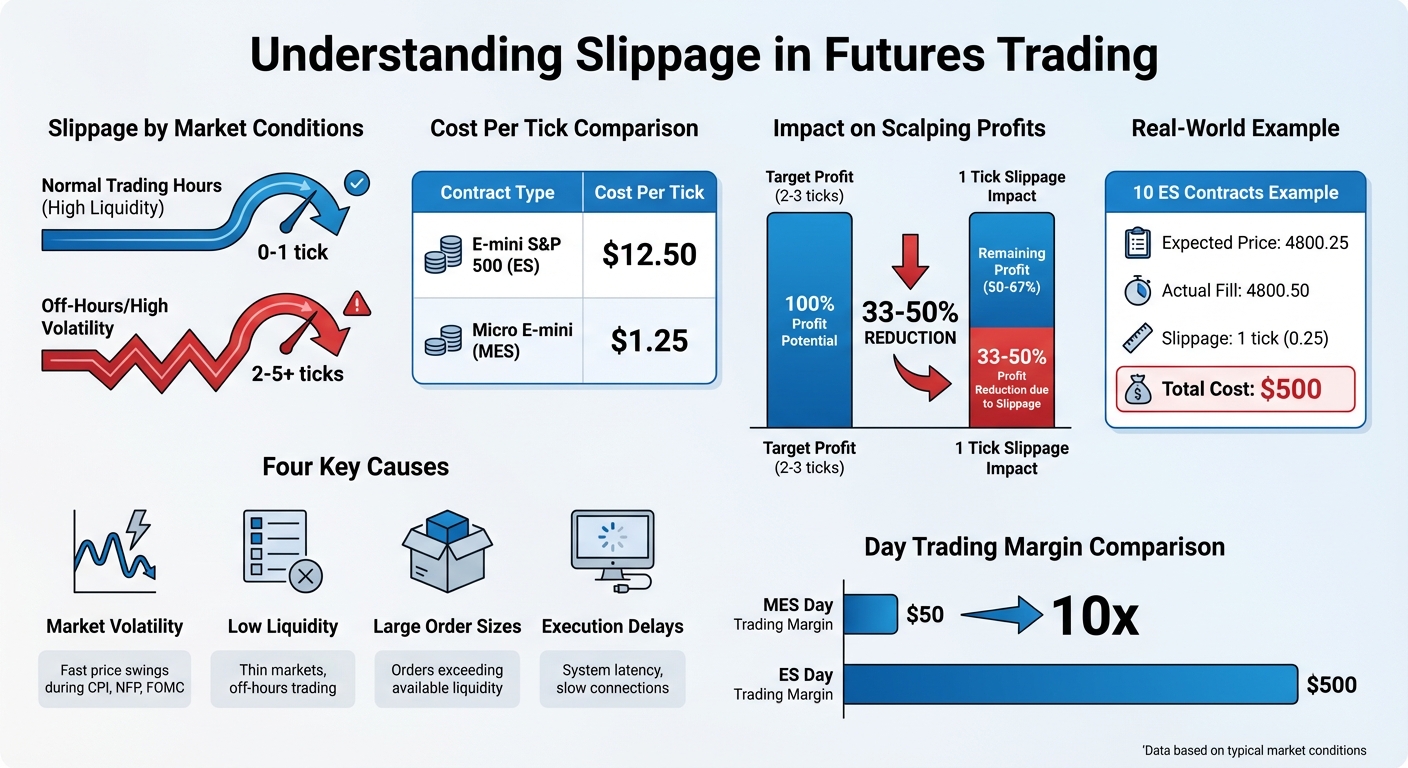

Slippage Impact Comparison: Full-Size vs Micro Futures Contracts

Knowing what leads to slippage can help you predict when it might occur and take steps to maintain accurate trade execution. Slippage typically stems from four key factors: market volatility, low liquidity, large order sizes, and execution delays.

Market Volatility

Fast price swings during volatile periods are one of the main reasons for slippage. Events like CPI, NFP, or FOMC releases often trigger rapid price changes, which can shift the visible price before your order is executed. In highly liquid futures markets such as the E-mini S&P 500 (ES) or Nasdaq 100 (NQ), slippage is usually minimal – staying within 0–1 tick during normal conditions. However, during periods of high volatility or outside regular trading hours, it can spike to 2–5 ticks or more.

"In fast-moving or less liquid markets, large or poorly timed orders can move the market against you." – Optimus Futures

When you place a market order, it consumes the available liquidity at the best price, and any remaining portion of the order gets filled at progressively worse prices. This happens because liquidity providers may widen spreads or reduce their participation during volatile conditions. Stop-loss orders are especially at risk since they convert into market orders when triggered. This can lead to fills at prices far worse than expected, potentially causing larger-than-anticipated losses.

Beyond sheer volatility, the depth of the market significantly affects how orders are executed.

Low Liquidity in Futures Markets

In thin markets, where buyers and sellers are limited at specific price levels, achieving precise order fills becomes challenging. If your market order exceeds the available volume at the best bid or ask, it "sweeps the order book", filling at increasingly unfavorable prices until the entire order is matched.

"Thin markets amplify slippage due to limited buyers and sellers at set price levels." – StoneX

Liquidity tends to be lower outside of regular U.S. trading hours. For scalpers aiming for small profits – like 2–3 ticks – losing even 1 tick to slippage can reduce expected profits by 33% to 50%. To put this into perspective, a single tick of slippage on one ES contract costs $12.50, while on a Micro E-mini (MES) contract, it costs $1.25.

Large Order Sizes

Submitting large orders can also lead to slippage. If your order size surpasses the available liquidity at your target price, the remainder will be filled at the next available price levels, which are often less favorable. For instance, if you buy 10 ES contracts but only 3 contracts are available at the best ask, the order will move through several price levels, resulting in a worse average fill price and higher costs as it "walks the book" to find sellers.

Since futures trading involves significant leverage, even small slippage of a few ticks can translate into substantial financial impact compared to non-leveraged assets.

Execution delays can further compound this issue.

Execution Delays

The time it takes for an order to go from being placed to being executed is another factor that contributes to slippage. Delays caused by system latency, slow internet connections, or the time needed to find counterparties in low-liquidity conditions can allow prices to shift before the order is filled. During periods of high volatility, these delays can result in execution prices that differ significantly from what you initially saw when placing the order.

"Slippage is the discrepancy between an order’s specified price and the price at which it’s actually filled at market." – StoneX

Using advanced trading infrastructure can help reduce these delays. For example, traders who use Direct Market Access (DMA) to route their orders directly to exchanges or employ server-side order hosting can cut down on latency and minimize slippage. Advanced trading tools, which will be discussed later, also play a role in addressing these issues effectively.

How to Measure and Quantify Slippage

To truly understand the cost of slippage, you need to track specific metrics that highlight how much the actual execution price deviates from your expected price. The basic formula is straightforward: subtract the expected market price at the time of order submission from the actual fill price. This deviation impacts both buy and sell orders equally, effectively widening the execution spread.

Traders use various methods to measure slippage, depending on their trading strategies. These include:

- Tick-based measurement: Tracks slippage in the smallest price increments (ticks).

- Point-based measurement: Useful for larger price movements, such as those in Nasdaq 100 contracts.

- Dollar-based measurement: Shows the direct financial impact of slippage.

- Basis points (bps): Commonly used for performance analysis, where 100 bps equals 1%.

Some brokers offer tools to limit slippage, like setting a maximum tolerance (e.g., 2%). If the price moves beyond this threshold, the order won’t execute. Measuring slippage effectively is key to evaluating execution quality and fine-tuning trading strategies for funded accounts.

Execution Price vs. Expected Price

The core calculation for slippage is simple: subtract your expected price from the actual fill price. For example, if a trader places an order to buy 10 ES contracts and the average fill price is 4800.50 while the best ask was 4800.25, the difference of 0.25 equals 1 tick of slippage per contract. In this case, the extra cost totals $500. Quantifying these differences is critical for improving execution and overall trading results.

To get a clearer picture of execution costs, monitor the pre-order price – the market price just before you submitted the order. This helps account for both slippage and market impact. Tools like Depth-of-Market (DOM) can provide insights into real-time liquidity, helping you anticipate execution quality for larger orders. When backtesting strategies, adding a slippage penalty (e.g., 5 bps) to unadjusted returns can give a more realistic performance assessment. Tracking these metrics is essential when choosing execution tools or evaluating prop firm partnerships.

Spread Widening and Tick-Based Costs

Spread widening is a key indicator of liquidity depletion. When the bid-ask spread increases, it often means your order is consuming available liquidity. Even a single tick of slippage can cut deeply into profits, particularly for scalping strategies.

"A single tick of slippage that might cost $25 in micro futures becomes $250 in full-size contracts – making execution efficiency critical for profitability." – Optimus Futures

It’s also important to monitor price recovery time. If prices take longer to stabilize, it indicates a significant market impact. In highly liquid markets like the ES during active trading hours, slippage is typically minimal – 0 to 1 tick. However, during off-hours, slippage can increase to 2–5 ticks or more. Keeping an eye on spread widening and tick-based costs can help you make smarter execution decisions and preserve profitability.

Strategies to Minimize Slippage and Improve Execution Accuracy

Understanding slippage is only half the battle; the next step is implementing strategies to reduce it and improve execution accuracy. By carefully choosing order types, timing trades, selecting the right contracts, and leveraging advanced trading tools, you can protect your profits and maintain your trading edge.

Using Limit Orders

Limit orders provide a level of control that market orders simply can’t match. With a limit order, you set the exact price at which you’re willing to buy or sell. For instance, placing a buy limit order at 4800.25 ensures you won’t pay more than that price. However, there’s a trade-off: if the market doesn’t hit your specified price, your order won’t be executed. This approach is especially useful during volatile market conditions, where prices can swing wildly.

Optimal Order Timing and Smart Routing

Timing and routing your trades can significantly impact execution quality. Trading during high-volume periods – such as the standard equity market hours of 9:30 AM to 4:00 PM EST – offers deeper liquidity and narrower spreads. On the flip side, placing market orders around major economic events, like GDP reports or Federal Reserve announcements, can expose you to wider spreads and reduced liquidity.

For better execution, tools like Direct Market Access (DMA) and server-side hosting can help. DMA allows for direct interaction with order books, while server-side hosting executes trades directly from the broker’s server, minimizing delays. For larger trades, splitting orders into smaller chunks can reduce market impact and improve fill quality. These strategies work hand-in-hand with contract selection, particularly when trading micro futures.

Trading Micro Futures Contracts

Choosing the right contract size can refine your trading precision. Micro futures contracts, such as the Micro E-mini S&P 500 (MES), are one-tenth the size of standard E-mini contracts. This smaller size reduces the financial impact of slippage. For example, a one-tick move in the MES costs only $1.25, compared to $12.50 for a standard E-mini (ES).

The smaller contract size also minimizes the risk of moving the market or exhausting liquidity. Additionally, micro contracts offer lower day trading margins – sometimes as low as $50 compared to $500 for standard contracts. This makes it easier to scale positions, take partial profits, and test strategies with minimal risk.

Using Low-Latency Trading Tools

Speed is critical in futures trading, and advanced tools can make all the difference. Automated trading systems and co-location services eliminate delays caused by human reaction times. These tools ensure trades are executed the moment a strategy signal is triggered.

Co-located servers, which are hosted near the exchange, further enhance execution speed by reducing the time it takes for orders to reach the market. Server-side execution also keeps orders at the exchange until they’re filled, bypassing delays caused by internet connections or local hardware. For active traders, even milliseconds can determine whether a trade is profitable or not. Many professional futures traders rely on platforms like Rithmic or Tradovate for their low-latency capabilities, so it’s essential to ensure your trading platform is compatible.

Evaluating Futures Prop Firms: Slippage and Execution Accuracy

When it comes to picking the right futures prop firm, a key factor to consider is the quality of their execution infrastructure. The tools and technology they provide can make or break your trading performance. A reliable platform ensures precise trade fills, while poor execution can lead to slippage that eats into your profits.

Top Futures Prop Firms for Liquidity and Execution Tools

Apex Trader Funding stands out for its ability to support multiple accounts while offering a stable platform for consistent execution. Similarly, Take Profit Trader provides the flexibility of multiple data feeds and eliminates daily loss limits, helping traders stay focused without added stress [12, 24].

Topstep takes a unique approach with its proprietary TopstepX platform. It incorporates simulated slippage into its Trading Combine, giving traders a realistic sense of market conditions. Meanwhile, Tradeify offers "Straight to SIM Funded" accounts, complete with a built-in trading journal to monitor execution accuracy. Across the board, firms that prioritize Direct Market Access (DMA) and server-side order hosting help reduce latency and slippage, making them an excellent choice for active traders.

Tools for Better Execution Accuracy

In addition to a strong infrastructure, advanced tools can help traders minimize slippage even further. For instance, DamnPropFirms provides resources like the Consistency Rule Calculator. This tool helps traders stick to firm-specific rules, such as ensuring no single day accounts for more than 30% of their total profit. By adhering to these rules, traders can avoid oversized positions that increase their risk of slippage.

Another important consideration is platform compatibility. Ensure the firm supports your preferred trading tools – whether it’s NinjaTrader, Sierra Chart, or TradingView – and offers reliable data feeds like Rithmic or Tradovate. For highly liquid contracts like the E‑mini S&P 500, slippage should typically range from 0 to 1 tick for small orders during active trading hours. If you notice consistent slippage beyond this range, it might be time to evaluate your firm’s infrastructure or reconsider your order execution strategy.

Conclusion

Slippage is a natural part of futures trading, and understanding how it works can help you better manage its impact on your trades. The gap between the price you expect and the price you actually get can directly influence your profits. As Topstep aptly puts it:

"Slippage teaches you something important: you can’t control the markets. Prices change, orders move, and the only thing you can control is how you respond."

To manage slippage effectively, start by measuring it. Track the difference between your expected and actual fill prices – this data can help you fine-tune your trading strategy. Use tools like limit orders to lock in your desired price, focus on trading during high-liquidity periods, and consider micro contracts to minimize the financial hit from less-than-ideal fills.

Your trading platform also plays a key role. Working with a prop firm that offers reliable direct market access (DMA) and low latency can make a difference. Websites like DamnPropFirms provide verified reviews, discount codes (up to 90% off as of January 2026), and helpful tools like the Consistency Rule Calculator to simplify navigating firm-specific requirements.

For more insights, you can compare the execution setups at firms like Apex Trader Funding, check simulated slippage metrics at Topstep, or explore instant funding options with Tradeify. Managing slippage starts with understanding its mechanics and leveraging the right tools to improve your execution.

FAQs

How can traders measure and reduce slippage in futures trading?

Traders can calculate slippage by comparing the price they expected to enter or exit a trade with the actual price at which the trade was executed. This can be done by reviewing past trades or placing small test orders under various market conditions to spot trends.

To minimize slippage, keep a close watch on bid-ask spreads. Wider spreads often signal a higher risk of slippage, particularly during periods of high market volatility. It’s also important to stay alert during major news events or times of low market liquidity, as these factors can amplify slippage. Tools like volatility indicators – such as the Average True Range (ATR) – can provide insights to help traders anticipate and manage slippage more effectively. By understanding these elements, traders can enhance execution precision and better manage their trading expenses.

How can I reduce slippage during periods of high market volatility?

To tackle slippage during high-volatility periods in futures trading, it’s all about refining your execution strategy. One practical tip? Use limit orders rather than market orders. With limit orders, you set the exact price you’re willing to trade at, helping you dodge those sudden, unfavorable price shifts.

Timing also plays a huge role. Keep an eye on major market events or economic announcements – these can spark volatility. Planning your trades during quieter periods can make a noticeable difference.

Another key factor is your trading platform. Opt for one that offers fast execution speeds and dependable order routing to cut down on delays. Pair this with advanced trading tools to track price movements closely and tweak your orders in real-time. When you combine these tactics, you’re better equipped to manage slippage and improve your trade execution.

How does selecting the right trading platform help reduce slippage?

Choosing the right trading platform plays a key role in reducing slippage. This is because a dependable platform ensures quicker and more precise order execution, which helps limit the gap between the price you expect and the price at which your order is actually filled – something that becomes even more critical during volatile market conditions.

Many advanced platforms also come equipped with features specifically designed to manage slippage. These can include tools like customizable order types and access to real-time market data. Opting for a platform built for accuracy and speed can not only enhance your trading performance but also safeguard your profits.