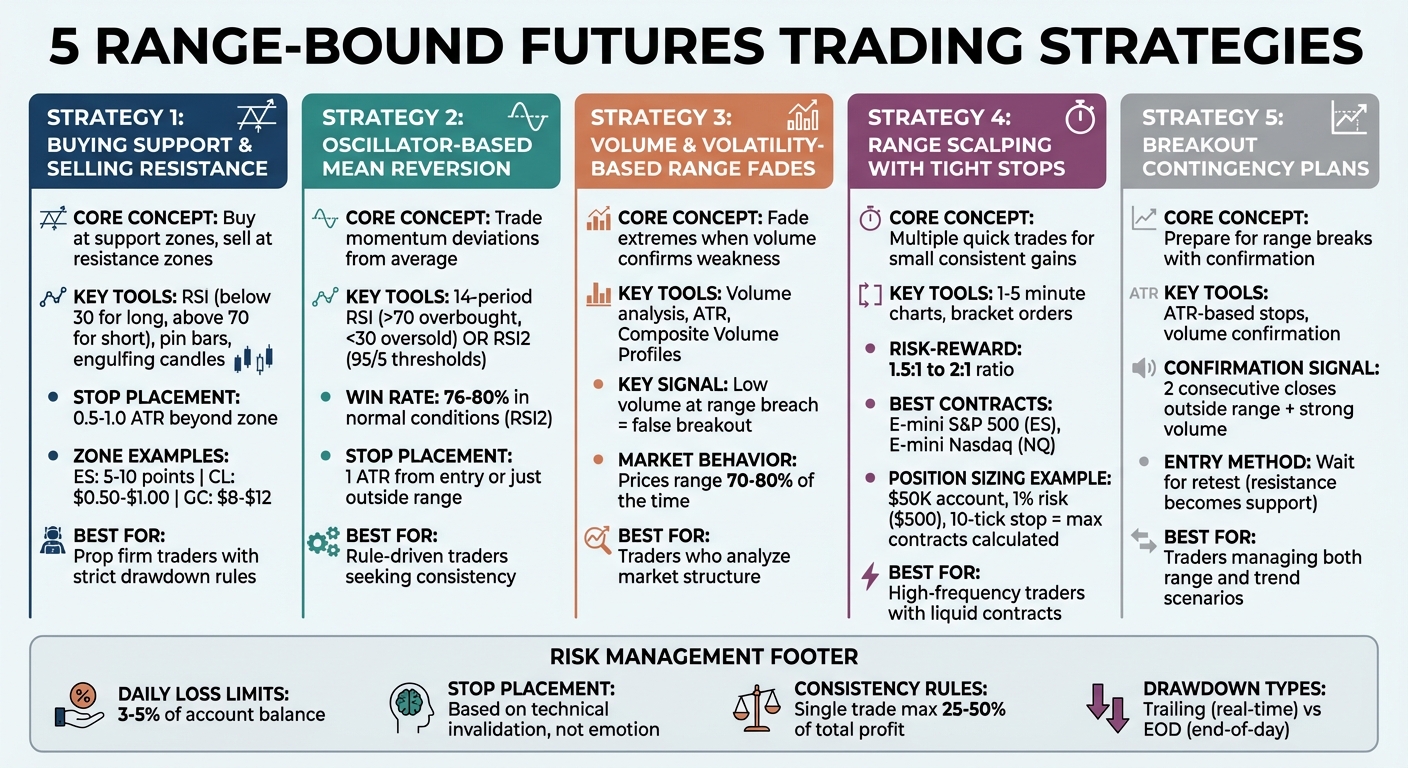

Range-bound trading focuses on profiting from markets that move predictably between support and resistance levels. This approach works well in sideways markets, where prices typically stay within defined boundaries. Here’s a quick breakdown of five strategies to capitalize on these conditions:

- Buying Support, Selling Resistance: Enter trades near support or resistance zones with confirmation from tools like RSI or candlestick patterns. Use stop-loss orders just outside the range.

- Oscillator-Based Mean Reversion: Use indicators like RSI or Stochastic Oscillator to identify overbought or oversold conditions. Pair these signals with price action near support/resistance for better accuracy.

- Volume and Volatility-Based Range Fades: Monitor volume to spot weakening momentum near range extremes. Low volume often signals false breakouts, while ATR helps adjust stops for volatility.

- Range Scalping with Tight Stops: Execute multiple small trades within narrow ranges using tight stop-loss orders. Focus on liquid futures like E-mini contracts for fast execution.

- Breakout Contingency Plans: Prepare for range breakouts by placing stops beyond key levels and confirming with strong volume or retests of broken levels.

Risk Management: Effective risk control is key, especially when trading through proprietary firms. Use ATR-based stop-losses, adhere to daily loss limits, and understand firm-specific rules like trailing drawdowns or minimum trade durations. Platforms like DamnPropFirms can help you compare these rules to find the best fit for your trading style.

These strategies, combined with disciplined risk management, can help you navigate range-bound markets while minimizing losses and staying compliant with prop firm guidelines.

5 Range-Bound Futures Trading Strategies Comparison Chart

Range-Bound Rumble: Conquering ES Chop Like a Pro

1. Buying Support and Selling Resistance

This trading approach revolves around a straightforward idea: buy when prices approach support levels and sell as they near resistance. It’s important to think of these levels not as fixed points but as zones. For instance, in S&P 500 futures (ES), a support zone could cover 5–10 points. In Crude Oil (CL), it might range from $0.50 to $1.00, while Gold (GC) typically sees zones of $8–$12.

To increase the odds of success, wait for confirmation signals like pin bars or engulfing candles before entering a trade. Tools like RSI can also help – consider going long when RSI dips below 30 at support or short when it rises above 70 at resistance. Volume changes are another vital clue, as they can confirm whether a bounce or breakout is likely.

When setting stop-loss orders, place them 0.5–1.0 ATR beyond the zone. If you’re working with wider zones, scale down your contract size to keep your dollar risk consistent. This method not only allows for precise entry and exit points but also helps enforce disciplined risk management.

This strategy is particularly useful for prop firm traders, as it aligns well with the strict drawdown rules many firms enforce. For example, Apex Trader Funding uses intraday trailing thresholds, while TakeProfit Trader relies on end-of-day calculations and requires traders to close their positions one minute before and after major economic events like FOMC announcements. Understanding these firm-specific rules can help you choose a trading environment that complements your style while minimizing the risk of account violations.

2. Oscillator-Based Mean Reversion

Oscillators are tools that measure momentum on a scale from 0 to 100, helping traders identify when futures prices deviate significantly from their average. Two of the most widely used oscillators are the Relative Strength Index (RSI) and the Stochastic Oscillator. For example, a 14-period RSI reading above 70 typically signals overbought conditions, while a reading below 30 suggests oversold levels. These indicators can guide traders in making rule-based entries, particularly in range-bound markets.

Some traders prefer a more sensitive approach, like the RSI2 strategy. This method uses a 2-period RSI with extreme thresholds – 95 for overbought and 5 for oversold. Veteran trader Chris Corwin Gayle highlights the advantage of this setting:

"The RSI setting moves much faster and hugs price movements closer, revealing extensions sooner".

This faster-moving RSI strategy has reportedly achieved a win rate of 76% to 80% during normal market conditions.

To refine entries, wait for confirmation. For instance, after an overbought RSI reading, wait until it drops below 70 before entering a short position. Similarly, after an oversold reading, wait until the RSI rises above 30 before considering a long position. Pair this with price action analysis near support or resistance levels, and consider using complementary technical indicators to filter out false signals in trending markets.

When placing trades, set stop-loss orders just outside the trading range or at a distance of one Average True Range (ATR) from the entry point. On platforms like TakeProfit Trader, it’s crucial to close positions one minute before and after major economic announcements to avoid breaching platform rules. Additionally, many prop firms enforce a consistency rule, capping any single trade’s contribution to no more than 50% of your total profit.

For traders using evaluation accounts, testing oscillator strategies with micro contracts, such as the Micro E-mini S&P 500 (MES), can help manage risk and stay within drawdown limits. Whether dealing with Apex Trader Funding‘s intraday trailing drawdown or Tradeify‘s end-of-day calculations, oscillator-based mean reversion provides a structured, rule-driven framework that aligns well with the constraints of prop trading firms.

3. Volume and Volatility-Based Range Fades

Using volume and volatility indicators can make fading range extremes more effective by confirming when a move is losing momentum. For example, if volume decreases as the price nears a support or resistance level, it often signals that the move is running out of steam and a reversal could be on the horizon. This strategy is particularly useful in futures markets, where prices tend to stay within ranges about 70% to 80% of the time. By incorporating volume and volatility signals, traders can fine-tune their entries for better accuracy.

Volume analysis is key to distinguishing real breakouts from false ones. Oddmund Groette from Quantified Strategies explains:

"Low volume during price level breaches often signifies a false breakout, making volume analysis crucial for validating price movements within a range".

Take this example: A trader identified a consistent range in Crude Oil futures, between $72 and $82. By using Composite Volume Profiles to spot areas with low liquidity at the range’s edges, they successfully faded price spikes lacking volume support at both the $82 resistance and $72 support levels.

Stop Placement and Position Sizing

When placing stops, using the Average True Range (ATR) can help account for market volatility. During high-volatility periods like the New York open, it’s smart to widen your stops and lower your position size to keep your dollar-risk consistent. Stops should be positioned just beyond key levels – for instance, if support is at $72, set your stop at $71. As Prop Firm Plus emphasizes:

"Your stop must be placed based on a clear technical invalidation level, not your emotional tolerance".

Position sizing also plays a crucial role, especially under prop firm rules. For example, in a $50,000 account trading E-mini S&P 500 futures (where one point equals $50), a 1% risk cap means you can risk up to $500 per trade. If your stop is 10 points away, you can only trade one contract. Many prop firms also enforce daily loss limits between 3% and 5%, so setting a personal limit at 3% helps provide a cushion against unexpected losses. Firms like Apex Trader Funding use trailing drawdowns tied to unrealized profits, while others like TakeProfit Trader require traders to avoid holding positions during major economic announcements.

Bracket Orders and Entry Timing

Bracket orders simplify execution by combining entry, stop-loss, and take-profit orders, removing emotional bias from the equation. To refine your entry timing, look for confirmation signals, such as a pin bar or a spike in volume. This disciplined approach aligns well with the rules many prop firms enforce, which often limit the profit contribution of a single trade to 25% to 40% of your total profit target. By sticking to these methods, you can maintain consistency and meet the expectations set by prop firms.

sbb-itb-46ae61d

4. Range Scalping with Tight Stops

Scalping takes the principles of range-bound trading and applies them to quick, repetitive trades aimed at small, consistent gains. In range scalping, traders focus on executing multiple trades within narrow price ranges, relying on tight stop-loss orders to manage risk. This method works particularly well with liquid futures contracts like the E-mini S&P 500 (ES) or E-mini Nasdaq (NQ), which offer tight spreads and fast execution speeds. Traders typically use 1–5-minute charts to pinpoint entries at key liquidity zones, striving for a risk-reward ratio between 1.5 and 2. Precision is key, especially when it comes to risk management, which is central to this approach.

Effective scalping starts with careful position sizing based on the distance to your stop-loss. For instance, if you have a $50,000 account and aim to risk 1% per trade (or $500), using a 10-tick stop on the E-mini S&P 500 means you should limit your contracts to ensure the risk doesn’t exceed $500. Stops should be placed just beyond significant levels to guard against sudden breakouts. Many scalpers also use bracket orders, which bundle entry, stop-loss, and take-profit levels into a single setup, reducing the risk of emotional trading decisions.

For scalpers trading through proprietary (prop) firms, staying within daily loss limits is non-negotiable. Most firms enforce drawdown rules ranging from 3% to 5% of the account balance. To stay safe, it’s smart to set a personal daily cap below the firm’s threshold – such as capping losses at 3% if the firm allows 5% – to account for potential slippage or execution mishaps. Another safeguard is a "three-loss rule", which involves stepping away after three consecutive losses to avoid revenge trading and protect your account.

However, not all prop firms allow unrestricted scalping. For example, Alpha Capital Group requires an average trade duration of more than two minutes, while Think Capital limits the percentage of trades held for under one minute to 50%. Conversely, Apex Trader Funding places no daily loss limits and supports high-frequency scalping without imposing minimum trade duration requirements.

"Your primary job as a trader is not to maximize gains on every trade, but to stay in the game long enough to let your edge play out over time".

For traders with smaller accounts, Micro E-mini contracts (MES/MNQ) can be a practical alternative. These contracts have one-tenth the tick value of standard E-minis, enabling more precise position sizing and better risk control. Scalping success lies in adapting these techniques to your account size and trading environment, ensuring you stay disciplined and focused on long-term consistency.

5. Range Trading with Breakout Contingency Plans

Range trading works well – until a breakout happens. To stay prepared, it’s essential to identify technical invalidation levels and position your stops just outside the established trendlines. Stops should be placed at clear technical levels beyond key trendlines. A true breakout typically comes with strong volume and at least two closes outside the range, while low-volume breaches often indicate a false breakout. Similar to earlier range strategies, this approach relies on clear technical signals to safeguard your account. This setup ties directly to the disciplined risk management principles outlined earlier.

When the range finally breaks, confirm it by waiting for two consecutive closes outside the range. Some traders prefer a retest strategy, where prior resistance turns into new support (or vice versa), providing a safer entry point with a clearer risk profile. Using the Average True Range (ATR) indicator can also help fine-tune stop-loss levels based on current market volatility.

Incorporate your breakout plan into your firm-specific risk rules. Prop trading firms often enforce strict guidelines, such as daily loss limits ranging from 3% to 5%. Additionally, many firms require traders to close all positions one minute before and after major economic announcements, as these events can trigger highly volatile breakouts.

"Stop-loss placement is critical in prop firm trading. You can’t afford to guess. Your stop must be placed based on a clear technical invalidation level, not your emotional tolerance." – Prop Firm Plus

Understanding your prop firm’s drawdown method is equally important. Trailing drawdowns, used by firms like Apex Trader Funding, adjust in real time based on your highest unrealized profit. This means that even a breakout that initially moves in your favor but later retraces could still trigger a violation. On the other hand, end-of-day (EOD) drawdowns – offered by firms like TakeProfit Trader and Tradeify – only update at market close. This provides traders with more flexibility to handle intraday fluctuations.

Risk Management and Prop Firm Rules

Solid risk management is the cornerstone of successful range-bound trading. To manage risk effectively, place your stop-loss orders just outside the range, adjusting for market volatility using the Average True Range (ATR). For example, on a $50,000 account with a 1% risk tolerance ($500), a 10-tick stop (valued at $12.50 per tick) allows for trading up to four contracts.

Prop firms typically enforce daily loss limits ranging from 3% to 5% of your account balance. To maintain control, set your personal daily loss cap at 3%. This buffer not only protects against slippage but also accounts for potential delays in trade execution. However, don’t rely solely on automated loss-limit systems. During periods of extreme volatility, these systems may lag, leaving you vulnerable to breaching your trailing maximum drawdown before the system intervenes.

"Most failed funded accounts don’t blow up because of bad market conditions. They fail because traders ignore or miscalculate risk." – Prop Firm Plus

Consistency rules are equally important for range traders. Many firms stipulate that no single trading day can contribute more than 30% to 50% of your total profits. For example, Take Profit Trader enforces a rule that no single day can exceed 50% of net profits. Additionally, most firms require a minimum of 5 to 7 trading days during the evaluation phase to demonstrate consistent performance.

Understanding the types of drawdowns is another critical aspect. Firms like Apex Trader Funding use a Live Trailing Threshold, which adjusts in real time as your unrealized profits increase. On the other hand, Tradeify and Take Profit Trader offer end-of-day (EOD) drawdowns, which update only at the market close. This provides greater flexibility during intraday trading swings. Incorporating these drawdown mechanisms alongside firm-specific consistency rules can help refine your trading strategy.

Just like with range-bound trading techniques, disciplined risk management is crucial for safeguarding profits and minimizing losses. To ensure your best trading days stay within acceptable limits, you can compare these rule variations using the Consistency Rule Calculator on DamnPropFirms.

Conclusion

By combining the strategies outlined earlier, traders can develop a well-rounded approach to range-bound trading. This method provides futures traders with a clear framework for navigating sideways markets effectively. The five key strategies – buying support and selling resistance, oscillator-based mean reversion, volume and volatility-based range fades, range scalping with tight stops, and incorporating breakout contingency plans – are most effective when used together. Start by identifying range boundaries through consistent price patterns, and confirm your entry points with technical indicators. Pay attention to volume patterns: a drop near key levels often suggests a bounce, while a sharp increase could indicate a breakout.

Success in range-bound trading hinges on disciplined risk management. Prop firms prioritize traders who can deliver steady, consistent results. Use tools like ATR-based stops to control risk, and set clear limits for both trade and daily exposure . Remember, trailing drawdowns tighten as unrealized gains grow, while end-of-day limits provide more flexibility during the trading session . By focusing on smart, disciplined risk management, you can set yourself apart as a professional trader.

FAQs

How can I pick the best range-bound trading strategy for my style?

To decide on the best range-bound strategy, it’s important to first evaluate your trading style and how much risk you’re willing to take. If you lean toward quick intraday trades and can manage tighter stop-losses, a straightforward price-channel strategy – buying near support and selling near resistance – could be a great fit. For added confidence, you might incorporate technical indicators like the RSI (overbought levels above 70, oversold below 30) or Bollinger Bands to help filter out false signals.

Next, make sure your strategy aligns with your risk management approach. If you prefer strict control over your trades, tools like the Average True Range (ATR) can help you set stop-loss levels or adjust position sizes based on market volatility. On the other hand, if you’re okay with handling larger price swings, a price-channel strategy that captures the entire range might offer more profit potential, though it does come with the risk of bigger drawdowns. Whatever you choose, always back-test your approach on the specific futures contract you plan to trade – whether it’s the E-mini S&P 500, crude oil, or another market – to ensure it performs as expected.

If funding is a hurdle, platforms like DamnPropFirms can connect you with futures prop firms that suit your trading style. Look for firms offering features like flexible rules, instant funding, or tools that support your strategy. These resources can help you scale your trading while keeping risk management intact.

What are the best ways to manage risk when trading range-bound futures?

Managing risk in range-bound futures trading requires a clear strategy and disciplined execution. One key tool is the use of stop-loss orders, which should be placed just outside the trading range. For long trades, position your stop-loss slightly below the support level. For short trades, place it just above resistance. To fine-tune this placement, consider using the Average True Range (ATR). A good rule of thumb is to set the stop-loss about 1 to 1.5 times the ATR from your entry point. This buffer helps account for normal price fluctuations, reducing the chances of being stopped out too early.

Another critical element is position sizing. Allocate only a small portion of your account – typically 1–2% – to any single trade. This conservative approach limits your potential losses and aligns well with the risk management rules often required by proprietary trading firms. If you want a more precise calculation, the Kelly Criterion can help determine the optimal position size based on your strategy’s win rate and payoff ratio.

Finally, keep a close eye on breakouts. If the price moves decisively beyond support or resistance, it could indicate a transition to a trending market. Exiting range-bound trades quickly in these situations can prevent minor losses from escalating. By combining these strategies, you can manage risk effectively while taking advantage of opportunities in range-bound markets.

How can I follow prop firm rules while trading range-bound futures strategies?

To successfully trade range-bound futures strategies during a prop firm evaluation, you need to stick to their risk-management rules. Begin by ensuring your position sizes respect the firm’s maximum drawdown and daily loss limits. For instance, many firms set drawdown limits between 6-9% and daily loss caps around 4%. Using tight stop-loss orders just beyond the range’s support or resistance levels can help you limit losses and avoid breaking these thresholds.

It’s also essential to understand the specific trading restrictions of the firm. Many firms ban trading during high-impact news events or disallow holding positions over the weekend. Checking an economic calendar can help you steer clear of trades that might be disrupted by sudden market volatility. Stick to approved instruments – like futures, indices, or metals – and avoid prohibited practices such as trade copying unless explicitly permitted.

Lastly, keep a detailed trading log to record your entries, exits, stop-loss levels, and the reasoning behind each trade. This not only keeps you compliant but also showcases responsible trading behavior. Following these guidelines will help you stay within the firm’s rules while executing range-bound strategies effectively.