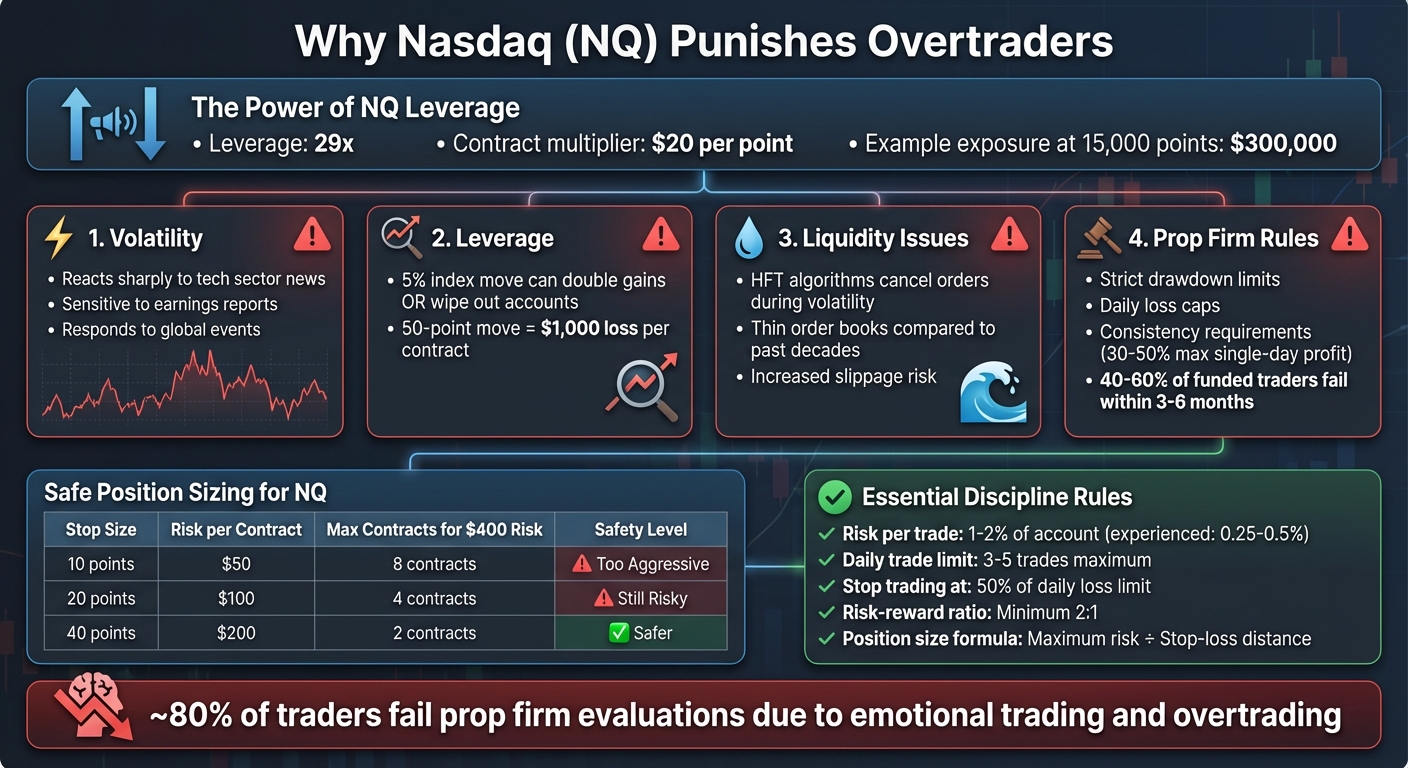

The Nasdaq (NQ) futures contract is unforgiving for overtraders. With 29x leverage and sharp price swings tied to the tech-heavy Nasdaq-100 Index, small mistakes can quickly snowball into significant losses. Overtrading – whether from impulsive decisions, revenge trading, or chasing losses – leads to breaches of strict risk rules enforced by proprietary trading firms.

Key reasons why overtrading NQ is risky:

- Volatility: Reacts sharply to tech sector news, earnings, and global events.

- Leverage: A 5% index move can double gains – or wipe out accounts.

- Liquidity Issues: High-frequency trading algorithms can worsen slippage during volatile moments.

- Prop Firm Rules: Trailing drawdown and consistency limits make impulsive trading costly.

To trade NQ successfully, disciplined risk management is essential. This includes setting clear stop-losses, limiting daily trades, and avoiding emotional decision-making. For beginners, Micro E-mini Nasdaq (MNQ) contracts offer a safer way to learn. The market rewards traders who focus on steady, controlled performance over impulsive, high-risk habits.

NQ Futures Trading Risk Factors and Position Sizing Guide

No Setup, No Trade | Staying Disciplined as a Trader | BlushNBullish

What Makes Nasdaq (NQ) Futures Different

The NQ futures contract is tied to the Nasdaq-100 Index, which represents 100 large-cap technology and growth companies. This tech-heavy makeup gives NQ its distinct personality, marked by volatility. Tech stocks are known for their sharp and rapid price swings, which means NQ futures are highly sensitive to sector-specific news, unexpected earnings results, and changes in investor sentiment toward growth stocks. These factors set the stage for the swift market moves discussed below.

Large Price Swings and Fast Market Moves

NQ futures trade nearly around the clock, responding instantly to global developments. Overnight activity in Asian markets or early economic reports from Europe can spark sharp price changes, often catching traders off guard. This constant price discovery makes the market especially challenging for those who overtrade, as positions can shift dramatically before there’s time to react.

The contract’s high liquidity can also amplify these swift price movements, especially when large institutional orders hit the market. Key events like U.S. jobs reports, Consumer Price Index data, or Federal Reserve announcements frequently lead to significant price shifts. For traders managing multiple positions, these sudden moves can quickly escalate small losses into major setbacks.

The situation becomes even riskier when leverage is factored in.

How Leverage Amplifies Trading Mistakes

With 29x leverage, even small price changes in NQ futures can lead to substantial gains – or losses. For example, each E-mini NQ contract represents $20 multiplied by the Nasdaq-100 Index value. If the index is at 15,000 points, one contract controls $300,000 worth of exposure, requiring only a fraction of that amount as margin.

"While leverage enhances profit potential, it also increases risk, meaning traders can suffer large losses even with small market movements." – Plus500

This leverage magnifies the risks of overtrading. A string of minor losses can quickly snowball into a margin call. If margin requirements aren’t met, brokers may liquidate positions – often at unfavorable prices. For instance, a 50-point move against a single contract could result in a $1,000 loss. Multiply that across several open positions, and the financial impact can be devastating. This dynamic makes overtrading particularly dangerous, as it increases the likelihood of forced liquidations.

"Trading Nasdaq Futures on margin can result in margin calls, which require traders to deposit additional funds to meet the margin requirements of their positions. Failure to do so can result in the liquidation of their positions and significant losses." – e-futures.com

Liquidity Problems During Market Events

Although NQ futures are generally highly liquid, modern electronic trading has introduced new challenges. The size of displayed order books has shrunk compared to earlier decades. High-frequency trading (HFT) algorithms frequently adjust or cancel orders during volatile periods. This creates fleeting liquidity that can disappear just when major economic events reduce overall market volume.

"While spreads have decreased from the early 2000s to today (mostly due to electronic trading), the actual displayed size of the bids and asks has also decreased. In the old days, you would see much thicker bids and offers, but these days a lot of stocks are 100 shares each side. When there are more than 100 shares, if you try to hit an entire level for all the liquidity available, frequently HFTs will cancel their orders, and you will get a partial fill." – Fernando Oliveira, Author of "Traders of the New Era"

For overtraders, this thin liquidity increases the risk of adverse selection – orders are more likely to execute when prices move against them and less likely to fill when prices move in their favor. High-frequency trading systems can detect frequent or large orders, cancel their own bids or offers, and force traders to accept worse prices. These algorithms, often located near exchanges for a speed advantage, can react to market changes in milliseconds – well before most traders can. This fleeting liquidity and increased slippage during critical moments make disciplined execution essential for navigating NQ futures effectively.

How Overtrading NQ Violates Prop Firm Rules

The volatility and leverage of NQ (Nasdaq futures) can amplify trading mistakes, often leading to violations of strict prop firm rules. Even one extra trade can result in significant losses, quickly breaching these rules. This highlights why trading NQ requires careful adherence to risk management principles.

Breaking Drawdown and Daily Loss Limits

Overtrading on NQ often signals poor risk management, which can directly lead to significant losses. When traders take multiple positions throughout the day, small losses can quickly pile up. The pressure to recover these losses often leads to impulsive decisions, like entering additional trades, which only compounds the problem. Given NQ’s leverage, positions can move against traders rapidly, increasing the likelihood of breaching daily loss limits or maximum drawdown thresholds.

"All investors must be keenly aware of the risks involved and of the consequences of poor trading habits and/or mismanaged resources." – Forexiz

Failing Consistency Requirements

Prop firms don’t just monitor loss limits – they also enforce rules around consistency. These firms often cap how much a single trading day can contribute to overall profits, typically limiting it to 30–50%. This ensures that traders focus on steady, incremental gains rather than relying on one-off successes. However, NQ’s high volatility makes meeting these consistency standards challenging. The temptation to chase quick profits often results in erratic performance, which disrupts the steady progress prop firms look for.

Statistics show that around 40–60% of funded traders lose their accounts within the first 3–6 months because they fail to transition from the evaluation mindset to disciplined trading. High-volatility periods, like the NY market open, can exacerbate this issue. Traders often experience FOMO (fear of missing out) during these times and enter trades impulsively, destabilizing their performance.

"They don’t want one-hit wonders. They want consistent traders." – Prop Firm App

Emotional Trading Mistakes on NQ

NQ’s fast-moving nature often triggers emotional reactions that lead to rule-breaking. Revenge trading – where traders attempt to recover losses by taking oversized, impulsive positions – can quickly drain accounts. On the flip side, overconfidence after a winning streak can result in excessive risk-taking.

These emotional pitfalls are a major reason why about 80% of traders fail prop firm evaluations. While many traders understand the rules intellectually, they struggle to apply them under emotional pressure. The combination of managing a funded account and navigating NQ’s volatility often leads to self-sabotage within 60 days, especially for those who prioritize large, risky profits over consistent, moderate gains.

sbb-itb-46ae61d

How to Prevent Overtrading NQ

Navigating the volatility of the NQ requires a disciplined approach to avoid breaking your own trading rules. To succeed with a fast-moving contract like NQ, you need clear boundaries, thoughtful risk management, and tools to keep impulsive decisions in check.

Setting Account-Level Risk Limits

Before placing a single trade, define your risk parameters. Establish your daily and maximum drawdown limits, and if you hit 50% of your daily loss limit, step away from trading for the day. Position sizing is just as important – limit your risk to 1–2% of your account balance for each trade. For example, if you have a $50,000 account, your maximum loss per trade should stay between $500 and $1,000. Many experienced traders go even lower, risking only 0.25% to 0.5% per trade [29, 31, 33].

Set daily loss limits, cap your total exposure to 5% of your capital, and limit yourself to 3–5 trades per day. Treat every trade as though it could be your last, questioning whether it aligns with your plan.

"Risk management is the foundation of success in prop trading." – OANDATeam

Managing Risk on Each Trade

Every trade should start with a predefined stop-loss based on market structure, not random numbers. Place stops near critical technical levels, like recent swing highs or lows, support and resistance zones, moving averages, or volume clusters/VWAP areas. For intraday NQ trading, stop-losses often range from 15 to 30 points. Use this formula to calculate your position size:

Position size = Maximum risk ÷ Stop-loss distance

For example, if your stop-loss distance is 20 points and each NQ point equals $5, you can calculate the maximum number of contracts based on your risk tolerance. Here’s a quick breakdown:

| Stop Size (points) | Risk per Contract ($5/point) | Max Contracts for $400 Risk |

|---|---|---|

| 10 | $50 | 8 (too aggressive) |

| 20 | $100 | 4 (still risky) |

| 40 | $200 | 2 (safer) |

Wider stops mean smaller position sizes. Aim for at least a 2:1 risk-reward ratio – if you’re risking 1%, aim for a 1.5% or greater profit target. When a trade moves in your favor, typically by 20–40 points with strong momentum, consider taking partial profits and moving your stop-loss to breakeven.

Timing matters too. Reduce your position size – or avoid trading entirely – during high-risk periods like the first 15–45 minutes after the market opens, on Fed meeting days, or around major economic data releases. Instead, focus on high-volume windows like the NY Open (9:30–11:00 AM EST) or Power Hour (3:00–4:00 PM EST). Avoid holding NQ positions overnight unless it’s part of a well-defined swing trade, as liquidity thins out and spreads widen after regular U.S. trading hours.

Tools to Control Impulsive Trading

Discipline goes beyond setting limits – it requires tools and habits to keep impulsive behavior in check. Start with a written trading plan that outlines your maximum contracts per trade, daily risk limits (e.g., stopping after 2–3 consecutive losses), minimum stop sizes, and clear entry/exit rules. A pre-market checklist can also help you stay grounded and avoid reactive decisions.

Take mandatory cooldown breaks. If a trade outcome – win or loss – deviates significantly from your average, step away for 10–20 minutes to prevent overconfidence or revenge trading. Set specific trading hours and shut down your platform at the end of your session to avoid impulsive trades. Keeping a trading journal can also help you track performance, document emotional patterns, and identify overtrading tendencies [28, 29]. Tools like DamnPropFirms’ Consistency Rule Calculator can help ensure you stay within your firm’s guidelines.

If you’re looking to reduce risk while learning, start with smaller contracts like MNQ (Micro E-mini Nasdaq 100). These contracts are one-tenth the size of standard NQ, allowing you to trade in real market conditions with less capital at stake. For day trading, MNQ margins can be as low as $50 [2, 7, 35].

"Risk management isn’t there to hold you back. It’s there so you can show up tomorrow – calm, funded, and ready." – Sam Saleh, Coach, Hola Prime

Creating a Discipline System for NQ Trading

Trading Nasdaq (NQ) without a disciplined approach can be a recipe for disaster. The market’s fast-paced and unpredictable nature demands more than just good intentions – you need a solid system to stay grounded and make rational decisions during volatile swings.

Daily Trading Routine and Workflow

A structured daily routine is your first line of defense against emotional trading. Start your day with premarket preparation. This includes reviewing overnight news, economic updates, and any shifts in market sentiment before the opening bell. Take time to analyze charts, identify key support and resistance levels, and validate potential setups through demo backtesting.

Stick to your trading plan during your session. Focus on quality over quantity – only take high-probability setups that align with your strategy [29, 39]. Every trade should have a stop-loss in place, based on your rules rather than emotions, and predefined profit targets.

At the end of each trading day, review your performance. Keep a detailed trading journal, noting key details about each trade. Regularly analyze this journal to spot patterns, correct mistakes, and refine your decision-making process. Your trades should always align with your broader risk management plan. For instance, João, a student of Tiago Mascarenhas, struggled with impulse trading and initially failed three prop firm challenges. By implementing a disciplined routine focused on strict risk rules and execution, he passed his next challenge in just five weeks. Today, João manages a $100,000 funded account with an 80% profit split.

Tracking your trading metrics will help reinforce this routine and alert you when you’re veering off course, such as overtrading.

Tracking Your Overtrading Patterns

Keeping an eye on your trading habits is essential to avoid overtrading. Compare the number of trades you take each day to your trading plan. If you’re consistently exceeding your planned trade count, it’s a sign you might be overtrading. Similarly, monitor your session win rate and win/loss ratio. An increase in the size of your losses compared to your wins often signals you’re chasing trades.

Pay close attention to your progress toward daily and maximum drawdown limits. If you hit 50% of your daily loss limit, it’s a good idea to step back and pause trading. Also, maintain consistency in your position sizes. Avoid the temptation to increase your trade size impulsively after a win or loss. For example, an analysis of 823 sessions of an E-mini Nasdaq (NQ) trading system revealed a 53.2% session win rate and a worst drawdown of $89,511. Metrics like these can help you gauge whether your strategy can withstand market pressure.

Using DamnPropFirms Tools for Better Risk Control

Automated tools can be a game-changer for maintaining discipline. The DamnPropFirms Consistency Rule Calculator helps ensure your trading stays within prop firm guidelines by evaluating whether you’re adhering to your predefined limits. For those managing multiple funded accounts, TradeSyncer simplifies execution by replicating trades across accounts simultaneously, reducing the urge to overtrade on a single account.

Additionally, the DamnPropFirms Discord community offers a space where over 3,000 traders share strategies and accountability practices to keep emotions in check. These tools and resources are designed to help you stick to your plan, even when emotions threaten to take the wheel.

Conclusion

The Nasdaq 100 index is a fast-moving, tech-heavy market where even minor percentage shifts can lead to substantial financial swings. With $20 per point movements and high leverage, losses can pile up quickly, potentially wiping out accounts in mere hours. This reality makes disciplined risk management absolutely essential when trading NQ.

To succeed, you need to maintain consistent profitability while sticking to strict drawdown limits and stop-loss rules. Prop firms prioritize traders who show steady, risk-conscious performance, making these principles non-negotiable. Ultimately, it’s consistent risk control that separates traders who secure funding from those who fall short.

Developing a disciplined trading system is key. Establish a structured routine, track your performance regularly, and use tools to avoid impulsive decisions. For beginners or those refining their strategies, starting with Micro E-mini Nasdaq (MNQ) contracts can help manage position sizes more effectively. This approach also allows you to build the emotional resilience needed for such a volatile market. By embedding these habits into your trading, you strengthen your ability to meet the rigorous standards set by prop firms.

The market rewards discipline and punishes recklessness. Overtrading, in particular, can be costly, as the market’s unforgiving nature will expose any lack of preparation or adherence to your plan. Stick to your strategy, respect the market’s dynamics, and let disciplined execution – an essential trait of consistently funded traders – be your defining edge.

FAQs

Why is overtrading the Nasdaq (NQ) futures contract so risky?

Overtrading E-Mini Nasdaq-100 (NQ) futures can be especially risky because of its high volatility and quick price changes. The Nasdaq-100 index is heavily tied to fast-moving tech stocks, which means prices can swing sharply in just seconds. For traders who frequently jump in and out of positions, these sudden moves can pile up losses rapidly. On top of that, the volatility can lead to what’s known as "volatility drag", where returns are gradually worn down, increasing the chance of major drawdowns.

Another challenge is liquidity. The NQ contract sees most of its trading activity during specific windows, such as when the market opens and closes. Outside of these peak times, the order book tends to thin out, leading to higher slippage and less favorable trade executions. Overtrading under these conditions not only drives up transaction costs but also exposes traders to greater risks. Add in the potential for margin calls during volatile periods, and it becomes clear that the NQ futures contract demands discipline. Those who trade excessively or without a solid plan often find it unforgiving.

What are the best strategies to manage risk when trading Nasdaq (NQ) futures?

Managing risk when trading Nasdaq (NQ) futures involves grasping its high volatility, leverage, and liquidity patterns. Since each point in an NQ contract equals $20, it’s essential to calculate how much money you’re putting at risk with each trade. A good rule of thumb? Keep your potential loss per trade to 1% or less of your account balance. Using stop-loss orders is a must, especially during the opening and closing minutes of the market, when price movements can be unpredictable and sharp.

To reduce slippage, focus on trading during U.S. market hours, when liquidity is at its peak. Avoid placing large trades outside these hours or during major news releases, as the market can be less predictable then. Adjust your stop-loss distances according to market conditions – tools like the Average True Range (ATR) can help. For calmer markets, tighter stops may work, while in fast-moving markets, you might need to give trades more breathing room.

If you’re trading in a prop firm environment, discipline becomes even more critical. Set a daily trade limit, keep a journal to monitor your performance, and stick to consistency rules to avoid overtrading. By combining careful position sizing, well-placed stop-loss orders, and trading during periods of high liquidity, you can build a solid strategy to navigate the unique risks of NQ futures trading.

How can I avoid emotional mistakes when trading Nasdaq (NQ) futures?

To navigate the fast-paced Nasdaq (NQ) futures market without letting emotions take over, it’s essential to have a well-defined trading plan and stick to it. Start by determining your maximum risk per trade – typically between 1% and 2% of your account balance. Set stop-loss levels before entering a trade and resist the temptation to adjust them once the trade is active. Also, establish daily loss limits and decide on a maximum number of trades. If you hit any of these limits, step away for the day to avoid overtrading and compounding losses.

Building mental discipline is just as important. Treat every trade as a chance to learn, rather than a personal victory or failure. Use a pre-trade checklist to ensure your setup aligns with your strategy, and keep a detailed trading journal to spot patterns in your behavior – especially impulsive decisions. Automating certain aspects of your trading, such as using conditional orders for entries and exits, can further help you avoid emotional reactions during volatile market swings.

Lastly, maintaining a healthy routine is key to staying sharp and focused. Take regular breaks, prioritize sleep, and limit distractions like news or social media during trading hours. A balanced lifestyle not only helps you stay calm under pressure but also makes it easier to remain consistent – an essential trait for long-term success in trading NQ futures.