Trading Nasdaq 100 (NQ) and S&P 500 (ES) futures can be highly rewarding but requires a clear strategy and disciplined execution due to their volatility and leverage. Here’s what you need to know:

- NQ: Focuses on tech-heavy Nasdaq 100 companies. It’s more volatile and faster-moving, ideal for active traders seeking momentum.

- ES: Tracks the broader S&P 500 index, offering steadier, predictable price action. It’s better suited for those preferring less volatility.

- Micro contracts (MES, MNQ): Scaled-down versions of ES and NQ, great for beginners or those with smaller accounts.

Key points:

- NQ has higher margins and volatility, while ES offers broader market exposure.

- Choose strategies based on market conditions: breakout trades during high volatility, mean reversion during quieter periods, or scalping for quick moves.

- Effective risk management is critical. Set daily loss limits, use stop-loss orders, and size positions carefully.

Quick Tip: NQ suits traders looking for speed and volatility, while ES is ideal for those preferring stability and balance. Micro contracts are a safer way to start.

How I Chart Support & Resistance for ES & NQ Futures | Simple Price Action Trading Strategy

Understanding NQ and ES Futures Contracts

NQ vs ES Futures Contract Specifications Comparison

Contract Specifications and Trading Hours

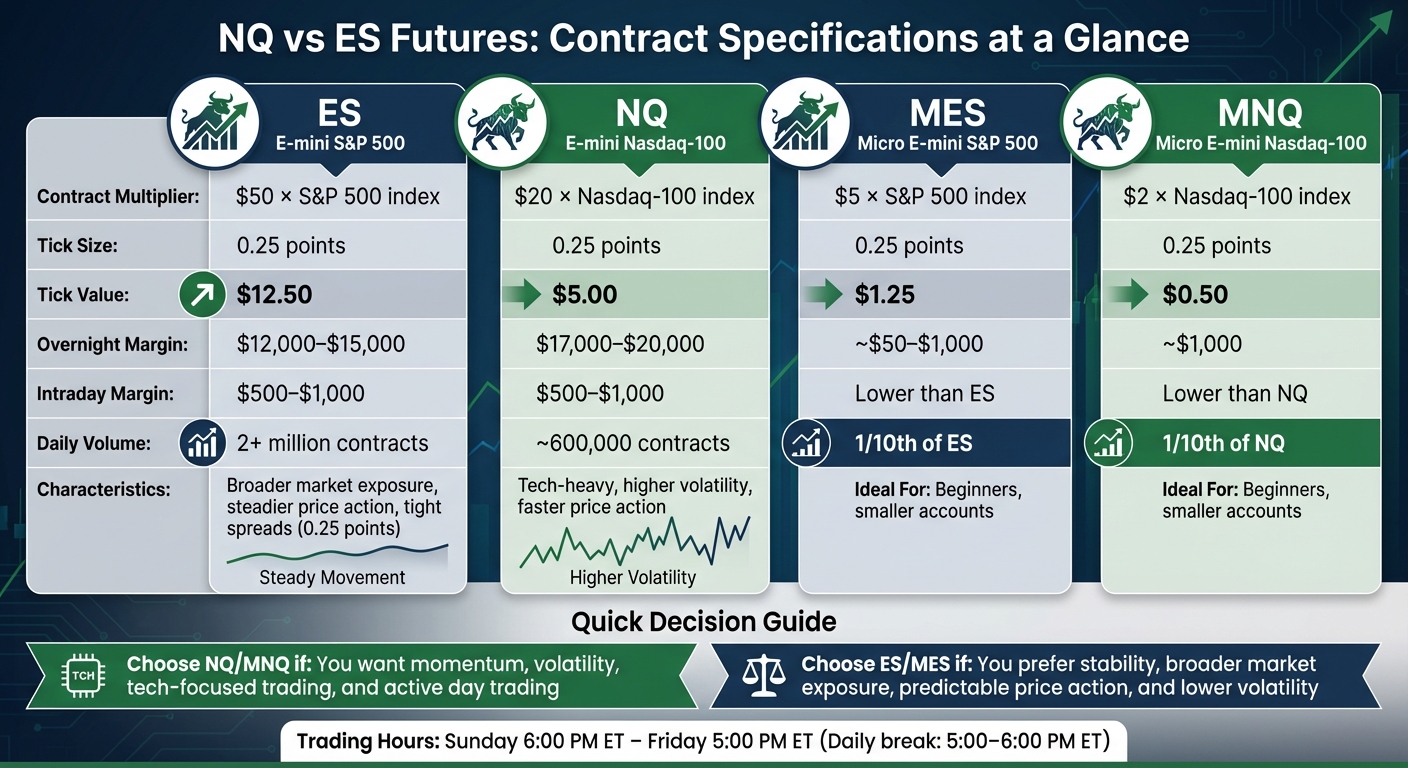

Both ES and NQ futures trade around the clock, starting Sunday at 6:00 PM ET and ending Friday at 5:00 PM ET, with a daily maintenance break from 5:00–6:00 PM ET.

The E-mini S&P 500 (ES) has a contract multiplier of $50 per index point, with a minimum tick size of 0.25 points. Each tick is worth $12.50. Margins for ES range between $12,000–$15,000 for overnight positions and $500–$1,000 for intraday trading. On the other hand, the E-mini Nasdaq-100 (NQ) uses a $20 multiplier per index point, with 0.25-point ticks valued at $5.00 each. NQ’s overnight margin requirements are higher, ranging from $17,000–$20,000, while intraday margins remain similar at $500–$1,000.

For traders with smaller accounts, Micro E-mini contracts (MES and MNQ) provide a scaled-down alternative, offering 1/10th the exposure of their larger counterparts. MES ticks are valued at $1.25, and MNQ ticks are worth $0.50. Margin requirements for these Micro contracts are significantly lower, starting as low as $50 for overnight positions.

| Contract | Multiplier | Tick Size | Tick Value | Overnight Margin | Intraday Margin |

|---|---|---|---|---|---|

| ES | $50 × S&P 500 | 0.25 points | $12.50 | $12,000–$15,000 | $500–$1,000 |

| NQ | $20 × Nasdaq-100 | 0.25 points | $5.00 | $17,000–$20,000 | $500–$1,000 |

| MES | $5 × S&P 500 | 0.25 points | $1.25 | ~$50–$1,000 | Lower than ES |

| MNQ | $2 × Nasdaq-100 | 0.25 points | $0.50 | ~$1,000 | Lower than NQ |

These details are essential for understanding how each contract operates and the level of exposure they provide.

How NQ and ES Differ

While the contract specifications are straightforward, the trading dynamics of ES and NQ differ significantly. The ES tracks 500 large-cap U.S. companies across various sectors, offering broad market exposure. With over 2 million contracts traded daily, its deep liquidity ensures tight bid-ask spreads – typically 0.25 points – and smoother price movements. In contrast, the NQ focuses on 100 non-financial, tech-heavy companies, trading about 600,000 contracts daily. While still highly liquid, NQ tends to have slightly wider spreads during slower trading periods.

NQ’s tech-centric composition drives its higher volatility and faster price action. From January 1, 2008, to December 31, 2020, NQ’s average volatility was 2% higher than ES, with a cumulative return of 608% compared to ES’s 236%. In 2023, NQ soared 55% – its strongest calendar year since 1999 – while ES delivered more moderate gains. Market analyst Jasper Osita notes:

moves faster than SPX. It reacts quicker than Dow. It respects structure better than most pairs or assets.

NQ’s concentration in sectors like Information Technology, communication, consumer discretionary, and healthcare (accounting for about 85% of its composition) makes it especially sensitive to interest rate changes, tech earnings, and sector-specific developments. By comparison, the S&P 500 has a more balanced sector distribution, with 62% in the same categories. These differences directly impact trading strategies and risk management approaches.

Choosing Between NQ and ES

Deciding between NQ and ES depends on your trading style, risk tolerance, and market conditions. Active day traders and scalpers often gravitate toward NQ for its momentum, volatility, and quick setups. ES, with its broader market exposure and steadier behavior, is better suited for traders seeking predictability. As Osita highlights:

If you’re an active trader looking for momentum, volatility, and smart setups, NAS100 is where the action is.

ES’s diversified structure makes it less reactive to individual sector news, making it a popular choice for long-term position traders and those using mean reversion strategies. Its thicker order book also minimizes the risk of slippage when placing larger trades.

For beginners or those testing new strategies, Micro contracts (MES and MNQ) are a practical starting point. These smaller contracts allow traders to engage with live markets while keeping risk under control. Many traders also shift between NQ and ES based on market conditions – favoring NQ during tech-driven, high-volatility sessions and turning to ES during periods of broader market focus.

Creating a Trading Framework

A structured, rules-based approach takes the guesswork and emotions out of trading. Before placing any trades, establish clear guidelines: decide when you’ll trade, identify the market conditions you’re targeting, and set your risk tolerance. This framework acts as your playbook for navigating NQ and ES futures with consistency.

Trading Sessions and Timing

NQ and ES futures trade almost 24 hours a day, but liquidity and volatility fluctuate throughout the session. The pre-market period (4:00 AM–9:30 AM ET) typically features lower volume and wider spreads. However, institutional activity often begins around 8:00 AM ET as traders digest overnight developments and prepare for the day ahead. The cash open (9:30 AM–10:30 AM ET) is marked by the highest volume and volatility, making it a prime window for breakout and momentum strategies. This first hour often sets the tone for the entire session.

Mid-day trading (11:00 AM–2:00 PM ET) slows down, with reduced volume and tighter price ranges. During this quieter period, mean reversion strategies – those that capitalize on prices returning to their average – are often more effective than directional plays. Activity ramps up again during the closing session (3:00 PM–4:00 PM ET), as institutional rebalancing drives fresh volatility. The overnight session (6:00 PM–4:00 AM ET) offers lower liquidity, which increases risk for active trading but provides an opportunity to monitor global market developments.

Once you’ve aligned your trading with session timings, the next step is to assess market conditions to choose the right strategies.

Identifying Market Conditions

Understanding whether the market is trending, range-bound, or choppy is key to selecting effective strategies. Tools like the Average True Range (ATR) and moving averages can help refine your entries. A higher ATR signals strong price movement, while lower ATR values point to consolidation. Moving averages, such as the 50-day and 200-day, offer additional insight: prices consistently above these levels suggest an upward trend, while oscillation around them indicates a range-bound market. The Average Directional Index (ADX) is another useful tool – readings above 25 indicate a strong trend, while values below 20 suggest sideways movement.

NQ’s focus on tech stocks often leads to sharp, multi-day moves during earnings seasons or Federal Reserve announcements. In contrast, ES tends to revert to key levels like VWAP or moving averages intraday, reflecting its broader diversification.

With session timing and market conditions in mind, the next step is to solidify your trades through detailed risk planning.

Risk Planning and Daily Preparation

Start each trading day with a clear risk plan. Set a daily loss limit – many traders cap this at 1–2% of their account balance. For example, if you’re trading with a $50,000 account, your maximum daily loss might range between $500 and $1,000. If you hit this limit, step away for the day to avoid further losses.

Define your per-trade risk ahead of time. For instance, a 4-point stop loss on ES equates to $200 per contract (based on its $50 multiplier). Similarly, a 10-point stop on NQ would also risk $200 per contract (with its $20 multiplier). Knowing these numbers allows you to size your positions correctly and avoid overexposure.

Your pre-market routine should include a review of the overnight price action, checking the economic calendar for key events like unemployment reports, Federal Reserve announcements, or CPI data, and marking key support and resistance levels from the prior session. For every trade, define your entry point, stop-loss, and profit target in advance. This preparation helps you make rational decisions, even when the market moves against you.

Finally, practice your strategies in a simulated environment for at least six months to a year before risking real capital. This step can significantly improve your confidence and performance.

Trading Strategies for NQ and ES

Once you’ve built a solid trading framework, it’s time to apply specific strategies tailored to different market conditions. Each approach should include clear entry and exit rules and take into account the unique behavior of the NQ and ES contracts. Below, you’ll find strategies that focus on breakout opportunities during volatile market openings, directional trend moves, and methods like mean reversion and scalping for more stable periods.

Opening Range Breakout Strategy

The opening range breakout (ORB) strategy is designed to capitalize on the momentum that often emerges right after the market opens. During the first 15–30 minutes of trading, the price tends to establish a range. A breakout above or below this range can indicate the session’s directional bias. To execute this strategy, identify the high and low of the opening range. If the price breaks above the high with volume confirmation, consider entering a long position. Conversely, if it breaks below the low, a short position might be appropriate. Place your stop-loss just inside the opposite boundary of the range.

The NQ, with its tech-heavy makeup and higher volatility, often produces sharper, more dramatic breakouts. Meanwhile, the ES typically exhibits smoother, more controlled price movements. When setting profit targets, account for these differences – NQ may require a higher reward-to-risk ratio due to its volatility, while ES allows for a steadier approach. This strategy also serves as a foundation for other trend-based methods.

Trend and Momentum Trading

Trend-following strategies thrive when the market displays clear directional movement, often building on the momentum of a breakout. Short-term moving averages, such as those on a 5-minute chart, can help you identify trends. If prices stay consistently above these averages and the lines slope upward, the market is likely in an uptrend. In such cases, consider entering long positions during pullbacks, placing your stop-loss below recent swing lows or key moving averages.

For NQ, wider stop-loss levels are often necessary to account for its higher volatility and avoid getting stopped out prematurely. On the other hand, ES’s steadier price action allows for tighter stops, preserving trade integrity without excessive risk.

Momentum indicators like the Relative Strength Index (RSI) can further refine your entries. For example, in an uptrend, a slight dip in the RSI might signal a good time to enter, while fading momentum could indicate when to exit.

Mean Reversion and Scalping

Mean reversion strategies work well during quieter market periods when prices tend to oscillate around key levels, such as the VWAP or moving averages. ES, in particular, often reverts to these averages intraday. If the price moves significantly away from the VWAP, consider entering a trade as it gravitates back toward the mean.

Scalping, on the other hand, focuses on capturing quick, small price movements. ES’s smooth price action and tight spreads make it ideal for scalping modest gains. NQ also offers opportunities for scalping but requires wider tick targets and stop-loss levels due to its larger price swings.

For both mean reversion and scalping, tools like order flow analysis and depth-of-market data can help you identify potential reversals and time your entries with greater precision. These approaches can be especially effective when paired with a disciplined risk management plan.

sbb-itb-46ae61d

Execution and Risk Management

A well-thought-out strategy is only as good as its execution and the ability to manage risk. Trading NQ and ES futures can amplify both profits and losses, often beyond the initial investment. This is why disciplined execution and strong risk management are the keys to avoiding significant account drawdowns and achieving consistent profitability.

Order Types and Entry Methods

The type of order you choose plays a huge role in how your trades play out. Market orders execute instantly at the current asking price, ensuring your trade goes through but without guaranteeing a specific price. These are especially useful when the market is moving fast, and you need to act quickly. On the other hand, limit orders let you specify the price you’re willing to pay or receive. For instance, if you want to buy ES at a specific level, a limit order will only execute at that price or better. While this gives you more control, there’s always the chance the market won’t reach your price, leaving you without a position.

To stay disciplined, always define your entry point, stop-loss level, and profit target before entering a trade. Pair these order types with strict risk controls to protect your capital.

Managing Trade Risk

Once you’ve chosen your order type, the next step is implementing strong risk management. This is especially critical when trading leveraged futures, where small price movements can have outsized effects. For example, NQ futures often require wider stop-loss levels due to their higher volatility, whereas ES futures might allow for tighter stops depending on market conditions.

Position sizing is another key aspect – limit the risk on any single trade to a small, predetermined percentage of your total capital. Beyond stop-loss orders, setting daily loss limits can help you stay disciplined. A study by CME Group found that traders who imposed daily loss limits of 2% of their capital were better at maintaining emotional control during volatile periods. Even the best strategies can fail without proper risk management, making it a non-negotiable part of trading.

Exit Planning and Trade Management

Risk management doesn’t stop with entering a trade – it extends to how you plan your exits. Predefine your profit targets using technical indicators like support and resistance levels or key price zones from previous sessions. For trending markets, consider using trailing stops to lock in profits while still allowing for further gains. For instance, in December 2024, a trader using a trailing stop on ES locked in a $1,200 profit by letting the position ride and adjusting the stop loss as the price moved higher.

"Effective exit strategies are as important as entry strategies in trading. They can mean the difference between a profitable trade and a loss." – Michael Zarembski, Senior Analyst, Charles Schwab

Stick to your exit plan. Avoid the temptation to adjust your stops in hopes of a reversal – it’s often better to take a controlled loss and analyze the trade for lessons. Chasing reversals can lead to larger losses and erode your discipline.

Tools and Performance Tracking

Having the right tools and consistently tracking your progress are key to becoming a better trader. Without them, it’s easy to keep repeating the same mistakes. When trading NQ and ES futures, you need reliable data, solid charting platforms, and a disciplined approach to evaluating your performance over time.

Data Sources and Charting Setup

The CME Group is the go-to exchange for NQ and ES futures, making it the most dependable source for market data. For real-time trading – especially if you’re using news-driven strategies – having fast and accurate data feeds is non-negotiable. Access to historical data with tick, minute, and daily resolution is equally important for backtesting and refining your strategies [9]. Platforms like Power E*TRADE, SierraChart, MultiCharts, and MetaTrader offer the charting and order execution tools you’ll need for effective trading [9]. These tools form the backbone for analyzing strategies and executing trades seamlessly in live markets.

When setting up your charts, focus on indicators that align with your trading style. For intraday strategies, VWAP (Volume-Weighted Average Price) can help identify fair value and potential support or resistance levels. Moving averages like the 9 and 21 EMAs are great for spotting momentum shifts, while tools such as MACD and RSI can confirm trend strength or signal overbought and oversold conditions. Scalpers often rely on Depth of Market (DOM) data to track bid-ask depth and volume in real time. If you’re swing trading, indicators like Fibonacci retracements and Bollinger Bands can help you pinpoint entry zones and spot extreme price moves. Combining multiple indicators – like pairing VWAP with volume data or moving averages – can give you more confidence before pulling the trigger on a trade.

Testing Your Strategies

Testing your strategies thoroughly is just as important as having risk controls in place. Backtesting allows you to see how your strategy would have performed in the past [9]. For instance, Papers With Backtest offers access to historical futures data and Python-based tools for algorithmic trading [9]. Platforms like Backtrader and QuantConnect are also excellent for building and testing algorithmic strategies [9].

Forward testing in a simulated environment is equally valuable. TradingSim suggests spending at least 6 months to a year in a simulator to evaluate your strategy’s win rate and log every trade before going live. Many brokers offer free demo accounts, which you can use to fine-tune your risk rules and trading approach. This practice phase is crucial for identifying weaknesses in your strategy and developing the discipline needed for live trading.

Tracking Results and Making Adjustments

Once you transition to live trading, keeping a close eye on your performance is essential. Maintain a detailed trade log that includes your entry and exit points, stop-loss levels, and the reasoning behind each trade. Many trading platforms also provide tools to track your total capital at risk across open positions in real time.

Key metrics like win rate, risk–reward ratios, and maximum drawdown can reveal patterns in your trading behavior. Are you cutting winners too soon? Are you holding onto losing trades for too long? Or are you risking too much on a single trade? Regularly analyzing these stats can help you identify areas where you need to improve and fine-tune your approach. As MetroTrade puts it:

What separates successful traders from inconsistent ones isn’t just their ability to find winners, it’s their ability to control risk, protect capital, and maintain discipline over time.

Conclusion

Trading NQ and ES futures successfully demands careful planning, disciplined execution, and a commitment to regularly reviewing your performance. To trade effectively, your strategies need to align with your personal goals, schedule, and risk tolerance. But beyond the strategies themselves, the key lies in understanding the tools and techniques that support them – and applying those consistently.

Risk management is just as crucial as strategy. As MetroTrade wisely states:

Risk management is more important than strategy selection. Even profitable systems can fail without stop-losses, proper position sizing, and the discipline to stick to a plan.

Every trade should start with a clear plan: define your entry point, stop-loss, and profit target. Neglecting this step can lead to poor decisions and unnecessary losses. Whether you’re aiming for quick scalping opportunities or holding positions for several days with swing trades, sticking to a well-thought-out plan helps you avoid emotional decision-making.

It’s also important to remember that futures trading involves significant risk. Leverage can magnify both profits and losses, so staying on top of your results and reviewing your performance regularly is essential. Make adjustments based on data and analysis – not on impulse.

Ultimately, your success in trading comes down to preparation, discipline, and a commitment to ongoing learning. Stay focused, manage your risk carefully, and continuously refine your approach. With the right mindset and execution, you’ll be better equipped to navigate the challenges of futures trading.

FAQs

What are the main differences between trading Nasdaq 100 (NQ) and S&P 500 (ES) futures?

The key difference between these two lies in the indices they represent. NQ futures are tied to the Nasdaq 100, which focuses on 100 major non-financial companies, with a heavy emphasis on tech and growth industries. These contracts tend to show higher volatility, making them popular for short-term trading or hedging strategies.

In contrast, ES futures are linked to the S&P 500, which includes 500 large U.S. companies spanning multiple sectors. This broader range typically results in less volatility, making ES futures a better fit for longer-term strategies or more cautious trading approaches. Both types of contracts trade almost around the clock, offering flexibility to suit different trading preferences.

What are the benefits of trading micro contracts like MES and MNQ for beginners?

Micro contracts, like MES (Micro E-mini S&P 500) and MNQ (Micro E-mini Nasdaq 100), are a great starting point for beginner traders. One of their biggest perks? They require much less capital compared to standard futures contracts, making them far more approachable for those new to trading.

Because of their lower margin requirements and smaller position sizes, micro contracts allow traders to dip their toes in the market without taking on significant financial risk. This setup is ideal for practicing strategies and gaining hands-on experience in the Nasdaq 100 and S&P 500 futures markets – all while keeping risk levels manageable.

What are the best strategies for managing risk when trading NQ and ES futures?

Managing risk in NQ and ES futures trading calls for a disciplined and thoughtful approach. A key strategy is to follow strict position sizing rules, such as limiting your risk to just 1-2% of your account per trade. This can help shield your capital during unpredictable market swings.

Using stop-loss orders is another essential tool to automatically cap losses on trades. Diversifying your positions can also reduce the risk of being overly exposed to one market or sector. Stick to high-probability setups that align with your trading plan, and steer clear of impulsive trades that deviate from your strategy. For extra protection, some traders turn to options strategies, like the 10% managed floor, to limit potential losses.

By blending these techniques, you can tackle the challenges of trading NQ and ES futures while keeping your trading account more secure.