In futures prop trading, most traders fail not because of bad strategies but due to poor risk management. Breaking firm-imposed limits like daily loss caps or maximum drawdowns leads to disqualification. Emotional mistakes – fear, greed, or revenge trading – amplify losses. Without strict discipline, even skilled traders risk failure.

Key takeaways:

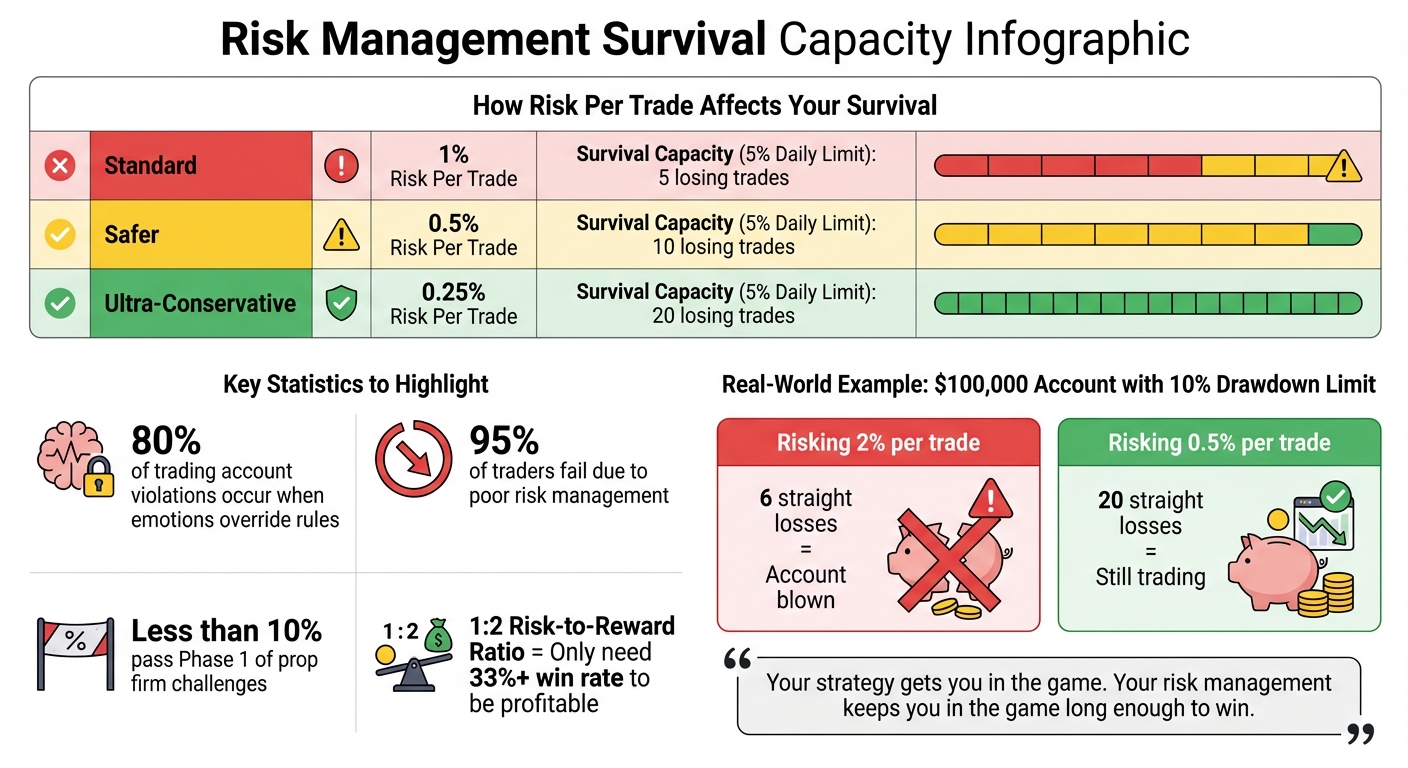

- Risk per trade matters: Risking 0.5% instead of 1% can double your survival capacity during losing streaks.

- Stop-losses are non-negotiable: Place them before entering trades and never widen them mid-trade.

- Daily loss limits: Keep personal limits below firm caps (e.g., stop at 3% if the firm allows 5%).

- Risk-to-reward ratio: Aim for at least 1:2 to stay profitable with a win rate above 33%.

- Tools help: Use position sizing calculators, bracket orders, and real-time monitoring to enforce discipline.

Top firms like Apex Trader Funding and Topstep have unique rules. Apex uses trailing drawdowns, while Topstep emphasizes consistency through structured evaluations. To succeed, align your strategy with firm requirements and focus on preserving capital over chasing big wins.

Risk Per Trade Impact on Trader Survival Capacity

Why Most Traders Fail: Poor Risk Management

The Psychology of Trading Without Risk Controls

When it comes to trading, emotions often wreak more havoc on accounts than flawed strategies ever could. Fear can paralyze traders, causing them to hesitate on solid setups or prematurely close winning trades just to secure small gains, even when their targets haven’t been reached. On the flip side, greed tempts traders to overleverage or increase their position sizes, chasing profits faster while abandoning their own risk-per-trade limits.

Then there’s revenge trading, a dangerous response to losses. Frustrated traders may impulsively jump into new trades or double down, desperate to recover their losses. Some go a step further by “averaging down” – adding more contracts to losing positions – which only magnifies their risk exposure and often leads to disastrous drawdowns. During volatile markets, many traders widen or abandon their stop-losses entirely, hoping for a reversal that rarely comes. What begins as a manageable loss can quickly spiral out of control.

"The best traders aren’t fearless. They’re consistent. And consistency only shows up when discipline takes over, especially when your emotions are screaming to do the opposite." – Team Topstep

The numbers don’t lie: about 80% of trading account violations occur when traders let emotions override their rules. Even after a winning streak, overconfidence can set in. Traders start to believe they’ve “mastered” the market, ditching their risk management strategies – only to face harsh consequences when the market humbles them.

These emotional missteps are often the root cause of financial breaches, leading to rapid account disqualification.

Financial Losses and Account Disqualification

Emotional trading mistakes quickly translate into financial losses, especially under the strict rules of proprietary trading firms. When discipline falters, traders often breach the risk limits that are essential for long-term survival.

Consider this: with a 1% risk per trade and a 5% daily loss limit, just five consecutive losing trades can result in disqualification. Lowering the risk to 0.5% per trade extends the buffer to 10 consecutive losses. On a $100,000 account with a 10% overall drawdown limit, risking 2% per trade means six straight losses could wipe out the account entirely.

Leverage in futures trading amplifies these risks. For example, a single-point movement in the E-mini S&P 500 equates to $50. Trading two Crude Oil (CL) contracts with a 75-tick move against you results in a $1,500 loss. On a $50,000 account, that single trade could exceed the daily drawdown limit and lead to account termination.

"If you’re not applying stop loss in your prop trading, your prop trading could be a ticking time bomb." – OANDATeam, OANDA

Even beyond simple losses, inconsistency – like erratic trade sizes – can trigger disqualification, even if the account is in profit. Ultimately, disciplined risk management is the dividing line between the few traders who succeed and the 95% who fail.

My Futures Risk Management Rules (EASY Guide to PASS Funding Firms)

Core Risk Management Rules for Futures Prop Firms

Futures prop firms provide traders with capital, but it comes with strict risk rules designed to protect their money – and keep traders from making costly mistakes. These aren’t just guidelines; they’re firm limits that, if broken, result in immediate account disqualification. These rules are crucial for safeguarding both the firm’s investments and your trading career. Mastering them can be the difference between a successful funded trading journey and failure.

How to Set Effective Stop-Loss Orders

Every trade needs a stop-loss in place before you enter the market – not after things start going south. Your stop-loss should be set at a technical level that clearly invalidates your trade idea, meaning it’s where your strategy no longer holds up.

Most prop firms require stop-losses to be active from the moment you enter a trade. Adjusting stops to give yourself more room mid-trade isn’t just risky – it shows a lack of discipline. To keep emotions in check, many traders rely on bracket orders. These automated orders handle your entry, stop-loss, and profit target all at once, reducing the chance of impulsive decisions.

"Every position needs a predetermined stop loss before you enter the trade, not after it goes against you." – Optimus Futures

Proper position sizing is just as important. For example, if you’re risking $500 on a trade and your stop-loss is 20 points away on the E-mini S&P 500 (ES), where each point equals $50, the total risk would be $1,000 – double your limit. Instead, trading the Micro ES (MES), which is $5 per point, allows you to stay within your $500 risk budget by using five contracts. Many professional traders stick to risking just 0.25% to 0.5% of their account per trade, even though most firms allow up to 1%.

Some platforms, like TopstepX, offer tools like the "Daily Risk Lock", which freezes your trading limits for the rest of the day if you hit certain thresholds. This feature prevents emotional trading after losses.

Following Daily Drawdown and Consistency Rules

In addition to stop-losses, firms enforce strict daily drawdown limits to cap losses. These limits typically range between 3% and 5% of your account balance. Hitting this limit either locks you out until the next day or results in permanent disqualification. Many traders take a more conservative approach, setting personal limits well below the firm’s cap. For instance, if the firm allows a 5% daily loss, you might stop trading at 3% or even 1.5%. Another popular strategy is the "50% Rule", where you stop trading after losing half of your daily limit.

| Risk Level | % Risk Per Trade | Survival Capacity (5% Daily Limit) |

|---|---|---|

| Standard | 1% | 5 losing trades |

| Safer | 0.5% | 10 losing trades |

| Ultra-Conservative | 0.25% | 20 losing trades |

Trailing drawdown rules are another safeguard. These typically limit losses to 10% from your account’s highest balance point. As your account grows, this "high-water mark" adjusts upward, encouraging traders to consistently lock in profits. Some traders prefer accounts with static drawdowns, where the limit stays fixed at the starting balance.

Consistency is also key. Firms like Apex Trader Funding require that no single trading day account for more than 30% of your total profit when requesting a payout. This rule discourages risky, one-off wins and promotes steady, repeatable performance. Firms want traders who treat capital responsibly, not those chasing massive, high-risk gains.

"The traders who pass prop challenges aren’t the ones taking big risks. They’re the ones who survive long enough for their edge to play out." – BabyPips

If your account drawdown reaches -5%, it’s wise to take a step back. A mandatory one-week break can help you reset mentally and reassess your strategy.

Using a 1:2 or Higher Risk-to-Reward Ratio

Maintaining a solid risk-to-reward ratio is essential for long-term success. Most successful prop traders aim for at least a 1:2 ratio, meaning they risk $1 to make $2. At this ratio, you only need to win slightly more than 33% of your trades to stay profitable. For example, over 40 trades with a 1:2 ratio and a 50% win rate, you could achieve about 10% account growth with a positive expectancy of 0.5R per trade.

Some traders push for even better ratios, such as 1:3 or higher, especially on their strongest setups. A smart approach is to categorize your trades: risk 1% on high-probability "Tier 1" setups and scale back to 0.5% or less on "Tier 2" setups that are less certain. This strategy helps protect your account during losing streaks while maximizing returns on your best opportunities.

Firms value consistent, disciplined execution over erratic trading patterns. For example, a trader risking $100 to make $50 would need an unrealistic 67% win rate just to break even. On the other hand, with a 1:2 ratio, you can remain profitable by winning just over 33% of your trades. Stick to your plan – don’t cut winners short or let losers run. Emotional decisions can quickly erode the edge you’ve worked hard to establish.

These principles form the backbone of disciplined risk management, setting the foundation for more advanced trading tools and strategies.

Tools for Risk Management in Futures Trading

Having the right tools can mean the difference between maintaining a funded trading account and blowing it during a challenge. Many traders fail not because their strategies are flawed, but because they lack the technological safeguards that enforce discipline when emotions take over.

Risk Calculators and Trade Management Tools

Position sizing calculators are essential for managing risk. They calculate the exact number of contracts to trade based on your maximum dollar risk. For instance, if you’re risking $500 on a trade with a 20-point stop in the Micro E-mini S&P 500 (MES), where each point equals $5, the calculator shows you should trade five contracts. Without such precision, overleveraging can quickly lead to disqualification.

Advanced Trade Management (ATM) systems, like those offered by NinjaTrader, take things a step further. These systems automatically place stop-loss and take-profit orders as soon as you enter a trade. Using One-Cancels-Other (OCO) logic, they ensure that if your profit target is reached, your stop-loss is canceled automatically. This eliminates hesitation during fast market moves.

Platforms such as Optimus Flow provide additional safeguards by allowing you to set hard limits on your account. These include maximum daily losses, position caps, or contract limits, which the software enforces automatically. Think of these features as circuit breakers, designed to prevent impulsive "revenge trading" after a tough loss.

These tools form the backbone of disciplined trading, offering real-time monitoring to keep your risk exposure in check.

Real-Time Analytics for Trade Monitoring

Real-time analytics give traders an edge by tracking their open trade exposure and current drawdown against firm-imposed limits as market conditions shift. Dashboards provide instant feedback, showing how close you are to exceeding daily loss caps or drawdown thresholds. In some cases, they even trigger auto-liquidation alerts when you’re nearing dangerous levels.

| Tool Category | Key Function | Example Platform Features |

|---|---|---|

| Position Sizing | Calculates contract quantity based on dollar risk | Prop Firm Plus calculators, manual spreadsheets |

| Automated Execution | Instantly submits stops and targets upon entry | NinjaTrader ATM, Optimus Flow bracket orders |

| Real-Time Monitoring | Tracks drawdown vs. firm limits in real time | Risk dashboards, PnL triggers, equity curve tracking |

| Discipline Enforcement | Locks rules mid-session to prevent impulsive changes | Contract limit caps, daily risk locks |

"The placement of contingent orders such as ‘stop-loss’ or ‘stop-limit’ orders will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders." – Optimus Futures

These tools are designed to protect your trading edge. For instance, when you’re down 2% on the day and feel tempted to double your position size, automated risk controls act as a safeguard, helping to preserve your account and your career.

With these foundational tools in place, traders can explore advanced measures to further secure their strategies.

sbb-itb-46ae61d

Risk Management at Top Futures Prop Firms

Grasping the specific risk rules of each proprietary trading firm is essential for passing evaluations and avoiding disqualifications. Apex Trader Funding and Topstep offer two distinct approaches to risk management, requiring traders to adjust their strategies to meet each firm’s requirements.

Apex Trader Funding: Risk Policies and Expectations

Apex employs a dynamic trailing drawdown system that adjusts with your account’s peak balance until it reaches the "Safety Net" (initial balance + drawdown limit + $100). For instance, with a $50,000 account and a $2,500 drawdown limit, your Safety Net would lock in at $52,600 once reached.

The firm enforces a 5:1 risk-reward ratio, meaning your stop loss cannot exceed five times your profit target. For example, if you’re aiming for a 10-tick profit, your maximum stop loss is capped at 50 ticks.

Apex also applies a 30% Consistency Rule at payout time. This means no single trading day can account for more than 30% of your total profit when requesting a withdrawal. For example, if your total profit is $5,000 and your best trading day generated $1,600, you would exceed the 30% limit and become ineligible for a payout.

"Stop losses are required: Trading without a stop loss or relying solely on the Trailing Threshold to manage risk is strictly prohibited." – Apex Trader Funding

To stay within Apex’s rules, it’s recommended to trade with only half of your maximum allowed contracts early on. Additionally, avoid holding opposing positions in correlated markets like ES and NQ, as Apex prohibits non-directional hedging. Setting personal daily loss caps at 50–60% of the firm’s official limit can also help buffer against slippage or execution errors.

Topstep, on the other hand, emphasizes structured evaluations and real-time risk adjustments.

Topstep: Risk Management Rules in Action

Topstep takes a structured, coaching-focused approach to risk management. The firm uses a two-step Trading Combine evaluation process, which includes strict daily loss limits and maximum position sizes. These parameters are locked in through the TopstepX platform’s Daily Risk Lock, which freezes your risk settings until 5:00 PM CT to help prevent impulsive trading decisions during the session.

To prevent overtrading, Topstep also limits the number of daily or weekly trades. Additionally, the firm’s Consistency Target requires traders to complete a minimum of two profitable days to pass the evaluation.

Topstep offers traders 100% of their first $10,000 in profits before transitioning to a 90/10 profit split. The platform has earned a strong reputation, maintaining a 4.5 out of 5 rating on Trustpilot from over 7,900 reviews, with 86% of those being 5-star ratings.

Here’s how the two firms compare:

| Feature | Apex Trader Funding | Topstep |

|---|---|---|

| Evaluation Steps | 1-Step | 2-Step (Trading Combine) |

| Drawdown Type | Dynamic Trailing (locks at Safety Net) | Daily Loss Limit & Max Drawdown |

| Consistency Rule | 30% Profit Cap per day for payouts | Consistency Target (min. 2 days) |

| Trading Hours | Anytime (including news) | Day trading only (must close daily) |

| Profit Split | 100% of first $25,000, then 90/10 | 100% of first $10,000, then 90/10 |

To comply with Topstep’s rules, use bracket orders – enforced by the TopstepX platform – to lock in your stop losses and profit targets. It’s also a good idea to set a personal daily loss limit that’s more conservative than the firm’s. For instance, if Topstep allows a 5% daily loss, consider setting your limit at 3% to account for slippage. If your account approaches a 3% drawdown, reducing your risk per trade to around 0.25% can help preserve your capital and stay within the firm’s limits.

Since 2022, Apex has paid out over $400 million to traders. Success in these programs depends on understanding each firm’s unique rules and tailoring your trading strategy to align with them.

Advanced Risk Management Strategies

Once you’ve got a handle on stop-losses and drawdowns, it’s time to step up your game with strategies designed to weather tough markets and keep your trading career on track.

Diversifying Across Futures Contracts

If you’re holding contracts like ES, NQ, and YM, you’re not diversifying – you’re just piling on the same type of risk. These equity indices tend to move together during major market shifts, which means you’re tripling your exposure instead of spreading it out.

True diversification means allocating your risk across assets that don’t move in sync. For instance, instead of sticking solely to equity index futures, mix it up with contracts influenced by different factors, like Crude Oil (CL), 10-Year T-Notes (ZN), or Gold (GC). When stocks take a hit, bonds might rally as investors look for safety, and energy markets could react to supply disruptions or geopolitical events.

Micro futures, which are 1/10 the size of standard contracts, are a great way to limit your risk while diversifying across uncorrelated assets. Stick to disciplined position sizing – keep your risk per trade between 0.25% and 1% of your total account equity. When volatility spikes, adjust your position sizes to maintain the same dollar amount at risk. For example, if you typically risk $500 per trade, scale down your contracts during choppy sessions to keep that risk level steady.

This kind of diversification not only helps stabilize your account during wild market swings but also ties directly into the importance of stress testing.

Stress Testing and Scenario Analysis

Stress testing is all about preparing your strategy for the worst-case scenarios before they happen. This means running your approach through extreme conditions, like overnight price gaps, sharp moves triggered by major news, or low-liquidity situations.

Scenario analysis is particularly useful for identifying gap risk – those moments when prices jump over your stop-loss during market openings or news events. Swing traders holding positions overnight should pay special attention to this. If a sudden gap blows past your set percentage risk, you could be underestimating your actual exposure.

When markets get more volatile, dynamically reduce your position sizes. If indicators like the VIX are spiking or spreads are widening, trimming your contracts helps keep your dollar-risk consistent. Similar to daily loss limits, stress testing ensures your strategy can handle even extreme market scenarios without exceeding your defined risk boundaries.

A practical tip? Avoid entering new trades 15 minutes before or after major economic announcements, such as CPI, NFP, or Fed releases. And if you hit a significant drawdown, consider applying the 50% Rule – cut your trade size in half to slow the bleeding and give yourself time to regain focus.

But it’s not just about numbers. Tracking your own trading behavior is equally important.

Keeping a Detailed Trading Journal

A trading journal isn’t just a log – it’s your secret weapon for spotting what’s really draining your account. It can reveal patterns like moving stops out of fear, trading out of boredom, or ignoring your own rules.

Log every trade’s details: entry and exit points, position size, stop-loss distance, risk-to-reward ratio, and even your emotional state. Were you calm or stressed? Did you feel desperate to recover losses? These psychological insights are just as important as the technical data.

"Your strategy gets you in the game. Your risk management keeps you in the game long enough to win." – BabyPips

Use R-Multiples to measure performance in terms of risk units instead of dollars. For example, risking $200 to aim for a $400 return equals a 2R win. This keeps your focus on risk-to-reward ratios and overall expectancy. At the end of each session, review your journal to see if you stuck to your risk plan, regardless of whether you made or lost money. Over time, these reviews reinforce discipline and consistency.

If your journal shows a drawdown of 5%, take a mandatory break – step away from trading for a week to reset mentally and analyze what went wrong. With less than 10% of traders passing Phase 1 of prop firm challenges, the edge often comes down to discipline – and your journal is the key to building it.

Conclusion

Risk management isn’t optional – it’s the lifeline that separates successful traders from those who fall by the wayside. Consider this: 80% of prop account violations happen because traders let emotions override their own rules. This highlights a hard truth: while your strategy may help you enter trades, it’s disciplined risk management that ensures you stay in the game long enough to see success.

To put it into perspective, risking just 0.5% per trade allows you to endure 10 consecutive losses under a 5% daily limit. In contrast, risking 1% per trade only covers five losses. With a 1:2 risk-to-reward ratio, you only need to win slightly more than 33% of your trades to turn a profit. These numbers aren’t random – they’re the safety net that distinguishes the 10% of traders who pass Phase 1 challenges from the 90% who don’t.

"Your primary job as a trader is not to maximize gains on every trade, but to stay in the game long enough to let your edge play out over time." – Prop Firm Plus

The tools of risk management – like stop-losses, position sizing, drawdown limits, diversification, stress testing, and journaling – serve as the backbone of your trading discipline. Firms such as Apex Trader Funding and Topstep emphasize that preserving capital strategically is far more effective than chasing sporadic large gains.

Make these principles a part of your trading routine. Set a personal daily loss limit below your firm’s cap, utilize bracket orders to remove emotional decision-making, and document every trade in your journal. If you reach a 5% drawdown, take a step back and pause for a week to reset. Success often rewards those who focus on avoiding catastrophic losses rather than chasing risky wins.

FAQs

What are the essential risk management tools for futures prop traders?

Effective risk management plays a key role in achieving success in futures prop trading. To manage risks effectively, traders can use tools like position-sizing calculators to figure out the right lot size for their trades and drawdown calculators to keep tabs on and control potential losses. Implementing stop-loss orders and bracket orders is another smart way to protect profits while limiting risks during active trades.

It’s also wise to leverage safeguards provided by your trading firm, such as daily risk limits or contract restrictions. These measures are not just about adhering to firm policies – they also help you maintain disciplined trading habits and improve your performance over the long haul.

How can traders manage their emotions to avoid mistakes like revenge trading?

Managing emotions plays a crucial role in steering clear of common trading mistakes, like revenge trading. One effective strategy is to develop a written risk management plan. This plan should outline key elements such as fixed position sizes, strict stop-loss orders, and daily loss limits. These boundaries act as guardrails, helping traders avoid impulsive decisions and the temptation to recover losses hastily.

Another helpful tool is maintaining a trading journal. By documenting trades, decisions, and outcomes, traders can uncover patterns and pinpoint emotional triggers that may influence their actions. Regular breaks during trading sessions can also provide a mental reset, preventing stress from clouding judgment. It’s equally important to reframe losses – not as personal failures but as opportunities to learn and grow.

By sticking to a disciplined approach and keeping long-term goals in sight, traders can navigate the markets with a clearer head, making decisions based on logic rather than emotion.

How do Apex Trader Funding and Topstep differ in their risk management rules?

Apex Trader Funding has a trailing max drawdown policy, requires traders to trade for at least seven days, and restricts holding positions outside approved trading hours. Topstep, on the other hand, follows a two-step evaluation process. This involves achieving a profit target, complying with a trailing drawdown and consistency rules, and completing a minimum five-day evaluation period.

Both firms prioritize strict risk management policies, aiming to help traders build disciplined habits while safeguarding their accounts. Knowing these distinctions can help you tailor your trading approach to meet the firm’s expectations, giving you a better shot at success.