Prop Firm Articles & Trading Education

Stay ahead of the curve with in-depth guides, prop firm reviews, and trading strategies. From challenge rules to payout policies, we cover everything you need to know to succeed with futures prop firms. Updated regularly with insights to help you trade smarter and grow as a professional trader.

Apex vs Topstep

Compare Apex and Topstep: one-step vs two-step evaluations, drawdown types, fees, payouts, and which firm fits your trading style.

Apex vs Take Profit Trader

Compare Apex Trader Funding and Take Profit Trader on drawdown models, payouts, profit splits, account limits, fees, and trading rules to choose the best fit.

Rithmic API: Real-Time Data for Futures Prop Traders

Ultra-fast tick-by-tick market data, server-side order management, and low-latency execution for scalpers, automation, and multi-account futures prop trading.

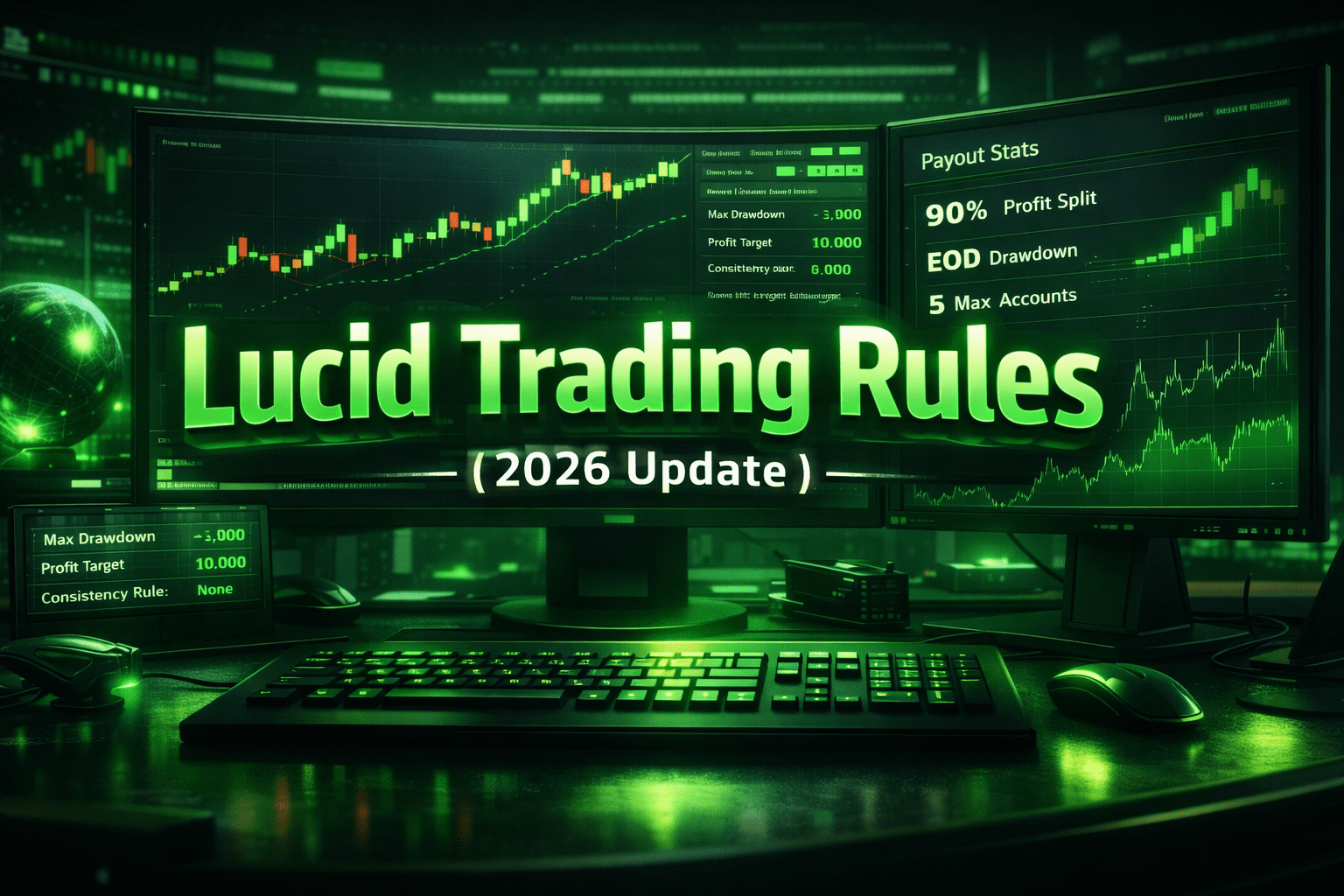

Lucid Trading Rules (2026 Update): Complete Guide To Evaluations, Payouts, And Consistency

Lucid Trading has become one of the most popular futures prop firms because of its simple rules, fast payouts, and end‑of‑day drawdown model—but 2026 brought some big changes you need to understand before you sign up. This guide breaks down all the latest Lucid Trading rules for LucidPro, LucidDirect, and…

How to Connect CQG to Trading Platforms

Clear step-by-step guide to set up CQG with trading platforms, system requirements, API options, and common fixes for connection issues.

How to Detect Spoofing in Futures Markets

Practical methods to spot spoofing in futures using heatmaps, Level 2 data, cancellation-rate metrics, and AI-driven detection.

Daily vs. Monthly Trade Performance Tracking

Compare daily vs. monthly trade tracking—pros, cons, and when to use each. Combine daily logs with monthly reviews to manage risk and meet prop-firm rules.

Apex Payout & Scaling Calculator

Calculate your Apex Trader Funding payouts with our interactive tool. See safety nets, scaling potential, and download your roadmap now!

How Drawdown Affects Payouts

Learn how trailing, daily, and end-of-day drawdown rules at prop firms affect payout eligibility and timing, plus practical risk controls to protect withdrawals.

Futures Prop Firm Payout Calculator

Calculate your payout from prop trading firms with ease! Enter your profit, split percentage, and fees to see your final earnings instantly.

Drawdown Management Tips for Funded Traders

Protect your funded account with strict drawdown rules: position sizing, stop-loss discipline, daily limits, profit buffers and emotional circuit-breakers to avoid liquidation.

5 Misconceptions About Consistency Rules Explained

Clarifies five common misconceptions about prop-firm consistency rules, how they affect payouts, and how to trade to stay compliant.

Lucid Trading Payout Proof (Real $3,000 Payout Paid in 30 Seconds)

Lucid Trading payout proof is real. In this post, we show a live payout from a LucidDirect instant funded account where a $3,000 withdrawal request was submitted and a $2,700 bank deposit hit in under 30 seconds after the 90/10 profit split. You will see exactly how Lucid payouts work,…

Instant Funding Futures Firms: 2026 Overview

Compare 2026 instant-funding futures firms — fees, drawdown rules, payout speed, and 90/10 profit splits to help experienced traders choose wisely.

Futures Profit Split Converter

Calculate your prop firm payout with our Futures Profit Split Converter. Input profits and splits to see your earnings breakdown instantly!

How to Submit KYC for Funded Accounts

Learn what documents prop firms require, when to submit KYC, how to upload proof of ID and address, and tips to speed approval.

Prop Firm Evaluation Planner

Evaluate prop trading firms with ease! Use our free planner to check funding, profit targets, and drawdown limits for smarter decisions.

Account Size Options: Apex vs. Topstep

Compare account sizes, drawdown types, scaling limits, and funding flexibility between two prop-firm models to find the best fit for your trading style.

How Max Drawdown Rules Shape Risk Management

Breaks down static, trailing, and end-of-day drawdown rules for futures prop firms and how to size positions, set buffers, and avoid account breaches.

How to Adjust Risk Using Backtesting Data

Backtesting reveals true strategy risk—use drawdown, RoR, ATR-based stops and disciplined position sizing to manage volatility and meet prop firm limits.

Consistency Rules Explained for Funded Account Success

How prop firms limit single-day profits, how to calculate and track compliance, and practical strategies and tools to meet funded-account payout rules.

Ultimate Guide to Volume and Price Action Trading

Use volume with price action to confirm trends, spot reversals, validate breakouts, and apply VWAP, Volume Profile and footprint charts.

Best Tools for Real-Time Futures Data Analysis

Compare five top platforms for real-time futures: features, pricing, order-flow tools, and prop-firm compatibility to match your trading style.

Take Profit Trader Payout Proof and Withdrawal Process Explained

This detailed breakdown covers real Take Profit Trader payout proof from a $150,000 funded account and explains the full Take Profit Trader withdrawal process step by step. See how daily withdrawals work, how the 80/20 profit split is applied, how long payouts take, and what actually hits the bank after…

Why Traders Fail Prop Challenges: Drawdown Mistakes

Master drawdown rules and strict risk control to avoid failing prop firm challenges.

Prop Firm Drawdown Policies Compared

Compare drawdown types, daily loss limits, scaling and payout rules across major futures prop firms to match rules with your trading style.

Trailing Drawdown Resets: Common Errors

Understand trailing drawdown resets, intraday vs EOD rules, common mistakes, and practical risk controls to avoid liquidation in prop accounts.

Customizable Dashboards for Prop Firm Traders: Features to Look For

Customizable dashboards are essential for prop traders to monitor equity, enforce compliance, manage funded accounts, and prevent costly rule breaches.

5 Volume Profile Strategies for High-Probability Trades

Five Volume Profile setups: edge rejections, HVN bounces, LVN breakouts, POC mean reversion and Value Area fades, with examples and risk rules.

Retail Sales Data: Checklist for Futures Traders

Checklist for futures traders: prep for the 8:30 AM retail sales release, analyze headline/core/control data, spot surprises, manage execution and post-trade review.

Trading Technologies vs Other Platforms in Prop Firms

Compare Trading Technologies with NinjaTrader, Rithmic, Tradovate and Sierra Chart for futures prop firms — features, latency, costs, and best-fit traders.

How Risk Management Policies Differ Across Prop Firms

Compare drawdown types, scaling limits, and consistency rules across leading futures prop firms to match risk policies with your trading approach.

Ultimate Guide to Trade Copying for Funded Accounts

How to copy trades across funded accounts safely—tools, firm rules, position sizing, latency fixes, and risk controls for scaling multi-account trading.

Eligibility Checklist for Instant Funding

Fast access to funded accounts for experienced traders—higher upfront fees, strict drawdown, position-sizing and consistency rules; confirm eligibility and limits first.

How Trade Frequency Affects Consistency Rules

How trade frequency impacts prop-firm consistency rules: avoid single-day profit spikes, meet minimum trading days, and use sizing, caps, and calculators to stay compliant.

Connecting Charting Tools to Futures Prop Firms

Connect TradingView or NinjaTrader to funded prop-firm futures accounts for unified charting, faster order execution, and rule-compliant risk control.

Prohibited Trading Practices in Futures Prop Firms

A complete guide to banned futures prop-firm tactics—hedging, latency arbitrage, copy trading, grid systems, bots and risk violations—plus rules to stay compliant.

Instant Funding Firms with No Monthly Fees

Compare instant funding programs with one-time fees, high profit splits, drawdown rules, and fast payouts to find the best fit for your trading style.

Backtesting for Prop Traders: Rules and Strategies

Practical backtesting guide for prop traders: simulate drawdown and daily loss rules, validate across market regimes, avoid overfitting, and manage risk.

Prop Firm Fee Structures: What Traders Should Know

Compare evaluation, activation, data, platform, commission, and profit-split costs to calculate 12‑month expenses and avoid hidden prop firm fees.

Tradeify vs. Lucid Trading: Australian Prop Firm Comparison

Head-to-head look at two top futures prop firms for Australian traders—compare fees, payout speed, drawdown rules, and funding flexibility.

Ultimate Guide to Prop Firm Discounts

Learn types, verification tips, and strategies to maximize prop firm discounts while avoiding hidden fees and timing promotions for funded trading accounts.

Verified Reviews of Prop Firm Payout Processes

Compare payout speed, verification, and profit splits across top prop firms with verified trader insights to pick reliable funding partners.

NinjaTrader 8 Setup for Prop Firms

Step-by-step NinjaTrader 8 setup for prop firms: system requirements, enabling Multi-Provider Mode, connecting Tradovate or Rithmic accounts, and troubleshooting.

FAQs on Consistency Rules and Profit Targets

How futures prop firms use consistency limits and profit targets, how they affect payouts, and practical steps traders can take to stay compliant.

Checklist for Choosing Rithmic Prop Firms

Compare Rithmic prop firms by connectivity, drawdown models, profit splits, payout rules, and total costs to find the best match for your trading style.

How Funding Tiers Work in Futures Prop Firms

How futures prop firm funding tiers operate: evaluation tests, profit targets, drawdown rules, scaling benefits and better profit splits for consistent traders.

Capital Allocation Rules for Futures Prop Traders

Rules for futures prop traders: drawdown and daily loss limits, position sizing, VIX-based volatility cuts, and scaling plans for funded accounts.

How Long Funded Account Approval Takes

Most funded account approvals take 1–2 business days after evaluation and KYC; instant funding options can grant access in minutes.

Futures Risk-to-Reward Ratio Converter

Calculate your futures trade’s risk-to-reward ratio instantly! Enter entry, stop-loss, and target prices to optimize your trading strategy now.

Best Platforms with Built-in Futures Simulators

Compare top platforms with built-in futures simulators, featuring market replay, paper trading funds, cloud/mobile access, and prop-firm prep tools.

Futures Profit Target Planner

Plan your futures trades with ease! Use our free Futures Profit Target Planner to calculate target prices and profits in seconds. Try it now!

Drawdown Rules for Futures Prop Firms

Intraday, EOD and static drawdowns define risk at futures prop firms—compare models, limits and suitability for scalpers, swing traders and funded accounts.

How to Use Contract Symbol Lookup Tools

Learn how futures symbols are formed, use platform lookup tools, avoid common symbol mistakes, and verify you’re trading the right contract.

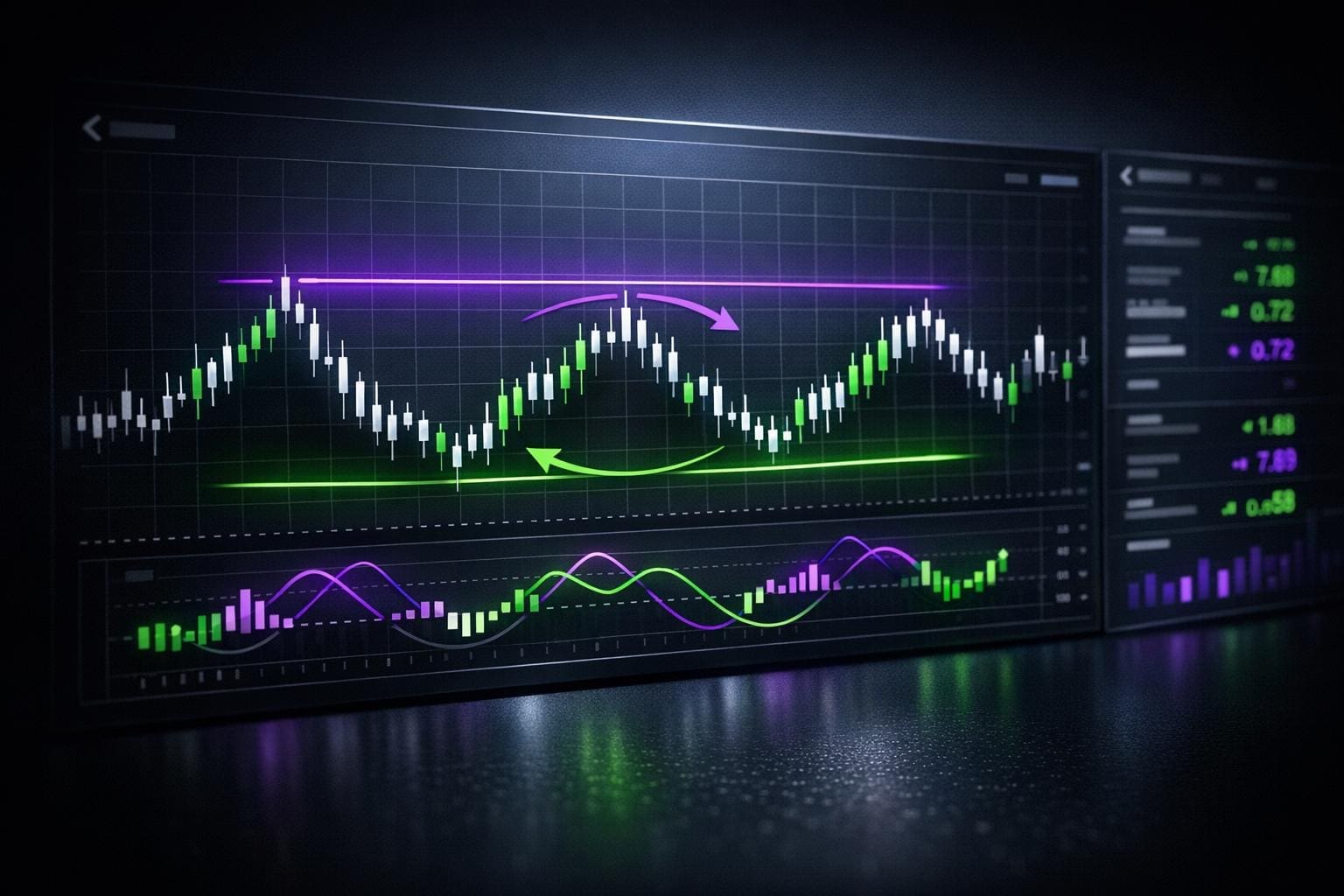

Order Flow Imbalances with Footprint Charts

Use footprint charts to spot order flow imbalances, stacked imbalances, delta and absorption zones to identify institutional activity, reversals, and trade setups.

Order Flow vs. Market Depth for Risk Control

Market depth maps where liquidity sits while order flow shows whether it’s being consumed—combining both sharpens entries, stop placement, and slippage control.

Equity vs Balance Drawdown Explained

Equity vs balance drawdown: one tracks closed trades for flexibility; the other updates in real time and demands stricter risk control.

Apex vs. Topstep: Profitability Rules Compared

A clear tradeoff: flexible profit splits and scaling with a trailing drawdown versus strict daily loss limits, structured evaluations, and quicker payouts.

Volume Nodes vs Value Areas in Futures

Compare volume nodes (HVN/LVN) and value areas (VAH/VAL) in futures trading and learn how using both improves entries, breakouts, and risk control.

Consistency Metrics for Tradeify: What to Know

How consistency rules cap single-day profits, how to calculate limits, account-specific thresholds, monitoring tools, and strategies to restore payout eligibility.

How to Use Dynamic Sizing to Scale Funded Accounts

Use volatility-adjusted position sizing, consistent % risk, and trade-quality filters to protect capital and scale funded trading accounts.

Futures Prop Firms With No Recurring Fees

Compare top futures prop firms that charge a single upfront fee, with details on profit splits, payout speed, drawdown rules, and cost savings.

Order Flow Tips for Low-Volume Futures Markets

Thinly traded futures demand an order-flow approach—use footprint charts, CVD, DOM, absorption signals and strict risk rules to trade volatility.

Fakeouts in Futures: Order Flow Strategies

Spot and trade fakeouts in futures with order-flow signals—delta, absorption, and volume-price divergence—plus fading/retest tactics and 1–2% risk rules.

Apex vs. Topstep: Evaluation Metrics Compared

Compare Apex and Topstep funding: drawdown methods, profit splits, account sizes, daily limits, and which suits aggressive vs. disciplined traders.

Prohibited Instruments on FundedNext Futures

Allowed CME futures, banned spot/CFD instruments and prohibited strategies on FundedNext Futures—enforcement, penalties, and compliance tips.

Top 5 Prop Firms with Customizable Dashboards

Customizable dashboards give futures traders better risk control, performance tracking, and faster, flexible payouts across top prop firms.

5 Types of Drawdown Rules in Prop Trading

Compare static, trailing, daily, end-of-day, and equity-based drawdown rules used by prop firms and learn how each affects trading risk and strategy.

Trade Execution Metrics: Firm-Specific Rules

Execution rules, drawdown limits, and consistency requirements determine which futures prop firm best fits your trading style.

What Is the Consistency Rule in Prop Trading?

Explains the prop trading consistency rule, how firms cap single‑day profits (20–50%), how it affects payouts, and practical tips to stay compliant.

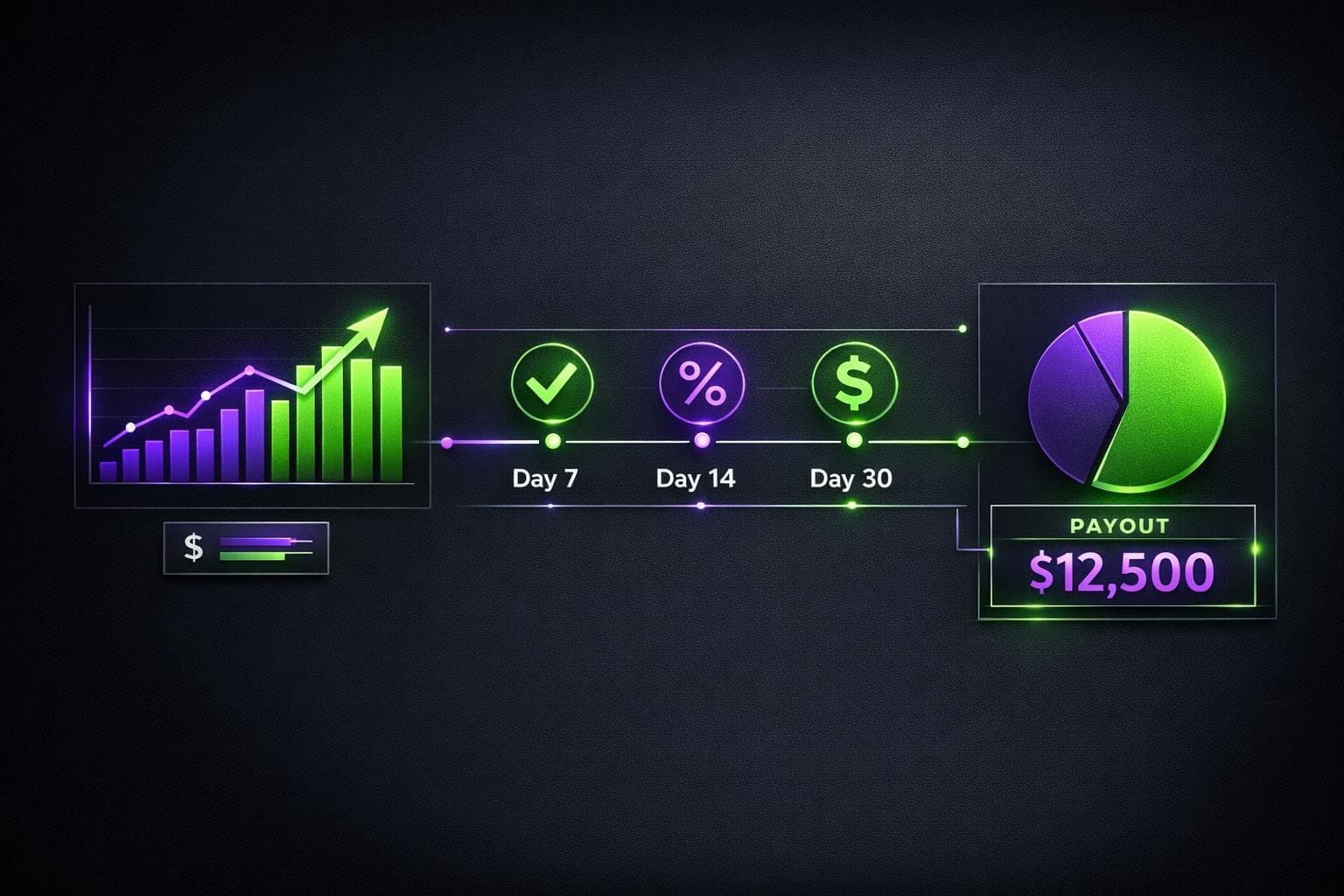

Fastest Prop Firm Payouts 2026

Compare 2026 futures prop firms by payout speed, frequency, profit splits and minimum trading days to find the fastest, most flexible payout options.

Zero DTE Options Risk Explained: Why Same-Day Options Are Getting More Dangerous

How zero DTE options amplify time decay, gamma swings and behavioral risks — why same‑day contracts can wipe out accounts without strict risk controls.

How Consistency Rules Affect Payouts

Consistency rules in futures prop trading limit how much a single day counts toward payouts, shaping risk management, strategy and withdrawal timing.

How Slippage Impacts Execution Accuracy

Small slippage can erode futures profits. Learn to measure slippage, use limit orders, trade during high-liquidity hours, and leverage low-latency tools to improve execution.

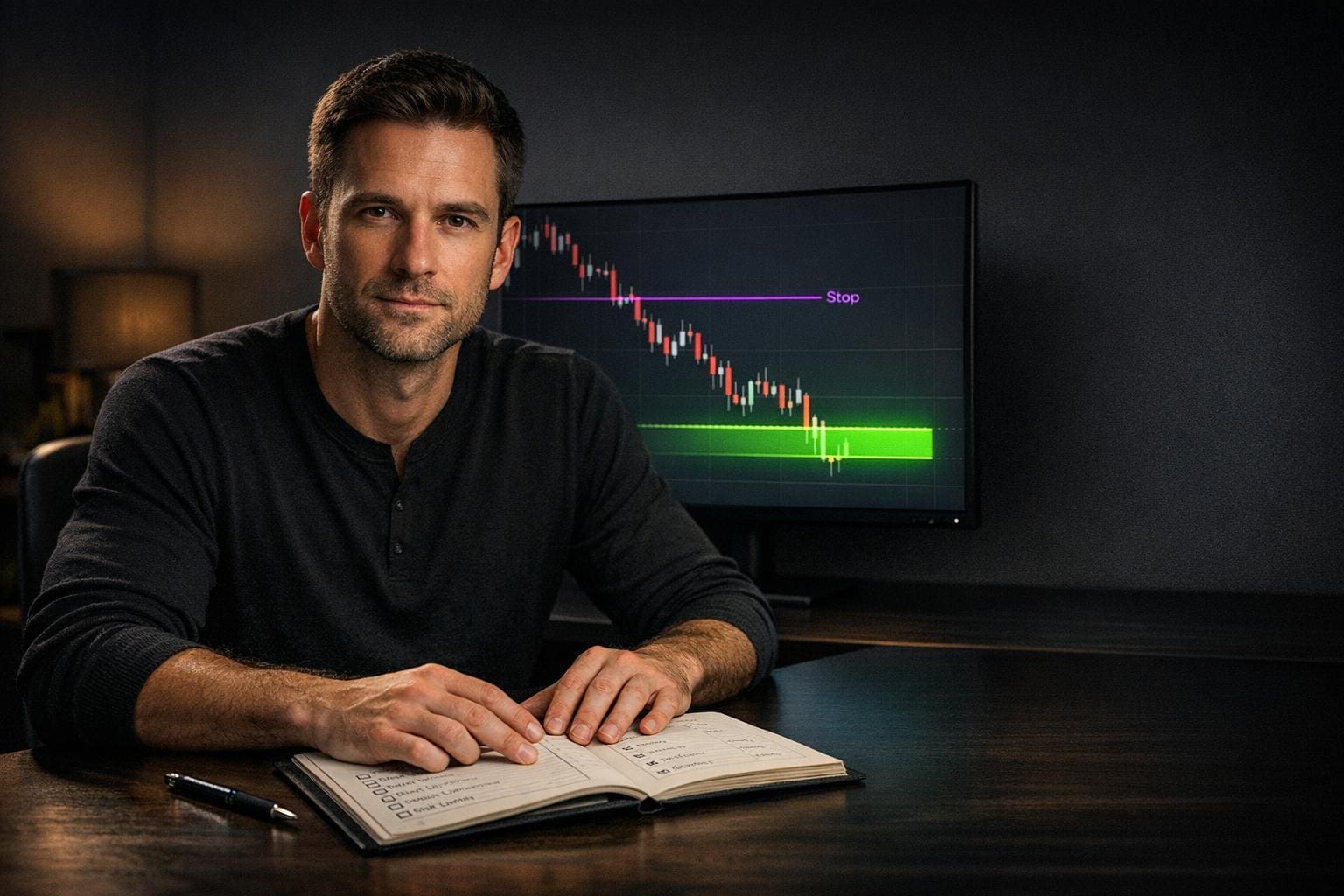

How to Build Discipline for Prop Firm Challenges

Discipline beats strategy in prop firm challenges — use strict risk limits, routines, a simple trading plan, emotional control, and a trading journal.

Scaling Rules in Apex Trader Funding

Overview of Apex Trader Funding’s scaling: 50% starting contract limit, safety-net thresholds to unlock full contracts, 30% daily consistency cap, and payout rules.

Static vs. Trailing Drawdown: Key Differences

Compare static and trailing drawdowns for prop traders: how each model affects risk, profit protection, monitoring needs, and which suits your trading style.

Best Crypto Prop Firms

Compare two top crypto prop firms offering funded accounts up to $200k, 80-90% profit splits, USDC payouts, and differing fees and evaluation paths.

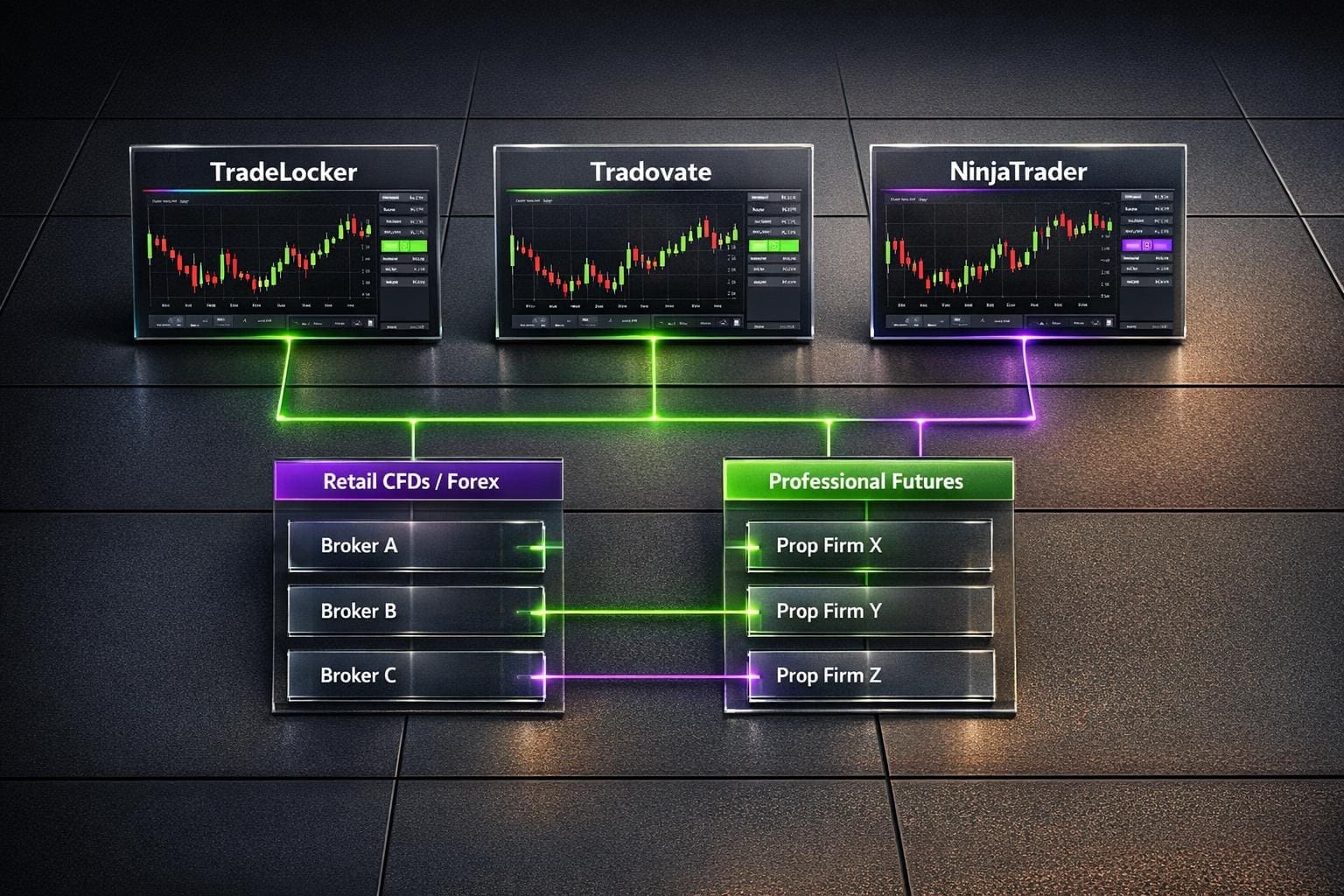

TradeLocker Brokers Explained: Best Brokers & Prop Firms That Support TradeLocker

Compare TradeLocker with Tradovate and NinjaTrader to find brokers and prop firms that best support retail CFD/forex or professional futures trading.

Best Futures Prop Firms for Promo Codes

Compare top futures prop firms and promo codes that slash evaluation fees, waive activation charges, and affect profit splits and payout terms.

Prop Firms That Accept US Clients

Compare U.S.-friendly futures prop firms: profit splits, payout speeds, drawdown rules, and account sizes to find the best fit for your trading style.

Max Drawdown Rules Across Top Prop Firms

Understand how intraday, EOD and static drawdown rules, daily loss caps, and reset fees change your odds with prop firms.

Top Volume Profile Strategies for Futures Traders

Seven practical volume profile strategies for futures traders—HVNs/LVNs, value-area fades, cumulative profiles, multi-timeframe setups, POC tactics and risk rules.

No Evaluation Prop Firm

Compare instant-funded prop firms that skip evaluations—fees, drawdown models, profit splits, and payout speeds for experienced traders.

Prop Firms For Stock Trading

Compare top prop firms for stock and index futures — funding, profit splits, drawdown rules, and payout speed to match your trading style.

Options Trading Prop Firms

Compare funding, profit splits, drawdown rules and payout speed across leading options trading prop firms to find the best fit for your strategy.

how do prop firms make money

Prop trading firms make most of their money from nonrefundable evaluation, reset and subscription fees rather than paying out trader profits.

which prop firms include free market data

Compare five prop firms that include free CME futures data, plus details on platforms, profit splits, fees, and payout speed to help you choose.

how to start a prop firm

Step-by-step guide to launching a proprietary trading firm: choose a model, estimate costs, meet CFTC/NFA rules, build your tech stack, and enforce risk controls.

Apex Trader Funding: Order Placement Rules

Clear summary of Apex Trader Funding order rules: daily 4:59 PM ET close, contract limits, one-direction trading, 30% consistency cap, 5:1 R:R.

Trailing vs Fixed Drawdown: Differences

Compare fixed (static) and trailing drawdowns — how each works, pros and cons, trading impacts, and how to pick prop firms based on drawdown rules.

Top 5 Futures Prop Firms With TradingView Integration

Seamless TradingView integration can simplify futures prop trading with direct chart order entry, faster execution, and clearer funding and profit-split options.

Payout Rules for Futures Prop Firms

Compare payout timelines, profit splits, consistency rules, minimum trading days, and withdrawal caps across 12 major futures prop firms.

5 Range-Bound Strategies for Futures Trading

Five practical range-bound futures strategies—support/resistance entries, oscillator mean reversion, volume/volatility fades, scalping, and breakout contingency with prop-firm risk controls.

Scaling Plans Explained: What Traders Need to Know

Clear guide to prop-firm scaling plans: how contract limits, profit targets, consistency rules and drawdowns determine capital increases and how to comply.

You Are Not Undisciplined, You Are Overstimulated

How sensory overload harms trading decisions and simple fixes, clean charts, fewer alerts, mindfulness, and tools to stop overtrading and improve consistency.

Psychology & Discipline (Hard Truth Content)

Why 90% of prop-trading success relies on mindset and discipline. Learn routines, stop techniques, journaling, and process-focused rules to trade consistently.

Checklist for MT4/MT5 Setup

Checklist to configure MT4/MT5 for prop-firm futures trading: login/server, install, add symbols, set charts/indicators, test on demo, and optimize with VPS.

Apex vs. Topstep: User Reviews Compared

A user-review comparison of flexible, high-split funding versus structured, education-focused programs—ratings, payouts, rules, and support evaluated.

How to Qualify for a Funded Futures Account

Learn the requirements, evaluation targets, drawdown rules, platform needs, and payout basics to qualify for a funded futures account.

Are prop firms legit

Unbiased comparison of prop firms: funding models, profit splits, payout rules, and pros/cons to help traders choose the right funded program.

The Difference Between Smart Aggression and Pure Recklessness

Learn how disciplined, volatility-adjusted position sizing and dynamic drawdown rules separate smart aggression from reckless trading in futures prop firms.

Risk-to-Reward Lies Traders Tell Themselves

Stop chasing arbitrary R:R targets – align win rate, position sizing, and drawdown limits to survive prop-firm challenges.

Why Stop Loss Distance Matters More Than Entry Precision

Why stop loss distance matters more than entry precision: it sets position size, controls dollar risk, and keeps you compliant with prop-firm drawdown rules.

Why Trading More Contracts Makes You Less Profitable

Bigger futures positions multiply losses, trigger emotional trading, and risk prop-firm rules—use proper position sizing and fixed risk to protect your account.

Trailing Drawdown Math Explained for Futures Prop Traders

How trailing drawdowns work in futures prop accounts, how they’re calculated with intraday equity, and practical tips to avoid unexpected liquidation.

How to Size ES Trades Like a Professional (Not a Gambler)

Step-by-step guide to sizing ES/MES trades: calculate contracts, use ATR-based volatility, follow prop firm limits, and keep risk under 1% per trade.

Risk Management (This Is Where Most Traders Die)

Risk rules for futures prop traders: position sizing, pre-set stop-losses, daily limits, 1:2 risk-to-reward, and firm-specific limits to protect capital.

Why Simplicity Beats Indicators in Nasdaq Futures

Simplicity beats indicators in Nasdaq futures: trade price action, VWAP, volume and key levels to act faster, cut losses, and meet prop firm rules.

How to Trade NQ Pullbacks Without Chasing Like an Idiot

Rule-based NQ pullback guide: identify trend with 20 EMA/VWAP, wait for Fibonacci or MA retracements, enter on price-action confirmation, and control risk.

Mean Reversion on ES: When It Works and When It Will Ruin You

Mean reversion on ES wins in range-bound, low-volatility markets — but in trends or volatility spikes it can wipe funded accounts without strict risk controls.

Why Most Traders Fail NQ Breakouts and How to Trade Them Properly

Why 87% of NQ breakout trades fail — learn a 3-step method to confirm breakouts, use ATR stops, size positions, and meet prop-firm rules.

Daily Loss Limits Explained for Beginners

Clear explanation of daily loss limits, static vs trailing rules, reset times, and practical tips to manage risk and protect trading capital.

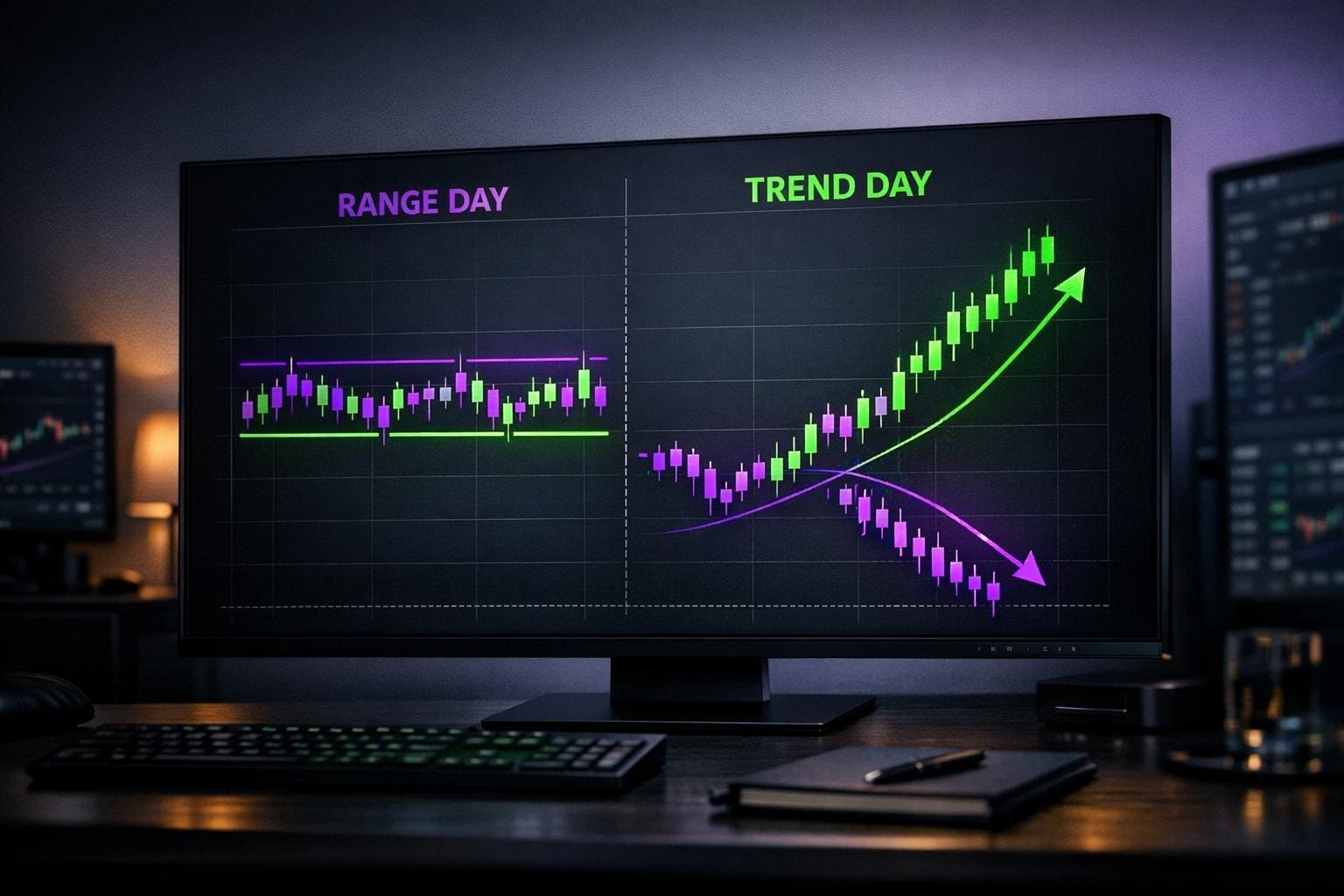

Range Days vs Trend Days on ES: How to Identify Them Before You Lose Money

Mistaking a trend day for a range day destroys profits—use ATR, pre-market volume and opening range to know before the bell.

How I Trade the First 90 Minutes of NQ Without Getting Chop-Killed

Practical NQ (Nasdaq-100) plan for the first 90 minutes: pre-market prep, opening range setups, position sizing, risk rules, and chop filters.

The Only 3 Intraday Market Structures That Matter on NQ

Master three intraday NQ structures—mid pivot, upper rotation, lower support—and trade Nasdaq futures with VWAP/volume confirmation and funded-account risk rules.

Lucid Trading Explained: Why This Futures Prop Firm Is Gaining Serious Momentum in 2026

Lucid Trading is gaining serious momentum in 2026 because it fixes the biggest problems traders face with prop firms. Instead of intraday trailing drawdown and bloated rule sets, Lucid focuses on end-of-day drawdown, fast payouts, and clean account structures that reduce execution stress. Traders can choose between evaluation-style accounts, flexible…

ES vs NQ Day Trading: Which One Actually Fits Your Psychology

Compare ES and NQ futures by volatility, liquidity, strategies, and trader psychology to find which contract matches your risk tolerance.

Top 5 Lessons from Failed Funded Accounts

Most funded trading accounts fail because traders break rules, mismanage risk, trade emotionally, overtrade, or refuse to adapt.

Why Nasdaq (NQ) Punishes Overtraders Faster Than Any Other Contract

NQ futures’ high leverage and volatility punish overtraders. Learn position sizing, stop-loss rules and discipline to avoid prop-firm breaches.

Core Strategy & Execution (NQ / ES Specific)

Rules-based strategies and execution for trading NQ (Nasdaq‑100) and ES (S&P 500) futures, covering session timing, micro contracts, risk controls, and order types.

Rithmic Setup for Prop Firms

Step-by-step Rithmic setup for prop firms: get credentials, install R|Trader Pro, enable plugin bridging, connect to NinjaTrader/Quantower, and troubleshoot issues.

Prop Firm Risk Rules: Adapting to Market Volatility

Adapt position sizing, set personal loss caps, and use compliance tools to avoid breaching prop firm drawdown and daily-loss rules during volatile markets.

MNQ Tick Value: Micro E-mini Futures Contract Specs

MNQ contract breakdown: 0.25 tick size, $0.50 tick value, $2 multiplier, trading hours, margins, and why traders use MNQ for precise risk and prop-firm evaluations.

Beginner Prop Firms with Instant Funding Options

Compare five beginner-friendly futures prop firms that offer instant funding, low fees, simple rules, and fast payouts.

Platform Fees vs. Data Feed Fees: Key Differences

Compare platform vs data feed fees for futures traders—what they cover, typical monthly costs, who charges them, and ways to reduce recurring expenses.

How Volume Profile Reveals Hidden Support Zones

Volume Profile reveals support hidden inside consolidation ranges by mapping traded volume—use HVNs, POC and VAL to place data-driven entries, stops, and manage futures risk.

Trade Copier Latency: Causes and Fixes

Identify and fix trade copier latency: network, hardware, software, and broker solutions to reduce slippage and sync multiple funded accounts.

Profit Splits Across Futures Prop Firms Explained

Most futures prop firms split profits 80–100% for traders, but payout timing, drawdown rules and evaluation difficulty determine real take-home pay.

Ultimate Guide to Trading Psychology in Risk Management

Manage fear, greed, and overconfidence in futures trading with rules, routines, stop-losses, journals and prop-firm alignment for consistent risk control.

Volume Profile vs Price Action: Key Differences

Compare Volume Profile and Price Action to learn how each method reads markets, their strengths and limits, and when to use or combine them for better trades.

Ultimate Guide to Becoming a Funded Futures Trader

A complete guide to funded futures trading: choose prop firms, pass evaluations, manage risk, and scale funded accounts while keeping most profits.

Trade Copying Services: Top 6 Platforms Compared

Compare six trade copying platforms for managing multiple funded futures accounts—speed, risk controls, broker compatibility, pricing, and scalability.

Risk-Reward Ratio vs. Win Rate: Key Differences

Strong risk-reward ratios can offset low win rates; learn how to calculate break-even win rates, expected value, and balance metrics for consistent trading.

Best Prop Firms for Futures Trading: 2025 Review

Compare top futures prop firms’ profit splits, evaluation rules, payouts and support to find the best fit for your trading style.

How to Meet Trading Objectives During Evaluations

Pass prop firm evaluations by prioritizing risk management, consistency, demo testing, and a written trading plan to protect capital and meet targets.

What Is Trade Copying in Futures Prop Trading?

Automated trade copying mirrors trades across multiple futures prop accounts for fast execution while demanding strict position sizing and drawdown limits.

Consistency Rules for Scalping Futures

Consistency rules force scalpers to spread profits across days — master position sizing, daily targets, and tracking to avoid prop-firm disqualification.

Top 5 Trade Copying Platforms for Futures Traders

Compare five leading copy-trading platforms for futures—execution speed, prop-firm compatibility, platform support and pricing for scalpers, algos, and retail traders.

Apex vs. Topstep: Prop Firm Comparison 2025

Explore the key differences between two leading prop firms, focusing on funding options, profit splits, evaluation processes, and who they best serve.

10 Best Instant Funding Prop Firms 2025

Explore the top instant funding prop firms of 2025, highlighting their features, profit splits, and scalability options for traders.

Position Sizing for Risk-Adjusted Scaling

Learn effective position sizing strategies for risk management in trading, including fixed fractional, R-multiple, and volatility-based methods.

Why Prop Firms Restrict News Event Trading

Explore why prop firms impose trading restrictions during news events to manage risks and maintain market stability.

Scaling Funded Accounts: Risk Management Essentials

Master disciplined risk management to scale your funded trading account effectively and achieve consistent profitability.

Prop Firm Payouts: Common Questions Answered

Learn how prop firm payouts work, including profit splits, timelines, and common issues to ensure smooth withdrawals and maximize trading profits.

Funded Account Checklist: 10 Steps Before Trading

Prepare for success in funded trading accounts with this essential checklist that covers rules, risk management, and platform setup.

Futures Trading Rule Analyzer

Analyze your futures trading stats against prop firm or exchange rules with our free tool. Ensure compliance and avoid costly violations today!

Prop Firm Red Flags: 8 Warning Signs to Avoid

Identify the key red flags to avoid when choosing a prop trading firm to protect your investments and ensure fair trading practices.

Prop Firm Consistency Rules: Complete Calculator Guide

Understand prop firm consistency rules and learn how to use calculators to ensure compliant, steady trading for successful funding.

Instant Funding vs Traditional Challenges: Which Wins?

Explore the differences between instant funding and traditional evaluation challenges in trading, and find the best fit for your style and goals.

How to Pass Prop Firm Challenges: 5 Key Strategies

Unlock the secrets to passing prop firm challenges with essential strategies for risk management, consistency, and effective trading practices.

Futures Contract Size Converter

Convert futures contract sizes instantly! From S&P 500 E-mini to Gold, switch between full, mini, or micro units with our simple trading tool.

Futures Trading Profit Calculator

Calculate your futures trading profits or losses instantly with our free tool. Enter contract size, entry/exit prices, and see detailed results!

Nasdaq Futures Risk Management Planner

Plan your futures trading risk with our free tool! Input account size and risk percentage to get tailored position sizing. Trade smarter today!

Futures Prop Firm Comparison Tool

Compare top futures prop firms like Apex Trader Funding and Topstep. Find the best funding, profit splits, and rules for your trading style!

Top 7 Futures Prop Firms for Funded Trading Accounts

Explore the top futures prop firms offering funded trading accounts, highlighting profit splits, evaluation processes, and payout speeds.

Alpha Futures Prop Firm Consistency Rule Explained: The Brutal Truth Traders Need To Know

The Alpha Futures prop firm consistency rule requires Standard funded traders to keep their largest winning day under forty percent of total profits per payout cycle to stay eligible for withdrawals. Advanced accounts skip the consistency rule but must log five winning days with two hundred dollars or more and…

How Many Trading Days Are In A Month?

U.S. stock markets average 20–22 trading days per month, but holidays and weekends change that count. This guide breaks down the 2026 trading calendar, explains how trading days impact futures traders and prop firm evaluations, and shows how rules like Daily Loss Limits and Consistency Requirements help build discipline and…

How Much Money Do You Need to Day Trade (No PDT Rule Required)

Wondering how much money you really need to start day trading? In this guide, we break down daily profit goals, account types, and the updated Pattern Day Trader (PDT) rule—now shifting from a fixed $25,000 minimum to a flexible intraday margin requirement by 2026. Learn how leverage, cash vs. margin…

How Many Trading Days In a Year 2025, 2026, 2027

U.S. stock markets operate roughly 250 to 252 trading days per year, depending on how weekends and federal holidays fall. Each year, the NYSE and Nasdaq close for select market holidays, leaving around 250 active trading sessions where investors and futures traders can participate. This guide breaks down the exact…

FundedNext Rapid Challenge Giveaway: Win a Futures Prop Firm Account

Trading Psychology: Why Mindset Beats Strategy Every Time

Learn how to master trading psychology, overcome emotional traps, and trade with discipline. Discover how futures prop firms and Daily Loss Limits can strengthen your mindset and protect your psychological capital.

Gold Futures Platforms: Brokers vs Prop Firms for GC

Trading Gold Futures (GC/MGC) has never been more accessible. You can open a personal brokerage account with Schwab or Webull, or start for under $100 using a futures prop firm like Topstep, FundedNext, or Take Profit Trader. Learn how platforms such as ProjectX and Tradovate provide built-in risk management tools…

Topstep vs FundedNext Futures 2025

Topstep has long been a leader in futures funding, but new rules, activation fees, and payout caps are driving traders toward FundedNext’s Legacy Challenge. With 1:1 profit-to-loss ratios, 24-hour payouts, no caps, and cheaper one-time pricing, FundedNext is quickly becoming the go-to prop firm for serious futures traders. Compare Topstep…

Apex Trader Funding 80% OFF Code (Updated January 2026) Get the Biggest Discount + Free Payout Guide

🔥 Apex 80% OFF Code is LIVE. Save big on all Apex Trader Funding evaluation accounts with code DGT. Get 80% OFF your first month, 50% OFF renewals. This guide explains exactly how the Apex 80% OFF sale works, which accounts offer the best value, and how to apply your…

What Is Take Profit Trader Leverage? A Complete Guide for Futures Prop Traders

Take Profit Trader doesn’t use traditional leverage ratios like 1:50 or 1:100 instead, it defines buying power through contract limits. In this guide, we break down how TPT’s 1:1 leverage model works, how the 1:10 mini-to-micro ratio gives traders flexibility, and why this approach creates safer, more consistent risk control…

How End-of-Day Drawdown Works in Futures Prop Firms

Understanding End-of-Day Drawdown (EOD) is crucial for any trader working with futures prop firms. This rule determines how your account balance is evaluated, how much flexibility you have during live trading, and what keeps your funded account active. Many leading prop trading firms now use EOD drawdown because it rewards…

Replikanto vs Apex Trade Copier

Compare Replikanto vs Apex Trade Copier two of the top copy trading tools for NinjaTrader prop firm traders. Discover which platform delivers faster execution, better multi-account control, and how TradeSyncer now outperforms both with seamless Rithmic, Tradovate, and TradingView integrations.

Tradeify Consistency Rule: Full Guide for Funded Traders

The Tradeify Consistency Rule Guide helps funded traders understand payout requirements and avoid delays. Learn the difference between Lightning (20% → 25% → 30%) and Growth Sim (35%) rules, see real examples, and use our free Tradeify Consistency Rule Calculator to instantly check if your profits qualify for a payout.

Apex Trader Funding Commandments: The 4 Rules Every Trader Must Follow for Payouts

The Apex Trader Funding Commandments outline the 4 rules every trader must follow to secure payouts: the 30% consistency rule, 30% drawdown rule, 5:1 risk-to-reward, and trading requirements. Learn how these guidelines protect your funded account, improve discipline, and guarantee smoother payout approvals with Apex.

What Are Futures Prop Firms? A Complete Guide for Traders

Futures trading has exploded in popularity over the last few years, and a big reason is the rise of futures proprietary trading firms—better known as prop firms. These firms provide traders with access to capital, giving them the chance to trade the markets without risking large amounts of their own…

FundedNext vs FundingTicks: Which Futures Prop Firm Is Better in 2026?

⚔️ FundedNext and FundingTicks both came from the forex world and are now battling in futures funding. FundedNext offers cheap entry with 100% splits and payouts in as little as 3 days, while FundingTicks stands out with its Zero Plan for instant funding and One Plan for uncapped payouts. Discover…

Best Prop Firms for Scalpers in 2026

Scalpers need speed, flexibility, and prop firms that don’t punish their style. In this guide, we reveal the top futures prop firms for scalpers in 2026, breaking down rules, payouts, and drawdowns so you know exactly where you can thrive.

Unrealized Trailing Drawdown Explained – Apex Trader Funding Rules (With Real Life Examples)

The unrealized trailing drawdown at Apex Trader Funding is the single biggest rule that trips up traders. Unlike a static drawdown, it moves up with your account’s highest unrealized gains and never moves back down—meaning intraday peaks can shrink your safety cushion even if you later close lower. In this…

Top 11 Questions Traders Ask About Apex Trader Funding (Answered)

Thinking about joining Apex Trader Funding but not sure how it all works? You’re not alone. Apex has quickly become one of the most popular futures prop firms in the world, paying out over $500 million to traders since 2022 and standing out with features like 20-account copy trading, fast…

How Do Prop Firms Work? A Beginner’s Guide to Futures Prop Firms

Futures prop firms let traders access large funded accounts by proving consistency in an evaluation. Learn how evaluations, drawdowns, payouts, and multiple accounts work with examples from Apex Trader Funding.