Prop firms are legitimate trading platforms that provide capital to traders in exchange for a share of the profits. They allow traders to engage in markets like futures, forex, and commodities without risking their own money upfront. However, success often depends on meeting strict rules during evaluations, such as profit targets and drawdown limits. While many traders fail these challenges, those who succeed can earn real payouts, even when trading on simulated accounts.

Here’s a quick breakdown of three popular prop firms:

- Topstep: Offers a structured, 1 step evaluation process. Traders keep 100% of their first $10,000, then switch to a 90/10 profit split. Known for its educational resources and community support.

- Apex Trader Funding: Features a simpler one-step evaluation. Traders keep 100% of their first $25,000, then move to a 90/10 split. Supports multiple accounts but enforces strict compliance rules.

- Lucid Trading: Provides flexible options, including instant funding. Profit splits reach up to 90%, with weekly payouts once profit thresholds are met.

Each firm has its own rules, payout structures, and support systems, making it essential to choose one that aligns with your trading goals. Below is a quick comparison of the best futures prop firms to help you decide.

Quick Comparison

| Feature | Topstep | Apex Trader Funding | Lucid Trading |

|---|---|---|---|

| Profit Split | 100% for first $10K, then 90/10 | 100% for first $25K, then 90/10 | Up to 90% |

| Evaluation Process | Multi-step | One-step | Instant or challenge-based |

| Payout Frequency | Up to 4 times a month | Up to 3 times a month | Weekly |

| Community Support | Strong | Moderate | Strong |

| Account Scaling | Up to 5 accounts | Up to 20 accounts | Up to $750K |

Choose based on your priorities: structured learning (Topstep), scaling and simplicity (Apex), or flexibility and fast payouts (Lucid Trading).

1. Topstep

Funding Models

Topstep uses a unique three-step process that stands out by calculating the Maximum Loss Limit based on your end-of-day balance rather than intraday drawdowns. This approach gives traders more flexibility, especially during volatile trading sessions. To qualify for funding, traders must first meet profit targets and adhere to risk rules in the Trading Combine. Once successful, they move on to the Express Funded Account (XFA), a simulated environment where they can earn real payouts. After completing five successful withdrawals from the XFA, traders may be promoted to a Live Funded Account, where they trade with Topstep’s actual capital, pending approval from the firm’s risk team.

Since its inception over 12 years ago, Topstep has helped more than 10,000 traders reach this advanced level, distributing over $10 million in payouts. This structured pathway ensures traders develop the skills needed to manage live capital effectively.

Now, let’s take a closer look at how profit sharing works.

Profit Splits

Topstep offers a straightforward profit-sharing model. Traders keep 100% of their first $10,000 in cumulative payouts across all funded accounts. After surpassing this amount, the profit split changes to 90/10, allowing traders to retain 90% of their profits while Topstep takes 10%. In 2024 alone, the firm issued an impressive 81,177 payouts to traders. This transparent structure highlights Topstep’s dedication to supporting its traders.

With profits in mind, let’s dive into the payout process.

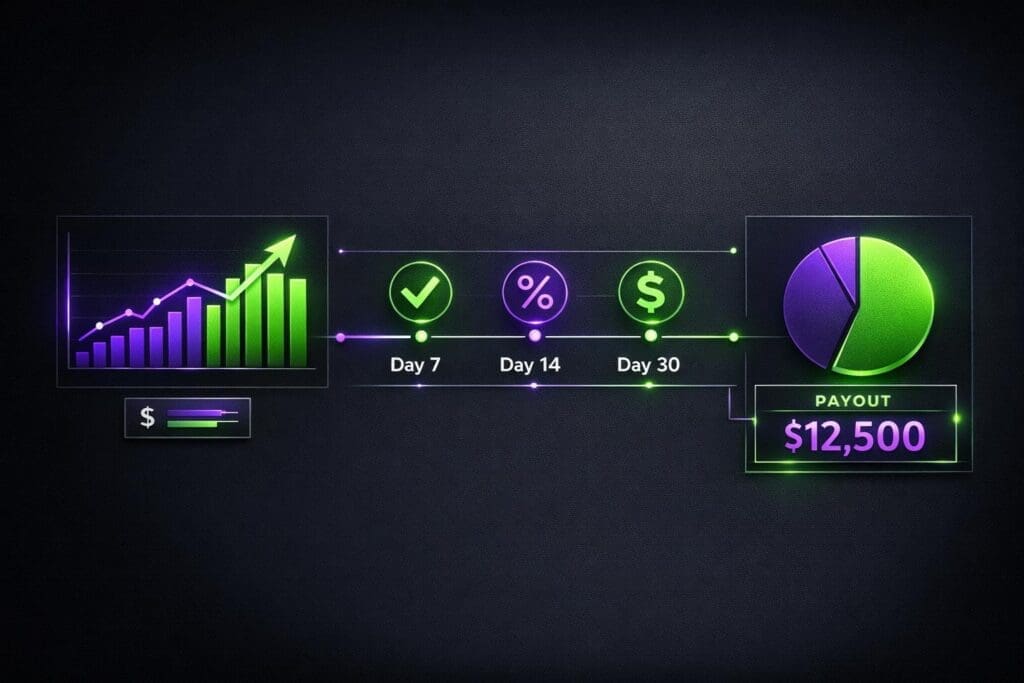

Payout Processes

For traders in the Express Funded Account, payouts require at least five winning days with a Net PNL of $150 or more. You can use a futures trading profit calculator to track your progress toward these targets. You can withdraw up to $5,000 or 50% of your account balance per request, with a limit of four payout requests per month. Once traders advance to the Live Funded Account and achieve 30 winning days, they gain access to daily payouts and full account control.

Withdrawals are processed within 1 to 3 business days via Wise or ACH transfers, though ACH and wire requests incur a $20 fee. The minimum withdrawal amount is $125. After your first payout, your Maximum Loss Limit resets to $0, ensuring your account balance cannot dip below its starting level.

Trader Support

Topstep goes beyond funding by offering robust trader support. Their educational platform, TopstepTV, provides real-time coaching and market analysis to guide traders during evaluations. Additionally, their Discord community of over 170,000 traders fosters accountability and strategy sharing.

The proprietary TopstepX™ platform includes tools like "Account Lockout" and the "Tilt" indicator, designed to help traders stay disciplined and manage emotional decisions.

"We’re not perfect, but we’re here to build better traders. That’s the whole point." – Michael Patak, Founder and CEO, Topstep

2. Apex Trader Funding

Funding Models

Apex Trader Funding operates with a straightforward, one-step evaluation process. To qualify, traders must achieve a specific profit target without exceeding the trailing drawdown limit. Once you meet the evaluation criteria and pay a $130 activation fee, you gain access to a Performance Account, allowing you to start earning real payouts. However, funded accounts are subject to a "30% Consistency Rule", which ensures that no single trading day can contribute more than 30% of your total profit when requesting a payout.

Since 2022, Apex has distributed an impressive $632,689,841 to traders, with average monthly payouts of $15,946,999. In April 2025, one trader received a record-breaking payout of $2,552,800.50. Additionally, traders can manage up to 20 accounts simultaneously using trade copiers, making multi-account management more efficient.

Now, let’s break down Apex’s profit-sharing structure.

Profit Splits

Apex offers an attractive profit-sharing model. For the first $25,000 in profits per account, you keep 100%. Once you exceed that threshold, the split adjusts to 90/10, meaning you retain 90% of additional profits, while Apex takes 10%. For your first five payouts, there are maximum withdrawal limits based on your account size. For example, a $25,000 account has a cap of $1,500 per payout, while a $300,000 account is capped at $3,500. These restrictions are lifted starting with your sixth payout, as long as you maintain the required minimum balance.

Let’s move on to the payout process.

Payout Processes

Apex processes payouts twice a month during designated windows: the 1st–5th and the 15th–19th. To qualify, you must complete at least 8 trading days, with at least 5 days showing a profit of $50 or more. The minimum withdrawal amount is $500. For the first three payouts, you’ll need to maintain a safety net equal to your drawdown limit plus $100. For instance, on a $50,000 account with a $2,500 drawdown limit, your safety net would be $2,600. To withdraw $2,000, your account balance would need to be at least $52,600.

"Getting my first payout took less than a week from request to money in my bank account. Apex is the fastest prop firm payout I’ve seen." – Chris T., Funded Trader

Payments are made through Deel, Wise, ACH bank transfers, or wire transfers. In December 2024, trader Patrick Wieland received a payout of $608,000, which he verified with bank proof on his YouTube channel.

Trader Support

Apex offers 24/7 customer support through an online help desk and fosters a community of around 59,000 members on Discord. The platform supports popular trading tools like NinjaTrader 8, Tradovate, RTrader Pro, and TradingView. While their educational resources are somewhat limited, Apex focuses on providing quick access to capital and speedy payouts. With a 4.5/5 star rating on Trustpilot based on over 15,000 reviews, traders often highlight the generous profit splits and efficient payout process. However, some have noted strict compliance audits and occasional minor delays with payouts.

3. Lucid Trading

Funding Models

Lucid Trading provides three funding options: Instant Funding, 1-Step Challenge, and Flex Challenge. The Instant Funding route allows you to begin trading right away, skipping any evaluation process. Account sizes range from $25,000 to $150,000. For the Challenge paths, traders must adhere to an 8% total drawdown and a 4% daily drawdown.

Now, let’s explore how Lucid Trading handles profit sharing.

Profit Splits

Lucid Trading offers traders up to a 90% profit split, no matter which funding model you choose. You can trade across a variety of markets, including CME products like NQ and ES.

Payout Processes

Lucid Trading ensures efficient weekly payouts, giving traders easy access to their funds. You can request withdrawals anytime during the calendar month, with processing completed within 15 minutes but sometimes within seconds. Available payout methods include ACH, wire transfer, PayPal, and several cryptocurrencies. The minimum withdrawal amount is $250.

Before your first withdrawal, you’ll need to meet specific safety thresholds – $1,600 for a $25K account, $2,600 for a $50K account, and $3,600 for a $100K account. Additionally, the platform enforces a 40% consistency rule, meaning no more than 40% of your total profits can come from a single trading day. Completing the KYC process is mandatory before initiating any withdrawals.

Watch how fast this trader receives his $3,000 payout from Lucid Trading.

Trader Support

Lucid Trader backs its funding and payout models with strong trader support. You can access the platform through Tradovate and Rithmic. The company has received positive feedback on Trustpilot, boasting over 950+ reviews as of early 2026. Traders frequently highlight fast payouts and transparent rules, although some have expressed concerns about the mandatory daily loss limits. Mobile-friendly access and responsive customer service ensure traders can manage their accounts and resolve issues efficiently.

For more details about Lucid Trading, check out our full Lucid Trading review.

sbb-itb-46ae61d

Is Prop Trading a Scam? Only 4% of Traders Get Paid (Bloomberg News)

Advantages and Disadvantages

Each of these three prop firms offers unique benefits and potential challenges. Here’s a breakdown to help you compare their features side by side.

Topstep has been around for 12 years, with 81,177 payouts reported in 2024. Its three-step program focuses on fostering discipline, offering coaching and access to a community of over 170,000 traders on Discord. Traders get to keep 100% of their first $10,000 in profits, after which the profit split shifts to 90/10. However, Topstep does charge evaluation and activation fees. If you’re looking for a quicker evaluation process, Apex Trader Funding might be worth considering.

Apex Trader Funding simplifies things with a one-step evaluation process and allows traders to keep 100% of their first $25,000 in profits. A standout feature is the ability to link up to 20 accounts simultaneously using trade copiers, making it a great option for high-frequency traders. However, Apex has faced criticism for denying payouts and requiring video evidence of trading sessions to ensure compliance with its 30% consistency rule. Faisal from TRADEPRO Academy shared his perspective:

"Apex has had some more turbulent times recently… they’ve been notoriously denying payouts without too much explanation".

Lucid Trading takes a different approach by offering daily withdrawals once a set profit buffer is met (for example, a $50,000 account requires a $3,000 buffer). It provides an 80/20 profit split for standard "Pro" accounts, with the potential to scale to a 90/10 split for "Pro+" accounts.

| Feature | Topstep | Apex Trader Funding | Lucid Trading |

|---|---|---|---|

| Profit Split | 100% of first $10K, then 90/10 | 100% of first $25K, then 90/10 | 90/10 for sim funded and 80/20 for live funded |

| Payout Frequency | Every 5 days | Every 8 days | 5 days (after meeting profit buffer) |

| Consistency Rule | 50% | 30% | 50% |

| Max Accounts | Up to 5 | Up to 20 | Up to 5 |

| Reliability | High; established track record | Mixed; strict compliance reports | High; known for fast, flexible withdrawals |

| Monthly Fees | $49–$149 | Around $30–$150 (varies by account size) | None, one time purchase |

Choosing the right firm depends on your priorities. If you’re after educational resources and long-term growth, Topstep might be the best fit. For those who want to scale aggressively with multiple accounts, Apex Trader Funding stands out. Meanwhile, Lucid Trading appeals to traders seeking quick and flexible payouts. Each firm offers a different path to success in prop trading, so it’s worth considering which aligns best with your trading goals.

Conclusion

Our review highlights the unique strengths and challenges of each firm, helping you identify which one aligns best with your trading approach.

Topstep stands out with its 12-year track record and 81,177 payouts, proving its reliability and commitment to trader satisfaction. It’s a great fit for those who value structured guidance and a supportive environment to grow their trading skills.

Apex Trader Funding has made an impressive $632 million in payouts since 2022, making it appealing for seasoned traders managing multiple accounts. However, its payout delays and strict verification requirements can be hurdles, so staying organized with trading records and adhering to the 30% consistency rule is crucial.

Lucid Trading offers flexibility with weekly withdrawals once the profit buffer is met, making it a solid choice for traders who prioritize quick access to earnings. However, it may not be the best option for those seeking extensive educational resources.

Ultimately, the right choice depends on your trading style and objectives. If you’re looking for a structured and stable platform, Topstep is a reliable option. Apex caters to experienced traders aiming to scale with multiple accounts, while Lucid Trading provides fast, flexible payouts. Each of these firms has proven legitimacy through real payouts, transparent rules, and solid business practices – what matters most is finding the one that aligns with your goals and trading discipline.

FAQs

What are the main differences between Topstep, Apex Trader Funding, and Lucid Trading?

Topstep, Lucid Trading, and Apex Trader Funding take different approaches when it comes to evaluation processes, pricing, and payout structures.

Topstep, established in 2012, is a veteran in the industry. It uses a two-step evaluation process where traders must hit specific profit targets and fulfill trading day requirements to secure funding. On the other hand, Apex Trader Funding, which started in 2021, offers a more flexible setup. Traders can choose between single or two-step challenges, benefit from shorter timelines, and even opt for resets. Apex is also known for its lower upfront costs, often running promotions to reduce fees, while Topstep generally charges around $200 monthly for its combine program.

When it comes to payouts, Topstep allows withdrawals after qualifying days and includes potential bonuses for traders managing larger account sizes. Apex, meanwhile, emphasizes lump-sum payouts once profit targets are met, with traders keeping a higher percentage of their earnings. The specifics of Lucid Trading’s evaluation process, fees, and payout structure make it a prime choice for instant funding.

How do profit splits work at prop trading firms?

Profit splits determine how proprietary trading firms share earnings with the traders they fund. Once traders pass an evaluation and receive a funded account, they keep a percentage of the net profits they generate. Typically, firms offer traders anywhere from 50% to 90% of the profits, while retaining the rest to account for risks and operational expenses.

Some firms implement tiered profit splits to reward consistent performance. For instance, a trader might begin with a 50% split, which could increase to 70% or higher as they achieve profit milestones or grow their account. These payouts are usually calculated after deducting any applicable fees, such as platform or data fees, and are distributed on a weekly or monthly basis according to the agreed percentage.

It’s crucial to understand a firm’s profit split structure and any potential performance-based upgrades to ensure it aligns with your trading objectives.

What factors should traders look at when selecting a prop firm?

When selecting a prop firm, start by assessing its reputation and reliability. Choose a firm with a solid history of timely payouts, transparent policies, and positive feedback from other traders. This step ensures you’re partnering with a company you can trust.

Next, dive into the financial terms. Look closely at the profit split – ideally, it should be between 70% and 90% in favor of traders. Evaluate drawdown limits and any rules about consistency or deadlines during the evaluation phase. Opt for a firm with terms that are fair and adaptable to your trading approach.

Finally, examine the firm’s operational features. Does it support your preferred trading platform and asset types? Are the evaluation structures reasonable? Access to ample capital, strong customer support, and useful resources can significantly enhance your trading experience. A firm with clear guidelines, low fees, and scalable funding options is often the smartest choice.