Trade copier latency is the delay between executing a trade on a master account and replicating it across follower accounts. In fast-moving markets like U.S. futures, even a one-second delay can lead to slippage, missed entries, or inconsistent positions across accounts. This is especially problematic for traders managing multiple funded accounts, where synchronization is crucial.

Key causes of latency include:

- Network Issues: Slow internet or long distances to broker servers.

- Hardware Limitations: Outdated CPUs, insufficient RAM, or slow storage.

- Software Inefficiencies: Poorly configured trade copiers or platform settings.

- Broker Delays: Slow order routing or server inefficiencies.

Solutions to reduce latency:

- Upgrade to fiber internet or use a VPS near your broker.

- Improve hardware with modern CPUs, more RAM, and SSDs.

- Optimize trade copier settings and platform configurations.

- Choose brokers with fast execution and servers close to trading hubs.

Investing in better infrastructure (e.g., VPS hosting at $20–$100/month) and hardware upgrades can significantly reduce delays. For traders managing multiple accounts, these steps can prevent costly slippage and improve trade synchronization.

Optimizing MT4 Performance & Trade Latency on VPS Servers for Algorithmic Trading

1. Network and Connectivity Solutions

Network latency is a common hurdle in trade copying. The time it takes for data to move from a master account, through copier software, and into follower accounts depends largely on your internet connection, the distance to broker servers, and how your trading system is hosted.

To combat latency, three key solutions stand out: upgrading to fiber internet, using a Virtual Private Server (VPS), and selecting server locations close to your broker or proprietary trading firm. Each option tackles delays differently, so understanding their benefits and trade-offs can help you choose the best fit for your needs.

Latency Reduction

The type of internet connection you use plays a big role in latency. For instance, typical U.S. home cable internet often delivers a round-trip latency of 40–120 ms to broker servers, depending on routing and distance. However, business-grade fiber internet can shrink that to just 5–30 ms in many metro areas. This difference becomes critical during fast market moves. A trader using a home Wi-Fi connection to copy scalping strategies on E-mini futures might experience frequent 1–2 tick worse fills. In contrast, a low-latency fiber connection could keep fills within 0–1 tick of the master account during normal market conditions.

For even better performance, relocating your trade copier to a VPS near your broker can make a big impact. If latency from your home PC to the broker is around 150–300 ms, moving to a VPS in the same region as the broker can cut that down to 5–50 ms. Some VPS providers even advertise latency as low as 0.5 ms when their servers are located in the same data center as the broker. This setup ensures sub-second trade copying with minimal delays, which is especially useful for fast-paced strategies.

Physical distance also matters. For example, trading from New York to London introduces roughly 65 ms of latency due to distance alone. Hosting near a U.S. exchange or broker reduces this to single-digit or low double-digit milliseconds. For traders managing multiple funded accounts with firms like Apex Trader Funding, Take Profit Trader, or Tradeify, these improvements can mean the difference between synchronized fills and frequent rejections.

Cloud-based trade copiers, such as Tradesyncer, take latency reduction even further. By leveraging optimized server infrastructure, Tradesyncer enables near-instant synchronization of trades from one master account to over 40 follower accounts across multiple proprietary trading firms, including Lucid Trading and FundedNext Futures. This approach ensures lightning-fast executions, ideal for traders managing multiple accounts.

Implementation Complexity

Upgrading to fiber internet is the easiest step. It typically involves scheduling an installation with your internet service provider (ISP), which may require running new cables to your home or office. While many metro areas in the U.S. offer fiber options, availability in rural areas can be limited. However, fiber alone doesn’t solve delays caused by long distances to broker servers – it simply improves connection stability and speed.

Setting up a VPS requires a bit more effort. You’ll need to choose a reliable VPS provider with servers near your broker, install trading platforms like MT4, MT5, or NinjaTrader, and configure your trade copier software on the remote server. Accessing the VPS is done via Remote Desktop Protocol (RDP), and while the setup is fairly straightforward, you’ll need to learn how to secure the server, allocate resources effectively, and troubleshoot any issues that arise.

For the lowest possible latency, colocation is an option. This involves placing your server directly inside or near the broker or exchange’s data center. While this setup delivers unparalleled speed, it requires advanced technical knowledge and is generally suited for professional traders or those managing a large number of funded accounts.

Cost (USD)

The cost of these solutions varies widely:

- Fiber Internet: For home or small office use, fiber internet typically costs $60–$120 per month, depending on your provider, speed, and location. While this replaces or slightly increases your existing internet bill, it’s a worthwhile investment for improving overall connection stability and reducing jitter.

- VPS Hosting: A trading VPS with low-latency routes to major brokers usually costs $20–$100+ per month. Entry-level plans, starting at $20–$40, are sufficient for a few trading terminals. Higher-end configurations with more CPU, RAM, and 24/7 support can exceed $80–$100 per month, especially for setups tailored to specific brokers.

- Colocation: Near-colocation or fully colocated hosting can cost several hundred dollars per month or more. This option is best suited for high-frequency trading or large-scale multi-account setups, as it includes server rental, network connectivity, and data center access.

Traders should weigh these costs against the potential benefits of improved fill quality and reduced slippage. For example, swing traders might find a basic VPS sufficient, while scalpers managing multiple accounts could justify the expense of high-end VPS or colocation setups. When handling five or more funded accounts from firms like TickTickTrader or Topstep, even small improvements in execution can offset hosting costs.

Suitability for Multi-Account Copying

As you scale up the number of follower accounts, both CPU load and the time needed to process multiple orders increase. This can lead to partial fills or rejections, particularly on platforms like NinjaTrader. A strong network connection is essential for smooth multi-account execution. While fiber internet enhances stability, handling ten or more accounts often requires a dedicated VPS to manage local resource limitations and bandwidth demands. For setups involving three or four accounts, fiber may suffice. But once you expand beyond that, transitioning to a VPS or another low-latency solution becomes critical to maintain synchronization and reduce execution risks.

Next, we’ll explore hardware upgrades and system optimizations to further minimize latency.

2. Hardware Upgrades and Optimization

After addressing network performance, upgrading your computer’s hardware is a key step in reducing copy latency.

Your computer’s internal components play a huge role in how quickly trades are replicated. Even with a fast internet connection, an outdated CPU, insufficient RAM, or a slow hard drive can create delays that impact execution quality. This becomes even more critical when managing multiple funded accounts across prop firms like Apex Trader Funding, Take Profit Trader, or Alpha Futures.

Upgrading hardware minimizes delays caused by local processing. Every millisecond matters as your trading platform processes incoming data, updates charts, and routes trade instructions. Below, we’ll explore which hardware upgrades make the biggest difference and how they stack up in terms of cost, complexity, and suitability for multi-account setups.

Latency Reduction

CPU: A modern processor is essential for handling market data, executing order logic, and transmitting trades. Intel i5/i7/i9 or AMD Ryzen processors with 4–8 physical cores are ideal, especially if you’re running multiple instances of platforms like MT4/MT5 or NinjaTrader. While many trading platforms rely on single-threaded processing for order execution, having extra cores can prevent slowdowns when running multiple terminals simultaneously. Traders who’ve upgraded from older mobile CPUs to desktop-grade processors often report fewer order rejections and faster order distribution across accounts.

RAM: The amount of memory your system has determines how many platforms, charts, and trade copiers you can run smoothly. If memory is insufficient, your system may start using the hard drive as virtual memory, causing noticeable slowdowns. For light setups, 8 GB of RAM is enough, but for managing multiple accounts, 16 GB is the minimum, and 32 GB is recommended to avoid performance issues. One trader observed a tenfold speed improvement in their trade copier simply by closing half of their MT4 terminals, highlighting how critical RAM is for smooth operation.

SSD Storage: Slow hard drives can cause delays when loading charts or reading large log files. Replacing a traditional HDD with an SSD – especially an NVMe SSD – ensures faster access to data, reducing interruptions during high trading activity. For setups dealing with heavy logging across multiple accounts, SSDs are a must-have to maintain low latency.

With these upgrades, local trade copying latency can drop to as little as 10–200 milliseconds, transforming delays from seconds to milliseconds.

Implementation Complexity

The complexity of hardware upgrades varies:

- RAM and SSD upgrades are relatively simple for desktop systems. Installing additional RAM or replacing an HDD with an SSD may require cloning your existing drive or reinstalling your operating system and trading software, followed by reconfiguring file paths and log directories.

- CPU upgrades are more involved. Replacing a processor might require a new motherboard, cooling system, or even a complete system rebuild. For many traders, buying a pre-built desktop optimized for trading can be a more practical solution.

Alternatively, migrating to a VPS (Virtual Private Server) offers an easier way to access high-performance hardware without physical upgrades. A trading-optimized VPS provides modern server-grade CPUs, ample RAM, and SSD storage. The process involves installing your trading platforms and copiers on the VPS, logging into your accounts, and running a parallel test phase to ensure smooth operation and acceptable latency.

To avoid downtime during upgrades, back up your templates and settings, make changes outside trading hours, test with small orders, and only retire your old setup after confirming stable performance over multiple sessions.

Cost (USD)

The cost of hardware upgrades depends on your trading needs and the number of accounts you manage:

- RAM Upgrade: Expanding from 8 GB to 16 GB costs around $40–$80, while upgrading to 32 GB may run $100–$150.

- SSD Upgrade: A 500 GB SATA SSD costs about $40–$60, while a 1 TB NVMe SSD ranges from $80–$120.

- Mid-Range Desktop: A new desktop with a 6-core CPU, 16–32 GB of RAM, and SSD storage typically costs $700–$1,200.

- High-End Workstation: For intensive setups, prices range from $1,200 to $2,000 or more.

- Trading VPS: Monthly VPS costs range from $60 to $200. Entry-level plans support a few terminals, while high-end configurations with better specs and 24/7 support cost $150–$200.

For single-account or light setups, spending $150–$300 on RAM and SSD upgrades can resolve most performance issues without replacing your entire system. For the best results, prioritize a reliable VPS near broker servers, followed by sufficient RAM and SSD storage, and then a high-performance CPU. VPS migration often provides the biggest latency improvements for the least upfront cost.

Suitability for Multi-Account Copying

As the number of follower accounts grows, CPU and memory demands increase. A trade copier must validate, adjust, and send multiple orders – sometimes sequentially – for each signal. For setups managing 5–20 funded accounts from firms like FundedNext Futures, Tradeify, FundingTicks, or The Futures Desk, ensure your system includes a modern multi-core CPU, 16–32 GB of RAM, and SSD storage to maintain latency between 10–200 milliseconds.

One NinjaTrader user with an Intel Core i7-8569U CPU @ 2.80 GHz and 16 GB of RAM noted that their trade copier introduced only a "split second" delay when executing trades across five funded accounts compared to a single account.

Next, we’ll look at software and platform optimizations to further minimize trade copying delays.

3. Software and Platform Optimization

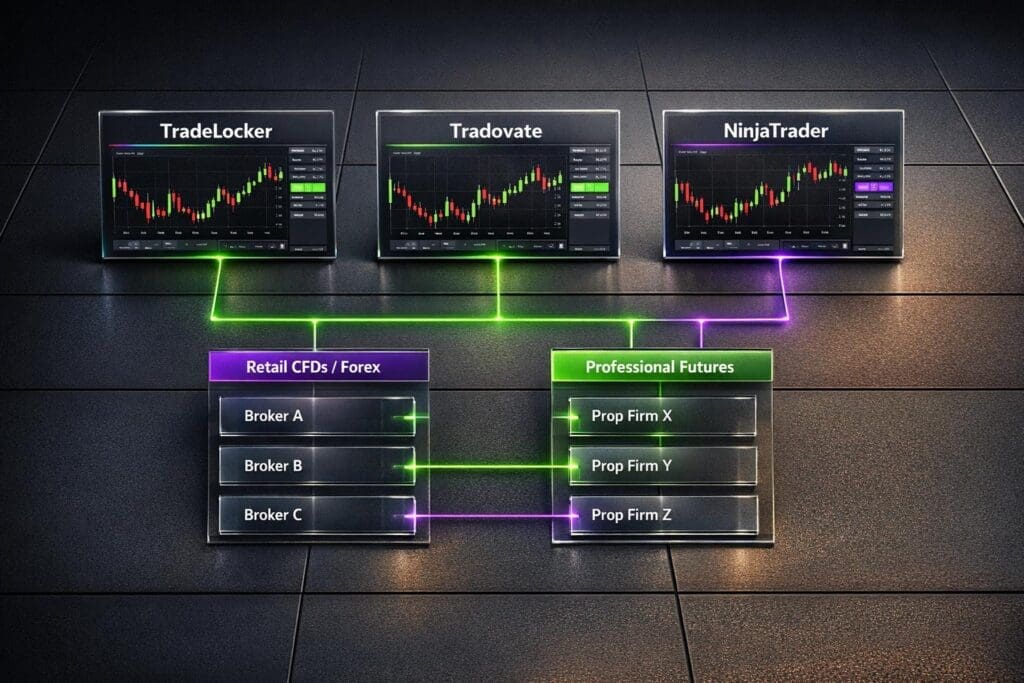

After optimizing your network and hardware, the next step is refining your trade copier settings, platform configurations, and API connections. Even minor inefficiencies in software can introduce delays of 100–500 milliseconds per trade, which can quickly add up when managing multiple accounts.

Delays at the software level often arise from factors like order processing methods (sequential vs. parallel), polling intervals for new trades, and safety measures like max-delay thresholds or risk filters. Poorly configured software or excessive platform plugins can extend delays beyond one second, especially in fast-moving markets. This can lead to order rejections or slippage on platforms such as MT4/MT5, NinjaTrader, or TradingView bridges. Adjusting these settings builds on earlier network and hardware optimizations to further tighten trade execution.

Latency Reduction

Trade Copier Settings:

One of the quickest ways to reduce latency is by fine-tuning your copier’s key settings. Most copiers include a max delay or timeout threshold – if an order takes too long to execute, it’s automatically rejected. Setting this threshold too low can cause unnecessary rejections, while setting it too high might hide underlying latency issues. Many experienced traders keep this threshold between 1–3 seconds and regularly monitor logs for irregularities. Reducing polling intervals from 500 ms to 100 ms can also cut latency, though this requires more CPU power. On a stable VPS, polling intervals of 50–100 ms are often ideal for trading U.S. index futures (like ES, NQ) or major forex pairs.

Sequential order submissions can create cumulative delays, so enabling batching or parallel submission – if supported by your copier – can help. Additionally, configuring your copier to handle partial fills and slippage without requiring extra confirmation cycles is crucial, especially during high-volatility events like U.S. Nonfarm Payrolls or FOMC announcements.

API Efficiency:

The API you use and how it’s configured play a significant role in reducing latency. Opt for WebSocket or FIX APIs instead of slower REST calls, and minimize unnecessary requests. U.S.-based traders can further cut delays by using infrastructure colocated near their broker’s servers, either through a VPS or proximity hosting. Cloud-based copiers running on platforms like AWS Lambda with API Gateway can achieve latencies as low as 10–200 ms when properly set up.

Platform-Specific Tweaks:

On MT4/MT5, running only the copier Expert Advisors (EAs) and disabling heavy indicators or additional EAs can significantly reduce CPU usage and improve copying speed. Moving from a desktop setup to a dedicated VPS can bring delays down from seconds to under one second. According to vendor recommendations, a well-configured MT4 Local Trade Copier should copy trades in under one second under normal conditions, with longer delays often indicating misconfigurations.

For NinjaTrader, copying trades to multiple follower accounts can cause delays, even on powerful CPUs. To minimize this, limit the number of simultaneous follower accounts, simplify ATM strategies, and avoid overly complex order types. Local account-to-account copy latency on NinjaTrader typically ranges from 10–200 ms, depending on CPU load and the number of followers.

TradingView bridge tools can also benefit from optimization. Reducing custom scripting overhead and ensuring the bridge application is the primary load on your VPS can help keep alert-to-order translation times under a few hundred milliseconds. Choosing tools that prioritize low-latency alert handling and direct API integration with your broker is far more effective than relying on slower polling or indirect routing methods.

A small reduction of 100–200 ms in software-induced delays can make a noticeable difference, especially during volatile periods. For U.S. futures like ES, NQ, or CL, even a few ticks of slippage can cost $12.50–$50 per contract per trade. Cutting these delays can quickly offset software costs when managing multiple accounts.

Implementation Complexity

To get started, disable any non-essential applications running on your trading terminal or VPS. This allows the copier and platform to fully utilize available CPU and RAM. Next, adjust copier settings and platform configurations following documented guidelines, such as modifying polling intervals, max-delay thresholds, and instrument mappings. For more advanced optimizations, consider switching API modes or distributing accounts across multiple instances, though this may require vendor assistance.

For traders without a technical background, a step-by-step approach works best. Begin with simple changes, like disabling unnecessary extras and streamlining your VPS environment. Then, tweak basic copier settings such as polling intervals and max delay. Once those adjustments are in place, move on to platform-specific optimizations, like limiting follower accounts or simplifying order types. Advanced changes, such as API configurations or infrastructure distribution, should be tackled last.

Cost (USD)

Trade copier licenses typically cost between $20–$80 per month or a one-time fee of a few hundred dollars. Professional platform add-ons range from $30–$150 per month. If you need setup or optimization support, expect to pay anywhere from $100 to $500.

For traders managing multiple funded accounts through prop firms like Lucid Trading, TickTickTrader, or FundedFuturesNetwork, these software expenses often pay for themselves by reducing slippage. Even small improvements in execution speed can offset monthly costs, especially when scaling across 5–10 accounts.

Cloud-based copiers like TradeSyncer offer the ability to copy trades from one master account to over 40 follower accounts on platforms like Tradovate, Rithmic, DxFeed, TradingView, and ProjectX. These tools promise near-instant synchronization and "lightning fast executions", though specific pricing details are not publicly available.

Suitability for Multi-Account Copying

When combined with earlier network and hardware optimizations, these software adjustments create a well-rounded strategy for minimizing trade copier latency. In the next section, we’ll explore how broker and infrastructure choices further influence execution speed.

sbb-itb-46ae61d

4. Broker and Infrastructure Choices

After optimizing your network, hardware, and software, the next step in reducing latency is refining your broker and infrastructure setup. Broker-side delays can add significant time – sometimes over a second – to your execution process. This delay is influenced by factors like the physical distance between your trading system and the broker’s servers, the efficiency of the broker’s matching engine, and their order-routing capabilities. These elements determine whether follower accounts match master prices or suffer from tick-level slippage.

For traders managing multiple futures prop firm accounts, these infrastructure decisions are especially important. Small differences in broker execution speed or server location can add up, potentially turning a profitable strategy into one plagued by slippage and order rejections.

Latency Reduction

Choosing the Right Broker:

When selecting a broker, prioritize those offering ECN/STP or direct market access. These brokers route orders directly to the market, reducing internal processing delays. Research shows that broker-side delays are often the primary bottleneck, with delays occasionally exceeding one second.

While evaluating brokers, don’t just focus on spreads and commissions. Pay attention to metrics like average execution speed (measured in milliseconds), fill rates during high-volatility periods, and support for algorithmic or high-frequency trading. Brokers with efficient matching and routing systems perform consistently better, especially during peak U.S. trading hours when liquidity is at its highest. For example, traders using prop firms like Apex Trader Funding, Take Profit Trader, or Alpha Futures should evaluate not just the firm’s payout structure but also the broker or clearing firm behind the account. Even minor improvements in broker execution speed or server proximity can reduce slippage and ensure accurate trade replication.

Server Location and Proximity Hosting:

The physical distance between your copier and the broker’s server plays a major role in latency. Hosting your VPS in the same city as your broker can bring latency down from around 400 milliseconds to under 100 milliseconds. Some VPS providers even advertise latencies as low as 0.5 milliseconds for specific brokers, showing the benefits of proximity hosting.

Key financial hubs include Chicago, which hosts the CME Group and most U.S. futures exchanges, and the New York/New Jersey area, a major hub for forex and equities trading. If your prop firm accounts clear through Chicago-based infrastructure, choose a VPS located in or near Chicago. Similarly, for brokers with servers in New York, align your VPS location accordingly. Running ping tests from your VPS to broker servers can help you aim for round-trip times under 100 milliseconds, further improving performance.

Switching from a home PC to a dedicated VPS can make a massive difference. One MT4 copier developer noted that trades should typically be copied in under one second, and moving from an overloaded home PC to a clean VPS setup improved copying speeds by up to 100 times in real-world scenarios.

Execution Infrastructure:

A dedicated VPS with a direct fiber connection is far more reliable than a home PC running on residential Wi-Fi. Home internet connections often introduce tens or even hundreds of milliseconds of latency, with occasional spikes during peak usage.

Cloud-based solutions, like copiers running on AWS Lambda with API Gateway, can achieve latencies as low as 10–200 milliseconds when configured properly. These platforms often come with uptime guarantees of 99.95%. For traders managing multiple accounts with firms like FundedNext Futures, Tradeify, or FundingTicks, this level of reliability is critical. Downtime during volatile markets can result in missed trades and lost profits.

Local copying, where master and follower accounts are on the same machine, offers the lowest latency. Tools based on NinjaTrader, for instance, report copy times ranging from 10 to 200 milliseconds, depending on CPU load and the number of follower accounts. By contrast, remote copying introduces delays from internet transit and broker round-trip times, which can stretch into several hundred milliseconds during high-congestion periods.

Implementation Complexity

Switching to a professional VPS setup is a straightforward way to reduce latency. Many VPS providers publish latency figures for platforms like MT4, MT5, NinjaTrader, and cTrader, making comparisons simple.

Once your VPS is set up, install your trading platform and copier software, log in to your master and follower accounts, and configure the copier settings to match your current setup. Keeping the VPS environment streamlined by disabling non-essential programs ensures that CPU and RAM resources are fully dedicated to trading.

Before fully transitioning, test latency and copier performance under live or simulated trading conditions. Document any broker-specific settings, such as API permissions or risk controls, to ensure smooth operation. For those less technically inclined, many VPS providers offer setup assistance or pre-configured trading environments to simplify the process.

Switching brokers, however, can be more complex. It may involve opening new accounts, transferring your trading strategy, and adjusting copier settings to accommodate the new broker’s platform and API. If you’re working with multiple prop firms, check their policies on broker changes and automation, as some firms may have specific requirements or restrictions. These steps are essential for minimizing latency and ensuring synchronized execution across all accounts.

Cost (USD)

Infrastructure costs vary depending on your needs. A basic VPS with sufficient CPU, RAM, and storage typically costs $20–$40 per month. Mid-tier plans with better performance and lower latency to major brokers range from $50–$100 per month. For premium proximity hosting or colocation – where servers are housed in the same data center as exchanges or broker infrastructure – expect to pay several hundred dollars per month. However, this setup offers the lowest possible latency.

While a home PC setup may seem cheaper after initial hardware and internet costs, it often suffers from higher and more inconsistent latency due to residential internet and Wi-Fi limitations. For swing trading or slower intraday strategies, a mid-tier VPS with latency between 20 and 100 milliseconds might suffice. Scalpers and high-frequency traders, especially those managing multiple prop firm accounts, can benefit significantly from investing in ultra-low-latency hosting.

Broker costs will depend on factors like trading volume, account type, and whether you’re using retail or funded prop firm accounts. However, a broker with superior execution infrastructure doesn’t necessarily charge higher commissions. Many ECN and direct-market-access brokers offer competitive pricing along with faster execution speeds, which can directly impact the accuracy and profitability of trade replication across all your accounts.

Pros and Cons

This section dives into the benefits and drawbacks of various strategies aimed at reducing latency, building on the earlier discussion about network, hardware, software, and broker factors. Each approach comes with trade-offs, so understanding them helps you focus on the solutions that best match your trading goals and budget.

Network and Connectivity Solutions can deliver quick improvements. Switching from Wi-Fi to a wired connection, upgrading to a low-latency internet service, or using a VPS near your broker’s servers are all effective ways to cut transmission delays. For instance, migrating to a VPS can shrink copying delays from several seconds to under one second. However, quality VPS hosting typically costs between $20 and $100 per month and requires some technical setup. Plus, while network upgrades help with transmission delays, they don’t solve issues caused by slow software or underpowered hardware.

Hardware Upgrades and Optimization are especially effective when your system is under heavy load. Adding more RAM, upgrading to a faster CPU, or switching to an SSD can significantly reduce processing delays, particularly if you’re running multiple trading terminals or managing several follower accounts. For example, upgrading hardware can boost trade copier efficiency by up to 100×. Similarly, reducing the number of MT4, MT5, or NinjaTrader instances can lead to a 10–100× performance improvement without spending a dime. That said, high-performance hardware can be expensive, ranging from $500 to over $2,000, and additional upgrades may offer diminishing returns once your system is no longer the bottleneck.

Software and Platform Optimization is often the most affordable way to improve performance. Streamlining your copier settings, removing unnecessary indicators and expert advisors, and closing unused platform instances can free up valuable CPU and RAM resources. For example, platforms like NinjaTrader can struggle with processing multiple order submissions, which increases latency when copying trades across several accounts. Balancing aggressive settings, like tight maximum delay values, is crucial to avoid rejected or skipped trades during volatile market conditions.

Broker and Infrastructure Choices can provide the lowest latency when combined with proximity hosting or colocation. Opting for a broker with efficient order routing and servers near major exchanges, such as those in Chicago, can drastically cut execution times. Some VPS providers even advertise latencies as low as 0.5 milliseconds to specific broker servers when using optimized setups. For traders managing multiple prop firm accounts with companies like Apex Trader Funding, Take Profit Trader, or FundedNext Futures, this level of speed can mean the difference between synchronized fills and costly slippage. However, premium hosting or colocation can cost several hundred dollars per month and requires coordinating server locations and broker relationships.

Here’s a quick summary of the key latency reduction strategies, their potential impact, costs, and ease of implementation:

| Solution Category | Latency Reduction Potential | Cost Range (USD/month) | Implementation Difficulty |

|---|---|---|---|

| Network & Connectivity | Moderate (10–50 ms improvement) | $0–$50 | Low to Medium |

| VPS / Proximity Hosting | High (<100 ms, sometimes <10 ms) | $20–$100+ | Medium |

| Hardware Upgrades | High (especially on overloaded systems) | $500–$2,000+ (one-time) | Medium |

| Reducing Platform Instances | High (10–100× performance boost) | $0 | Low |

| Removing Unnecessary EAs/Indicators | High (CPU/RAM savings) | $0 | Low |

| Disabling Antivirus/Background Apps | Moderate to High | $0 | Low to Medium |

| Software Settings Optimization | Low to Moderate (a few ms improvement) | $0 | Low |

| Broker & Infrastructure Choices | High | $100–$500+ | Medium to High |

For most traders, combining multiple strategies yields the best results. For example, a NinjaTrader user managing five funded accounts with a Replikanto trade copier noticed that orders took slightly longer to propagate across all accounts compared to a single account – sometimes causing rejections on some accounts while others were filled. By upgrading hardware, fine-tuning software settings, and hosting the platform on a low-latency VPS near the broker’s servers, they reduced delays and improved fill synchronization.

Ultimately, the key is identifying your specific bottlenecks – whether it’s network transmission, processing power, software inefficiency, or broker execution speed – and addressing them in a way that maximizes impact. Network upgrades might fix transmission issues, but they won’t help if your CPU is maxed out. Similarly, a powerful PC won’t make a difference if resource-heavy indicators are slowing you down. Prioritize solutions based on where you’re experiencing the most significant delays.

Conclusion

Bringing down trade copier latency involves pinpointing the trouble spots and implementing a range of targeted solutions.

If you’re managing just one or two accounts on a tight budget, start with the basics. Close unnecessary background apps and switch to a wired internet connection. These small tweaks can often cut latency from over 10 seconds to under a single second in many cases. Still facing delays? Run a speed test with only your trading platform and copier active to identify potential network issues.

For traders handling 2–10 accounts, upgrading to a dedicated VPS near your broker’s servers is a smart move. This step can boost copying speeds significantly – up to 100 times faster than using a bogged-down home computer. A reliable VPS typically costs between $20 and $100 per month and can bring latency down to under 100 milliseconds when located in the same region as your broker. Make sure the VPS is exclusively used for trading platforms. For instance, one trader saw a dramatic improvement in copier performance after configuring their VPS correctly. If you’re working with even more accounts, you’ll need to step up your infrastructure game.

For advanced setups – traders managing over 10 accounts across multiple prop firms – a professional-grade infrastructure is essential. High-performance VPS or dedicated servers with strong single-core CPUs are ideal, especially when colocated near broker and prop firm data centers. Some specialized VPS providers even promise latencies as low as 0.5 milliseconds to specific broker servers. At this level, fine-tune your copier settings by testing delay thresholds and live order submissions. Work with brokers and prop firms that offer dependable infrastructure and low server latency. Futures traders scaling multiple accounts with prop firms can benefit from platforms like DamnPropFirms, which provide comparisons of infrastructure quality, trade copying policies, and scaling rules to help avoid technical bottlenecks.

For those less technically inclined, managed cloud services offer a hassle-free alternative. These services handle infrastructure, networking, and software optimization, letting you focus entirely on trading. While you may have less control over the setup, the reliability and ease of use make them a solid choice for many traders.

FAQs

How can I identify whether my trade copier latency is caused by network issues or hardware limitations?

To figure out whether the latency in your trade copier is due to network issues or hardware limitations, start by examining your internet connection. A slow or unstable connection can result in delays when transmitting trade data. Use tools like speed tests to measure your download and upload speeds, as well as latency (ping). If these numbers are underwhelming, consider upgrading your internet plan or switching to a more reliable provider.

If your internet connection checks out, the problem might lie with your hardware. Make sure your computer or server has enough processing power and memory to run the trade copier software smoothly. Outdated hardware or limited resources can slow down data processing. Upgrading your equipment or optimizing your system specifically for trading tasks can go a long way in cutting down latency.

What are the advantages of using a VPS for trade copying instead of upgrading my home internet?

Using a VPS (Virtual Private Server) for trade copying comes with some clear perks compared to simply upgrading your home internet. A VPS offers a stable, high-speed connection with very low latency since it’s hosted in professional data centers built for consistent, uninterrupted performance. This means trades can be executed faster and more reliably – something that’s absolutely crucial in fast-paced markets.

Another big advantage? A VPS runs 24/7, so you don’t have to worry about power outages, hardware issues, or your home internet cutting out. Plus, it lets you access your trading platform from anywhere, adding flexibility and convenience. For traders who prioritize reliability and precision, a VPS often proves to be the smarter option.

What’s the best way to reduce latency and achieve fast trade execution when managing multiple funded accounts?

To keep latency low and ensure trades execute quickly across multiple funded accounts, using a dependable cloud-based trade copier is essential. This kind of software enables you to sync trades across multiple prop firms efficiently, minimizing the risk of delays from server problems or software glitches.

When choosing a trade copier, make sure it’s compatible with the prop firms you’re working with, such as Apex Trader Funding, Take Profit Trader, FundedNext, Lucid Trading, and Tradeify. Look for tools that offer reliable performance and can scale easily, so you can manage trades smoothly across all your accounts.