When trading futures, two often-overlooked costs – platform fees and data feed fees – can significantly impact your expenses. Here’s the breakdown:

- Platform Fees: Charged by brokers or software providers, these fees cover trading platforms and tools. Costs range from $10 to $100/month and may be waived based on trading volume or account size.

- Data Feed Fees: Paid to exchanges for real-time market data, like Level 1 and Level 2 quotes. Costs typically range from $20 to $250+/month depending on data type and user classification (retail vs. professional).

Together, these fees can add $100–$250+ to your monthly trading costs, often matching or exceeding commissions. Active traders may benefit from premium tools, while less frequent traders might opt for basic or bundled services to save money.

Quick Comparison:

| Aspect | Platform Fees | Data Feed Fees |

|---|---|---|

| Purpose | Trading software/tools | Real-time/historical market data |

| Charged By | Broker or platform provider | Exchanges (e.g., CME, Nasdaq) |

| Cost | $10–$100/month (or waived) | $20–$250+/month |

| Waivers | Often waived for high volume | Rarely waived |

| Example | $20/month for platform access | $40/month for CME Level 2 data |

To save, review broker fee structures, use bundled packages, meet trading volume thresholds, or explore promotions. Managing these fees can help you optimize trading costs and boost net returns.

What Are Platform Fees?

Definition and Purpose

Platform fees are the monthly charges brokers and trading firms impose to maintain the technology and tools traders rely on. Think of it as paying rent for your digital trading workspace. These fees cover the costs of trading software, charting tools, and the infrastructure that ensures smooth order execution and market analysis.

They go toward things like software updates, server upkeep, cybersecurity, and customer support. Beyond the basics, platform fees also support the development of advanced features like automated trading systems, custom order types, flexible workspaces, and integrated research tools.

How Platform Fees Are Charged

Understanding how brokers price platform fees is just as important as knowing what they cover.

Brokers use several pricing models for these fees. The most common include flat monthly subscriptions, tiered pricing based on account size or trading volume, per-trade charges, or usage-based models. Some brokers also tie platform fees directly to your trading activity.

Examples of Platform Fees

For basic platforms, charges might range from $0 to $5 per trade, providing essential tools for traders. On the other hand, premium platforms, which come with advanced features, often charge between $5 and $10 per trade. Historically, traditional full-service brokers bundled platform access with their commissions, which typically fell between $4.95 and $6.95 per trade. Discount brokers, leveraging automation, have managed to keep costs lower for their users.

In the world of proprietary (prop) trading, platform-related fees can vary widely. Some firms charge activation fees for access to funded accounts, while others promote no activation fees or monthly charges as a way to stand out.

Interestingly, some brokers allow traders to switch between platforms using the same data feed without incurring extra platform fees. This flexibility lets traders experiment with different interfaces. However, switching to a different data feed during the same billing cycle might result in additional charges for market data on both feeds.

Paying a slightly higher platform fee can sometimes lead to better execution quality, more reliable uptime during market volatility, or improved charting tools. In the long run, these benefits could make your trading experience more efficient and cost-effective. Next, we’ll dive into data feed fees.

Which Market Data Subscription do I Need? (Futures, Stocks, Options)

What Are Data Feed Fees?

Data feed fees are what keep you connected to the live pulse of the market. While platform fees cover your trading software, data feed fees ensure access to the real-time and historical market data you need to trade effectively. These fees, charged by exchanges like CME, NYSE, and NASDAQ, provide essential tools such as live price quotes, order book depth, and trade history. Without them, you’d likely be stuck with delayed or incomplete data, making it harder to make informed decisions.

These fees are collected by exchanges and data vendors responsible for processing and distributing market information. For example, CME Group considers data feed fees a core trading cost, separate from other expenses like commissions or platform charges. This data powers everything from basic price updates to advanced order flow analysis, ensuring your charts stay current and helping you gauge market sentiment.

Definition and Types of Data Feeds

Data feeds come in a few different tiers, each offering varying levels of detail:

- Level I Data: This provides the basics – bid, ask, trade, and volume data. It gives a top-level view of the market and is often included with broker accounts. For retail traders focused on swing or position trading, this level is usually sufficient.

- Level II Data: Also known as depth-of-market (DOM), this tier shows multiple price levels in the order book. It helps traders identify market depth and potential support or resistance zones, making it particularly useful for day traders and scalpers who depend on detailed order flow information.

- Full-Depth or Direct Feeds: These offer the most comprehensive view, delivering unfiltered, tick-by-tick data directly from the exchange with ultra-low latency. High-frequency trading firms and institutional algorithmic traders often rely on these feeds. While they provide unmatched detail and speed, they come at a steep price – retail subscriptions typically range from $20 to $100 per month, but direct feeds for institutional setups can cost tens of thousands of dollars monthly.

How Data Feed Fees Are Charged

Most data feed fees are billed as monthly flat rates tied to specific data products. These charges can vary depending on whether you’re a retail or professional user. They may include fixed monthly fees, per-subscriber rates, or redistribution costs, with professionals often facing higher costs.

Examples of Data Feed Fees

To put it into perspective, an active futures trader might spend around $250 per month when combining multiple data services and exchange fees. On the other hand, institutional traders subscribing to direct feeds from several U.S. exchanges – along with extras like co-location or microwave links – can see costs climb into the tens of thousands per month.

For retail traders, the costs are more manageable. Standard consolidated feeds from brokers typically range from $20 to $100 per month, making them a practical option for those trading on a smaller scale.

Prop trading firms handle these fees differently. Some pass exchange costs directly to traders, others bundle them into activation or monthly fees, and a few even include them as part of their overall service. When evaluating a prop firm, it’s important to confirm whether real-time data is included or charged separately and to check which exchanges are covered. For detailed reviews of futures prop firms and their fee structures, you can visit DamnPropFirms.

sbb-itb-46ae61d

Key Differences Between Platform Fees and Data Feed Fees

Building on our earlier breakdown of individual fee types, let’s dive into the key differences between platform fees and data feed fees. While both show up on your monthly trading statement, they serve entirely separate purposes and come from different sources. Knowing these distinctions can help you better allocate your trading budget and prioritize the services that align with your strategy.

Think of it this way: platform fees give you access to the trading "vehicle" (the interface), while data feed fees provide the "fuel" (real-time market data). For example, if you’re using Interactive Brokers‘ TWS platform, you might pay a platform fee (if applicable) to access the software, plus a separate fee for real-time Level 2 quotes on Nasdaq or NYSE stocks, or futures data from CME Group.

Platform fees are typically charged monthly by brokers and range from $10 to $100. These fees are often waived if your account size or trading volume meets certain thresholds. On the other hand, data feed fees – billed monthly by exchanges – usually fall between $20 and $100 for retail traders and are rarely waived.

Comparison Table: Platform Fees vs. Data Feed Fees

| Aspect | Platform Fees | Data Feed Fees |

|---|---|---|

| Purpose | Access to trading software, order entry, basic tools | Access to real-time/historical market data, Level 2 quotes |

| Charged By | Broker or platform provider | Exchanges (e.g., CME, Nasdaq), passed through by broker |

| Billing Frequency | Monthly flat fee; may be waived | Monthly flat fee; rarely waived |

| Typical Cost | $10–$100/month (or waived) | $20–$250+/month, depending on data type |

| What You Receive | Trading interface, basic research tools | Real-time prices, Level 1/Level 2 quotes, order flow |

| Example | $20/month for a pro trading platform | $40/month for real-time CME futures data |

When Each Fee Applies

Platform fees generally apply when you’re using a broker’s advanced or professional trading platform. These platforms are often designed for futures, options, or active stock trading. Traders who need advanced order types, algorithmic tools, or access to multiple asset classes are more likely to encounter these fees.

Data feed fees, on the other hand, kick in when you require real-time or Level 2 market data. For instance, a day trader relying on real-time Nasdaq Level 2 data or CME futures tick data will incur data feed fees. In contrast, long-term investors using delayed data can often avoid these charges. Swing traders might get by with Level 1 data, while scalpers and high-frequency traders typically need the fastest and most detailed feeds.

To understand which fees apply to you, review your brokerage agreement and fee schedule. Pay special attention to whether your account is classified as "retail" or "professional", as professional accounts often come with higher data costs. Forex traders generally don’t pay separate data feed fees because forex is decentralized, and the data is usually built into the spread. Futures and stock traders, however, will almost always see these fees itemized.

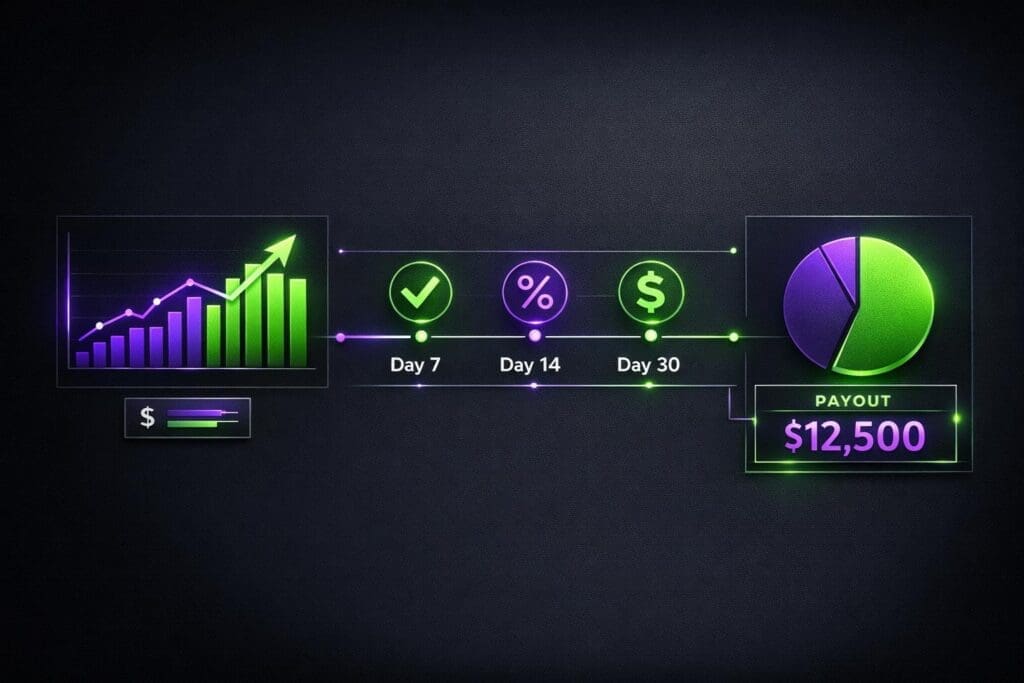

Impact on Trading Costs

Both platform and data feed fees add to your fixed costs, which can eat into your profitability. For instance, paying $20 in platform fees and $50 in data feed fees means $70 in monthly fixed costs. For smaller accounts, this can significantly impact your bottom line. High-frequency traders face even higher costs, making it essential to optimize fee structures.

Let’s break it down further: imagine a futures day trader making 100 round-trip trades a month. If commissions are $2 per contract, that’s $200 in commission costs. Adding $70 to $100 in platform and data fees brings total monthly costs to $270–$300. For smaller accounts, these fees can be a major hurdle.

Fee structures vary across brokers. Retail stock brokers often bundle market data into commissions or offer free basic data with an option to upgrade to Level 2. Platform fees are less common for basic accounts. Futures brokers, however, typically charge separate platform and data fees – usually $10 to $50 each per month – because they pass along exchange fees from groups like CME. Prop firms handle these charges differently: some include platform and data fees in their monthly subscription or challenge fees, while others charge extra for advanced data packages.

For detailed fee breakdowns, check out futures prop firm pages on DamnPropFirms, like Apex Trader Funding, FundedNext Futures, Take Profit Trader, or Tradeify.

Choosing a broker or prop firm that offers bundled or low-cost data and waived platform fees can save you hundreds of dollars annually. For traders managing multiple accounts or testing strategies, these savings can be the difference between turning a profit and just breaking even. Next, we’ll explore practical ways to reduce these recurring fees.

How to Reduce Platform and Data Feed Fees

Cutting down platform and data feed fees can lead to noticeable savings over time. Here’s how you can manage and reduce these costs effectively.

Review Broker Fee Structures

Start by carefully examining your broker’s fee schedule. Look for charges listed under categories like "platform access", "software", "terminal fees", "market data", or "exchange data fees." Fees are often scattered across different sections, so a thorough review is crucial.

Determine whether platform fees are fixed monthly charges or vary based on account size or trading activity. For data feeds, check if fees are applied per individual feed (e.g., Nasdaq TotalView or NYSE OpenBook) or grouped into bundles. Additionally, some brokers charge fees per user or device, which can quickly add up if you use multiple workstations. Be sure to differentiate between delayed data (often free) and real-time data (nearly always paid).

Advanced data, such as Level 2 quotes, Depth of Market, or historical tick data, may come with extra costs. For instance, while a broker might advertise a $10/month platform fee, they could tack on $20–$50 per month for each exchange data feed.

To get a clearer picture, create a spreadsheet comparing brokers side by side. Factor in your trading needs, like the number of data feeds required, the types of assets you trade, and how often you trade each month. This will help you identify which broker offers the most cost-effective fee structure for your strategy.

Some brokers include exchange data fees in their commissions or spreads, while others list them separately. While bundled fees might sometimes save money, transparent pricing can make it easier to understand your overall costs. Once you’ve broken down your fees, look for possible discounts to reduce your expenses further.

Use Discounts and Promotions

Take advantage of discounts and promotions to minimize costs. Many brokers offer introductory deals, such as discounted or waived fees for the first three to six months. These promotions can provide substantial savings during the trial period, giving you time to evaluate the platform.

Volume-based discounts are another common option. For example, a broker might waive a $20/month platform fee if you trade 50 or more futures contracts per month. Similarly, some stock brokers offer free Level 2 data for accounts with $50,000 or more in equity or for accounts that execute 20 or more trades monthly. Review your broker’s pricing tiers to see if increasing your trading activity or account balance could qualify you for reduced fees.

Bundled packages often provide better value. Instead of paying separately for platform access and each data feed (e.g., $20/month for the platform and $30–$60/month per futures data feed, totaling $100–$150/month), brokers may offer an all-inclusive "professional" package for $75–$100/month that covers everything you need.

For those trading with proprietary firms, platforms like DamnPropFirms offer exclusive discounts and promo codes that can significantly lower recurring platform and data fees. Verified codes from DamnPropFirms have saved traders anywhere from 10% to 90% on prop firm challenges, translating to savings ranging from $10 to over $1,000. Additionally, the DamnPropFirms Discord community, with over 3,000 traders, is a great place to find the latest deals and money-saving tips.

To dive deeper into fee comparisons, check out reviews of top prop firm partners like Apex Trader Funding, Take Profit Trader, FundedNext Futures, and others.

Bundle Services and Meet Volume Requirements

Bundling services and meeting volume thresholds can help you save even more. Bundled packages combine platform access, data feeds, and sometimes research tools into a single, more affordable monthly fee.

For instance, a stock trader in the U.S. might typically pay $10/month for platform access and $20–$40/month for Nasdaq and NYSE Level 2 data, totaling $70–$90/month. A bundled "all-access" package might cost just $50/month. Similarly, futures traders paying for platform and data feeds separately may find that a bundled professional package – priced around $75–$100/month – offers better value.

When considering bundled options, compare the total cost of individual fees with the bundle price to calculate your savings accurately. Make sure the bundle includes only the tools and data feeds you actually need; paying for unnecessary extras can cancel out the benefits.

Meeting certain trading volume or account size thresholds can also lead to fee reductions. For example, brokers often waive platform and data fees for accounts that trade a minimum number of contracts per month (e.g., 25–50 round-turn futures contracts) or maintain a minimum balance (e.g., $25,000–$100,000). A futures broker might waive a $20/month platform fee for accounts trading 50 or more contracts monthly, while a stock broker might offer free Level 2 data for accounts with $50,000 in equity or 20+ trades per month.

If you’re an active trader, consider negotiating directly with your broker. Sharing details about your average monthly volume, account size, and current fees might help you secure better terms. If your broker is unwilling to adjust, using competitors’ pricing as leverage can sometimes lead to more favorable rates.

Conclusion

Platform fees and data feed fees are core components of your trading expenses, alongside commissions. Platform fees cover the tools you rely on – software for placing trades, analyzing charts, and managing orders. These fees are typically charged by brokers or software vendors. Data feed fees, on the other hand, provide the market information you need, such as real-time quotes, Level II depth, or exchange-specific data streams, and are generally tied to exchanges or data providers. The exact cost depends on the instruments you trade and the level of detail you require.

For active traders, these fees can add up quickly, often reaching $150–$300 or more per month. If not managed carefully, they can eat into your trading profits and increase pressure to overtrade just to cover fixed costs. Unfortunately, many new traders overlook these expenses, focusing solely on commissions and spreads. This oversight often leads to unnecessary subscriptions for multiple platforms or redundant data feeds. Additionally, failing to regularly review fee structures means missing out on promotions, volume discounts, or bundled deals that could significantly reduce costs.

The upside? Actively managing these fees can improve your profitability and reduce the stress of fixed expenses. Start by reviewing your current setup for unused or overlapping tools. Consider switching to broker-provided platforms to eliminate separate fees, and look for volume-based or bundled pricing options. Always recalculate your break-even point after making changes, so you’re clear on how much profit you need to cover your costs.

When trimming expenses, prioritize reliable execution and adequate data quality. Decide what’s essential for your trading – whether it’s real-time Level I data, advanced charting, or order flow tools – and aim for the most cost-effective setup that meets those needs. Begin with a lean configuration, then upgrade only when there’s a clear, measurable benefit to your performance or workflow.

Treat these fees like any other business expense that requires diligent management. Keep a log of all charges, compare them to your net profits, and monitor payout percentages, especially if you’re trading through prop firms. Fee optimization isn’t a one-time task – it’s an ongoing process that helps you retain more of your earnings.

If you’re trading futures and looking for ways to cut costs, DamnPropFirms is a valuable resource. It offers tools to compare prop firms based on total costs and features, including platform access, data feeds, and other trading expenses. The site provides verified reviews, discount codes, and calculators like the Consistency Rule Calculator to help you assess firms such as Apex Trader Funding, Take Profit Trader, and Topstep, among others. Many of these firms offer bundled or subsidized services, and the DamnPropFirms Discord community of over 3,000 traders regularly shares tips on saving money. Use these resources to benchmark your costs and explore better options as the trading landscape evolves.

FAQs

Can I qualify for platform fee waivers based on my trading volume or account size?

Qualifying for platform fee waivers usually hinges on factors like your trading volume or account size. Many platforms reward active traders or those with substantial balances by reducing or even waiving fees. For instance, you might qualify if you execute a large number of trades each month or maintain a high account balance.

To find out if you’re eligible, review your platform’s fee structure or terms. If anything is unclear, it’s a good idea to contact the platform’s support team – they can explain their waiver policies and how your trading activity might fit into them.

How can I manage and reduce data feed fees while ensuring access to essential market data?

Managing data feed fees efficiently requires a mix of careful planning and smart use of resources. Start by evaluating your trading requirements and subscribing only to the feeds that are absolutely necessary for the markets or instruments you’re focusing on. Many providers offer tiered pricing plans, so opting for a lower-tier plan can help cut costs while still providing essential data.

You might also want to explore platforms that include data feed services as part of their packages. These bundled options can often be more affordable than purchasing feeds individually. If you’re trading with a proprietary firm, check if they offer to cover or subsidize data feed costs as part of their support. Finally, make it a habit to regularly review your subscriptions. This way, you can cancel any feeds you no longer use and ensure you’re only paying for the tools that genuinely add value to your trading.

What’s the difference between platform fees and data feed fees, and how can they affect my trading profitability?

Understanding platform fees and data feed fees is crucial for managing your trading expenses and keeping your costs under control. Here’s a quick breakdown:

- Platform fees: These are the charges for using a trading platform’s software, tools, and features. They’re typically billed on a monthly or annual basis.

- Data feed fees: These cover the cost of accessing real-time market data, such as price charts and order book details. Unlike platform fees, these are usually charged separately by exchanges or data providers.

Both types of fees can eat into your profits by adding to your overall trading costs. To keep things efficient, look for platforms with competitive pricing and only subscribe to the data feeds essential for your strategy. If you’re into futures trading, resources like DamnPropFirms can help you find prop firms that offer budget-friendly trading options, instant funding, and tools designed to help you maximize your earnings.